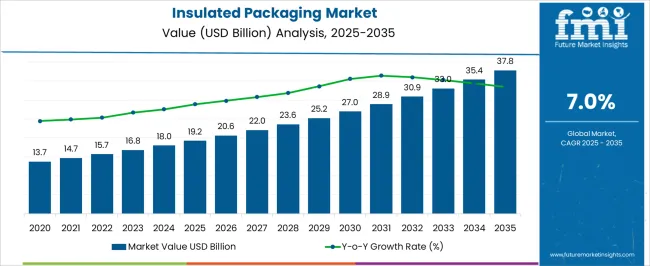

The insulated packaging market, registers at USD 19.2 billion in 2025 and projected to reach USD 37.8 billion by 2035, is set to expand at a CAGR of 7.0%. Between 2020 and 2024, the market moves from USD 13.7 billion to USD 18.0 billion, reflecting early adoption driven by growing demand in food, beverage, and pharmaceutical sectors where temperature-sensitive logistics are critical. Annual increments such as USD 14.7 billion in 2021, USD 15.7 billion in 2022, USD 16.8 billion in 2023, and USD 18.0 billion in 2024 indicate steady growth, supported by rising consumption of frozen and chilled foods, increased e-commerce activity, and stricter regulations for drug storage and distribution. By 2025, the market achieves USD 19.2 billion and advances strongly to USD 27.0 billion by 2030, contributing nearly 42% of the overall projected increase. This phase benefits from expanding use of advanced materials such as vacuum-insulated panels, phase-change materials, and recyclable insulation systems designed to enhance efficiency while reducing environmental impact. Annual values during this stage rise consistently from USD 20.6 billion in 2026 to USD 27.0 billion in 2030, showcasing strong adoption across global supply chains. From 2031 to 2035, the market grows from USD 28.9 billion to USD 37.8 billion, adding nearly 36% of total growth. This later stage reflects mainstream integration of insulated packaging in cold chain networks for biologics, specialty foods, and direct-to-consumer deliveries, supported by innovation in reusable systems and digital monitoring technologies. Overall, the insulated packaging market demonstrates a resilient and accelerating trajectory through 2035, fueled by globalization of trade, consumer health awareness, and technological advances in material science.

| Metric | Value |

|---|---|

| Insulated Packaging Market Estimated Value in (2025 E) | USD 19.2 billion |

| Insulated Packaging Market Forecast Value in (2035 F) | USD 37.8 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

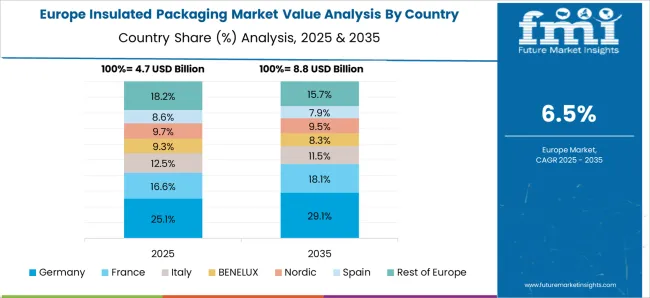

The insulated packaging market holds a significant position within the broader packaging sector, accounting for roughly 15–17% of global specialty and temperature-controlled packaging sales. Within food and beverage distribution, insulated packaging secures about 10–12% share, driven by the need to maintain product integrity, temperature control, and extended shelf life for perishable and frozen goods. In pharmaceutical and biopharmaceutical logistics, the market captures approximately 3–5% share, supported by demand for cold-chain solutions, biologics transportation, and temperature-sensitive diagnostic kits. E-commerce and last-mile delivery segments contribute around 2–3% share, fueled by rising home delivery of meal kits, frozen foods, and specialty ingredients requiring thermal protection. Market growth is propelled by innovations in polymer foams, vacuum-insulated panels, and recyclable thermal materials, enhancing insulation performance and reducing weight for transportation efficiency. Manufacturers are increasingly adopting modular, reusable, and collapsible designs, while logistics providers integrate smart monitoring and IoT-enabled temperature tracking to ensure product compliance. Regional adoption is highest in North America and Europe due to mature cold-chain infrastructure and stringent regulatory requirements, whereas Asia-Pacific shows steady growth from expanding e-commerce, perishable exports, and pharmaceutical distribution networks. Continuous investment in R&D, material optimization, and partnerships with end-users ensure insulated packaging maintains steady relevance and share within multiple industrial and consumer applications.

The insulated packaging market is witnessing significant momentum due to the growing need to preserve temperature-sensitive goods across food, pharmaceutical, and chemical industries. Rapid growth in e-commerce and home delivery services especially for perishable items has led to higher demand for effective insulation solutions.

Regulatory mandates for cold chain compliance and heightened consumer expectations for product freshness have further accelerated adoption. Additionally, advances in lightweight materials and multi-layered insulation technology are enhancing performance while optimizing shipping costs.

With sustainability in focus, manufacturers are also introducing recyclable and biodegradable options, aligning insulated packaging with broader environmental goals and market expansion strategies.

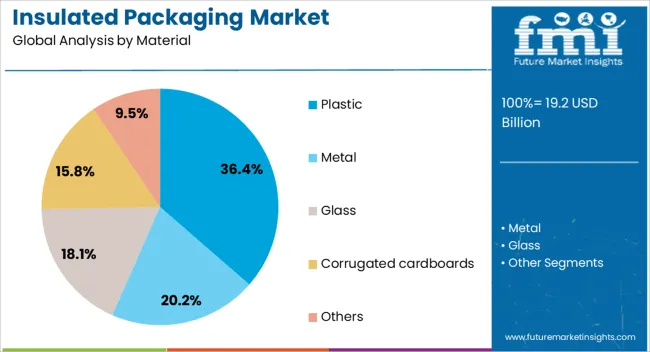

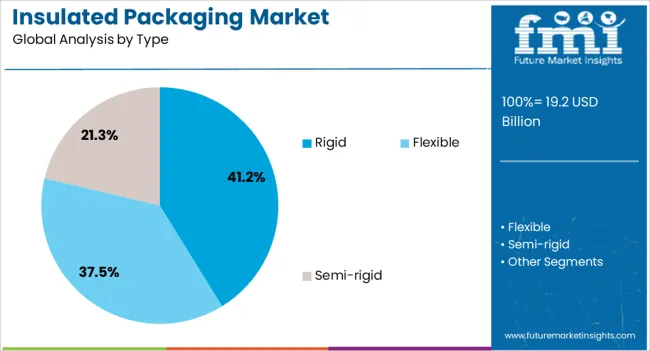

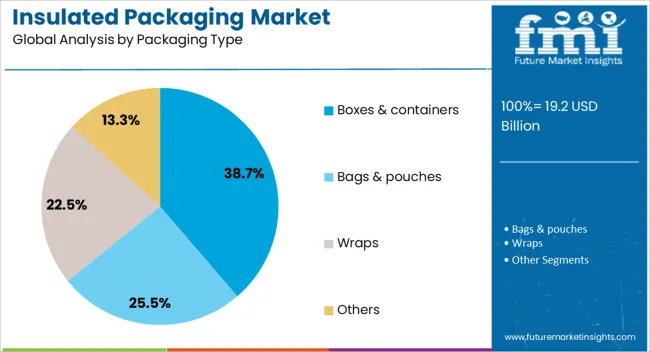

The insulated packaging market is segmented by material, type, packaging type, end-use industry, and geographic regions. By material, insulated packaging market is divided into Plastic, Metal, Glass, Corrugated cardboards, and Others. In terms of type, insulated packaging market is classified into Rigid, Flexible, and Semi-rigid. Based on packaging type, insulated packaging market is segmented into Boxes & containers, Bags & pouches, Wraps, and Others. By end-use industry, insulated packaging market is segmented into Food & beverages, Pharmaceutical, Industrial, Consumer goods, and Others. Regionally, the insulated packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Plastic is expected to lead the material segment with a 36.40% share in 2025, driven by its superior thermal insulation properties, lightweight nature, and cost-effectiveness. Its ability to be molded into various forms while maintaining structural integrity under temperature fluctuations has made it the go-to material for both rigid and flexible insulated packaging.

Industries such as pharmaceuticals and food delivery rely heavily on plastic-based insulation for cold chain logistics, especially in high-volume shipments.

Moreover, developments in recyclable and biodegradable plastics are helping address sustainability concerns while maintaining performance standards, supporting continued dominance of the segment.

Rigid insulated packaging is projected to account for 41.20% of the market by 2025, making it the most preferred structural type. Its dominance stems from its enhanced durability, stackability, and ability to maintain consistent thermal barriers during transit.

Rigid solutions are increasingly used in the transportation of vaccines, frozen food, and temperature-sensitive chemicals, where structural protection is as critical as insulation. The segment’s adoption is also fueled by long-distance supply chain needs, where repeated handling requires robust packaging formats.

Innovations such as vacuum-insulated panels and hard-shell coolers are further boosting its adoption across industrial and consumer applications.

Boxes & containers are forecast to lead the packaging type category with a 38.70% share in 2025, primarily due to their versatility and broad application in cold chain logistics. These solutions provide excellent insulation performance while being customizable in size, shape, and insulation layer thickness.

Popular among food and beverage distributors, meal kit services, and biopharmaceutical firms, they offer a reliable and user-friendly method for maintaining product integrity. Their compatibility with both passive and active cooling methods also enhances adaptability.

As last-mile delivery networks expand, insulated boxes and containers are expected to remain the backbone of temperature-controlled shipments.

Insulated packaging demand is fueled by cold-chain food logistics, pharmaceutical shipments, material innovation, and regulatory compliance. Continuous improvements in design, materials, and monitoring systems ensure quality, safety, and reliability across diverse applications.

Insulated packaging adoption is strongly driven by the need to preserve perishable foods, frozen products, and meal kits during transit. The growth is fueled by e-commerce delivery services, increasing online grocery sales, and meal subscription boxes. Temperature-controlled packaging ensures that products maintain quality, freshness, and safety from distribution centers to end consumers. Manufacturers are increasingly using polymer foams, corrugated solutions with thermal liners, and vacuum-insulated panels to enhance thermal protection and minimize product spoilage. Retailers and logistics providers are focusing on lightweight, reusable, and modular insulated solutions to reduce shipping costs and environmental footprint. Cold-chain requirements for dairy, meat, seafood, and frozen meals remain key growth drivers, alongside rising consumer expectations for timely, intact deliveries.

The insulated packaging segment benefits from the rising distribution of vaccines, biologics, and temperature-sensitive drugs, requiring strict adherence to cold-chain regulations. Pharmaceutical companies and logistics partners are adopting advanced thermal materials, phase-change packs, and insulated shippers to comply with stringent storage and transport guidelines. Growth is stimulated by clinical trial shipments, biopharmaceutical exports, and increasing home healthcare deliveries that require safe, controlled packaging solutions. Insulated carriers equipped with temperature-monitoring sensors are increasingly deployed to track shipment conditions and prevent temperature excursions. Regulatory mandates from FDA, EMA, and WHO reinforce compliance standards, driving innovation in container design and thermal performance. Manufacturers are collaborating with courier services to ensure timely and compliant distribution of sensitive medical products.

Insulated packaging growth is further supported by advancements in material composition, including expanded polystyrene, polyurethane foams, and layered reflective films, improving thermal retention and weight efficiency. Lightweight, stackable, and reusable solutions reduce transportation costs and enhance operational flexibility. Customized shapes, sizes, and collapsible designs are increasingly favored for e-commerce and direct-to-consumer shipments. Passive thermal solutions and integration with gel packs or phase-change materials extend shelf life and maintain product integrity during extended transit. Manufacturers are emphasizing durability, cost optimization, and ease of handling for logistics teams. Rising focus on reducing packaging volume and optimizing insulation efficiency ensures competitive advantage in crowded markets, particularly for food and pharmaceutical supply chains.

Compliance with food safety and pharmaceutical cold-chain regulations continues to shape the insulated packaging landscape. Strict standards governing temperature thresholds, material safety, and transportation protocols influence product development and supply chain operations. International trade in frozen and perishable goods, as well as biologics exports, drives demand for standardized packaging solutions capable of maintaining thermal consistency. Retailers and logistics providers are investing in traceable and monitored packaging to satisfy regulatory audits and customer expectations. Expansion of cross-border cold-chain networks requires adaptable, durable, and high-performing insulated solutions. Investment in process standardization, thermal testing, and smart monitoring devices supports market players in meeting global quality and safety benchmarks.

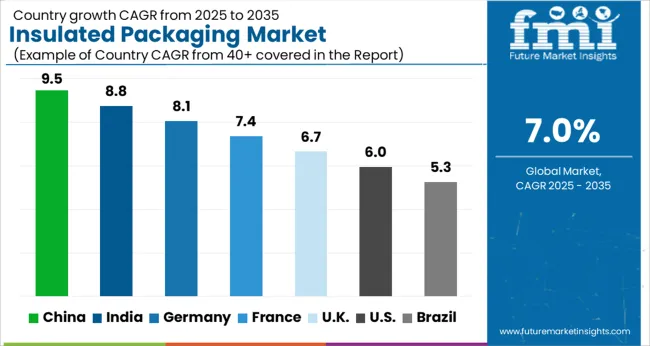

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The insulated packaging market is projected to grow globally at a CAGR of 7.0% between 2025 and 2035, supported by rising demand for cold-chain food logistics, pharmaceuticals, and temperature-sensitive product distribution. China leads with a CAGR of 9.5%, fueled by expanding e-commerce grocery networks, growing perishable goods shipments, and investments in high-performance thermal packaging solutions. India follows at 8.8%, driven by rising meal-kit deliveries, pharmaceutical cold-chain adoption, and growth in frozen and chilled food consumption. France posts 7.4%, supported by regulatory compliance in food and pharmaceutical transport, adoption of reusable insulated containers, and modernization of distribution networks. The United Kingdom grows at 6.7%, shaped by expanding refrigerated logistics, direct-to-consumer deliveries, and adoption of modular packaging systems, while the United States records 6.0%, reflecting established cold-chain infrastructure, pharmaceutical distribution, and retail adoption of insulated solutions. The analysis spans over 40 countries, with these five serving as benchmarks for production scaling, supply chain optimization, and strategic investment in thermal packaging solutions.

China is projected to post a CAGR of 9.5% for 2025–2035, significantly above the global baseline of 7.0%. During 2020–2024, the market grew at 7.8%, supported by expanding e-commerce grocery networks, increased frozen and chilled food shipments, and investments in high-performance thermal packaging. Early growth was backed by retail logistics modernization, adoption of insulated containers, and partnerships with cold-chain operators. The following decade is expected to see stronger expansion due to rising pharmaceutical cold-chain requirements, growth in direct-to-consumer food deliveries, and demand for reusable and modular insulated solutions. Scaling of domestic production and strategic alliances with global packaging suppliers will maintain momentum.

India is expected to register a CAGR of 8.8% from 2025 to 2035, up from 7.2% during 2020–2024. Early growth was driven by adoption of meal-kit deliveries, pharmaceutical cold-chain infrastructure, and rising consumption of frozen and chilled foods. Regional logistics networks and growing retail chains supported market penetration. In the next decade, higher expansion will be driven by modernization of distribution networks, integration of reusable insulated packaging, and growth of temperature-sensitive product deliveries. Strategic collaborations with international cold-chain solution providers and scaling of domestic production will further enhance growth.

France is projected to record a CAGR of 7.4% for 2025–2035, above the global rate of 7.0%. Between 2020 and 2024, the market grew at 6.5%, reflecting modernization of refrigerated logistics, stricter temperature compliance regulations, and rising demand for reusable insulated containers. Initial growth was bolstered by upgrades in food and pharmaceutical transport systems, adoption of modular packaging solutions, and partnerships with distribution operators. The next decade is expected to witness accelerated growth due to increasing direct-to-consumer deliveries, higher adoption of insulated e-commerce packaging, and regulatory pressures for cold-chain safety. Domestic manufacturers scaling production and entering export markets will strengthen France’s position.

The United Kingdom is expected to post a CAGR of 6.7% from 2025 to 2035, above the global 7.0% baseline. Between 2020 and 2024, growth stood at 5.9%, driven by expansion of refrigerated logistics, adoption of direct-to-consumer delivery models, and increasing e-commerce grocery penetration. Early momentum was supported by retrofitting of food distribution networks, collaboration with packaging suppliers, and regulatory compliance with cold-chain standards. The upcoming decade is projected to see higher CAGR due to rising demand for temperature-sensitive pharmaceuticals, scale-up of modular and reusable insulated solutions, and integration of logistics technology to optimize delivery efficiency. Strategic investments and partnerships will reinforce market adoption.

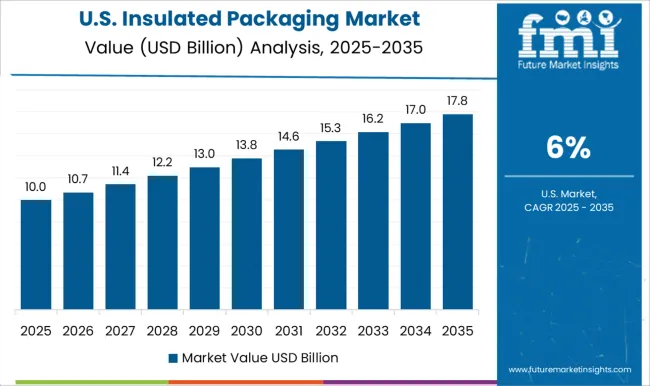

The United States is projected to grow at a CAGR of 6.0% during 2025–2035, slightly below the global rate. From 2020 to 2024, growth was recorded at 5.4%, supported by established cold-chain infrastructure, pharmaceutical distribution, and steady retail adoption. Initial growth was influenced by gradual scaling of insulated packaging production and incremental expansion of e-commerce grocery deliveries. In the next decade, market expansion will be supported by higher pharmaceutical cold-chain adoption, increasing frozen and chilled food consumption, and innovations in reusable and modular thermal packaging. Strategic partnerships, capacity enhancements, and regional distribution optimization will sustain growth momentum.

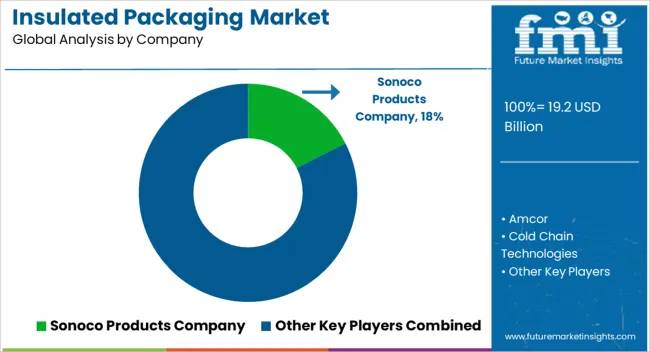

The insulated packaging market features key players such as Sonoco Products Company, Amcor, Cold Chain Technologies, Cold Ice, Cryopak Industries, DuPont, Huhtamaki, Icertech, Innovative Energy, and Insulated Products Corporation, along with Intelsius, MARKO FOAM PRODUCTS, Nordic Cold Chain Solutions, Pelican BioThermal, Polar Tech Industries, Sealed Air Corporation, Sofrigam, Tempack Packaging Solutions, Therapak, TP Solutions, and Woolcool. Sonoco Products Company leads with broad production capacity and diverse thermal packaging solutions for food, pharmaceuticals, and logistics applications. Amcor emphasizes high-performance insulated materials and sustainable distribution solutions, enhancing dollar sales and share across global markets. Cold Chain Technologies and Cryopak Industries focus on specialized thermal packaging and modular container systems for sensitive shipments. Companies such as Pelican BioThermal, Nordic Cold Chain Solutions, and Intelsius prioritize temperature-controlled transport and laboratory cold-chain solutions to expand market reach. Market competition is shaped by innovations in reusable, modular, and high-efficiency insulation, strategic partnerships with logistics providers, and investments in automation for scalable production. Share growth is driven by e-commerce grocery, pharmaceutical cold-chain adoption, and rising demand for frozen and chilled food shipments. Firms are increasingly investing in regional footprint expansion, co-branded product collaborations, and advanced thermal performance certifications to enhance dollar sales, while maintaining focus on reliability, logistics integration, and regulatory compliance. The USA, China, India, UK, and France represent key growth regions where strategic positioning, cold-chain adoption, and distribution efficiency determine market leadership and long-term competitiveness.

| Item | Value |

|---|---|

| Quantitative Units | USD 19.2 Billion |

| Material | Plastic, Metal, Glass, Corrugated cardboards, and Others |

| Type | Rigid, Flexible, and Semi-rigid |

| Packaging Type | Boxes & containers, Bags & pouches, Wraps, and Others |

| End-use Industry | Food & beverages, Pharmaceutical, Industrial, Consumer goods, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sonoco Products Company, Amcor, Cold Chain Technologies, Cold Ice, Cryopak Industries, DuPont, Huhtamaki, Icertech, Innovative Energy, Insulated Products Corporation, Intelsius, MARKO FOAM PRODUCTS, Nordic Cold Chain Solutions, Pelican BioThermal, Polar Tech Industries, Sealed Air Corporation, Sofrigam, Tempack Packaging Solutions, Therapak, TP Solutions, and Woolcool |

| Additional Attributes | Dollar sales by product type, share by end-use (food, pharma, logistics), regional growth rates, CAGR projections, material trends, temperature-controlled adoption, competitor strategies, distribution channels, and regulatory compliance impact. |

The global insulated packaging market is estimated to be valued at USD 19.2 billion in 2025.

The market size for the insulated packaging market is projected to reach USD 37.8 billion by 2035.

The insulated packaging market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in insulated packaging market are plastic, metal, glass, corrugated cardboards and others.

In terms of type, rigid segment to command 41.2% share in the insulated packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Insulated Products Market Size and Share Forecast Outlook 2025 to 2035

Insulated Concrete Form (ICF) Market Size and Share Forecast Outlook 2025 to 2035

Insulated Bins Market Size and Share Forecast Outlook 2025 to 2035

Insulated Tumblers Market Size and Share Forecast Outlook 2025 to 2035

Insulated Corrugated Boxes Market Size and Share Forecast Outlook 2025 to 2035

Insulated Drum Covers Market Size and Share Forecast Outlook 2025 to 2035

Insulated Glass Market Growth – Trends & Forecast 2025 to 2035

Insulated Wires & Cables Market Growth – Trends & Forecast 2025 to 2035

Insulated Shipping Boxes Market Innovations & Growth 2025-2035

Insulated Coolers Market Insights - Growth & Forecast 2025 to 2035

Insulated Cup Sleeves Market Analysis – Size, Growth & Forecast 2025 to 2035

Insulated Food Delivery Bags Market Analysis – Growth & Forecast 2025 to 2035

Insulated Gate Bipolar Transistors Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Leading Insulated Corrugated Boxes Manufacturers

Industry Share Analysis for Insulated Styrofoam Shipping Boxes Companies

Market Share Insights for Insulated Tumblers Providers

Insulated Styrofoam Shipping Boxes Market Growth & Forecast 2025 to 2035

Insulated Food Containers Market

Insulated Envelops Market

Insulated Paper Bags Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA