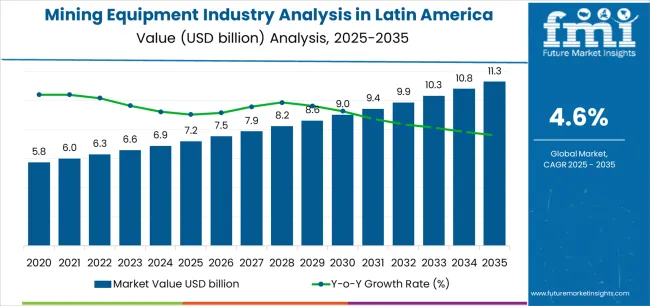

Global Latin America mining equipment demand is projected to grow from USD 7.2 billion in 2025 to approximately USD 11.3 billion by 2035, recording an absolute increase of USD 4.1 billion over the forecast period. This translates into total growth of 56.9%, with demand forecast to expand at a compound annual growth rate (CAGR) of 4.6% between 2025 and 2035. Overall sales are expected to grow by nearly 1.57X during the same period, supported by rising Latin America mining activities, increasing automation adoption, and growing demand for efficient extraction equipment across metal mining and non-metallic mineral operations. Latin America, led by Chile, Brazil, and Peru, continues to demonstrate strong growth potential driven by copper expansions, ESG-driven fleet renewals, and mining modernization initiatives.

Between 2025 and 2030, Latin America mining equipment demand is projected to expand from USD 7.2 billion to USD 9 billion, resulting in a value increase of USD 1.8 billion, which represents 43.9% of the total forecast growth for the decade. This phase of growth will be shaped by rising Latin America mining operations globally, particularly across Chile and Brazil where copper expansions and iron ore modernization are accelerating equipment upgrades. Increasing mechanization of metal mining extraction and growing adoption of automated equipment systems continue to drive demand. Equipment suppliers are expanding their production capabilities to address the growing complexity of modern Latin America mining operations and ESG requirements, with Latin American mining operations leading investments in fleet renewal technologies.

From 2030 to 2035, demand is forecast to grow from USD 9 billion to USD 11.3 billion, adding another USD 2.3 billion, which constitutes 56.1% of the overall ten-year expansion. This period is expected to be characterized by expansion of battery electric and hydrogen fuel-cell equipment, integration of advanced automation and autonomous operation technologies, and development of standardized equipment protocols across different mining operations. The growing adoption of sustainable mining practices and electrification initiatives, particularly in Chile and Brazil, will drive demand for more sophisticated equipment and specialized technical capabilities.

Between 2020 and 2025, Latin America mining equipment demand experienced steady expansion, driven by increasing Latin America mining activities in copper, iron ore, gold, and lithium extraction and growing awareness of automation benefits for operational efficiency and environmental compliance. The sector developed as mining operations, especially in Chile and Peru, recognized the need for specialized equipment and advanced technologies to improve productivity while meeting stringent ESG and environmental regulations. Mining companies and equipment rental providers began emphasizing proper equipment maintenance and technological upgrades to maintain operational efficiency and regulatory compliance.

| Metric | Value |

|---|---|

| Latin America Mining Equipment Sales Value (2025) | USD 7.2 billion |

| Latin America Mining Equipment Forecast Value (2035) | USD 11.3 billion |

| Latin America Mining Equipment Forecast CAGR (2025-2035) | 4.6% |

Demand expansion is being supported by the rapid increase in Latin America mining operations worldwide, with Chile maintaining its position as a copper production leadership region, and the corresponding need for specialized equipment for extraction, transportation, and processing activities. Modern mining operations rely on advanced mechanized equipment to ensure efficient mineral extraction, environmental compliance, and optimal productivity. Latin America mining requires comprehensive equipment systems including mining trucks, excavators, drilling rigs, and autonomous-ready machinery to maintain operational efficiency and extraction excellence.

The growing complexity of Latin America mining operations and increasing ESG regulations, particularly stringent requirements in Chile and Brazil, are driving demand for advanced equipment from certified manufacturers with appropriate technology and engineering expertise. Mining companies are increasingly investing in automation and electrification technologies to improve operational efficiency, reduce environmental impact, and enhance operational safety in challenging Latin America mining environments. Regulatory requirements and mining operation specifications are establishing standardized equipment procedures that require specialized capabilities and trained operators, with Chilean and Brazilian operations often setting benchmark standards for regional mining practices.

Demand is segmented by equipment type, mining type, end user, sales channel, and powertrain/drivetrain. By equipment type, sales are divided into mining trucks (rigid dump trucks, articulated dump trucks, autonomous-ready truck packages), excavators, dozers, drilling equipment, loaders, and support machinery. Based on mining type, demand is categorized into metal mining (copper, iron ore, gold, lithium) and non-metallic mining. In terms of end user, sales are segmented into mining operators (global majors, mid-tier/private operators, state-owned enterprises) and rental service providers. By sales channel, demand is divided into new equipment (direct OEM sales, authorized dealers) and aftermarket services. For powertrain/drivetrain, sales are segmented into conventional diesel (Tier 4 Final/Stage V, Tier 3 legacy fleets) and alternative powertrains. Regionally, demand is divided across Latin America, with Chile, Brazil, Peru, Colombia, Bolivia, Mexico, and Argentina representing key growth markets for Latin America mining equipment technologies.

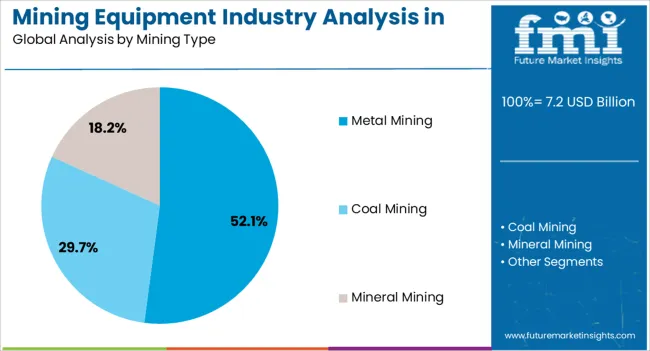

Metal mining is expected to represent 52.1% of Latin America mining equipment demand in 2025, highlighting its critical role as the dominant application segment. Large-scale metal mining operations, particularly in Chile, Brazil, and Peru, require comprehensive equipment fleets to maintain extraction efficiency across diverse geological conditions. Within metal mining, copper operations lead with 24.5% share, driven by Chile's position as the world's largest copper producer and ongoing expansion projects across the region. Iron ore mining accounts for 14.2%, primarily concentrated in Brazil's established operations and modernization programs. Gold mining represents 9.8% of demand, supported by operations across Peru, Colombia, and Mexico, while lithium extraction claims 3.6% share as Bolivia, Chile, and Argentina scale pilot projects toward commercial production phases. The segment is fueled by increasing global capital investments into mining infrastructure, with operators prioritizing advanced machinery that integrates digital monitoring, automation, and predictive maintenance. In Latin America, leading mining companies are spearheading adoption of electrified and autonomous equipment to reduce emissions, enhance productivity, and improve operational efficiency.

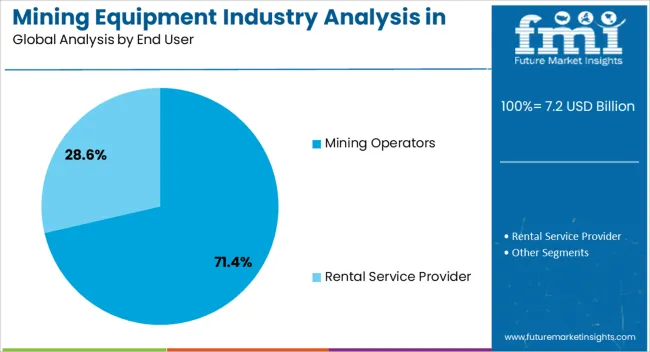

Mining operators are projected to contribute 71.4% of demand in 2025, making them the dominant end-user category for mining equipment. Within this segment, global majors represent 42% of equipment ownership, as multinational mining corporations maintain extensive in-house fleets to exercise control over operations and implement standardized equipment strategies across multiple sites. Mid-tier and private operators account for 19.3% of demand, preferring equipment ownership to support site-specific customization and long-term cost optimization. State-owned enterprises contribute 10.1%, primarily concentrated in Brazil, Bolivia, and Mexico where government-backed mining operations maintain strategic equipment inventories. Ownership allows operators to customize equipment for site-specific geological conditions, whether copper porphyry deposits, iron ore formations, or alluvial gold operations. The segment benefits from operators prioritizing fleet standardization, comprehensive maintenance programs, and early adoption of next-generation technologies including electrification and autonomy. In Latin America, leading mining companies are establishing regional equipment strategies that balance capital efficiency with operational flexibility across diverse commodity portfolios.

Latin America mining equipment demand is advancing steadily due to increasing Latin America mining activities and growing recognition of automation and mechanization benefits, with Chile and Brazil serving as key drivers of technological innovation and ESG standards. However, the sector faces challenges including high capital costs, need for continuous maintenance and operator training, and varying equipment requirements across different geological conditions and commodity types. Electrification initiatives and automation programs, particularly advanced in Chilean and Brazilian operations, continue to influence equipment specifications and operational patterns.

The growing pipeline of copper expansion projects across Chile and Peru, combined with lithium brine operations scaling from pilot to commercial phases in Bolivia, Chile, and Argentina, is creating sustained equipment demand across extraction, hauling, and processing applications. Major copper producers are investing in pit-to-plant productivity upgrades, brownfield debottlenecking projects, and new greenfield developments that require comprehensive equipment fleets spanning mining trucks, excavators, drilling rigs, and auxiliary machinery. Lithium operations present specialized equipment requirements including brine extraction systems, evaporation pond infrastructure, and material handling equipment adapted for chemical processing environments. These commodity-driven expansion programs are generating multi-year equipment procurement cycles that support sustained demand growth across the forecast period.

Modern equipment manufacturers, led by Caterpillar, Komatsu, and Hitachi, are incorporating advanced automation systems and alternative powertrains that improve operational efficiency, reduce emissions, and enhance productivity. Integration of autonomous hauling systems, remote operation capabilities, and real-time fleet management technologies enables more precise equipment operation and comprehensive performance tracking. Advanced equipment also supports next-generation mining operations including zero-emission mining environments and fully automated extraction systems that maximize productivity while minimizing environmental impact, with Chilean mining operations increasingly adopting these technologies through strategic partnerships with equipment OEMs and technology providers.

| Country | CAGR (2025-2035) |

|---|---|

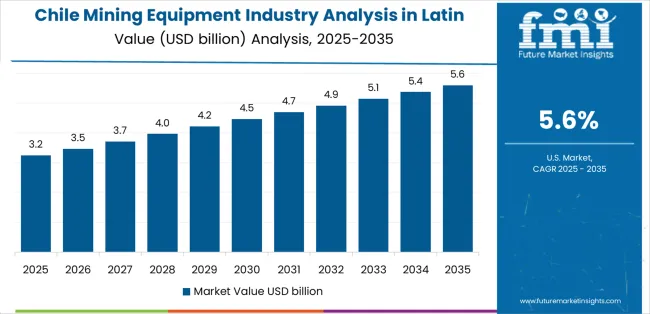

| Chile | 5.6% |

| Brazil | 4.9% |

| Peru | 4.8% |

| Bolivia | 4.6% |

| Colombia | 4.4% |

| Mexico | 4.2% |

| Argentina | 3.5% |

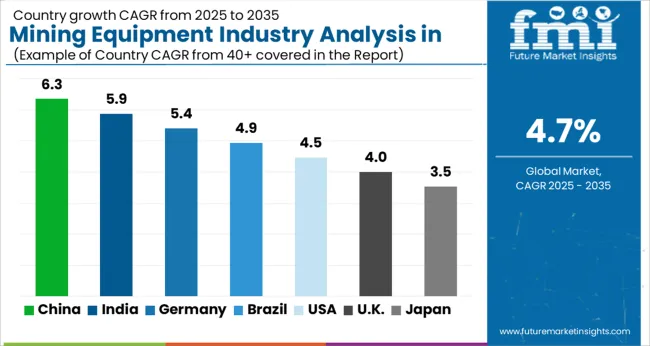

The Latin America mining equipment market is witnessing steady growth, supported by rising commodity demand, ESG-driven fleet renewals, and the integration of advanced equipment across operations. Chile leads the region with a 5.6% CAGR, reflecting large pipeline of copper expansions and strong ESG-driven fleet renewals driving equipment investments. Brazil follows with a 4.9% CAGR, supported by iron ore and gold expansions alongside growing rental and rebuild ecosystems. Peru grows at 4.8%, driven by copper brownfield debottlenecking and pit-to-plant productivity upgrades across established operations.

Demand for Latin America mining equipment in Chile is projected to exhibit strong growth with a CAGR of 5.6% through 2035, driven by ongoing copper mining expansion projects, increasing adoption of automated equipment systems, and stringent ESG compliance requirements. As the dominant Latin American player in copper production, the country's emphasis on mining sustainability and environmental compliance is creating significant demand for advanced equipment with enhanced emission reduction capabilities and autonomous operation features. Major equipment manufacturers and mining operators are establishing comprehensive equipment deployment strategies to support productivity improvement and regulatory compliance across Chilean operations.

Demand for Latin America mining equipment in Brazil is expanding at a CAGR of 4.9%, supported by extensive iron ore mining operations, growing gold extraction activities, and development of comprehensive rental and rebuild ecosystems across established mining regions. The country's mining sector, representing a crucial component of Latin American mining production, is increasingly adopting advanced equipment technologies including automation systems, fleet management platforms, and predictive maintenance capabilities. Equipment suppliers and mining operations are gradually implementing comprehensive equipment upgrade programs to serve expanding Latin America mining activities throughout Brazil and broader Latin America.

Demand for Latin America mining equipment in Peru is growing at a CAGR of 4.8%, driven by established copper mining operations implementing brownfield debottlenecking projects and pit-to-plant productivity upgrades. The country's mining sector, an integral part of Latin American copper production, is gradually integrating modern equipment technologies to improve extraction efficiency and operational performance. Mining operations and equipment service providers are investing in equipment fleet optimization and operator training to address growing productivity requirements and align with regional industry standards.

Demand for Latin America mining equipment in Bolivia is growing at a CAGR of 4.6%, driven by lithium brine projects scaling from pilot to commercial phases across high-altitude salt flats. The country's emerging lithium sector is creating specialized equipment requirements adapted for brine extraction, evaporation infrastructure, and material handling applications. Equipment suppliers are developing technical expertise to support Bolivia's unique lithium production methods while establishing service networks to address maintenance requirements in remote operational environments.

Demand for Latin America mining equipment in Colombia is expanding at a CAGR of 4.4%, supported by diversification from coal toward metals mining and renewed exploration spending across gold, copper, and nickel prospects. The country's mining sector is gradually integrating modern equipment to support exploration activities and early-stage production operations. Equipment rental providers and mining operators are establishing fleet deployment strategies to serve growing diversification initiatives.

Demand for Latin America mining equipment in Mexico is growing at a CAGR of 4.2%, driven by gold and silver underground mining investments and supportive supply chain infrastructure. The country's established underground mining operations are adopting modern equipment to improve extraction efficiency and safety performance. Equipment manufacturers benefit from Mexico's proximity to North American production facilities and established service networks.

Demand for Latin America mining equipment in Argentina is expanding at a CAGR of 3.5%, driven by lithium and copper pre-production fleet investments. Currency dynamics favor used equipment acquisitions as operators optimize capital efficiency during project development phases. The country's emerging lithium sector and copper exploration activities are establishing equipment requirements adapted for high-altitude Andean conditions.

The mining equipment industry analysis in Latin America is defined by competition among specialized equipment manufacturers, automation technology providers, and rental service companies, with North American and European manufacturers maintaining significant regional influence. Manufacturers are investing in advanced equipment technologies, electrification systems, automation capabilities, and comprehensive service networks to deliver reliable, efficient, and sustainable equipment solutions across Latin America and global operations. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and presence across Latin America and international markets.

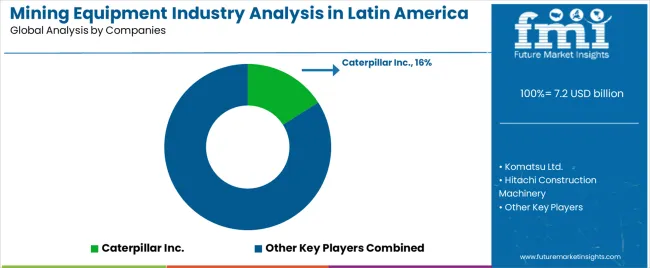

Caterpillar Inc., United States-based and holding 16% market share, offers comprehensive Latin America mining equipment including mining trucks, excavators, and dozers with focus on durability, productivity, and autonomous capabilities across Latin American and global operations. The company showcased its first battery-electric 793 mining truck in Latin America in November 2025, demonstrating commitment to electrification initiatives. Komatsu Ltd., Japan with extensive Latin American operations, emphasizes comprehensive mining machinery solutions with integrated automation and monitoring systems, collaborating with General Motors to integrate hydrogen fuel-cell power modules for the 930E haul truck platform in December 2025.

Hitachi Construction Machinery delivers advanced mining equipment including excavators and haul trucks serving Latin American mining operations. Liebherr Group, Switzerland, provides comprehensive mining equipment solutions with emphasis on reliability and aftermarket support. Epiroc AB, Sweden, offers drilling equipment, loaders, and automation systems for Latin American underground and surface mining operations. Sandvik AB provides mining equipment and technology solutions with focus on productivity and sustainability. Volvo Construction Equipment emphasizes articulated dump trucks and wheel loaders adapted for Latin American mining conditions. SANY Heavy Industry and XCMG, China-based manufacturers, are expanding presence through competitive pricing and growing aftermarket networks. Metso delivers crushing, screening, and mineral processing equipment supporting Latin American mining operations.

Mining equipment represents critical infrastructure for efficient extraction of copper, iron ore, gold, lithium, and other minerals that support global economic development. With the Latin American market projected to reach USD 11.3 billion by 2035, driven by copper expansions, ESG imperatives, and automation adoption, the sector stands at the intersection of productivity enhancement, environmental compliance, and operational excellence. The equipment ecosystem-spanning mining trucks, excavators, drilling rigs, autonomous systems, and support machinery-requires coordinated action across equipment manufacturers, mining operators, technology providers, regulatory bodies, financing institutions, and workforce development organizations to unlock its full value potential while addressing the operational complexities of diverse mining environments across the region.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.3 billion |

| Equipment Type | Mining trucks (rigid dump trucks, articulated dump trucks, autonomous-ready truck packages), excavators, dozers, drilling equipment, loaders, continuous miners, ground support equipment, utility machinery, personnel carriers |

| Mining Type | Metal mining (copper, iron ore, gold, lithium), non-metallic mining |

| End User | Mining operators (global majors, mid-tier/private operators, state-owned enterprises), rental service providers |

| Sales Channel | New equipment (direct OEM sales, authorized dealers), aftermarket services |

| Powertrain/Drivetrain | Conventional diesel (Tier 4 Final/Stage V, Tier 3 legacy fleets), battery-electric, hydrogen fuel-cell |

| Regions Covered | Latin America, North America, Europe, Asia Pacific, Middle East & Africa |

| Countries Covered | Chile, Brazil, Peru, Bolivia, Colombia, Mexico, Argentina (Latin America), United States, Canada, China, Australia, India, South Africa, Germany, United Kingdom |

| Key Companies Profiled | Caterpillar Inc., Komatsu Ltd., Hitachi Construction Machinery, Liebherr Group, Epiroc AB, Sandvik AB, Volvo Construction Equipment, SANY Heavy Industry, XCMG, Metso |

| Additional Attributes | Dollar sales by equipment type, mining type, end user, sales channel, and powertrain/drivetrain segment, regional demand trends across Latin America, competitive landscape with established North American, European, Asian, and emerging Latin American manufacturers and technology innovators, operator preferences for owned versus rental equipment models, integration with automation technologies and electrification systems particularly advanced in Chile and Brazil, innovations in battery-electric equipment, hydrogen fuel-cell systems, and autonomous mining operations, and adoption of remote operation capabilities, real-time fleet management systems, and advanced predictive maintenance features for enhanced operational efficiency and environmental performance across Latin American and global mining operations |

The global mining equipment industry analysis in latin america is estimated to be valued at USD 7.2 billion in 2025.

The market size for the mining equipment industry analysis in latin america is projected to reach USD 11.3 billion by 2035.

The mining equipment industry analysis in latin america is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in mining equipment industry analysis in latin america are metal mining and non-metallic mining.

In terms of end user, mining operators segment to command 71.4% share in the mining equipment industry analysis in latin america in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Food Service Equipment Market Trends – Growth, Demand & Forecast 2025–2035

Latin America Construction Equipment Market Growth - Trends & Forecast 2025 to 2035

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

EduTech Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Cloud ERP Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Wind Turbine Industry Analysis in Latin America Growth - Trends & Forecast 2025 to 2035

Hyperscale Cloud Industry Market Trends – Growth & Forecast 2024-2034

Fountain Dispenser Equipment Industry Analysis in North America Growth, Trends and Forecast from 2025 to 2035

Cloud Backup Service Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Fintech as a Service Market Analysis – Growth & Trends 2024-2034

Walk-in Cooler & Freezer Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA