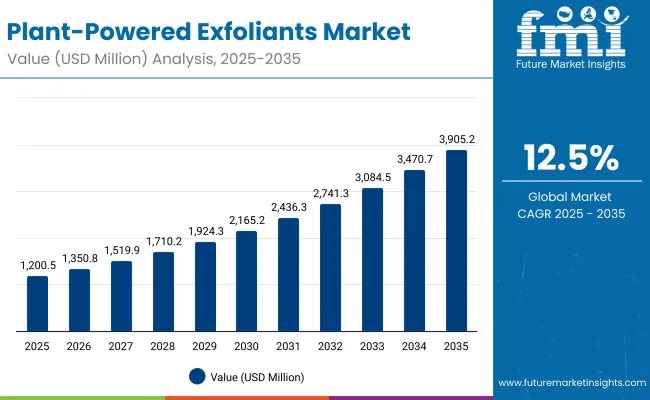

The market for plant-powered exfoliants is anticipated to be valued at USD 1,200.5 million in 2025, reaching approximately USD 3,905.2 million by 2035. This expansion of more than USD 2,700 million over the decade signifies a growth rate of 12.5% CAGR, translating to more than a threefold increase in overall size.

Plant-Powered Exfoliants Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 1,200.5 million |

| Market Forecast Value in (2035F) | USD 3,905.2 million |

| Forecast CAGR (2025 to 2035) | 12.50% |

Growth momentum during the first half of the forecast period is expected to take the market from USD 1,200.5 million in 2025 to USD 2,165.2 million in 2030, adding nearly USD 965 million, which represents close to 36% of the decade’s total increase. The second half is projected to be more aggressive, contributing around USD 1,740 million as the market expands from USD 2,165.2 million in 2030 to USD 3,905.2 million in 2035, signaling accelerated adoption across regions and consumer groups.

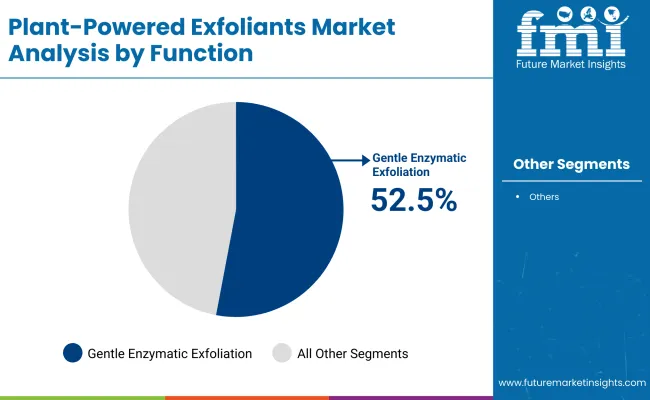

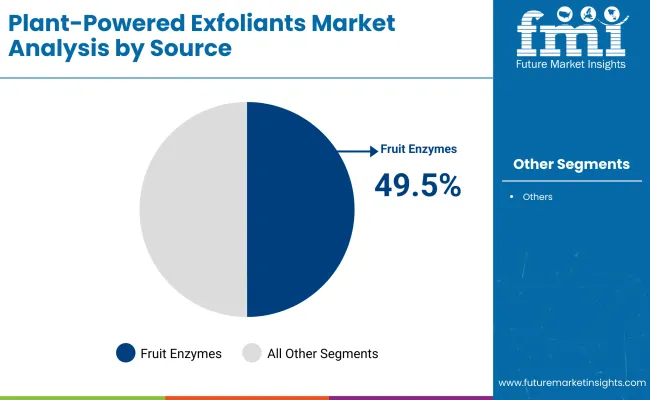

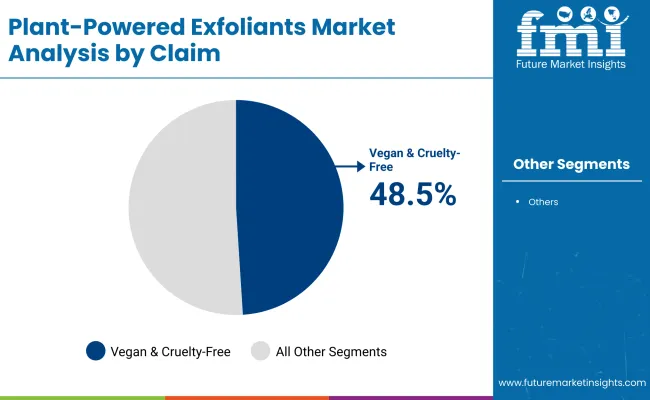

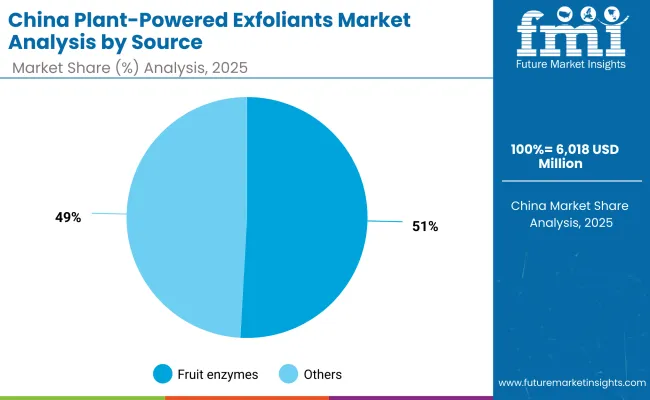

Functionally, gentle enzymatic exfoliation is anticipated to lead with 52.5% share in 2025, equaling a market value of USD 630.3 million, supported by rising demand for skin-friendly, irritation-free solutions. By source, fruit enzymes are projected to account for 49.5% share in 2025, equaling USD 593.9 million, while other natural substrates marginally edge higher at 50.5%. In claims-based positioning, vegan and cruelty-free products are expected to secure 48.5% of the market in 2025, valued at USD 581.8 million, reflecting heightened consumer emphasis on ethical and sustainable choices. Across the outlook period, the competitive balance is expected to be shaped by sustainability narratives, clinical validation of efficacy, and the growing premium placed on biodegradable and eco-friendly product formats.

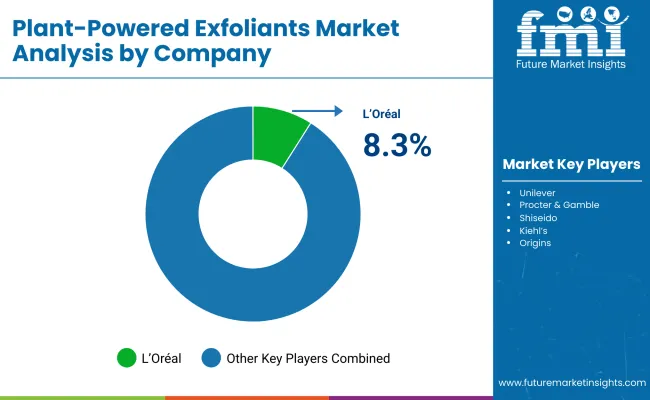

Between 2020 and 2024, the Plant-Powered Exfoliants Market transitioned from a niche sustainability-driven category into a mainstream skincare segment, supported by regulatory action against microplastics and surging consumer demand for vegan and cruelty-free claims. During this period, global leaders like L’Oréal consolidated early mover advantage, holding over 8% share of global value, while indie brands built momentum through digital-first strategies. Competitive positioning relied heavily on natural claims and ethical branding, with product efficacy and dermatologist validation emerging as differentiators.

Demand in 2025 is expected to accelerate as enzymatic exfoliation becomes the preferred format, while value expansion is projected to be amplified by premiumization, eco-certifications, and upcycled ingredients. From 2025 onward, the revenue mix is forecasted to shift toward clinically validated, multifunctional formulations. Large multinational players are anticipated to pivot toward hybrid models that merge sustainability with performance, while niche innovators will continue to gain traction by leveraging direct-to-consumer platforms and influencer-driven compliance, and proven efficacy, moving beyond basic natural positioning to full-spectrum value creation.

Growth in the plant-powered exfoliants market is being driven by a convergence of health, sustainability, and performance priorities. Rising consumer preference for gentle, non-irritating skincare has reinforced demand for enzymatic exfoliation, which is positioned as safer for sensitive skin compared to abrasive alternatives. The influence of vegan and cruelty-free claims is expected to remain significant, as ethical considerations are increasingly factored into purchasing decisions.

Clean-label and biodegradable product innovations are being supported by regulatory scrutiny of microplastics, encouraging accelerated adoption of plant-based alternatives. Digital retail expansion and influencer-led education have widened consumer awareness, making efficacy claims and sustainability narratives more visible. Furthermore, the appeal of upcycled ingredients is being amplified as brands highlight waste reduction and circularity in their sourcing practices. This combination of consumer-driven ethics, clinical efficacy validation, and eco-compliance is projected to sustain double-digit growth, with plant-powered exfoliants becoming a core element of routine skincare across global markets.

The segmentation of the plant-powered exfoliants market reflects evolving consumer needs, efficacy-driven choices, and ethical considerations. By function, the preference for gentle enzymatic exfoliation has been reinforced by dermatological guidance and consumer awareness around skin sensitivity. By source, fruit enzymes are expected to gain strong acceptance due to their natural origin and proven performance, while other botanicals broaden formulation diversity. By claim, vegan and cruelty-free positioning has been elevated as a decisive purchase driver, aligning with sustainability and ethical beauty trends. Together, these segments define the strategic priorities for innovation and branding, as companies are expected to emphasize safety, transparency, and ecological responsibility to strengthen market penetration across both mature and emerging economies.

| Segment | Market Value Share, 2025 |

|---|---|

| Gentle enzymatic exfoliation | 52.5% |

| Others | 47.5% |

The function segment is projected to be led by gentle enzymatic exfoliation, which accounts for 52.5% of market share in 2025, valued at USD 630.3 million. Its leadership is supported by a strong preference for irritation-free, clinically validated exfoliation methods. Growing sensitivity concerns among consumers are expected to reinforce its adoption in daily routines. Dermatologist endorsements and clean-beauty positioning have further validated its credibility. Other functions such as deep cleansing and oil control will remain relevant, but enzymatic exfoliation is expected to dominate due to its balance of efficacy and safety. This leadership is projected to persist throughout the forecast period, as innovation continues to emphasize non-invasive, skin-friendly solutions across global markets.

| Segment | Market Value Share, 2025 |

|---|---|

| Fruit enzymes | 49.5% |

| Others | 50.5% |

The source segment is projected to remain balanced, with fruit enzymes capturing 49.5% of the market in 2025, valued at USD 593.9 million. Fruit-derived actives such as papain, bromelain, and pumpkin enzymes have been favored for their natural origins and proven ability to enhance texture and radiance. Meanwhile, other natural sources, including grains, seeds, and herbal extracts, will collectively account for a slightly larger share, reflecting the broad base of available formulations. This near parity signals that formulation innovation, rather than raw material type, will determine consumer adoption. Transparency in sourcing and validation of performance are expected to shape long-term differentiation, while the sustainability of sourcing pathways will play a central role in competitive positioning.

| Segment | Market Value Share, 2025 |

|---|---|

| Vegan & cruelty-free | 48.5% |

| Others | 51.5% |

The claim segment is projected to be heavily influenced by ethical and sustainability considerations, with vegan and cruelty-free products holding 48.5% share in 2025, valued at USD 581.8 million. This reflects the growing importance of conscious consumption and the prioritization of products aligned with animal welfare and eco-friendly practices. Regulatory and retail pressures are expected to reinforce the importance of verified claims, as greenwashing scrutiny intensifies across global markets. Other claims, including clean-label and organic certifications, will retain importance, but cruelty-free positioning is expected to remain a strong differentiator. This segment’s expansion will be driven by millennial and Gen Z preferences, ensuring continued demand for brands that combine ethical narratives with proven product performance.

The expansion of the plant-powered exfoliants market is being influenced by complex consumer expectations, regulatory developments, and sustainability imperatives, with opportunities tempered by cost pressures and validation requirements in a highly competitive personal care landscape.

Regulatory Shift toward Microplastic Alternatives

Global restrictions on synthetic microbeads have created an environment in which plant-based exfoliants are positioned as regulatory-compliant solutions. This shift is expected to accelerate investment in biodegradable substrates that meet tightening environmental norms while maintaining skin safety. The regulatory momentum is not only limiting the use of conventional exfoliants but also elevating demand for verifiable, naturally sourced alternatives.

Compliance with eco-toxicology standards is being framed as a strategic advantage, ensuring that companies with plant-powered innovations are rewarded with easier market access and stronger retailer endorsements. As bans expand across Europe, Asia, and North America, adoption of sustainable exfoliants is projected to intensify, reshaping competitive dynamics across global beauty portfolios.

Integration of Upcycled Ingredients

The integration of upcycled botanicals, such as coffee grounds and grape seeds, has emerged as a defining trend in exfoliation products. This practice addresses dual objectives: consumer preference for sustainable choices and brand efforts to enhance value through waste reduction. Upcycling is being positioned not simply as an environmental gesture but as a method of creating high-performing, story-driven ingredients that connect with consumers on ethical and experiential levels. As supply chain circularity becomes central to brand narratives, marketing differentiation is expected to pivot toward provenance, transparency, and measurable impact. Over the next decade, upcycled exfoliants are anticipated to transition from niche to mainstream, aligning market growth with broader sustainability agendas.

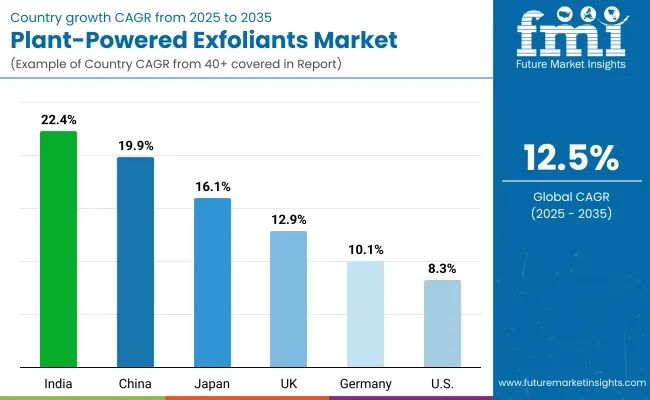

| Countries | CAGR |

|---|---|

| China | 19.9% |

| USA | 8.3% |

| India | 22.4% |

| UK | 12.9% |

| Germany | 10.1% |

| Japan | 16.1% |

The global plant-powered exfoliants market demonstrates varied growth trajectories across leading economies, shaped by regulatory priorities, consumer behavior, and innovation adoption. Asia is expected to dominate expansion, with China and India at the forefront, while developed markets maintain steady but slower progress.

India is projected to record the fastest CAGR of 22.4% between 2025 and 2035, supported by a young demographic, strong awareness of natural skincare, and the rapid penetration of direct-to-consumer beauty platforms. Domestic innovation and affordable sustainable formulations are anticipated to position India as a growth leader. China, expanding at 19.9% CAGR, is expected to benefit from regulatory crackdowns on synthetic exfoliants and the strong influence of social commerce, which amplifies the appeal of fruit-enzyme-based and vegan-certified products.

Japan is forecast to advance at 16.1% CAGR, driven by its preference for minimalism and dermatologically safe formulations. Europe shows moderate but stable expansion, with the UK (12.9%) and Germany (10.1%) supported by regulatory enforcement of eco-friendly claims and consumer trust in certified products. The hSA, with 8.3% CAGR, reflects a mature but competitive landscape, where ethical positioning and innovation in multifunctional products are expected to maintain relevance. Across these markets, growth is projected to be steered by eco-compliance, ethical claims, and digital-led consumer engagement.

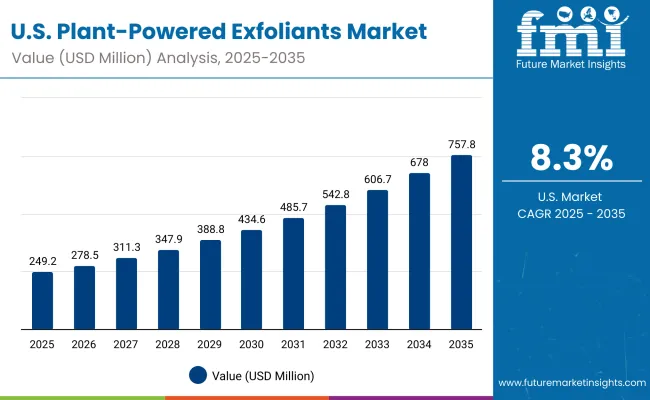

| Year | USA Plant-Powered Exfoliants Market (USD Million) |

|---|---|

| 2025 | 249.24 |

| 2026 | 278.56 |

| 2027 | 311.33 |

| 2028 | 347.95 |

| 2029 | 388.87 |

| 2030 | 434.61 |

| 2031 | 485.73 |

| 2032 | 542.87 |

| 2033 | 606.72 |

| 2034 | 678.08 |

| 2035 | 757.84 |

The plant-powered exfoliants market in the United States is projected to grow at a CAGR of 11.8% between 2025 and 2035, expanding from USD 249.24 million in 2025 to USD 757.84 million by 2035. During the first half of the period, sales are expected to rise from USD 249.24 million in 2025 to USD 434.61 million in 2030, contributing nearly 35% of the decade’s growth. In the second half, the market is anticipated to accelerate, adding more than USD 323 million as it climbs from USD 434.61 million in 2030 to USD 757.84 million in 2035, signaling strong adoption momentum across consumer demographics.

Growing preference for dermatologist-endorsed and irritation-free formulations is expected to strengthen gentle enzymatic exfoliation as the leading function. The emphasis on vegan and cruelty-free claims is projected to drive further market expansion, reinforced by increasing consumer awareness of ethical and sustainable choices. Digital-first platforms, subscription-based models, and influencer engagement are expected to enhance visibility and loyalty, while premium pricing opportunities will likely emerge through verifiable eco-certifications and clinical validation.

The plant-powered exfoliants market in the United Kingdom is projected to grow at a CAGR of 12.9% from 2025 to 2035, supported by rising adoption of eco-certified and cruelty-free skincare solutions. Value expansion is expected to be anchored by regulatory enforcement on microplastics, which is driving brand focus on biodegradable alternatives. Ethical claims and premiumization are anticipated to play a decisive role, as UK consumers place high importance on transparency and sustainability. Retail partnerships with specialty beauty chains and online subscription models are expected to strengthen brand visibility and accelerate adoption across demographics.

The plant-powered exfoliants market in India is forecasted to expand at a CAGR of 22.4% during 2025-2035, making it the fastest-growing global market. Growth momentum is expected to be supported by the country’s young population, increasing skincare awareness, and rapid digital retail penetration. Affordable yet sustainable products are projected to dominate, with strong demand emerging from acne-care and sensitive-skin segments in humid climates. Local sourcing of botanicals and the integration of Ayurvedic principles with modern formulations are anticipated to shape product differentiation. Distribution through D2C platforms and tier-II/III city adoption are expected to accelerate overall market penetration.

The plant-powered exfoliants market in China is anticipated to grow at a CAGR of 19.9% between 2025 and 2035, driven by rapid consumer acceptance of fruit-enzyme-based and vegan-certified products. Stringent crackdowns on synthetic exfoliants and growing alignment with eco-regulations are expected to support strong expansion. Social commerce and livestreaming platforms are projected to amplify product awareness, while KOL endorsements are expected to accelerate conversions. Domestic players are likely to scale quickly through price competitiveness and product localization, while international brands will be differentiated by claims authenticity and dermatologist co-validation.

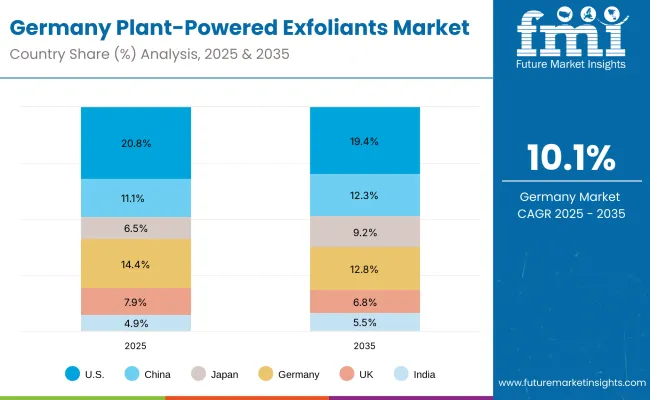

| Countries | 2025 |

|---|---|

| USA | 20.8% |

| China | 11.1% |

| Japan | 6.5% |

| Germany | 14.4% |

| UK | 7.9% |

| India | 4.9% |

| Countries | 2035 |

|---|---|

| USA | 19.4% |

| China | 12.3% |

| Japan | 9.2% |

| Germany | 12.8% |

| UK | 6.8% |

| India | 5.5% |

The plant-powered exfoliants market in Germany is projected to expand at a CAGR of 10.1% from 2025 to 2035, sustained by strong consumer demand for clean-label and certified organic skincare. Regulatory frameworks emphasizing eco-compliance and non-toxic ingredients are expected to shape product innovation and retail positioning. Specialty beauty retailers and pharmacies are projected to serve as primary distribution channels, while e-commerce adoption continues to broaden reach. Germany’s established reputation for quality-conscious consumption is anticipated to create opportunities for brands offering validated sustainability and clinical efficacy.

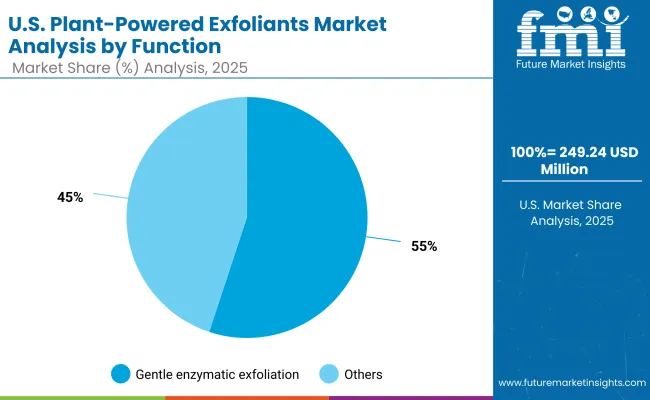

| Segment | Market Value Share, 2025 |

|---|---|

| Gentle enzymatic exfoliation | 55.1% |

| Others | 44.9% |

The plant-powered exfoliants market in the United States is projected at USD 249.24 million in 2025. Gentle enzymatic exfoliation contributes 55.1% of this value, equal to USD 137.40 million, while other functions account for 44.9%, or USD 111.85 million. This dominance of enzymatic formats reflects a strong consumer shift toward non-abrasive, dermatologist-endorsed solutions, aligning with the country’s high prevalence of sensitive skin concerns.

The emphasis on skin safety and clinical validation has reinforced enzymatic formulations as the preferred option, while other functional benefits such as deep pore cleansing and oil control continue to retain relevance. Innovation pipelines are increasingly focused on refining enzyme stability, enhancing delivery systems, and integrating multi-benefit claims, which are projected to further consolidate enzymatic leadership. Competitive differentiation is expected to be determined by scientific substantiation and the ability to communicate measurable skin outcomes through trusted channels.

| Segment | Market Value Share, 2025 |

|---|---|

| Fruit enzymes | 50.9% |

| Others | 49.1% |

The plant-powered exfoliants market in China is projected to be strongly led by fruit enzyme-based solutions, which are expected to hold 50.9% share in 2025, valued at USD 6,018 million. Other sources, including grains, seeds, and herbal extracts, are anticipated to account for 49.1% share, equivalent to USD 6,529 million, reflecting a near-balanced split across natural formulations. The preference for fruit enzymes has been reinforced by consumer trust in gentle, naturally active solutions that deliver both efficacy and safety, aligning with the rising demand for dermatologist-approved skincare.

At the same time, other sources are gaining prominence due to their adaptability in multifunctional claims and sustainability narratives. Rapid adoption is expected to be shaped by eco-compliance, social commerce influence, and brand storytelling around upcycled botanicals. The competitive outlook is projected to be determined by the ability to pair clinical efficacy with visible sustainability commitments.

The plant-powered exfoliants market is moderately fragmented, with global leaders, mid-sized natural beauty innovators, and niche ethical specialists competing for share. L’Oréal holds the leading position globally, with a projected value share of 8.3% in 2025. Its early investment in sustainable skincare, integration of cruelty-free claims, and clinical backing of enzymatic formulations have positioned it as the dominant multinational player. The market share for L’Oréal in 2024 was estimated slightly above 8%, reflecting steady consolidation of its leadership.

Other global leaders such as Unilever, Procter & Gamble, and Shiseido are active participants in this space, leveraging strong distribution systems and premium skincare lines to capture incremental demand. These companies are expected to focus on upcycled botanicals, dermatologist-validated innovations, and biodegradable product ranges to strengthen their portfolios. Mid-sized players including Kiehl’s, Origins, Juice Beauty, and Yves Rocher are building differentiation through sustainability-first storytelling, localized sourcing, and digital-first retail approaches. Meanwhile, specialist brands such as Herbivore Botanicals and Tata Harper have carved out strong reputations within the clean beauty niche, gaining traction among millennial and Gen Z consumers.

Competitive differentiation is expected to evolve away from basic natural ingredient claims toward verifiable sustainability certifications, clinical evidence of efficacy, and transparent sourcing narratives. The ability to combine ethical positioning with performance-driven results will likely define market leadership in the decade ahead.

Key Developments in Plant-Powered Exfoliants Market

| Item | Value |

|---|---|

| Value (Quantitative) | Global market size: USD 1,200.5 million (2025); USD 3,905.2 million (2035); CAGR 12.5% (2025-2035) |

| Function | Gentle enzymatic exfoliation; Others (deep pore cleansing, oil control & acne treatment, brightening/radiance, anti-aging renewal, texture smoothing) |

| Source | Fruit enzymes (papain, bromelain, pumpkin); Others (grain & legume scrubs, nut & seed powders, leaf/herbal extracts, upcycled plant exfoliants) |

| Claim | Vegan & cruelty-free; Others (clean-label, organic-certified, biodegradable particles) |

| Product Type | Powders & dry blends; Cream scrubs; Peel-off masks; Cleansers & gels; Multi-action exfoliating masks |

| Channel | E-commerce; Pharmacies; Natural/organic stores; Specialty beauty retailers; Mass retail; Spas & salons |

| End-use (Consumer) | Unisex; Women; Men; Teen/young adult acne care |

| Regions Covered | North America; Europe; Asia-Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; Canada; Germany; France; United Kingdom; China; Japan; India; Brazil; South Africa |

| Key Companies Profiled | L’Oréal; Unilever; Procter & Gamble; Shiseido; Kiehl’s; Origins; Juice Beauty; Herbivore Botanicals; Tata Harper; Yves Rocher |

| Additional Attributes | Dollar sales by function, source, and claim; tracking of gentle enzymatic leadership; adoption of vegan/cruelty-free and biodegradable claims; regulatory shifts away from microplastics; rise of upcycled inputs; D2C/e-commerce penetration; clinical efficacy and irritation-reduction evidence; packaging concentrates/solids; country-level growth (e.g., India 22.4% CAGR, China 19.9%); premiumization and price/mix analysis. |

The global Plant-Powered Exfoliants Market is estimated to be valued at USD 1,200.5 million in 2025.

The market size for the Plant-Powered Exfoliants Market is projected to reach USD 3,905.2 million by 2035.

The Plant-Powered Exfoliants Market is expected to grow at a CAGR of 12.5% between 2025 and 2035.

The key product types in the Plant-Powered Exfoliants Market include powders & dry blends, cream scrubs, peel-off masks, cleansers & gels, and multi-action exfoliating masks.

In terms of function, gentle enzymatic exfoliation is expected to command the largest share at 52.5% in the Plant-Powered Exfoliants Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Exfoliants Peeling Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA