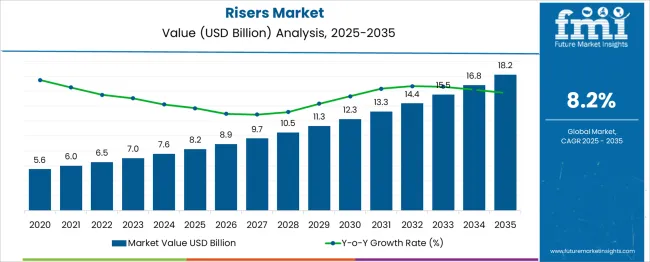

The Risers Market is estimated to be valued at USD 8.2 billion in 2025 and is projected to reach USD 18.2 billion by 2035, registering a compound annual growth rate (CAGR) of 8.2% over the forecast period.

The risers market is forecasted to exhibit steady growth from USD 5.6 billion in 2021 to USD 11.3 billion by 2030, effectively doubling in value over the decade. This expansion reflects a compound annual growth rate (CAGR) of approximately 8.2%, driven by rising offshore oil and gas exploration activities and increasing investments in subsea infrastructure. Between 2021 and 2025, the market grows from USD 5.6 billion to USD 7.6 billion, indicating gradual adoption of advanced riser technologies designed to withstand harsh offshore environments and deepwater pressures.

The second half of the decade, spanning 2026 to 2030, projects a sharper increase from USD 8.2 billion to USD 11.3 billion, fueled by new deepwater projects, retrofitting of aging infrastructure, and the integration of risers with floating production systems. Technological innovations including hybrid riser systems, enhanced corrosion-resistant alloys, and flexible riser designs contribute to this growth by improving safety, durability, and operational efficiency.

Additionally, the expanding role of risers in offshore carbon capture and storage (CCS) initiatives and hydrogen transport is widening application opportunities beyond conventional oil and gas sectors. Regionally, significant investments in the Gulf of Mexico, North Sea, and Asia-Pacific offshore basins underscore the market’s geographical diversity. This growth trajectory reflects the risers market’s ability to adapt to evolving energy demands and environmental considerations, positioning it as a critical component of modern offshore production systems through 2030.

| Metric | Value |

|---|---|

| Risers Market Estimated Value in (2025 E) | USD 8.2 billion |

| Risers Market Forecast Value in (2035 F) | USD 18.2 billion |

| Forecast CAGR (2025 to 2035) | 8.2% |

The risers market plays a crucial role within the broader offshore oil and gas infrastructure sector, which includes various components such as pipelines, flowlines, and subsea equipment. Risers are an essential part of offshore energy extraction, allowing the transfer of oil, gas, and fluids from subsea production systems to surface facilities. The global risers market is estimated to hold a share of approximately 7% to 10% within the broader offshore pipeline and subsea infrastructure market.

This market share is driven by the increasing demand for offshore oil and gas production, particularly in deepwater and ultra-deepwater fields, where risers are used to transport production fluids to surface facilities. In terms of application, rigid risers, such as steel catenary risers (SCR) and buoyant risers, dominate, holding around 60% to 70% of the market share. Flexible risers, which are more suitable for dynamic offshore environments, capture a growing share, driven by technological advancements and their ability to accommodate movement in harsh sea conditions.

The deepwater drilling segment is the primary growth driver for the risers market, as exploration and production in deepwater and ultra-deepwater regions increase globally. Geographies such as the Gulf of Mexico, Brazil, and offshore Africa are seeing a rise in deepwater projects, thereby boosting demand for risers. Despite representing a smaller share in the overall offshore infrastructure market, risers are crucial for ensuring the safe and efficient transportation of hydrocarbons from offshore reserves to surface facilities, reinforcing their significance in offshore oil and gas operations.

The risers market is experiencing steady momentum as offshore oil and gas development shifts focus toward deeper and more complex fields. A resurgence in deepwater and ultra-deepwater drilling projects, especially in regions like the Gulf of Mexico, Brazil, and West Africa, has reinforced the need for advanced riser systems capable of withstanding high pressure, dynamic environments, and challenging thermal conditions.

Governments and operators are emphasizing production from existing offshore fields through subsea tiebacks and extended reach drilling, further driving investment in reliable riser infrastructure. Technological improvements in fatigue-resistant materials, coupled with enhanced structural modeling and monitoring systems, have enabled risers to operate with greater safety and efficiency.

The market is also benefiting from long-term oil price stability and a favorable regulatory environment promoting domestic energy security. As floating production units become more prevalent and field complexity increases, the risers market is expected to witness consistent growth supported by innovations in design, corrosion mitigation, and hybrid integration with subsea processing technologies.

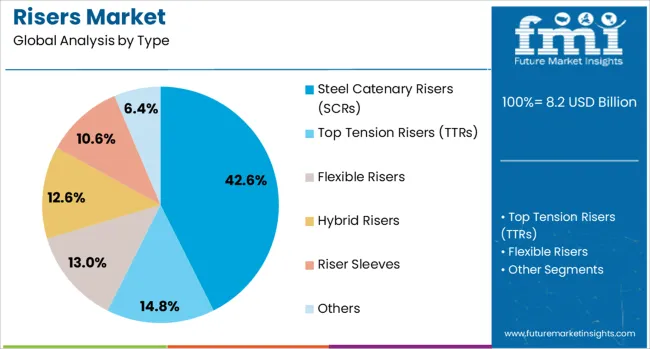

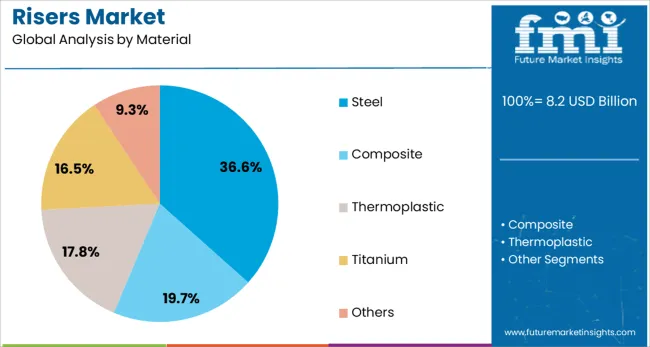

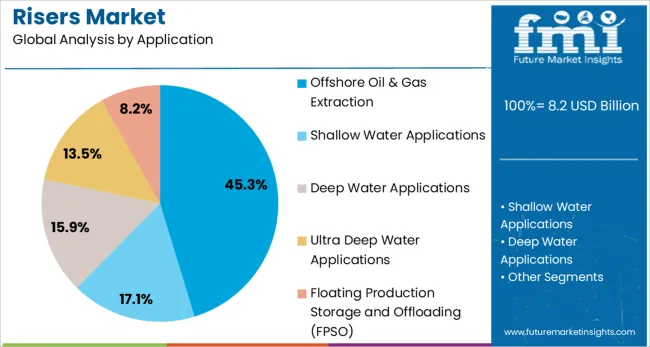

The risers market is segmented by type, material, water depth, installation method, application, and geographic regions. The risers market is divided by type into Steel Catenary Risers (SCRs), Top Tension Risers (TTRs), Flexible Risers, Hybrid Risers, Riser Sleeves, and Others. In terms of material, the riser market is classified into Steel, Composite, Thermoplastic, Titanium, and Others. Based on water depth of the risers, the market is segmented into Shallow Water (up to 300 m), Deep Water (300–1,500 m), and Ultra Deep Water (1,500+ m).

By installation method of the risers market is segmented into Wet Installation, Dry Installation, Reel-lay Installation, and J-lay Installation. By application of the risers market is segmented into Offshore Oil & Gas Extraction, Shallow Water Applications, Deep Water Applications, Ultra Deep Water Applications, and Floating Production Storage and Offloading (FPSO). Regionally, the risers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Steel Catenary Risers are expected to account for 42.6% of the total risers market revenue in 2025, making them the leading type segment. Their widespread adoption is being supported by their structural simplicity, cost-effectiveness, and proven performance in deepwater and ultra-deepwater fields. These risers offer favorable dynamic response characteristics and are highly compatible with floating production systems such as FPSOs and TLPs.

Their ability to accommodate large vertical displacements and resist fatigue under cyclic loading has made them a preferred choice for high-pressure subsea developments. The use of high-strength carbon steel and advanced welding techniques has further improved their durability and operating lifespan.

In addition, operators are increasingly selecting steel catenary risers for brownfield expansions due to their lower installation costs and flexible configuration for various water depths. Their performance in harsh offshore environments, combined with engineering reliability and simplified maintenance requirements, continues to drive their deployment across major offshore production regions.

The steel segment is projected to hold 36.6% of the overall revenue share in the risers market by 2025, reflecting its established role as a primary material in offshore riser systems. Steel has been widely adopted due to its excellent mechanical properties, including tensile strength, fatigue resistance, and load-bearing capacity under dynamic subsea conditions. Advancements in metallurgical processes and the availability of corrosion-resistant alloys have further enhanced its applicability in aggressive offshore environments.

Steel risers offer greater stability and structural integrity, which is crucial for maintaining pressure integrity and ensuring uninterrupted hydrocarbon flow. Additionally, the widespread availability of fabrication expertise, global supply chains, and standardization in specifications has facilitated large-scale adoption in both shallow and deepwater projects.

Despite increasing interest in composite and hybrid materials, steel remains the material of choice for most operators seeking a balance between performance, cost, and reliability. Its long-standing operational track record and adaptability to various configurations support its continued dominance.

The shallow water segment is anticipated to represent 52.7% of the risers market revenue in 2025, driven by continued exploration and production activity in mature offshore basins. Shallow water fields are characterized by lower operational costs, faster project timelines, and established infrastructure, which collectively support the deployment of riser systems at scale.

The compatibility of conventional riser designs with fixed platforms, combined with lower installation complexity and ease of inspection, has further accelerated their use in shallow water environments. Additionally, national oil companies and independent operators continue to focus on maximizing output from existing shallow reservoirs to enhance energy security and reduce reliance on imports.

The segment’s growth is also supported by the retrofitting of older platforms with upgraded riser technologies to extend production life. As more investment flows into enhanced oil recovery and low-cost brownfield projects in shallow waters, the demand for reliable and standardized riser systems is expected to remain strong across Asia Pacific, the Middle East, and West Africa.

The risers market is expanding due to rising offshore drilling and demand for reliable subsea connections in harsh environments. Opportunities are growing through FPSO adoption, hybrid riser systems, and subsea tie-back projects, enhancing deepwater production efficiency.

The risers market is being influenced by growing offshore oil and gas exploration combined with the need for safe subsea production systems. Increased drilling activity in deep and ultra-deep waters has been emphasized as a critical factor, given the high energy demand from industrial and power sectors. Demand for advanced flexible and rigid risers has increased as operators seek reliable connections between subsea wells and floating platforms. High-pressure and temperature conditions in offshore environments require risers designed with enhanced material durability. This trend has created opportunities for specialized riser manufacturers offering corrosion-resistant solutions tailored for harsh subsea conditions, reinforcing their relevance in high-investment offshore projects and floating production systems.

Growth opportunities are being shaped by extensive offshore development projects targeting unconventional reserves and marginal fields. Market potential is being strengthened by the adoption of floating production, storage, and offloading (FPSO) units that require multiple riser configurations for operational efficiency. The increasing deployment of hybrid riser systems is considered significant as they deliver flexibility in deepwater applications. Companies offering integrated engineering services and digital monitoring solutions for riser integrity have gained prominence as operators prioritize operational safety and cost reduction. Rising investments in subsea tie-back projects have expanded the scope for riser demand, especially where pipeline infrastructure is limited, enabling a more connected and efficient production network across offshore fields.

The risers market is witnessing significant growth, primarily driven by the increasing exploration and production activities in deepwater and ultra-deepwater offshore fields. As conventional oil and gas reserves become more difficult to access, there is a rising reliance on offshore reserves, particularly in regions like the Gulf of Mexico, offshore Brazil, and Africa. These areas require advanced riser systems, such as steel catenary and flexible risers, to transport production fluids safely and efficiently. The ongoing shift towards more complex and deeper water drilling activities is propelling demand for high-performance risers capable of withstanding extreme marine conditions. Additionally, technological advancements, such as the development of hybrid riser systems and enhanced material compositions, are supporting the growth of this market by improving riser reliability, reducing maintenance costs, and enhancing overall system efficiency. The rising emphasis on energy security and sustainable oil and gas production is also fueling the demand for risers in offshore infrastructure projects.

Despite the positive growth outlook, the risers market faces several challenges, particularly related to high installation and maintenance costs. The complexity of deepwater projects and the high pressures associated with ultra-deepwater drilling increase the cost of riser systems, making them a significant part of offshore project budgets. Additionally, the need for specialized materials and construction techniques to ensure riser integrity under harsh environmental conditions, such as strong currents, high pressures, and corrosive seawater, adds further complexity to the market. Environmental concerns related to the potential risks of riser failures, such as oil spills or structural damage, have led to more stringent regulatory requirements, which can delay project timelines and increase costs. These factors could limit the market penetration of riser systems in certain regions, especially where budget constraints and environmental regulations are more stringent. However, with continued innovation in riser technology and material science, these challenges are expected to be mitigated over time.

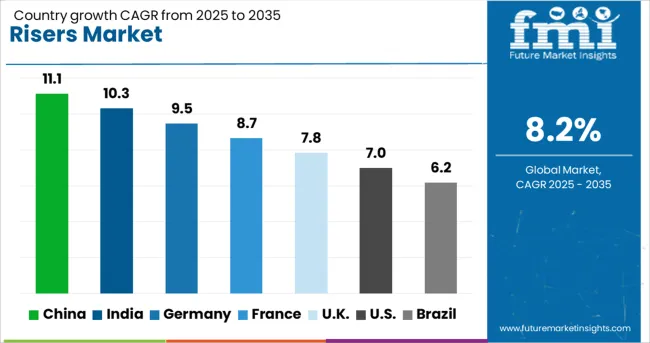

| Country | CAGR |

|---|---|

| China | 11.1% |

| India | 10.3% |

| Germany | 9.5% |

| France | 8.7% |

| UK | 7.8% |

| USA | 7.0% |

| Brazil | 6.2% |

The risers industry, projected to grow at a global CAGR of 8.2% from 2025 to 2035, is witnessing strong momentum across major regions. China, a BRICS member, is leading with an 11.1% CAGR driven by extensive offshore exploration and large-scale deepwater projects. India, also part of the BRICS group, is experiencing a 10.3% CAGR supported by significant investments in subsea tie-backs and floating production systems.

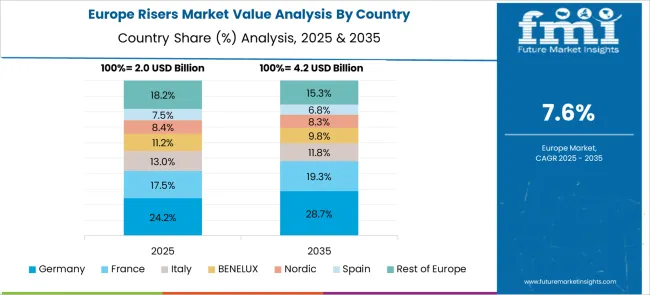

Germany, an OECD member, is registering a 9.5% CAGR, attributed to technological enhancements in flexible riser manufacturing and steady offshore engineering demand. The United Kingdom, an OECD country, follows with a 7.8% CAGR, benefitting from North Sea redevelopment and life extension programs.

The United States, another OECD member, records a 7.0% CAGR with growth tied to subsea projects in the Gulf of Mexico and renewed interest in marginal fields. Emerging economies such as China and India continue to dominate global share, while mature markets like the UK and US maintain stable offshore investment. The report includes comprehensive insights on over 40 countries, with the top five presented here for reference.

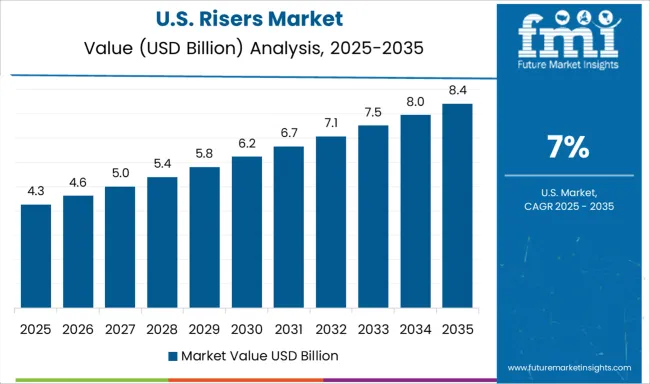

The CAGR of the risers market in the United States rose from approximately 5.6% during 2020-2024 to nearly 7.0% for 2025-2035. The increase is linked to new investments in deepwater projects within the Gulf of Mexico and enhanced regulatory clarity encouraging subsea development.

Major offshore contractors adopted advanced flexible and hybrid risers, improving installation efficiency and reducing operational downtime. Riser monitoring technologies combined with fatigue detection systems were included to meet safety and life extension goals. Cost optimization strategies by USA operators favored high-performance riser designs for FPSO-based projects in marginal fields.

The CAGR in the United Kingdom increased from around 6.3% during 2020-2024 to nearly 7.8% in 2025-2035. This rise is driven by the redevelopment of North Sea assets and extensions of existing subsea tie-backs. Decommissioning delays prompted operators to invest in advanced risers to extend asset life under stricter inspection rules.

FPSO-linked projects added complexity, increasing the demand for hybrid and steel catenary risers. Market expansion was supported by UK-based engineering firms focusing on digitalized monitoring and predictive maintenance for riser integrity. The post-2025 scenario saw more capital deployed in marginal fields where pipeline connectivity is limited.

The CAGR for Germany moved up from about 7.4% in 2020-2024 to 9.5% during 2025-2035. This growth was encouraged by advanced riser manufacturing for European offshore and export markets. German engineering firms that specialized in composite and corrosion-resistant materials saw higher demand due to stricter safety standards.

Production of flexible risers expanded for deepwater projects in West Africa and the North Sea. Integration of real-time monitoring sensors in riser systems became standard practice. Procurement from major oil companies boosted domestic component suppliers, securing their role in EU-based energy transition strategies emphasizing subsea infrastructure upgrades.

The CAGR in China surged from nearly 8.9% for 2020-2024 to about 11.1% during 2025-2035, driven by rapid expansion in offshore exploration within the South China Sea. State-owned enterprises invested heavily in ultra-deepwater production systems requiring specialized riser designs. Chinese suppliers adopted automated fabrication technologies for steel catenary and hybrid risers to address large-scale project timelines.

Joint ventures between domestic and global EPC firms accelerated the transfer of advanced riser configurations. The strategic focus on energy security post-2025 led to long-term contracts for FPSO deployment, which reinforced demand for advanced riser systems across multiple offshore fields.

The CAGR value shifted from approximately 8.4% during 2020-2024 to around 10.3% for 2025-2035. Growth was influenced by aggressive exploration programs in the Krishna-Godavari Basin and the Gulf of Mannar. India adopted floating production units requiring complex riser configurations for multi-well operations. Private operators introduced digital twins for riser fatigue monitoring, improving inspection schedules and lifecycle costs.

Increased foreign investment in subsea EPC services supported riser manufacturing hubs in Gujarat and Tamil Nadu. Offshore marginal field development saw higher reliance on risers instead of traditional pipelines due to flexibility in deployment and reduced capital intensity.

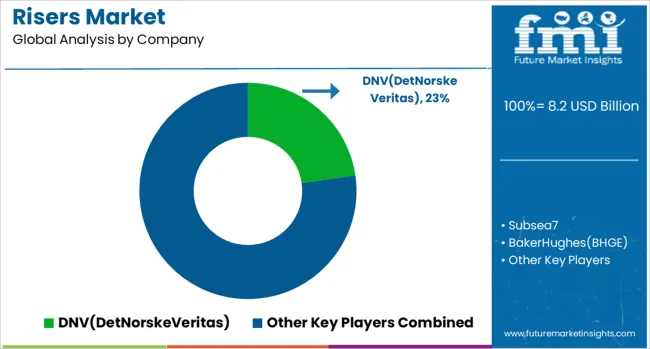

In the global risers market, leading players are strategically focusing on deepwater development, hybrid riser systems, and integrity management services to ensure the reliable and efficient transportation of hydrocarbons from deepwater offshore fields to surface facilities. Companies such as DNV (Det Norske Veritas) and TechnipFMC are pushing the envelope by integrating advanced riser engineering solutions with digital monitoring tools.

These innovations help track the integrity and performance of risers in real-time, providing valuable data that can predict and prevent potential failures, thus improving the overall lifecycle performance of offshore infrastructure. This technology is particularly valuable in extreme subsea conditions, where maintaining the structural integrity of risers is critical for long-term production reliability. Baker Hughes (BHGE) and National Oilwell Varco (NOV) continue to focus on developing high-strength riser components that are tailored for ultra-deepwater projects.

These components are designed with enhanced fatigue resistance and real-time diagnostics to meet the demanding operational conditions in deeper offshore reserves. Additionally, firms like Subsea7, Aker Solutions, and Saipem are spearheading the development of flexible riser installations and hybrid configurations that are well-suited for Floating Production Storage and Offloading (FPSO) units, which are becoming increasingly prevalent in offshore production.

The use of hybrid riser systems, combining both rigid and flexible elements, enhances the flexibility and adaptability of offshore projects. Material advancements from companies like Vallourec and Claxton Engineering, with their focus on composite and corrosion-resistant risers, are also essential in extending the operational life of risers in corrosive and high-pressure environments.

Strategic collaborations between EPC (Engineering, Procurement, and Construction) firms and component suppliers have helped to improve the operational safety of offshore systems while reducing downtime and enhancing project efficiency in harsh offshore environments. These innovations and collaborations are driving the growth and transformation of the riser market in the offshore oil and gas sector.

In June 2025, Baker Hughes announced it to acquire Continental Disc Corporation to boost its customer base

| Item | Value |

|---|---|

| Quantitative Units | USD 8.2 Billion |

| Type | Steel Catenary Risers (SCRs), Top Tension Risers (TTRs), Flexible Risers, Hybrid Risers, Riser Sleeves, and Others |

| Material | Steel, Composite, Thermoplastic, Titanium, and Others |

| Water Depth | Shallow Water (up to 300 m), Deep Water (300–1,500 m), and Ultra Deep Water (1,500+ m) |

| Installation Method | Wet Installation, Dry Installation, Reel-lay Installation, and J-lay Installation |

| Application | Offshore Oil & Gas Extraction, Shallow Water Applications, Deep Water Applications, Ultra Deep Water Applications, and Floating Production Storage and Offloading (FPSO) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DNV(DetNorskeVeritas), Subsea7, BakerHughes(BHGE), NationalOilwellVarco(NOV), Vallourec, ClaxtonEngineering, Saipem(a subsidiary of Eni), TechnipFMC, and AkerSolutions |

| Additional Attributes | Dollar sales, share, regional demand trends, material preferences (steel, composite), FPSO adoption impact, competitive landscape, deepwater project pipeline, cost optimization opportunities, and regulatory compliance factors influencing procurement strategies. |

The global risers market is estimated to be valued at USD 8.2 billion in 2025.

The market size for the risers market is projected to reach USD 18.2 billion by 2035.

The risers market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in risers market are steel catenary risers (scrs), top tension risers (ttrs), flexible risers, hybrid risers, riser sleeves and others.

In terms of material, steel segment to command 36.6% share in the risers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Subsea Umbilicals Risers And Flowlines Market Size and Share Forecast Outlook 2025 to 2035

Marine Manifolds and Risers Market

Deep Depth Subsea Umbilicals, Risers and Flowlines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA