The eGRC market is witnessing substantial growth driven by the increasing need for integrated governance, risk management, and compliance solutions across organizations of all sizes. The future outlook for this market is shaped by the rising complexity of regulatory requirements, the growing focus on risk mitigation, and the demand for real-time compliance monitoring. Organizations are increasingly adopting digital solutions to streamline processes, enhance operational efficiency, and ensure regulatory adherence.

Advancements in cloud computing, artificial intelligence, and analytics are further enabling organizations to implement scalable and automated eGRC systems. The shift towards centralized risk management frameworks and data-driven decision-making is supporting the adoption of comprehensive eGRC platforms.

Additionally, increasing awareness of cybersecurity threats and the financial and reputational impact of non-compliance is encouraging investment in software-driven governance solutions As enterprises seek to improve operational resilience, ensure audit readiness, and optimize compliance workflows, the eGRC market is expected to maintain a strong growth trajectory in both established and emerging regions.

| Metric | Value |

|---|---|

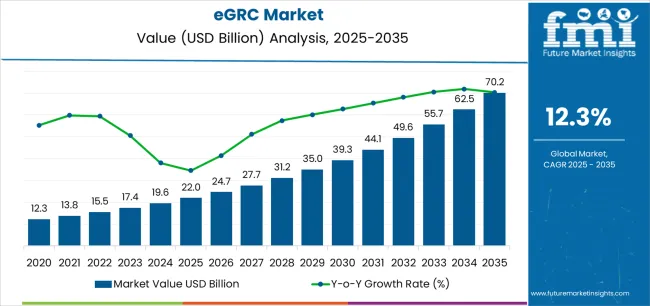

| eGRC Market Estimated Value in (2025 E) | USD 22.0 billion |

| eGRC Market Forecast Value in (2035 F) | USD 70.2 billion |

| Forecast CAGR (2025 to 2035) | 12.3% |

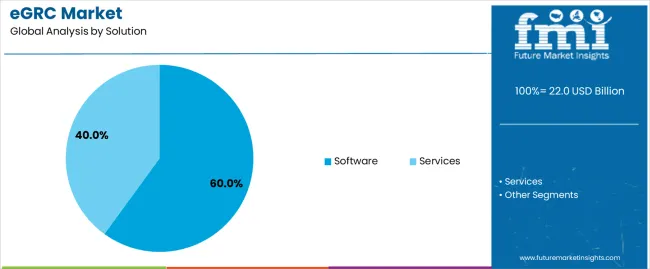

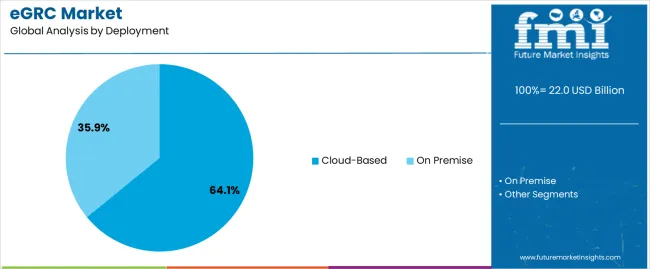

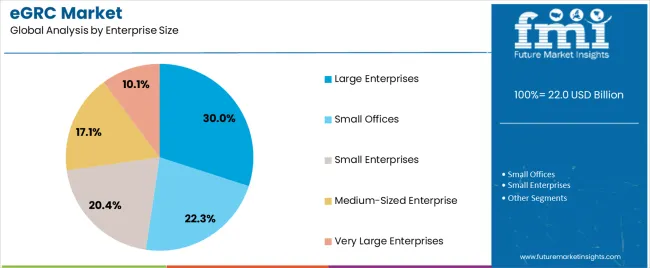

The market is segmented by Solution, Deployment, Enterprise Size, and Industry and region. By Solution, the market is divided into Software and Services. In terms of Deployment, the market is classified into Cloud-Based and On Premise. Based on Enterprise Size, the market is segmented into Large Enterprises, Small Offices, Small Enterprises, Medium-Sized Enterprise, and Very Large Enterprises. By Industry, the market is divided into Finance, Manufacturing & Resources, Distribution Services, Services, Public Sector, and Infrastructure. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The software solution segment is projected to hold 60.00% of the eGRC market revenue share in 2025, establishing it as the leading solution type. This dominance is driven by the flexibility, scalability, and automation capabilities provided by software-based eGRC platforms. Organizations prefer software solutions for their ability to integrate governance, risk, and compliance processes into a unified framework, enhancing operational efficiency and reducing manual intervention.

The increasing need for real-time monitoring, reporting, and analytics further supports the adoption of software solutions. Additionally, the ability to customize workflows and implement enterprise-wide risk management strategies has reinforced the segment’s growth.

Software-based solutions also enable seamless updates to accommodate evolving regulations, making them a preferred choice for businesses aiming to maintain compliance proactively As enterprises focus on digital transformation and operational resilience, software solutions are expected to remain the primary driver of growth in the eGRC market.

The cloud-based deployment segment is expected to capture 64.10% of the eGRC market revenue share in 2025, highlighting its leading position. This growth is driven by the scalability, cost-effectiveness, and ease of implementation offered by cloud-based eGRC solutions.

Organizations increasingly prefer cloud deployment for its ability to provide real-time access, facilitate remote monitoring, and support multi-location operations. Cloud-based platforms reduce infrastructure costs and simplify system maintenance, enabling enterprises to focus on core business activities while ensuring compliance and risk management.

The growing acceptance of SaaS models, coupled with enhanced data security and disaster recovery capabilities, has further accelerated adoption Cloud deployment also allows for faster updates and integration with emerging technologies, reinforcing its dominance in the market.

The large enterprise segment is anticipated to account for 30.00% of the eGRC market revenue in 2025, making it the leading end-user category. Growth in this segment is driven by the complex regulatory and operational requirements of large organizations, which necessitate comprehensive risk management and compliance solutions.

Large enterprises benefit from scalable eGRC systems that integrate multiple business units, geographies, and compliance frameworks into a centralized platform. The ability to generate detailed analytics, track regulatory changes, and implement proactive risk mitigation strategies has reinforced adoption in this segment.

Additionally, increasing investment in digital transformation initiatives and enterprise-wide governance programs has further driven the uptake of eGRC solutions among large organizations As regulatory landscapes evolve and operational complexity increases, large enterprises are expected to remain the primary adopters of advanced eGRC systems.

This below table presents the expected CAGR for the Global eGRC market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the year from 2025 to 2035, the industry is predicted to surge at a CAGR of 12.4%, followed by a slightly lower growth rate of 12.2% in the second half (H2) of the same year.

| Particular | Value CAGR |

|---|---|

| H1, 2025 | 12.4% (2025 to 2035) |

| H2, 2025 | 12.2% (2025 to 2035) |

| H1, 2025 | 12.6% (2025 to 2035) |

| H2, 2025 | 12.0% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to hold at 12.6% in the first half from 2025-2035 and remain considerably decrease at 12.0% in the second half 2025-2035. In the first half (H1) 2025-2035 the market witnessed an increase of 20 BPS while in the second half (H2) 2025-2035 the market witnessed a decrease of 20 BPS.

Rising Cybersecurity Threats and Government Regulations Creates the Demand of eGRC Solutions

The businesses are increasingly focusing on strengthening their security frameworks to protect their databases against data breaches and reputational damage.

The rising number of cyberattacks are pushing businesses to adopt comprehensive eGRC solutions that holds the capabilities to integrate cybersecurity measures with governance and compliance strategies.

The average cost of a data breach reached USD 22 million in 2025, which shows the emergence of robust security measures, as per IBM. This is leading to increase in the demand of eGRC platforms that can provide real-time risk analysis, automate compliance with challenging regulations and ensure strong data protection mechanisms are in place.

Many regulatory agencies around the world are making strict regulations around cybesecurity, which makes it hard for companies to comply with these standards. As a result, eGRC providers are updating their services to include advanced cybersecurity features.

Emergence of Integrated Risk Management Solutions in Several Industries.

Integrated risk management helps businesses in aligning risk management processes with strategic goals while improving decision-making and operational efficiency.

The adoption of integrated risk management solutions are rapidly deployed, owing to the emergence of regulatory demands. For example, GDPR and CCPA are pushing the companies to integrate their risk management practices with compliance efforts to avoid financial penalties and brand damage.

These solutions assists in consolidating risk data from different sources and enables businesses to monitor and minimize the risks in real-time.

IBM upgraded OpenPages with Watson in 2025, an AI-powered IRM solution providing real-time risk insights for businesses, showing the industry's move towards using AI and machine learning for managing complex risk environments. The other market leading companies offer all-inclusive IRM frameworks that combine risk, compliance, and audit functions into one platform.

The companies offers these frameworks to improve alignment with corporate governance strategies.

On the other hand, the COVID-19 pandemic also showed the importance of IRM as businesses deal with uncertainties and new risks. The companies are applying an integrated approach to manage risks across different industries.

Integration Complexities Might Pose as a Challenge in eGRC Landscape

As companies use more eGRC solutions to handle risk and compliance, integrating these systems with current IT setups has become a bigger challenge. This integration includes syncing different data sources, fitting with existing workflows, and making sure different systems can work together, which can take a lot of time and money.

The need for eGRC solutions that cover governance, risk, and compliance is growing, but it's hard to fit these solutions into a company's current systems. For example, big companies often have old systems that don't work well with new eGRC platforms. This means a lot of customization is needed, which can slow down getting the system up and raise costs.

Recent changes have shown that integrating different systems has become more challenging. For instance, the shift to digital processes and using private cloud services has made it important for systems to work well together.

The COVID-19 pandemic added to this by making many companies switch to remote work quickly, which meant that eGRC systems had to support this change and connect with more cloud applications.

In 2025, companies like Pathlock introduced new products to help with this, but it still takes a lot of work to fully connect them to complex IT setups.

As rules and regulations keep changing, eGRC systems also need to change. This means redoing how different systems work together to follow the new rules in all parts of the business. Having to make these ongoing changes shows how much effort it takes to keep an eGRC system working well.

Real-time Risk Management

Real-time risk management is an opportunity with rising complexities in regulatory environment and cybersecurity threats. With real-time risk management, businesses are able to respond swiftly to emerging threats. This ensures the compliance of businesses during rapidly evolving regulations and maintain business continuity.

On the other hand, the pandemic also had a fair share in the acceleration of real-time risk management demand. Owing to the unprecedented disruptions which highlighted the importance of responsive risk management systems. Businesses are increasingly adopting eGRC solutions that have the capabilities of integrating real-time monitoring and analytics.

It enables these businesses to detect and minimize the risks as they occur. For example, financial institutions are utilizing real-time early warning systems for credit risk management, which reduces the risk for non-performing assets and improves the financial ability.

Technological advancements have highly improved real-time risk management in eGRC solutions. eGRC solutions are able to predict and manage risks more accurately, which helps in making better decision. This is due to ability of eGRC solutions to integrate AI, ML and advanced analytics.

The eGRC market went through notable fluctuations and technological advancements in the historical period. The industry was valued at a valuation of USD 11,460.9 million in 2020 to reach USD 17,545.2 million in 2025 with a CAGR of 11.2 % from 2020 to 2025.

During pandemic, companies started to move towards cloud solutions rapidly due to the remote working trends. This digital transformation generated the demand of governance, risk and compliance solutions for enterprises. The pandemic also LED to increased focus on operational risk management and business continuity planning.

eGRC market witnessed a considerable growth during the forecasting period between 2025 and 2035. The market reached the valuation of USD 61,875.4 million in 2035 from USD 19,592.6 million in 2025 with the CAGR of 12.3%.

During the forecasting period, the regulatory frameworks are expected to become more complex and this is expected to drive the demand of eGRC solutions rapidly. Another expectation is that the focus on ESG and sustainability is going to increase during the forecasting period.

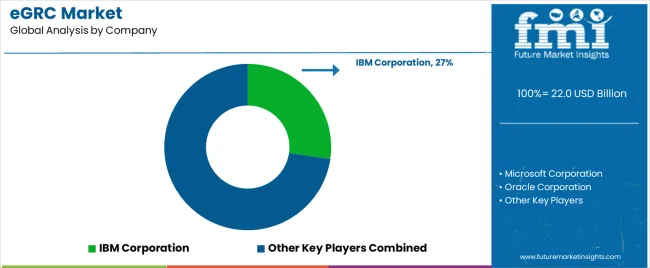

Tier 1 companies have acquired substantial share of 35% to 40% in the eGRC market. These companies offer broad portfolio of eGRC solutions. IBM Corporation, Microsoft Corporation, Oracle Corporation and MetricStream are top Tier 1 companies that hold the largest market share globally. These vendors focus on providing end-to-end solutions and cater to large scale enterprises.

Tier 2 vendors in the global eGRC market are focusing on enhancing their end-to-end solutions capability. These vendors have the global market reach but lack in competing owing to the gaps in features and capabilities. The vendors in tier 2 bracket includes Thomas Reuters, SAI360, Navex Global among others. These vendors hold around 25% to 30% market share.

Tier 3 companies represent 30% to 35% of share of total eGRC industry. These vendors focus on the market expansion and providing end-user specific solutions. The vendors in the bracket includes Mitratech, Inc., LexComply among others.

The below country-wise market analysis of the eGRC explains the recent developments and different government approaches in the market. The analysis also gives an idea of the country’s expected progress in the market landscape.

The data describes key highlights, growth factors, and CAGRs of these countries.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 18.4% |

| China | 15.9% |

| USA | 12.7% |

| Germany | 11.5% |

The Indian government's focus on digital transformation, including initiatives like "Digital India" and strict data protection laws, has greatly increased the need for eGRC solutions. Swiss GRC, a European company that focuses on governance, risk, and compliance solutions, entered the Indian market in February 2025 to provide solutions in BFSI sector. This shows the increasing need for advanced GRC solutions to handle the intricate regulatory landscape in India.

In addition, iOPEX Technologies, a global digital transformation service provider, launched a compliance and governance add-on for ServiceNow's creator workflows, tailored for Indian businesses. This solution incorporates advanced risk management techniques, showing the growing demand for personalized, flexible eGRC solutions in the country.

The Chinese government is updating its regulations in finance, healthcare, and manufacturing to meet global standards, leading to a higher need for strong eGRC solutions. For example, Huawei has a solution called "Risk Management and Compliance" that uses AI and big data to monitor and report in real-time for Chinese businesses. It's popular in industries like telecom and finance where following rules is important.

Local companies like Newland Digital Technology are creating eGRC platforms in the cloud that meet the specific needs of the Chinese market, such as strict data localization and cybersecurity laws. These platforms help businesses follow the quickly changing Chinese rules and handle risks related to data breaches and operational issues.

The growth in USA is driven by increased cybersecurity risks and the fast adoption of digital changes, which require strong solutions for managing rules and risks. For instance, Credo AI introduced a platform in March 2025 to make sure AI is used ethically in businesses.

Also, the Bank of East Asia started using Wolters Kluwer's OneSumX software for reporting rules in late 2025, showing the need for advanced compliance tools in banking. These solutions highlight how the USA leads in using advanced tech to handle compliance and risk quickly, which helps the overall growth of the eGRC market.

The below section provides the category wise insights in the market with recent developments and future projections.

Cloud-based eGRC solutions are dominating as they are flexible22 and cost-effective. They help manage risks in real time22 integrate well with current systems22 and keep data secure. This makes them great for companies worldwide in different industries.

| Segment | Cloud (Deployment) |

|---|---|

| Value Share (2025) | 64.1% |

Microsoft launched its eGRC solution on Azure in 2025. This solution uses AI and machine learning to automate compliance tasks and give real-time insights into potential risks. Similarly22 IBM's OpenPages with Watson on Cloud provides AI-powered risk management and compliance solutions for organizations to rapidly identify and address risks.

The finance industry leads in the eGRC market as it has strict rules to follow22 faces high financial risks22 and needs to uphold trust through compliance and risk management. Financial institutions have to follow complex regulations like Basel III22 GDPR22 and the Sarbanes-Oxley Act. This requires strong eGRC solutions that can handle lots of sensitive data and give real-time updates on compliance.

| Segment | Finance (Industry) |

|---|---|

| Value Share (2025) | 32.3% |

For instance22 BNB Paribas announced in October 2025 that they will be implementing Lenvi Riskfactor’s full-service risk management and fraud analytics software to support its risk management and operations efficiency.

The vendors in the market are focusing on untapped markets like Latin America and Africa. In order to meet the demand of SMEs, these companies are also offering cloud-based solutions.

However, the new companies entering the market are making it more competitive. The top sellers in the market provide integrated solutions and use AI and ML to offer advanced business solutions.

Recent Market Developments

eGRC market includes Software and Services.

The segment is divided into cloud-based and on premise.

Small Offices (1-9 employees), Small Enterprises (10-99 employees), Medium-sized Enterprise (100-499 employees), Large Enterprises (500-999 employees) and Very Large Enterprises (1,000+ employees) are segmented in this category.

Finance, Manufacturing & Resources, Distribution Services, Services, Public Sector and Infrastructure are segmented in this category.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific Western Europe, Eastern Europe and Middle East and Africa (MEA).

The global eGRC market is estimated to be valued at USD 22.0 billion in 2025.

The market size for the eGRC market is projected to reach USD 70.2 billion by 2035.

The eGRC market is expected to grow at a 12.3% CAGR between 2025 and 2035.

The key product types in eGRC market are software and services.

In terms of deployment, cloud-based segment to command 64.1% share in the eGRC market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA