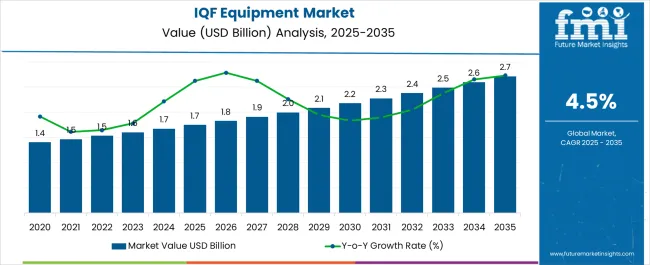

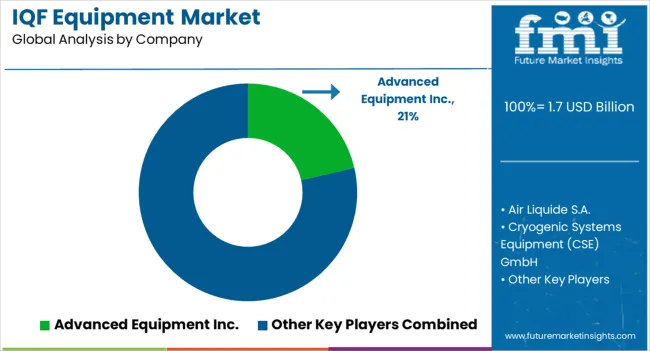

The Individual Quick Freezing Equipment Market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 2.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period. A half-decade weighted growth analysis indicates consistent expansion, with early-phase growth driven by the increasing demand for high-quality frozen foods and the rise of the frozen food industry globally. Between 2025 and 2030, the market grows from USD 1.7 billion to USD 2.2 billion, contributing USD 0.5 billion in growth, with a CAGR of 5.4%. This initial acceleration is supported by advancements in freezing technologies and an increase in the adoption of IQF systems in the food processing industry to preserve food quality, texture, and nutrients.

The demand for frozen fruits, vegetables, and ready-to-eat meals, especially in emerging markets, fuels this growth. From 2030 to 2035, the market continues to expand from USD 2.2 billion to USD 2.7 billion, adding USD 0.5 billion in growth, with a slightly lower CAGR of 4.0%. The deceleration reflects the market's maturation, as the technology becomes more widely adopted and competition increases. Growth remains steady as the demand for efficient, high-performance freezing systems continues, particularly in the growing demand for frozen seafood and prepared meals. The half-decade weighted growth analysis indicates strong early-phase acceleration, followed by stable, sustained growth as the market matures.

| Metric | Value |

|---|---|

| Individual Quick Freezing Equipment Market Estimated Value in (2025 E) | USD 1.7 billion |

| Individual Quick Freezing Equipment Market Forecast Value in (2035 F) | USD 2.7 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The individual quick freezing equipment market is expanding rapidly owing to the increasing demand for frozen food products, advancements in food preservation technologies, and the growing emphasis on minimizing food wastage. Rising consumer preference for ready-to-cook and convenience foods is propelling manufacturers to adopt freezing systems that ensure minimal loss of texture, flavor, and nutritional value.

Stringent regulations regarding food safety and quality across regions have further reinforced the need for advanced freezing technologies that can deliver rapid and uniform freezing. Additionally, the rising export of perishable products such as seafood, meat, fruits, and vegetables has contributed to the widespread adoption of IQF systems in the food supply chain.

The market outlook remains optimistic as global food processors increasingly prioritize energy efficiency, hygiene standards, and product integrity through specialized freezing equipment.

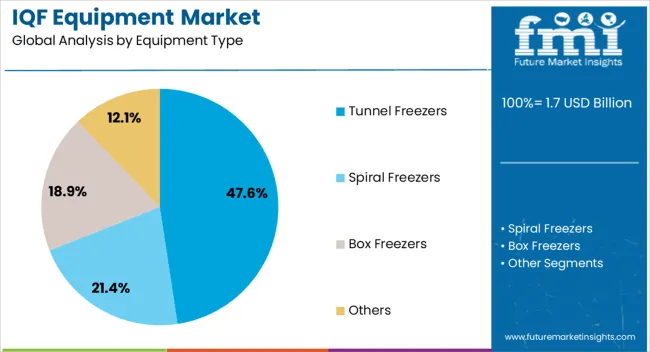

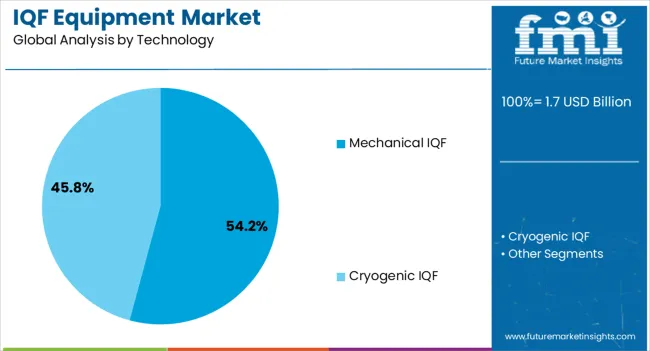

The individual quick freezing equipment market is segmented by equipment type, technology, application, end-use, and geographic regions. By equipment type, the individual quick freezing equipment market is divided into Tunnel Freezers, Spiral Freezers, Box Freezers, and Others. In terms of technology, the individual quick freezing equipment market is classified into Mechanical IQF and Cryogenic IQF.

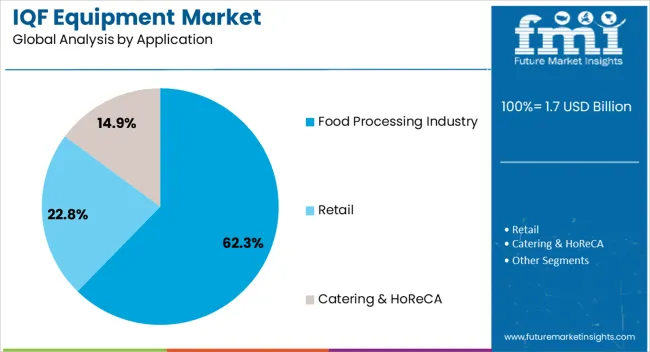

Based on the application, the individual quick freezing equipment market is segmented into the Food Processing Industry, Retail, and Catering & HoReCA. By end-use, the individual quick freezing equipment market is segmented into Direct Sales and Indirect Sales. Regionally, the individual quick freezing equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Tunnel freezers are expected to account for 47.60% of total revenue by 2025 within the equipment type category, establishing them as the leading segment. This dominance is driven by their high throughput capacity, continuous freezing ability, and suitability for handling a variety of product shapes and sizes.

The design supports efficient airflow and precise temperature control, resulting in consistent product quality. Their widespread use in large-scale operations has been further reinforced by the growing demand for uniform freezing of bulk food items.

The adaptability of tunnel freezers across multiple food categories and their ability to integrate with automated production lines have positioned this equipment type as the preferred solution in industrial freezing applications.

The mechanical IQF technology segment is projected to hold 54.20% of the market share by 2025, making it the most dominant technology in use. This leadership is attributed to its operational simplicity, cost efficiency, and minimal maintenance requirements compared to cryogenic alternatives.

Mechanical IQF systems rely on cold air circulation to freeze products individually, maintaining their shape and quality while enhancing product shelf life. The technology is well-suited for a wide range of food products, including fruits, vegetables, seafood, and bakery items.

As processors aim to reduce overhead costs and improve sustainability metrics, mechanical IQF systems continue to gain preference due to their energy efficient designs and consistent performance across diverse food types.

The food processing industry segment is anticipated to capture 62.30% of total market revenue by 2025 under the application category, making it the largest and fastest-growing area of use. This growth is supported by increasing consumer demand for frozen foods that maintain freshness and nutritional content over extended storage periods.

Food processors are increasingly relying on IQF systems to meet high volume demand while adhering to strict safety and hygiene regulations. The technology’s ability to preserve product integrity, reduce bacterial risk, and maintain high throughput aligns with the operational needs of modern food processing facilities.

As demand for export-quality frozen goods accelerates globally, the food processing industry continues to dominate the market by leveraging IQF solutions for product standardization and extended shelf life.

The individual quick freezing (IQF) equipment market is growing due to the increasing demand for high-quality frozen foods across the globe. IQF technology is crucial for preserving the texture, taste, and nutritional value of food by freezing individual pieces rapidly, which is highly sought after in the food processing industry. The growing consumption of frozen food, along with innovations in freezing technology to improve energy efficiency and capacity, is driving market expansion. Despite challenges such as high initial investment costs and energy consumption, the market continues to evolve with the rise in demand for ready-to-eat and convenience foods.

The demand for individual quick freezing (IQF) equipment is primarily driven by the increasing global consumption of high-quality frozen foods. IQF technology allows for the rapid freezing of individual pieces of food, which helps maintain the food's original texture, flavor, and nutritional content, making it highly preferred by consumers and food processors alike. With an increasing number of consumers seeking convenient, ready-to-eat, and preservative-free meals, the demand for frozen foods is growing. The food processing industry is also adopting IQF technology to improve product shelf-life while maintaining food quality, which is essential for markets where fresh produce is not easily accessible. Additionally, advancements in freezing technology to enhance energy efficiency and capacity are also contributing to the growth of the IQF equipment market.

A key challenge for the individual quick freezing (IQF) equipment market is the high initial investment required for purchasing and installing advanced freezing systems. The cost of setting up IQF equipment can be prohibitive for smaller food processing companies or businesses in emerging markets. Additionally, IQF systems often require significant energy consumption, particularly when processing large volumes of food. The need for energy-efficient systems is becoming more critical due to rising energy prices and increased focus on reducing operational costs. This challenge is compounded by the complexity of maintaining and operating such advanced machinery. The high capital expenditure and ongoing energy costs can limit the widespread adoption of IQF equipment, especially for smaller-scale operations that may not have the resources to invest in these technologies.

The individual quick freezing (IQF) equipment market offers significant opportunities driven by technological advancements and the increasing adoption of IQF technology in emerging markets. Innovations in freezing technology, such as improvements in energy efficiency, faster freezing times, and automated systems, are opening new opportunities for growth. These advancements not only improve the performance of IQF systems but also reduce operational costs, making them more accessible to a wider range of food processors. The expansion of food processing industries in emerging markets, especially in regions such as Asia-Pacific and Africa, presents an opportunity for manufacturers to introduce cost-effective IQF equipment solutions. As the demand for frozen foods rises in these regions, the market for IQF equipment is expected to expand significantly, providing long-term growth potential.

A key trend in the individual quick freezing (IQF) equipment market is the increasing integration of automation and smart features into freezing systems. Automation technologies, such as automated loading and unloading systems, as well as real-time monitoring and control systems, are becoming more prevalent in IQF equipment. These innovations improve operational efficiency, reduce labor costs, and enhance the consistency and quality of the frozen products. The integration of IoT (Internet of Things) and machine learning technologies allows for better monitoring, predictive maintenance, and performance optimization of IQF systems. As the demand for high-quality, traceable frozen foods rises, these smart technologies are helping manufacturers ensure that products are processed efficiently and in compliance with food safety standards. The trend toward automation and smart systems is expected to continue driving the evolution of IQF equipment.

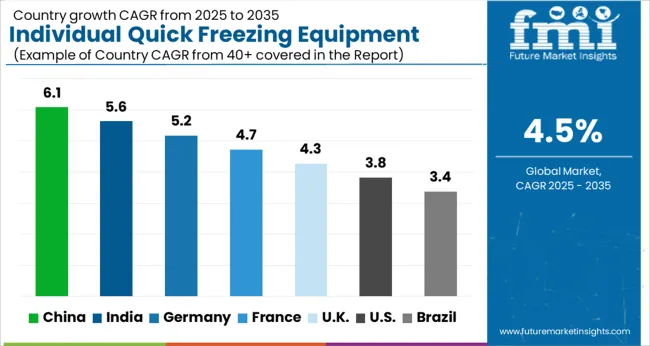

Global IQF equipment market demand is projected to rise at a 4.5% CAGR from 2025 to 2035. Of the profiled markets out of 40 covered, China leads at 6.1%, followed by India at 5.6%, and France at 4.7%, while the United Kingdom records 4.3% and the United States posts 3.8%. The United States and the United Kingdom show slower growth. Divergence reflects local catalysts: rising demand for frozen food, technological advancements, and increasing food processing activities in China and India, while more mature markets like the United States and the United Kingdom experience moderate growth due to established infrastructure and market saturation. The analysis spans over 40 countries, with the top markets shown below.

The IQF equipment market in China is expanding rapidly at a CAGR of 6.1%, driven by the country's booming frozen food industry and increasing demand for advanced food processing technologies. As one of the largest producers of frozen foods globally, China is focusing on improving food preservation, quality, and shelf-life, which is accelerating the adoption of IQF equipment. The rise in consumer demand for processed, ready-to-eat meals and growing distribution networks further enhances the market for IQF equipment. The government’s investments in food processing and export infrastructure are also key growth drivers.

The IQF equipment market in India is growing at a CAGR of 5.6%, supported by the rapid growth of the frozen food sector and the increasing demand for high-quality food preservation technologies. The rise in consumer demand for frozen fruits, vegetables, and ready-to-eat meals is propelling the market forward. The government’s focus on increasing food processing capacity, along with initiatives like the Pradhan Mantri Kisan Sampada Yojana, supports the growth of the IQF equipment market. India’s expanding retail and distribution networks further enhance the adoption of IQF technology in the food processing sector.

The IQF equipment market in France is expanding at a CAGR of 4.7%, driven by increasing consumer demand for frozen food products and higher-quality food preservation techniques. The country’s strong tradition in food processing and exports is fueling the market for IQF equipment, especially in the production of frozen vegetables, fruits, and seafood. The rise of modern retail channels and e-commerce platforms in France is further driving the need for efficient food preservation technologies. Government investments in food safety standards and processing technologies are key growth factors in the French market.

The United Kingdom’s IQF equipment market is growing at a moderate CAGR of 4.3%, driven by increasing demand for frozen food and processed ready-to-eat meals. The UK has a well-established food processing sector, with high-quality standards that support the adoption of advanced IQF technologies. The rise in consumer preference for convenient, frozen, and healthy food options further fuels market demand. The UK’s growing food export sector is enhancing the need for efficient food preservation solutions like IQF. Despite slower growth compared to emerging markets, the UK remains a strong player in the IQF equipment market.

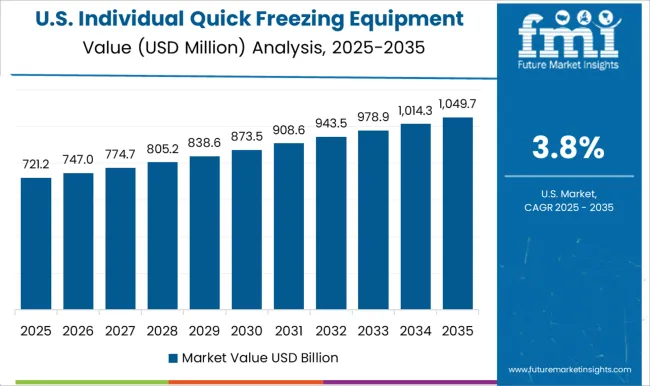

The USA IQF equipment market is growing at a CAGR of 3.8%, with steady demand from the frozen food industry. The United States has a mature and established market for frozen food, including fruits, vegetables, and meats. While growth is moderate compared to emerging markets, the demand for IQF equipment remains strong due to the ongoing need for food quality preservation and increased demand for ready-to-eat meals. Technological advancements in food preservation, as well as the push for food safety and efficiency, continue to drive the market forward in the USA

The individual quick freezing (IQF) equipment market is driven by a range of companies offering advanced freezing solutions that cater to the food processing industry while ensuring high product quality and energy efficiency. Advanced Equipment Inc. is a key player, providing uniform and energy-efficient IQF systems for the agricultural and food processing industries. Air Liquide S.A. is a global leader in cryogenic-based IQF systems, offering rapid freezing solutions for a variety of food products, improving speed and product quality.

Cryogenic Systems Equipment (CSE) GmbH specializes in cryogenic freezing technologies, emphasizing cost-effectiveness, speed, and food preservation. GEA Group AG is known for offering a broad range of IQF equipment suitable for both large and small-scale food processing operations, ensuring consistent and efficient freezing. JBT Corporation delivers cutting-edge IQF solutions, focusing on automation and efficiency in the meat, poultry, and seafood sectors. Korutek Engineering provides tailored IQF systems designed for superior freezing capacity and energy savings. Marel hf offers advanced IQF solutions for the fish, meat, and poultry industries, focusing on productivity, product quality, and energy efficiency. NESPAK SRL specializes in custom-designed IQF equipment to meet the diverse needs of the food processing industry. OctoFrost Group is recognized for its high-performance, energy-efficient IQF systems. Scanico A/S ensures high-quality food preservation, focusing on maintaining flavor, texture, and nutritional value. Skaginn 3X offers state-of-the-art IQF technology emphasizing speed and product integrity. The Linde Group and Unifreezing Ltd. offer cryogenic and cost-effective IQF freezing systems, meeting the growing demand for fast and reliable freezing technology across the food industry.

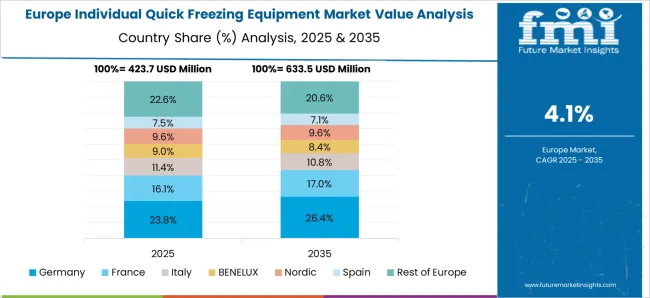

Dollar sales by product type (cryogenic IQF systems, mechanical IQF systems) and end-use segments (food processing, meat, poultry, seafood, fruits, vegetables). Demand dynamics are driven by the increasing need for high-quality frozen food, growing consumer demand for frozen convenience foods, and the need for energy-efficient freezing technologies. Regional trends show strong growth in North America, Europe, and Asia-Pacific, with innovations in freezing technology, improved food preservation, and the growing adoption of IQF systems in the food processing industry fueling market expansion.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 Billion |

| Equipment Type | Tunnel Freezers, Spiral Freezers, Box Freezers, and Others |

| Technology | Mechanical IQF and Cryogenic IQF |

| Application | Food Processing Industry, Retail, and Catering & HoReCA |

| End-use | Direct Sales and Indirect Sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Advanced Equipment Inc.; Air Liquide S.A.; Cryogenic Systems Equipment, Inc. (CSE); GEA Group AG; JBT Corporation; Korutek Engineering; JBT Marel Corporation (Marel freezing solutions); OctoFrost Group; Scanico A/S (a Middleby company); Skaginn 3X; Starfrost (UK) Ltd.; Linde (CRYOLINE); UniFreezing B.V.; Van Abeelen. |

| Additional Attributes | Dollar sales by product type (cryogenic IQF systems, mechanical IQF systems) and end-use segments (food processing, meat, poultry, seafood, fruits, vegetables). Demand dynamics are driven by the increasing need for high-quality frozen food, growing consumer demand for frozen convenience foods, and the need for energy-efficient freezing technologies. Regional trends show strong growth in North America, Europe, and Asia-Pacific, with innovations in freezing technology, improved food preservation, and the growing adoption of IQF systems in the food processing industry fueling market expansion. |

The global individual quick freezing equipment market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the individual quick freezing equipment market is projected to reach USD 2.7 billion by 2035.

The individual quick freezing equipment market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in individual quick freezing equipment market are tunnel freezers, spiral freezers, box freezers and others.

In terms of technology, mechanical iqf segment to command 54.2% share in the individual quick freezing equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Individual Quick Freezing Market Size and Share Forecast Outlook 2025 to 2035

Airport Quick Service Restaurant Market Size and Share Forecast Outlook 2025 to 2035

Fast Food & Quick Service Restaurant Market Trends – Growth & Forecast 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market – Advanced Agricultural Machinery 2024-2034

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Galley Equipment Market Analysis and Forecast by Fit, Application, and Region through 2035

Garage Equipment Market Growth – Trends & Forecast 2024-2034

Sorting Equipment Market Size and Share Forecast Outlook 2025 to 2035

General Equipment Rental Services Market Size and Share Forecast Outlook 2025 to 2035

Bagging Equipment Market Size and Share Forecast Outlook 2025 to 2035

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Medical Equipment Covers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA