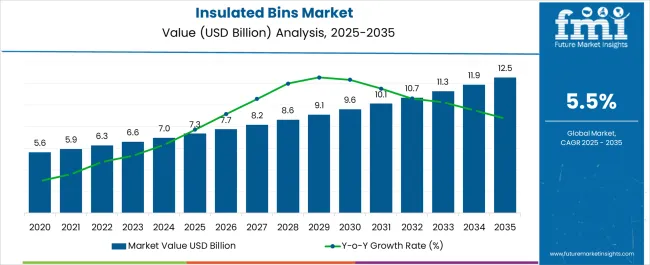

The Insulated Bins Market is estimated to be valued at USD 7.3 billion in 2025 and is projected to reach USD 12.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Insulated Bins Market Estimated Value in (2025 E) | USD 7.3 billion |

| Insulated Bins Market Forecast Value in (2035 F) | USD 12.5 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The insulated bins market is experiencing consistent growth due to rising demand for temperature controlled storage and transport solutions across multiple industries. Increasing focus on maintaining product integrity in perishable goods supply chains has been a key factor supporting adoption.

The integration of durable materials, improved insulation technologies, and ease of handling has further reinforced the market’s utility in both short haul and long haul applications. Stringent regulations governing food safety, pharmaceutical logistics, and cold chain operations have accelerated the deployment of insulated bins.

Moreover, advancements in lightweight designs, recyclability, and ergonomic handling features are strengthening market adoption. The outlook for the sector remains positive as industries seek sustainable, reusable, and reliable alternatives that enhance operational efficiency while aligning with global sustainability and safety standards.

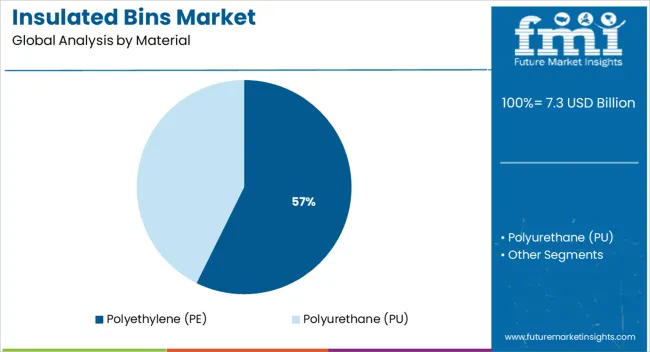

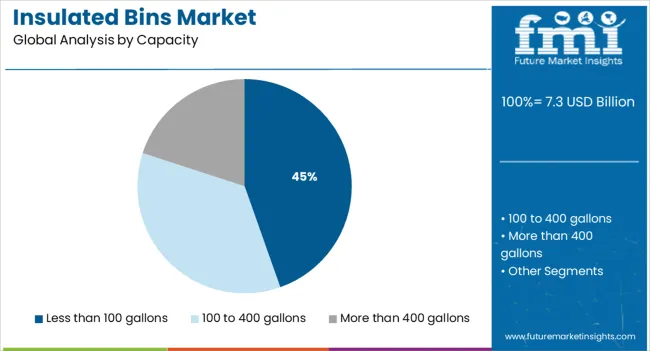

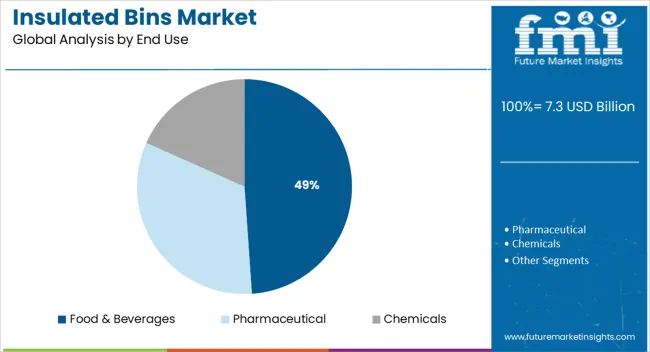

The market is segmented by Material, Capacity, and End Use and region. By Material, the market is divided into Polyethylene (PE) and Polyurethane (PU). In terms of Capacity, the market is classified into Less than 100 gallons, 100 to 400 gallons, and More than 400 gallons. Based on End Use, the market is segmented into Food & Beverages, Pharmaceutical, and Chemicals. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyethylene material segment is projected to represent 57.30% of total market revenue by 2025 within the material category, positioning it as the leading choice. This dominance is attributed to the durability, impact resistance, and cost effectiveness of polyethylene, which make it highly suitable for insulated bin production.

Its versatility across various operating temperatures and resistance to chemical degradation enhance its adoption in both food and industrial applications. The material’s recyclability and alignment with sustainability goals have also supported widespread use.

These factors together reinforce the leadership of polyethylene in the insulated bins market.

The less than 100 gallons capacity segment is expected to account for 44.60% of the overall market revenue by 2025, making it the dominant capacity range. This growth is driven by the increasing need for manageable, portable, and space efficient storage solutions in food service, fisheries, and retail supply chains.

The segment benefits from its suitability in small to medium scale operations where frequent handling, short distance transportation, and limited storage space are critical.

Its adaptability and ease of cleaning make it the preferred choice for quick turnaround usage, thereby reinforcing its position as the leading capacity format in the insulated bins market.

The food and beverages segment is projected to hold 48.90% of market revenue by 2025 under the end use category, making it the largest application sector. This growth is being supported by stringent food safety standards, rising consumption of fresh and frozen food products, and the expansion of global cold chain logistics.

Insulated bins are widely used to ensure temperature stability, prevent contamination, and extend shelf life during transport and storage. Additionally, the segment has benefited from growing consumer demand for ready to eat and packaged food items that require reliable preservation methods.

As a result, food and beverages remain the primary end use, driving the largest share of insulated bin adoption.

The global insulated bins market has anticipated a CAGR of 5.1% during the historic period with a market value of USD 7.3 billion in 2025.

The expanding e-commerce and online food delivery services has led to a higher demand for insulated bins to transport food safely and maintain the quality during delivery.

Expansion of e-commerce has led to an increase in the delivery of temperature-sensitive products, such as pharmaceuticals, fresh produce, and other perishable goods like seafood, temperature-sensitive drugs, meats. Insulated bins play an important role in maintaining the cold chain and ensuring that these products are delivered safely and in good condition.

The other factor which is influencing the growth of insulated bins market is to the rise in concern of environmental issues has led to an increase in demand for insulated bins as they help in reducing the carbon footprint by reducing the need for refrigerated transportation and storage. The insulated bins market is anticipated to experience a positive growth rate during the forecast period.

The expansion of food and pharmaceutical industries has led to an increased need for temperature-controlled storage and transportation which is driving the demand for insulated bins. Also increasing awareness of food safety, companies are more focused on ensuring that the products are stored and transported in the best possible conditions, driving demand for insulated bins.

The ease of trade between different countries has led to an increase in the shipping of perishable goods over longer distances, driving the demand for insulated bins as a means of ensuring that the goods reach the destination in good condition. Traditional refrigerated containers are more expensive than insulated bins and the cost of purchasing or leasing them become a significant barrier for many companies. The refrigerated containers are not as mobile as insulated bins.

It consume a significant amount of energy as compare to insulated bins, their limited range of sizes, which may not be possible to find the exact size needed for a particular shipment. This may result in inefficient use of space. Refrigerated containers contribute to carbon emissions, all these factors become the barrier for the many companies which desire to transport or store the temperature-sensitive goods.

Insulated bins are typically less expensive as compare to refrigerated containers, they are available in variety of sizes, and also they consume less energy as compare to traditional refrigerated containers. Also their environmental friendly nature add extra edge in the growth of insulated bins market.

The insulated bins are made available with IoT capabilities, such as sensors, GPS tracking and automated systems, which can be used for temperature monitoring, inventory management, and tracking the location of the bin which is also known as an Smart Insulated Bins.

The manufacturers are developing insulated bins that use biodegradable insulation materials, which can help reduce environmental impact. Also, the manufacturers are developing insulated bins that can be easily collapsed or folded down for storage and transportation, making them more convenient and space-efficient, known as collapsible insulated bins.

There are insulated bins that are equipped with automated systems such as opening and closing system, which can be controlled remotely which is called automated insulated bins. The development of advanced technology enabled and innovative insulated bins by the manufacturers creates growth opportunity for the target market.

The food & beverages segment is projected to reach the valuation of USD 7.3 billion by the end of 2025 in the global insulated bins market. Food industries carries high demand for insulated bins as the growth of the global food and beverage market, shows need for insulated bins has increased as many companies look to transport products over longer distances.

Consumers are increasingly demanding convenient, ready-to-eat food and beverage products, which can be stored and transported in insulated bins. Insulated bins help to reduce food waste by maintaining the quality and freshness of food products and extending their shelf life.

Foods like seafood, meats, ice-creams, juices consumption is uplifted in developed countries such as Germany, USA, France, Canada, etc. Ice-cream contributed the most sales of frozen food market. Also e-commerce has streamlined the supply chain for food and beverage products, reducing waste and increasing efficiency, which requires the use of insulated bins to maintain the temperature and quality of the products during transportation

Germany is projected to hold around 22% of the European insulated bins market by the end of 2025. According to the International Trade Administration (ITA), Germany is one of the biggest manufacturer and exporter of medicines and drugs in Europe. United States was by far the primary destination for German pharmaceuticals exports in 2024.

The global demand for medicines and drugs is growing, driven by an aging population, the rise of chronic diseases, and the increasing availability of treatments for previously untreatable conditions. Germany has access to raw materials that are used in the production of medicines and drugs, making it economically advantageous for them to export these products.

With the growing demand for exporting medicine and drugs within different regions, need to prevent temperature fluctuations that can damage medicines or reduce their potency. Also protect medicines from damage during transportation become necessity and need for insulated bins is uplifted.

The players operating in the insulated bins market are aiming at introducing new technology within insulated bins which is grabbing attention of the end use industries. Some of the development by the key players are:

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.5% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion, Volume in Units and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered |

Material, Capacity, End Use, Region |

| Regions Covered |

North America; Latin America; East Asia; South Asia & Pacific; Western Europe; Eastern Europe; Central Asia; Russia & Belarus; Balkan Countries; Baltic Countries; Middle East & Africa |

| Key Countries Covered |

USA, Canada, Mexico, Brazil, Germany, UK, France, Italy, Spain, Russia, China, Japan, India, GCC countries, Australia & New Zealand, South Africa |

| Key Companies Profiled |

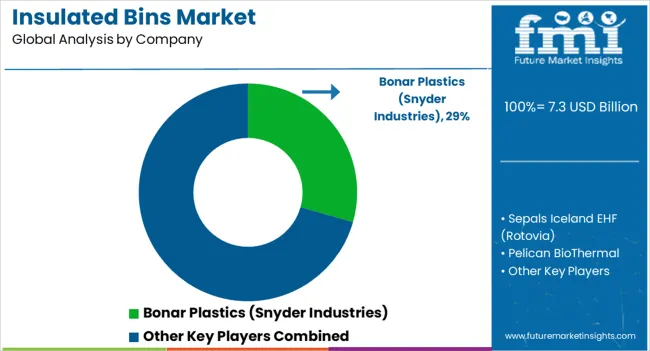

Bonar Plastics (Snyder Industries); Sepals Iceland EHF (Rotovia); Pelican BioThermal; Csafe Global LLC; Cold Chain Technologies; Sonoco TharmoSafe; Cryopak; Intelsius (DGP Company); Cascades Inc.; Transoplast Group; DACO Corporation; K.K Nag Pvt. Ltd.; Aristoplast Production Pvt.Ltd; IP-GROUP; NORAH Plastics; KRAUTZ - TEMAX Europe; Olivo; Polarplas (India) Private Limited |

| Customization & Pricing | Available upon Request |

The global insulated bins market is estimated to be valued at USD 7.3 billion in 2025.

The market size for the insulated bins market is projected to reach USD 12.5 billion by 2035.

The insulated bins market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in insulated bins market are polyethylene (pe) and polyurethane (pu).

In terms of capacity, less than 100 gallons segment to command 44.6% share in the insulated bins market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Insulated Products Market Size and Share Forecast Outlook 2025 to 2035

Insulated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Insulated Concrete Form (ICF) Market Size and Share Forecast Outlook 2025 to 2035

Insulated Tumblers Market Size and Share Forecast Outlook 2025 to 2035

Insulated Corrugated Boxes Market Size and Share Forecast Outlook 2025 to 2035

Insulated Drum Covers Market Size and Share Forecast Outlook 2025 to 2035

Insulated Glass Market Growth – Trends & Forecast 2025 to 2035

Insulated Wires & Cables Market Growth – Trends & Forecast 2025 to 2035

Insulated Shipping Boxes Market Innovations & Growth 2025-2035

Insulated Cup Sleeves Market Analysis – Size, Growth & Forecast 2025 to 2035

Insulated Coolers Market Insights - Growth & Forecast 2025 to 2035

Insulated Food Delivery Bags Market Analysis – Growth & Forecast 2025 to 2035

Insulated Gate Bipolar Transistors Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Leading Insulated Corrugated Boxes Manufacturers

Industry Share Analysis for Insulated Styrofoam Shipping Boxes Companies

Market Share Insights for Insulated Tumblers Providers

Insulated Styrofoam Shipping Boxes Market Growth & Forecast 2025 to 2035

Insulated Food Containers Market

Insulated Envelops Market

Insulated Paper Bags Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA