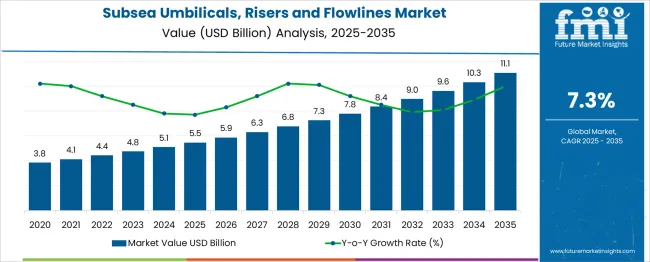

The Subsea Umbilicals Risers and Flowlines Market is estimated to be valued at USD 5.5 billion in 2025 and is projected to reach USD 11.1 billion by 2035, registering a compound annual growth rate (CAGR) of 7.3% over the forecast period. A five-year growth contribution analysis indicates a clear acceleration trend, with the first phase (2025–2030) taking the market from USD 5.5 billion to 7.8 billion, generating USD 2.3 billion or 41% of total growth. This initial phase is driven by steady demand for subsea tieback systems, flexible risers, and smaller-scale deepwater projects in mature offshore basins. In contrast, the second half (2030–2035) adds USD 3.3 billion, accounting for 59% of incremental gains, reflecting a stronger expansion as operators scale ultra-deepwater developments, invest in long-distance subsea flowlines, and deploy advanced materials for high-pressure, high-temperature environments.

Annual additions rise from USD 0.4–0.5 billion in early years to over USD 0.7 billion per year toward the end of the forecast period, highlighting a back-weighted growth curve aligned with increased global offshore energy investments. This trajectory suggests strategic opportunities for suppliers to focus on capacity optimization, enhanced insulation technologies, and integrated digital monitoring systems to capture higher-margin projects dominating the latter part of the decade.

| Metric | Value |

|---|---|

| Subsea Umbilicals Risers And Flowlines Market Estimated Value in (2025 E) | USD 5.5 billion |

| Subsea Umbilicals Risers And Flowlines Market Forecast Value in (2035 F) | USD 11.1 billion |

| Forecast CAGR (2025 to 2035) | 7.3% |

The subsea umbilicals, risers and flowlines market is poised for steady expansion, influenced by growing investments in offshore oil and gas exploration and the increasing viability of deepwater and ultra-deepwater projects. As operators focus on maximizing recovery and minimizing environmental risk, there has been a shift toward integrated subsea systems that enable remote operations, reduced topside dependency and greater field longevity.

The market is experiencing enhanced momentum due to maturing shallow water fields that demand life-extension solutions, and rising energy security concerns that are prompting nations to tap underutilized offshore reserves. Technological innovation in flexible pipe systems, corrosion-resistant alloys and digital monitoring capabilities is reinforcing the role of URF systems in supporting complex subsea architectures.

Government policies in support of cleaner hydrocarbon extraction and partnerships between energy majors and engineering firms have also enabled capital infusion into frontier basins. Going forward, the market is expected to be shaped by sustainable subsea design practices, automation and digital twin integration for optimized asset performance.

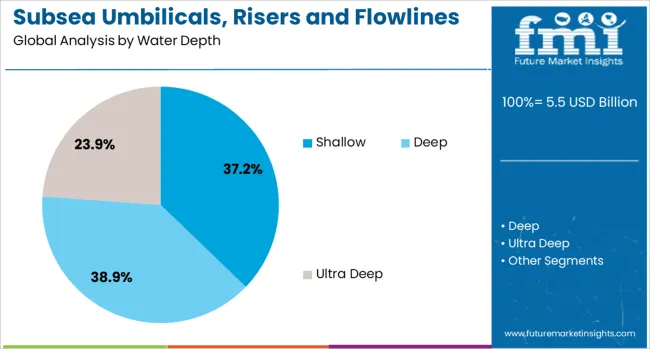

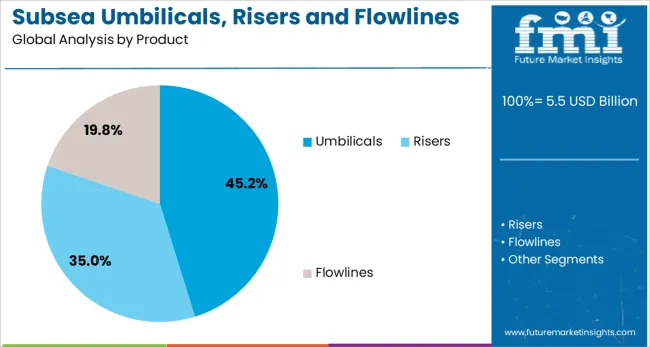

The subsea umbilicals, risers, and flowlines market is segmented by water depth, product, and geographic regions. The water depth of the subsea umbilicals, risers, and flowlines market is divided into Shallow, Deep, and ultra-deep. In terms of the subsea umbilicals, risers, and flowlines market, it is classified into Umbilicals, Risers, and Flowlines. Regionally, the subsea umbilicals risers and flowlines industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The shallow water depth segment is anticipated to contribute 37.2% of the total revenue share in the subsea umbilicals, risers and flowlines market in 2025, maintaining its stronghold due to widespread legacy infrastructure and lower operational complexities. The relative ease of installation is reinforcing this segment’s dominance, lower capital investment and established regulatory frameworks that favor nearshore resource development.

Shallow water fields continue to be economically viable due to their proximity to shore, reduced need for high-pressure technologies and favorable return on investment timelines. URF systems in these zones are typically deployed for life extension, field tiebacks and infill drilling campaigns that optimize production in mature basins.

The presence of well-developed logistics and support infrastructure further reduces downtime and enhances intervention efficiency. Additionally, the growing integration of automation and condition monitoring technologies in shallow water installations has enabled more predictive maintenance and extended operational life, reinforcing their strategic value in the overall market.

The umbilicals segment is projected to account for 45.2% of the total revenue share in the subsea umbilicals, risers and flowlines market by 2025, emerging as the leading product category. This leadership is attributed to the critical role umbilicals play in connecting subsea equipment to topside facilities by transmitting power, control signals and hydraulic fluids. Increasing deployment of subsea processing units and satellite wells has elevated the importance of advanced umbilical systems that offer greater functionality and reliability under extreme subsea conditions.

Their ability to support multiple functions in a single bundled line has improved installation efficiency and reduced operational risks. The segment’s growth has also been bolstered by innovations in thermoplastic and steel tube designs, which enhance durability and fatigue resistance.

As energy operators emphasize real-time control, remote diagnostics and reduced surface footprint, umbilicals have gained strategic importance in facilitating autonomous subsea operations. Continued investments in remote tieback projects and field expansions are expected to sustain the segment’s dominant position.

Subsea umbilicals risers and flowlines (SURF) are being deployed to connect subsea production systems with surface facilities for fluid transfer, power delivery, and control signal distribution. Application of SURF systems has been observed in deepwater oil and gas fields and offshore renewable energy arrays. Products with high-pressure resistance, chemical compatibility, and integrated fiber-optic control lines are needed for operational reliability. Demand has been driven by increasing subsea tieback projects, floating production platforms, and investment in greenfield developments linked to offshore wind farms. Suppliers offering engineered end-to-end system integration, lifecycle monitoring capabilities, and strict quality validation are well-positioned to lead in this advanced ocean engineering sector.

Subsea umbilicals, risers and flowlines have been implemented to establish critical connections between seabed production systems and floating or fixed platforms. These components enable safe transfer of hydrocarbons, injection fluids, hydraulic control and power signals under extreme subsea conditions. Rising investment in deepwater fields and tieback projects has accelerated the requirement for SURF systems due to the cost benefits of linking smaller satellite wells to existing infrastructure. Advanced composite materials and flexible pipe designs have been applied to improve fatigue resistance and operational life in dynamic ocean environments. Integration of fiber-optic cables for real-time monitoring and data transmission has enhanced safety and operational efficiency. Increased global demand for energy resources has reinforced the adoption of SURF solutions across major offshore basins.

Robust opportunities have been driven by growth in floating offshore platforms such as semi‑submersibles, spar structures, and tension-leg units. Demand for flexible riser systems and dynamic umbilicals has increased due to deepwater oil & gas developments and emerging floating wind farms. Electrification of subsea infrastructure is creating openings for power umbilicals to feed seabed sensors and control systems. Expansion of subsea tiebacks and brownfield redevelopment is enabling retrofitting of legacy subsea fields with new flowline architectures. Supplier partnerships with engineering contractors and subsea service providers are being leveraged to offer turnkey SURF packages. Regional plays in deepwater basins off South America, Australia, and West Africa are expected to accelerate the uptake of high-specification umbilical and flowline solutions globally.

Prominent trends include the adoption of modular and standardised SURF components, simplifying onsite assembly and reducing lead times. Electrically trace‑heated flowlines and hybrid umbilicals combining power, fiber optics, and hydraulic circuits are being integrated to support multiphase flow and heating requirements. Real-time integrity monitoring systems using fiber‑optic sensors and distributed temperature sensing are becoming standard for controlling degradation and flow assurance. Materials innovation, such as corrosion-resistant alloys and composite pipe elements, is being applied to extend service life and reduce maintenance windows. Digital twin platforms and predictive analytics tools are being used to simulate riser and flowline performance under dynamic loading. Scale-up of lightweight reel‑based flowline deployment is being adopted for faster mobilization in remote offshore projects.

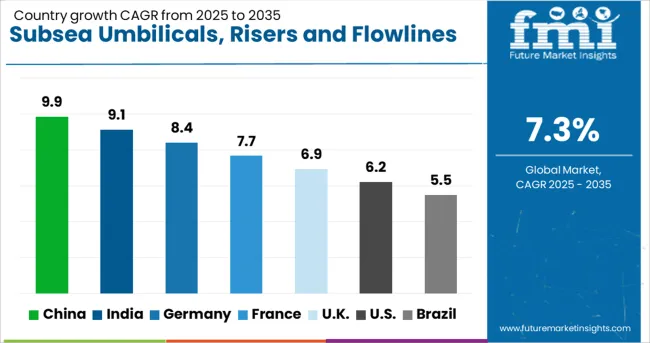

| Country | CAGR |

|---|---|

| China | 9.9% |

| India | 9.1% |

| Germany | 8.4% |

| France | 7.7% |

| UK | 6.9% |

| USA | 6.2% |

| Brazil | 5.5% |

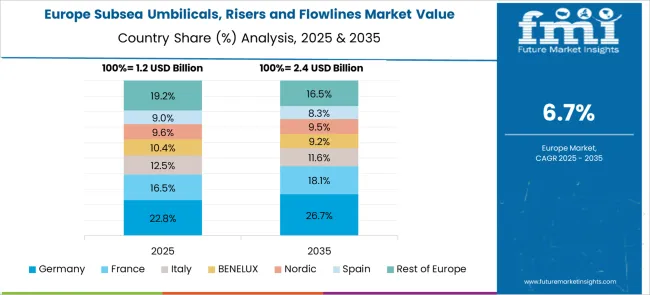

The global subsea umbilicals, risers and flowlines (SURF) market is projected to grow at 7.3% CAGR from 2025 to 2035, supported by increasing deepwater oil and gas projects, offshore renewable integration, and technological advancements in subsea connectivity. Among BRICS nations, China leads at 9.9%, driven by major offshore energy developments and domestic equipment manufacturing. India follows at 9.1%, benefiting from deepwater exploration in the Krishna-Godavari basin and offshore wind initiatives. Within OECD markets, Germany records 8.4%, supported by offshore wind cable installations and advanced subsea engineering. France posts 7.7%, driven by subsea robotics integration, while the UK grows at 6.9%, focusing on pipeline integrity and decommissioning. The report evaluates more than 40 countries, with five key markets highlighted.

China is projected to grow at 9.9% CAGR, led by major deepwater energy projects in the South China Sea and expansion of offshore wind installations. Investments in advanced umbilicals and flexible risers dominate, as state-owned enterprises prioritize subsea system integration for complex fields. Local manufacturers are expanding capabilities for high-pressure flowlines, reducing dependency on imports and improving cost efficiency. Adoption of digital monitoring and automated deployment tools is increasing across subsea installations. Strategic partnerships with global EPC firms enhance expertise in installation and maintenance of critical subsea infrastructure for oil, gas, and renewable energy sectors.

India is projected to expand at a 5.0% CAGR, supported by trade growth in textiles, chemicals, and automotive components. Government initiatives such as Sagarmala and Gati Shakti drive the modernization of ports and improve connectivity to industrial clusters. Rising export volumes of agricultural produce and processed foods increase demand for reefer container services. Freight forwarders are adopting digital booking platforms and offering door-to-port logistics solutions to streamline operations for SMEs. Partnerships with global carriers ensure capacity availability on high-demand trade lanes, including India-Europe and Middle East routes.

Germany is forecast to grow at 8.4% CAGR, driven by rapid expansion of offshore wind energy projects in the North Sea and Baltic Sea. Demand for subsea cables, risers, and interconnection flowlines remains strong as utilities upgrade power transmission capacity for renewable energy integration. German OEMs are leading in designing lightweight composite risers and corrosion-resistant umbilicals for extreme marine conditions. Compliance with EU energy transition targets accelerates deployment of smart subsea monitoring systems for operational reliability. Partnerships with global subsea specialists support development of digital twin-based project execution strategies for efficiency and cost reduction.

France is projected to grow at a 7.7% CAGR, supported by offshore oilfield redevelopment and renewable integration projects. Deployment of flexible flowlines and high-capacity umbilicals is increasing for hybrid offshore installations combining oil, gas, and wind energy systems. French engineering firms focus on robotics and automation for subsea inspection and installation, improving safety and cost efficiency. Government-backed programs under long-term energy transition plans encourage technology upgrades in subsea infrastructure. Collaboration with EPC leaders enables access to advanced control systems and project execution capabilities for global-scale offshore projects.

The UK is expected to grow at 6.9% CAGR, driven by demand from decommissioning projects in the North Sea and expansion of offshore wind connectivity. Subsea integrity management is becoming critical for aging pipelines, spurring adoption of advanced monitoring technologies. Equipment providers are introducing next-generation flowlines with improved fatigue resistance for extended operational life. The government supports subsea projects through regulatory frameworks promoting efficient decommissioning and renewable energy integration. Local manufacturers collaborate with global technology firms to strengthen supply for critical subsea infrastructure across wind farms and legacy oil platforms.

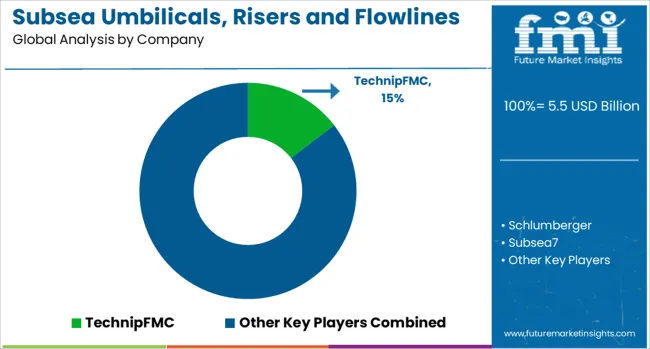

The subsea umbilicals, risers, and flowlines (SURF) market is dominated by global engineering and oilfield service leaders such as TechnipFMC, Schlumberger, Subsea 7, Aker Solutions, Saipem, Halliburton, and Baker Hughes, complemented by specialized firms including Prysmian Group, Oceaneering International, JDR Cable Systems, and DeRegt Cables. These companies operate in a capital-intensive segment where high entry barriers stem from complex subsea engineering, stringent regulatory compliance, and the need for advanced installation vessels and deepwater expertise. Market competition is shaped by technological innovation, project execution capabilities, and cost efficiency as operators seek to reduce capital expenditure while maintaining reliability in harsh offshore environments. TechnipFMC and Subsea 7 lead integrated SURF solutions combining design, procurement, and installation, while Aker Solutions and Saipem specialize in advanced riser and flowline systems for ultra-deepwater developments.

Prysmian Group and JDR Cable Systems play a critical role in supplying high-performance umbilicals for power and control signal transmission, whereas Vallourec, Tenaris, and ArcelorMittal dominate the steel pipe supply chain for flowlines and risers. Oceaneering International differentiates through subsea robotics and intervention services, enhancing efficiency during installation and maintenance phases. Strategic priorities include development of standardized, modular systems, electrification of subsea infrastructure, and integration of digital monitoring solutions for predictive maintenance. Future competitive dynamics will revolve around deepwater and ultra-deepwater projects, offshore wind power connections, and low-carbon initiatives. Companies investing in advanced materials, corrosion-resistant alloys, and hybrid umbilical designs are well-positioned to capitalize on evolving energy transition trends while sustaining profitability in a high-stakes market.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.5 Billion |

| Water Depth | Shallow, Deep, and Ultra Deep |

| Product | Umbilicals, Risers, and Flowlines |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | TechnipFMC, Schlumberger, Subsea7, AkerSolutions, Saipem, Halliburton, BakerHughes, PrysmianGroup, OceaneeringInternational, Tenaris, Vallourec, JohnWoodGroup, JDRCableSystems, ArcelorMittal, OilStatesIndustries, Dril-Quip, and DeRegtCables |

| Additional Attributes | Dollar sales by system type (static risers, dynamic risers, umbilicals, flowlines) and material (steel, thermoplastic, composite), driven by demand in deepwater oil, subsea processing, and offshore wind. Regional leaders include North America and Europe, with Asia‑Pacific accelerating demand through new offshore field development. Innovation targets light‑weight materials, sensor-enabled subsea monitoring, and carbon capture-ready flowlines. Environmental drivers include leak-resistant design and regulatory compliance for subsea installations. |

The global subsea umbilicals risers and flowlines market is estimated to be valued at USD 5.5 billion in 2025.

The market size for the subsea umbilicals risers and flowlines market is projected to reach USD 11.1 billion by 2035.

The subsea umbilicals risers and flowlines market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in subsea umbilicals risers and flowlines market are shallow, _umbilicals, _risers, _flowlines, deep, _umbilicals, _risers, _flowlines, ultra deep, _umbilicals, _risers and _flowlines.

In terms of product, umbilicals segment to command 45.2% share in the subsea umbilicals risers and flowlines market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Deep Depth Subsea Umbilicals, Risers and Flowlines Market Size and Share Forecast Outlook 2025 to 2035

Subsea Navigation and Tracking Market Size and Share Forecast Outlook 2025 to 2035

Marine Manifolds and Risers Market

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Subsea Umbilical Clamps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Risers Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Subsea Multiphase Flowmeter Market Size and Share Forecast Outlook 2025 to 2035

Subsea Power Grid Systems Market Analysis - Size, Growth, and Forecast 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Subsea Manifolds Market

Andro Supplements Market

Candle Filter Cartridges Market Size and Share Forecast Outlook 2025 to 2035

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA