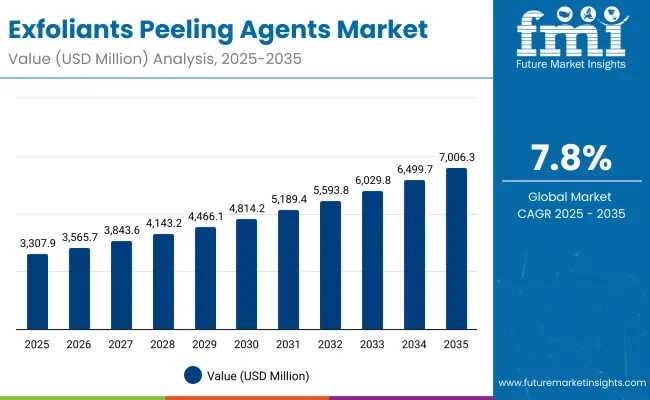

A valuation of USD 3,307.9 million is anticipated for the Exfoliants Peeling Agents Market in 2025, which is projected to rise to USD 7,006.3 million by 2035. This increase of USD 3,698.4 million over the decade reflects a near doubling of market size, achieved at a CAGR of 7.8%. Market expansion is expected to be powered by surging demand for high-performance raw materials across skincare and dermatology formulations, supported by advanced delivery systems and rising dermatology engagement worldwide.

Exfoliants Peeling Agents Market Key Takeaways

| Metric | Value |

|---|---|

| Exfoliants Peeling Agents Market Estimated Value in (2025E) | USD 3,307.9 million |

| Exfoliants Peeling Agents Market Forecast Value in (2035F) | USD 7,006.3 million |

| Forecast CAGR (2025 to 2035) | 7.80% |

During the initial five-year period from 2025 to 2030, growth is forecasted from USD 3,307.9 million to USD 4,814.2 million, adding USD 1,506.3 million, equivalent to around 41% of the decade’s expansion. This phase is likely to be defined by broad-based adoption of exfoliant actives across consumer skincare and professional treatment formulations. Synthetic sources are expected to dominate with a 59.7% share in 2025, reflecting their scalability and cost advantages in formulation supply. In the same year, liquid concentrates are anticipated to lead physical form preferences with 52% share, indicating a strong alignment with ease-of-use in product integration.

From 2030 to 2035, the market is projected to rise further from USD 4,814.2 million to USD 7,006.3 million, contributing USD 2,192.1 million or 59% of total decade growth. This acceleration is predicted to be driven by premiumization trends in Asia-Pacific, higher adoption of encapsulated systems for controlled release, and a growing pivot toward bio-based exfoliants that align with sustainability goals.

From 2020 to 2024, the category of exfoliants and peeling agents experienced steady advancement as awareness of scientifically backed skin solutions increased globally. By 2025, the market is projected at USD 3,307.9 million, setting the stage for significant growth over the next decade. Expansion to USD 7,006.3 million by 2035 is anticipated, representing more than a twofold increase in value.

Competitive positioning is expected to evolve, with raw material suppliers focusing not only on traditional synthetic actives but also on natural-origin and fermentation-derived alternatives. While synthetic ingredients dominate in 2025 due to cost and consistency advantages, demand for botanical and encapsulated systems is predicted to rise rapidly, fueled by premium skincare and dermatology-driven formulations.

Regional momentum is forecasted to be led by Asia-Pacific, particularly China and India, where double-digit CAGRs are projected. Established leaders such as DSM-Firmenich and BASF are expected to retain prominence, though competitive intensity is likely to be shaped by innovation in bio-based sourcing, delivery systems, and sustainable formulation approaches. Ecosystem strength and innovation in controlled-release actives are predicted to determine long-term differentiation.

Growth in the Exfoliants Peeling Agents Market is being fueled by increasing consumer demand for clinically validated skincare solutions that deliver visible results. Rising awareness of skin health and preventive dermatology is driving the adoption of chemical and bio-based exfoliants across both mass-market and premium product ranges. The preference for clean-label formulations is pushing suppliers to innovate with botanical and fermentation-derived ingredients, while synthetic actives continue to hold prominence due to scalability and reliability. Technological advances in encapsulation and controlled-release systems are enabling improved stability and efficacy, thereby expanding formulation opportunities. Strong momentum is being observed in Asia-Pacific markets, where younger demographics and higher spending on skincare are accelerating adoption. Professional dermatology treatments are also contributing to demand as advanced peeling agents gain acceptance in clinical practice. With sustainability and performance positioned as key drivers, innovation pipelines are expected to ensure sustained market expansion through 2035.

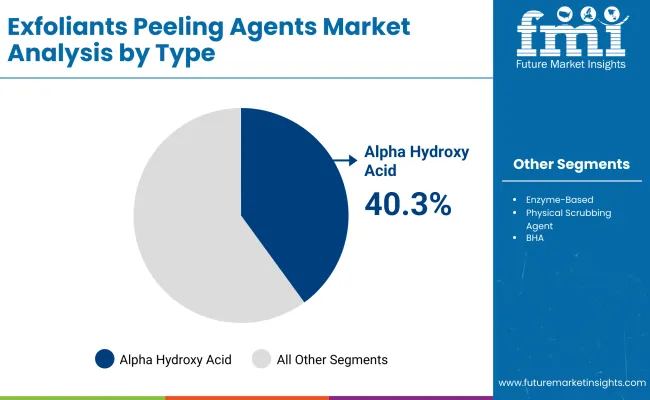

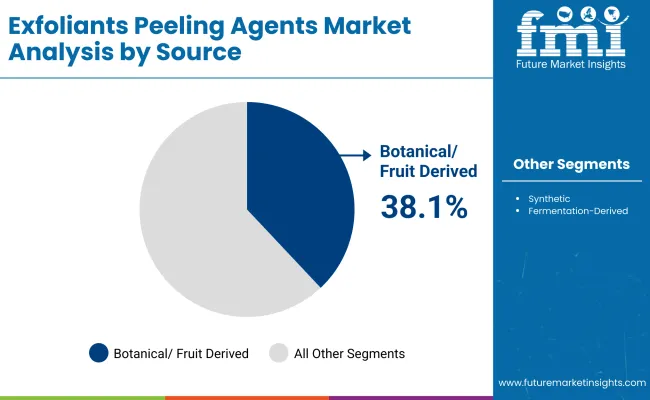

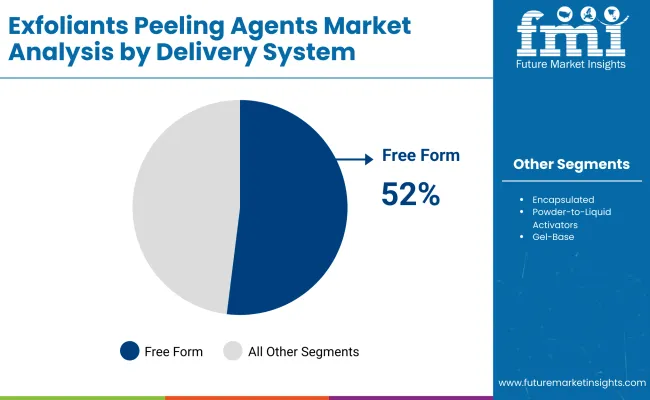

The Exfoliants Peeling Agents Market has been segmented across type, source, and delivery system to highlight the structural drivers of demand within the raw materials landscape. Each segment provides unique insights into how ingredient selection, formulation practices, and evolving consumer expectations are shaping growth. By type, Alpha Hydroxy Acids (AHAs) and other exfoliant categories are considered, offering a view into performance-driven adoption. By source, the balance between synthetic options and botanical or fruit-derived alternatives is examined, reflecting the shift between scalability and naturality. By delivery system, the focus lies on free-form actives and advanced systems such as encapsulated solutions, illustrating the technological evolution influencing stability and efficacy. This segmentation framework enables a forward-looking understanding of how the market is expected to expand through 2035.

| Type | Market Value Share, 2025 |

|---|---|

| Alpha hydroxy acids (AHA) | 40.3% |

| Others | 59.7% |

The type segment is expected to be led by Alpha Hydroxy Acids (AHAs), holding 40.3% share in 2025, equivalent to USD 1333.08 million. AHAs are widely adopted due to their efficacy in skin renewal, gentle exfoliation, and compatibility across consumer and professional formulations. Demand is being supported by proven clinical outcomes and high consumer awareness. The remaining 59.7% share, valued at USD 1974.82 million, is attributed to other exfoliant types, offering broader options for formulators. Continued innovation in multi-acid blends and hybrid exfoliants is anticipated to expand usage in advanced dermatology and skincare. With premium skincare growth accelerating, AHAs are expected to maintain a strong foothold in the market.

| Source | Market Value Share, 2025 |

|---|---|

| Botanical/fruit derived | 38.1% |

| Others | 61.9% |

The source segment is projected to be dominated by synthetic ingredients, accounting for 61.9% of the market in 2025 with USD 2047.59 million in value. Synthetic-origin exfoliants are being preferred for their consistency, cost-effectiveness, and scalability in industrial production, making them critical for large-volume personal care and dermatology formulations. Botanical and fruit-derived ingredients are expected to represent 38.1% share, valued at USD 1260.31 million, as naturality-driven trends continue to shape consumer preference. Over the forecast period, the balance between synthetic and bio-based sourcing is anticipated to evolve, with sustainability and regulatory guidelines influencing supplier strategies. Growth is predicted to be led by hybrid sourcing models, ensuring both performance reliability and alignment with clean-label claims.

| Delivery System | Market Value Share, 2025 |

|---|---|

| Free form | 52% |

| Others | 48.0% |

The delivery system segment is forecasted to be led by free-form actives, which are anticipated to hold 52% market share in 2025, valued at USD 1720.11 million. Free-form exfoliants are widely integrated into mass-market skincare and dermatology applications due to ease of formulation and broad compatibility with multiple product formats. Other systems, including encapsulated and gel-based solutions, are estimated to account for 48% share (USD 1587.79 million), reflecting growing importance in premium and controlled-release applications. Over the next decade, encapsulation technologies are expected to gain momentum, driven by rising demand for enhanced stability and targeted delivery. Nevertheless, free-form systems are likely to retain dominance in volume terms, ensuring accessibility across mainstream consumer categories.

Complex formulation requirements and evolving dermatology standards are reshaping the Exfoliants Peeling Agents Market, as scalability, bio-based sourcing, and clinical validation gain priority. Despite challenges in regulatory compliance and cost dynamics, long-term growth is expected to remain strong across global ingredient supply chains.

Integration of Dermatology-Backed Claims in Ingredient Development

Market expansion is being reinforced by the integration of dermatology-backed efficacy claims into ingredient innovation pipelines. Exfoliant actives are increasingly being validated through controlled clinical studies, ensuring credibility with professional dermatologists and formulators. Such evidence-based positioning is anticipated to elevate trust among end-use brands, particularly within the premium skincare and medical-grade formulation segments. This alignment with clinical dermatology is expected to improve adoption in therapeutic and preventive care contexts, creating new revenue pathways for raw material suppliers.

Rising Cost Pressures in Bio-Based Ingredient Sourcing

Growth potential is being constrained by escalating costs associated with botanical and fruit-derived exfoliants, which require complex extraction processes and strict compliance with sustainable sourcing standards. Supply fluctuations caused by agricultural variability and rising certification expenses are expected to add further strain. While demand for natural-origin solutions is increasing, limited scalability and price volatility could restrict broader application in cost-sensitive product categories. Formulators may be compelled to adopt hybrid models blending synthetic and bio-based actives, balancing sustainability with affordability.

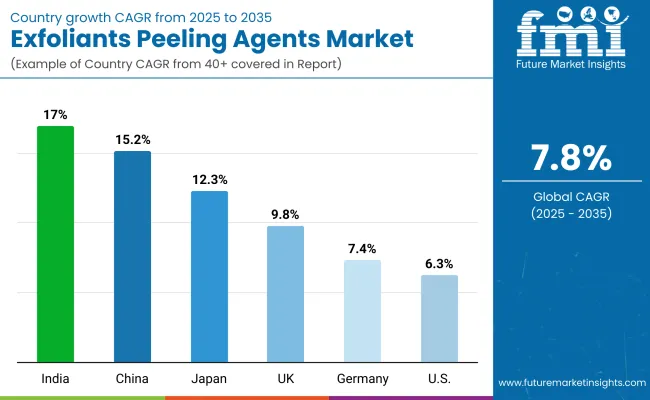

| Country | CAGR |

|---|---|

| China | 15.2% |

| USA | 6.3% |

| India | 17.0% |

| UK | 9.8% |

| Germany | 7.4% |

| Japan | 12.3% |

The global Exfoliants Peeling Agents Market is projected to demonstrate distinct growth patterns across key countries, shaped by consumer sophistication, dermatology integration, and regional sourcing ecosystems. Asia-Pacific is expected to emerge as the fastest-expanding region, supported by China at a 15.2% CAGR and India at 17.0%. Growth in these markets is anticipated to be driven by younger demographics, rapid premiumization of skincare, and greater dermatology engagement in urban centers. India’s trajectory is further strengthened by evolving domestic manufacturing capabilities in cosmetics and increasing alignment with international quality benchmarks.

Japan is forecasted to expand at 12.3% CAGR, supported by demand for high-performance formulations rooted in science-led beauty traditions. Europe maintains a strong growth outlook, with the UK at 9.8% and Germany at 7.4%, reflecting stringent regulatory standards and brand emphasis on sustainability. Broader Europe at 9.1% CAGR is expected to benefit from clean-label ingredient mandates and advanced dermatology practices.

The USA is projected to grow more moderately at 6.3%, reflecting maturity of its skincare market, though opportunities are being created in professional dermatology and clinical peeling solutions. Collectively, country-level trends indicate that innovation pipelines and sustainability credentials will play decisive roles in competitive positioning.

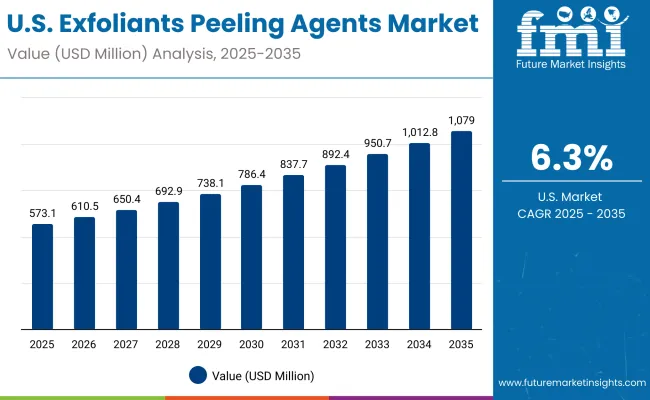

| Year | USA Exfoliants Peeling Agents Market (USD Million) |

|---|---|

| 2025 | 573.13 |

| 2026 | 610.56 |

| 2027 | 650.44 |

| 2028 | 692.92 |

| 2029 | 738.18 |

| 2030 | 786.40 |

| 2031 | 837.76 |

| 2032 | 892.48 |

| 2033 | 950.77 |

| 2034 | 1012.87 |

| 2035 | 1079.03 |

The Exfoliants Peeling Agents Market in the United States is projected to expand at a CAGR of 6.3% during 2025-2035, reflecting steady but mature growth dynamics in one of the most established skincare and dermatology markets. Sales are expected to increase from USD 573.13 million in 2025 to USD 1,079.03 million by 2035, supported by both consumer and professional demand. Professional dermatology treatments are anticipated to play a crucial role, as chemical peeling and advanced exfoliation become widely integrated into clinical practices. Consumer-driven adoption is predicted to continue through mass-market skincare, while premium brands are likely to focus on encapsulated actives for differentiated product positioning.

The Exfoliants Peeling Agents Market in the United Kingdom is projected to expand at a CAGR of 9.8% between 2025 and 2035, reflecting steady demand growth across both consumer skincare and professional treatment channels. A combination of regulatory-driven safety standards and high consumer awareness is expected to guide ingredient adoption. Synthetic actives are anticipated to retain a strong share, though botanical derivatives are gaining visibility as clean-label claims grow in importance. Professional dermatology usage is forecasted to rise as advanced peeling agents are introduced into clinical practices, strengthening supplier opportunities in medical-grade formulations.

The Exfoliants Peeling Agents Market in India is forecasted to grow at a CAGR of 17.0% through 2025–2035, making it one of the fastest-expanding global markets. Strong growth is being enabled by a young consumer base, rising disposable incomes, and premium skincare adoption. Domestic manufacturing capacity for cosmetic ingredients is being scaled, while global suppliers are targeting localized innovation tailored to Indian consumer needs. Dermatology engagement in urban centers is expected to accelerate uptake of professional-grade peeling agents, particularly in preventative and corrective skincare.

The Exfoliants Peeling Agents Market in China is projected to expand at a CAGR of 15.2% from 2025 to 2035, supported by premiumization trends and widespread adoption of dermatology treatments. Demand is anticipated to accelerate as advanced exfoliants become central to anti-aging and corrective skincare categories. International and domestic brands are investing in localized ingredient sourcing to meet consumer expectations for transparency and efficacy. Regulatory frameworks encouraging safer formulations are expected to support the adoption of encapsulated and bio-based exfoliants.

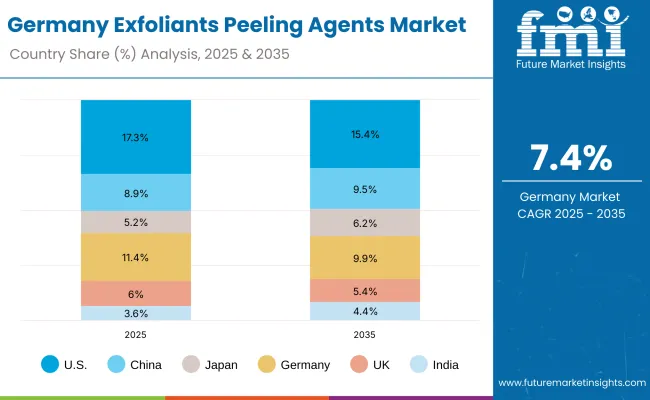

| Country | 2025 |

|---|---|

| USA | 17.3% |

| China | 8.9% |

| Japan | 5.2% |

| Germany | 11.4% |

| UK | 6.0% |

| India | 3.6% |

| Country | 2035 |

|---|---|

| USA | 15.4% |

| China | 9.5% |

| Japan | 6.2% |

| Germany | 9.9% |

| UK | 5.4% |

| India | 4.4% |

The Exfoliants Peeling Agents Market in Germany is forecasted to expand at a CAGR of 7.4% during 2025–2035, reflecting stable growth supported by regulatory compliance and high brand innovation. Sustainability-driven sourcing is expected to be prioritized, as Germany continues to be a hub for clean-label and eco-friendly personal care. Professional dermatology treatments are predicted to remain integral to demand, with medical-grade peeling solutions gaining traction in therapeutic contexts. Established skincare brands are anticipated to favor controlled-release and bio-based actives to strengthen premium positioning.

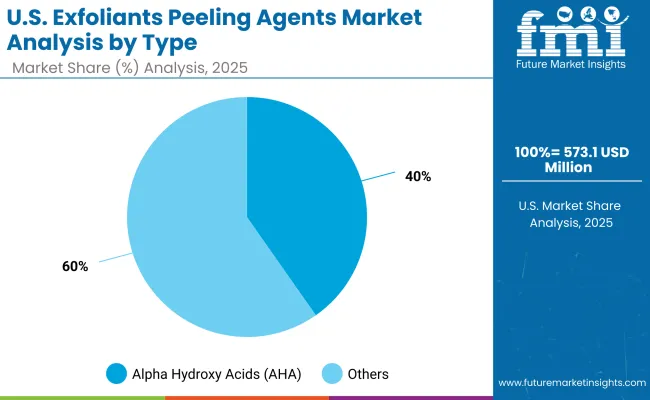

| USA By Type | Market Value Share, 2025 |

|---|---|

| Alpha hydroxy acids (AHA) | 40.3% |

| Others | 59.7% |

The Exfoliants Peeling Agents Market in the USA is projected at USD 573.13 million in 2025. AHAs contribute 40.3% (USD 230.97 million), while other exfoliant categories represent 59.7% (USD 342.16 million), highlighting a diversified reliance on multiple active ingredients. The continued significance of AHAs stems from their proven role in skin renewal and compatibility across both consumer and professional formulations. Their adoption is expected to be reinforced by dermatology-led evidence and increasing demand in premium skincare. The larger share of other exfoliants reflects the expanding spectrum of actives, including PHAs, enzyme-based ingredients, and physical scrubbing agents, which provide formulators with flexibility to tailor performance and sustainability claims. Over the next decade, USA growth is anticipated to be supported by innovation in hybrid blends and encapsulated delivery systems that enhance efficacy and safety.

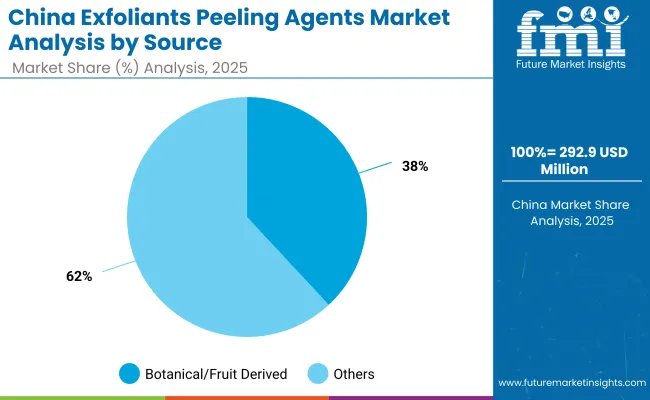

| China By Source | Market Value Share, 2025 |

|---|---|

| Botanical/fruit derived | 38.1% |

| Others | 61.9% |

The Exfoliants Peeling Agents Market in China is projected at USD 292.93 million in 2025. Botanical and fruit-derived exfoliants contribute 38.1% (USD 111.61 million), while other sources dominate with 61.9% (USD 181.32 million). The stronger share of synthetic and alternative sources reflects their scalability and consistency in large-scale production, which aligns with China’s rapidly expanding skincare and personal care sector. Botanical-derived actives, however, are expected to see accelerating demand as clean-label claims and consumer preference for natural-origin solutions gain prominence in premium skincare. The market’s long-term growth is anticipated to be reinforced by regulatory encouragement for safer, high-quality formulations and increasing dermatology adoption of clinically validated bio-based actives. Hybrid sourcing strategies that combine performance-driven synthetics with sustainability-linked botanicals are likely to define the competitive positioning of suppliers in China.

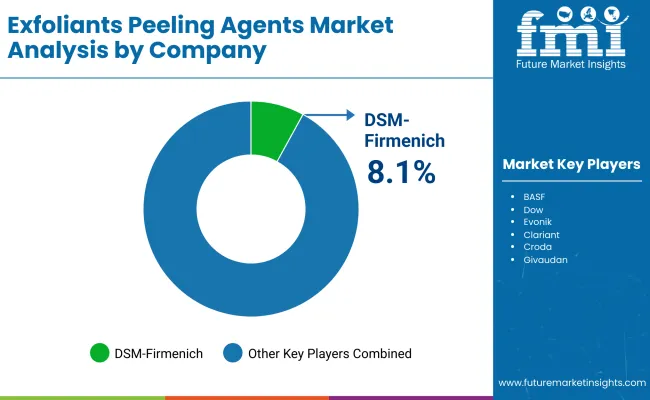

| Company | Global Value Share 2025 |

|---|---|

| DSM-Firmenich | 8.1% |

| Others | 91.9% |

The Exfoliants Peeling Agents Market is moderately fragmented, with global leaders, mid-sized innovators, and niche ingredient specialists competing across a wide spectrum of formulation needs. Global suppliers such as DSM-Firmenich, BASF, Croda, Clariant, Evonik, Symrise, and Givaudan are recognized as core participants in this market. Their leadership is anchored in diversified ingredient portfolios, extensive R&D pipelines, and global distribution networks that cater to skincare, haircare, and professional dermatology channels. DSM-Firmenich is estimated to dominate with a global share of 8.1% in 2025, and its leadership is expected to have been established with a slightly lower but significant share in 2024 (around 7.9%), reflecting strong positioning in active ingredient innovation.

Mid-sized companies including Ashland, Seppic, and Provital are strengthening their presence through botanical and fermentation-derived actives, supported by sustainability claims and partnerships with global skincare brands. These players are increasingly targeting encapsulated and controlled-release delivery systems to compete in premium and professional-grade formulations.

Niche-focused innovators are developing highly specialized exfoliants tailored for dermatology, natural cosmetics, and hybrid formulations, with differentiation achieved through sustainability-driven sourcing and clinical validation. Competitive dynamics are shifting toward evidence-based efficacy, bio-based alternatives, and integrated ingredient platforms that align with dermatology-backed claims and consumer preference for safety and transparency.

Key Developments in Exfoliants Peeling Agents Market

| Item | Value |

|---|---|

| Quantitative Units | USD 3,307.9 million (2025); USD 7,006.3 million (2035); 7.8% CAGR (2025 to 2035) |

| Type | Alpha hydroxy acids (AHA); Others (BHA, PHA, enzyme-based, physical scrubbing agents) |

| Source | Botanical/fruit derived; Others (synthetic & fermentation-derived) |

| Delivery System | Free form; Others (encapsulated, powder-to-liquid activators, gel-base systems) |

| Application | Facial peels & serums; Body scrubs; Scalp exfoliants; Professional chemical peels |

| End-use Industry | Skincare brands; Hair & scalp care brands; Professional dermatology/clinics |

| Regions Covered | North America; Europe; East Asia; South Asia & Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; China; India; United Kingdom; Germany; Japan |

| Key Companies Profiled | DSM-Firmenich; BASF; Croda; Clariant; Evonik; Symrise; Givaudan; Ashland; Seppic; Provital |

| Additional Attributes | Segment shares (e.g., Synthetic 59.7% vs Botanical 38.1% in 2025; Free form 52%); country growth (India 17.0% CAGR; China 15.2%; USA 6.3%); sustainability and clean-label sourcing; innovation in encapsulation/controlled release; regulatory compliance shaping reformulation; professional dermatology adoption; premiumization in Asia; USA value path USD 573.13 million (2025) → USD 1,079.03 million (2035). |

The global Exfoliants Peeling Agents Market is estimated to be valued at USD 3,307.9 million in 2025.

The market size for the Exfoliants Peeling Agents Market is projected to reach USD 7,006.3 million by 2035.

The Exfoliants Peeling Agents Market is expected to grow at a CAGR of 7.8% between 2025 and 2035.

The key product types in the Exfoliants Peeling Agents Market are Alpha Hydroxy Acids (AHAs), Beta Hydroxy Acids (BHAs), Poly Hydroxy Acids (PHAs), enzyme-based exfoliants, and physical scrubbing agents.

In terms of type, Alpha Hydroxy Acids (AHAs) are expected to hold a 40.3% share, while synthetic sources dominate with 59.7% share in the Exfoliants Peeling Agents Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plant-Powered Exfoliants Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Market Growth – Product Innovations & Applications from 2025 to 2035

Raising Agents Market Trends – Growth & Industry Forecast 2024 to 2034

Weighing Agents Market Size and Share Forecast Outlook 2025 to 2035

Draining Agents Market Size and Share Forecast Outlook 2025 to 2035

Flatting Agents Market Size and Share Forecast Outlook 2025 to 2035

Clouding Agents Market Trends - Growth Factors & Industry Analysis

Cognitive Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Agents Market Size and Share Forecast Outlook 2025 to 2035

Leavening Agents Market Analysis - Size, Growth, and Forecast 2025 to 2035

Market Share Breakdown of Anti-Slip Agents Manufacturers

Coalescing Agents Market Size and Share Forecast Outlook 2025 to 2035

Mattifying Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA