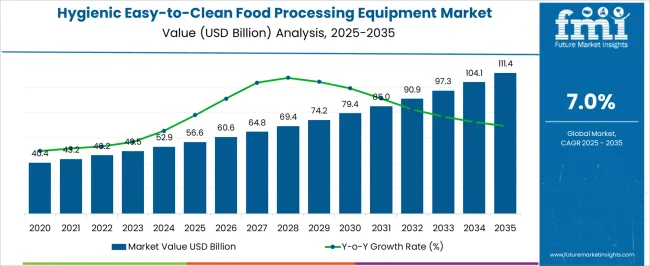

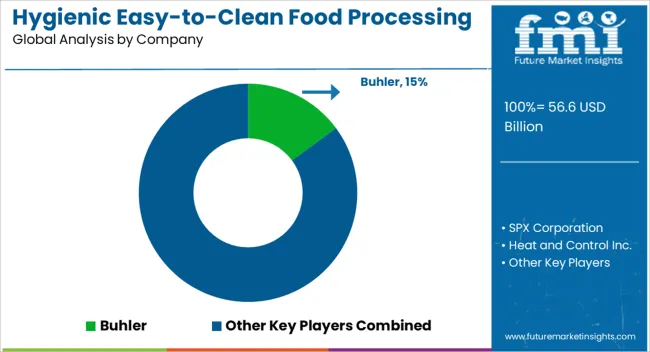

The hygienic easy-to-clean food processing equipment market is estimated to be valued at USD 56.6 billion in 2025 and is projected to reach USD 111.4 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

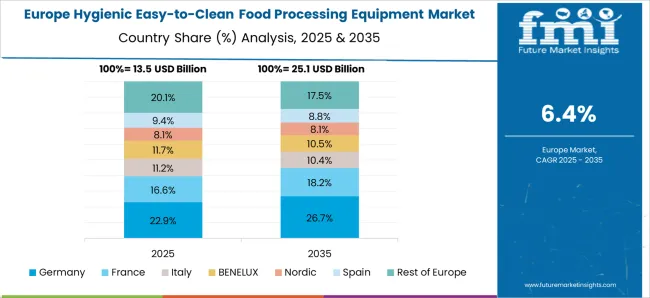

Asia-Pacific is anticipated to record the fastest expansion, driven by its large-scale manufacturing base, strong demand for processed food, and rising regulatory emphasis on food hygiene standards. Cost-efficient production facilities and rapid technology adoption enable the region to dominate future market share. Europe, by contrast, is likely to experience stable but moderate growth. Strong food safety legislation, stringent hygiene standards, and established food processing industries sustain consistent demand, but the region faces saturation in equipment adoption. Upgrades in automation and compliance-driven investments will remain the primary drivers rather than new large-scale capacity expansions.

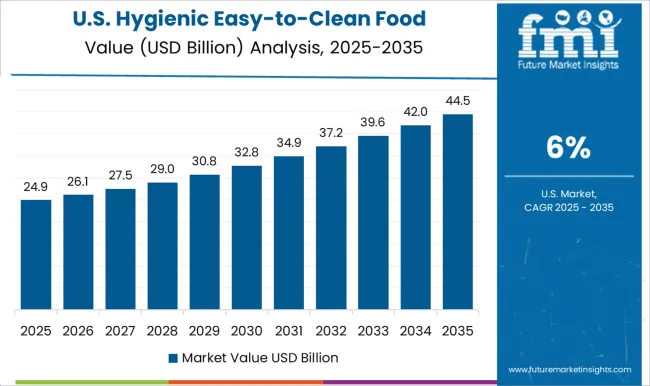

North America’s growth stands between Asia-Pacific and Europe, driven by continuous modernization of food production facilities and high adoption of automation and digital sanitation systems. The market expansion is relatively restrained due to a mature processing industry with high penetration of hygienic equipment. Asia-Pacific emerges as the key growth accelerator, while Europe remains compliance-driven, and North America consolidates through advanced upgrades, creating a pronounced regional imbalance in growth trajectories over the forecast horizon.

| Metric | Value |

|---|---|

| Hygienic Easy-to-Clean Food Processing Equipment Market Estimated Value in (2025 E) | USD 56.6 billion |

| Hygienic Easy-to-Clean Food Processing Equipment Market Forecast Value in (2035 F) | USD 111.4 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

The hygienic easy to clean food processing equipment market represents a specialized part of global food machinery, reflecting its crucial role in maintaining safety and efficiency. Within the broader food processing equipment sector, it accounts for about 6.2%, emphasizing the growing preference for designs that reduce contamination risks and improve cleaning efficiency. In the sanitary equipment industry, it secures 4.8%, supported by rising compliance requirements. Across the global packaging and food handling machinery space, the segment holds nearly 3.5%, while in the automation-driven food equipment category, its share is about 2.9%. Within the industrial hygiene equipment market, it is positioned at 3.1%, demonstrating its link with food-grade sanitation standards. Recent developments in this market have highlighted significant progress in design, materials, and integration technologies.

Modular and automated clean in place (CIP) systems have gained traction, reducing downtime and enhancing operational efficiency. Equipment manufacturers have invested in stainless steel designs with minimal welds and polished surfaces to address microbial risks. The adoption of robotic cleaning units has emerged as a groundbreaking trend, helping to lower labor costs while ensuring consistent sanitation. Key players are collaborating with digital monitoring solution providers, enabling predictive maintenance and hygiene compliance tracking. Furthermore, the use of eco-friendly cleaning-in-place chemicals is rising as companies adopt sustainability-linked strategies. These advancements demonstrate how safety, compliance, and efficiency are shaping the direction of this specialized equipment market.

The market is experiencing significant growth driven by increasing emphasis on food safety, hygiene compliance, and operational efficiency across the global food processing industry. Rising consumer demand for safe, high-quality dairy, beverage, and processed food products is encouraging manufacturers to adopt equipment that minimizes contamination risk and supports rapid cleaning cycles.

Regulatory standards and certifications for hygiene in food processing facilities are reinforcing the need for equipment that can be cleaned thoroughly without extended downtime. Technological advancements in modular design, automated cleaning systems, and corrosion-resistant materials are enabling faster and more effective cleaning processes.

The market is also being influenced by trends such as plant automation, digital monitoring of hygiene protocols, and sustainability initiatives that reduce water and chemical usage during cleaning Looking ahead, the increasing adoption of smart food processing facilities and the integration of automated cleaning solutions are expected to create substantial opportunities for market growth, ensuring operational continuity while meeting stringent safety standards.

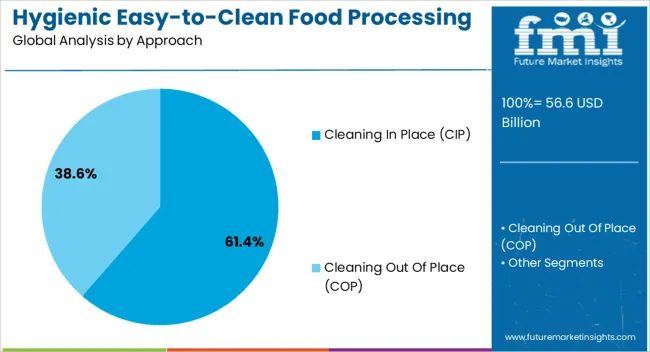

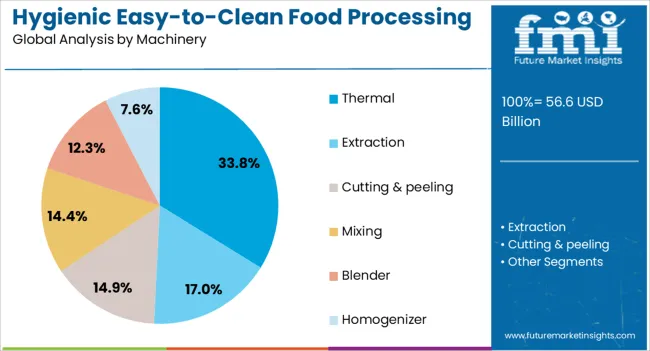

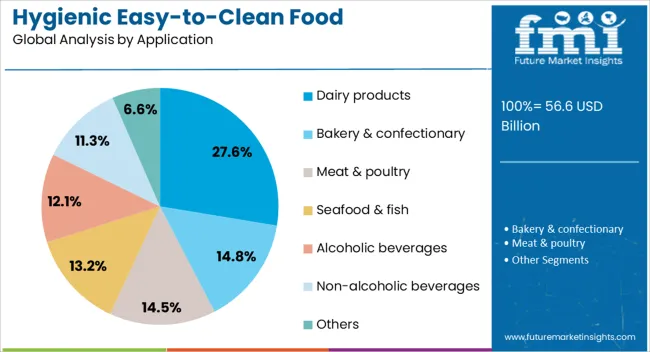

The hygienic easy-to-clean food processing equipment market is segmented by approach, machinery, application, and geographic regions. By approach, hygienic easy-to-clean food processing equipment market is divided into Cleaning In Place (CIP) and Cleaning Out Of Place (COP). In terms of machinery, hygienic easy-to-clean food processing equipment market is classified into thermal, extraction, cutting & peeling, mixing, blender, and homogenizer. Based on application, hygienic easy-to-clean food processing equipment market is segmented into dairy products, bakery & confectionary, meat & poultry, seafood & fish, alcoholic beverages, non-alcoholic beverages, and others. Regionally, the hygienic easy-to-clean food processing equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Cleaning In Place (CIP) approach is expected to hold 61.40% of the hygienic easy to clean food processing equipment market revenue in 2025, making it the leading approach segment. This dominance is being driven by its ability to clean complex processing lines efficiently without the need for complete disassembly. The adoption of CIP systems has been facilitated by the increasing complexity of food processing operations and the requirement for minimal production downtime.

These systems allow consistent and repeatable cleaning processes, reduce the risk of contamination, and optimize the use of cleaning agents and water. Growth has also been supported by the integration of automated monitoring and control, ensuring compliance with hygiene standards while lowering operational costs.

Industries with high throughput, particularly dairy and beverage processing, benefit significantly from CIP approaches due to their reliability, scalability, and adaptability to varying production volumes As food safety regulations continue to tighten globally, the Cleaning In Place segment is expected to maintain its leadership, driven by efficiency, compliance, and enhanced operational safety.

The thermal machinery segment is projected to account for 33.80% of the market revenue in 2025, positioning it as a leading machinery type. The growth of this segment is being supported by its role in ensuring product safety through pasteurization, sterilization, and heat treatment processes, which are essential for extending shelf life and reducing microbial risks. Thermal systems are favored in food processing operations that require precise temperature control, consistency, and energy-efficient operation.

The adaptability of thermal equipment to various food matrices, including liquids, semi-solids, and powders, has also contributed to its widespread adoption. Automation and integration with digital process controls allow precise regulation of heating cycles, minimizing the risk of underprocessing or overprocessing.

The increasing demand for hygienically processed dairy, beverage, and ready-to-eat food products has accelerated the deployment of thermal machinery Going forward, the segment is expected to benefit from rising industry focus on energy-efficient, hygienic, and scalable thermal solutions that ensure product safety and regulatory compliance while supporting high production volumes.

The dairy products application segment is anticipated to hold 27.60% of the overall market revenue in 2025, making it the largest application segment. This leadership is being driven by the high hygiene requirements in dairy processing, including milk, cheese, yogurt, and other dairy derivatives, where contamination can significantly impact safety and product quality. Equipment that is easy to clean, resistant to microbial growth, and compatible with automated cleaning protocols is increasingly preferred in this sector.

The segment’s growth has been reinforced by rising global demand for dairy products, modernization of processing facilities, and stricter food safety regulations. Continuous processing lines, combined with hygienic and modular equipment design, allow efficient production while ensuring compliance with safety standards.

Additionally, dairy processors are prioritizing equipment that reduces downtime during cleaning cycles and supports high-throughput operations The increasing awareness among consumers regarding product safety and quality is expected to sustain the adoption of easy-to-clean food processing equipment in the dairy sector, maintaining its market leadership in applications.

The market has grown as food safety, operational efficiency, and compliance with international standards have become priorities across the food and beverage industry. Equipment designed with hygienic surfaces, smooth welds, non-toxic materials, and quick disassembly features supports sanitation while reducing downtime. Demand is reinforced by rising concerns over contamination, regulatory pressure, and the need for streamlined cleaning procedures that lower water, energy, and chemical use. Manufacturers are focusing on innovations in design, automation, and material science to meet industry-specific requirements, including bakery, dairy, meat, beverage, and confectionery sectors.

The introduction of stringent global regulations related to hygiene in food manufacturing has been a major driver for adoption. Regulatory frameworks such as the FDA standards in the United States, EFSA guidelines in Europe, and FSSAI rules in India mandate strict cleaning and sanitation protocols. Equipment that allows rapid cleaning without harboring bacteria or allergens reduces risks of contamination while helping manufacturers avoid penalties. Smooth, crevice-free designs and materials resistant to microbial growth are increasingly used. With public scrutiny of foodborne illness rising, compliance with hygiene rules has become non-negotiable, pushing industries to invest in advanced easy-to-clean food processing solutions that deliver both safety and efficiency.

Advancements in stainless steel alloys, antimicrobial coatings, and high-polish finishes have improved the hygiene, durability, and cleaning efficiency of food processing equipment. Corrosion-resistant materials reduce risks associated with harsh sanitizing chemicals, while coatings help prevent bacterial growth and surface degradation. Innovative polymers and composites are also being integrated into certain machine components to improve resilience without compromising hygiene standards. The food industry is increasingly demanding equipment that not only meets safety regulations but also ensures longevity in challenging environments where exposure to moisture, acidity, and heat is routine. Material innovation continues to expand the range of safe and durable solutions available in this market.

The incorporation of automation and smart technologies is enhancing hygienic easy-to-clean equipment capabilities. Automated Clean-in-Place (CIP) systems and programmable sanitation cycles improve cleaning consistency while reducing human error. Sensors and monitoring systems ensure that hygiene standards are consistently met, with real-time data enabling corrective actions if cleaning processes are incomplete. Robotics and automated conveyors are designed with easy-to-clean structures, ensuring compliance without disrupting productivity. As food producers increasingly adopt Industry 4.0 practices, hygiene-focused automation has become a cornerstone in modern facilities. This integration of smart systems strengthens both regulatory compliance and operational efficiency, positioning such equipment as a strategic asset for advanced food processing.

Adoption patterns vary by region depending on food production capacity, regulatory oversight, and consumer expectations. North America and Europe, with stringent food safety frameworks, have been early adopters of hygienic processing solutions. Asia Pacific, driven by rapid food industry growth in China, India, and Southeast Asia, represents a fast-growing market where modernization and export requirements are boosting equipment upgrades. Latin America and the Middle East are progressively integrating such technologies to meet international standards and support local industrial expansion. Regional market dynamics are further influenced by government food safety campaigns, infrastructure investment, and the rise of processed food demand, creating diverse opportunities for equipment manufacturers.

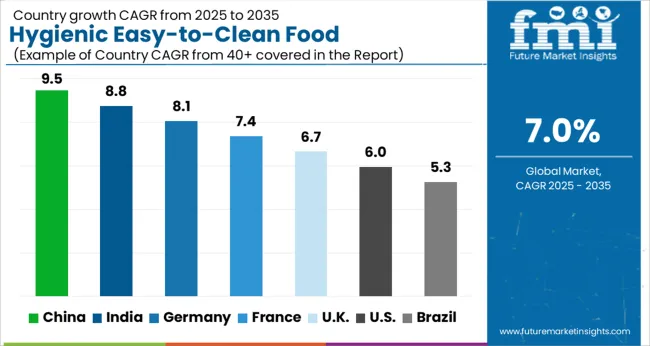

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The market is projected to expand consistently across major economies, driven by demand for safer and more efficient manufacturing systems. China, with a projected 9.5%, remains the strongest market supported by modernization in large scale food plants. India is anticipated at 8.8%, influenced by expanding packaged dairy and beverage segments. Germany, estimated at 8.1%, benefits from automated solutions and strong bakery and meat processing industries. The United Kingdom is expected to record 6.7% due to stringent safety regulations and processed food requirements. The United States, at 6.0%, continues to adopt hygienic technologies in high capacity facilities. These developments indicate the critical role of advanced equipment in global food processing expansion. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is anticipated to expand at a CAGR of 9.5%, supported by rising food processing demand and a shift toward high-quality manufacturing practices. Growing packaged food consumption and industrial-scale production have increased the adoption of hygienic equipment. Manufacturers are investing in automated systems that enhance safety and minimize contamination risks. Regulatory emphasis on hygiene standards and food safety compliance further drives adoption. Stainless steel-based machinery with easy cleaning mechanisms is gaining traction in dairy, bakery, and beverage sectors. Increasing consumer preference for safe and reliable food products encourages investment in advanced technologies. China continues to dominate due to its robust processing industry and expanding capacity.

India is projected to grow at a CAGR of 8.8%, fueled by rising consumption of processed and ready-to-eat food products. The demand for equipment with easy cleaning capabilities is driven by stricter hygiene standards and growing exports of processed food. Investments by multinational and domestic companies in modernizing processing facilities further boost demand. Stainless steel machinery designed for minimal contamination is becoming common across dairy, meat, and bakery industries. Increased focus on energy-efficient equipment also supports adoption. India’s expanding food supply chain and regulatory oversight continue to strengthen market growth in hygienic food processing equipment.

Germany is expected to achieve a CAGR of 8.1%, supported by its advanced food and beverage sector and strong regulatory environment. The country’s focus on precision engineering and high-quality standards accelerates adoption of hygienic processing equipment. Automation and digitization in food manufacturing enhance operational efficiency while ensuring strict hygiene compliance. Growth is fueled by demand in dairy, confectionery, and beverage sectors. Manufacturers prioritize machinery with stainless steel surfaces, modular designs, and quick cleaning features. Germany’s commitment to innovation in hygienic design, combined with strong consumer expectations for food safety, ensures sustained market progress.

The United Kingdom is projected to grow at a CAGR of 6.7% as the food processing industry invests in safe and efficient machinery. Increasing consumer concerns regarding hygiene and safety have driven manufacturers to adopt easy-to-clean systems. The market is expanding in bakery, dairy, and meat processing where contamination control is essential. Regulatory compliance and food quality certifications influence purchasing decisions. Adoption of modular and energy-efficient equipment is further supported by industry modernization efforts. The United Kingdom’s focus on maintaining strict hygiene levels across processing plants ensures consistent demand growth for advanced food equipment.

The United States is forecast to expand at a CAGR of 6.0%, driven by increasing adoption of advanced food processing solutions across large-scale production facilities. Demand is supported by strict food safety regulations and consumer awareness regarding hygiene standards. Investments in stainless steel and automated equipment with clean-in-place features are strengthening the market. Growth is prominent in meat, dairy, and beverage processing, where contamination risks are closely monitored. Manufacturers are focusing on equipment efficiency, easy maintenance, and sustainability in design. The USA food industry’s emphasis on consistent safety and productivity drives steady market expansion.

The market is shaped by global manufacturers that deliver advanced machinery designed to maintain food safety, streamline operations, and reduce contamination risks. Buhler is a recognized leader offering innovative processing solutions tailored to grain milling, bakery, and confectionery industries with a focus on hygienic design and efficient cleaning mechanisms. SPX Corporation provides a wide range of sanitary processing systems engineered to meet regulatory standards, ensuring durability and operational safety in dairy, beverage, and food sectors. Heat and Control Inc. specializes in equipment for frying, coating, seasoning, and packaging, emphasizing hygienic designs that allow quick disassembly and thorough washdowns. Rheon Automatic is notable for automated dough and food processing systems that integrate hygiene and efficiency, meeting the needs of large-scale food producers.

Middleby Corp delivers solutions for commercial kitchens and food manufacturing, incorporating hygienic engineering to optimize safety and performance. Avery Weigh Tronix contributes precision weighing and monitoring systems that integrate with food processing lines, ensuring accuracy while maintaining compliance with sanitary requirements. Tetra Pak, a pioneer in processing and packaging technologies, offers hygienic solutions with easy-to-clean features that support long production runs and strict food quality standards. Collectively, these providers establish benchmarks in efficiency, safety, and hygiene, helping manufacturers achieve compliance with food industry regulations while maximizing productivity and minimizing downtime.

| Item | Value |

|---|---|

| Quantitative Units | USD 56.6 billion |

| Approach | Cleaning In Place (CIP) and Cleaning Out Of Place (COP) |

| Machinery | Thermal, Extraction, Cutting & peeling, Mixing, Blender, and Homogenizer |

| Application | Dairy products, Bakery & confectionary, Meat & poultry, Seafood & fish, Alcoholic beverages, Non-alcoholic beverages, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Buhler, SPX Corporation, Heat and Control Inc., Rheon Automatic, Middleby Corp, Avery Weigh Tronix, and Tetra Pack |

| Additional Attributes | Dollar sales by equipment type and application, demand dynamics across dairy, meat, beverage, and bakery sectors, regional trends in hygienic equipment adoption, innovation in design, material durability, and automation, environmental impact of cleaning processes and resource usage, and emerging use cases in ready-to-eat food production and sustainable processing solutions. |

The global hygienic easy-to-clean food processing equipment market is estimated to be valued at USD 56.6 billion in 2025.

The market size for the hygienic easy-to-clean food processing equipment market is projected to reach USD 111.4 billion by 2035.

The hygienic easy-to-clean food processing equipment market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in hygienic easy-to-clean food processing equipment market are cleaning in place (cip) and cleaning out of place (cop).

In terms of machinery, thermal segment to command 33.8% share in the hygienic easy-to-clean food processing equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hygienic Pump and Valve Market Forecast Outlook 2025 to 2035

B2B Hygienic Paper Market Size and Share Forecast Outlook 2025 to 2035

Hand Hygienic Product Market

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Garage Equipment Market Forecast and Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Galley Equipment Market Analysis and Forecast by Fit, Application, and Region through 2035

Sorting Equipment Market Size and Share Forecast Outlook 2025 to 2035

General Equipment Rental Services Market Size and Share Forecast Outlook 2025 to 2035

Bagging Equipment Market Size and Share Forecast Outlook 2025 to 2035

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Medical Equipment Covers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA