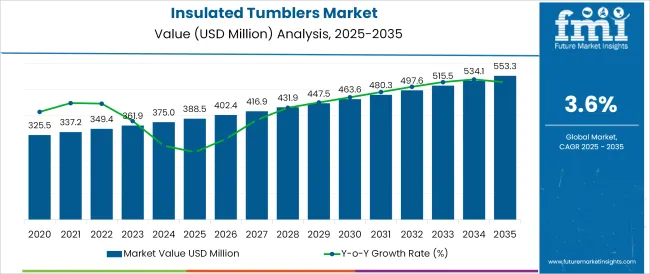

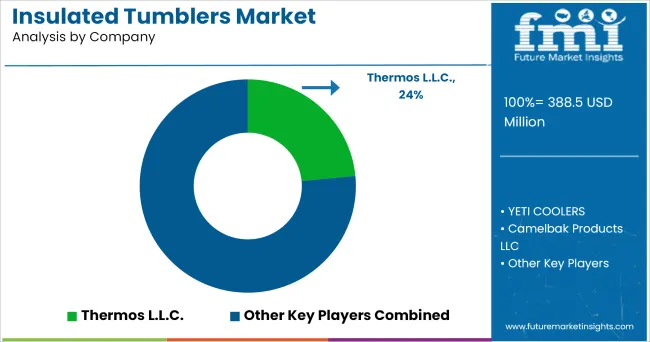

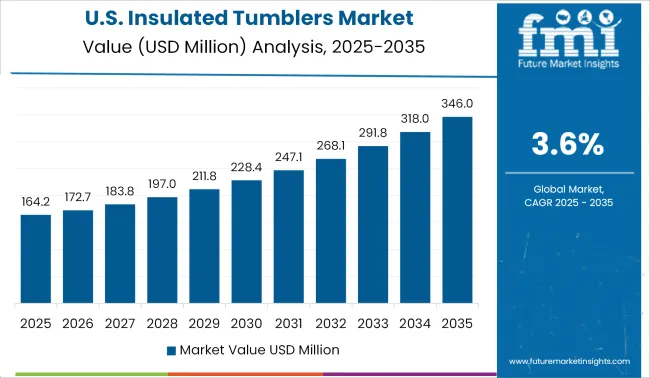

The Insulated Tumblers Market is estimated to be valued at USD 388.5 million in 2025 and is projected to reach USD 553.3 million by 2035, registering a compound annual growth rate (CAGR) of 3.6% over the forecast period.

The insulated tumblers market is witnessing sustained expansion, fueled by rising consumer demand for portable, reusable drinkware that maintains temperature integrity for extended durations. Increasing awareness around environmental sustainability has led to a shift away from single-use plastics toward durable, refillable solutions. Leading brands are focusing on double-wall vacuum insulation technologies that preserve hot and cold temperatures for longer periods, enhancing user experience.

The influence of health conscious and on the go lifestyles is also prompting greater demand for customizable, BPA-free tumblers that align with personal preferences and aesthetics. With coffee culture, wellness routines, and hydration tracking gaining traction, insulated tumblers have evolved into both functional and fashion-forward accessories.

E-commerce platforms, corporate gifting programs, and outdoor recreational trends are further expanding market penetration. Moving forward, advancements in insulation materials, ergonomic design, and personalization technologies are expected to reinforce the product’s utility across every day, fitness, and professional use cases.

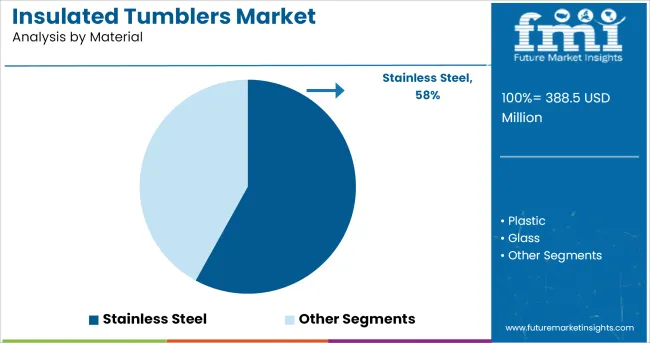

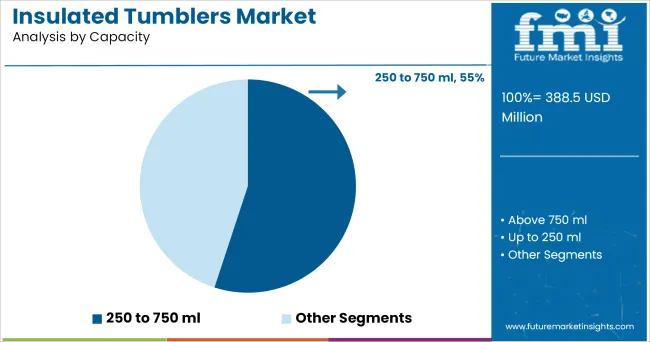

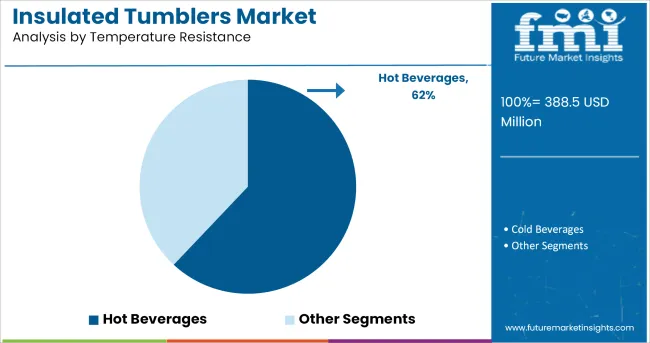

The market is segmented by Material, Capacity, and Temperature Resistance and region. By Material, the market is divided into Stainless Steel, Plastic, and Glass. In terms of Capacity, the market is classified into 250 to 750 ml, Above 750 ml, and Up to 250 ml. Based on Temperature Resistance, the market is segmented into Hot Beverages and Cold Beverages.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Stainless steel tumblers are projected to command 58.0% of total revenue in the material segment by 2025, making it the leading choice among consumers. This dominance is driven by stainless steel’s superior insulation properties, durability, and resistance to corrosion making it ideal for both hot and cold beverage retention.

Its ability to maintain structural integrity under various temperature conditions has made it highly preferred across diverse use environments from workplaces to outdoor settings. Stainless steel is also perceived as a premium material, enhancing product appeal in both mainstream and high-end markets.

With growing demand for sustainable, non-toxic, and long-lasting materials, stainless steel aligns with evolving environmental standards and consumer values. Moreover, its compatibility with engraving, powder-coating, and colour customization has reinforced its relevance in both retail and promotional product segments, ensuring continued leadership in the insulated tumblers market.

The 250 to 750 ml capacity range is forecast to hold 55.0% of the total market revenue in 2025, making it the most preferred size category among consumers. This segment’s popularity stems from its versatility, portability, and optimal fit for daily hydration needs coffee servings, and smoothie portions

The size range is well-suited for standard cup holders backpack pockets, and work desk use enhancing convenience in both professional and recreational environments. Manufacturers have prioritized this range for mass production due to favourable volume-to-weight ratios, which reduce material usage while maintaining insulation performance.

Additionally, consumer preference for lightweight, easy-to-carry tumblers that align with fast-paced routines has further boosted adoption. Branding initiatives, health and fitness trends, and lifestyle merchandising have all centred on this volume category, reinforcing its status as the market’s core capacity standard.

Hot beverage use is expected to account for 62.0% of the total revenue in the temperature resistance category by 2025, maintaining its position as the dominant application. This segment’s leadership is fueled by the global surge in coffee and tea consumption, with consumers seeking temperature-stable drinkware that prevents spills, maintains warmth, and enhances flavour retention.

Technological improvements in vacuum insulation and lid design have enabled tumblers to preserve beverage temperature for hours, aligning with commuting office, and travel routines. Furthermore, rising demand for safe and reusable alternatives to paper cups and polystyrene containers has accelerated market movement toward insulated solutions tailored for hot beverages.

As café culture expands and consumers prioritize comfort and convenience in beverage consumption, hot beverage-resistant tumblers are expected to remain the core revenue driver for manufacturers and retailers alike.

The insulated tumblers are made from high-quality food-grade stainless steel, which is highly durable and unbreakable. It has an electro-polished interior, ensuring that the tumbler remains pure and rust-free, imparting no flavours. Its spill-proof lid comes with a removable rubber gasket to prevent it from spilling and is leak-proof.

The insulated tumbler has a vacuum double wall design, which ensures good insulation. The unique double-wall vacuum insulation technology protects the temperature for hours and keeps cold beverages ice-cold up to 24 hours and hot drinks warm over six hours.

Additionally, its wide mouth opening allows easy access to the surface base helps for easy cleaning. Its superior double powder coating provides additional grip helps in easy to hold and carry. The attractive and visually appealing shape and design grab the customer’s attention and are comfortable and portable to carry in hand.

Therefore, the emerging trend of the most flexible, convenient, and safe packaging solution among consumers will enhance the.

The insulated tumblers are highly preferred during traveling, outings, and sports activities. The portable and handy insulated tumblers are favoured in outdoor camping, hiking, biking, and shopping due to their excellent convenience, high quality, and earth-friendly qualities. Nowadays, outings and traveling is increasing tremendously.

Even due to busy lifestyles, on-the-go liquid food ordering is also growing. Today, with growing quick-service restaurants and fast food service of restaurants and cafes, the insulated tumblers are gaining attractiveness owing to their outstanding ability to retain the drink hot or cold for a longer duration.

Therefore, the changing consumer’s choice and habits for the most secure, safe, and sustainable packaging solution will drive the insulated tumblers market.

The double-walled, vacuum-sealed insulated tumbler keeps the drink hot or cold for hours. The growing trend and preference for customized printing will create excellent marketing potential. The customized printing on the insulated tumbler will showcase the company’s logo and maximum message visibility.

Furthermore, the insulated tumblers are safe, convenient, and easy to carry. Nowadays, the trend of celebrating birthdays, anniversaries, special days is gaining popularity. Personalized insulated tumblers are favoured as a perfect gift by consumers because of their excellent features and functionality. Therefore, the eye-catchy colours and design with customized printing will generate an insulated tumblers market.

A few printing processes like screen printing, 3D printing, sublimation printing, and embossing will enhance the insulated tumblers’ aesthetic look and visual appearance but these processes increase the overall production cost which directly impacts the price of product in the market. It is expected to restrain the market for insulated tumblers.

Key players such as:

are actively involved in insulated tumblers market for different applications.

Key Asian players such as:

are actively involved in insulated tumblers market for different applications.

The manufacturers involved in manufacturing insulated tumblers s adopt various strategies such as innovation and product launch to serve the increasing demand for the insulated tumblers market.

Retaining the quality, taste, and flavour for a longer duration is the utmost priority for food packaging. Due to long busy working hours and hectic lifestyles in the USA, people prefer the ready-to-drink and outside food ordering.

The USA has the world’s most prominent food outlets. The rising popularity of quick-service restaurants, cafes, and foodservice restaurants is opting for temperature-controlled and safe packing solutions to cater to the growing demand for the fastest and secure food delivery. Consumers prefer the most secure and safe food packaging due to the rising concern for health, sanitation, and hygiene.

Furthermore, with the USA’s growing outdoor sporting activities and outings, people prefer the most convenient and reliable packaging. Therefore, by considering these inherent capabilities, the insulated tumbler will showcase significant growth in the USA market.

The global insulated tumblers market is estimated to be valued at USD 388.5 million in 2025.

The market size for the insulated tumblers market is projected to reach USD 553.3 million by 2035.

The insulated tumblers market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in insulated tumblers market are stainless steel, plastic and glass.

In terms of capacity, 250 to 750 ml segment to command 55.0% share in the insulated tumblers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Insights for Insulated Tumblers Providers

Insulated Products Market Size and Share Forecast Outlook 2025 to 2035

Insulated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Insulated Concrete Form (ICF) Market Size and Share Forecast Outlook 2025 to 2035

Insulated Bins Market Size and Share Forecast Outlook 2025 to 2035

Insulated Corrugated Boxes Market Size and Share Forecast Outlook 2025 to 2035

Insulated Drum Covers Market Size and Share Forecast Outlook 2025 to 2035

Insulated Glass Market Growth – Trends & Forecast 2025 to 2035

Insulated Wires & Cables Market Growth – Trends & Forecast 2025 to 2035

Insulated Shipping Boxes Market Innovations & Growth 2025-2035

Insulated Coolers Market Insights - Growth & Forecast 2025 to 2035

Insulated Cup Sleeves Market Analysis – Size, Growth & Forecast 2025 to 2035

Insulated Food Delivery Bags Market Analysis – Growth & Forecast 2025 to 2035

Insulated Gate Bipolar Transistors Market Growth - Trends & Forecast 2025 to 2035

Industry Share Analysis for Insulated Styrofoam Shipping Boxes Companies

Market Share Breakdown of Leading Insulated Corrugated Boxes Manufacturers

Insulated Styrofoam Shipping Boxes Market Growth & Forecast 2025 to 2035

Insulated Food Containers Market

Insulated Envelops Market

Insulated Paper Bags Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA