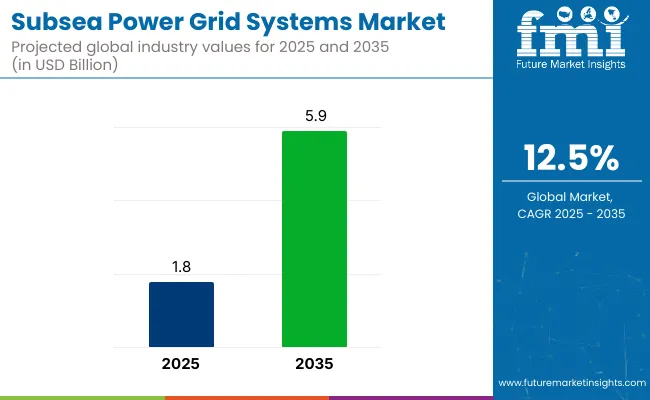

The global subsea power grid systems market is valued at USD 1.8 billion in 2025 and is expected to reach USD 5.9 billion by 2035, reflecting a CAGR of 12.5%. This significant growth is expected to be driven by the increasing demand for offshore renewable energy, deep-sea oil and gas exploration, and technological advancements in power transmission and smart grid integration.

| Metric | Value |

|---|---|

| Estimated Size (2025) | USD 1.8 billion |

| Projected Value (2035) | USD 5.9 billion |

| CAGR (2025 to 2035) | 12.5% |

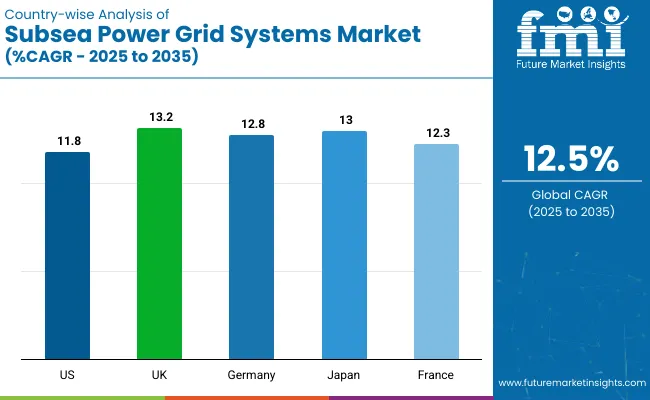

The market is also being supported by strong government incentives promoting offshore electrification and carbon neutrality goals. The subsea power grid systems market is expected to remain dominant in Europe especially in the UK, with a CAGR of 13.2% through 2035. Meanwhile, Japan and Germany closely follow this rapid growth, expanding at CAGRs of 13.0% and 12.8% respectively.

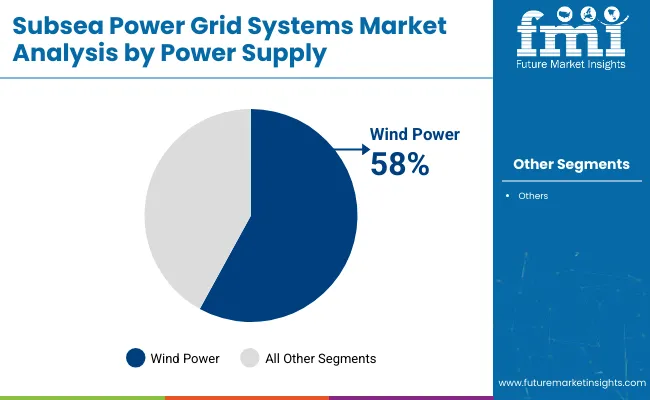

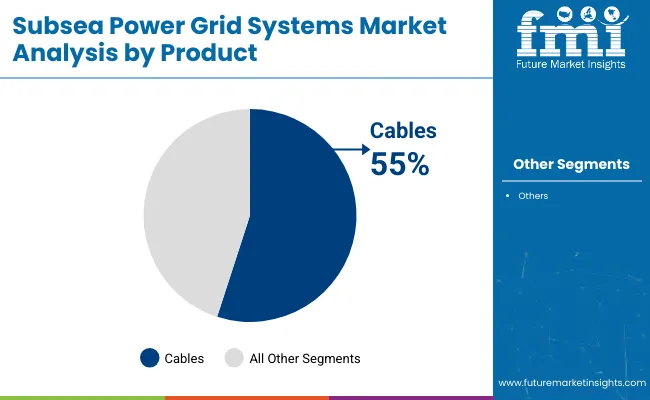

Wind power is projected to lead the power supply segment by holding nearly 58% of the market share, while cables are expected to remain the top product, owing to their critical role in connecting offshore and onshore grids, accounting for 55% market share in 2025.

ABB Ltd. has been witnessing strong profitability due to its strategic focus on high-voltage direct current (HVDC) solutions and digital monitoring technologies. In contrast, companies in regions with stringent regulatory compliance, such as Europe, are facing challenges related to permitting delays, though success is being achieved through government incentives and tax subsidies promoting offshore electrification. Nearly 60% of stakeholders have identified high capital costs as a barrier, while 73% of policymakers have confirmed that carbon reduction targets will accelerate adoption.

The subsea power grid systems market holds a niche but crucial share across its parent markets. Within the subsea power transmission market, it accounts for a significant 30-35% due to its role in enabling offshore energy distribution. In the broader subsea equipment market, it holds around 12-15%, as it supports both oil & gas and renewable sectors.

Within the offshore energy infrastructure market, it contributes approximately 10%, reflecting its relevance in power delivery for offshore platforms. Its share in the submarine cable market and power distribution equipment market is more limited, at around 5-8%, primarily supporting long-distance and high-voltage subsea applications.

The subsea power grid systems market is segmented into power supply, product, and region. By power supply, it includes wind power, captive generation, and others (marine energy, hybrid renewable systems).By product, it includes cables, variable speed drives, transformers, switchgears, and others (connectors, subsea nodes). By region, it covers North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa.

Wind power is anticipated to remain the most lucrative segment, accounting for nearly 58% share of the power supply segment in 2025. This growth is being driven by rapid offshore wind farm installations in Europe, North America, and East Asia.

Captive generation is also gaining traction as oil and gas firms adopt independent offshore power solutions to reduce dependency on traditional grids. Other sources, like marine energy and hybrid systems, are slowly emerging with technological advancements in wave and tidal energy.

Cables are expected to dominate the product segment, holding a 55% market share in 2025. High-voltage subsea cables remain critical for connecting offshore installations to onshore grids efficiently. Variable speed drives are also gaining adoption to enable precise control of power flow, enhancing operational energy savings.

Transformers play a vital role in voltage stabilization while switchgears ensure safe power distribution, especially in deep water conditions. Others include connectors and subsea nodes that support integrated grid operations.

Recent Trends in the Subsea Power Grid Systems Market

Challenges in the Subsea Power Grid Systems Market

The UK leads the subsea power grid systems market with the highest projected CAGR of 13.2%, driven by floating wind farms and HVDC adoption. Japan follows closely at 13.0%, fueled by offshore wind expansion and government-private collaborations. Germany holds a strong position with 12.8% CAGR, supported by North Sea and Baltic Sea projects.

France is next with 12.3%, leveraging floating wind and interconnectors for energy security. The USA grows at 11.8%, propelled by offshore wind and clean energy policies. Overall, European nations and Japan exhibit faster growth, while the USA maintains steady momentum in offshore renewable integration.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The subsea power grid system revenue in the USA is projected to grow at a CAGR of 11.8% from 2025 to 2035. Growth is being driven by the expansion of offshore wind energy projects and deep water oil and gas exploration. Technological advancements in subsea cables and transformers are enhancing energy efficiency, while government policies promoting clean energy are supporting market expansion across coastal states and offshore platforms.

The subsea power grid systems sales in the UK are expected to register a CAGR of 13.2% during the forecast period. This growth is being propelled by extensive offshore wind energy developments and net-zero emissions commitments. Floating wind farms and interconnectors are expanding, while advancements in HVDC cables are enhancing energy transfer across the region and into mainland Europe efficiently.

Germany’s subsea power grid systems market is estimated to grow at a CAGR of 12.8% through 2035. This expansion is driven by offshore wind energy projects in the North Sea and Baltic Sea and the country’s transition away from fossil fuels. Innovations in power electronics and grid automation are further enhancing energy efficiency and supporting Germany’s ambitious renewable energy goals.

The revenue of subsea power grid systems in France is projected to witness a CAGR of 12.3% from 2025 to 2035. The country’s growth is driven by offshore wind farm expansions and investments in subsea cable networks. The development of floating wind technologies and cross-border interconnectors is enhancing regional energy security and sustainability objectives effectively.

Japan’s subsea power grid systems market is anticipated to expand at a CAGR of 13.0% through the forecast period. Growth is being fueled by offshore wind energy projects, technological advances in HVDC subsea cables, and initiatives aimed at reducing reliance on fossil fuels. Collaborative efforts between the government and the private sector are further enhancing grid efficiency and offshore energy security.

The subsea power grid systems market is moderately consolidated, with a few global leaders holding significant market shares. Companies such as ABB Ltd., Siemens Energy, General Electric Company, and Nexans SA are competing by developing advanced HVDC cable technologies, expanding manufacturing capabilities, and forming strategic offshore energy partnerships. These firms are enhancing their competitive positioning through R&D investments in AI-based grid management and by integrating smart monitoring systems for operational efficiency.

Company strategies are focusing on technological innovation to improve energy efficiency, reduce transmission losses, and support carbon neutrality targets. Pricing competitiveness is observed in turnkey project bids, while strategic partnerships with offshore wind developers and oil & gas firms are enabling market expansion.

For instance, ABB and Nexans are increasingly collaborating with energy companies to deliver integrated subsea power solutions. In contrast, General Electric is strengthening its subsea electrification portfolio to cater to deep water energy projects and floating wind farms.

Recent Subsea Power Grid Systems Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1.8 billion |

| Projected Market Size (2035) | USD 5.9 billion |

| CAGR (2025 to 2035) | 12.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion/Volume in Units |

| By Power Supply | Wind Power, Captive Generation, Others (Marine Energy, Hybrid Renewable Systems) |

| By Product | Cables, Variable Speed Drives, Transformers, Switchgears, Others (Connectors, Subsea Nodes) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia, Pacific, East Asia, Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | ABB Ltd., Aker Solutions ASA, Bandak AS, Dril -Quip, Inc., Expro Group, General Electric Company, JDR Cable Systems Ltd., Nexans SA, Norddeutsche Seekabelwerke GmbH, Oceaneering International, Inc. |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis, and company strategy insights. |

Wind Power, Captive Generation, Others

Cables, Variable Speed Drivers, Transformers, Switchgears, Others

North America, Latin America, Europe, Asia Pacific, Middle East and Africa

The market size is valued at USD 1.8 billion in 2025.

The market is forecasted to reach USD 5.9 billion by 2035, reflecting a CAGR of 12.5%.

Wind power is expected to lead the market with a 58% segment share in 2025.

Cables are projected to dominate with a 55% market share in 2025.

The UK is anticipated to be the fastest-growing market with a CAGR of 13.2% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Subsea Navigation and Tracking Market Size and Share Forecast Outlook 2025 to 2035

Subsea Umbilical Clamps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Subsea Umbilicals Risers And Flowlines Market Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Subsea Multiphase Flowmeter Market Size and Share Forecast Outlook 2025 to 2035

Subsea Manifolds Market

Deep Depth Subsea Umbilicals, Risers and Flowlines Market Size and Share Forecast Outlook 2025 to 2035

Power Plant Boiler Market Forecast Outlook 2025 to 2035

Power Ring Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Equipment for Data Center Market Size and Share Forecast Outlook 2025 to 2035

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Generator for Military Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Isolation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Window Lift Motor Market Size and Share Forecast Outlook 2025 to 2035

Powered Surgical Staplers Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Controllers Market Size and Share Forecast Outlook 2025 to 2035

Power Inverter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA