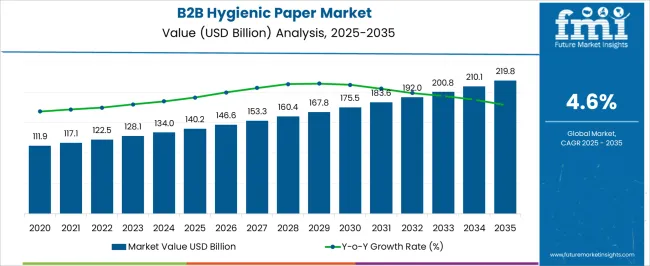

The B2B hygienic paper market is expected to grow from USD 140.2 billion in 2025 to USD 219.8 billion by 2035, reflecting a CAGR of 4.6%, indicating steady year-on-year growth. In 2025, the market value stands at USD 140.2 billion, increasing from USD 134.0 billion in 2024, and rises to USD 146.6 billion in 2026. Each year experiences a consistent growth of roughly 4–5%, driven by steady demand from hotels, restaurants, healthcare facilities, and corporate environments. This predictable YoY expansion allows manufacturers and distributors to plan production, manage inventory efficiently, and maintain stable revenue streams across key industrial and commercial segments.

By 2035, the market is projected to reach USD 219.8 billion, representing an absolute increase of USD 79.6 billion from 2025, supported by the 4.6% CAGR. Yearly values progress steadily, growing from USD 153.3 billion in 2027 to USD 210.1 billion in 2034. These incremental annual gains provide stakeholders with clear visibility into market demand, enabling effective capacity planning, supply chain optimization, and strategic investment. The consistent YoY growth highlights reliable opportunities for expansion, production scaling, and long-term engagement across the B2B hygienic paper sector.

| Metric | Value |

|---|---|

| B2B Hygienic Paper Market Estimated Value in (2025 E) | USD 140.2 billion |

| B2B Hygienic Paper Market Forecast Value in (2035 F) | USD 219.8 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The B2B hygienic paper segment is a significant part of the broader commercial and institutional paper products market. In 2025, the segment accounts for USD 140.2 billion, representing approximately 18–19% of the total parent market. By 2035, it is projected to reach USD 219.8 billion, maintaining a similar share of around 18–19%. This consistent percentage indicates that B2B hygienic paper will remain a major contributor to overall revenue, driven by continued demand from hotels, restaurants, healthcare facilities, offices, and other commercial establishments. The stable share highlights its essential role in supporting operational hygiene and facility management within the larger paper products ecosystem.

Growing at a CAGR of 4.6% from 2025 to 2035, the B2B hygienic paper segment demonstrates steady expansion alongside the parent market. Maintaining roughly an 18–19% share over the decade provides manufacturers and distributors with predictable revenue streams while enabling strategic planning for production and supply chain optimization. The segment’s consistent contribution underscores its relevance as a core component of commercial paper consumption, offering long-term opportunities for market growth, operational scaling, and investment within the broader institutional and industrial paper products industry.

The B2B hygienic paper market is gaining momentum due to increasing hygiene standards across corporate, hospitality, and institutional sectors. Rising awareness regarding workplace sanitation, coupled with post-pandemic regulatory norms, has driven demand for reliable and cost-effective paper hygiene solutions.

Corporate procurement trends favor bulk purchasing of standardized hygienic products, encouraging manufacturers to optimize distribution and supply chain efficiencies. Environmental regulations, product certifications, and source traceability are playing a growing role in influencing B2B buyers’ purchasing criteria.

Demand is also shaped by innovations in packaging, eco-friendly production methods, and smart dispensers that reduce waste and enhance hygiene compliance.

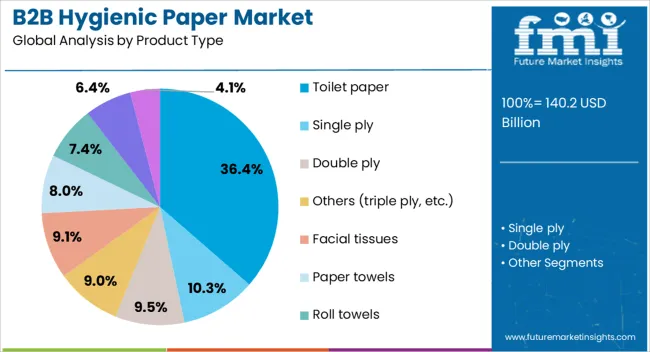

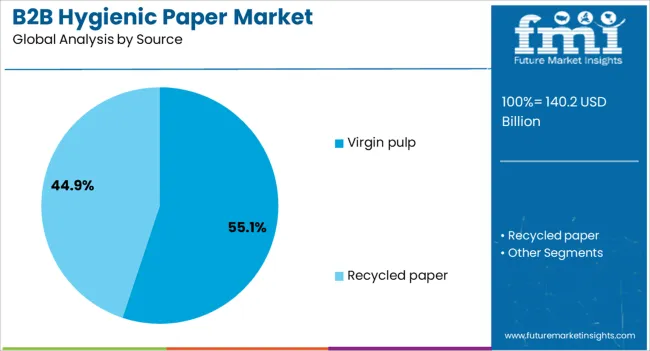

The B2B hygienic paper market is segmented by product type, source, pricing, end-use industry, distribution channel, and geographic regions. By product type, B2B hygienic paper market is divided into Toilet paper, Single ply, Double ply, Others (triple ply, etc.), Facial tissues, Paper towels, Roll towels, Folded towels, and Others (center-pull towels, etc.). In terms of source, B2B hygienic paper market is classified into Virgin pulp and Recycled paper.

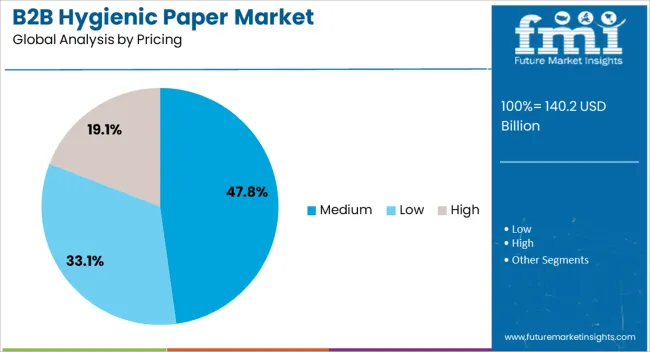

Based on pricing, B2B hygienic paper market is segmented into Medium, Low, and High. By end-use industry, B2B hygienic paper market is segmented into HoReCa, Healthcare, Corporate offices, and Others. By distribution channel, B2B hygienic paper market is segmented into Indirect and Direct. Regionally, the B2B hygienic paper industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Toilet paper is projected to lead the product type category with 36.40% of the B2B hygienic paper market share by 2025. This segment’s dominance is driven by its consistent demand across offices, hotels, hospitals, and educational institutions.

The increased frequency of restroom sanitation protocols and touchless restroom design has further reinforced the need for high-quality, absorbent, and easy-to-dispense toilet paper in B2B settings. Additionally, advancements in bulk roll dispensers and refill systems have enabled better inventory management and cost efficiency for large facilities.

Brand visibility, user comfort, and performance consistency remain key drivers sustaining demand in this segment.

Virgin pulp is anticipated to contribute 55.10% of the market in 2025, securing its position as the dominant raw material source for B2B hygienic paper production. This preference stems from the need for high-strength, soft, and contaminant-free paper products, which virgin pulp consistently delivers.

B2B buyers prioritize quality and uniformity, especially in high-footfall environments where durability and hygiene standards are critical. While recycled alternatives are gaining traction, virgin pulp remains essential for meeting stringent sanitary certifications and providing premium-quality tissue.

Manufacturers sourcing responsibly managed virgin pulp are also favored in sectors emphasizing sustainability compliance and traceable sourcing.

The medium pricing tier is forecast to command 47.80% of the B2B hygienic paper market share by 2025, making it the most preferred pricing segment. It balances cost-efficiency with acceptable quality for institutions and enterprises seeking value-driven procurement without compromising user satisfaction.

Medium-priced hygienic paper products are well-suited for bulk contracts, offering a competitive mix of durability, softness, and reliable supply. This segment also benefits from increasing brand options and performance upgrades that meet facility managers' expectations.

As procurement teams optimize budgets while adhering to hygiene mandates, the medium pricing category is set to remain the sweet spot for most B2B buyers.

The B2B hygienic paper market is growing as businesses and institutions increasingly prioritize hygiene, sanitation, and sustainability. Products such as toilet paper, facial tissues, paper towels, and napkins are essential in offices, hotels, healthcare facilities, restaurants, and educational institutions. Rising awareness of hygiene standards, particularly in healthcare and hospitality sectors, is driving demand. Sustainability trends are encouraging the use of recycled fibers, eco-friendly production processes, and biodegradable products. Companies offering high-quality, cost-effective, and environmentally responsible hygienic paper solutions are well-positioned to capture growth across commercial and institutional clients globally. Digital ordering platforms and supply chain optimization further facilitate B2B distribution and recurring purchases.

The market faces challenges due to fluctuating pulp and paper prices, quality consistency, and compliance with hygiene and safety regulations. Raw material costs can impact profit margins and pricing strategies for B2B suppliers. Maintaining consistent softness, strength, and absorbency across bulk orders is critical to satisfy commercial clients. Hygiene standards and certifications vary by region and sector, requiring manufacturers to adhere to strict testing and documentation protocols. Additionally, large-scale clients often demand reliable supply chains, timely delivery, and product traceability. Companies must invest in efficient procurement, quality control, and regulatory compliance to ensure customer satisfaction and mitigate risks associated with variability in raw materials or production processes.

The market is trending toward eco-friendly products, customized offerings, and digital procurement solutions. Businesses increasingly prefer hygienic paper made from recycled fibers, sustainably sourced materials, and biodegradable packaging. Suppliers are developing tailored solutions for specific sectors, such as high-absorbency towels for healthcare or luxury tissue products for hospitality. Digital platforms and B2B marketplaces simplify ordering, inventory management, and subscription-based supply, ensuring consistent replenishment and cost control. Innovations in embossing, ply count, and moisture resistance enhance product quality and appeal to commercial clients. These trends indicate a shift toward sustainable, personalized, and technologically facilitated supply models that improve efficiency, client satisfaction, and long-term partnerships.

The market offers opportunities in expanding commercial and institutional sectors, rising hygiene awareness, and growing sustainability initiatives. Hotels, restaurants, hospitals, and corporate offices are investing in hygienic products to improve guest and employee safety. Regulatory requirements for hygiene in healthcare and foodservice drive demand for premium paper solutions. Sustainability initiatives and corporate social responsibility programs encourage businesses to switch to eco-friendly products. Emerging markets with rapid urbanization, commercial development, and increasing institutional establishments present additional growth potential. Companies that provide high-quality, certified, and environmentally responsible hygienic paper products with efficient delivery and supply management can capitalize on rising adoption across B2B clients globally.

Market growth is restrained by price sensitivity, intense competition, and supply chain challenges. Commercial clients often prioritize cost-effectiveness due to bulk purchasing, limiting margins for premium or sustainable products. Competition from regional manufacturers, private labels, and imported products can further pressure pricing. Supply chain disruptions, including raw material availability, logistics, and distribution delays, may impact timely delivery. Additionally, packaging, storage, and transportation requirements for bulk hygienic paper add complexity and costs. Until cost-efficient production, reliable supply networks, and differentiation through sustainability or quality are widely achieved, market growth may remain concentrated among large-scale commercial buyers and sectors with stringent hygiene requirements.

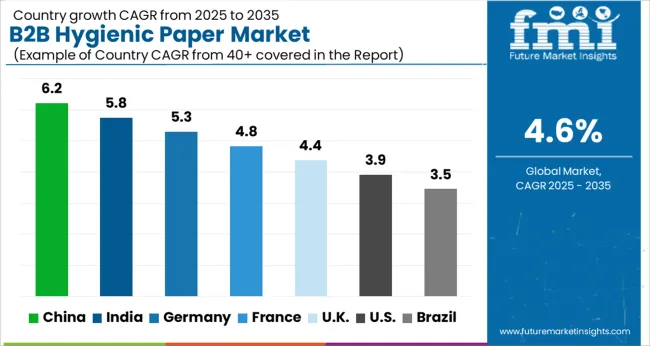

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

| USA | 3.9% |

| Brazil | 3.5% |

The global B2B hygienic paper market is projected to grow at a CAGR of 4.6% through 2035, supported by increasing demand across hotels, hospitals, offices, and industrial facilities. Among BRICS nations, China has been recorded with 6.2% growth, driven by large-scale production and deployment of tissue, napkins, and paper towels for commercial establishments, while India has been observed at 5.8%, supported by rising adoption in healthcare, hospitality, and corporate facilities. In the OECD region, Germany has been measured at 5.3%, where production and utilization for industrial, commercial, and healthcare hygiene solutions have been steadily maintained. The United Kingdom has been noted at 4.4%, reflecting consistent use in office and hospitality sectors, while the USA has been recorded at 3.9%, with production and utilization across hospitals, hotels, and institutional facilities being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China is leading the growth of the B2B hygienic paper market, registering a CAGR of 6.2%, driven by expanding commercial, hospitality, and healthcare sectors. Manufacturers are producing tissue rolls, napkins, and hand towels tailored for institutional and corporate use. Increasing awareness of hygiene standards in offices, hotels, restaurants, and hospitals is boosting demand. Government initiatives promoting sanitation, public health, and industrial hygiene further support market expansion. Pilot projects in corporate offices, healthcare facilities, and foodservice outlets demonstrate operational benefits including improved sanitation, employee satisfaction, and compliance with hygiene regulations. Collaborations between domestic suppliers and international brands are enhancing product quality, packaging, and cost-efficiency. Rising urbanization and institutional hygiene awareness continue to propel China’s market for B2B hygienic paper.

B2B hygienic paper market in India is growing at a CAGR of 5.8%, fueled by rising hygiene awareness in offices, healthcare facilities, hotels, and restaurants. Manufacturers are supplying tissue rolls, napkins, hand towels, and dispensers suitable for commercial use. Government initiatives promoting sanitation, public health, and corporate hygiene standards are supporting adoption. Pilot implementations in hospitals, hotels, and corporate campuses demonstrate operational benefits such as reduced contamination, improved workplace hygiene, and customer satisfaction. Collaborations between domestic producers, distributors, and international brands are improving product quality, durability, and availability. India’s growing urbanization and institutional hygiene awareness are key drivers of market expansion.

Germany’s B2B hygienic paper market is recording a CAGR of 5.3%, supported by stringent workplace hygiene regulations, industrial standards, and a mature commercial sector. Manufacturers are offering high-quality tissue rolls, hand towels, napkins, and dispensers for offices, hospitals, and hospitality facilities. Government initiatives promoting sanitation, employee safety, and industrial hygiene standards encourage adoption. Pilot projects in healthcare institutions, hotels, and corporate offices demonstrate operational benefits including improved hygiene compliance, reduced contamination, and enhanced efficiency. Collaborations between technology providers, distributors, and end-users are enhancing product sustainability, packaging, and availability. Germany’s focus on hygiene compliance and premium-quality solutions continues to drive market growth.

The United Kingdom’s B2B hygienic paper market is growing at a CAGR of 4.4%, supported by hygiene regulations, public health initiatives, and demand from offices, healthcare facilities, and hospitality businesses. Manufacturers are supplying tissue rolls, hand towels, napkins, and dispensers with high absorbency and durability. Government programs promoting sanitation, workplace hygiene, and compliance with public health standards are boosting adoption. Pilot implementations in hospitals, hotels, and corporate offices demonstrate operational benefits such as improved sanitation, reduced contamination, and enhanced staff and customer experience. Collaborations between domestic producers, distributors, and institutional clients are improving product quality, cost-effectiveness, and distribution networks. Rising awareness of hygiene and safety continues to support growth in the UK market.

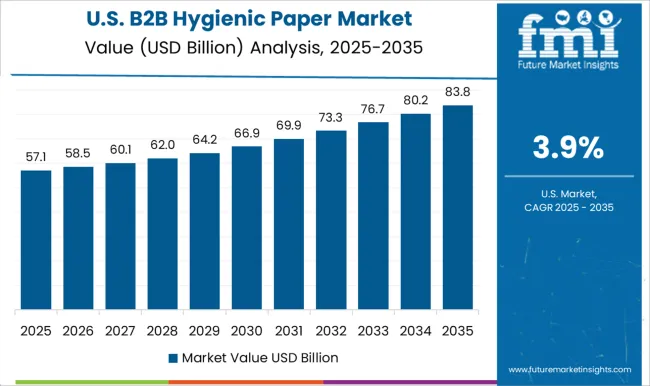

The United States B2B hygienic paper market is expanding at a CAGR of 3.9%, driven by compliance with workplace hygiene standards, healthcare regulations, and commercial sanitation initiatives. Manufacturers provide tissue rolls, hand towels, napkins, and dispensers for offices, healthcare facilities, and hospitality sectors. Government programs promoting sanitation, occupational safety, and industrial hygiene support adoption. Pilot projects in hospitals, hotels, and corporate campuses demonstrate operational benefits including improved hygiene compliance, reduced cross-contamination, and better operational efficiency. Collaborations between domestic suppliers, distributors, and end-users enhance product quality, distribution, and cost-effectiveness. The USA market growth is supported by increasing institutional awareness of hygiene and safety requirements.

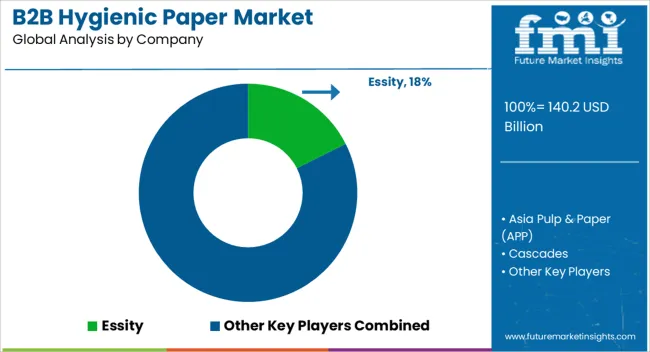

Demand for hygienic paper products in commercial, institutional, and industrial settings is served by global suppliers offering a range of paper grades, formats, and roll sizes. Essity is positioned as a leading provider, with brochures highlighting multi-ply tissue, jumbo rolls, and dispensers designed for high-traffic environments, including technical specifications for absorption, tensile strength, and sheet count. Asia Pulp & Paper (APP) competes with bulk tissue and towel solutions, with literature emphasizing environmental certifications, fiber quality, and standardized roll dimensions. Cascades and CMPC Tissue provide specialty paper for washrooms and food service, with brochures presenting durability metrics, softness ratings, and compatibility with dispensers. Georgia-Pacific and Hengan International offer high-volume and institutional-grade products, with technical literature detailing absorption performance, ply configuration, and roll diameter options. Kimberly-Clark, Kruger, and Metsa Tissue focus on both premium and standard-grade hygienic papers, with brochures highlighting machine compatibility, moisture resistance, and sheet uniformity. Procter & Gamble (P&G), Renova, SCA, Sofidel, The Navigator Company, and WEPA supply both standard and tailored formats for offices, hospitality, and healthcare facilities, with brochures detailing ply composition, embossing, and packaging sizes.

| Item | Value |

|---|---|

| Quantitative Units | USD 140.2 Billion |

| Product Type | Toilet paper, Single ply, Double ply, Others (triple ply, etc.), Facial tissues, Paper towels, Roll towels, Folded towels, and Others (center-pull towels, etc.) |

| Source | Virgin pulp and Recycled paper |

| Pricing | Medium, Low, and High |

| End-Use Industry | HoReCa, Healthcare, Corporate offices, and Others |

| Distribution Channel | Indirect and Direct |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Essity, Asia Pulp & Paper (APP), Cascades, CMPC Tissue, Georgia-Pacific, Hengan International, Kimberly-Clark, Kruger, Metsa Tissue, Procter & Gamble (P&G), Renova, SCA, Sofidel, The Navigator Company, and WEPA |

| Additional Attributes | Dollar sales vary by product type, including toilet paper, paper towels, facial tissues, and napkins; by application, such as hospitality, healthcare, offices, and industrial facilities; by end-use industry, spanning commercial establishments, healthcare, and institutional sectors; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising hygiene awareness, increasing commercial infrastructure, and demand for sustainable paper products. |

The global B2B hygienic paper market is estimated to be valued at USD 140.2 billion in 2025.

The market size for the B2B hygienic paper market is projected to reach USD 219.8 billion by 2035.

The B2B hygienic paper market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in B2B hygienic paper market are toilet paper, single ply, double ply, others (triple ply, etc.), facial tissues, paper towels, roll towels, folded towels and others (center-pull towels, etc.).

In terms of source, virgin pulp segment to command 55.1% share in the B2B hygienic paper market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

B2B Services Review Platforms Market Size and Share Forecast Outlook 2025 to 2035

B2B Middleware Market Size and Share Forecast Outlook 2025 to 2035

B2B Travel Market Size and Share Forecast Outlook 2025 to 2035

B2B Sports Nutrition Market Analysis by Form, Application, Packaging, Distribution Channel and Region through 2035

B2B Telecommunication Market Analysis by Solution, End-User, Vertical, and Region from 2025 to 2035

B2B Payments Platform Market

Hygienic Pump and Valve Market Forecast Outlook 2025 to 2035

Hygienic Easy-to-Clean Food Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Hand Hygienic Product Market

Paperboard Partition Market Size and Share Forecast Outlook 2025 to 2035

Paper Box Market Size and Share Forecast Outlook 2025 to 2035

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Pallet Market Size and Share Forecast Outlook 2025 to 2035

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Paper Wrap Market Size and Share Forecast Outlook 2025 to 2035

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Market Size and Share Forecast Outlook 2025 to 2035

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Paper Processing Resins Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA