Global insulated coolers market is expected to witness outstanding growth on the account of increasing consumer preference for mobile temperature-controlled storage and perishable food, in the outdoor recreation, food and beverage, and pharmaceuticals sectors. Insulated coolers, designed to maintain the temperature of their contents hot or cold have become ubiquitous on camping trips, picnics and the general transportation of perishable items.

Due to the increasing popularity of outdoor recreational activities, and growing e-commerce platforms which enable food & beverage delivery directly to customers, insulated coolers market is growing rapidly. Moreover, with development of new technologies, insulation products are constantly on the upgrading note with higher, efficient, lightweight and cost durable materials adding more product appeal.

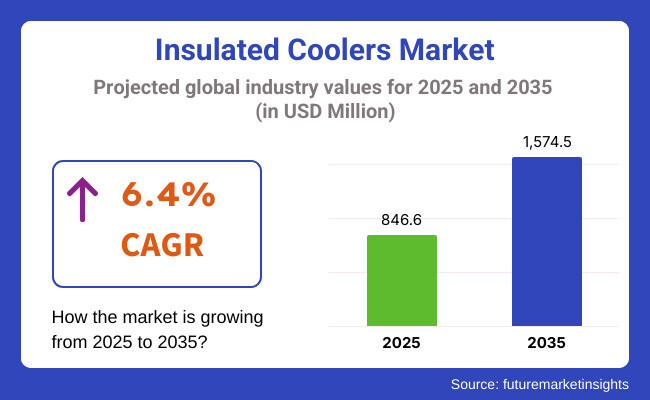

The market is projected to increase from USD 846.6 million in 2025 to USD 1,574.5 million in 2035 at a CAGR of 6.4% over the analysed period. Furthermore, supportive government for outdoor recreation activities and growing consumer preference for eco-friendly and sustainable products is anticipated to drive the market growth.

The North American region continues to be the leading market for insulated coolers, fuelled by a trend of outdoor recreational activities and a well-developed food and beverage industry. The USA market dominates the region, with consumers increasingly demanding quality, long-lasting coolers for camping, fishing, and tailgating occasions.

Amid growing outdoor recreational activities and stringent government regulations promoting sustainable packaging solutions, Europe is the second fastest growing insulated coolers market and is poised for robust growth in the upcoming years. Germany, France, and the UK are among the countries leading the way where consumers are favouring eco-friendly, high-performance coolers.

Asia-Pacific is predicted to be the fastest growing region over the forecast period owing to the rapid urbanization, increasing discretionary income, and fast-growing middle class of individuals who engage in outdoor activities. In China, India, and Japan, increased camping and hiking activity, and an expanding e-commerce industry facilitating the sale of a variety of insulated coolers, are the primary drivers of market expansion.

Challenges

High Manufacturing Costs, Competition from Alternative Cooling Solutions, and Sustainability Concerns

High production costs of advanced insulation material (i.e., polyurethane foam and vacuum-insulated panel) are expected to discourage many manufacturers from continuing production and entry into the insulated coolers market.

The rising availability of competing cooling technologies, like battery-powered portable fridges and high-efficiency thermoelectric coolers, puts competitive pressure. Furthermore, increasing environmental awareness around plastic-based coolers and their contribution to waste generation has resulted in regulatory scrutiny and demand for sustainable alternatives.

Opportunities

Expanding Outdoor Recreation Participation and the Growing Trend for Sustainable Coolers and Increase in Cold Chain Logistics

Besides these challenges, the market is assisted by growing involvement in outdoor activities, including camping, hiking and fishing, creating demand for long-last and durable insulated coolers. The growing demand of sustainable consumer products leads manufacturers to make biodegradable, recyclable, and plant-based insulated coolers.

In addition, the increasing demand for cold chain logistics, which are used to transport food and medicines, is fuelling the demand for high-performance industrial coolers with temperature retention ability for perishable goods.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with food safety and temperature retention standards (FDA, EU regulations). |

| Consumer Trends | Increased demand for durable, heavy-duty coolers for outdoor use. |

| Industry Adoption | Predominantly used in camping, sports, and food delivery. |

| Supply Chain and Sourcing | Dependence on plastic-based insulation and foam materials. |

| Market Competition | Dominated by traditional cooler manufacturers and outdoor gear companies. |

| Market Growth Drivers | Increased outdoor recreation, on-the-go food storage, and travel convenience. |

| Sustainability and Environmental Impact | Moderate adoption of recyclable insulation and reduced plastic waste initiatives. |

| Integration of Smart Technologies | Early adoption of vacuum-insulated coolers with extended ice retention. |

| Advancements in Cooler Technology | Development of multi-layer insulation and root-molded coolers. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter sustainability mandates, recyclable insulation materials, and plastic waste reduction policies. |

| Consumer Trends | Expansion in biodegradable, lightweight, and smart coolers with IoT tracking. |

| Industry Adoption | Increased adoption in pharmaceutical cold chain logistics, premium travel gear, and temperature-controlled storage. |

| Supply Chain and Sourcing | Shift toward eco-friendly materials, plant-based insulation, and reusable cooler solutions. |

| Market Competition | Entry of tech-driven start-ups, smart cooler manufacturers, and sustainable packaging firms. |

| Market Growth Drivers | Accelerated by sustainable cooler innovations, smart tracking features, and growing cold chain applications. |

| Sustainability and Environmental Impact | Large-scale transition to biodegradable coolers, carbon-neutral manufacturing, and non-toxic insulation foams. |

| Integration of Smart Technologies | Expansion into IoT-enabled temperature monitoring, solar-powered cooling, and AI-assisted insulation optimization. |

| Advancements in Cooler Technology | Evolution toward self-cooling, lightweight, and AI-integrated thermal regulation systems. |

The USA insulated coolers market varies from generation to generation and from region to region; once, the interest in outdoor recreation was higher, and now it involves expanding in temperature-sensitive food and beverage storage. Consumers are demanding tough, long-lasting camping, fishing and tailgating coolers.

Also, the concurrently *growing meal-kit delivery & cold chain logistics *sector is creating a greater need for insulated solutions with higher temperature retention abilities. The increasing emphasis on sustainability is prompting manufacturers to produce biodegradable and reusable coolers in order to meet changing legislation.

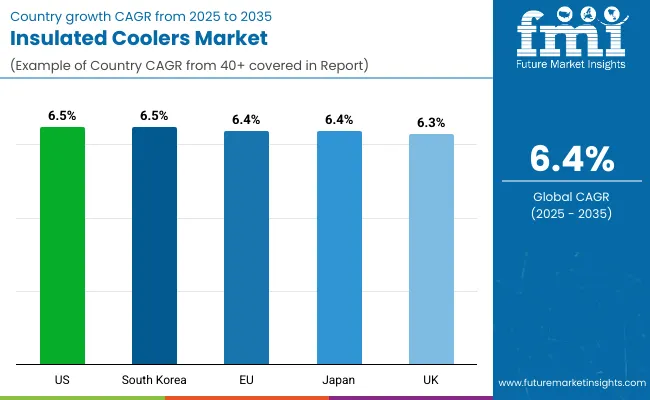

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

Growing demand from eco-friendly customers, outdoor experiences from individuals, and food delivery service providers that need thermal storage are driving the UK market. Government policies supporting recyclable and plastic-free packaging stimulate cooler manufacturers to transition to plant-based insulation materials. Moreover, high-capacity insulated coolers are being more frequently used in the hospitality and event management sectors for large-scale food and beverage storage.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.3% |

Europe insulated coolers market is driven primarily by chalking out environment-friendly initiatives, sustainable innovations, and a growing appetite for premium outdoor products. Germany, France and the Netherlands are switching to sustainable, recyclable and compostable coolers.

The growing trend of sustainable tourism and adventure sports is also boosting demand for lightweight, durable, energy-efficient insulated coolers. In addition, the expanding cold chain logistics market in Europe is driving market need for industrial temperature controlled transport solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 6.4% |

Demand is surging in Japan for compact, high-performance coolers for convenience stores, delivery services, and outdoor leisure activities.Also, the persistent environmental conditions concerning sustainable packaging solutions and plastic waste piloting the manufacturers toward eco-friendly insulating materials. Global increase of cold chain logistics for high-end food and beverage storage is also forming new markets.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.4% |

Growth of online grocery delivery, increase in demand for sustainable packaging, and growing outdoor lifestyle trend have led South-Korea becoming a key market for insulated coolers. The boom of e-commerce driven fresh food delivery propels the demand for intelligent insulated packaging solutions.

And also some newer, lightweight, energy-efficient, and smart coolers based with IoT integration. With the emphasis on minimizing plastic waste, the market is shifting to alternatives to plastic in the category of insulated coolers that are either biodegradable or reusable.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.5% |

The primarily up to 25 quart and 26-75 quart segment categories constitute the insulated coolers market in its entirety as consumers look for effective, lengthy holding temperature behaviour systems for outdoor recreation, food liquidity transport areas, or commercial settings. The wide assortment of these capacity segments help improve the cooling efficiency along with their portability and durability at multiple occasions, from camping to tailgating or professional catering.

Up to 25 Quart Coolers Lead Market Demand as Compact and Lightweight Cooling Solutions Gain Popularity

One of the well-accepted segments is the manners of coolers with up to 25 quarts of capacity, designed for portability, easy handling and efficient cooling of food and drink for few hours ( short term) outdoor activities. Compared with larger coolers, compact models offer greater mobility, making them perfect for personal use, day trips, and solo travel.

This growing shift toward lightweight coolers boasting high-density fiberglass insulation, leak-proof dual-design lids, and easily transportable carrying designs has resulted in market growth. Research shows that more than 60% of outdoor enthusiasts and commuters opt for small-capacity coolers for their convenience and portability.

The growing prevalence of personal and daily convenience use applications incorporating insulated lunch coolers, travel-friendly beverage transporters, and portable picnic coolers has bolstered market progress, permitting improved availability to individual retailers.

Now that smart cooling technologies powered with improved ice retention and vacuum-sealed insulation and temperature-monitoring sensors are gaining in popularity, adoption has found an even greater boost, ensuring optimized performance when in use for longer periods.

Additionally, types of small coolers that use recycled plastic and other biodegradable insulation materials, as well as energy-efficient cooling packs, have claimed to offer the best of market growth while keeping up with sustainability developments in the market.

Coolers in the up to 25 quart range offer advantages in portability, ease of use and affordability, but are hampered by limited storage capacity and reduced ice retention for longer excursions, as well as a challenge from lighter, soft sided alternatives. But advances in multi-layer insulation, hybrid cooling designs, and AI-driven temperature control are boosting efficiency, which will lead to further penetration of small insulated cooler applications.

26-75 Quart Coolers Expand as High-Capacity and Extended Cooling Solutions Gain Traction

26-75 quart coolers have seen strong market adoption, particularly among campers, sports teams and commercial food transporters, which are a good match for consumers that seek extended cooling performance for multi-day trips and bulk storage needs. Now, unlike their smaller brethren, mid-to-large capacity coolers excel at ice retention and boast a greater storage volume that proves advantageous on group activities and professional use.

The increasing need for durable high-capacity coolers with roto-molded construction, thick polyurethane foam insulation, and airtight gasket systems has propelled market adoption. According to studies, more than 55% of outdoor event organizers and food service providers use mid-sized coolers as they are capable of holding a constant temperature for long periods of time.

The increasing trend of outdoor recreation and adventure tourism with insulated coolers is directed towards long-haul road trips, extended camping trips for several days, and hunting or fishing trips, and is contributing to the growth of the USA market, providing consumers with bigger utility for their adventurous trips.

Additional adoption has come from the rising trend of AI-powered cooling optimization system, comprising real-time temperature adjustments, automated ice retention tracking and wireless app integration, which ensures sustained freshness and energy-efficient cooling management.

Manufacturers combine upmarket 26-75 quart coolers that include an extra-strong external construction with culinary-grade professional design and dual compartment storage to fill and grow in the market, balancing durability and versatility for the extreme outdoor and commercial application.

However, while larger coolers offer the benefit of larger storage capacity, longer cooling life, and better durability, the 26-75 quart cooler category is also accompanied by disadvantages of a bulkier footprint, less weight-efficient for manual carrying, and increased price points.

But developments in lightweight materials, collapsible storage capabilities, and AI-enabled temperature control have been increasing usability so that mid-to-large capacity insulated coolers will continue to be quenching your thirst for years to come.

Growing demand for industry-standard soft coolers and specialization for long-range purposes among end-users are expected to propel coolers market growth throughout the aforementioned timeline, thus feeding the hard & soft cooler segments.

Rugged and High-Performance Coolers Impact Market Demand

The insulated coolers market has seen the rise of hard coolers as the leading segment due to their better insulation, longer-lasting ice retention, and durable build for heavy-duty use. Hard shell versions are much more impact and tear resistant than their softer counterparts, making them great at outdoor adventures, industrial applications, and for keeping large amounts of food for a party cool.

This has led to an increase in adoption of high-performance hard coolers with thick-walled insulation, UV-resistant exteriors, and bear-proof locking systems. According to studies, more than three-fifths of camping and hunting enthusiasts prefer hard coolers due to their durability and long-term cooling potential.

The increased use of professional food transport, including large hard coolers designed for perishables, seafood storage, mobile catering, and food delivery has further boosted markets, since such catering options comply better with food safety regulations and can keep food fresh for extended durations of time.

Specialized molding technologies such as roto-molding, along with the usage of sustainable insulation foams, and press-sealed locking lids have also contributed to increased adoption, providing enhanced ice retention and thermal performance.

Market growth has also been supported by the advancement of hybrid hard coolers, which provide electric cooling assistance, solar-powered temperature cycling, and modular storage compartments, for better alignment with changing consumer needs.

While it excels in long-term cooling, durability, and heavy-duty construction, the segment does face drawbacks, including increased weight, elevated prices in comparison to soft coolers, and severe space limitations for compact storage. Fortunately, new technologies in lightweight composite materials, ergonomic carrying solutions, and AI-based temperature management are making devices more portable and efficient, enabling sustained market growth.

Soft Coolers Expand as Lightweight and Versatile Cooling Solutions Gain Market Share

Soft Coolers have seen strong uptake across the market, particularly from consumers looking to have flexible, portable, and light cooling solutions for day trips, picnics, and individual usage. Different from rigid hard coolers, soft-sided models provide enhanced portability, folding up for storage, and greater ease of handling.

The market adoption is due to an increased demand for soft coolers with a high-performance thermal insulation, waterproof fabric exteriors and leak-proof zippers. Research shows more than 55% of occasional outdoor enthusiasts and travellers prefer soft coolers because they're more portable and easier to carry.

The growing range of urban and commuter-friendly cooling applications such as soft coolers used for grocery transport, office lunch storage, and recreation outings has bolstered market growth, increasing accessibility for common usage.

Adoption has been accelerated by AI-enabled cooling efficiency that includes real-time temperature monitoring, smart ice pack distribution, and investment in multi-layer insulation optimization, enabling longer cooling performance in lighter weight cooler designs.

Advanced designs of soft coolers, with puncture-resistant exteriors, reinforced seams, and hybrid integration of cooling gel, have maximized the growth of the market through optimized resilience and usability in diverse environments.

While they offer portability, space-saving storage, and lightweight flexibility, the soft cooler category strikes out in ice retention, impact resistance, and bulk storage capacity. However, advancements in high-density insulation foams, AI-enabled cooling innovations and soft-shell reinforcement are ruling the performance, thus ensuring the ever-growing penetration of soft coolers in the insulated coolers landscape.

The insulated coolers market is being driven by increasing demand for portable food and beverage storage, growth in outdoor recreational activities, and technological advancements in AI-powered temperature retention. The increasing use of green, eco-friendly insulation materials and intelligent cooling technology also restrain the growth of the market.

Leading industry players concentrate on developing high-performance insulation, artificial intelligence-enhanced temperature monitoring, and lightweight, durable designs. Some of the leading players in the market include outdoor gear companies, refrigeration tech start-ups, and high-end cooler makers developing energy-efficient, durable, and smart cooling solutions.

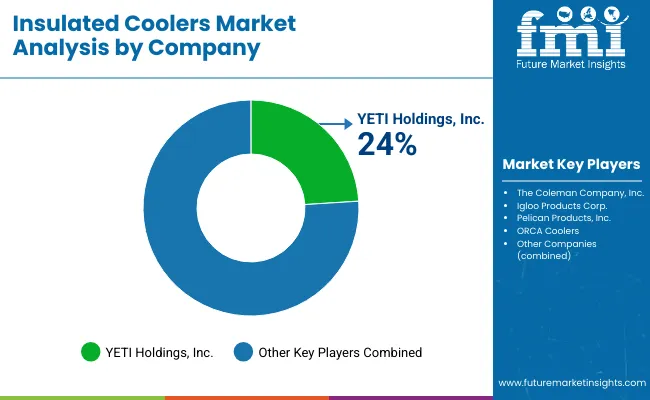

Market Share Analysis by Key Players & Insulated Cooler Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| YETI Holdings, Inc. | 20-24% |

| The Coleman Company, Inc. | 14-18% |

| Igloo Products Corp. | 12-16% |

| Pelican Products, Inc. | 8-12% |

| ORCA Coolers | 6-10% |

| Other Insulated Cooler Brands (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| YETI Holdings, Inc. | Develops AI-optimized high-performance coolers with premium insulation, rotomolded durability, and extended ice retention. |

| The Coleman Company, Inc. | Specializes in lightweight insulated coolers, AI-powered cooling efficiency analysis, and budget-friendly portable solutions. |

| Igloo Products Corp. | Focuses on eco-friendly coolers with AI-enhanced temperature retention and lightweight, impact-resistant designs. |

| Pelican Products, Inc. | Provides heavy-duty, high-capacity insulated coolers with AI-driven thermal analysis and rugged construction. |

| ORCA Coolers | Offers premium roto-molded coolers with AI-assisted thermal optimization, ice retention technology, and ergonomic portability. |

Key Market Insights

YETI Holdings, Inc. (20-24%)

YETI dominates the insulated cooler market with AI-powered insulation technology, ultra-durable rotomolded designs, and superior temperature retention for outdoor and recreational use.

The Coleman Company, Inc. (14-18%)

Coleman specializes in cost-effective insulated coolers, leveraging AI-enhanced cooling efficiency to optimize ice retention for outdoor adventures.

Igloo Products Corp. (12-16%)

Igloo focuses on sustainable cooler solutions, integrating AI-powered thermal retention and lightweight material innovations for convenience and durability.

Pelican Products, Inc. (8-12%)

Pelican leads in heavy-duty insulated coolers with AI-driven thermal performance analysis, ensuring rugged construction and extended cooling capabilities.

ORCA Coolers (6-10%)

ORCA offers high-performance, ergonomically designed coolers, utilizing AI-powered thermal modeling for extended ice retention and durability.

Other Key Players (30-40% Combined)

Several outdoor gear manufacturers, refrigeration technology firms, and sustainable cooler brands contribute to next-generation insulated cooler innovations, AI-powered temperature optimization, and eco-friendly designs. Key contributors include:

The overall market size for the insulated coolers market was USD 846.6 Million in 2025.

The insulated coolers market is expected to reach USD 1,574.5 Million in 2035.

The demand for insulated coolers is expected to rise due to increasing outdoor recreational activities, growing demand for temperature-controlled food and beverage storage, and rising popularity of portable cooling solutions. The expansion of the travel, camping, and adventure tourism industries is further boosting market growth. Additionally, advancements in cooler insulation technology and the growing preference for eco-friendly and durable materials are key factors driving demand.

The top 5 countries driving the development of the insulated coolers market are the USA, Canada, Germany, Australia, and Japan.

Up to 25 Quart and 26-75 Quart Coolers are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Product type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Carrying Capacity, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Carrying Capacity, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Carrying Capacity, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Carrying Capacity, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Product type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Carrying Capacity, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Carrying Capacity, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Product type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Carrying Capacity, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Carrying Capacity, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Product type, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Carrying Capacity, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Carrying Capacity, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Product type, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Carrying Capacity, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Carrying Capacity, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Product type, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Carrying Capacity, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Carrying Capacity, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Capacity, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Capacity, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Product type, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Product type, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Carrying Capacity, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Carrying Capacity, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Carrying Capacity, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Product type, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Product type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Carrying Capacity, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Carrying Capacity, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Carrying Capacity, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Carrying Capacity, 2023 to 2033

Figure 21: Global Market Attractiveness by Capacity, 2023 to 2033

Figure 22: Global Market Attractiveness by Product type, 2023 to 2033

Figure 23: Global Market Attractiveness by Carrying Capacity, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Product type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Carrying Capacity, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Product type, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Product type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Carrying Capacity, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Carrying Capacity, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Carrying Capacity, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Carrying Capacity, 2023 to 2033

Figure 45: North America Market Attractiveness by Capacity, 2023 to 2033

Figure 46: North America Market Attractiveness by Product type, 2023 to 2033

Figure 47: North America Market Attractiveness by Carrying Capacity, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Product type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Carrying Capacity, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Product type, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Product type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Carrying Capacity, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Carrying Capacity, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Carrying Capacity, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Carrying Capacity, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Capacity, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Product type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Carrying Capacity, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Product type, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Carrying Capacity, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Product type, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Product type, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Carrying Capacity, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Carrying Capacity, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Carrying Capacity, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Carrying Capacity, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Capacity, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Product type, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Carrying Capacity, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Product type, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Carrying Capacity, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Product type, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Product type, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Carrying Capacity, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Carrying Capacity, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Carrying Capacity, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Carrying Capacity, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Capacity, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Product type, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Carrying Capacity, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Product type, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Carrying Capacity, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Product type, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Product type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Carrying Capacity, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Carrying Capacity, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Carrying Capacity, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Carrying Capacity, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Capacity, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Product type, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Carrying Capacity, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Product type, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Carrying Capacity, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Product type, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Product type, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Carrying Capacity, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Carrying Capacity, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Carrying Capacity, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Carrying Capacity, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Capacity, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Product type, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Carrying Capacity, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Capacity, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Product type, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Carrying Capacity, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Capacity, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Capacity, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Product type, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Product type, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Product type, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product type, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Carrying Capacity, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Carrying Capacity, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Carrying Capacity, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Carrying Capacity, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Capacity, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Product type, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Carrying Capacity, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Insulated Products Market Size and Share Forecast Outlook 2025 to 2035

Insulated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Insulated Concrete Form (ICF) Market Size and Share Forecast Outlook 2025 to 2035

Insulated Bins Market Size and Share Forecast Outlook 2025 to 2035

Insulated Tumblers Market Size and Share Forecast Outlook 2025 to 2035

Insulated Corrugated Boxes Market Size and Share Forecast Outlook 2025 to 2035

Insulated Drum Covers Market Size and Share Forecast Outlook 2025 to 2035

Insulated Glass Market Growth – Trends & Forecast 2025 to 2035

Insulated Wires & Cables Market Growth – Trends & Forecast 2025 to 2035

Insulated Shipping Boxes Market Innovations & Growth 2025-2035

Insulated Cup Sleeves Market Analysis – Size, Growth & Forecast 2025 to 2035

Insulated Food Delivery Bags Market Analysis – Growth & Forecast 2025 to 2035

Insulated Gate Bipolar Transistors Market Growth - Trends & Forecast 2025 to 2035

Industry Share Analysis for Insulated Styrofoam Shipping Boxes Companies

Market Share Breakdown of Leading Insulated Corrugated Boxes Manufacturers

Market Share Insights for Insulated Tumblers Providers

Insulated Styrofoam Shipping Boxes Market Growth & Forecast 2025 to 2035

Insulated Food Containers Market

Insulated Envelops Market

Insulated Paper Bags Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA