The farm equipment market is advancing steadily, supported by mechanization trends, rising labor costs, and increased focus on productivity enhancement in agriculture. Government subsidies, access to credit, and the modernization of farming practices are driving demand for advanced equipment across small and medium-scale farms.

Technological improvements in engine performance, precision farming, and telematics integration are enhancing efficiency and reducing operational costs. The current market environment reflects strong adoption in developing regions, where farmers are shifting from manual operations to machinery-based cultivation.

Growth is further reinforced by the expansion of rental services and the introduction of fuel-efficient, compact models tailored for diversified crop systems. With the increasing emphasis on sustainable agriculture and higher yield optimization, the global farm equipment market is poised for long-term expansion.

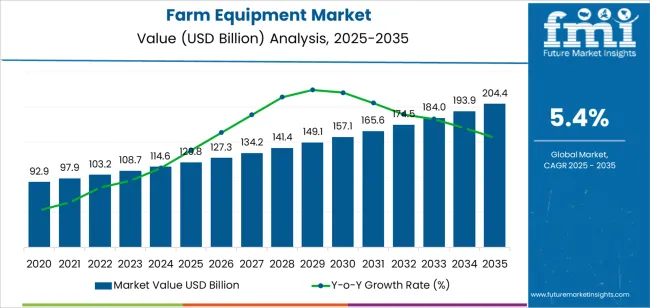

| Metric | Value |

|---|---|

| Farm Equipment Market Estimated Value in (2025 E) | USD 120.8 billion |

| Farm Equipment Market Forecast Value in (2035 F) | USD 204.4 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

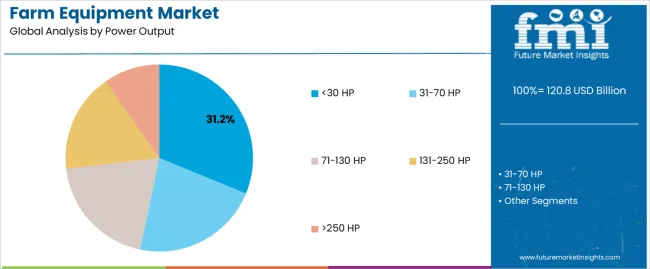

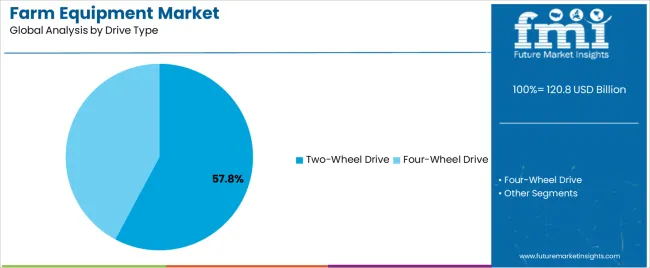

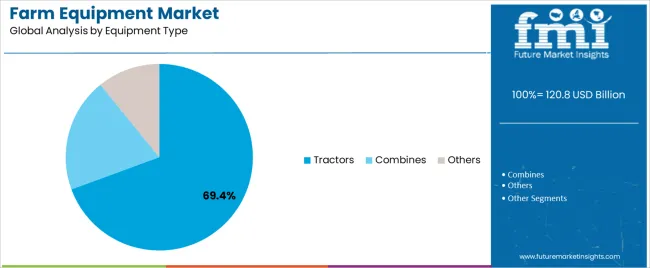

The market is segmented by Power Output, Drive Type, and Equipment Type and region. By Power Output, the market is divided into <30 HP, 31-70 HP, 71-130 HP, 131-250 HP, and >250 HP. In terms of Drive Type, the market is classified into Two-Wheel Drive and Four-Wheel Drive. Based on Equipment Type, the market is segmented into Tractors, Combines, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The <30 HP segment holds approximately 31.2% share in the power output category, driven by its extensive adoption among small and marginal farmers. These machines provide a cost-effective solution for basic field operations such as tilling, sowing, and transport in smaller landholdings.

Compact size, fuel efficiency, and lower maintenance costs make them ideal for localized agricultural practices. The segment benefits from government support programs and financing options encouraging mechanization in rural areas.

As demand for affordable, lightweight tractors and equipment rises in emerging economies, the <30 HP segment is expected to maintain a strong market presence.

The two-wheel drive segment dominates the drive type category with approximately 57.8% share, reflecting its cost advantage and suitability for standard agricultural operations. These systems provide adequate traction for dry and light soil conditions, common in small and medium-sized farms.

Simplicity in design, reduced fuel consumption, and ease of maintenance contribute to their widespread preference. The segment’s dominance is also supported by higher affordability and easy availability across major agricultural markets.

With ongoing efforts to enhance farm productivity at reduced operational costs, the two-wheel drive segment is projected to continue leading the market through the forecast period.

The tractors segment leads the equipment type category with approximately 69.4% share, underpinned by its central role in farm mechanization. Tractors serve as the primary power source for a range of agricultural implements, from plowing and harrowing to hauling and irrigation.

Increased adoption is driven by technological enhancements, including GPS guidance and precision control systems, which optimize field efficiency. The segment benefits from strong product availability, brand competition, and government initiatives promoting mechanized farming.

As agriculture modernizes globally, tractors are expected to remain the most essential and widely used equipment type within the farm equipment market.

The farm equipment market generated an estimated revenue of USD 92.9 billion in 2020. In four years, the market grew at a pace of 7.10% and added revenue of USD 25.70 billion. Several reasons can be attributed to this growth:

The market is anticipated to surpass a valuation of USD 204.4.00 billion, expanding at a 5.40% CAGR through 2035. While the market is expected to experience remarkable growth, several restraining factors could adversely affect its development:

Depending on the power output, the farm equipment market is bifurcated into < 30 HP, 31-70 HP, 71-130 HP, 131-250 HP, and >250 HP. The <30 HP segment is anticipated to grow at a CAGR of 5.20% through 2035.

| Attributes | Details |

|---|---|

| Top Power Output | <30 HP |

| CAGR (2025 to 2035) | 5.20% |

The farm equipment market is categorized by drive type into two-wheel drive and four-wheel drive. The two-wheel drive segment dominates the market and is anticipated to grow at a CAGR of 5.00% through 2035.

| Attributes | Details |

|---|---|

| Top Drive Type | Two-wheel Drive |

| CAGR (2025 to 2035) | 5.00% |

The section provides an analysis of the farm equipment market by country, including Japan, China, the United States, South Korea, and the United Kingdom. The table presents the CAGRs for each country through 2035.

| Countries | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.40% |

| Japan | 6.90% |

| United Kingdom | 6.60% |

| China | 5.90% |

| United States | 5.70% |

South Korea is one of the leading countries in the market. The South Korean farm equipment market is anticipated to retain its dominance by progressing at a CAGR of 7.40% until 2035.

Japan also dominates the farm equipment market. The Japanese farm equipment market is anticipated to retain its dominance by progressing at an annual growth rate of 6.90% through 2035.

The United Kingdom, too, dominates the farm equipment market in the international marketplace. The United Kingdom farm equipment market is anticipated to exhibit an annual growth rate of 6.60% through 2035.

China is also one of the leading countries in the global farm equipment market, which is anticipated to register a CAGR of 5.90% through 2035.

The United States, too, leads the farm equipment market. Over the next ten years, the demand for farm equipment is projected to rise at a 5.70% CAGR.

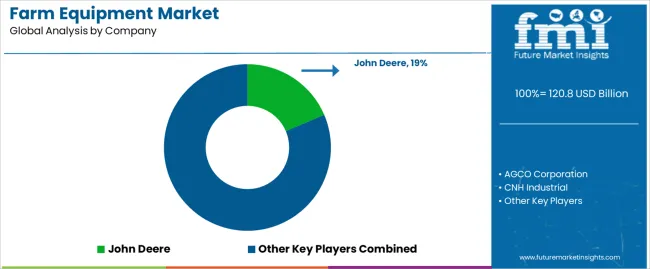

The market for farm equipment is filled with numerous players that cater to small as well as large farmers. Prominent companies in the market include John Deere, AGCO Corporation, CNH Industrial, Kubota Corporation, Mahindra & Mahindra Limited, Claas KGaA mbH, SDF Group, Escorts Group, Yanmar Co., Ltd., and Deutz-Fahr.

These companies offer a wide range of farm equipment and machinery, including tractors, harvesters, implements, and precision agriculture technologies, catering to the diverse needs of farmers. Government bodies also collaborate with these companies to provide affordable yet effective farming equipment to farmers with low per capita income.

Recent Developments

The global farm equipment market is estimated to be valued at USD 120.8 billion in 2025.

The market size for the farm equipment market is projected to reach USD 204.4 billion by 2035.

The farm equipment market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in farm equipment market are <30 hp, 31-70 hp, 71-130 hp, 131-250 hp and >250 hp.

In terms of drive type, two-wheel drive segment to command 57.8% share in the farm equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Poultry Farming Equipment Market Size and Share Forecast Outlook 2025 to 2035

Horse Drawn Farming Equipment Market Size and Share Forecast Outlook 2025 to 2035

Farming Sack and Tote Market Size and Share Forecast Outlook 2025 to 2035

Farm Animal Drug Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Farm Tire Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Indoor Farming Market Analysis - Size, Share, and Forecast 2025 to 2035

A Detailed Global Analysis of Brand Share for the Indoor Farming Market

Seafood Farming Chillers Market Forecast and Outlook 2025 to 2035

Vertical Farming Market Size and Share Forecast Outlook 2025 to 2035

AI for Hydroponic Farming Market Size and Share Forecast Outlook 2025 to 2035

Precision Livestock Farming Market Size and Share Forecast Outlook 2025 to 2035

Internet Of Things In Farm Management Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Disinfectant for Pets and Farms Market - Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Garage Equipment Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA