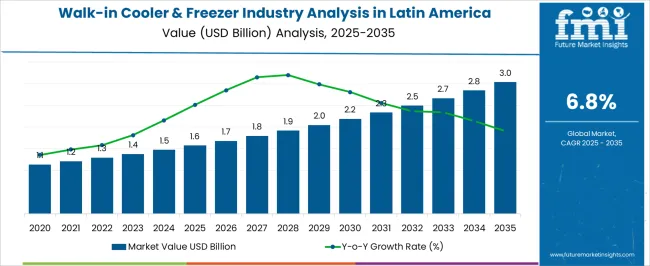

The Walk-in Cooler & Freezer Industry Analysis in Latin America is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 3.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

The walk-in cooler and freezer industry in Latin America is experiencing steady growth, supported by the expansion of the foodservice sector, retail modernization, and the growing need for reliable cold storage solutions. Rising consumer demand for frozen and perishable goods has accelerated the deployment of advanced refrigeration systems across supermarkets, restaurants, and logistics hubs.

Technological improvements in insulation, temperature control, and energy efficiency have further enhanced product performance. The regional market benefits from increased investment in food processing and cold chain infrastructure, particularly in emerging economies.

Additionally, the adoption of self-contained and modular units has improved installation flexibility and maintenance efficiency. With continued urbanization and expansion of organized retail, the Latin American walk-in cooler and freezer industry is expected to maintain stable growth through the forecast period.

| Metric | Value |

|---|---|

| Walk-in Cooler & Freezer Industry Analysis in Latin America Estimated Value in (2025 E) | USD 1.6 billion |

| Walk-in Cooler & Freezer Industry Analysis in Latin America Forecast Value in (2035 F) | USD 3.0 billion |

| Forecast CAGR (2025 to 2035) | 6.8% |

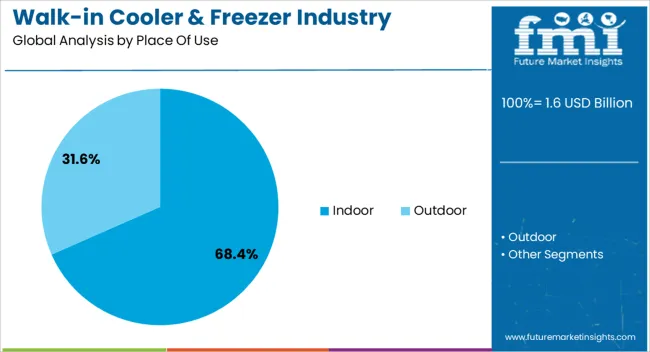

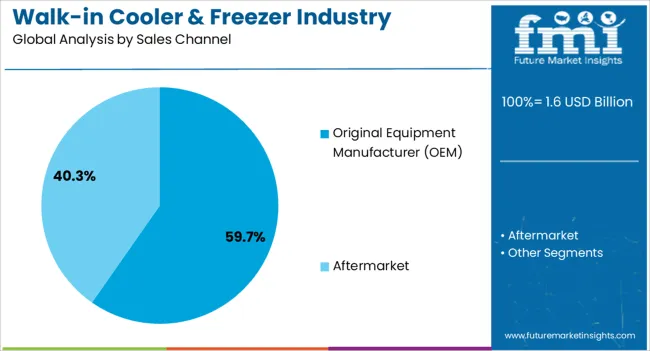

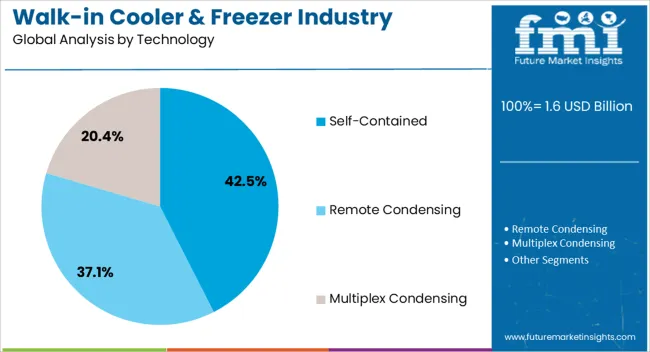

The market is segmented by Place Of Use, Sales Channel, Technology, and End Use and region. By Place Of Use, the market is divided into Indoor and Outdoor. In terms of Sales Channel, the market is classified into Original Equipment Manufacturer (OEM) and Aftermarket. Based on Technology, the market is segmented into Self-Contained, Remote Condensing, and Multiplex Condensing. By End Use, the market is divided into Retail Food Services, Cold Storage Warehouse, Breweries, Commercial Kitchen & Restaurants, Pharmaceuticals, Research Laboratories, and Hospitals & Mortuaries. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The indoor segment dominates the place of use category, holding approximately 68.4% share, driven by its suitability for commercial kitchens, retail outlets, and storage facilities requiring controlled environments. Indoor installations benefit from better temperature stability, reduced exposure to weather conditions, and ease of integration into existing building layouts.

The segment’s growth is further supported by foodservice operators prioritizing efficient space utilization and energy management.

With increasing demand for on-site storage in urban areas and regulatory emphasis on food safety, indoor units are expected to continue leading adoption across the region.

The original equipment manufacturer (OEM) segment leads the sales channel category with approximately 59.7% share, reflecting the dominance of direct supply arrangements with retailers, restaurants, and distributors. OEMs offer customized design solutions, ensuring optimized energy efficiency and operational reliability.

Their ability to provide end-to-end solutions including installation and maintenance services enhances customer loyalty. The segment benefits from strategic partnerships between manufacturers and regional distributors that strengthen aftersales support.

With the expansion of cold chain networks and ongoing replacement demand for legacy systems, OEM sales are projected to remain the leading channel.

The self-contained segment accounts for approximately 42.5% share of the technology category, supported by its plug-and-play functionality and ease of maintenance. These systems integrate refrigeration components within a single unit, simplifying installation and reducing downtime.

The segment’s popularity has grown due to rising demand from small and medium-sized foodservice establishments seeking efficient and space-saving solutions. Improvements in compressor technology and refrigerant management have enhanced system performance and sustainability.

With increasing preference for flexible and low-maintenance refrigeration options, self-contained systems are expected to maintain their competitive advantage.

Sales of walk-in coolers & freezers recorded a CAGR of 3.2% between 2020 and 2025. The total industry size accounted for USD 1,383.7 million in 2025.

Latin America is expected to evolve with changing consumer preferences and industry dynamics, presenting opportunities for many businesses requiring cold storage solutions, such as commercial food chains, pharmaceuticals & healthcare, cold storage warehouses, etc.

| Historical CAGR (2020 to 2025) | 3.2% |

|---|---|

| Forecast CAGR (2025 to 2035) | 6.8% |

Future Scope: Increased demand for ready-to-eat meals and frozen foods is expected to drive walk-in coolers & freezer adoption in convenience stores and supermarkets owing to the rising urbanization & busy lifestyle. The trend of online grocery delivery is booming, impacting the industry positively for walk-in coolers & freezers in LATAM. These services add flexibility and recurring revenue, facilitating easier penetration in Latin America.

Increasing Focus on the Agricultural Sector:

Substantial growth of the agricultural sector is a pivotal factor contributing to the growth of the walk-in cooler and freezer in LATAM. The region's vast agricultural output, including fruits, vegetables, and meat products, requires a sophisticated cold chain infrastructure for storage and transportation to prevent spoilage and contamination. Walk-in refrigeration systems play a critical role in maintaining the quality and freshness of these agricultural products, prompting heightened adoption within this sector.

Government & Private Companies' Investments in Cold Chain Facilities:

Rising government and private investments in commercial refrigeration in Latin America to improve the overall infrastructure for storage and distribution. Cold chain investments also benefit the agricultural sector by reducing post-harvest losses. This support is also encouraging farmers and producers to adopt better storage practices, increasing the overall demand for walk-in cooler & freezer.

Growing Demand in the Retail Industry:

Rising urbanization is driving the demand for quick and easy access to a variety of fresh and frozen products at a single stop. This shift is propelling the requirement for efficient coolers and freezers in supermarkets and convenience stores, also driven by a need to comply with food safety regulations, ensuring that food products meet quality standards throughout the supply chain.

The Need for Precise Temperature Control for Pharmaceutical Products

A pivotal driver of walk-in cooler & freezer demand is the imperative need for precise temperature control, particularly driven by the stringent requirements to uphold the efficiency of pharmaceutical products. The pharmaceutical industry relies heavily on maintaining specific temperature ranges for storing medications and vaccines to ensure their stability and effectiveness. This necessity propels the demand for advanced cooling solutions, such as walk-in coolers and freezers equipped with cutting-edge temperature control technology.

These solutions not only safeguard the integrity of pharmaceuticals but also cater to the broader healthcare sector, creating a significant demand. Furthermore, as healthcare infrastructure in Latin America continues to expand, the call for reliable and sophisticated cooling systems is anticipated to witness sustained growth, bolstering the overall demand for the walk-in chiller freezer industry in LATAM.

High Replacement Sales Due to Outdated Equipment Standards

As industries across the region strive to modernize their infrastructure, many businesses in sectors such as retail food services, cold storage warehouses, and commercial kitchens find themselves compelled to upgrade their existing walk-in refrigeration systems.

The push for compliance with evolving industry standards, technological advancements, and the need for energy-efficient solutions contribute to a surge in replacement sales. End users are seeking cutting-edge walk-in coolers and freezers that not only adhere to the latest standards but also offer improved performance, reducing operational costs and environmental impact.

High Rate of Compressor Failure

Several factors, including irregular maintenance practices, power fluctuations, and environmental conditions, can cause the malfunction of compressors, leading to disruptions in the cooling systems and resulting in temperature inconsistencies. The frequency of compressor failures not only poses operational challenges for businesses relying on these refrigeration units but also increases maintenance costs and downtime.

Another factor limiting the adoption of industrial refrigeration in Latin America is limited access to skilled technicians for timely repairs and replacements. Addressing this restraint requires focusing on improving maintenance protocols, enhancing technical expertise in the field, and investing in advanced technologies that offer more reliable and durable compressors.

The table below shows the estimated shares of the top two countries. Brazil and Mexico are set to record higher CAGRs of 6.8% and 7.1%, respectively, through the forecast period 2025 to 2035.

| Countries | CAGR (2025 to 2035) |

|---|---|

| Brazil | 6.8% |

| Mexico | 7.1% |

Brazil is estimated to hold a significant share of 48.2% in 2025 and is expected to continue its dominance throughout the forecast period, growing at a steady rate of 6.8%. The sales of walk-in coolers & freezers in Brazil are anticipated to grow from USD 1.6 million in 2025 to USD 1,366.9 million by 2035.

The following factors are driving Brazil walk-in coolers & freezers sales:

Mexico commands a substantial presence as the leading country for warehousing, holding around 30% of the overall regional share in 2025. Mexico is expected to play a pivotal role in driving significant growth and opportunities for walk-in coolers & freezers by following a 7.1% CAGR through 2035. It is expected to remain among the top two countries of walk-in coolers & freezers in Latin America, with expected valuations of USD 860.0 million by 2035.

Growth of the pharmaceutical industry, a hub for manufacturing and industrial activities, interest, and investments from global players in Mexico signifies the region's potential growth owing to a favorable environment in Mexico to expand their operations and cater to the growing demand for walk-in coolers & freezers.

As per the analysis, commercial kitchens & restaurants hold a share of 32.4% in 2025. It is projected to reach a size of USD 3 million by 2035, with a steady growth rate of 6.2% during the forecast period.

| Top Segment by End Use | Commercial Kitchen & Restaurants |

|---|---|

| CAGR (2025 to 2035) | 6.2% |

Demand for walk-in coolers and freezers in Latin America for commercial kitchens and restaurants is witnessing a notable upswing due to various contributing factors.

Based on technology, the self-contained category is anticipated to dominate over other technologies till 2035. It is set to exhibit a CAGR of 6.8% during the forecast period.

| Top Segment by Technology | Self-contained Cooling Technology |

|---|---|

| CAGR (2025 to 2035) | 6.8% |

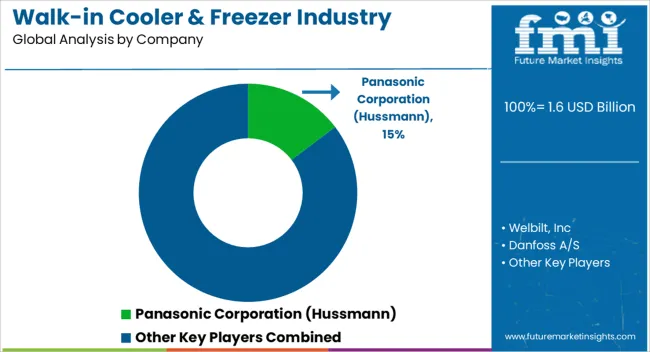

Latin America's competitive landscape is fragmented, with leading players accounting for about 15% to 25% of the market. The presence of established players from North America and Europe shows a competitive landscape with high-quality standards of walk-in coolers and freezers. Manufacturers are focusing on emphasizing research and development activities to introduce products with lower GWP and GHG emissions and modular designs to gain a competitive advantage.

Leading manufacturers are collaborating with research institutions and healthcare providers to understand and address their unique needs for temperature control. Meanwhile, new manufacturers are focusing on technological advancements in insulation materials and refrigeration systems catering to diverse temperature requirements, leading to a demand for specialized walk-in cooler & freezer. Also, they are highlighting the use of recycled materials and low-carbon manufacturing processes for the growing demand for green solutions.

Recent Developments

| Attribute | Details |

|---|---|

| Estimated Industry Size (2025) | USD 1,473.1 million |

| Projected Industry Size (2035) | USD 2,827.7 million |

| Anticipated Growth Rate (2025 to 2035) | 6.8% |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Value (USD million) and Volume (Units) |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Industry Segments Covered | Place of Use, Sales Channel, Technology, End Use, Country |

| Regions Covered | Latin America |

| Key Countries Covered | Brazil, Mexico, Argentina, Chile, Rest of LATAM |

| Key Companies Profiled | Panasonic Corporation (Hussmann); Welbilt, Inc; Danfoss A/S; USA Cooler; SRC Refrigeration; TMP Manufacturing Company; American Panel Corporation; Arctic Industries Inc.; Amerikooler LLC; Commercial Cooling - Par Engineering, Inc.; Thermo-Kool; Bally Refrigerated Boxes, Inc; Nor-Lake Inc.; Air Services & Refrigeration Specialties Inc; Refrigerator Manufacturers, Inc.; Everidge; Master-Bilt; Imperial Brown; Polar King. International, Inc. |

The global walk-in cooler & freezer industry analysis in latin america is estimated to be valued at USD 1.6 billion in 2025.

The market size for the walk-in cooler & freezer industry analysis in latin america is projected to reach USD 3.0 billion by 2035.

The walk-in cooler & freezer industry analysis in latin america is expected to grow at a 6.8% CAGR between 2025 and 2035.

The key product types in walk-in cooler & freezer industry analysis in latin america are indoor and outdoor.

In terms of sales channel, original equipment manufacturer (oem) segment to command 59.7% share in the walk-in cooler & freezer industry analysis in latin america in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Walk-in Services Market Growth – Trends & Forecast 2024-2034

Walk-In Cooler and Freezer Market Growth – Trends & Forecast 2024-2034

Walk-in Coolers and Freezers Market Size and Share Forecast Outlook 2025 to 2035

Water-cooled Walk-in Temperature & Humidity Chamber Market Size and Share Forecast Outlook 2025 to 2035

United States Walk-in Cooler and Freezer Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

EGR Coolers Market Size and Share Forecast Outlook 2025 to 2035

Air Coolers Market Trends - Size, Growth & Forecast 2025 to 2035

Foam Cooler Box Market Analysis - Growth & Trends 2025 to 2035

Wine Cooler Market - Trends, Growth & Forecast 2025 to 2035

Combi Cooler Market Growth – Trends & Forecast 2025 to 2035

Heater-Cooler Devices Market Size and Share Forecast Outlook 2025 to 2035

Flue Gas Coolers Market Size and Share Forecast Outlook 2025 to 2035

Back Bar Coolers Market Analysis - Demand & Growth Forecast 2025 to 2035

Insulated Coolers Market Insights - Growth & Forecast 2025 to 2035

Glass Door Coolers Market Insights – Growth & Forecast 2025 to 2035

Desert Air Cooler Market Growth - Size & Forecast 2025 to 2035

Charge Air Coolers Market

Premium Wine Cooler Market Analysis - Growth & Forecast 2025 to 2035

Railway After-Cooler Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA