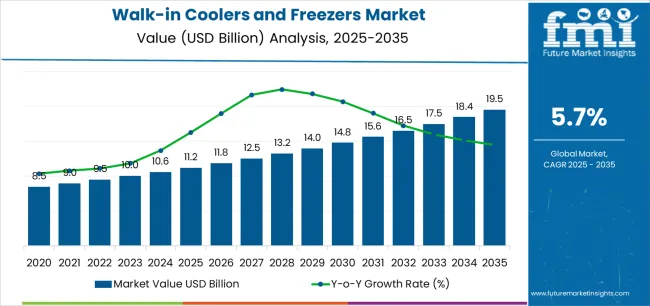

The global walk-in coolers and freezers market is likely to reach USD 19.6 billion by 2035, recording an absolute increase of USD 8.4 billion over the forecast period. The market is valued at USD 11.2 billion in 2025 and is set to rise at a CAGR of 5.7% during the assessment period. The market size is expected to grow by 1.8 times during the same period, supported by rapid expansion of retail food services and cold chain infrastructure worldwide, driving demand for modular refrigeration systems and increasing investments in commercial kitchens, cold storage warehouses, and pharmaceutical storage facilities globally.

Between 2025 and 2030, the walk-in coolers and freezers market is projected to expand from USD 11.2 billion to USD 15.1 billion, resulting in a value increase of USD 3.9 billion, which represents 46.4% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for cold chain logistics and retail food storage solutions, product innovation in natural refrigerant systems and energy-efficient technologies, as well as expanding integration with IoT-enabled temperature monitoring and smart facility management initiatives. Companies are establishing competitive positions through investment in low-GWP refrigerant technologies, modular construction capabilities, and strategic market expansion across retail, hospitality, and pharmaceutical cold storage applications.

From 2030 to 2035, the market is forecast to grow from USD 15.1 billion to USD 19.6 billion, adding another USD 4.5 billion, which constitutes 53.6% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized natural refrigerant systems, including advanced R-744 (CO₂) and R-290 (propane) technologies and integrated smart monitoring solutions tailored for specific temperature-sensitive storage requirements, strategic collaborations between equipment manufacturers and cold chain logistics providers, and an enhanced focus on energy efficiency and environmental sustainability. The growing emphasis on carbon-neutral refrigeration and smart cold storage management will drive demand for advanced, high-performance walk-in cooler and freezer solutions across diverse commercial and industrial applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 11.2 billion |

| Market Forecast Value (2035) | USD 19.6 billion |

| Forecast CAGR (2025-2035) | 5.7% |

The walk-in coolers and freezers market grows by enabling food service operators, retailers, and pharmaceutical companies to achieve superior temperature control and storage efficiency while meeting evolving food safety and regulatory compliance demands. Commercial operators face mounting pressure to improve energy efficiency and reduce environmental impact, with modern walk-in systems incorporating natural refrigerants providing 30-40% better energy performance over conventional HFC-based systems, making advanced units essential for retail, hospitality, and pharmaceutical storage applications. The cold chain expansion movement's need for reliable, scalable refrigeration infrastructure creates demand for modular walk-in solutions that can enhance storage capacity, maintain precise temperature control, and ensure consistent performance across diverse operating conditions.

Government initiatives promoting food safety standards and environmental sustainability drive adoption in retail food services, commercial kitchens, and pharmaceutical storage applications, where refrigeration reliability has a direct impact on product quality and regulatory compliance. The global shift toward natural refrigerants and emission reduction accelerates walk-in cooler demand as operators seek alternatives to high-GWP refrigerants that contribute to climate change. The higher initial capital costs for natural refrigerant systems and infrastructure requirements compared to conventional equipment may limit adoption rates among price-sensitive small businesses and regions with limited technical support capabilities.

The market is segmented by place of use, technology, end use, and region. By place of use, the market is divided into indoor and outdoor installations. Based on technology, the market is categorized into remote condensing, self-contained, and multiple condensing systems. By end use, the market includes retail food services, commercial kitchens & restaurants, cold storage warehouses, pharmaceuticals, research laboratories, hospitals & mortuaries, and others. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

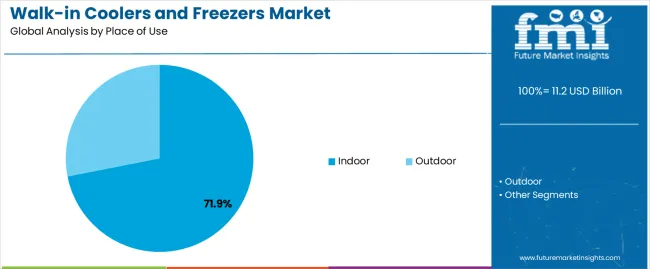

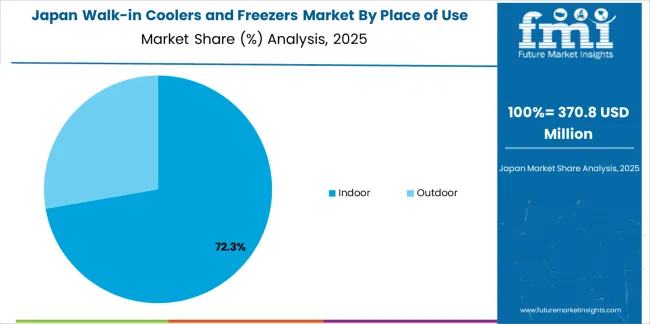

The indoor segment represents the dominant force in the walk-in coolers and freezers market, capturing approximately 71.9% of total market share in 2025. This advanced category encompasses refrigeration units installed within existing building structures, featuring integrated climate control, convenient accessibility, and seamless integration with food service and storage operations, delivering comprehensive performance capabilities with optimal space utilization. The indoor segment's market leadership stems from its exceptional convenience for high-traffic commercial operations, superior protection from weather elements and ambient temperature fluctuations, and compatibility with retail and hospitality facilities that require frequent access and efficient workflow integration.

The outdoor segment maintains a substantial 28.1% market share, serving operators who require additional cold storage capacity without consuming valuable interior space or need temporary refrigeration solutions for seasonal demand fluctuations. Outdoor installations offer flexibility for facilities with space constraints, providing supplementary storage that can be installed quickly without major building modifications. Despite requiring enhanced weatherproofing and insulation, outdoor walk-ins appeal to operators seeking cost-effective expansion options and agricultural businesses requiring proximity to loading areas.

Key advantages driving the indoor segment include:

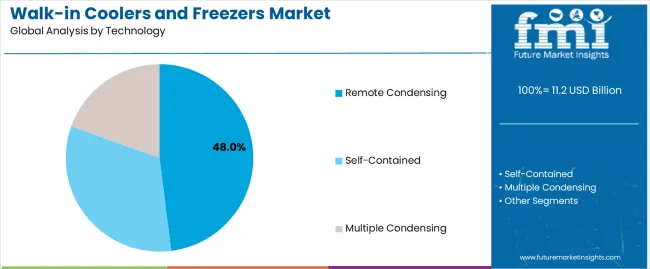

The remote condensing segment represents the leading technology category in the walk-in coolers and freezers market, capturing approximately 48.0% of total market share in 2025. This critical technology encompasses systems where the condensing unit is installed separately from the refrigerated space, typically outdoors or in mechanical rooms, where advanced configurations deliver superior cooling capacity with reduced noise levels in customer-facing areas. The remote condensing segment's dominance reflects the technology's fundamental advantages in commercial applications requiring quiet operation, efficient heat rejection, and flexible installation configurations.

The self-contained segment maintains a substantial 36.0% market share, serving applications where simplicity, portability, and lower installation costs are priorities, particularly in smaller facilities or temporary installations. Multiple condensing systems account for 20.0% market share, featuring centralized refrigeration plants serving multiple walk-in units, offering enhanced energy efficiency and simplified maintenance for large-scale operations with numerous cold storage rooms.

Key factors driving remote condensing segment leadership include:

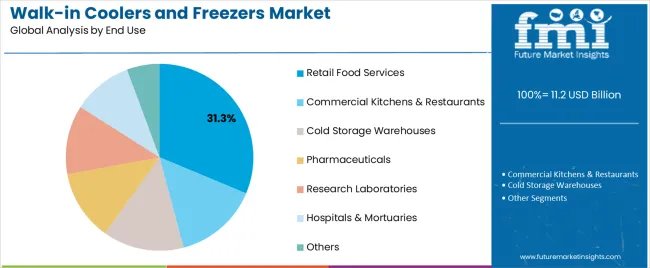

The retail food services segment represents the leading end-use category in the walk-in coolers and freezers market, capturing approximately 31.3% of total market share in 2025. This critical segment encompasses supermarkets, grocery stores, convenience stores, and quick-service restaurants where walk-in refrigeration delivers efficient bulk storage capabilities supporting high-volume product turnover. The retail food services segment's dominance reflects the fundamental role of walk-in coolers and freezers in supporting modern retail food operations, from fresh produce storage to frozen food inventory management.

The commercial kitchens & restaurants segment maintains a substantial 26.0% market share, serving full-service restaurants, hotels, catering operations, and institutional foodservice facilities requiring reliable cold storage for diverse ingredient inventory. Cold storage warehouses account for 18.5% market share, featuring large-scale refrigeration installations supporting distribution operations and third-party logistics providers. Pharmaceuticals represent 9.5% of the market, supporting temperature-sensitive drug storage and vaccine cold chain requirements. Research laboratories hold 5.3% market share, while hospitals & mortuaries account for 5.0%, and other applications represent 4.4% of the market.

Key factors driving retail food services segment leadership include:

The market is driven by three concrete demand factors tied to cold chain expansion and food safety outcomes.

The rapid growth of retail food services and quick-service restaurants creates increasing requirements for efficient cold storage infrastructure, with global QSR expansion growing 6-8% annually in emerging markets worldwide, requiring reliable walk-in systems for fresh and frozen ingredient storage.

The stringent food safety regulations and temperature monitoring requirements drive operators toward modern refrigeration systems, with walk-in coolers featuring IoT-enabled monitoring enabling real-time temperature tracking and automated compliance documentation while reducing food spoilage risks.

The e-commerce grocery expansion and last-mile delivery infrastructure accelerate adoption of walk-in refrigeration, with urban micro-fulfillment centers requiring compact, high-efficiency cold storage solutions that support rapid order fulfillment and maintain product quality throughout the distribution chain.

Market restraints include high initial capital costs affecting equipment accessibility for small independent operators, with commercial-grade walk-in installations priced 40-60% higher than reach-in refrigeration alternatives, creating financial barriers for startup restaurants and small grocery stores operating on limited capital budgets. Refrigerant transition challenges associated with natural refrigerant adoption pose implementation barriers, as operators evaluate total cost of ownership implications including specialized installation requirements, technician training needs, and potential safety considerations for flammable refrigerants in certain applications. Energy consumption concerns affecting operating costs create additional challenges, particularly in regions with high electricity rates where conventional refrigeration systems can account for 40-50% of facility energy consumption, driving demand for energy-efficient alternatives.

Key trends indicate accelerated natural refrigerant adoption in developed markets, particularly in regions with strict environmental regulations where R-744 (CO₂) and R-290 (propane) systems enable compliance with F-gas phase-down requirements while reducing operating costs through superior energy efficiency. Smart monitoring and predictive maintenance technology advancement trends toward cloud-connected temperature sensors, automated defrost optimization, and AI-assisted energy management platforms are enabling next-generation efficiency improvements and food safety enhancements. The market thesis could face disruption if alternative food preservation technologies such as high-pressure processing or modified atmosphere packaging reduce dependency on traditional cold storage, potentially reshaping refrigeration requirements and capacity planning across the food retail sector.

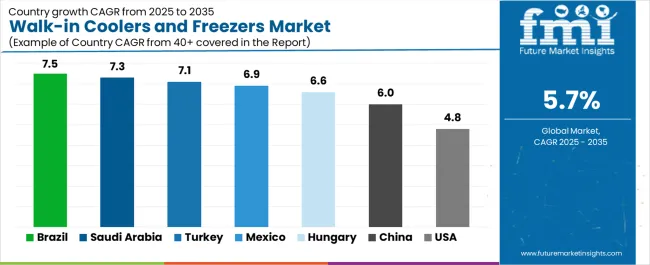

| Country | CAGR (2025-2035) |

|---|---|

| Brazil | 7.5% |

| Saudi Arabia | 7.3% |

| Turkey | 7.1% |

| Mexico | 6.9% |

| Hungary | 6.6% |

| China | 6.0% |

| USA | 4.8% |

The walk-in coolers and freezers market is gaining momentum worldwide, with Brazil taking the lead thanks to rapid QSR and supermarket expansion combined with new cold-chain buildout for inland logistics. Close behind, Saudi Arabia benefits from hospitality projects and pharma distribution hubs requiring precise cold rooms, positioning itself as a strategic growth hub in the Middle East region. Turkey shows strong advancement, where modern retail penetration and food export processing drive modular walk-in demand. Mexico demonstrates robust growth through nearshoring of food processing and cross-border grocery formats adding capacity, signaling continued investment in cold storage infrastructure. Meanwhile, Hungary stands out for EU food manufacturing upgrades and pharma packaging clusters, while China and the USA continue to record consistent progress driven by urban grocery e-commerce and equipment replacement cycles. Together, Brazil and Saudi Arabia anchor the global expansion story, while established markets build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

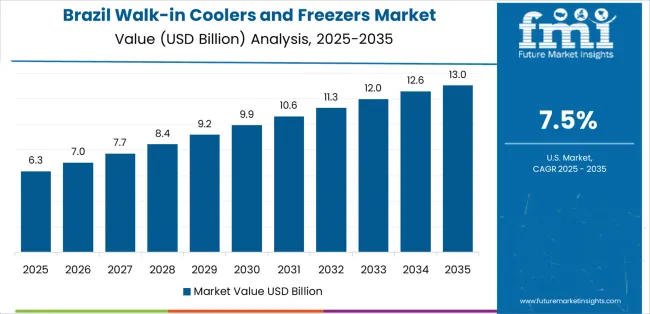

Brazil demonstrates the strongest growth potential in the Walk-in Coolers and Freezers Market with a CAGR of 7.5% through 2035. The country's leadership position stems from rapid quick-service restaurant expansion, modern retail format penetration in secondary cities, and comprehensive cold chain infrastructure development programs supporting inland agricultural logistics. Growth is concentrated in major metropolitan regions, including São Paulo, Rio de Janeiro, Belo Horizonte, and Brasília, where supermarket chains, foodservice operations, and distribution centers are implementing advanced walk-in refrigeration for temperature-sensitive product storage. Distribution channels through refrigeration contractors, equipment distributors, and direct facility relationships expand deployment across retail clusters and food processing zones. The country's agricultural export competitiveness and domestic food retail modernization provide market momentum for cold storage expansion, including financing schemes for small business equipment procurement and food safety compliance.

Key market factors:

In major urban centers, hospitality developments, and pharmaceutical distribution corridors, the adoption of walk-in cooler and freezer systems is accelerating across hotel properties, healthcare facilities, and food retail applications, driven by Vision 2030 hospitality expansion and healthcare infrastructure programs. The market demonstrates strong growth momentum with a CAGR of 7.3% through 2035, linked to comprehensive tourism sector expansion and increasing focus on pharmaceutical cold chain enhancement solutions. Saudi operators are implementing modern walk-in refrigeration and temperature monitoring platforms to ensure product quality while meeting stringent health regulations in key urban regions including Riyadh, Jeddah, Mecca, and emerging Red Sea tourism developments. The country's economic diversification initiatives create sustained demand for hospitality refrigeration solutions, while increasing emphasis on healthcare infrastructure drives adoption of pharmaceutical-grade cold storage that enhances regulatory compliance.

Turkey's expanding food sector demonstrates sophisticated implementation of walk-in refrigeration systems, with documented case studies showing 25-35% energy savings in modern retail and food processing facilities through natural refrigerant adoption. The country's food infrastructure in major producing regions, including Istanbul, Ankara, Izmir, and Antalya, showcases integration of walk-in technologies with existing cold chain practices, leveraging expertise in agricultural exports and food manufacturing. Turkish operators emphasize equipment durability and service responsiveness, creating demand for reliable walk-in systems that support operational commitments and food safety requirements. The market maintains strong growth through focus on food export competitiveness and modern retail expansion, with a CAGR of 7.1% through 2035.

Key development areas:

The Mexican market leads in food processing infrastructure expansion based on nearshoring trends and cross-border retail format integration for enhanced supply chain efficiency. The country shows solid potential with a CAGR of 6.9% through 2035, driven by manufacturing investment and increasing modern retail penetration across major industrial corridors, including Bajío region, Monterrey industrial zone, Tijuana, and Central Mexico. Mexican operators are adopting technology-enhanced walk-in refrigeration for compliance with food safety standards and USA export requirements, particularly in food processing facilities serving North American markets and retail chains implementing standardized cold storage specifications. Technology deployment channels through national refrigeration distributors, regional contractors, and food processing direct procurement programs expand coverage across diverse applications.

Leading market segments:

Hungary's walk-in coolers and freezers market demonstrates sophisticated implementation focused on pharmaceutical packaging operations and food manufacturing systems, with documented integration achieving EU compliance standards for temperature-sensitive product handling. The country maintains steady growth momentum with a CAGR of 6.6% through 2035, driven by pharmaceutical foreign direct investment and operators' emphasis on quality assurance principles aligned with European regulatory frameworks. Major industrial regions, including Budapest, Debrecen, Szeged, and Győr, showcase advanced deployment of validated walk-in refrigeration that integrates seamlessly with existing pharmaceutical manufacturing and food processing infrastructure.

Key market characteristics:

In major metropolitan areas, e-commerce fulfillment centers, and modern retail developments, food operators are implementing walk-in refrigeration programs to enhance cold chain capabilities and support urban grocery delivery services, with documented case studies showing efficient temperature control in high-density logistics operations. The market shows solid growth potential with a CAGR of 6.0% through 2035, linked to ongoing e-commerce grocery expansion, national cold chain modernization initiatives, and increasing focus on food safety enhancement solutions. Chinese operators are adopting efficient walk-in systems and smart monitoring technologies to maintain product quality while complying with food safety regulations in major urban regions including Shanghai, Beijing, Guangzhou, and Shenzhen metropolitan areas.

Market development factors:

The United States' walk-in coolers and freezers market demonstrates mature implementation focused on equipment replacement cycles and natural refrigerant transition programs, with documented integration achieving significant energy savings through CO₂ and propane system adoption. The country maintains steady growth through equipment modernization programs and environmental compliance requirements, with a CAGR of 4.8% through 2035, driven by comprehensive regulatory support for low-GWP refrigerant adoption and energy efficiency mandates in commercial refrigeration. Major retail regions, including California, Texas, Florida, and Northeast corridor, showcase advanced walk-in deployment where operators integrate modern natural refrigerant systems with existing retail and foodservice infrastructure for enhanced sustainability.

Key market characteristics:

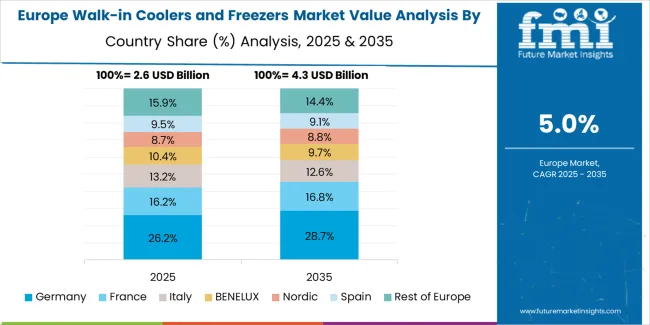

The walk-in coolers and freezers market in Europe is projected to grow from USD 3.1 billion in 2025 to USD 5.1 billion by 2035, registering a CAGR of 5.1% over the forecast period. Germany is expected to maintain its leadership position with a 24.0% market share in 2025, declining slightly to 22.0% by 2035, supported by its advanced food retail infrastructure and major supermarket chains including Edeka, Rewe, and Aldi operations across Bavaria, North Rhine-Westphalia, and Baden-Württemberg regions. France follows with a 16.5% share in 2025, projected to reach 17.0% by 2035, driven by comprehensive supermarket refurbishment programs and stadium catering upgrades for major sporting venues. The United Kingdom holds a 15.5% share in 2025, expected to moderate to 15.2% by 2035 amid retail estate rationalization but steady council-facility upgrades and food safety modernization. Italy commands a 12.4% share in 2025, reaching 12.8% by 2035, backed by tourism-linked hospitality demand and restaurant sector expansion. Spain accounts for 9.8% in 2025, rising to 10.3% by 2035 on hospitality growth and food service development. The Nordic countries represent 8.3% in 2025, expanding to 8.8% by 2035 through strong energy-efficiency programs and natural refrigerant leadership. Benelux maintains around 6.6% share across the period, while Rest of Europe grows from 7.0% to 7.9% by 2035 on modern trade format expansion in Central & Eastern European markets.

The Japanese walk-in coolers and freezers market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of natural refrigerant systems and energy-efficient technologies with existing food retail infrastructure across convenience store networks, restaurant operations, and traditional food wholesaler communities. Japan's emphasis on energy efficiency and environmental responsibility drives demand for certified walk-in equipment that supports sustainability commitments and quality expectations in premium domestic food retail standards. The market benefits from strong partnerships between international refrigeration manufacturers and domestic equipment distributors including foodservice equipment associations, creating comprehensive service ecosystems that prioritize system reliability and technical support programs. Retail centers in Tokyo, Osaka, Fukuoka, and other major urban areas showcase advanced walk-in implementations where refrigeration programs achieve 95% operational efficiency through precision temperature control systems and integrated energy management platforms.

The South Korean walk-in coolers and freezers market is characterized by growing international technology provider presence, with companies maintaining significant positions through comprehensive installation support and technical services capabilities for modern retail and high-value pharmaceutical applications. The market demonstrates increasing emphasis on natural refrigerant equipment and technology-enhanced monitoring systems, as Korean operators increasingly demand certified walk-in refrigeration that integrates with domestic food safety management systems and sophisticated facility control platforms deployed across major retail chains. Regional refrigeration contractors are gaining market share through strategic partnerships with international manufacturers, offering specialized services including system validation support and application-specific refrigeration programs for intensive cold storage operations. The competitive landscape shows increasing collaboration between multinational equipment companies and Korean food retail technology specialists, creating hybrid service models that combine international manufacturing expertise with local operator knowledge and precision cold chain systems.

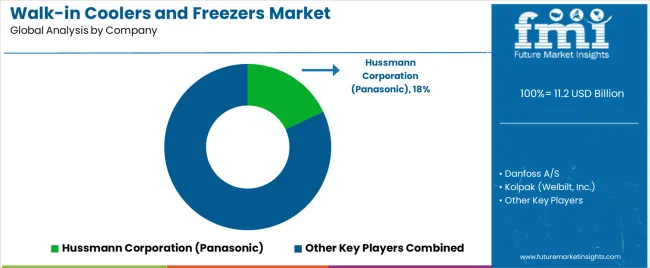

The walk-in coolers and freezers market features approximately 12-18 meaningful players with moderate concentration, where the top three companies control roughly 25-30% of global market share through established distribution networks and comprehensive product portfolios. Competition centers on energy efficiency, refrigerant technology, and installation support capabilities rather than price competition alone. Hussmann Corporation (Panasonic) leads with approximately 10.5% market share through its comprehensive walk-in refrigeration and Evolve Technologies portfolio emphasizing low-GWP systems.

Market leaders include Hussmann Corporation (Panasonic), Danfoss A/S, and Kolpak (Welbilt, Inc.), which maintain competitive advantages through global distribution infrastructure, extensive contractor networks, and deep expertise in commercial refrigeration across multiple food service segments, creating trust and reliability advantages with retailers and foodservice operators. These companies leverage research and development capabilities in natural refrigerant technology and ongoing service support relationships to defend market positions while expanding into smart monitoring and energy management solutions.

Challengers encompass Master-Bilt and Norlake, Inc., which compete through specialized walk-in designs and strong regional presence in key food retail markets. Product specialists, including Amerikooler LLC, Imperial Brown, and Thermo-Kool, focus on specific applications or regional markets, offering differentiated capabilities in modular construction, custom configurations, and rapid delivery programs. Regional players including Bally Refrigerated Boxes, Inc. and USA Cooler create competitive pressure through localized manufacturing advantages and responsive installation capabilities, particularly in high-growth markets where proximity to customers provides advantages in delivery timelines and technical support relationships.

Walk-in coolers and freezers represent efficient cold storage solutions that enable food service operators to achieve 30-40% better energy performance compared to conventional HFC-based systems, delivering superior temperature control and storage capacity with enhanced reliability in demanding commercial applications. With the market projected to grow from USD 11.2 billion in 2025 to USD 19.6 billion by 2035 at a 5.7% CAGR, these essential refrigeration systems offer compelling advantages - energy efficiency, natural refrigerant adoption, and food safety compliance opportunities - making them critical for retail food services (31.3% market share), commercial kitchens & restaurants (26.0% share), and cold storage operations seeking alternatives to conventional reach-in refrigeration that cannot provide adequate bulk storage capacity.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 11.2 billion |

| Place of Use | Indoor, Outdoor |

| Technology | Remote Condensing, Self-Contained, Multiple Condensing |

| End Use | Retail Food Services, Commercial Kitchens & Restaurants, Cold Storage Warehouses, Pharmaceuticals, Research Laboratories, Hospitals & Mortuaries, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country Covered | Brazil, Saudi Arabia, Turkey, Mexico, Hungary, China, USA, and 40+ countries |

| Key Companies Profiled | Hussmann Corporation (Panasonic), Danfoss A/S, Kolpak (Welbilt, Inc.), Master-Bilt, Norlake, Inc., Amerikooler LLC, Imperial Brown, Thermo-Kool, Bally Refrigerated Boxes, Inc., USA Cooler |

| Additional Attributes | Dollar sales by place of use, technology, and end use categories, regional adoption trends across North America, Europe, and Asia Pacific, competitive landscape with refrigeration manufacturers and contractor networks, technology requirements and specifications, integration with temperature monitoring platforms and facility management systems, innovations in natural refrigerant technology and energy efficiency, and development of specialized walk-in systems with enhanced food safety and environmental compliance capabilities. |

The global walk-in coolers and freezers market is estimated to be valued at USD 11.2 billion in 2025.

The market size for the walk-in coolers and freezers market is projected to reach USD 19.5 billion by 2035.

The walk-in coolers and freezers market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in walk-in coolers and freezers market are indoor and outdoor.

In terms of technology, remote condensing segment to command 48.0% share in the walk-in coolers and freezers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Walk-In Cooler and Freezer Market Growth – Trends & Forecast 2024-2034

United States Walk-in Cooler and Freezer Market - Size, Growth, & Forecast Outlook 2025 to 2035

EGR Coolers Market Size and Share Forecast Outlook 2025 to 2035

Air Coolers Market Trends - Size, Growth & Forecast 2025 to 2035

Flue Gas Coolers Market Size and Share Forecast Outlook 2025 to 2035

Back Bar Coolers Market Analysis - Demand & Growth Forecast 2025 to 2035

Insulated Coolers Market Insights - Growth & Forecast 2025 to 2035

Glass Door Coolers Market Insights – Growth & Forecast 2025 to 2035

Charge Air Coolers Market

Refrigeration Coolers Market Growth – Trends & Forecast 2025 to 2035

Automotive Engine Oil Coolers Market

Bariatric Walking Aids Market Size and Share Forecast Outlook 2025 to 2035

Assisted Walking Devices Market Size and Share Forecast Outlook 2025 to 2035

Walking Aid Market Analysis by Product, Technology, End-user, and Region 2025 to 2035

Reach-In Freezers Market - Industry Demand & Market Growth 2025 to 2035

Cryogenic Freezers Market Size and Share Forecast Outlook 2025 to 2035

Cryopreservation Freezers Market Outlook – Size & Forecast 2025-2035

Ultra-Low Temperature Freezers Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA