The EduTech industry in Latin America is expanding steadily. Growth is being driven by increased digitalization in education, rising investments in e-learning infrastructure, and government initiatives aimed at improving access to quality education. The current market landscape reflects strong adoption of digital platforms, cloud-based learning tools, and interactive classroom technologies.

Rapid internet penetration and the proliferation of smart devices have accelerated integration of technology into both academic and corporate learning environments. Despite challenges such as infrastructure gaps and varying affordability across regions, initiatives supporting digital inclusion and teacher training are strengthening market potential.

The future outlook remains positive, with countries investing in hybrid education models and personalized learning solutions Growth rationale is anchored in sustained demand for scalable, flexible, and cost-effective learning systems, continuous innovation in content delivery platforms, and the expansion of collaborative partnerships between private technology providers and educational institutions, ensuring long-term industry advancement across the Latin American region.

| Metric | Value |

|---|---|

| EduTech Industry Analysis in Latin America Estimated Value in (2025 E) | USD 7.5 billion |

| EduTech Industry Analysis in Latin America Forecast Value in (2035 F) | USD 28.9 billion |

| Forecast CAGR (2025 to 2035) | 14.5% |

The market is segmented by Component and End-user and region. By Component, the market is divided into Hardware, Software, and Services. In terms of End-user, the market is classified into Academic Institution, Government Organization, Enterprises, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment, accounting for 42.70% of the component category, has been leading the market due to its foundational role in enabling digital learning environments across schools, universities, and training centers. Increased deployment of laptops, tablets, and smartboards has enhanced accessibility and engagement in classrooms.

Government programs promoting digital literacy and public-private collaborations for device distribution have reinforced adoption. The segment’s growth has also been supported by declining hardware costs and localized manufacturing initiatives that make technology more affordable for institutions and students.

Continuous innovation in device durability, connectivity, and performance has improved user experience and reduced maintenance costs As educational ecosystems become increasingly reliant on integrated technology infrastructure, demand for hardware solutions is expected to remain stable, positioning this segment as a critical enabler of ongoing EduTech transformation in Latin America.

The academic institution segment, representing 55.30% of the end-user category, has been the dominant user group within the EduTech industry due to the widespread adoption of digital learning platforms, virtual classrooms, and smart content management systems. Integration of technology into formal education has been accelerated by policy support for blended and remote learning frameworks.

Universities and schools are increasingly leveraging analytics-driven platforms to enhance curriculum delivery and student engagement. Continuous emphasis on improving digital literacy among educators and learners has supported long-term adoption.

Strategic collaborations with EduTech providers have allowed institutions to implement scalable and customized learning solutions that align with regional education standards With ongoing investment in infrastructure modernization and technology-enabled pedagogy, the academic institution segment is expected to sustain its leadership position, driving consistent growth and innovation across the Latin American EduTech ecosystem.

The EduTech industry in Latin America experienced a CAGR of 13.0% from 2020 to 2025. Total valuation at the end of 2025 reached about USD 5,729.9 million. This was mainly due to increased popularity of remote learning.

The COVID-19 pandemic led to a rapid adoption of digital tools and online learning methods during the historical period. Similarly, a focus on skills development, especially mobile learning and language acquisition, increased popularity of EdTech in Latin America.

Certain challenges like limited digital infrastructure and low internet access, however, affected the pace of adoption, especially in remote areas. Overall, Latin America witnessed tremendous growth in the EduTech industry, reflecting education's transformation through technology integration.

In the assessment period, the Latin America EdTech industry is expected to rise at a CAGR of 14.5% from 2025 to 2035. Total revenue in the region will likely reach USD 25,286.6 million by the end of 2035.

The EduTech industry is expected to expand further due to increasing government support and growing awareness of the importance of technology in education. Innovations in mobile learning and growing demand for personalized learning pathways will shape the landscape.

Digital infrastructure challenges are expected to be addressed progressively, leading to greater adoption of EduTech in Latin America, especially in remote and underserved areas. Overall, the Latin America EduTech industry is poised for dynamic growth, offering opportunities for providers and students in the coming years.

Semi-annual Update

| Particular | Value CAGR |

|---|---|

| H1 | 13.8% (2025 to 2035) |

| H2 | 14.1% (2025 to 2035) |

| H1 | 12.5% (2025 to 2035) |

| H2 | 12.8% (2025 to 2035) |

The table below showcases the CAGRs of two leading countries in Latin America’s EduTech industry. Mexico is estimated to witness a CAGR of 18.1% from 2025 to 2035. Argentina, on the other hand, is anticipated to record growth at a CAGR of 16.2% through 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| Mexico | 18.1% |

| Argentina | 16.2% |

Mexico’s EduTech industry is projected to expand with a CAGR of 18.1%, totaling a high valuation of USD 7,289.4 million in 2035. This can be attributed to rising adoption of digital learning tools in the country.

As per the latest analysis, Argentina EduTech industry value is anticipated to total USD 5,469.6 million in 2035, registering at a CAGR of 16.2%. This is due to ongoing digital transformation in education and rising demand for digital learning solutions.

The section below highlights growth projections of top segments in Latin American digital education industry. Based on component, the software segment is expected to generate significant revenue for EduTech companies in Latin America, exhibiting a CAGR of 16.5% through 2035. By end-users, the academic institution segment will likely grow at a higher CAGR of 16.4%.

Growth Outlook by Component

| By Component | Value CAGR |

|---|---|

| Hardware | 12.7% |

| Software | 16.5% |

| Services | 14.5% |

As per the latest analysis, the software segment is expected to dominate the Latin America EduTech industry during the forecast period. It will likely thrive at a CAGR of 16.5%, totaling a valuation of USD 10,325.2 million by 2035.

Growth Outlook by End-user

| End-user | Value CAGR |

|---|---|

| Government Organization | 14.2% |

| Academic Institution | 16.4% |

| Enterprises | 12.2% |

| Others | 10.7% |

Based on end-user, the academic institution segment is expected to grow at a robust CAGR of 16.4% during the forecast period. It will likely generate revenue worth USD 12,863.7 million by 2035.

Key players are focusing on providing tailored EduTech solutions to meet the specific needs of their clients. They are adopting different strategies to boost their revenue and strengthen their presence in Latin America.

Key Strategies Adopted by Leading Players

Investment in E-Learning

The pandemic has resulted in a significant increase in the Latin American e-learning marketplaces, which is expected to continue long after the viral issue has been overcome. Government initiatives to set up sophisticated learning systems are encouraging the migration of many global players to Latin America

Product Innovation

Top EduTech solution providers are constantly launching new products and platforms to stay ahead of the competition. For instance, recently, Chegg launched a new platform for educators. The new platform will be able to share educational content with millions of learners. Such development ultimately helps students in Latin America as well.

Strategic Partnerships and Collaborations

Top companies focus on inorganic growth strategies such as partnerships and collaborations to expand their presence in Latin America.

Expansion into Emerging Industries

Latin America EduTech industry expansion reflects the growing demand for innovative education solutions and highlights the industry’s commitment to diversity in underserved populations. Entering emerging regions highlights EdTech’s ability to address educational gaps and contribute to inclusive learning opportunities in Latin America.

Mergers and Acquisition

Several companies are also adopting strategies like mergers and acquisitions to strengthen their footprint across Latin America.

Key Developments in the Latin America EduTech Industry

| Attribute | Details |

|---|---|

| Estimated Value (2025) | USD 6,513.6 million |

| Projected Revenue (2035) | USD 25,286.6 million |

| Anticipated Growth Rate (2025 to 2035) | 14.5% CAGR |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Segments Covered | Component, End-user, Country |

| Regions Covered |

Latin America |

| Key Countries Covered | Brazil, Mexico, Argentina, Chile, Colombia, Peru, Rest of Latin America |

| Key Companies Profiled | Coursera; Blackboard Inc. (Anthology); Digital House; Platzi in; PleIQ; Agenda Edu; UOL EduTech; UBITS LLC; Crehana; Coderhouse; Edx; Papumba; ARVORE; SIMA E-learning |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

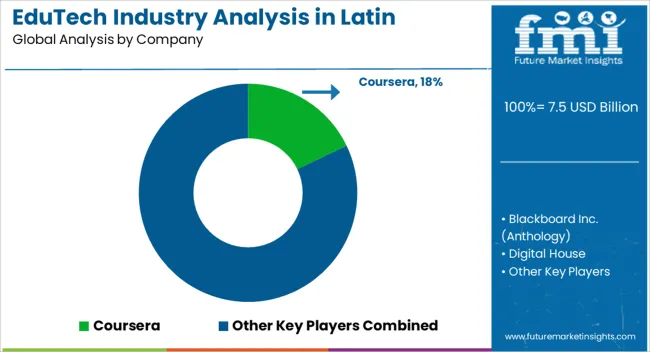

The global edutech industry analysis in latin america is estimated to be valued at USD 7.5 billion in 2025.

The market size for the edutech industry analysis in latin america is projected to reach USD 28.9 billion by 2035.

The edutech industry analysis in latin america is expected to grow at a 14.5% CAGR between 2025 and 2035.

The key product types in edutech industry analysis in latin america are hardware, _interactive whiteboard, _ar/vr devices, _smart projectors, _webcasting devices, _others, software, _learning management system platform, _virtual classroom software, _others, services, _professional services and _managed learning services.

In terms of end-user, academic institution segment to command 55.3% share in the edutech industry analysis in latin america in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Cloud ERP Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Wind Turbine Industry Analysis in Latin America Growth - Trends & Forecast 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Hyperscale Cloud Industry Market Trends – Growth & Forecast 2024-2034

Cloud Backup Service Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Fintech as a Service Market Analysis – Growth & Trends 2024-2034

Walk-in Cooler & Freezer Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Digital Marketing Analytics Industry Analysis in Latin America Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Aqua Feed Additives Market Trends – Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA