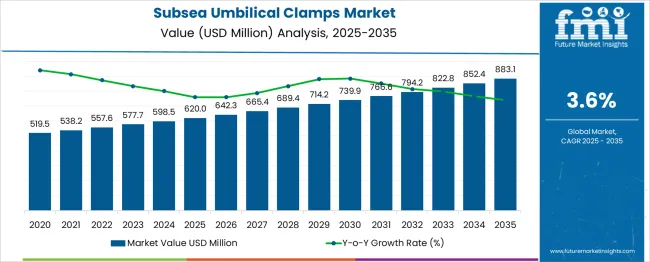

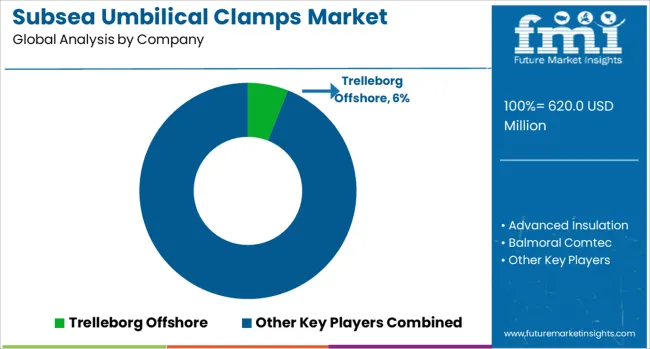

The global subsea umbilical clamps market is projected to grow from USD 620.0 million in 2025 to approximately USD 883.1 million by 2035, recording an absolute increase of USD 263.0 million over the forecast period. This translates into a total growth of 42.4%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.6% between 2025 and 2035. The overall market size is expected to grow by nearly 1.42X during the same period, supported by the rising demand for deepwater oil and gas exploration, increasing subsea infrastructure development, and growing emphasis on reliable umbilical protection systems.

Between 2025 and 2030, the subsea umbilical clamps market is projected to expand from USD 620.0 million to USD 739.9 million, resulting in a value increase of USD 119.9 million, which represents 45.6% of the total forecast growth for the decade. This phase of growth will be shaped by increasing deepwater exploration activities, rising demand for subsea production systems, and growing investments in offshore renewable energy projects. Service providers are expanding their clamp manufacturing capabilities to address the growing complexity of modern subsea umbilical protection requirements.

From 2030 to 2035, the market is forecast to grow from USD 739.9 million to USD 883.1 million, adding another USD 143.1 million, which constitutes 54.4% of the overall ten-year expansion. This period is expected to be characterized by expansion of ultra-deepwater applications, integration of advanced composite materials, and development of specialized clamp designs for harsh subsea environments. The growing adoption of subsea processing systems and floating production facilities will drive demand for more sophisticated clamp solutions and specialized engineering expertise.

Between 2020 and 2025, the subsea umbilical clamps market experienced steady expansion, driven by increasing offshore oil and gas production and growing awareness of umbilical protection requirements in deepwater applications. The market developed as subsea contractors recognized the need for specialized clamp systems to protect critical umbilical infrastructure from environmental hazards and mechanical damage.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 620.0 million |

| Forecast Value in (2035F) | USD 883.1 million |

| Forecast CAGR (2025 to 2035) | 3.6% |

Market expansion is being supported by the rapid increase in deepwater and ultra-deepwater drilling activities worldwide and the corresponding need for reliable umbilical protection systems. Modern offshore installations rely on sophisticated umbilical networks that require precise protection and positioning to ensure proper functioning of subsea production systems including blowout preventers, manifolds, and processing equipment. Even minor damage to umbilicals can result in costly production shutdowns and environmental risks.

The growing complexity of subsea developments and increasing focus on operational safety are driving demand for high-quality clamp systems from certified manufacturers with appropriate materials and engineering expertise. Oil and gas operators are increasingly requiring comprehensive umbilical protection solutions to maintain operational integrity and ensure compliance with environmental regulations. Technical specifications and industry standards are establishing requirements for specialized clamp designs that can withstand extreme subsea conditions.

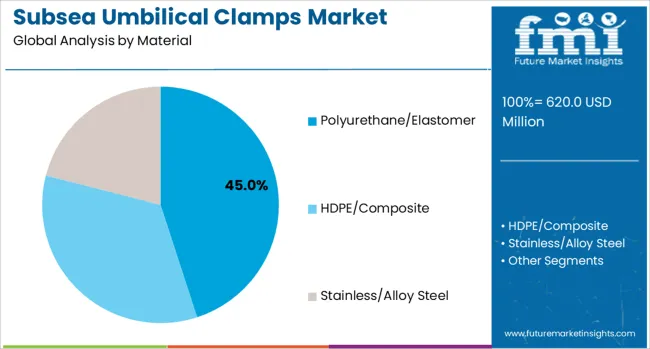

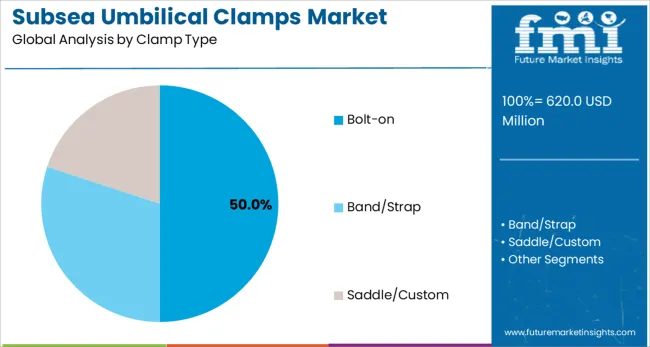

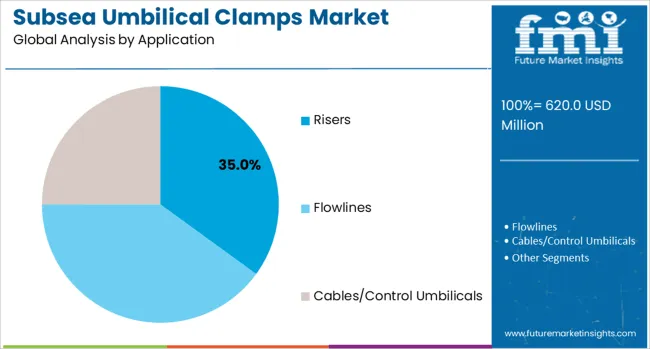

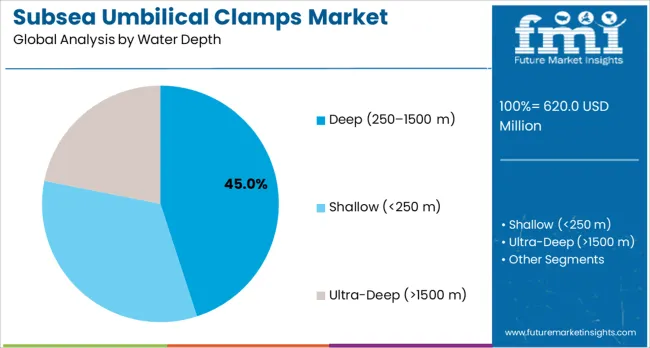

The market is segmented by material type, clamp type, application, water depth, and region. By material type, the market is divided into polyurethane/elastomer, HDPE/composite, and stainless/alloy steel. Based on clamp type, the market is categorized into bolt-on, band/strap, and saddle/custom designs. In terms of application, the market is segmented into risers, flowlines, and cables/control umbilicals. By water depth, the market is classified into shallow (<250m), deep (250-1500m), and ultra-deep (>1500m). Regionally, the market spans major offshore production areas including Brazil, Saudi Arabia, United States, United Kingdom, and France.

The polyurethane/elastomer segment is projected to account for 45% of the subsea umbilical clamps market in 2025, reflecting its position as the material of choice for demanding offshore environments. These materials offer superior flexibility, high chemical resistance, and robust fatigue performance, making them ideally suited for dynamic subsea applications. Their ability to dampen vibration and absorb mechanical stress ensures long-term reliability under cyclical loading conditions common in risers, flowlines, and control umbilicals.

Polyurethane/elastomer clamps also demonstrate strong resistance to seawater corrosion, oil, and hydraulic fluids, extending operational life in harsh conditions. Widespread adoption is further supported by well-established material standards and the availability of specialized formulations from multiple global suppliers. With offshore projects continuing to demand reliability in deeper and more dynamic environments, polyurethane/elastomer clamps remain the most versatile and trusted option for subsea umbilical protection.

Bolt-on clamps are expected to account for 50% of subsea umbilical clamp demand in 2025, reflecting their proven reliability and adaptability. Bolted designs provide secure, evenly distributed clamping forces that are essential for long-term subsea stability. They are especially valued in offshore projects where maintenance opportunities are limited, as bolt-on clamps can be pre-installed with confidence in performance and, when required, adjusted or replaced during subsea interventions. Their modularity supports use across risers, flowlines, and control umbilicals, ensuring broad applicability.

Standardized engineering practices and extensive field data further validate bolt-on clamps as the industry benchmark for safety and performance. The segment also benefits from ease of integration into existing subsea structures and compatibility with various materials, including polyurethane/elastomers. As offshore operations demand both robustness and flexibility, bolt-on clamps remain the dominant design for securing critical subsea assets.

Risers and cables/control umbilicals are each projected to contribute 35% of the subsea umbilical clamps market in 2025, reflecting their critical importance in subsea operations. Riser clamps must withstand dynamic stresses, thermal expansion, and cyclic loading while ensuring structural integrity under harsh environmental conditions. These applications often demand specialized designs that balance strength with flexibility to maintain safety in high-pressure environments. Similarly, clamps used for cables and control umbilicals must provide precise positioning, electrical isolation, and mechanical protection for communication and power transmission lines.

Failures in these applications can lead to significant operational disruptions or environmental incidents, making clamp reliability paramount. With offshore projects requiring comprehensive protection systems, both risers and cables/control umbilicals remain at the core of demand. Their shared importance underpins the market’s steady growth, while flowlines account for the balance of clamp application needs.

The deep water (250–1500m) segment is projected to account for 45% of the subsea umbilical clamps market in 2025, reflecting the concentration of offshore development in this depth range. Deep water projects represent the balance between technical feasibility and cost efficiency, with established clamp designs and materials proving highly effective in these environments. Operations at these depths require clamps capable of withstanding high hydrostatic pressures, fluctuating temperatures, and dynamic mechanical loading from risers and umbilicals.

Multiple clamp types and materials are typically deployed together to meet diverse functional requirements, from vibration damping to electrical isolation. Industry confidence in deep water technologies, combined with a steady pipeline of projects in regions such as the Gulf of Mexico, West Africa, and Brazil, ensures sustained demand. As offshore operators pursue reliable solutions, deep water remains the largest and most stable water depth segment.

The subsea umbilical clamps market is advancing steadily due to increasing deepwater exploration and growing recognition of umbilical protection importance. However, the market faces challenges including high material costs, need for specialized manufacturing capabilities, and varying design requirements across different subsea environments. Standardization efforts and qualification programs continue to influence product development and market adoption patterns.

The growing deployment of ultra-deepwater production systems is driving demand for advanced clamp designs that can withstand extreme pressures and temperatures. Ultra-deepwater clamps require specialized materials and engineering approaches that provide long-term reliability in the most challenging subsea environments. These applications are particularly valuable for frontier exploration projects and next-generation subsea processing systems that require uncompromising umbilical protection.

Modern clamp manufacturers are incorporating advanced composite materials and hybrid designs that improve performance while reducing weight and cost. Integration of carbon fiber reinforced plastics and specialized elastomers enables more precise clamp designs with enhanced durability and corrosion resistance. Advanced materials also support protection of next-generation umbilical technologies including high-voltage electrical systems and fiber optic communication cables.

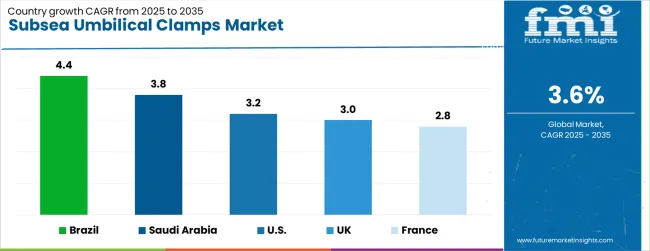

| Countries | CAGR (2025 to 2035) |

|---|---|

| Brazil | 4.4% |

| Saudi Arabia | 3.8% |

| United States | 3.2% |

| United Kingdom | 3.0% |

| France | 2.8% |

The subsea umbilical clamps market is growing across key offshore production regions, with Brazil leading at a 4.4% CAGR through 2035, driven by continued pre-salt field development and expanding deepwater production capacity. Saudi Arabia follows at 3.8%, supported by offshore field development programs and increasing subsea infrastructure investments. The United States grows steadily at 3.2%, driven by Gulf of Mexico deepwater projects and emerging renewable energy applications. The United Kingdom records 3.0%, emphasizing North Sea field maintenance and decommissioning activities. France shows 2.8% growth, focusing on offshore wind applications and subsea cable protection systems.

The report covers an in-depth analysis of 40+ countries; five top-performing countries are highlighted below.

Revenue from subsea umbilical clamps in Brazil is projected to exhibit the highest growth rate with a CAGR of 4.4% through 2035, driven by continued expansion of pre-salt oil field development and increasing demand for deepwater production infrastructure. The country's extensive offshore operations and growing subsea processing capabilities are creating significant demand for specialized clamp systems. Major oil operators and service providers are establishing comprehensive umbilical protection programs to support the growing population of deepwater production systems.

Revenue from subsea umbilical clamps in Saudi Arabia is expanding at a CAGR of 3.8%, supported by increasing offshore field development and growing investment in subsea production systems. The country's expanding offshore capabilities and increasing deepwater exploration activities are driving demand for professional clamp solutions. Specialized manufacturers and service providers are establishing capabilities to serve the growing offshore infrastructure requirements.

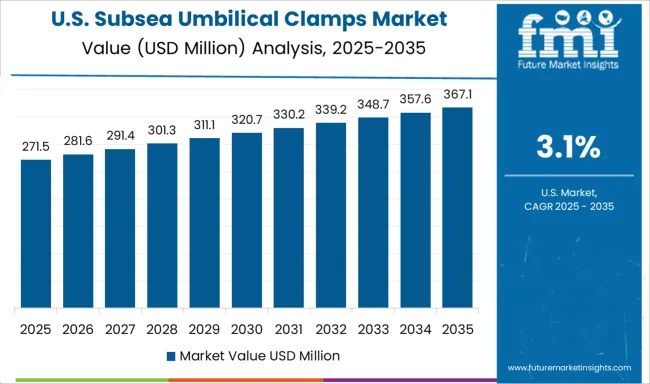

Revenue from subsea umbilical clamps in the United States is growing at a CAGR of 3.1%, driven by continued Gulf of Mexico deepwater development and increasing emphasis on subsea infrastructure reliability. The country's established offshore industry and advanced subsea technologies are creating sustained demand for high-quality clamp systems. Specialized manufacturers and service providers maintain comprehensive capabilities to serve diverse offshore applications.

Demand for subsea umbilical clamps in the United Kingdom is projected to grow at a CAGR of 3.0%, supported by ongoing North Sea operations and expanding offshore renewable energy infrastructure. British manufacturers and service providers are implementing comprehensive clamp capabilities that meet stringent quality standards and environmental requirements. The market is characterized by focus on mature field applications, decommissioning support, and offshore wind development.

Demand for subsea umbilical clamps in France is expanding at a CAGR of 2.8%, driven by increasing offshore wind development and growing emphasis on subsea cable protection systems. French manufacturers and service providers are establishing comprehensive clamp capabilities to serve marine renewable energy applications. The market benefits from government renewable energy policies and European offshore development programs.

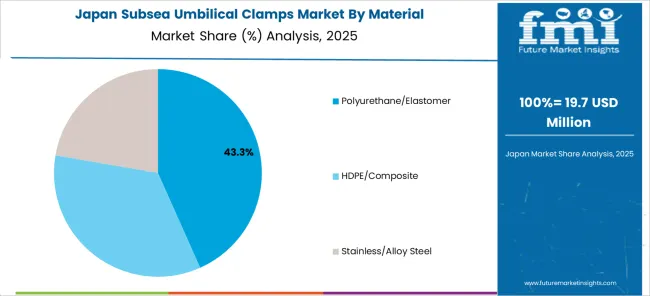

The Japan subsea umbilical clamps market is showing a clear focus on material differentiation as it gears up for deepwater applications in 2025. With a total market value of USD 19.7 million, the sector is strategically prioritizing performance-driven materials to meet the technical demands of offshore energy infrastructure. Polyurethane and elastomer-based clamps are expected to dominate, accounting for 43.3% of the market share. These materials offer superior flexibility, corrosion resistance, and durability under extreme subsea pressures, making them indispensable for long-term deployment.

The market also sees substantial traction for HDPE/composite-based clamps, which are lighter, cost-efficient, and easier to handle, supporting Japan’s push toward more efficient installation and maintenance processes in deepwater projects. Meanwhile, stainless and alloy steel clamps continue to play a role where high load-bearing capacity and mechanical strength are required, particularly in harsher operating environments.

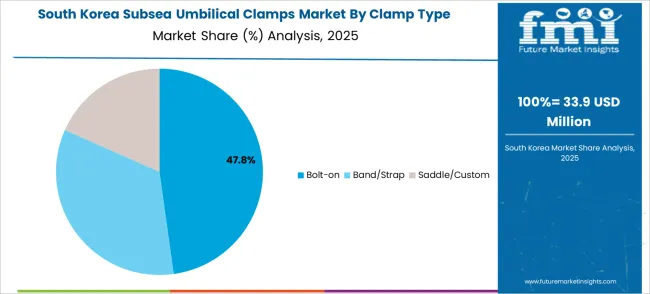

In South Korea, the market is expected to remain dominated by bolt-on clamp designs, which hold a 47.8% share in 2025. Band/strap clamps account for 30% of the market, while saddle/custom designs represent 20%. This distribution reflects South Korea's emphasis on proven clamp technologies and standardized approaches to subsea umbilical protection. The focus on bolt-on designs supports the country's shipbuilding industry expertise and offshore engineering capabilities.

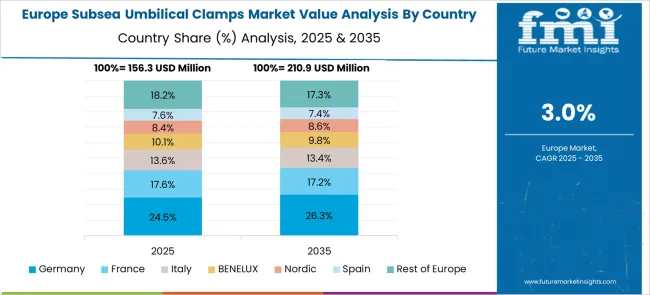

The European subsea umbilical clamps market demonstrates advanced development across major economies with the UK leading through its offshore engineering expertise and North Sea operations experience, supported by companies like Tekmar Group, Trelleborg Offshore, and Advanced Insulation pioneering innovative clamp technologies for diverse subsea applications. Norway shows significant strength through companies like Balmoral Comtec and CRP Subsea, leveraging extensive offshore oil and gas experience in harsh North Sea environments.

The Netherlands contributes through Nexans Umbilicals (ancillaries), supporting integrated umbilical and clamp solutions, while international players like Oceaneering and Matrix Composites & Engineering establish strong European presence. France and other European regions exhibit expanding adoption in renewable energy applications, particularly offshore wind developments requiring specialized subsea infrastructure. The market benefits from extensive offshore experience, stringent safety standards, and the region's leadership in subsea engineering, positioning Europe as a key innovation center for next-generation umbilical clamp solutions across oil and gas, renewable energy, and marine infrastructure applications requiring reliable subsea connection and protection systems.

The subsea umbilical clamps market is defined by competition among specialized manufacturers, subsea equipment providers, and offshore engineering companies. Companies are investing in advanced materials technology, specialized manufacturing capabilities, comprehensive testing programs, and technical expertise to deliver reliable, cost-effective, and innovative clamp solutions. Strategic partnerships, technological development, and geographic expansion are central to strengthening product portfolios and market presence.

Advanced Insulation (UK) offers comprehensive clamp solutions with a focus on thermal protection and advanced material applications. Balmoral Comtec (UK) provides specialized clamp systems integrated with subsea buoyancy and protection solutions. CRP Subsea (UK) delivers advanced composite clamp designs with emphasis on weight reduction and corrosion resistance. DOF Subsea (Norway) emphasizes engineered clamp solutions with focus on custom applications and harsh environment performance.

Deepwater Buoyancy (USA) offers clamp systems integrated with comprehensive subsea buoyancy solutions. Matrix Composites & Engineering (Australia) provides advanced composite clamp designs with specialized manufacturing capabilities. Nexans Umbilicals (France) delivers clamp solutions as ancillary products integrated with comprehensive umbilical systems. Oceaneering (USA) offers comprehensive clamp solutions integrated into full-service subsea operations.

Tekmar Group (UK) provides specialized clamp expertise with focus on cable protection and renewable energy applications. Trelleborg Offshore (Sweden) delivers advanced polymer clamp solutions with emphasis on reliability and environmental performance across global offshore markets.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 620.0 million |

| Material Type | Polyurethane/Elastomer, HDPE/Composite, Stainless/Alloy Steel |

| Clamp Type | Bolt-on, Band/Strap, Saddle/Custom |

| Application | Risers, Flowlines, Cables/Control Umbilicals |

| Water Depth | Shallow (<250m), Deep (250-1500m), Ultra-Deep (>1500m) |

| Regions Covered | Brazil, Saudi Arabia, United States, United Kingdom, France, Japan, South Korea |

| Countries Covered | Brazil, Saudi Arabia, United States, United Kingdom, France, Japan, South Korea and other major offshore markets |

| Key Companies Profiled | Advanced Insulation, Balmoral Comtec, CRP Subsea, DOF Subsea, Deepwater Buoyancy, Matrix Composites & Engineering, Nexans Umbilicals, Oceaneering, Tekmar Group, and Trelleborg Offshore |

| Additional Attributes | Dollar sales by clamp material and configuration type, regional demand trends, competitive landscape, buyer preferences for modular versus custom solutions, integration with subsea integrity management systems, innovations in corrosion resistance, load optimization, and deepwater installation methods |

The global subsea umbilical clamps market is estimated to be valued at USD 620.0 million in 2025.

The market size for the subsea umbilical clamps market is projected to reach USD 883.1 million by 2035.

The subsea umbilical clamps market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in subsea umbilical clamps market are polyurethane/elastomer, hdpe/composite and stainless/alloy steel.

In terms of clamp type, bolt-on segment to command 50.0% share in the subsea umbilical clamps market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Subsea Navigation and Tracking Market Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Subsea Multiphase Flowmeter Market Size and Share Forecast Outlook 2025 to 2035

Subsea Power Grid Systems Market Analysis - Size, Growth, and Forecast 2025 to 2035

Subsea Manifolds Market

Subsea Umbilicals Risers And Flowlines Market Size and Share Forecast Outlook 2025 to 2035

Deep Depth Subsea Umbilicals, Risers and Flowlines Market Size and Share Forecast Outlook 2025 to 2035

Umbilical Market Size and Share Forecast Outlook 2025 to 2035

Umbilical Tapes Market

Umbilical Vessel Catheters Market

Disposable Umbilical Cord Protection Bag Market Size and Share Forecast Outlook 2025 to 2035

Clamps Market Size and Share Forecast Outlook 2025 to 2035

Cranial Clamps Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA