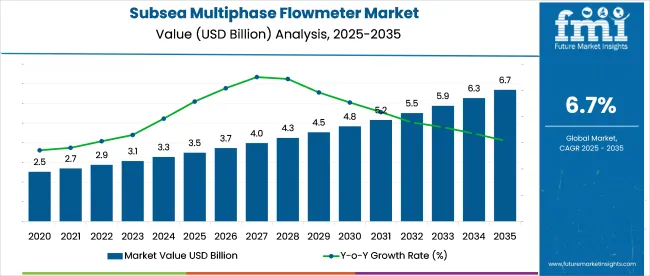

The Subsea Multiphase Flowmeter Market is estimated to be valued at USD 3.5 billion in 2025 and is projected to reach USD 6.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period.

| Attribute | Value |

|---|---|

| Market Size in 2025 | USD 3.5 billion |

| Market Size in 2035 | USD 6.7 billion |

| CAGR (2025 to 2035) | 6.7% |

The subsea multiphase flowmeter market is witnessing robust growth, supported by the rising demand for real-time flow measurement and enhanced production monitoring in offshore oil and gas operations. Industry journals and engineering publications have emphasized the growing complexity of subsea production systems, which has necessitated the deployment of advanced flowmeter technologies for accurate measurement of oil, gas, and water mixtures.

Leading energy companies have increased investments in subsea infrastructure upgrades and digital oilfield initiatives, driving the adoption of multiphase flowmeters in new and mature offshore fields. Additionally, technological advancements in sensor accuracy, data processing algorithms, and remote monitoring have improved operational efficiency and reduced production downtime.

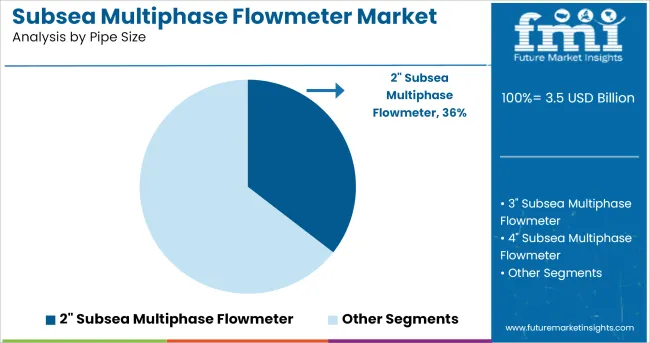

The market outlook remains positive as global offshore exploration and production activities recover, particularly in deepwater and ultra-deepwater fields. Segmental growth is expected to be driven by the 2" Subsea Multiphase Flowmeter in pipe size, Subsea Well Testing as the key application, and Stainless Steel Subsea Multiphase Flowmeters due to their durability in harsh subsea environments.

The market is segmented by Pipe Size, Application, and Construction Material and region. By Pipe Size, the market is divided into 2 Subsea Multiphase Flowmeter, 3 Subsea Multiphase Flowmeter, 4 Subsea Multiphase Flowmeter, 6 Subsea Multiphase Flowmeter, 8 Subsea Multiphase Flowmeter, and 10 Subsea Multiphase Flowmeter. In terms of Application, the market is classified into Subsea Well Testing, Production Monitoring, Production Measurement, and Others.

Based on Construction Material, the market is segmented into Stainless Steel Subsea Multiphase Flowmeter, Duplex Steel Subsea Multiphase Flowmeter, Corrosion Resistant Alloys Subsea Multiphase Flowmeter, Titanium Subsea Multiphase Flowmeter, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 2" Subsea Multiphase Flowmeter segment is projected to contribute 35.5% of the subsea multiphase flowmeter market revenue in 2025, establishing itself as the leading pipe size category. Growth of this segment has been driven by its suitability for small to mid-sized flowlines commonly deployed in subsea production systems.

Offshore operators have favored the 2" flowmeter for its compact footprint and ease of integration into existing subsea infrastructure without requiring extensive modifications. Engineering teams have highlighted the segment’s versatility in accommodating varying flow regimes and phase fractions, making it suitable for a wide range of well conditions.

Additionally, the growing number of subsea tiebacks and brownfield developments, where space constraints are a concern, has further supported the adoption of 2" flowmeters. As offshore production optimization continues to prioritize accurate, compact, and efficient measurement solutions, the 2" Subsea Multiphase Flowmeter segment is expected to sustain its market dominance.

The Subsea Well Testing segment is projected to account for 42.8% of the subsea multiphase flowmeter market revenue in 2025, maintaining its leadership in application areas. Growth in this segment has been supported by the need for accurate, in-situ measurement of multiphase flow during well commissioning, reservoir evaluation, and production optimization.

Offshore operators have increasingly integrated flowmeters into well testing operations to obtain real-time, continuous flow data, reducing reliance on conventional surface testing equipment. This approach has improved testing accuracy while minimizing environmental risks and logistical costs associated with retrieving fluids to the surface.

Furthermore, advancements in data analytics and remote monitoring have enhanced the operational value of subsea well testing, enabling faster decision-making. As offshore exploration expands into deeper and more complex reservoirs, the Subsea Well Testing segment is expected to remain a critical application area for multiphase flowmeter deployment.

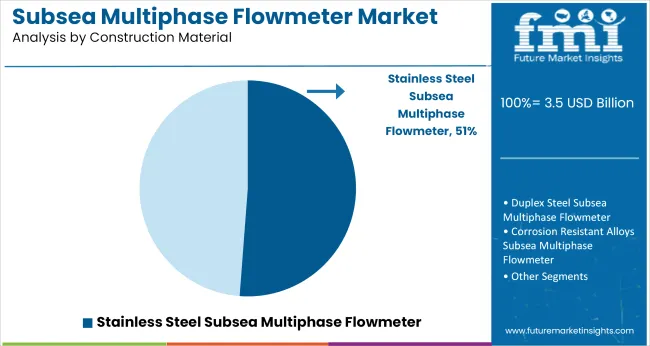

The Stainless Steel Subsea Multiphase Flowmeter segment is projected to hold 51.20% of the subsea multiphase flowmeter market revenue in 2025, positioning itself as the dominant construction material category. Growth in this segment has been driven by the superior corrosion resistance and mechanical strength of stainless steel, making it well-suited for harsh subsea environments.

Engineers and procurement teams have prioritized stainless steel flowmeters for their ability to withstand high-pressure, high-temperature (HPHT) conditions and exposure to corrosive fluids typically encountered in offshore oil and gas operations. Stainless steel’s durability has contributed to extended equipment lifespans and reduced maintenance intervals, enhancing lifecycle cost-effectiveness.

Additionally, manufacturers have continued to refine stainless steel flowmeter designs to optimize weight and ease of installation without compromising structural integrity. With offshore operators focused on operational reliability and safety, the Stainless Steel Subsea Multiphase Flowmeter segment is expected to maintain its leading position in the market.

Till date there are approximately 5,000 subsea wells distributed all over the globe, along with many more being drilled each day. Several wells are more than a decade old. Hence exploration of new wells requires regular flow metering solutions. Multiphase flow meters offer various applications such as subsea well testing, production monitoring, production measurement, and others.

Global oil and gas companies are continuously developing new functionalities and developments for subsea multiphase flowmeters to be used in a wide range of applications. Multiphase flow meter is used to address various challenges in oil & gas exploration and production process.

Subsea multiphase flow meters provide critical well testing operations. Production monitoring, measurement, and others can be considered as key applications of subsea multiphase flowmeters. Subsea multiphase flowmeters have proven to be efficient, light, agile, and an economic solution against conventional techniques. They provide various advantages, such as they characterize flow regimes at the wellhead and quickly detect slugging, which is the most difficult flow to measure. Subsea multiphase flowmeter addresses the complex flow metering solutions.

Automation and digitalization tools integrated with subsea multiphase flowmeters provide new opportunities for explorations. Increasing investments in global oil and gas projects will give impetus to the subsea multiphase flowmeter market. Oil production investments anticipated in the offshore areas of USA, ASEAN countries and China as well as Russia is expected to create opportunities for the subsea multiphase flowmeter market.

Future Market Insights expects the global in-line transit time ultrasonic flow meter market to expand at over 8.5% CAGR through 2035.

The demand for subsea multiphase flowmeter is increasing in regions such as South Asia and Pacific and North America. The demand trend for stainless steel subsea multiphase flowmeter for offshore applications is majorly driven by regions such as the Americas, South Asia and Pacific and Middle East and Africa.

Globally, the increasing investment in oil and gas projects and rise in number of subsea explorations are some of the key potential factors for market growth. Additionally, increasing focus on multiphase meter technologies across the globe is expected to boost the market demand in the coming future.

Competitive price offerings and rise in end user satisfaction based on the performance and use of advanced technologies are the key aims of R&D activities. Moreover, establishing sales and service facilities in emerging countries coupled with long-term partnerships with regional distributors are also paving the way for the expansion of channel reach.

Future Market Insights has projected the USA to remain one of the most lucrative markets throughout the course of the forecast period. A key factor supporting market expansion is the country’s high production and consumption of oil. The oil production output increased by 11% from 2020 to 2020 and holds more than 17% of share in 2020.

The increasing production and consumption of oil and gas will stay essential in the upward trend for the oil and gas industry. Since subsea multiphase flowmeters form a crucial part in production, monitoring, and measurement, growth of subsea multiphase flowmeters is imminent. However, President Biden’s regulations regarding a transition from fossil fuels towards electric mobility can restrain the growth of the subsea multiphase flowmeter market.

Russia led within Europe in oil production with more than 12% of market share in 2020. In recent years, there has been growth in oil & gas production, and its multiphase flow metering solutions has become crucial. Devices that have the ability to sustain and show accurate results have become mandatory. Demand for subsea multiphase flowmeters has been rising over the last few years.

This trend will continue to increase sales figures over the years to come, because of rising investments in the oil & gas industry. Increasing investments will provide a significant opportunities for a comprehensive list of applications including subsea well testing, production monitoring, production measurement, and associated well applications, thereby presenting growth opportunities for the subsea multiphase flowmeters market.

China holds nine-tenth of the East Asia market share, and this is no surprise as there is an abundance of oil & gas production and reserves in the region, owing to which, demand for subsea multiphase flowmeter is rising steadily. Growth in the region is likely to take place at a CAGR even more than 7.4% over the forecast period of 2024 to 2035. Another reason for this lucrative growth trend is rising demand for multiphase flow metering solutions for production monitoring and measurement, which recently grew significantly due to rising investment in oil & gas projects in the region.

Over the last few years, new and improved designs with automation and digitalization of multiphase flow meters have been launched by numerous market players, on back of significant sales of subsea multiphase flowmeter in the global manufacturers are introducing products that are built to last and need less maintenance during the tenure of their usage. The ASEAN countries also have numerous small to medium manufacturers, and exhibit high accessibility of aftersales services, which make them a leading market for subsea multiphase flowmeter.

Moreover, ASEAN countries hold more than 3% of market share in oil & natural gas production for 2020. Other factors such as increasing demand from ongoing and upcoming oil & gas projects in the region will have a great demand for subsea multiphase flowmeter, and will continue to do so over the coming years.

There has been a significant surge in use of subsea multiphase flowmeter in GCC countries. The region has some of the world's fastest-growing economies, thanks to a surge in oil & natural gas revenues as well as investment boom fueled by decades of petroleum revenue savings.

The core GCC states of Saudi Arabia, United Arab Emirates, Kuwait, and Qatar are leading oil & gas producing countries, due to which, imports of multiphase flowmeters for monitoring and measurement purposes are driving the sales of subsea multiphase flowmeter.

The market share of subsea multiphase flowmeters for 10’’ pipe size is quite high. It accounts for more than 40% of the market share by value. The reason behind such vast sales is the fact that oil & gas exploration and production are adequately conducted in larger volumes, and the need for large size pipes in production and transmission purposes in oil & gas industry creates a surge in demand for 10’’ subsea multiphase flowmeters. Another factor for growth in sales is that increasing investments in oil & gas industry across the world.

Subsea multiphase flowmeters are used in various applications in the oil & gas industry, especially for measuring various kinds of liquids and gases. The most popular application amongst these is production measurement. Since the invention of these meters, liquid & gas production measurement has been a dominant end use. The production measurement segment is expected to expand at a significant CAGR owing to the precise measurement of oil & gas in exploration and production process.

Looking toward supply-side trends, large market players are more into stainless steel subsea multiphase flowmeter. Manufacturers are focusing more on advancements in these material, thereby boosting sales across regions. Stainless steel subsea multiphase flowmeter hold as much as one-third market share.

There is also an increase in sales of duplex steel subsea multiphase flowmeter due to the fact that these provide high strength and excellent corrosion resistance and the industry is moving toward products more material properties. Over the forecast period, subsea multiphase flowmeters are expected to witness surging demand.

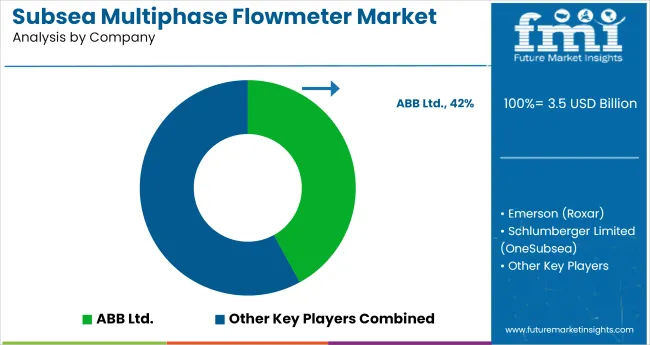

Global subsea multiphase flowmeter market is largely dominated by key players globally, occupying more than three-fourth of the market share. Some of the players are focusing to carve a niche for specific demography. The global market for subsea multiphase flowmeter comprises some large scale and middles scale manufacturers focusing on product innovation and high end technology development.

Key industry participants are investing in strategic alliances and partnerships to gain a competitive advantage in the evolving global market. These partnerships allow companies to strengthen their technical expertise with improved production capacity. Also, the technical collaboration of industry participants is estimated to contribute to growth in the oil and gas intervention projects.

For instance, in 2020, Saudi Aramco, one of the leading public petroleum and natural gas Company in Saudi Arabia awarded Baker Hughes a stimulation and well testing contract in 2020. The contract included optimizing production across existing as well as new wells across the nation.

In February 2024, Emerson introduced a new embedded software aids automation and digitalization of oil and gas multiphase flow measurement to boost process automation and the application of the Roxar™ 2600 Multiphase Flow Meter (MPFM) for the oil and gas industry.

Some of the leading companies operating in the market are:

| Attribute | Details |

|---|---|

| Forecast Period | 2024 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for Value and Units for Volume |

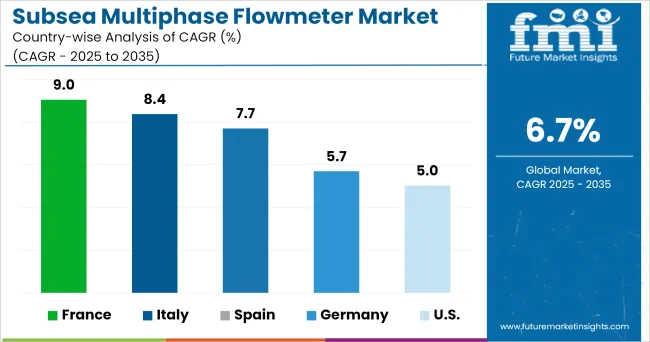

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; and the Middle East & Africa |

| Key Countries Covered | USA, Canada, Germany, UK, France, Italy, Spain, Russia, China, Japan, South Korea, India, ASEAN, Oceania, Turkey, Northern Africa, and South Africa |

| Key Segments Covered | Technology, Application, End User, and Region |

| Key Companies Profiled | Weatherford; Baker Hughes; AMETEK Inc.; Schlumberger Limited; ABB Ltd; TechnipFMC plc; Emerson; KROHNE Japan KK; Peitro Fiorentini S.p.a.; Haimo Technologies Group Corp; Tokico System Solutions Ltd |

| Report Coverage | Market Forecasts, Brand Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global subsea multiphase flowmeter market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the subsea multiphase flowmeter market is projected to reach USD 6.7 billion by 2035.

The subsea multiphase flowmeter market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in subsea multiphase flowmeter market are 2 subsea multiphase flowmeter, 3 subsea multiphase flowmeter, 4 subsea multiphase flowmeter, 6 subsea multiphase flowmeter, 8 subsea multiphase flowmeter and 10 subsea multiphase flowmeter.

In terms of application, subsea well testing segment to command 42.8% share in the subsea multiphase flowmeter market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Subsea Navigation and Tracking Market Size and Share Forecast Outlook 2025 to 2035

Subsea Umbilical Clamps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Subsea Umbilicals Risers And Flowlines Market Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Subsea Power Grid Systems Market Analysis - Size, Growth, and Forecast 2025 to 2035

Subsea Manifolds Market

Deep Depth Subsea Umbilicals, Risers and Flowlines Market Size and Share Forecast Outlook 2025 to 2035

Magnetic Flowmeter Market Size and Share Forecast Outlook 2025 to 2035

Ultrasonic Flowmeters Market Trends – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA