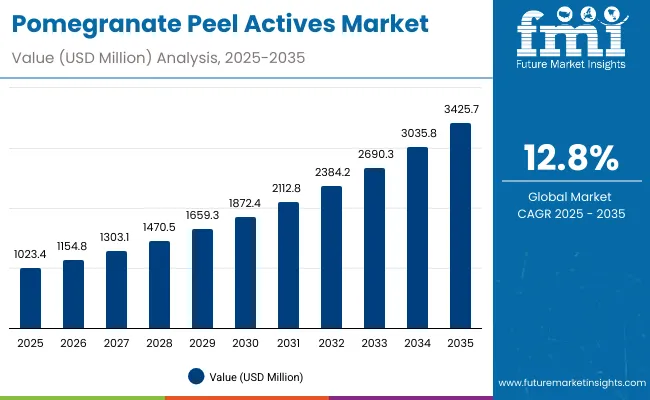

The Pomegranate Peel Actives Market is expected to record a valuation of USD 1,023.4 million in 2025 and USD 3,425.7 million in 2035, with an increase of USD 2,402.3 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 12.8% and a more than 2X increase in market size.

Pomegranate Peel Actives Market Key Takeaways

| Metric | Value |

|---|---|

| Pomegranate Peel Actives Market Estimated Value in (2025E) | USD 1,023.4 million |

| Pomegranate Peel Actives Market Forecast Value in (2035F) | USD 3,425.7 million |

| Forecast CAGR (2025 to 2035) | 12.8% |

During the first five-year period from 2025 to 2030, the market increases from USD 1,023.4 million to USD 1,872.4 million, adding USD 849 million, which accounts for 35% of the total decade growth. This phase records steady adoption of antioxidant-rich actives in serums, creams, and capsules, driven by rising demand for anti-aging and skin-protective formulations. The antioxidant function segment dominates this period, supported by strong consumer preference for natural protection against oxidative stress.

The second half from 2030 to 2035 contributes USD 1,553.3 million, equal to 65% of total growth, as the market jumps from USD 1,872.4 million to USD 3,425.7 million. This acceleration is powered by widespread adoption of natural/organic claims, rapid expansion of e-commerce channels, and rising investments by global and regional cosmetic brands. By the end of the decade, serums and antioxidant-led formulations capture the largest share, while clean-label and Ayurvedic-inspired claims gain prominence. Premiumization and digital-first product launches further accelerate consumer adoption.

From 2020 to 2024, the Pomegranate Peel Actives Market expanded steadily, driven by consumer adoption of natural antioxidants and multifunctional skincare formulations. During this period, the competitive landscape was shaped by global ingredient suppliers and early-mover botanical specialists, with leading firms like Sabinsa and BASF controlling a notable share of revenue. Competitive differentiation relied on standardized extraction methods, supply chain traceability, and clean-label positioning, while smaller players focused on Ayurvedic-inspired and niche organic claims. Service-based innovations such as D2C brand-led launches had limited traction, contributing less than 10% of market value.

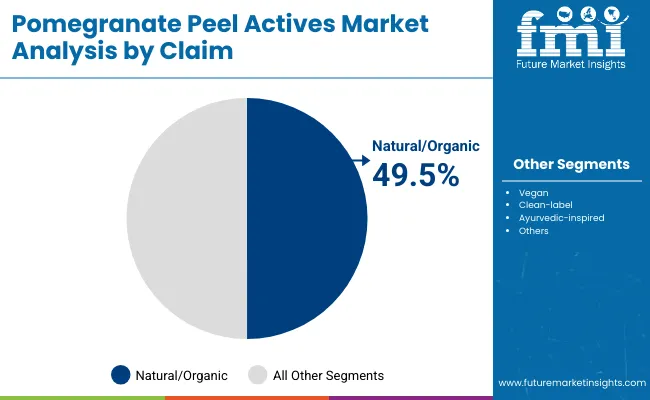

Demand for Pomegranate Peel Actives will expand to USD 1,023.4 million in 2025, and the revenue mix will shift as natural/organic claims grow to over 49.5% share. Traditional ingredient suppliers face rising competition from digital-first and indie beauty brands leveraging e-commerce and influencer-driven strategies. Major players are pivoting to hybrid models that combine clinical validation, sustainability certifications, and digital consumer engagement to retain relevance. Emerging entrants specializing in Ayurvedic-inspired, vegan, and clean-label formulations are gaining share. The competitive advantage is moving away from ingredient sourcing alone to ecosystem strength, regulatory credibility, and recurring consumer loyalty through premium skincare applications.

Consumers are increasingly shifting toward natural and plant-based antioxidants as alternatives to synthetic ingredients in skincare. Pomegranate peel, being rich in polyphenols and flavonoids, is recognized for its ability to combat oxidative stress and skin damage. This positions it as a trusted ingredient in anti-aging and protective skincare. With clean-label and natural/organic claims driving purchasing decisions, the demand for pomegranate peel actives is accelerating, especially in markets like China and India where botanical remedies are culturally embedded.

The growing influence of Ayurvedic-inspired beauty and the premiumization of skincare are fueling the adoption of pomegranate peel actives. Consumers are seeking multifunctional solutions that combine anti-aging, brightening, and acne-control benefits in serums, creams, and capsules. Brands are capitalizing on this trend by formulating products that merge traditional knowledge with modern efficacy. This dual appeal of cultural heritage and scientific validation is boosting consumer trust and expanding the market, particularly across Asia-Pacific and Europe.

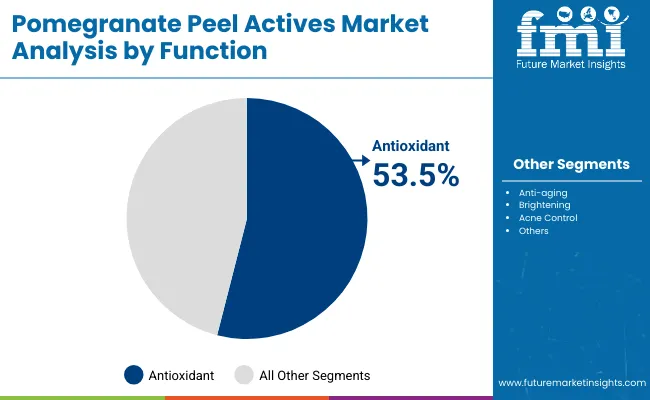

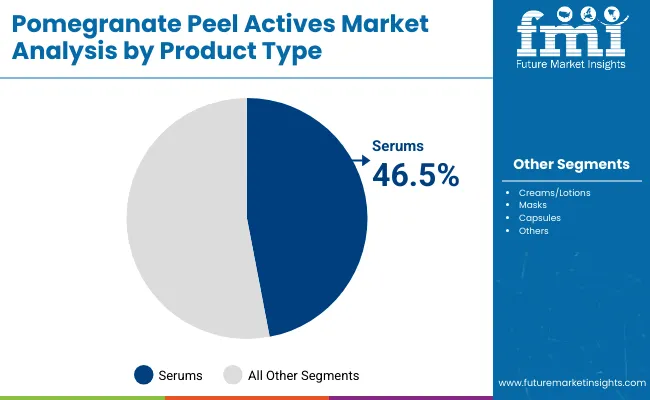

The market is segmented by function, product type, claim, distribution channel, and region, reflecting the diverse applications and positioning of pomegranate peel actives in skincare. Functions include antioxidant, anti-aging, brightening, and acne control, highlighting the ingredient’s multifunctional potential across consumer needs. Product type classification covers serums, creams/lotions, masks, and capsules to cater to both premium and mass-market formulations. Based on claims, segmentation includes natural/organic, vegan, clean-label, and Ayurvedic-inspired products, underscoring rising consumer demand for transparency and heritage-driven beauty. In terms of distribution channel, categories encompass e-commerce, pharmacies, specialty beauty stores, and mass retail, with online platforms rapidly expanding their share. Regionally, the scope spans North America, Europe, and Asia-Pacific, with the fastest growth expected in China and India, supported by strong cultural alignment with botanical skincare and rapid digital retail adoption.

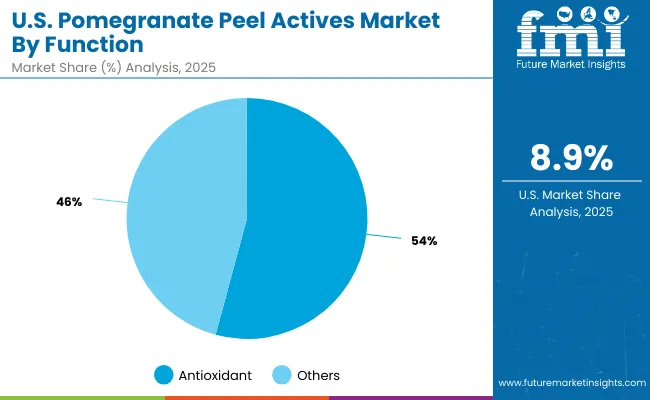

| Function | Value Share% 2025 |

|---|---|

| Antioxidant | 53.5% |

| Others | 46.5% |

The antioxidant segment is projected to contribute the largest share of the Pomegranate Peel Actives Market revenue in 2025, maintaining its lead as the dominant functional category. This dominance is driven by rising consumer demand for natural antioxidants to protect against oxidative stress, premature aging, and environmental damage. Brands are increasingly formulating serums, creams, and capsules with pomegranate peel actives to position products as multifunctional skincare solutions. The segment’s growth is also supported by the clean-label and natural/organic claims that resonate with global consumers. As awareness of plant-derived antioxidants continues to rise, the antioxidant function is expected to remain the backbone of the Pomegranate Peel Actives Market.

| Claim | Value Share% 2025 |

|---|---|

| Natural/organic | 49.5% |

| Others | 50.5% |

The natural/organic segment is forecasted to hold the leading share of the Pomegranate Peel Actives Market in 2025, driven by the rising preference for clean-label and plant-based skincare solutions. Consumers increasingly associate natural and organic claims with safety, sustainability, and efficacy, making them a critical differentiator for premium and mass-market products alike. This segment’s growth is further supported by regulatory emphasis on transparency and the cultural relevance of botanical formulations in Asia-Pacific. As brands continue to highlight heritage-inspired and eco-friendly positioning, natural/organic products are expected to maintain dominance in the market.

| Product Type | Value Share% 2025 |

|---|---|

| Serums | 46.5% |

| Others | 53.5% |

The serums segment is projected to account for the largest share of the Pomegranate Peel Actives Market revenue in 2025, establishing it as the leading product type. Serums are preferred for their concentrated formulations, fast absorption, and ability to deliver visible skincare benefits such as antioxidant protection, anti-aging, and brightening. Their lightweight texture and compatibility with multi-step routines make them highly popular across both premium and mass-market brands. Innovation in delivery systems and the integration of natural/organic claims are further driving serum adoption. Given their strong consumer appeal and multifunctional positioning, serums are expected to maintain their leadership in the Pomegranate Peel Actives Market.

Clinical Validation of Antioxidant Efficacy

The growth of the Pomegranate Peel Actives Market is strongly driven by increasing clinical validation of peel-derived polyphenols and tannins, which demonstrate superior antioxidant capacity compared to other botanicals. Skincare brands are leveraging these findings to differentiate anti-aging and protective claims in serums and creams, especially in regulated markets like the EU. This evidence-based positioning builds consumer trust, enabling premium pricing and deeper penetration in pharmacy and specialty beauty channels where clinically supported formulations hold stronger appeal.

Ayurvedic and Heritage-Backed Marketing in Asia-Pacific

A major growth driver is the alignment of pomegranate peel actives with Ayurvedic and traditional beauty narratives in India and China. Local and global brands are rebranding peel extracts as heritage-inspired ingredients, integrating them into Ayurvedic-inspired and holistic skincare. This cultural resonance not only strengthens consumer acceptance but also allows products to stand apart from conventional plant actives. Coupled with the rapid rise of e-commerce platforms in Asia-Pacific, this heritage-backed marketing is enabling faster uptake across both premium urban consumers and cost-sensitive rural markets.

High Variability in Peel Extract Quality

One of the key restraints for the market is the high variability in extract quality due to differences in sourcing, processing methods, and standardization of bioactive compounds. Unlike fruit pulp, pomegranate peels require specific extraction processes to retain antioxidant potency. Inconsistent supply chains often result in products with varying efficacy, limiting brand trust in international markets. This creates challenges for companies attempting to secure approvals in regulated regions like the USA and EU, where quality assurance and repeatable performance are critical to scaling distribution.

Rise of Capsule and Ingestible Beauty Formats

A notable trend is the expansion of pomegranate peel actives into ingestible beauty products such as capsules and functional supplements. Consumers are increasingly embracing “beauty from within” solutions, seeking antioxidant protection and anti-aging benefits beyond topical skincare. Brands are launching capsule formats that combine peel actives with vitamins and collagen to target holistic wellness. This crossover into nutricosmetics not only broadens application scope but also creates recurring revenue opportunities, particularly in Asia and Europe, where ingestible beauty has been rapidly gaining mainstream traction.

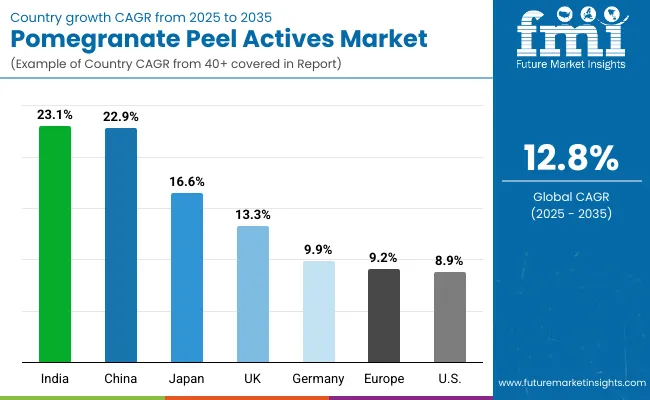

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 22.9% |

| USA | 8.9% |

| India | 23.1% |

| UK | 13.3% |

| Germany | 9.9% |

| Japan | 16.6% |

The global Pomegranate Peel Actives Market shows pronounced regional disparities in growth, strongly influenced by cultural acceptance of botanical remedies, regulatory frameworks for clean-label skincare, and digital-first adoption patterns.

Asia-Pacific emerges as the fastest-growing region, anchored by India at 23.1% CAGR and China at 22.9% CAGR. This acceleration is fueled by consumer preference for Ayurvedic-inspired and herbal actives, strong demand for natural/organic claims, and the rapid expansion of e-commerce platforms. In China, government encouragement of clean-label cosmetics and consumer trust in traditional plant actives are boosting demand. India’s trajectory reflects rising disposable incomes, urban beauty awareness, and the integration of pomegranate actives into Ayurvedic-inspired premium skincare.

Japan, with a CAGR of 16.6%, showcases demand for multifunctional skincare products where anti-aging and antioxidant benefits are paired, aligning with the country’s preference for science-backed and innovative formulations. Europe maintains a strong growth profile, led by Germany (9.9%) and the UK (13.3%), supported by strict EU regulations on cosmetic safety and rising demand for sustainability in sourcing and formulation. Consumer preference for clean-label, dermatologist-tested products keeps Europe ahead of North America in terms of per-capita adoption.

North America shows moderate expansion, with the USA at 8.9% CAGR, reflecting a mature skincare market with established players. Growth is driven more by premiumization, clean-label awareness, and digital engagement than by rapid adoption. While expansion is steady, the USA is less aggressive compared to Asia-Pacific in embracing herbal and Ayurvedic positioning, focusing instead on dermatologist-tested efficacy and clinical validation.

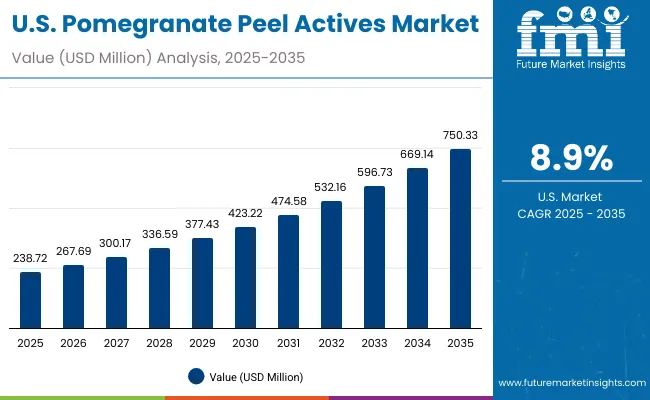

| Year | USA Pomegranate Peel Actives Market (USD Million) |

|---|---|

| 2025 | 238.72 |

| 2026 | 267.69 |

| 2027 | 300.17 |

| 2028 | 336.59 |

| 2029 | 377.43 |

| 2030 | 423.22 |

| 2031 | 474.58 |

| 2032 | 532.16 |

| 2033 | 596.73 |

| 2034 | 669.14 |

| 2035 | 750.33 |

The Pomegranate Peel Actives Market in the United States is projected to grow at a CAGR of 8.9%, reflecting steady but moderate expansion compared to Asia-Pacific markets. Growth is led by rising consumer preference for dermatologist-tested and clinically validated products, with strong adoption across antioxidant and anti-aging skincare. Premium serums and creams featuring pomegranate actives are gaining traction in pharmacies, specialty stores, and online platforms. USA consumers increasingly favor clean-label and multifunctional solutions, driving opportunities for brands to position products at the intersection of efficacy, transparency, and sustainability.

The Pomegranate Peel Actives Market in the United Kingdom is expected to grow at a CAGR of 13.3%, supported by strong consumer interest in natural and organic skincare. Demand is accelerating in antioxidant-rich and anti-aging formulations, with serums and creams positioned as premium offerings in pharmacies, specialty beauty stores, and e-commerce. Clean-label and sustainability claims resonate strongly with UK consumers, driving the adoption of pomegranate peel actives in both mainstream and niche beauty brands. The market is further supported by innovation programs, collaborations between global suppliers and indie labels, and increasing awareness of multifunctional plant-derived actives.

India is witnessing rapid growth in the Pomegranate Peel Actives Market, which is forecast to expand at a CAGR of 23.1% through 2035. This momentum is fueled by rising disposable incomes, expanding urban middle-class populations, and strong cultural alignment with Ayurvedic and herbal skincare traditions. Pomegranate peel actives are increasingly integrated into serums, creams, and capsules positioned as natural anti-aging and antioxidant-rich solutions. Growth is not limited to metro citiestier-2 and tier-3 cities are emerging as high-potential markets due to e-commerce expansion and affordability of natural formulations. Collaboration between global suppliers and Indian brands is also fostering localized innovation tailored to diverse skin types and climates.

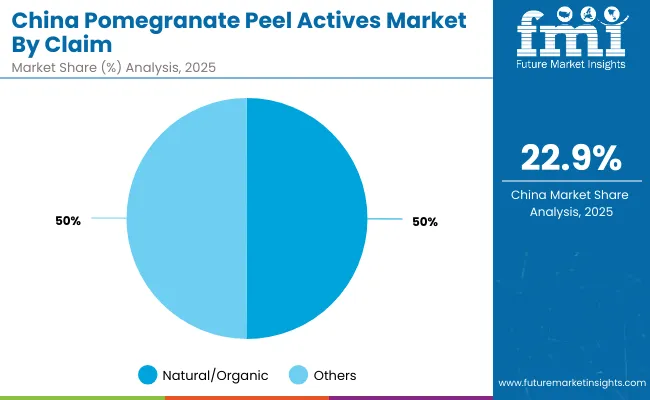

The Pomegranate Peel Actives Market in China is expected to grow at a CAGR of 22.9%, the highest among leading economies. This momentum is driven by strong consumer preference for herbal and natural skincare solutions, supported by cultural alignment with traditional medicine. Natural/organic claims lead the market with 50.1% share in 2025, reflecting consumer trust in plant-based actives. Domestic beauty brands are highly competitive, offering affordable formulations that appeal to mass consumers, while international players expand through cross-border e-commerce targeting the premium skincare segment. Regulatory initiatives promoting clean-label and safe formulations further reinforce consumer trust, positioning China as a key growth hub.

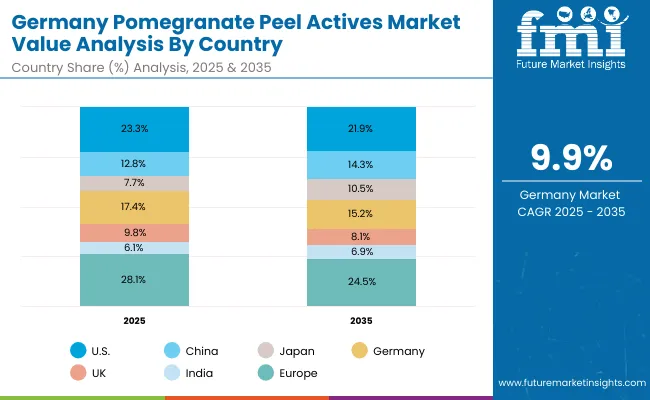

| Countries | 2025 Share (%) |

|---|---|

| USA | 23.3% |

| China | 12.8% |

| Japan | 7.7% |

| Germany | 17.4% |

| UK | 9.8% |

| India | 6.1% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 21.9% |

| China | 14.3% |

| Japan | 10.5% |

| Germany | 15.2% |

| UK | 8.1% |

| India | 6.9% |

The Pomegranate Peel Actives Market in Germany is projected to grow at a CAGR of 9.9%, reflecting steady but moderate expansion compared to faster-growing Asian markets. Germany remains one of the largest European consumers of antioxidant-rich and anti-aging skincare, with strong adoption of clean-label and dermatologist-tested formulations. The country’s share of the global market is forecast to decline from 17.4% in 2025 to 15.2% in 2035, as Asia-Pacific economies outpace Europe in growth. Regulatory rigor under EU cosmetic standards strengthens consumer confidence, while sustainability-focused sourcing and packaging continue to shape product positioning. Premium serums and creams remain the most favored product types, supported by pharmacy distribution and a rising preference for natural/organic claims.

| USA by Function | Value Share% 2025 |

|---|---|

| Antioxidant | 54.2% |

| Others | 45.8% |

The Pomegranate Peel Actives Market in the United States is projected at USD 238.7 million in 2025, expanding steadily at a CAGR of 8.9% to reach USD 750.3 million by 2035. Antioxidant functions dominate with a 54.2% share, reflecting consumer demand for protection against oxidative stress and environmental damage. Growth is supported by a strong preference for dermatologist-tested and clinically validated products, particularly in serums and creams. While mature compared to Asia-Pacific, the USA market is seeing increasing traction in clean-label and multifunctional formulations. E-commerce and specialty beauty retailers are strengthening accessibility, while premium positioning continues to drive consumer loyalty.

| China by Claim | Value Share% 2025 |

|---|---|

| Natural/organic | 50.1% |

| Others | 49.9% |

The Pomegranate Peel Actives Market in China is expected to expand rapidly at a CAGR of 22.9% through 2035, making it one of the fastest-growing global markets. Natural/organic claims lead with 50.1% share in 2025, reflecting strong consumer trust in plant-based formulations and alignment with traditional Chinese herbal practices. Growth is further supported by government initiatives encouraging clean-label cosmetics, as well as the rapid rise of e-commerce and cross-border beauty platforms. Domestic brands are leveraging affordability and heritage marketing to capture mass adoption, while global players are targeting premium segments with advanced serums and anti-aging formulations.

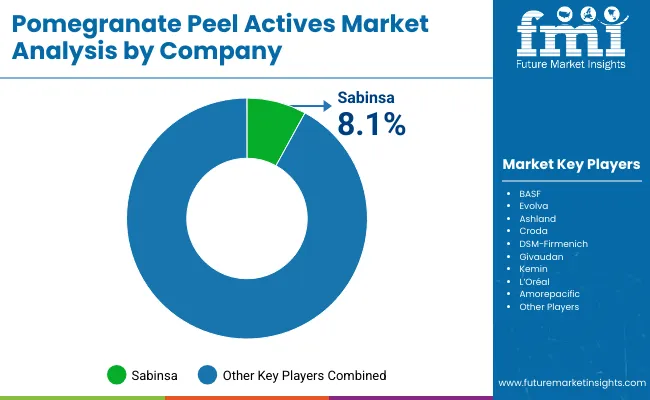

| Company | Global Value Share 2025 |

|---|---|

| Sabinsa | 8.1% |

| Others | 91.9% |

The Pomegranate Peel Actives Market is moderately fragmented, with global ingredient suppliers, multinational cosmetic companies, and niche botanical specialists competing across diverse skincare applications. Global leaders such as Sabinsa, BASF, Croda, DSM-Firmenich, and Givaudan hold significant positions, driven by advanced extraction technologies, standardized formulations, and deep partnerships with cosmetic brands worldwide. Their strategies increasingly emphasize clinical validation, sustainable sourcing, and regulatory compliance to secure trust across regulated markets like Europe and North America.

Established mid-sized players, including Evolva, Ashland, and Kemin, cater to the rising demand for natural antioxidants and multifunctional actives. These firms are accelerating adoption through clean-label positioning, nutraceutical crossovers, and innovative delivery systems, making them highly relevant for both skincare and ingestible beauty categories.

Niche-focused providers such as Amorepacific, L’Oréal, and Forest Essentials leverage heritage-inspired and Ayurvedic-driven marketing to differentiate products. Their strength lies in cultural storytelling, regional adaptability, and consumer engagement through digital-first campaigns and e-commerce platforms. Competitive differentiation is shifting away from basic ingredient sourcing toward ecosystem strategies that combine sustainable supply chains, clinical efficacy, and digital-first branding. As consumer preferences tilt toward multifunctional, natural, and Ayurvedic-inspired skincare, players that can align heritage with science-backed validation will shape long-term leadership.

Key Developments in Pomegranate Peel Actives Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,023.4 Million |

| Function | Antioxidant, Anti-aging, Brightening, Acne control |

| Product Type | Serums, Creams/lotions, Masks, Capsules |

| Channel | E-commerce, Pharmacies, Mass retail, Specialty beauty stores |

| Claim | Vegan, Natural/organic, Clean-label, Ayurvedic -inspired |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sabinsa, BASF, Evolva, Ashland, Croda, DSM- Firmenich, Givaudan, Kemin, L’Oréal, Amorepacific |

| Additional Attributes | Dollar sales by function and product type, adoption trends in antioxidant and anti-aging formulations, rising demand for serums and capsule-based delivery formats, sector-specific growth in e-commerce, pharmacies, and specialty beauty retail, revenue segmentation by natural/organic, clean-label, and Ayurvedic -inspired claims, integration with sustainability certifications and eco-friendly packaging, regional trends influenced by cultural reliance on herbal skincare and regulatory frameworks, and innovations in extraction techniques, bioactive standardization, and multifunctional formulation technologies. |

The global Pomegranate Peel Actives Market is estimated to be valued at USD 1,023.4 million in 2025.

The market size for the Pomegranate Peel Actives Market is projected to reach USD 3,425.7 million by 2035.

The Pomegranate Peel Actives Market is expected to grow at a 12.8% CAGR between 2025 and 2035.

The key product types in the Pomegranate Peel Actives Market are serums, creams/lotions, masks, and capsules.

In terms of product type, the serums segment is expected to contribute significantly in 2025, holding 46.5% of the market share, driven by strong consumer preference for concentrated and fast-absorbing formulations that deliver visible antioxidant and anti-aging benefits.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Punica Granatum (Pomegranate) Seed Oil Market Analysis by End-user Industry, Distribution Channel and Region Through 2035

Peelable Lid Stock Market Size and Share Forecast Outlook 2025 to 2035

Peel off Face Mask Market Size and Share Forecast Outlook 2025 to 2035

Peelable lidding films Market Size and Share Forecast Outlook 2025 to 2035

Peel Oil Market

Peel Pouches Market

Easy Peel Film Market Size and Share Forecast Outlook 2025 to 2035

Key Companies & Market Share in the Easy Peel Film Packaging Sector

Easy Peel Film Packaging Market Analysis by PP and PE Through 2034

Pharma Peeler Centrifuge Market Size and Share Forecast Outlook 2025 to 2035

Potato Peel Powder Market Size and Share Forecast Outlook 2025 to 2035

Chemical Peel Market Size and Share Forecast Outlook 2025 to 2035

Grapefruit Peel Market Size and Share Forecast Outlook 2025 to 2035

Exfoliants Peeling Agents Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Peel-Off Ends Maker Market Size and Share Forecast Outlook 2025 to 2035

Glycolic Acid Peel Market Insights – Growth & Forecast 2024-2034

AHA/BHA Chemical Peels Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Industrial Steam Peeler Market Size and Share Forecast Outlook 2025 to 2035

Exfoliating Scrubs and Peels Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Botanical Bioactives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA