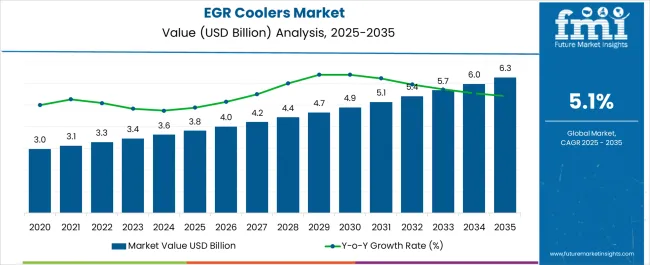

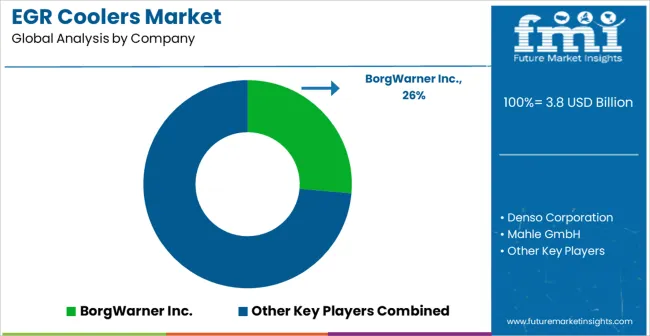

The EGR Coolers Market is estimated to be valued at USD 3.8 billion in 2025 and is projected to reach USD 6.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

| Metric | Value |

|---|---|

| EGR Coolers Market Estimated Value in (2025 E) | USD 3.8 billion |

| EGR Coolers Market Forecast Value in (2035 F) | USD 6.3 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The EGR Coolers market is experiencing significant growth driven by the increasing demand for emissions reduction technologies in internal combustion engines, particularly in the automotive sector. The future outlook for this market is shaped by stricter environmental regulations and rising awareness regarding vehicle emissions and air quality. The adoption of diesel engines, which are widely used in commercial and passenger vehicles, has created a strong demand for effective EGR cooling solutions to enhance engine efficiency and reduce nitrogen oxide emissions.

Advancements in cooler design and materials technology have further improved thermal management, durability, and integration with engine systems. Investments in emission-compliant vehicles and growing focus on sustainable transportation have accelerated the deployment of EGR coolers globally.

Additionally, increasing vehicle production in emerging markets, along with rising consumer expectations for fuel efficiency and environmental compliance, continues to support the market’s expansion As regulatory pressures tighten and automotive manufacturers prioritize emission reduction, the EGR Coolers market is poised for steady growth in both developed and developing regions.

The egr coolers market is segmented by engine type, material type, end user, sales channel, and geographic regions. By engine type, egr coolers market is divided into Diesel Engine and Gasoline Engine. In terms of material type, egr coolers market is classified into Steel and Alloy Material. Based on end user, egr coolers market is segmented into Automotive, Two Wheeler, Passenger Car, Commercial Vehicle, and Marine. By sales channel, egr coolers market is segmented into Original Equipment Manufacturer (OEM) and Aftermarket. Regionally, the egr coolers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

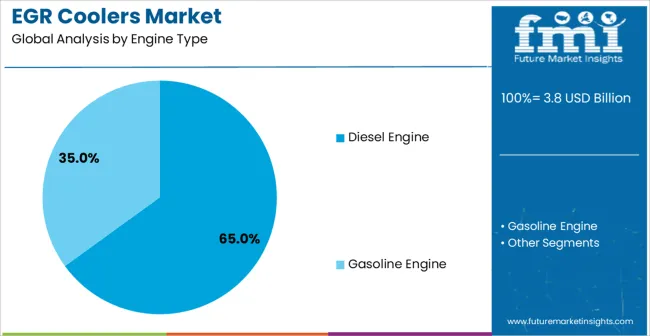

The diesel engine segment is projected to hold 65.0% of the EGR Coolers market revenue share in 2025, establishing it as the leading engine type. This dominance is driven by the widespread use of diesel engines in commercial and passenger vehicles, which require advanced exhaust gas recirculation solutions to meet stringent emission norms.

The segment has benefited from increasing adoption of emission control technologies and the integration of EGR coolers to enhance fuel efficiency and reduce nitrogen oxide emissions. The growing production of diesel-powered vehicles in emerging markets has further reinforced demand.

Additionally, technological advancements in cooler design, including improved heat transfer and corrosion resistance, have made diesel engines more compatible with EGR cooling solutions These factors collectively contribute to the leading position of the diesel engine segment in the market.

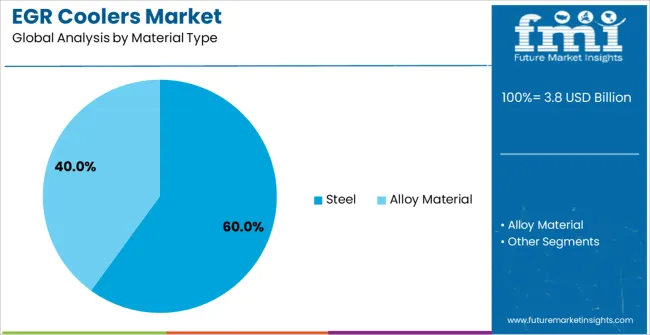

The steel material type segment is expected to capture 60.0% of the EGR Coolers market revenue share in 2025, making it the dominant material choice. Steel is preferred due to its excellent durability, thermal conductivity, and resistance to high-temperature exhaust gases, which are critical for the long-term performance of EGR coolers.

The segment’s growth is supported by advancements in material processing and fabrication technologies that enhance corrosion resistance and reduce maintenance requirements. Additionally, steel allows for scalable and cost-effective manufacturing, meeting the demand from both OEMs and aftermarket providers.

The combination of performance, reliability, and economic advantages has reinforced the prominence of steel as the preferred material in EGR cooler production.

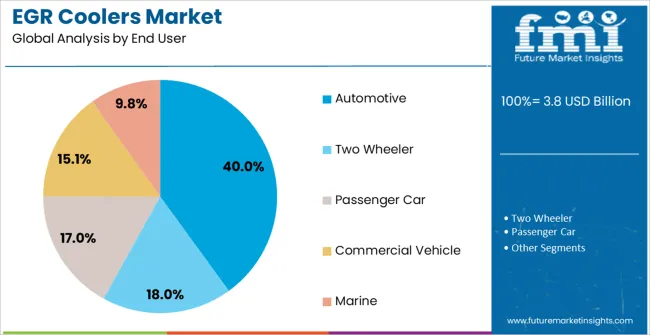

The automotive end-user segment is anticipated to account for 40.0% of the EGR Coolers market revenue in 2025, establishing it as the leading end-use industry. This growth is driven by the high adoption of diesel and gasoline vehicles requiring efficient emission control systems.

Automotive manufacturers are increasingly integrating EGR coolers into engines to comply with emission regulations and improve fuel efficiency. The rising focus on environmental sustainability and regulatory compliance has accelerated the deployment of these coolers in passenger and commercial vehicles.

Additionally, the growing production of vehicles in both developed and emerging markets, combined with consumer demand for cleaner and more efficient engines, supports the expansion of the automotive segment The ability of EGR coolers to enhance engine performance while reducing harmful emissions makes them a critical component in the automotive sector.

Exhaust Gas Recirculation Coolers are more commonly known as EGR coolers are the component of exhaust gas recirculation unit that are used to reduce the temperature of exhaust gases and resend to this unburnt fuel to engine in order to decrease the operating temperature of engine cylinder’s as well as prevent the emission of harmful gases emission such as NOx. The chief aim of EGR Coolers is to decrease air temperature is to increase the density of intake air well as enhance the performance of vehicles.

Steel as a material is majorly used for EGR Cooler fabrication owing to its high strength which can continuously work under harsh environment such as rust or rust flakes.

Therefore, leading players in the global EGR Coolers market are using steel for production of EGR Coolers and supply to automotive vehicle and marine applications.

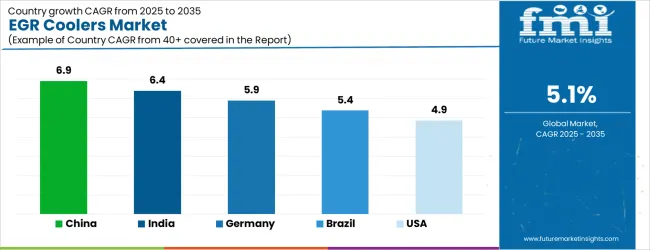

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| Brazil | 5.4% |

| USA | 4.9% |

| UK | 4.4% |

| Japan | 3.8% |

The EGR Coolers Market is expected to register a CAGR of 5.1% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.9%, followed by India at 6.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 3.8%, yet still underscores a broadly positive trajectory for the global EGR Coolers Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.9%. The USA EGR Coolers Market is estimated to be valued at USD 1.3 billion in 2025 and is anticipated to reach a valuation of USD 1.3 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 191.3 million and USD 110.6 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.8 Billion |

| Engine Type | Diesel Engine and Gasoline Engine |

| Material Type | Steel and Alloy Material |

| End User | Automotive, Two Wheeler, Passenger Car, Commercial Vehicle, and Marine |

| Sales Channel | Original Equipment Manufacturer (OEM) and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BorgWarner Inc., Denso Corporation, Mahle GmbH, Valeo S.A., Continental AG, Delphi Technologies, Hanon Systems, and Faurecia SE |

The global egr coolers market is estimated to be valued at USD 3.8 billion in 2025.

The market size for the egr coolers market is projected to reach USD 6.3 billion by 2035.

The egr coolers market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in egr coolers market are diesel engine and gasoline engine.

In terms of material type, steel segment to command 60.0% share in the egr coolers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Egress Gateway Market Size and Share Forecast Outlook 2025 to 2035

eGRC Market - Trends & Forecast through 2034

EGR Valve Market

Regression Analysis Tool Market

Integrated Traffic System Market Size and Share Forecast Outlook 2025 to 2035

Integrated Chemistry Systems Market Size and Share Forecast Outlook 2025 to 2035

Integrated Mineral Analyzer Market Size and Share Forecast Outlook 2025 to 2035

Integrated Motor Protector Market Size and Share Forecast Outlook 2025 to 2035

Integrated Universal Integrated Circuit Card (iUICC) Modules Market Size and Share Forecast Outlook 2025 to 2035

Integrated SIM (iSIM) Market Size and Share Forecast Outlook 2025 to 2035

Integrated 3D Radar Market Size and Share Forecast Outlook 2025 to 2035

Pomegranate Peel Actives Market Size and Share Forecast Outlook 2025 to 2035

Integrated UPS Market Size and Share Forecast Outlook 2025 to 2035

Integrated Labeling System Market Size and Share Forecast Outlook 2025 to 2035

Integrated Quantum Optical Circuits Market Size and Share Forecast Outlook 2025 to 2035

Integrated Graphics Chipset Market Analysis by Device Type, Industry Vertical, and Region – Growth, Trends, and Forecast from 2025 to 2035

Integrated Food Ingredients Market Analysis -Size, Share & Forecast 2025 to 2035

Integrated Gas System Market Growth – Trends & Forecast 2025 to 2035

Integrated Passive Devices (IPDs) Market

Integrated CMOS Tri-gate Transistor Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA