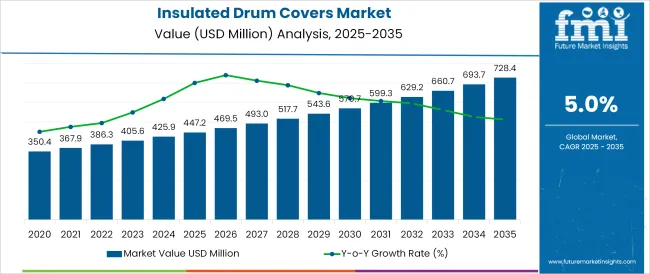

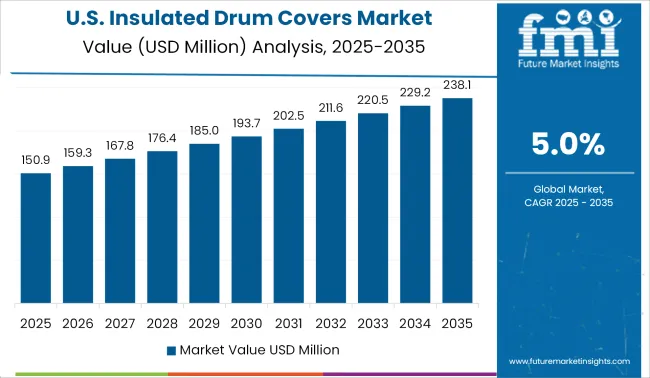

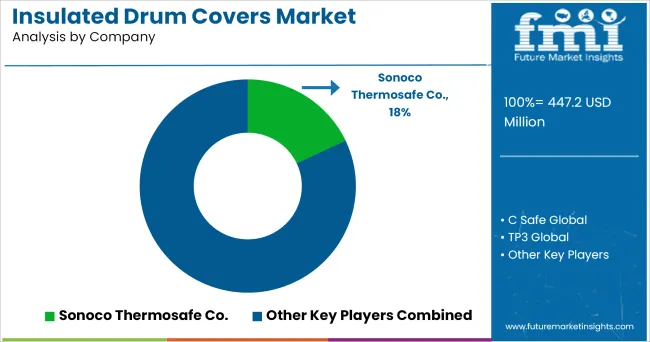

The Insulated Drum Covers Market is estimated to be valued at USD 447.2 million in 2025 and is projected to reach USD 728.4 million by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

The insulated drum covers market is expanding steadily, supported by rising demand for temperature regulation in industrial storage and transportation systems. The need to maintain material stability, prevent freezing or overheating, and enhance energy efficiency has led to widespread adoption of insulated covers, particularly in chemical, pharmaceutical, food processing, and petrochemical sectors.

Manufacturers are focusing on developing covers using materials that offer high thermal resistance, reusability, and weatherproof performance. As energy costs continue to rise and supply chain integrity becomes more critical, insulated drum covers are being prioritized as an operational safeguard.

In addition, stricter compliance with safety and environmental standards has encouraged industries to invest in reusable insulation solutions. Future growth is expected to be influenced by innovations in lightweight composite materials and multilayer insulation technologies designed to reduce heat loss while withstanding harsh external environments.

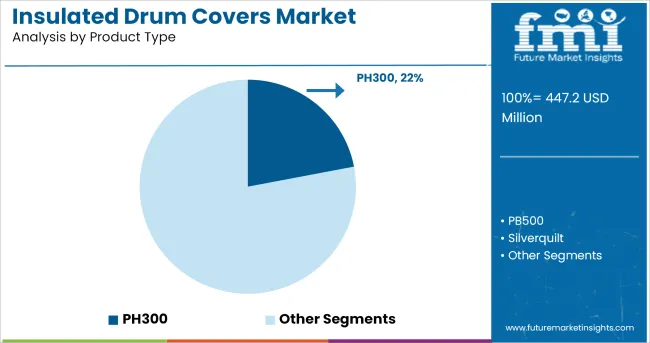

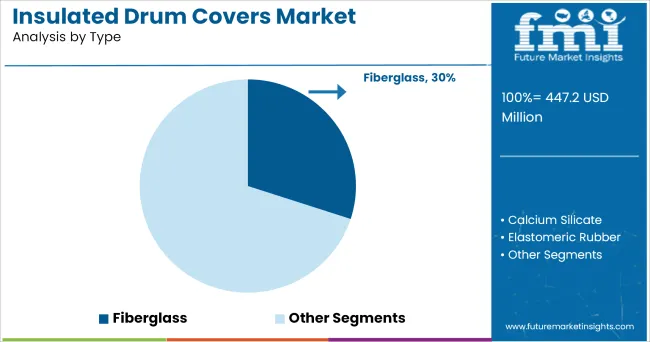

The market is segmented by Product Type, Type, End-Use, Price Range, and Sales Channel and region. By Product Type, the market is divided into PH300, PB500, Silverquilt, PP150, PB400, and SQ6. In terms of Type, the market is classified into Fiberglass, Calcium Silicate, Elastomeric Rubber, and Polyurethane.

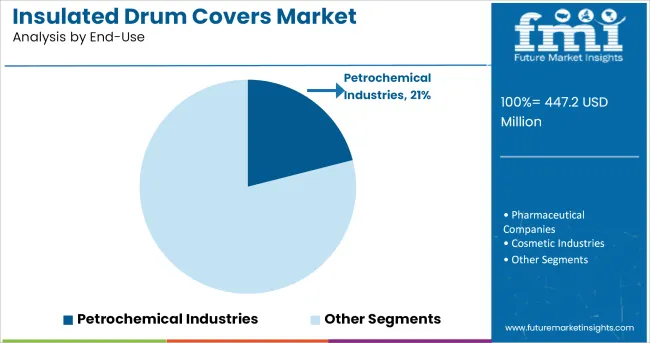

Based on End-Use, the market is segmented into Petrochemical Industries, Pharmaceutical Companies, Cosmetic Industries, Paint/Chemical Industries, Food and Beverage Industries, and Commercial Cargo Service Providers. By Price Range, the market is divided into USD 100 - USD 500, Below USD 100, USD 500 - USD 1000, USD 1000 - USD 5000, and Above USD 5000.

By Sales Channel, the market is segmented into Direct Sales, Specialty Stores, and Online Retailers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

PH300-based insulated drum covers are expected to account for 22.0% of total market revenue in 2025. This segment’s growth is being supported by the material's enhanced thermal insulation properties and resistance to extreme temperatures, making it suitable for sensitive applications. PH300 materials offer a high strength-to-weight ratio and can be integrated into multi-layered insulation systems without compromising flexibility or durability.

Their compatibility with both indoor and outdoor usage has made them a preferred choice in regulated environments where stable drum temperatures must be maintained. The segment is also benefitting from increasing demand in industries requiring reusable, flame-retardant insulation solutions.

As regulations around product safety and contamination control tighten, PH300 materials continue to gain acceptance for their ability to meet both thermal and safety performance benchmarks.

Fiberglass-based insulated drum covers are projected to hold a dominant 30.0% share of the overall market in 2025. This leadership is being driven by the superior thermal resistance, affordability, and mechanical durability of fiberglass materials in both high-temperature and corrosive environments.

Fiberglass insulation is widely adopted in sectors dealing with volatile substances and temperature-sensitive chemicals due to its ability to minimize thermal loss and maintain consistent drum temperatures. The segment's growth is also supported by its widespread availability and compatibility with standard drum sizes and closure systems.

As companies seek long-lasting, low-maintenance insulation options that meet industry safety certifications, fiberglass-based covers have remained a primary choice. Moreover, fiberglass continues to be favored for its cost-effectiveness, making it suitable for both permanent installations and temporary protection in transit or storage.

The petrochemical industry is anticipated to account for 21.0% of the total market revenue in 2025, making it one of the leading end-use segments. This dominance is being fueled by the sector’s reliance on thermal control for the safe handling and storage of high-value chemicals, resins, and reactive compounds.

Insulated drum covers are essential in protecting materials from temperature fluctuations that can impact product integrity or create safety hazards. Petrochemical facilities increasingly adopt reusable insulated covers to reduce operational risks, lower energy consumption, and support compliance with hazardous material regulations. Furthermore, the use of drum covers helps reduce heat loss during transport and staging, contributing to operational efficiency and cost savings.

With global demand for petrochemical products rising and environmental regulations tightening, insulated drum covers are becoming an indispensable component of material handling protocols across this sector.

Insulated drum cover reduces temperature concerns. It helps maintain the temperature of cargo by providing a barrier between cargo and air around it, protecting it from freeze, heat and temperature spikes.

In addition to that, the need for manufacturers in the food and beverage, paint/ chemical, pharmaceutical and cosmetic industries to maintain the standard of their products while they are shipped abroad is a major driving factor for the increasing demand for insulated covers.

The main preference of consumers these days is focused on global use. The recent product innovations in the market have improved user experience in terms of ease of usage. It is expected to be driven by government support for accelerated adoption across several countries.

Further, it is expected to boost demand due to an increase in preference from commercial and residential sectors. Several advantages of this market include re-usability and cost-efficiency, leading to a wide range of applications across nations. This will eventually generate benefits for the government, low-energy consumption community owners and consumers at last.

In recent years, many developing nations have witnessed substantial growth in urbanization and increased foreign investments which can also increase the longevity of the product substantially. Drums are used for the transportation and storage of industrial products which requires appropriate handling of filling products.

The increased use of drums will increase the sale of drum covers. The global drum covers market is witnessing a transition where buyers from developed as well as developing markets are opting for the same.

In the USA, drum covers are widely acknowledged to be an efficient and safe way to transport or store chemical compounds and liquid goods. However, they often fail to provide adequate protection against damaging changes in temperature during transportation.

Also, Latin America has a boost in demand for drums and drum covers since there is a huge demand for petrochemicals. The developing parts of America will see an increase in sales of drum covers as it allows them to withstand temperature-related spoilage during shipping.

Moreover, the reliability of drum covers is found well in rigorous testing procedures. Having been qualified in thermal test chambers and real-life scenarios, they help with meeting regulatory compliance requirements and such assurance is expected to drive insulated drum covers product adoption shortly.

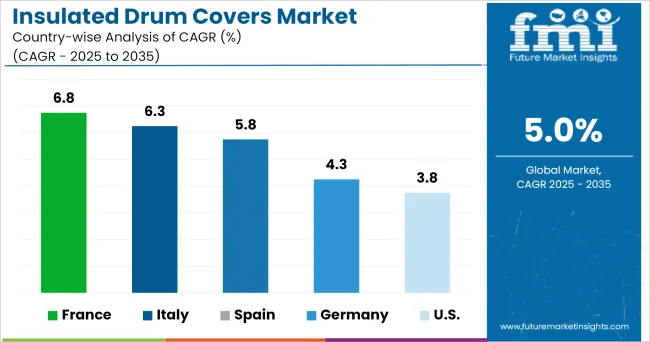

The demand for insulated drum covers in the European market is estimated to grow significantly in the upcoming years. In addition, food-grade and UN-certified drums are used for hazardous chemicals and food and beverage industries. Drums hold a substantial share of the intermediate bulk containers market.

Moreover, demand for petrochemicals in developed as well as developing regions is boosting the drums and drum covers market, since drum helps to maintain the temperature, which is quintessential in the transport of petrochemical products. Packaging has made it possible for the shipping industry to transport large-volume products in better condition.

Some of the leading manufacturers and suppliers of insulated drum cover market include

The report is a compilation of first-hand information, qualitative and quantitative assessments by industry analysts, and inputs from industry experts and industry participants across the value chain.

The report provides an in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global insulated drum covers market is estimated to be valued at USD 447.2 million in 2025.

The market size for the insulated drum covers market is projected to reach USD 728.4 million by 2035.

The insulated drum covers market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in insulated drum covers market are ph300, pb500, silverquilt, pp150, pb400 and sq6.

In terms of type, fiberglass segment to command 30.0% share in the insulated drum covers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Insulated Products Market Size and Share Forecast Outlook 2025 to 2035

Insulated Packaging Market Size and Share Forecast Outlook 2025 to 2035

Insulated Concrete Form (ICF) Market Size and Share Forecast Outlook 2025 to 2035

Insulated Bins Market Size and Share Forecast Outlook 2025 to 2035

Insulated Tumblers Market Size and Share Forecast Outlook 2025 to 2035

Insulated Corrugated Boxes Market Size and Share Forecast Outlook 2025 to 2035

Insulated Glass Market Growth – Trends & Forecast 2025 to 2035

Insulated Wires & Cables Market Growth – Trends & Forecast 2025 to 2035

Insulated Shipping Boxes Market Innovations & Growth 2025-2035

Insulated Coolers Market Insights - Growth & Forecast 2025 to 2035

Insulated Cup Sleeves Market Analysis – Size, Growth & Forecast 2025 to 2035

Insulated Food Delivery Bags Market Analysis – Growth & Forecast 2025 to 2035

Insulated Gate Bipolar Transistors Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Leading Insulated Corrugated Boxes Manufacturers

Industry Share Analysis for Insulated Styrofoam Shipping Boxes Companies

Market Share Insights for Insulated Tumblers Providers

Insulated Styrofoam Shipping Boxes Market Growth & Forecast 2025 to 2035

Insulated Food Containers Market

Insulated Envelops Market

Insulated Paper Bags Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA