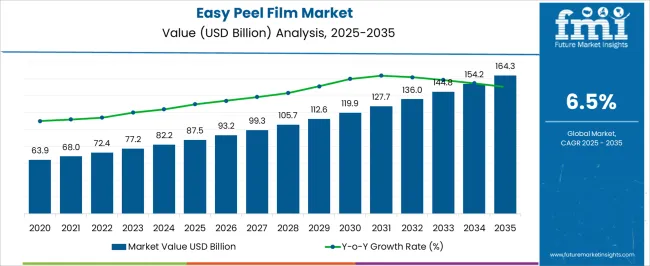

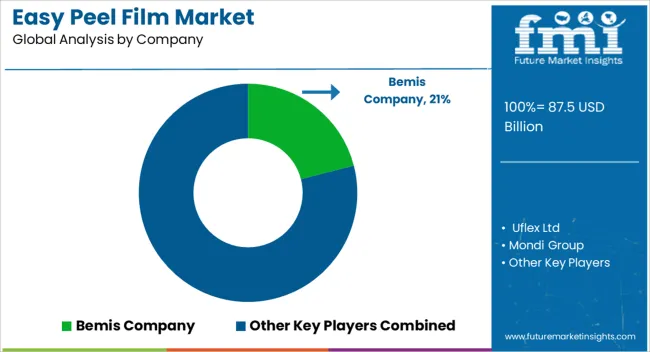

The easy peel film market is estimated to be valued at USD 87.5 billion in 2025 and is projected to reach USD 164.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

Growth is influenced by rising demand for convenient packaging in food, beverages, healthcare, and consumer goods, where easy peel films improve product accessibility, extend shelf life, and enhance sealing integrity. Material innovations such as multi-layer coextrusion, recyclable compositions, and improved barrier properties are strengthening adoption across multiple industries. A 5-year growth block analysis highlights variations in market expansion across defined intervals. From 2025 to 2030, growth is steady, supported by established adoption in North America and Europe, where the food and beverage sector drives consistent demand.

Between 2030 and 2035, the market experiences stronger growth momentum as Asia Pacific and Latin America record higher adoption, fueled by rising packaged food consumption, healthcare packaging needs, and expansion of retail distribution channels. Across both growth blocks, innovation in peel strength customization and eco-friendly materials emerges as a critical driver, ensuring widespread application versatility. The analysis shows that while mature markets provide stability in early years, emerging economies deliver accelerated gains in the later block, shaping the overall USD 76.8 billion opportunity during the 2025–2035 period.

| Metric | Value |

|---|---|

| Easy Peel Film Market Estimated Value in (2025 E) | USD 87.5 billion |

| Easy Peel Film Market Forecast Value in (2035 F) | USD 164.3 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

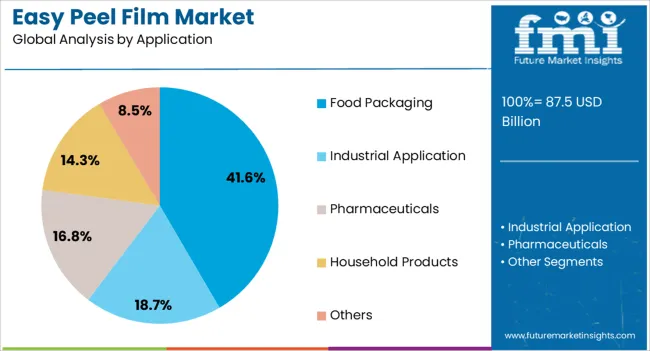

The easy peel film market is strongly shaped by the food and beverage sector, which accounts for nearly 45% of the market share, driven by demand for convenient packaging in ready-to-eat meals, dairy products, and frozen foods. The pharmaceutical industry contributes around 20%, relying on easy peel films for safe, tamper-evident, and sterile packaging of medical products. Consumer goods packaging represents about 15%, where peelable films enhance product accessibility. Industrial applications hold nearly 10%, covering bulk packaging and protective layers. The remaining 10% comes from cosmetics and personal care, where user-friendly packaging improves customer experience and product safety.

The easy peel film market is advancing through innovations in materials and applications. Biodegradable and recyclable peel films are gaining attention as industries seek packaging that aligns with environmental goals. Multi-layer film structures are being developed to improve barrier properties against moisture and oxygen, extending product shelf life. Heat-resistant films are being adopted in microwaveable and oven-ready packaging. Manufacturers are introducing thinner films with enhanced strength to reduce material use while maintaining performance. Strategic investments in research and partnerships are helping companies expand product portfolios and capture emerging markets. Growing preference for convenient and safe packaging is driving overall adoption.

The market is showing consistent growth due to increasing demand for user-friendly and tamper-evident packaging solutions across multiple industries. A noticeable shift toward convenience and hygiene has accelerated the adoption of easy peel films, especially in food, healthcare, and personal care sectors.

The current market dynamics are being shaped by changing consumer preferences, rising disposable incomes, and increased focus on product safety and shelf-life extension. These films offer the benefit of clean and easy opening without compromising the integrity of the packaging, which is driving demand across developed and emerging economies alike.

Moreover, sustainability trends are prompting manufacturers to develop recyclable and eco-conscious peel films, paving the way for innovation-led growth As global consumption patterns continue to evolve and packaging becomes a critical differentiator in consumer goods, the Easy Peel Film market is expected to expand steadily with new opportunities arising from advancements in multilayer film technology and customization capabilities.

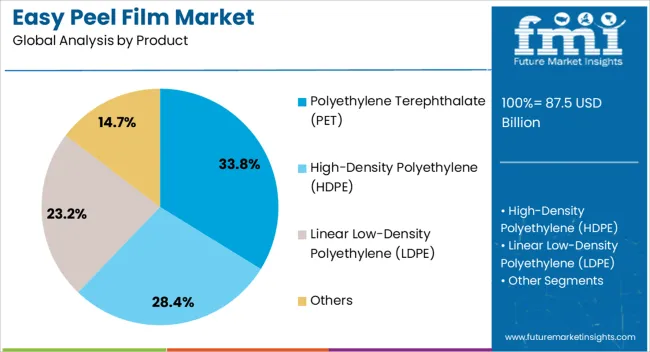

The easy peel film market is segmented by product, application, and geographic regions. By product, easy peel film market is divided into polyethylene terephthalate (PET), high-density polyethylene (HDPE), linear low-density polyethylene (LDPE), and others. In terms of application, easy peel film market is classified into food packaging, industrial application, pharmaceuticals, household products, and others. Regionally, the easy peel film industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyethylene terephthalate product segment is expected to hold 33.8% of the overall easy peel film market revenue in 2025, making it the leading product type. This segment’s growth has been supported by PET’s excellent clarity, mechanical strength, and compatibility with various sealing layers, which contribute to enhanced package integrity and visual appeal.

Preference for PET has been driven by its superior barrier properties that protect against moisture and gases, making it ideal for perishable items. Additionally, its ability to undergo heat treatment without deforming makes it suitable for high-speed processing and packaging environments.

PET films have also gained favor due to their recyclability and suitability for multilayer constructions, enabling manufacturers to meet both performance and sustainability goals As demand for durable yet easy-to-open packaging continues to rise, PET-based films are expected to maintain their leading position due to their reliability and functional adaptability in various end-use applications.

The food packaging application segment is projected to account for 41.6% of the total market revenue in 2025, positioning it as the most dominant application area. The strong performance of this segment is being driven by increasing consumer demand for convenience and safety in packaged food products. Easy peel films have been widely adopted in food applications due to their ability to preserve freshness while offering effortless opening without the need for tools.

These films support portion control, reduce the risk of contamination, and improve user experience across ready-to-eat meals, dairy, snacks, and frozen foods. Manufacturers are favoring easy peel films in this segment to meet regulatory standards and enhance product appeal through clean and secure sealing.

The shift in consumer behavior toward packaged and on-the-go food options has further reinforced the segment’s growth With evolving food retail formats and the expansion of cold chain logistics, the demand for reliable and easy-to-use packaging solutions is expected to keep the food packaging segment at the forefront of market growth.

The easy peel film market is expanding due to rising demand in food packaging, ready-to-eat meals, and consumer convenience products. Global revenue exceeded USD 6.8 billion in 2024, with Asia Pacific contributing 38% due to strong growth in packaged food and beverage industries across China, India, and Southeast Asia. North America accounts for 28%, supported by high adoption in frozen meals, dairy, and beverage packaging. Europe contributes 26%, driven by growing demand for convenience-based packaging in Germany, UK, and France. The market benefits from the versatility of polyethylene, polypropylene, and polyester films. Strong sealing performance, tamper evidence, and microwave compatibility are increasing global adoption across food, pharmaceutical, and household packaging.

Packaged food and beverage applications account for 45% of global adoption of easy peel films. Asia Pacific dominates with 38% market share, led by rising consumption of ready-to-eat meals and dairy products. North America contributes 28% due to strong frozen meal packaging demand. Europe holds 26%, focusing on dairy, meat, and beverage sealing applications. Peelable lidding films improve convenience and tamper evidence while ensuring product freshness. Microwave compatibility and strong heat-sealing properties enhance adoption in packaged meals. Adoption in single-serve and multipack formats is expanding. Growing popularity of portable, on-the-go food options continues to strengthen demand for easy peel films globally.

Technological advancements in easy peel films include multilayer structures with polyethylene, polypropylene, PET, and EVOH. These materials enhance sealing, puncture resistance, and product protection. Multilayer films extend shelf life by 15–20% while maintaining easy-open features. Innovations in resin blends and co-extrusion improve sealing performance on rigid trays and flexible pouches. Asia Pacific focuses on affordable multilayer films, while North America emphasizes premium peelable lidding for frozen and chilled foods. Europe prioritizes high-barrier films for meat and dairy packaging. Rising adoption of peelable seals in pharmaceutical blister packs and household goods is broadening the scope of applications. Advancements improve user convenience and product safety across industries.

Easy peel films are widely adopted across food, pharmaceutical, and household packaging. Food applications account for 70% of usage due to high demand in dairy, frozen meals, and beverages. Pharmaceutical applications contribute 15%, with peelable blister packs and medical trays gaining traction. Household and consumer goods packaging represents 10–12% of adoption. Asia Pacific leads adoption with strong packaged food demand in India and China. North America emphasizes frozen meal and dairy packaging, while Europe focuses on high-barrier peel films for meat and cheese. Rising convenience packaging demand across multiple industries is driving consistent market expansion worldwide.

Easy peel films face challenges from raw material price fluctuations and recycling complexity. Multilayer film structures, combining polyethylene, polypropylene, and EVOH, increase production costs by 15–20% compared to monolayer films. Recycling remains difficult due to mixed resin compositions, limiting adoption in regions with strict environmental standards. High-quality sealing materials add further cost pressures, impacting adoption in price-sensitive markets. Supply chain dependencies for specialty resins affect material availability in Asia Pacific and Latin America. Manufacturers are addressing challenges with mono-material peel films, advanced resin blends, and lightweight designs. Despite these efforts, production costs, recyclability, and raw material access remain key constraints.

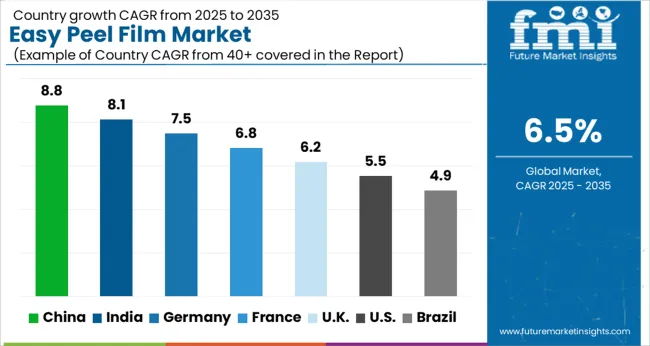

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

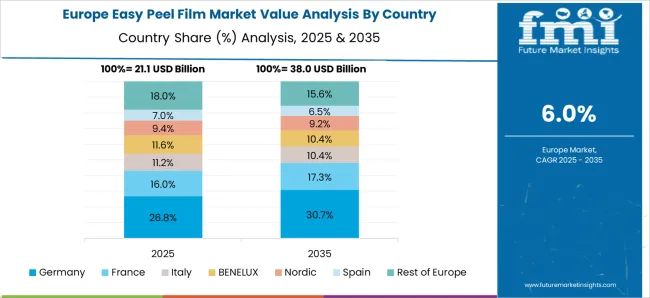

| France | 6.8% |

| UK | 6.2% |

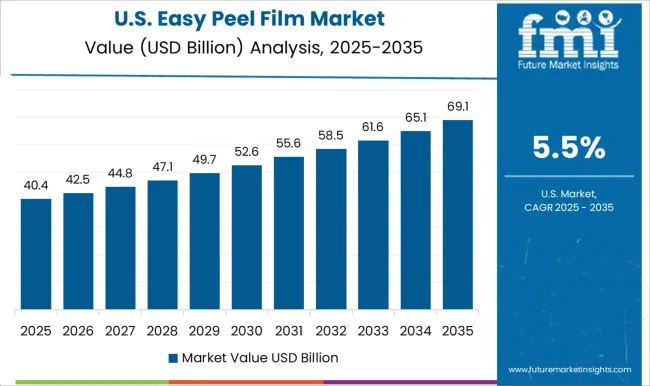

| USA | 5.5% |

| Brazil | 4.9% |

The easy peel film market is projected to grow at a global CAGR of 6.5% through 2035, driven by rising demand in food packaging, healthcare, and consumer goods applications. China leads at 8.8%, 35% above the global benchmark, supported by BRICS-led growth in flexible packaging, ready-to-eat food segments, and large-scale manufacturing capacity. India follows at 8.1%, 25% above the global average, reflecting increasing adoption in food processing, pharmaceutical packaging, and retail-ready products. Germany records 7.5%, 15% above the benchmark, shaped by OECD-driven advancements in high-performance films, industrial packaging, and innovation in convenience-focused solutions. The United Kingdom posts 6.2%, 5% below the global rate, influenced by selective usage in premium food packaging and healthcare-related applications. The United States stands at 5.5%, 15% below the benchmark, with steady demand in retail packaging, healthcare, and specialized industrial uses. BRICS economies drive volume growth, OECD markets emphasize efficiency, innovation, and product performance, while ASEAN nations contribute through expanding food packaging and consumer product industries.

The easy peel film market in China is projected to expand at a CAGR of 8.8%, outperforming the global CAGR of 6.5%, with packaging demand driving consumption in the food, pharmaceutical, and personal care sectors. In 2024, 47% of newly manufactured films featured multi-layer structures that improved seal integrity and convenience. Production hubs in Zhejiang, Shandong, and Guangdong raised output by 18% to serve domestic and export markets. Suppliers such as Amcor China, Sealed Air China, and Berry Global China invested in high-barrier films with enhanced puncture resistance and peel performance. Growth is influenced by increasing packaged meal consumption and demand for consumer-friendly packaging formats.

The easy peel film market in India is expected to register a CAGR of 8.1%, above the global 6.5%, supported by rising packaged food consumption, household products, and flexible packaging demand. In 2024, 44% of newly produced films targeted dairy, ready-to-eat meals, and beverage packaging. Facilities in Gujarat, Maharashtra, and Tamil Nadu increased capacity by 15% to meet domestic needs and regional exports. Companies such as Uflex, Jindal Poly Films, and Amcor India focused on lightweight structures with advanced peel strength and compatibility with automated filling systems. Expansion is encouraged by convenience-driven product formats and increasing adoption of flexible packaging in organized retail channels.

Germany’s easy peel film market is projected to grow at a CAGR of 7.5%, higher than the global CAGR of 6.5%, driven by stringent packaging standards in food and healthcare. In 2024, 41% of new production focused on recyclable multilayer films with enhanced safety features. Production facilities in Bavaria and North Rhine-Westphalia scaled output by 12% to serve domestic and EU demand. Leading players including Mondi Germany, Sealed Air, and Amcor targeted innovation in tamper-evident and sterilizable peel films for pharmaceutical and medical packaging. Growth is also shaped by rising convenience packaging requirements in bakery and dairy categories.,

The easy peel film market in the United Kingdom is forecast to grow at a CAGR of 6.2%, close to the global CAGR of 6.5%, supported by steady demand in food retail and healthcare packaging. In 2024, 39% of newly produced films targeted ready meals, dairy containers, and convenience-focused packaging. Production in the Midlands and Northern regions expanded by 10% to meet supermarket-driven requirements. Suppliers such as Amcor UK, Sealed Air UK, and Coveris emphasized resealable formats and consumer-friendly film designs that improve accessibility and reduce wastage. Market expansion is influenced by changing eating habits and rising adoption of portion-controlled packaging formats.

The easy peel film market in the United States is projected to grow at a CAGR of 5.5%, below the global CAGR of 6.5%, due to maturity in flexible packaging and established processing sectors. In 2024, 37% of newly manufactured films targeted convenience packaging for frozen meals, dairy, and bakery products. Facilities in Texas, California, and Ohio increased output by 9% to maintain national supply. Suppliers including Berry Global, Sealed Air USA, and Amcor USA focused on peel strength consistency, puncture resistance, and microwave compatibility. Market growth is driven by demand for consumer convenience, innovation in meal packaging, and healthcare adoption of peel films.

Competition in the easy peel film market is being shaped by sealing performance, opening convenience, and alignment with food and pharmaceutical packaging needs. Market positions are being maintained through certified materials, technical support, and broad distribution that ensures consistent supply. Bemis Company is being represented with lidding films designed for secure seals and effortless removal, while Uflex Ltd is being promoted with peelable films suited for both hot and cold seal applications. Mondi Group is being applied with multilayer films designed for product protection and ease of use. Sealed Air Corporation is being showcased with easy peel options tailored for vacuum packs and protective packaging.

Coveris Holdings S.A. is being positioned with films structured for reliable sealing and extended product life. Berry Global Group is being recognized with peelable solutions offering clarity and food packaging reliability. Winpak Ltd is being advanced with lidding films designed for dairy, meat, and convenience foods. Cosmo Films Ltd is being represented with peelable substrates engineered for sealing and printability. Toray Plastics (America), Inc. is being applied with polyester and polypropylene films designed for food packaging. Mitsubishi Chemical Holdings Corporation is being promoted with high-performance films used in healthcare and industrial applications. Flex Films is being highlighted with peelable solutions engineered for barrier protection. Taghleef Industries Group is being showcased with recyclable peelable films structured for consumer packaging. Terphane LLC is being advanced with polyester films designed for durability and ease of use. Klöckner Pentaplast Group is being applied with peelable solutions tailored for healthcare and food safety. Constantia Flexibles Group is being positioned with lidding and barrier films designed for safe packaging and user convenience.

Strategies are being centered on product refinement, regulatory compliance, and expansion of technical support and supply chains. Research and development efforts are being directed toward better sealing strength, film durability, and recyclability. Product brochures are being structured with specifications covering sealing temperature range, barrier strength, thickness, and packaging compatibility. Features such as tamper evidence, transparency, printability, and ease of handling are being emphasized to support procurement and production planning. Each brochure is being arranged to highlight certification records, usage conditions, and service support. Technical content is being presented in a clear, evaluation-ready format to assist packaging engineers, processors, and purchasing teams in selecting easy peel films that match performance, safety, and operational requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 87.5 billion |

| Product | Polyethylene Terephthalate (PET), High-Density Polyethylene (HDPE), Linear Low-Density Polyethylene (LDPE), and Others |

| Application | Food Packaging, Industrial Application, Pharmaceuticals, Household Products, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bemis Company, Uflex Ltd, Mondi Group, Sealed Air Corporation, Coveris Holdings S.A., Berry Global Group, Winpak Ltd, Cosmo Films Ltd, Toray Plastics (America), Inc, Mitsubishi Chemical Holdings Corporation, Flex Films, Taghleef Industries Group, Terphane LLC, Klöckner Pentaplast Group, and Constantia Flexibles Group |

| Additional Attributes | Dollar sales by film type and end use, demand dynamics across food, beverages, and pharmaceuticals, regional trends in packaged product consumption, innovation in seal strength and material compatibility, environmental impact of plastic waste and recycling, and emerging use cases in ready-to-eat meals and medical packaging. |

The global easy peel film market is estimated to be valued at USD 87.5 billion in 2025.

The market size for the easy peel film market is projected to reach USD 164.3 billion by 2035.

The easy peel film market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in easy peel film market are polyethylene terephthalate (pet), high-density polyethylene (hdpe), linear low-density polyethylene (ldpe) and others.

In terms of application, food packaging segment to command 41.6% share in the easy peel film market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Key Companies & Market Share in the Easy Peel Film Packaging Sector

Easy Peel Film Packaging Market Analysis by PP and PE Through 2034

Easy Open Packaging Market Size and Share Forecast Outlook 2025 to 2035

Hygienic Easy-to-Clean Food Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Peelable Lid Stock Market Size and Share Forecast Outlook 2025 to 2035

Peel off Face Mask Market Size and Share Forecast Outlook 2025 to 2035

Peel Oil Market

Peel Pouches Market

Peelable lidding films Market Size and Share Forecast Outlook 2025 to 2035

Pharma Peeler Centrifuge Market Size and Share Forecast Outlook 2025 to 2035

Potato Peel Powder Market Size and Share Forecast Outlook 2025 to 2035

Chemical Peel Market Size and Share Forecast Outlook 2025 to 2035

Grapefruit Peel Market Size and Share Forecast Outlook 2025 to 2035

Exfoliants Peeling Agents Market Size and Share Forecast Outlook 2025 to 2035

Pomegranate Peel Actives Market Size and Share Forecast Outlook 2025 to 2035

Aluminum Foil Peel-Off Ends Maker Market Size and Share Forecast Outlook 2025 to 2035

Glycolic Acid Peel Market Insights – Growth & Forecast 2024-2034

AHA/BHA Chemical Peels Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Industrial Steam Peeler Market Size and Share Forecast Outlook 2025 to 2035

Exfoliating Scrubs and Peels Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA