From 2025 to 2035, the air coolers market is anticipated to witness substantial growth, driven by factors such as the upsurge in global temperatures, a growing consumer inclination towards energy-efficient solutions, and a rise in adoption of eco-friendly appliances. Based on type, air coolers represent the largest share, owing to the fact that they are a great economical and effective substitute for air conditioners, whose high power consumption and intricate installation make it difficult for them to be set up in offices and homes.

One of the key factors fueling the market growth is the rising need for cost-effective cooling solutions, particularly in developing economies. Air coolers also utilize evaporative cooling technology, made for less power consumption and maximizing the quality of air in-house as it adds a little moisture to the air; hence a good choice for dry and arid climates. Moreover, the increasing incorporation of IoT technology in air cooler systems, remote controlling features, and air cleansing systems to promote user benefit and augment market penetration is expected to fuel the market growth.

Urbanization and infrastructure spanning developing countries also drive market development. Carbon emissions, for example, have increased demand for climate control solutions as several locations have seen an influx of residential and commercial buildings over the years. More and more governments and environmental organizations are also suggesting appliances that help save an energy which can aid in reducing carbon footprints, leading consumers to go for air coolers as against traditional air conditioning systems.

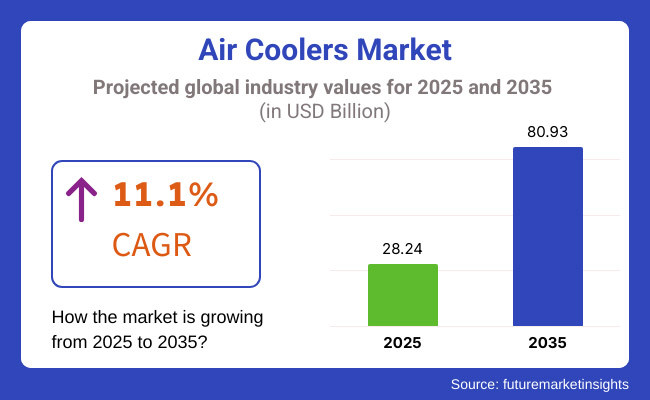

The air coolers market accounted for USD 28.24 billion in the year 2025 and is expected to reach USD 80.93 billion by the year 2035, at a CAGR of 11.1% during the forecast period.

The air coolers market in North America is growing at a moderate pace, with the United States and Canada leading the demand for air coolers. In dry regions of the Southwestern USA, consumers have increasingly sought air coolers as a more energy-efficient alternative to air conditioning. The shift towards sustainable and eco-friendly appliances is also contributing to the growth of the market.

Air coolers market is flourishing in Southern Europe, and countries like Spain, Italy, and Greece will continue to lead the sales. Demand for energy-efficient appliances in addition to the fact that governments are introducing laws to reduce energy consumption are fuelling market growth.

The air coolers market finds it’s most promising phase in Asia-Pacific, where nations like China, India, and other Southeast Asian countries are the largest consumers. High temperatures, a large population and increasing disposable incomes in the region are driving market growth. So if all this is not enough, rural areas with no access to the electricity grid are turning to solar-powered and battery-operated air coolers, as well.

Increasing temperature and urbanization are the key reasons contributing to rise in demand for air coolers in Latin America, particularly in Brazil and Mexico. Air coolers are the alternative to air-conditioning in case, the later machines are not quite affordable for the middle income families. But the penetration declines in very humid coastal areas.

The air coolers market in Middle East & Africa is driven by the increasing purchase of air coolers in countries, such as Saudi Arabia, the United Arab Emirates and South Africa. The growth is fueled by the region’s scorching heat and advocates’ push for energy-saving cooling solutions. This means air coolers can be a good solution for the dry region using evaporative cooling technology.

Challenges

Energy Consumption and Cooling Efficiency Limitations

Energy consumption and cooling efficiency challenges retail competition is from air conditioners, which can outcool at least under extremely hot and humid conditions where evaporative cooling is less effective. Users are also faced with operational challenges, such as water dependency for cooling, noise levels, and space limitations. To remain competitive, manufacturers must respond to the call for improved cooling performance, quieter operation, and water-efficient systems.

Opportunities

Rising Demand for Energy-Efficient and Eco-Friendly Cooling Solutions

The increasing need for energy-efficient further product used for energy conservation promotes the air coolers product demand as the substitute to use air conditioner. The high electricity costs coupled with government initiatives encouraging the use of energy-efficient electrical appliances are indirectly fuelling the sales of air coolers in the residential, commercial, and industrial applications. The industry is also experiencing the success of technologically advanced smart air coolers with added features like IoT-based systems, remote control, and improved techniques like multi-stage filtration and hybrid cooling systems.

From 2020 to 2024, the air coolers market saw a gradual increase, supported by growing urbanization, escalating temperatures, and economy-minded shoppers searching for low-cost cooling options. When it comes to the sales of air coolers, it was the introduction of e-commerce platforms and the growing demand for portable and smart air coolers that contributed to increased sales. Yet competition from ACs, restrictions in humid areas, and fear over water consumption were significant difficulties. To counter it, manufacturers all adapted the device with inverter technology, better fan design, and energy-efficient models to boost performance.

In terms of 2025 to 2035, the market will see huge technological developments in efficiency of cooling, environmental friendly refrigerants, and smart control systems. Artificial intelligence and internet of things (IoT) will allow cooling to be customized for users, solar-powered air coolers will grow in demand for off-grid and sustainable cooling solutions. Moreover, innovative hybrid cooling technologies, such as integration of evaporative cooling with dehumidification, will make air coolers much more usable in different climatic environments.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with energy efficiency regulations |

| Market Growth | Increased adoption in cost-sensitive markets |

| Industry Adoption | Focus on residential and small commercial applications |

| Technology Innovations | Development of inverter-based and smart air coolers |

| Market Competition | Dominance of established brands with affordable models |

| Sustainability and Efficiency | Initial efforts to enhance water and energy efficiency |

| Smart Cooling Integration | Limited adoption of IoT-enabled air coolers |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of eco-friendly cooling policies, stricter water consumption regulations |

| Market Growth | Growth in sustainable cooling solutions, solar-powered air coolers |

| Industry Adoption | Expansion into industrial and large-scale commercial cooling segments |

| Technology Innovations | AI-integrated cooling systems, hybrid evaporative-dehumidifier solutions |

| Market Competition | Entry of eco-friendly cooling startups and AI-powered smart cooling solutions |

| Sustainability and Efficiency | Large-scale implementation of solar, hybrid, and self-sustaining cooling technologies |

| Smart Cooling Integration | Advanced AI-powered cooling personalization, app-based climate control systems |

The USA air coolers market is growing steadily as a result of growing demand for energy-efficient cooling systems, increased environmental awareness, and advancing evaporative cooling technology. Given this, businesses and consumers are looking at cost-efficient, environmentally-friendly alternatives to traditional air conditioning units, especially as power prices soar.

The growing adoption of smart home technologies and Internet of Things (IoT) based cooling systems are also contributing towards the market expansion. As Los Angeles, Phoenix and Houston don’t even know the meaning of a record-high summer heat, the demand for portable and ducted air coolers are rising sharply Commercial air coolers are also being used in industries like agriculture, food processing, and data centers that require controlled environment and need to save on energy costs.

In addition, government initiatives to promote energy-efficient appliances and green building solutions are also driving adoption of evaporative coolers. Furthermore, growing apprehensions regarding carbon emissions and refrigerant-based cooling systems are changing consumer preferences to sustainable cooling technologies which involve water-based cooling mechanisms instead of harmful chemical refrigerants.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 11.5% |

The United Kingdom air coolers market is growing due to rising summer temperatures, the emphasis on energy-efficient cooling, and the less energy consumed when compared to more traditional air conditioning. UK used to simply use fans and air conditioning, but tastes are changing with evaporative cooling being considered as a more sustainable and cheaper alternative.

High electricity prices and preferences for natural cooling methods are fueling rising adoption of residential air coolers in large towns and cities such as London, Manchester and Birmingham. Moreover, commercial and industrial verticals like food processing plants, retail outlets, and office spaces are adopting air coolers to increase ventilation and manage thermal comfort without high energy consumption.

In addition, the UK government's commitment to sustainability and decarbonisation targets will help foster the development of low-energy cooling systems which favour evaporative air coolers in preference to conventional air conditioning.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 10.8% |

The EU air coolers market is expected to expand at a steady pace, driven by stringent energy efficiency regulations, rising summer heatwaves, and growing adoption of green cooling solutions. And in regions such as Germany, France, Spain, and Italy, demand is also growing for the industrial and residential air cooler.

EU Moves to curb carbon emissions through building efficiency, driving investments in evaporative cooling tech as a cleaner alternative to standard a/c furthermore, the rising trend of sustainable building and smart city projects is expected to propel the adoption of energy-efficient air coolers in Europe.

As hotter summers become a degree more common, consumers are increasingly looking for environmentally friendly, adaptable cooling systems for homes, commercial spaces and outdoor events that don’t waste too much power.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 11.0% |

The rapid growth of the air coolers market in Japan is attributed to increasing temperatures, growing energy conservation initiatives, and the development of compact cooling solutions. Evaporative air coolers are finding increasing use in residential, commercial, and industrial sectors with Japan’s energy efficiency initiatives favoring low-power cooling technologies.

The air coolers are now integrated with smart home tech with the introduction of Wi-Fi, voice control, and automatic cooling settings are also contributing towards the market. Furthermore, Japan's already established and efficient electronics sector is revolutionizing portable and multi-functional air cooling systems that are favourably substituting into air coolers due to their reduced power consumption than conventional air conditioners.

As knowledge of urban heat islands and energy sustainability has grown, so has the number of households and businesses turning to eco-friendly air coolers to provide indoor comfort while decreasing energy consumption.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 11.3% |

South Korea Air Coolers' market size is growing rapidly; in line with the soaring electricity cost, climate variability, and rising pressure to enhance smart cooling solutions. In urban apartments and high-density commercial spaces, consumers are actively on the lookout for cost-effective alternatives to air conditioning.

Demand for IoT-enabled air coolers with energy-saving capabilities is driving the growth of smart home appliances in South Korea. Additionally, they are supporting a proliferation of industrial air coolers across sectors like logistics, food processing, and electronics manufacturing that need care for ventilation and low-power consumption

The South Korean government is placing great emphasis on carbon neutrality and eco-friendly urban planning, which is also contributing to increased adoption of energy-efficient cooling systems in the region, spurring demand for advanced air coolers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 11.2% |

Desert coolers dominate the air coolers market due to their high cooling capacity and efficient operation in hot, dry conditions. So, these coolers cover large areas with significant cooling through high-powered fans and large water tanks for continuous and wide cooling which makes them well-suited for big homes/ commercial setups/ outdoor adaptable usages.

Desert cooler consumers opt for energy-efficient conventional compact desert coolers that provide higher air displacement at lower power consumption. The cooling capacity of an air conditioner is also influenced by innovative incorporations such as advanced cooling pads, inverter technology and IoT-based remote controls, with manufacturers leveraging them further to enhance performance with user convenience.

Furthermore, rising demand for sustainable cooling solutions has led to the rapid adoption of solar-powered and water-efficient desert coolers, especially in high-temperature and water-scarce regions. The proliferation of smart desert coolers with app-based controls and automated settings reinforce this segment's supremacy.

Tower cooler is growing rapidly in urban households and commercial offices because of its space-saving design, trendy looks, and high-airflow performance. Tower models differ from traditional air coolers as they provide vertical airflow, which allows them to provide even cooling in confined spaces without consuming additional space on the floor.

Demand for tower coolers offering digital displays, touch control and quiet operation has also increased due to preference for contemporary and elegant home appliances. Due to their portability and lightweight structure, they are one of the best choices for consumers who want moving portable cooling solutions.

Key manufacturers are also concentrating on improving the cooling performance by incorporating multi-stage air purification, advanced honeycomb cooling pads, and energy-efficient motors. This segment is further propelled by the proliferation of smart tower coolers possessing Wi-Fi and voice control technology.

Residential segment is the largest consumer of air coolers as growing preference of households for cost-effective and power saving substitute for air conditioners drives the market. Homeowners choose air coolers for their cost-effective operation, eco-friendliness and humidity regulated air delivery, especially in hot and dry climates.

This will accelerate the trend toward smart home appliances, prompting manufacturers to launch remote-controlled, Wi-Fi-based & automatic air coolers for residential use. Also, rise of concerns regarding indoor air quality is driving demand for air coolers with air purifying filters, offering benefits of cooling as well as improved air quality.

The commercial segment is the highest revenue contributor to the air coolers market, due to the high demand from offices, restaurants, educational institutions, and warehouses. Air cooler in a factory, the industrial air cooler is a choice by businesses as an economical method of cooling that helps to save on electricity in comparison to HVAC systems.

Large air coolers with sophisticated cooling technology designed for industrial and commercial spaces are ideal for stable temperature control in large spaces. Features includes custom configuration cooling, metal bodies, multiple fan airflow design to further improve their performance and longevity.

The case of air cooler market is constantly growing due to soaring global temperature coupled with the rising demand for energy-efficient cooling solutions, an increase in urbanization, and many more. This trend is driving innovations from evaporative cooling technique to IoT-enabled smart coolers, and hybrid air cooling systems. The companies ruling this space are focusing on high-efficiency airflow technology, intelligent temperature balancing, and environmentally sound, and refrigerant air conditioning techniques to enhance consumer experience while minimizing power utilization.

Market Share Analysis by Key Players & Cooler Technology Providers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Symphony Limited | 18-22% |

| Bajaj Electricals Ltd. | 14-18% |

| Honeywell International Inc. | 10-14% |

| LG Electronics Inc. | 8-12% |

| Havells India Ltd. | 5-9% |

| Others | 30-40% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Symphony Limited | Global leader in evaporative air coolers, offering IoT-enabled smart coolers, industrial air cooling solutions, and hybrid energy-efficient models. |

| Bajaj Electricals Ltd. | Specializes in home and commercial air coolers with advanced humidity control, remote operation, and low-power consumption technology. |

| Honeywell International Inc. | Focuses on high-capacity portable air coolers with eco-friendly refrigerant-free cooling solutions for industrial and residential applications. |

| LG Electronics Inc. | Develops hybrid air cooling systems combining advanced airflow control with IoT integration for enhanced cooling efficiency. |

| Havells India Ltd. | Offers high-performance air coolers with anti-bacterial filters, collapsible louvers, and energy-efficient cooling technology. |

Key Market Insights

Symphony Limited (18-22%)

With a wide range of cooling solutions like Evaporative technology, smart air coolers with AI based climate adaptation and environment friendly residential and industrial models, Symphony is the air coolers market leader in the world.

Bajaj Electricals Ltd. (14-18%)

Bajaj Electricals aims for energy efficient air cooler that has turbo hair throw, automatic water level indicator, and high performance cooling pads.

Honeywell International Inc. (10-14%)

Honeywell provides high-capacity air coolers for industrial, commercial, and residential use, integrating smart sensors for optimized cooling and humidity control.

LG Electronics Inc. (8-12%)

LG is expanding its portfolio of hybrid air cooling systems, incorporating IoT-enabled remote control, multi-directional airflow, and energy-efficient cooling technology.

Havells India Ltd. (5-9%)

Havells is a key player in compact and high-power air coolers with antimicrobial air filtration, collapsible louvers, and durable cooling media for long-term efficiency.

Other Key Players (30-40% Combined)

The overall market size for air coolers market was USD 28.24 billion in 2025.

The air coolers market is expected to reach USD 80.93 billion in 2035.

The air coolers market will rise due to increasing consumer preference for energy-efficient cooling solutions, driven by the growing need for cost-effective alternatives to air conditioning, rising temperatures due to climate change, and the expanding presence of portable and smart air cooling systems. Additionally, the shift toward eco-friendly cooling technologies, the integration of advanced features such as IoT connectivity and hybrid cooling mechanisms, and the rising demand from residential and commercial sectors for sustainable cooling solutions will further propel market growth during the forecast period.

The top 5 countries which drives the development of air coolers market are USA, European Union, Japan, South Korea and UK.

Desert cooler demand supplier to command significant share over the assessment period.

Table 01: Global Market Value (US$ Billion) Forecast, By Product Type, 2017 to 2032

Table 02: Global Market Volume (Units) Forecast, By Product Type, 2017 to 2032

Table 03: Global Market Value (US$ Billion) Forecast, By Application, 2017 to 2032

Table 04: Global Market Volume (Units) Forecast, By Application, 2017 to 2032

Table 05: Global Market Value (US$ Billion) Forecast, By Sales Channel, 2017 to 2032

Table 06: Global Market Volume (Units) Forecast, By Sales Channel, 2017 to 2032

Table 07: Global Market Value (US$ Billion) Forecast, By Region, 2017 to 2032

Table 08: Global Market Volume (Units) Forecast, By Region, 2017 to 2032

Table 09: North America Market Value (US$ Billion) Forecast, By Product Type, 2017 to 2032

Table 10: North America Market Volume (Units) Forecast, By Product Type, 2017 to 2032

Table 11: North America Market Value (US$ Billion) Forecast, By Application, 2017 to 2032

Table 12: North America Market Volume (Units) Forecast, By Application, 2017 to 2032

Table 13: North America Market Value (US$ Billion) Forecast, By Sales Channel, 2017 to 2032

Table 14: North America Market Volume (Units) Forecast, By Sales Channel, 2017 to 2032

Table 15: North America Market Value (US$ Billion) Forecast, By Country, 2017 to 2032

Table 16: North America Market Volume (Units) Forecast, By Country, 2017 to 2032

Table 17: Latin America Market Value (US$ Billion) Forecast, By Product Type, 2017 to 2032

Table 18: Latin America Market Volume (Units) Forecast, By Product Type, 2017 to 2032

Table 19: Latin America Market Value (US$ Billion) Forecast, By Application, 2017 to 2032

Table 20: Latin America Market Volume (Units) Forecast, By Application, 2017 to 2032

Table 21: Latin America Market Value (US$ Billion) Forecast, By Sales Channel, 2017 to 2032

Table 22: Latin America Market Volume (Units) Forecast, By Sales Channel, 2017 to 2032

Table 23: Latin America Market Value (US$ Billion) Forecast, By Country, 2017 to 2032

Table 24: Latin America Market Volume (Units) Forecast, By Country, 2017 to 2032

Table 25: Europe Market Value (US$ Billion) Forecast, By Product Type, 2017 to 2032

Table 26: Europe Market Volume (Units) Forecast, By Product Type, 2017 to 2032

Table 27: Europe Market Value (US$ Billion) Forecast, By Application, 2017 to 2032

Table 28: Europe Market Volume (Units) Forecast, By Application, 2017 to 2032

Table 29: Europe Market Value (US$ Billion) Forecast, By Sales Channel, 2017 to 2032

Table 30: Europe Market Volume (Units) Forecast, By Sales Channel, 2017 to 2032

Table 31: Europe Market Value (US$ Billion) Forecast, By Country, 2017 to 2032

Table 32: Europe Market Volume (Units) Forecast, By Country, 2017 to 2032

Table 33: South Asia Market Value (US$ Billion) Forecast, By Product Type, 2017 to 2032

Table 34: South Asia Market Volume (Units) Forecast, By Product Type, 2017 to 2032

Table 35: South Asia Market Value (US$ Billion) Forecast, By Application, 2017 to 2032

Table 36: South Asia Market Volume (Units) Forecast, By Application, 2017 to 2032

Table 37: South Asia Market Value (US$ Billion) Forecast, By Sales Channel, 2017 to 2032

Table 38: South Asia Market Volume (Units) Forecast, By Sales Channel, 2017 to 2032

Table 39: South Asia Market Value (US$ Billion) Forecast, By Country, 2017 to 2032

Table 40: South Asia Market Volume (Units) Forecast, By Country, 2017 to 2032

Table 41: East Asia Market Value (US$ Billion) Forecast, By Product Type, 2017 to 2032

Table 42: East Asia Market Volume (Units) Forecast, By Product Type, 2017 to 2032

Table 43: East Asia Market Value (US$ Billion) Forecast, By Application, 2017 to 2032

Table 44: East Asia Market Volume (Units) Forecast, By Application, 2017 to 2032

Table 45: East Asia Market Value (US$ Billion) Forecast, By Sales Channel, 2017 to 2032

Table 46: East Asia Market Volume (Units) Forecast, By Sales Channel, 2017 to 2032

Table 47: East Asia Market Value (US$ Billion) Forecast, By Country, 2017 to 2032

Table 48: East Asia Market Volume (Units) Forecast, By Country, 2017 to 2032

Table 49: Oceania Market Value (US$ Billion) Forecast, By Product Type, 2017 to 2032

Table 50: Oceania Market Volume (Units) Forecast, By Product Type, 2017 to 2032

Table 51: Oceania Market Value (US$ Billion) Forecast, By Application, 2017 to 2032

Table 52: Oceania Market Volume (Units) Forecast, By Application, 2017 to 2032

Table 53: Oceania Market Value (US$ Billion) Forecast, By Sales Channel, 2017 to 2032

Table 54: Oceania Market Volume (Units) Forecast, By Sales Channel, 2017 to 2032

Table 55: Oceania Market Value (US$ Billion) Forecast, By Country, 2017 to 2032

Table 56: Oceania Market Volume (Units) Forecast, By Country, 2017 to 2032

Table 57: MEA Market Value (US$ Billion) Forecast, By Product Type, 2017 to 2032

Table 58: MEA Market Volume (Units) Forecast, By Product Type, 2017 to 2032

Table 59: MEA Market Value (US$ Billion) Forecast, By Application, 2017 to 2032

Table 60: MEA Market Volume (Units) Forecast, By Application, 2017 to 2032

Table 61: MEA Market Value (US$ Billion) Forecast, By Sales Channel, 2017 to 2032

Table 62: MEA Market Volume (Units) Forecast, By Sales Channel, 2017 to 2032

Table 63: MEA Market Value (US$ Billion) Forecast, By Country, 2017 to 2032

Table 64: MEA Market Volume (Units) Forecast, By Country, 2017 to 2032

Figure 01: Global Market Value (US$ Billion) and Volume (Units) Analysis, 2017 to 2032

Figure 02: Global Market Value (US$ Billion) and Volume (Units) Forecast 2022 to 2032

Figure 03: Global Market Value (US$ Billion) and Volume (Units), 2017 to 2032

Figure 04: Global Market Absolute $ Opportunity (US$ Billion) 2022 to 2032

Figure 05: Global Market Value (US$ Billion) and Volume (Units) Forecast 2022 to 2032

Figure 06: Global Market Value (US$ Billion) Analysis by Product Type, 2017 to 2032

Figure 07: Global Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 08: Global Market Y-o-Y Growth (%) Projections, By Product Type, 2022 to 2032

Figure 09: Global Market Attractiveness by Product Type, 2022 to 2032

Figure 10: Global Market Value (US$ Billion) Analysis by Application, 2017 to 2032

Figure 11: Global Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 12: Global Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2032

Figure 13: Global Market Attractiveness by Application, 2022 to 2032

Figure 14: Global Market Value (Units) Analysis by Sales Channel, 2017 to 2032

Figure 15: Global Market Volume (Units) Analysis by Sales Channel, 2017 to 2032

Figure 16: Global Market Y-o-Y Growth (%) Projections, By Sales Channel, 2022 to 2032

Figure 17: Global Market Attractiveness by Sales Channel, 2022 to 2032

Figure 18: Global Market Value (Units) Analysis by Region, 2017 to 2032

Figure 19: Global Market Volume (Units) Analysis by Region, 2017 to 2032

Figure 20: Global Market Y-o-Y Growth (%) Projections, By Region, 2022 to 2032

Figure 21: Global Market Attractiveness by Region, 2022 to 2032

Figure 22: North America Market Value (US$ Billion) Analysis by Country, 2017 to 2032

Figure 23: North America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 24: North America Market Y-o-Y Growth (%) Projections, By Country, 2022 to 2032

Figure 25: North America Market Attractiveness by Country, 2022 to 2032

Figure 26: North America Market Value (US$ Billion) Analysis by Product Type, 2017 to 2032

Figure 27: North America Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 28: North America Market Y-o-Y Growth (%) Projections, By Product Type, 2022 to 2032

Figure 29: North America Market Attractiveness by Product Type, 2022 to 2032

Figure 30: North America Market Value (US$ Billion) Analysis by Application, 2017 to 2032

Figure 31: North America Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 32: North America Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2032

Figure 33: North America Market Attractiveness by Application, 2022 to 2032

Figure 34: North America Market Value (Units) Analysis by Sales Channel, 2017 to 2032

Figure 35: North America Market Volume (Units) Analysis by Sales Channel, 2017 to 2032

Figure 36: North America Market Y-o-Y Growth (%) Projections, By Sales Channel, 2022 to 2032

Figure 37: North America Market Attractiveness by Sales Channel, 2022 to 2032

Figure 38: Latin America Market Value (US$ Billion) Analysis by Country, 2017 to 2032

Figure 39: Latin America Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 40: Latin America Market Y-o-Y Growth (%) Projections, By Country, 2022 to 2032

Figure 41: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 42: Latin America Market Value (US$ Billion) Analysis by Product Type, 2017 to 2032

Figure 43: Latin America Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 44: Latin America Market Y-o-Y Growth (%) Projections, By Product Type, 2022 to 2032

Figure 45: Latin America Market Attractiveness by Product Type, 2022 to 2032

Figure 46: Latin America Market Value (US$ Billion) Analysis by Application, 2017 to 2032

Figure 47: Latin America Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 48: Latin America Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2032

Figure 49: Latin America Market Attractiveness by Application, 2022 to 2032

Figure 50: Latin America Market Value (Units) Analysis by Sales Channel, 2017 to 2032

Figure 51: Latin America Market Volume (Units) Analysis by Sales Channel, 2017 to 2032

Figure 52: Latin America Market Y-o-Y Growth (%) Projections, By Sales Channel, 2022 to 2032

Figure 53: Latin America Market Attractiveness by Sales Channel, 2022 to 2032

Figure 54: Europe Market Value (US$ Billion) Analysis by Country, 2017 to 2032

Figure 55: Europe Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 56: Europe Market Y-o-Y Growth (%) Projections, By Country, 2022 to 2032

Figure 57: Europe Market Attractiveness by Country, 2022 to 2032

Figure 58: Latin America Market Value (US$ Billion) Analysis by Product Type, 2017 to 2032

Figure 59: Latin America Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 60: Latin America Market Y-o-Y Growth (%) Projections, By Product Type, 2022 to 2032

Figure 61: Latin America Market Attractiveness by Product Type, 2022 to 2032

Figure 62: Europe Market Value (US$ Billion) Analysis by Application, 2017 to 2032

Figure 63: Europe Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 64: Europe Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2032

Figure 65: Europe Market Attractiveness by Application, 2022 to 2032

Figure 66: Europe Market Value (Units) Analysis by Sales Channel, 2017 to 2032

Figure 67: Europe Market Volume (Units) Analysis by Sales Channel, 2017 to 2032

Figure 68: Europe Market Y-o-Y Growth (%) Projections, By Sales Channel, 2022 to 2032

Figure 69: Europe Market Attractiveness by Sales Channel, 2022 to 2032

Figure 70: South Asia Market Value (US$ Billion) Analysis by Country, 2017 to 2032

Figure 71: South Asia Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 72: South Asia Market Y-o-Y Growth (%) Projections, By Country, 2022 to 2032

Figure 73: South Asia Market Attractiveness by Country, 2022 to 2032

Figure 74: South Asia Market Value (US$ Billion) Analysis by Product Type, 2017 to 2032

Figure 75: South Asia Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 76: South Asia Market Y-o-Y Growth (%) Projections, By Product Type, 2022 to 2032

Figure 77: South Asia Market Attractiveness by Product Type, 2022 to 2032

Figure 78: South Asia Market Value (US$ Billion) Analysis by Application, 2017 to 2032

Figure 79: South Asia Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 80: South Asia Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2032

Figure 81: South Asia Market Attractiveness by Application, 2022 to 2032

Figure 82: South Asia Market Value (Units) Analysis by Sales Channel, 2017 to 2032

Figure 83: South Asia Market Volume (Units) Analysis by Sales Channel, 2017 to 2032

Figure 84: South Asia Market Y-o-Y Growth (%) Projections, By Sales Channel, 2022 to 2032

Figure 85: South Asia Market Attractiveness by Sales Channel, 2022 to 2032

Figure 86: East Asia Market Value (US$ Billion) Analysis by Country, 2017 to 2032

Figure 87: East Asia Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 88: East Asia Market Y-o-Y Growth (%) Projections, By Country, 2022 to 2032

Figure 89: East Asia Market Attractiveness by Country, 2022 to 2032

Figure 90: East Asia Market Value (US$ Billion) Analysis by Product Type, 2017 to 2032

Figure 91: East Asia Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 92: East Asia Market Y-o-Y Growth (%) Projections, By Product Type, 2022 to 2032

Figure 93: East Asia Market Attractiveness by Product Type, 2022 to 2032

Figure 94: East Asia Market Value (US$ Billion) Analysis by Application, 2017 to 2032

Figure 95: East Asia Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 96: East Asia Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2032

Figure 97: East Asia Market Attractiveness by Application, 2022 to 2032

Figure 98: East Asia Market Value (Units) Analysis by Sales Channel, 2017 to 2032

Figure 99: East Asia Market Volume (Units) Analysis by Sales Channel, 2017 to 2032

Figure 100: East Asia Market Y-o-Y Growth (%) Projections, By Sales Channel, 2022 to 2032

Figure 101: East Asia Market Attractiveness by Sales Channel, 2022 to 2032

Figure 102: Oceania Market Value (US$ Billion) Analysis by Country, 2017 to 2032

Figure 103: Oceania Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 104: Oceania Market Y-o-Y Growth (%) Projections, By Country, 2022 to 2032

Figure 105: Oceania Market Attractiveness by Country, 2022 to 2032

Figure 106: Oceania Market Value (US$ Billion) Analysis by Product Type, 2017 to 2032

Figure 107: Oceania Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 108: Oceania Market Y-o-Y Growth (%) Projections, By Product Type, 2022 to 2032

Figure 109: Oceania Market Attractiveness by Product Type, 2022 to 2032

Figure 110: Oceania Market Value (US$ Billion) Analysis by Application, 2017 to 2032

Figure 111: Oceania Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 112: Oceania Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2032

Figure 113: Oceania Market Attractiveness by Application, 2022 to 2032

Figure 114: Oceania Market Value (Units) Analysis by Sales Channel, 2017 to 2032

Figure 115: Oceania Market Volume (Units) Analysis by Sales Channel, 2017 to 2032

Figure 116: Oceania Market Y-o-Y Growth (%) Projections, By Sales Channel, 2022 to 2032

Figure 117: Oceania Market Attractiveness by Sales Channel, 2022 to 2032

Figure 118: MEA Market Value (US$ Billion) Analysis by Country, 2017 to 2032

Figure 119: MEA Market Volume (Units) Analysis by Country, 2017 to 2032

Figure 120: MEA Market Y-o-Y Growth (%) Projections, By Country, 2022 to 2032

Figure 121: MEA Market Attractiveness by Country, 2022 to 2032

Figure 122: MEA Market Value (US$ Billion) Analysis by Product Type, 2017 to 2032

Figure 123: MEA Market Volume (Units) Analysis by Product Type, 2017 to 2032

Figure 124: MEA Market Y-o-Y Growth (%) Projections, By Product Type, 2022 to 2032

Figure 125: MEA Market Attractiveness by Product Type, 2022 to 2032

Figure 126: MEA Market Value (US$ Billion) Analysis by Application, 2017 to 2032

Figure 127: MEA Market Volume (Units) Analysis by Application, 2017 to 2032

Figure 128: MEA Market Y-o-Y Growth (%) Projections, By Application, 2022 to 2032

Figure 129: MEA Market Attractiveness by Application, 2022 to 2032

Figure 130: MEA Market Value (Units) Analysis by Sales Channel, 2017 to 2032

Figure 131: MEA Market Volume (Units) Analysis by Sales Channel, 2017 to 2032

Figure 132: MEA Market Y-o-Y Growth (%) Projections, By Sales Channel, 2022 to 2032

Figure 133: MEA Market Attractiveness by Sales Channel, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Charge Air Coolers Market

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Air Measuring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA