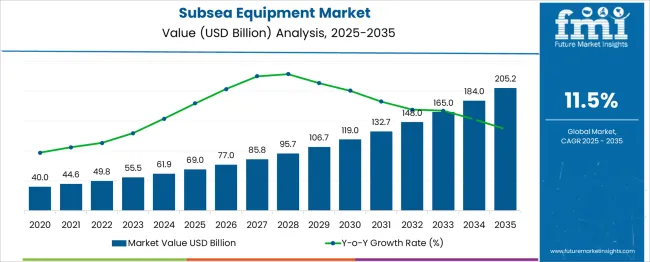

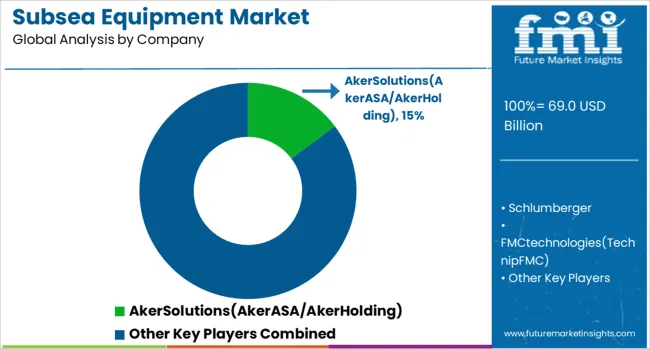

The Subsea Equipment Market is estimated to be valued at USD 69.0 billion in 2025 and is projected to reach USD 205.2 billion by 2035, registering a compound annual growth rate (CAGR) of 11.5% over the forecast period.

Year-on-year growth analysis reveals a consistent acceleration with negligible volatility, indicating strong demand fundamentals and predictable capital allocation cycles.

Early-phase increments average USD 8-10 billion annually, moving the market from USD 69.0 billion to 95.7 billion between 2025 and 2028, with YOY percentage growth in the range of 11.6-12.0%, reflecting solid momentum from brownfield tie-ins and early-stage offshore projects.

Mid-phase years (2029-2032) mark an inflection point as yearly gains expand to USD 11-15.3 billion, driving market value from USD 106.7 billion to 148.0 billion, supported by multi-billion-dollar deepwater developments and growing adoption of subsea boosting and compression systems. The final phase (2033-2035) demonstrates the steepest gains, with annual additions exceeding USD 20 billion, reinforcing a back-loaded growth structure tied to large-scale subsea tiebacks and integrated energy transition projects.

This trajectory underscores a highly scalable market with minimal risk of demand contraction, signaling strategic opportunities for suppliers to invest in high-capacity manufacturing, modularized designs, and subsea digitalization technologies to capture late-stage growth dominance.

| Metric | Value |

|---|---|

| Subsea Equipment Market Estimated Value in (2025 E) | USD 69.0 billion |

| Subsea Equipment Market Forecast Value in (2035 F) | USD 205.2 billion |

| Forecast CAGR (2025 to 2035) | 11.5% |

The subsea equipment market plays a crucial role across several broader marine and energy-related sectors, but its share varies by category. In the offshore oil and gas equipment market, subsea equipment accounts for 25-28%, as it includes critical components like trees, manifolds, and umbilicals essential for deepwater production. Within the subsea renewable energy equipment market, the share is approximately 30-32%, driven by offshore wind and tidal projects requiring advanced subsea systems for power transmission and structural support.

In the marine survey and inspection equipment market, subsea equipment contributes around 15-18%, primarily through sensors and ROV tools for infrastructure monitoring. In the underwater robotics and ROV market, the share stands at 10-12%, as these vehicles often deploy and operate subsea components rather than constitute the equipment itself.

For the offshore construction and installation market, subsea equipment represents 12-14%, given its role in laying pipelines, installing control systems, and maintaining subsea networks. Despite a modest share in some broader markets, demand for subsea systems is accelerating with deeper offshore drilling, expansion of offshore renewable projects, and rising requirements for subsea integrity management. This positions subsea equipment as an indispensable enabler for safe, efficient, and high-capacity offshore energy infrastructure.

The expansion of offshore oil and gas projects, particularly in deepwater and ultra-deepwater regions, is encouraging the deployment of advanced subsea systems that can ensure efficient production, monitoring, and control.

The market is also being supported by the evolution of subsea processing technologies, which reduce dependency on topside facilities and enhance reservoir recovery rates. Regulatory pressure to reduce environmental impact and increase operational safety is further encouraging the adoption of intelligent, compact, and modular subsea solutions.

Additionally, collaborations among offshore engineering firms and digital service providers are enabling the integration of real-time monitoring, predictive maintenance, and digital twins in subsea operations. With growing exploration in high-potential offshore basins and the transition toward digitally enhanced oilfield equipment, the market is expected to see continued capital inflow and technological upgrades over the forecast period.

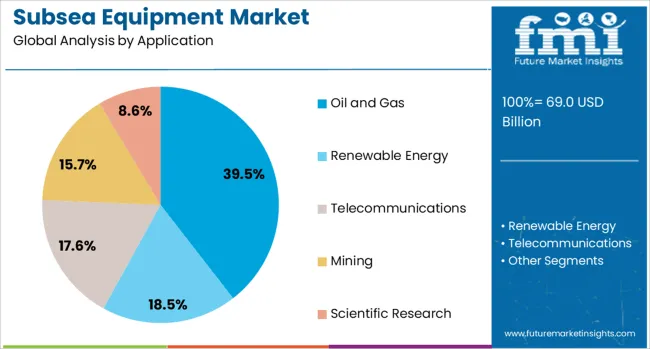

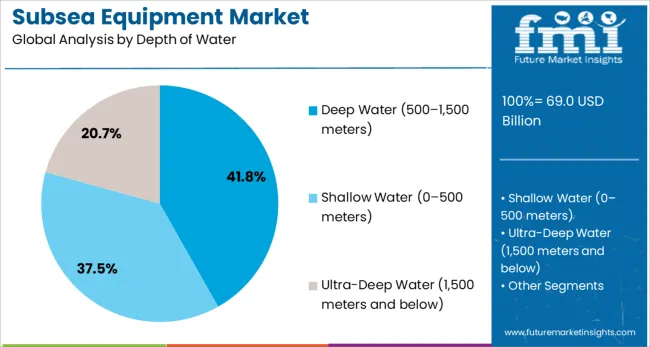

The subsea equipment market is segmented by application, water depth, system type, product type, and geographic regions. The subsea equipment market is divided into Oil and Gas, Renewable Energy, Telecommunications, Mining, and Scientific Research. The subsea equipment market is classified by water depth into Deep Water (500–1,500 meters), Shallow Water (0–500 meters), and Ultra-Deep Water (1,500 meters and below).

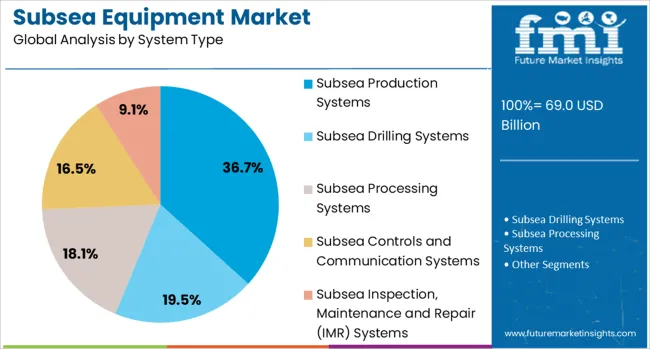

The subsea equipment market is segmented by system type into Subsea Production Systems, Subsea Drilling Systems, Subsea Processing Systems, Subsea Controls and Communication Systems, and Subsea Inspection, Maintenance and Repair (IMR) Systems.

The subsea equipment market is segmented by product type into Subsea Trees, Subsea Wellheads, Subsea Manifolds, Subsea Pipelines and Risers, Subsea Control Modules, Subsea Sensors and Instruments, and Subsea Umbilicals and Cables. Regionally, the subsea equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The oil and gas application segment is projected to account for 39.5% of the revenue share in the subsea equipment market in 2025, making it the dominant area of application. This leadership is being driven by the increasing development of offshore oil and gas reserves in frontier regions where conventional surface infrastructure is not feasible. Rising global energy consumption and the strategic need for supply diversification have pushed exploration and production activities into deeper waters.

Subsea equipment has become critical in enabling efficient extraction, pressure control, and flow assurance in these complex environments. Advances in subsea robotics, control systems, and integrity management have supported long-term field development plans while minimizing downtime.

Additionally, the emphasis on improving recovery factors and lowering lifecycle costs through enhanced subsea asset deployment is encouraging continued investments in this segment. The oil and gas sector’s focus on digital enablement, including remote monitoring and automated control, is further reinforcing the relevance of subsea technologies for future offshore field development.

The deep water segment, defined as depths between 500 and 1500 meters, is expected to represent 41.8% of the total subsea equipment market share in 2025, making it the leading depth category. This dominance is supported by the increasing number of deepwater projects sanctioned globally, particularly in regions such as South America, West Africa, and the Gulf of Mexico.

The push to access deepwater reserves is being driven by the depletion of shallow-water fields and the growing confidence in field economics due to enhanced recovery technologies and improved project execution. Deepwater environments require highly reliable, pressure-resistant, and automated subsea systems, which has spurred the development of specialized production, processing, and intervention tools.

The availability of flexible subsea architecture and modular field designs has allowed operators to reduce development timelines and operational risks. Additionally, the integration of digital twins and condition-based maintenance strategies in deepwater equipment has enabled performance optimization in remote and harsh underwater conditions, leading to increased adoption.

The subsea production systems segment is anticipated to hold 36.7% of the subsea equipment market share in 2025, establishing it as the most prominent system type. This segment’s leadership is attributed to its critical role in offshore field development, enabling the extraction and initial processing of hydrocarbons directly on the seafloor. Subsea production systems are being widely utilized to enhance oil recovery, reduce surface facility footprints, and support tiebacks to existing infrastructure.

Their growth is being driven by continuous innovation in subsea boosting, separation, and compression technologies that improve production rates and lower operational costs. The increasing use of modular and standardized components within production systems has streamlined installation and maintenance processes, promoting scalability and cost-efficiency.

The strategic integration of real-time data analytics and advanced control systems within subsea production units has further optimized performance, particularly in deep and ultra-deepwater fields. As offshore operators continue to prioritize long-term field viability and emissions reduction, this segment is expected to remain central to future investments in subsea development.

Systems such as remotely operated vehicles (ROVs), subsea pumps, umbilicals, and connectors are being deployed to support installation, inspection, and maintenance tasks at depth. Equipment with advanced materials and real‑time telemetry has been preferred for harsh marine environments. Growth has been encouraged by deepwater project pipelines, subsea tiebacks, and offshore wind farm expansion. Providers offering robust, pressure‑rated hardware with digital monitoring interfaces are positioned to lead in this critical subsea engineering segment.

Subsea equipment has been increasingly utilized in deepwater oil and gas fields, offshore wind farms, and undersea transmission projects requiring reliable and long-life systems. Demand has risen for pressure-resistant components, advanced control systems, and remotely operated vehicles to enable operations in harsh environments where human intervention is not feasible. Integration with digital monitoring platforms and condition-based maintenance systems has improved efficiency and reduced downtime for critical subsea assets. Offshore wind developments, combined with subsea tieback projects for hydrocarbon fields, have further accelerated adoption. As global energy networks expand toward marine resources, investment in high-performance subsea equipment offering durability and precise operational control continues to gain momentum among developers and service contractors.

Subsea operations require equipment capable of withstanding extreme pressures, corrosion, and temperature variations, leading to high material and design costs. Deployment in deepwater environments increases installation complexity, requiring specialized vessels, remote handling tools, and highly skilled personnel. Maintenance and repair present logistical challenges as the retrieval and redeployment of subsea assets demand significant time and expense. Technical failures such as connector leaks or control system malfunctions can disrupt operations and result in costly downtime. Standardization across subsea components remains limited, creating compatibility issues in integrated systems. These factors, combined with capital-intensive procurement models, have slowed market penetration in cost-sensitive regions and smaller offshore projects.

The expansion of offshore wind farms and deepwater oil & gas exploration has enabled substantial opportunities. Infrastructure requirements for subsea power cables, turbines, and communication networks have driven the development of advanced subsea equipment like connectors, manifolds, and umbilicals. Demand from renewable energy project integrators has introduced prospects for specialized hardware in seabed foundations and inspection tools. Upgrades in aging offshore oil platforms are prompting retrofits involving new subsea control systems and robotics. Collaboration among equipment providers, OEMs, and EPC contractors is creating integrated supply solutions for turnkey subsea installations. Regional expansion in frontier offshore basins and floating engineering technologies is expected to further elevate the adoption of marine-grade subsea equipment solutions.

Prevailing trends include widespread integration of remotely operated vehicles (ROVs) and autonomous underwater vehicles (AUVs) for subsea inspection, repair, and maintenance tasks. Condition monitoring sensors and telemetry-enabled systems are being embedded in subsea installations for real-time data transmission. Standardized modular subsea modules and plug-and-play hardware are being adopted to reduce deployment time and improve system compatibility. Use of advanced materials such as titanium and high-performance polymers is increasing to support prolonged exposure under high pressure and corrosive seawater. Investment in digital twins and simulation platforms has been initiated to enhance planning and risk analysis. Surface-to-subsea connectivity via fiber-optic communication lines is being expanded to support remote control and diagnostics of underwater equipment.

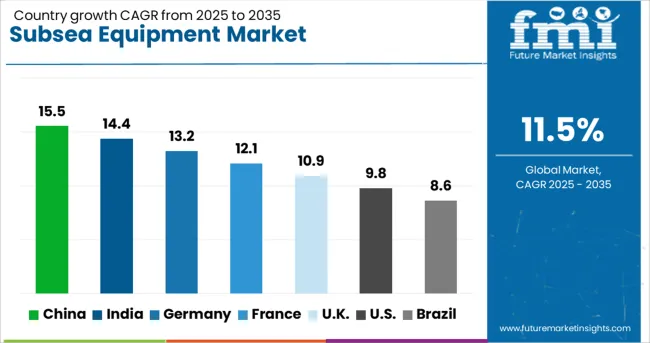

| Country | CAGR |

|---|---|

| China | 15.5% |

| India | 14.4% |

| Germany | 13.2% |

| France | 12.1% |

| UK | 10.9% |

| USA | 9.8% |

| Brazil | 8.6% |

The global subsea equipment market is expected to grow at 11.5% CAGR between 2025 and 2035, driven by increasing deepwater exploration, offshore wind development, and infrastructure modernization in oil and gas sectors. Among BRICS nations, China leads at 15.5%, leveraging advanced offshore engineering projects and rapid capacity expansion.

India follows with 14.4%, supported by new deepwater oil blocks and localized equipment manufacturing. In OECD countries, Germany posts 13.2%, benefiting from offshore wind farms and subsea cable projects. France records 12.1% with a strong focus on subsea robotics and automation, while the UK grows at 10.9%, driven by decommissioning activities and maintenance of mature oil fields. The report analyzes more than 40 countries, highlighting the top five below.

China is projected to grow at 15.5% CAGR, driven by massive investments in offshore energy infrastructure, particularly in deepwater oil and gas exploration in the South China Sea. State-backed enterprises are deploying advanced subsea production systems, flexible risers, and umbilicals to enhance operational efficiency. Offshore wind projects add momentum, with large-scale turbine installations requiring specialized subsea foundations and cables. Domestic manufacturers are investing in high-specification subsea control systems and pipeline intervention tools to reduce import dependency. Collaborative projects with global engineering firms are accelerating technology transfer and digital integration.

India is forecast to expand at 14.4% CAGR, supported by government energy policies targeting offshore development and diversification. Major exploration projects in the Krishna-Godavari basin are driving investments in subsea wellheads, manifolds, and tie-back systems. Offshore wind energy initiatives under national renewable targets are contributing to growth in subsea cable installations. Domestic engineering companies are scaling up production to meet growing demand, reducing dependency on foreign imports. International partnerships with global subsea specialists are accelerating adoption of advanced control systems and remote monitoring solutions to ensure operational reliability.

Germany is expected to grow at 13.2% CAGR, with strong demand driven by offshore wind capacity expansion in the North Sea and Baltic Sea. Subsea cables, connectors, and foundation systems dominate requirements as grid operators implement large-scale interconnection projects. German manufacturers focus on subsea robotics and autonomous inspection tools for underwater maintenance operations. Federal energy transition initiatives prioritize high-efficiency subsea control systems integrated with predictive monitoring technologies. Strategic collaborations between domestic OEMs and international players enhance capacity for rapid deployment in large wind farm projects.

France is projected to register a 12.1% CAGR, supported by increased investment in offshore renewable projects and the modernization of subsea oil and gas assets. ROVs (remotely operated vehicles) and autonomous underwater systems are widely deployed for inspection and repair tasks in harsh marine conditions. Subsea interconnector projects are gaining traction to enhance cross-border energy exchange within Europe. French firms are integrating AI-based predictive maintenance into subsea systems for better operational uptime. Collaborative ventures with EPC contractors are enabling efficient deployment of subsea infrastructure across wind and hydrocarbon projects.

The UK is forecast to expand at 10.9% CAGR, fueled by offshore decommissioning programs in the North Sea and growth of offshore wind installations. Subsea demand is also rising for anchoring systems, connectors, and advanced umbilical cables. Manufacturers are introducing compact ROVs and autonomous inspection technologies to enhance efficiency in aging fields. Government-backed initiatives for offshore infrastructure upgrades support investment in subsea monitoring and control systems. Partnerships between local engineering firms and global subsea technology providers are fostering innovation in installation and maintenance solutions.

The subsea equipment market is dominated by global oilfield service giants and specialized engineering firms, including Aker Solutions, Schlumberger, FMC Technologies (TechnipFMC), Baker Hughes GE (BHGE), Siemens, Technip, Oceaneering International, Transocean, Dril-Quip Inc., National Oilwell Varco (NOV), and Nexans.

These companies compete in a highly capital-intensive industry characterized by high entry barriers due to complex engineering requirements, deepwater operational risks, and stringent safety and regulatory standards. Market rivalry is intense as operators demand cost optimization, improved reliability, and shorter project timelines, especially amid volatile crude oil prices and energy transition pressures. Aker Solutions and TechnipFMC lead in integrated subsea production systems and umbilicals, while Schlumberger and BHGE leverage digitalization and advanced control technologies for subsea processing and monitoring.

Siemens plays a key role in subsea power and electrification systems, supporting efficiency in long-distance tiebacks and deepwater fields. Oceaneering International and Dril-Quip Inc. specialize in remotely operated vehicles (ROVs), connectors, and subsea tree systems, while Transocean offers advanced drilling capabilities for ultra-deepwater applications. Nexans strengthens the value chain with high-voltage subsea cables essential for powering subsea equipment and offshore energy infrastructure.

Strategic differentiation is driven by proprietary technologies, subsea boosting and compression solutions, and integration of digital twins for predictive maintenance. Future competitiveness will hinge on electrification, standardization, and cost-effective modular designs to meet growing demand from deepwater oil and gas projects and offshore renewable developments. Companies investing in subsea robotics, condition monitoring, and low-carbon solutions are best positioned to maintain leadership in this evolving energy ecosystem.

| Item | Value |

|---|---|

| Quantitative Units | USD 69.0 Billion |

| Application | Oil and Gas, Renewable Energy, Telecommunications, Mining, and Scientific Research |

| Depth of Water | Deep Water (500-1,500 meters), Shallow Water (0-500 meters), and Ultra-Deep Water (1,500 meters and below) |

| System Type | Subsea Production Systems, Subsea Drilling Systems, Subsea Processing Systems, Subsea Controls and Communication Systems, and Subsea Inspection, Maintenance and Repair (IMR) Systems |

| Product Type | Subsea Trees, Subsea Wellheads, Subsea Manifolds, Subsea Pipelines and Risers, Subsea Control Modules, Subsea Sensors and Instruments, and Subsea Umbilicals and Cables |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AkerSolutions(AkerASA/AkerHolding), Schlumberger, FMCtechnologies(TechnipFMC), BHGE, Siemens, Technip, OceaneeringInternational, Transocean(TransoceanLtd.), Dril-QuipInc., NationalOilVarco, and Nexans |

| Additional Attributes | Dollar sales by product category (subsea production systems, ROVs, umbilicals, manifolds, wellheads) and application (oil & gas, offshore wind, subsea mining). Market demand is fueled by deepwater exploration, offshore field developments, and renewable energy integration. Regional trends highlight strong growth in Asia-Pacific and Europe due to offshore wind projects. Key innovations include all-electric subsea systems, digital twin-enabled asset monitoring, and advanced corrosion-resistant materials for extreme subsea environments. |

The global subsea equipment market is estimated to be valued at USD 69.0 billion in 2025.

The market size for the subsea equipment market is projected to reach USD 205.2 billion by 2035.

The subsea equipment market is expected to grow at a 11.5% CAGR between 2025 and 2035.

The key product types in subsea equipment market are oil and gas, renewable energy, telecommunications, mining and scientific research.

In terms of depth of water, deep water (500–1,500 meters) segment to command 41.8% share in the subsea equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Subsea Navigation and Tracking Market Size and Share Forecast Outlook 2025 to 2035

Subsea Umbilical Clamps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Subsea Umbilicals Risers And Flowlines Market Size and Share Forecast Outlook 2025 to 2035

Subsea Multiphase Flowmeter Market Size and Share Forecast Outlook 2025 to 2035

Subsea Power Grid Systems Market Analysis - Size, Growth, and Forecast 2025 to 2035

Subsea Manifolds Market

Deep Depth Subsea Umbilicals, Risers and Flowlines Market Size and Share Forecast Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Garage Equipment Market Forecast and Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Galley Equipment Market Analysis and Forecast by Fit, Application, and Region through 2035

Sorting Equipment Market Size and Share Forecast Outlook 2025 to 2035

General Equipment Rental Services Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA