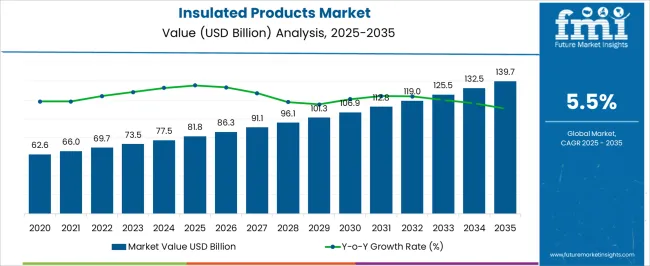

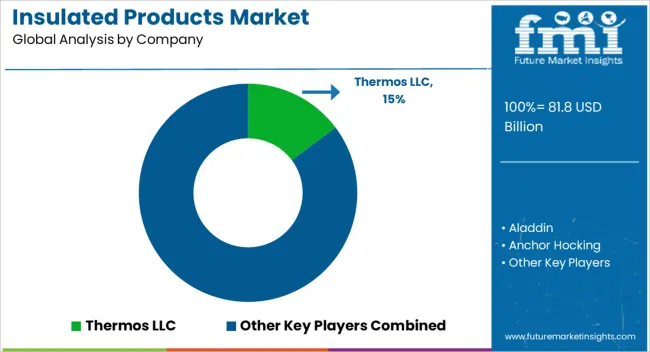

The insulated products market is expected to grow from USD 81.8 billion in 2025 to USD 139.7 billion by 2035, registering a CAGR of 5.5%. Over the first five years (2025–2030), the market expands from USD 81.8 billion to USD 106.9 billion, reflecting steady growth fueled by rising demand for thermal insulation in construction, refrigeration, and industrial applications. Increasing urbanization, energy efficiency regulations, and growing industrial output drive investments in polyurethane, mineral wool, and foam-based insulation solutions.

The focus on sustainable building materials and energy-saving retrofits also supports adoption across residential and commercial segments. In the second half of the decade (2030–2035), the market accelerates from USD 106.9 billion to USD 139.7 billion, supported by emerging technologies such as vacuum insulation panels, phase-change materials, and advanced composite insulation systems. Growth is reinforced by government initiatives promoting net-zero energy buildings, reduction of carbon footprints, and stricter building codes globally. North America and Europe lead in technology adoption, while Asia-Pacific emerges as the fastest-growing region due to industrial expansion, infrastructure development, and rising demand in residential and commercial construction. The overall 10-year period highlights the market’s resilience and long-term potential, emphasizing innovation and regulatory alignment as key drivers for sustained growth.

| Metric | Value |

|---|---|

| Insulated Products Market Estimated Value in (2025 E) | USD 81.8 billion |

| Insulated Products Market Forecast Value in (2035 F) | USD 139.7 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The insulated products market is influenced by five major parent industries. The construction and building materials market holds the largest share at 30%, as insulation is widely used in walls, roofs, and HVAC systems to regulate temperature and improve building performance. The appliances and refrigeration market contributes 25%, with insulated panels, doors, and components used in refrigerators, freezers, and cold storage equipment. The automotive and transportation market accounts for 15%, driven by insulated panels, thermal barriers, and cabin insulation in vehicles, buses, and trains to maintain comfort and energy efficiency.

The packaging and cold chain market makes up 20%, as insulated containers, boxes, and shipping solutions are critical for transporting perishable goods and pharmaceuticals. The industrial and equipment market provides 10%, where insulated products are applied in pipelines, tanks, and machinery to maintain process temperatures and ensure operational efficiency. Construction, appliances, and packaging segments account for 75% of demand, highlighting that temperature regulation, product protection, and energy management remain the primary drivers, while transportation and industrial applications support additional growth opportunities.

The insulated products market is witnessing consistent expansion, supported by rising consumer demand for temperature-retaining solutions across household, commercial, and outdoor applications. Market growth is being driven by shifting lifestyle patterns, increased health-conscious consumption habits, and the adoption of reusable and eco-friendly insulated items. Producers are focusing on enhancing thermal efficiency, durability, and design appeal to cater to evolving consumer expectations.

Regional growth is being accelerated by urbanization, expanding middle-class income levels, and heightened awareness regarding sustainable consumption. Price competitiveness and innovations in materials are enabling broader penetration across retail and institutional sectors.

Industry participants are also leveraging e-commerce channels and direct-to-consumer strategies to strengthen market reach. Over the forecast horizon, the market is expected to benefit from technological advancements in vacuum insulation, lightweight composite integration, and improved manufacturing scalability, all of which are likely to bolster product appeal and sustain demand momentum globally.

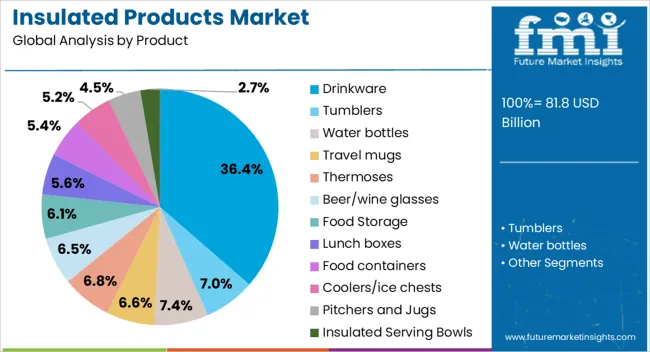

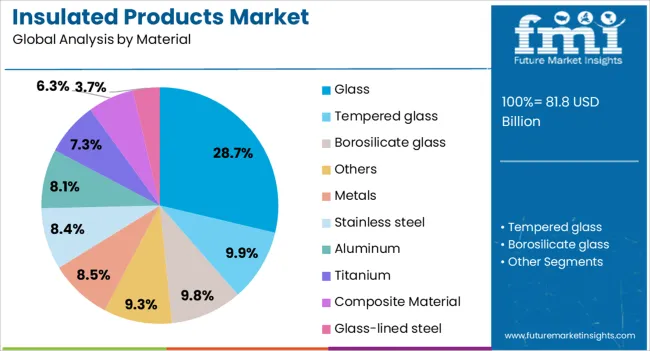

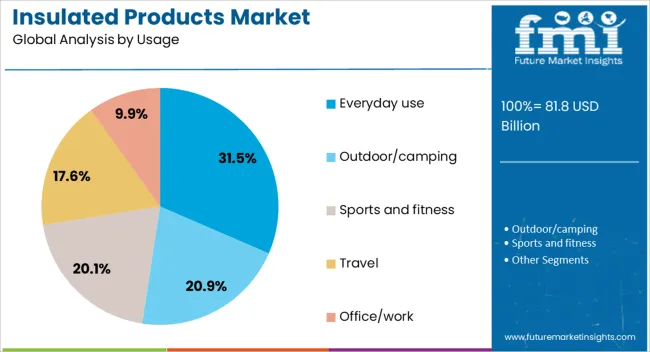

The insulated products market is segmented by product, material, usage, design, insulation technology, capacity, temperature retention, and geographic regions. By product, insulated products market is divided into Drinkware, Tumblers, Water bottles, Travel mugs, Thermoses, Beer/wine glasses, Food Storage, Lunch boxes, Food containers, Coolers/ice chests, Pitchers and Jugs, and Insulated Serving Bowls. In terms of material, insulated products market is classified into Glass, Tempered glass, Borosilicate glass, Others, Metals, Stainless steel, Aluminum, Titanium, Composite Material, and Glass-lined steel. Based on usage, insulated products market is segmented into Everyday use, Outdoor/camping, Sports and fitness, Travel, and Office/work.

By design, insulated products market is segmented into Sweat-proof exterior, Non-slip base, Ergonomic grip, Wide-mouth opening, Collapsible, and Built-in strainers/infusers. By insulation technology, insulated products market is segmented into Vacuum insulation, Double-wall insulation, Foam insulation, and Reflective insulation. By capacity, insulated products market is segmented into Medium (16-32 oz), Small (under 16 oz), Large (32-64 oz), and Extra large (over 64 oz).

By temperature retention, insulated products market is segmented into Dual temperature (hot and cold), Cold retention, and Heat retention. Regionally, the insulated products industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The drinkware segment, holding 36.40% of the product category, has emerged as the leading segment owing to its strong adoption in both residential and on-the-go consumption contexts. Its dominance is supported by a consistent shift toward reusable bottles, tumblers, and mugs as part of sustainable lifestyle choices.

Advanced insulation technologies, such as double-wall vacuum sealing, have improved thermal retention, enabling longer temperature maintenance for both hot and cold beverages. Design versatility, brand personalization, and portability have contributed to its popularity across varied consumer demographics.

The segment’s market share has also been reinforced by significant presence in gifting, promotional merchandise, and premium product lines. Distribution efficiency through online marketplaces and retail partnerships has further expanded consumer access, while continuous product innovation, including spill-proof mechanisms and ergonomic designs, is expected to sustain its leadership position over the coming years.

The glass segment, representing 28.70% of the material category, has maintained a prominent market position due to its non-reactive nature, aesthetic appeal, and perceived premium quality. Its use in insulated products is being strengthened by advancements in toughened and borosilicate glass technology, which improve impact resistance and thermal performance.

Consumer preference for chemical-free, BPA-free alternatives has reinforced demand, particularly in premium and health-conscious segments. Glass-based insulated products have found strong traction in niche categories such as luxury drinkware, decorative serveware, and specialty storage containers.

While heavier than alternative materials, improved manufacturing processes have enabled lighter and more durable designs without compromising safety. Increased availability through specialized retailers and branded outlets has broadened market penetration, and future growth will likely be driven by innovation in hybrid-material designs that combine glass aesthetics with enhanced insulation layers for broader functional applications.

The everyday use segment, accounting for 31.50% of the usage category, is leading due to its wide applicability in daily routines across households, workplaces, and travel scenarios. Its strength lies in the consistent demand for reliable temperature control in beverages and meals consumed throughout the day. Products in this segment are favored for their practicality, ease of cleaning, and compatibility with various liquids and foods.

Consumer adoption is being supported by the affordability and availability of diverse styles catering to different user preferences, from compact bottles to larger storage flasks. This segment also benefits from heightened awareness around reducing single-use plastic consumption, driving preference for reusable insulated products in daily life.

Marketing strategies emphasizing convenience, health benefits, and sustainability are further enhancing segment growth. Looking ahead, improvements in portability, lighter materials, and multifunctional designs are expected to reinforce this segment’s market leadership.

The insulated products market is growing as construction, industrial, and consumer sectors prioritize energy efficiency, thermal protection, and operational safety. Demand is driven by residential and commercial building projects, HVAC systems, refrigeration, and industrial equipment requiring temperature control. Challenges include raw material price volatility, regulatory compliance, and installation complexities. Opportunities exist in advanced materials, lightweight insulation solutions, and modular or prefabricated products for faster deployment. Trends highlight fire-resistant materials, sustainable designs, and smart insulation integrated with sensors for temperature monitoring.

Manufacturers and construction firms increasingly adopt insulated products to enhance energy efficiency, maintain temperature control, and ensure safety in buildings, refrigeration systems, and industrial operations. Products such as foam boards, blankets, panels, and pipe insulation help reduce heat loss, prevent condensation, and maintain consistent temperatures. The push for energy cost reduction and operational efficiency in commercial and residential buildings, coupled with industrial process optimization, is driving market adoption. High-performance insulation is essential for HVAC systems, cold storage facilities, and process equipment, positioning insulated products as critical solutions for thermal management and safety compliance across multiple sectors.

Constraints in the market include fluctuations in raw material prices such as polyurethane, polystyrene, and mineral wool, impacting production costs. Supply chain disruptions and regional availability of specialized insulation materials may affect lead times. Compliance with fire safety, building codes, and industrial regulations adds complexity for manufacturers. Technical challenges include maintaining thermal performance under varying environmental conditions, moisture resistance, and structural durability. Installation difficulties and compatibility with existing systems can further limit adoption. Buyers increasingly seek suppliers offering certified, reliable products, technical support for installation, and consistent performance to ensure long-term efficiency and regulatory adherence.

Opportunities exist in lightweight, high-performance materials, modular panels, and prefabricated insulation solutions that enable faster and more efficient installation. Demand for thermally efficient solutions in residential, commercial, and industrial applications is rising globally, driven by energy cost reduction and operational efficiency goals. Specialty products such as fire-resistant boards, acoustic insulation, and flexible blankets cater to niche segments with high safety and performance requirements. Suppliers providing application-ready solutions, customization, and integration support are well positioned to capture growth in expanding construction, HVAC, refrigeration, and industrial markets.

The market is trending toward smart insulation solutions integrated with sensors for real-time temperature and energy monitoring, improving operational efficiency. Fire-resistant materials, acoustic insulation, and multifunctional panels are gaining traction across buildings and industrial processes. Modular, prefabricated, and lightweight designs reduce installation time, improve handling, and enhance adaptability. Digital monitoring and building automation integration are increasingly demanded for commercial and industrial facilities. Suppliers offering innovative, high-performance, and application-ready insulated products are best positioned to meet the evolving requirements of energy-efficient construction, industrial thermal management, and consumer applications.

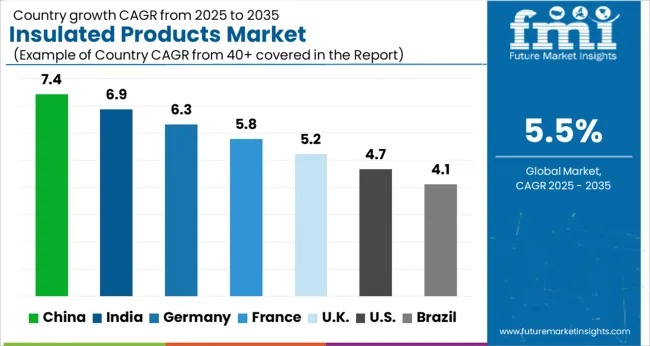

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The insulated products market is driven by demand for portable, temperature-retaining containers and reusable alternatives to single-use packaging. Vacuum flasks, thermal bottles, insulated tumblers, and food containers are increasingly adopted for home, office, and outdoor use. Convenience-oriented and health-conscious consumers prioritize products that maintain beverage or food temperature while remaining lightweight and easy to carry. Market growth is supported by outdoor recreation trends, travel, and urban lifestyles, while innovations in thermal retention and ergonomic design enhance product appeal and differentiation. Competition is shaped by durability, insulation performance, and design aesthetics.

Thermos LLC and Zojirushi Corporation lead through high-performance vacuum-insulated bottles and food jars rated for extended temperature maintenance. S’well and Corkcicle compete via premium finishes, stylish designs, and sustainability-focused messaging. CamelBak and Nalgene target outdoor and adventure consumers with BPA-free, impact-resistant bottles, while Contigo emphasizes leak-proof lids and hands-free operation. Kitchen and home solutions are offered by Tupperware, Aladdin, and World Kitchen, highlighting portable thermal storage for food and beverages. Regional and niche players focus on specialized materials, modular designs, or cost-efficient solutions to capture segment-specific demand.

Dollar sales by product type (bottles, tumblers, food containers, flasks), material type (stainless steel, glass, plastic), and end-use (home, outdoor, travel, office). Demand is driven by increasing health consciousness, convenience trends, and sustainability adoption. Regional trends highlight strong growth in North America and Europe due to active lifestyle adoption, while Asia-Pacific shows rapid expansion from urbanization, rising disposable income, and growing outdoor activity participation.

| Item | Value |

|---|---|

| Quantitative Units | USD 81.8 Billion |

| Product | Drinkware, Tumblers, Water bottles, Travel mugs, Thermoses, Beer/wine glasses, Food Storage, Lunch boxes, Food containers, Coolers/ice chests, Pitchers and Jugs, and Insulated Serving Bowls |

| Material | Glass, Tempered glass, Borosilicate glass, Others, Metals, Stainless steel, Aluminum, Titanium, Composite Material, and Glass-lined steel |

| Usage | Everyday use, Outdoor/camping, Sports and fitness, Travel, and Office/work |

| Design | Sweat-proof exterior, Non-slip base, Ergonomic grip, Wide-mouth opening, Collapsible, and Built-in strainers/infusers |

| Insulation Technology | Vacuum insulation, Double-wall insulation, Foam insulation, and Reflective insulation |

| Capacity | Medium (16-32 oz), Small (under 16 oz), Large (32-64 oz), and Extra large (over 64 oz) |

| Temperature Retention | Dual temperature (hot and cold), Cold retention, and Heat retention |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Thermos LLC, Aladdin, Anchor Hocking, Bormioli Rocco, CamelBak Products LLC, Contigo, Corkcicle, Hanover, Nalgene Outdoor Products, Newell Brands, OXO International, S'well Bottle, Tupperware Brands Corporation, World Kitchen LLC, and Zojirushi Corporation |

| Additional Attributes |

The global insulated products market is estimated to be valued at USD 81.8 billion in 2025.

The market size for the insulated products market is projected to reach USD 139.7 billion by 2035.

The insulated products market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in insulated products market are drinkware, tumblers, water bottles, travel mugs, thermoses, beer/wine glasses, food storage, lunch boxes, food containers, coolers/ice chests, pitchers and jugs and insulated serving bowls.

In terms of material, glass segment to command 28.7% share in the insulated products market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Insulated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Insulated Concrete Form (ICF) Market Size and Share Forecast Outlook 2025 to 2035

Insulated Bins Market Size and Share Forecast Outlook 2025 to 2035

Insulated Tumblers Market Size and Share Forecast Outlook 2025 to 2035

Insulated Corrugated Boxes Market Size and Share Forecast Outlook 2025 to 2035

Insulated Drum Covers Market Size and Share Forecast Outlook 2025 to 2035

Insulated Glass Market Growth – Trends & Forecast 2025 to 2035

Insulated Wires & Cables Market Growth – Trends & Forecast 2025 to 2035

Insulated Shipping Boxes Market Innovations & Growth 2025-2035

Insulated Coolers Market Insights - Growth & Forecast 2025 to 2035

Insulated Cup Sleeves Market Analysis – Size, Growth & Forecast 2025 to 2035

Insulated Food Delivery Bags Market Analysis – Growth & Forecast 2025 to 2035

Insulated Gate Bipolar Transistors Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Leading Insulated Corrugated Boxes Manufacturers

Industry Share Analysis for Insulated Styrofoam Shipping Boxes Companies

Market Share Insights for Insulated Tumblers Providers

Insulated Styrofoam Shipping Boxes Market Growth & Forecast 2025 to 2035

Insulated Food Containers Market

Insulated Envelops Market

Insulated Paper Bags Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA