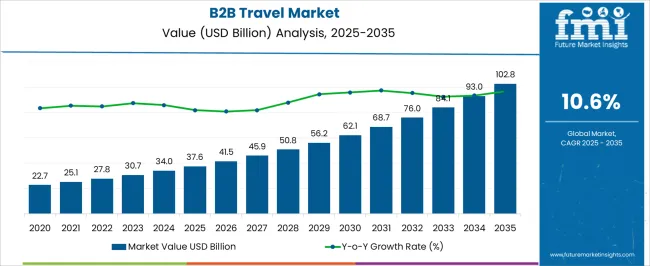

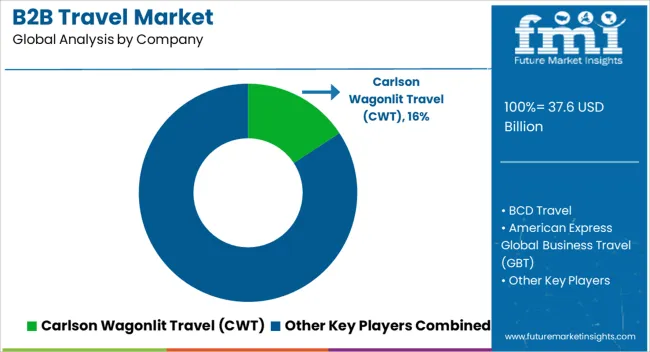

The B2B Travel Market is estimated to be valued at USD 37.6 billion in 2025 and is projected to reach USD 102.8 billion by 2035, registering a compound annual growth rate (CAGR) of 10.6% over the forecast period. Core expenses are largely concentrated in airfare, accommodation contracts, and ground transportation arrangements, which form the backbone of the B2B travel offering. Travel agencies and corporate travel management firms incur substantial costs in negotiating bulk rates, managing booking platforms, and ensuring service reliability across geographies. Technology integration represents a significant portion of the value chain, as advanced booking engines, analytics platforms, and mobile solutions are essential for enhancing efficiency, enabling real-time adjustments, and providing data-driven insights to corporate clients. Investment in cybersecurity and payment processing infrastructure further contributes to operational expenditure.

The personnel costs, including account management, client support, and travel consultancy services, are integral to maintaining service quality and ensuring customer satisfaction. The value chain also includes intermediaries such as global distribution systems, online booking platforms, and specialized tour operators, which facilitate seamless coordination between service providers and corporate clients. Negotiated supplier rates, service customization, and volume of transactions influence margins. Efficient management of supplier contracts, coupled with scalable technology deployment, determines profitability and competitive positioning. The cost-structure and value-chain dynamics are central to the growth trajectory, operational efficiency, and strategic expansion of the market.

| Metric | Value |

|---|---|

| B2B Travel Market Estimated Value in (2025 E) | USD 37.6 billion |

| B2B Travel Market Forecast Value in (2035 F) | USD 102.8 billion |

| Forecast CAGR (2025 to 2035) | 10.6% |

The B2B travel market is regarded as a significant segment within corporate and professional travel services. It is estimated to hold 8.5% of the overall travel and tourism industry, reflecting its role in managing business trips, corporate bookings, and global itineraries. Within corporate travel services, the share is higher at 12.3% due to integrated booking, expense management, and travel policy compliance. The event and meeting management sector accounts for 4.2%, driven by conferences, exhibitions, and incentive travel. Travel technology solutions contribute 3.7%, highlighting adoption of digital platforms and automation. Business services and outsourcing account for 2.9%, covering travel consultancy, agency services, and managed travel programs. Recent industry trends have been shaped by the digital transformation of corporate travel and increasing demand for automated, end-to-end booking solutions. Groundbreaking developments include AI powered travel management platforms, real-time data analytics for cost optimization, and mobile applications for itinerary management and compliance tracking. Key players have focused on partnerships with airlines, hotels, and technology providers to expand service portfolios and enhance customer experience. Strategies include personalized corporate travel packages, integration with expense reporting tools, and predictive analytics to optimize bookings. Regional growth is led by North America and Europe, while Asia Pacific is rapidly expanding due to increasing multinational corporate presence and rising adoption of managed travel solutions.

The B2B travel market is experiencing measured yet steady growth, supported by the expansion of corporate travel budgets, the rising prevalence of global business collaborations, and the sustained importance of in-person engagements in fostering partnerships and deal closures. Current market conditions are being shaped by a combination of post-pandemic recovery in international mobility and the increasing use of technology-enabled booking and travel management systems.

Industry participants are focusing on integrating data-driven solutions, enhancing personalization, and optimizing cost-efficiency for corporate clients. Demand is being reinforced by the rising number of cross-border events, training programs, and business meetings, particularly in emerging economic hubs.

Over the forecast horizon, further growth is anticipated as businesses prioritize strategic travel for relationship-building, market expansion, and participation in industry-specific events. A shift toward hybrid models combining physical presence with virtual participation is expected to sustain the relevance of B2B travel services, while technological adoption in booking platforms will continue to streamline planning, payment, and reporting processes, reinforcing operational efficiency and market competitiveness.

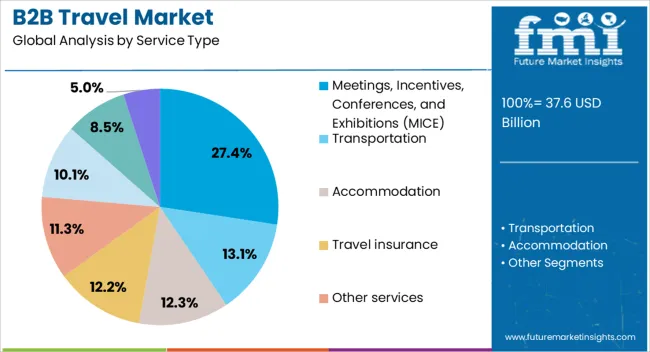

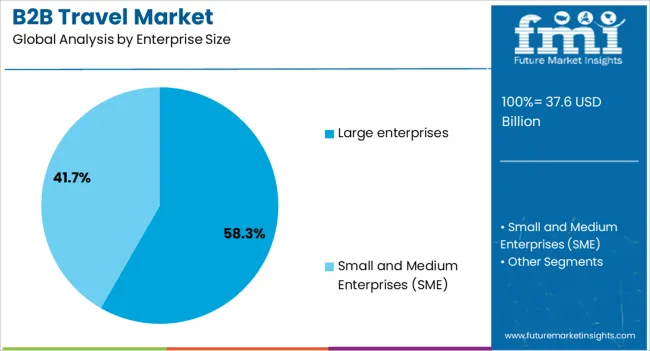

The B2B travel market is segmented by service type, enterprise size, booking method, end user, and geographic regions. By service type, the B2B travel market is divided into Meetings, Incentives, Conferences, and Exhibitions (MICE), Transportation, Accommodation, Travel insurance, Other services, Visa services, Concierge services, and Travel consulting. In terms of enterprise size, the B2B travel market is classified into Large enterprises and Small and Medium Enterprises (SME).

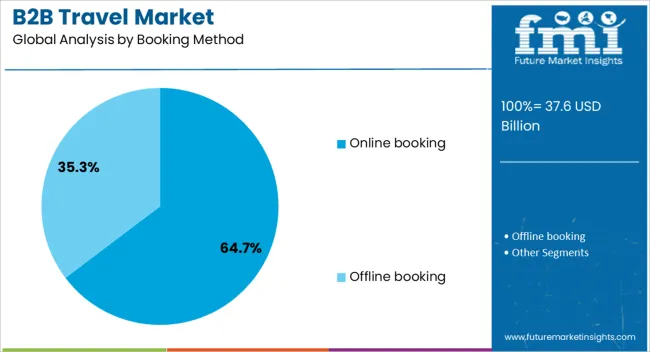

Based on the booking method, the B2B travel market is segmented into Online booking and Offline booking. By end user, the B2B travel market is segmented into Financial services & consulting, Technology & manufacturing, Healthcare & pharmaceuticals, Government & education, and Others. Regionally, the B2B travel industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The meetings, incentives, conferences, and exhibitions (MICE) segment, holding 27.40% of the service type category, is being driven by the sustained demand for large-scale, face-to-face business gatherings, which remain integral to networking, knowledge exchange, and deal-making. Corporate investment in MICE travel has been bolstered by the strategic role these events play in brand positioning, partner engagement, and talent development.

Destination diversity and improved connectivity have further supported the appeal of MICE offerings, while specialized service providers are enhancing value propositions through event customization, integrated logistics, and on-site support. The growth of regional conference hubs and government-backed trade promotion initiatives has also underpinned demand resilience.

Although virtual conferencing technologies have introduced alternative engagement channels, the irreplaceable value of physical presence in building trust and fostering deeper relationships has maintained MICE’s competitive edge. Over the forecast period, innovation in venue experience design, sustainability practices, and attendee engagement tools is expected to enhance both the scale and profitability of the segment.

The large enterprises segment, accounting for 58.30% of the enterprise size category, has retained its lead due to its substantial travel budgets, extensive international operations, and the necessity for consistent global engagement across multiple business units. Such organizations rely heavily on B2B travel solutions to manage complex itineraries, bulk bookings, and multi-destination arrangements, often requiring premium service levels and integrated travel management systems.

Procurement strategies have increasingly focused on consolidating travel suppliers to achieve cost efficiencies and service consistency across regions. The segment’s strength is further reinforced by its participation in high-value conferences, trade shows, and strategic meetings that are critical to expansion and competitive positioning.

Enhanced travel policy compliance, supported by advanced reporting and analytics tools, has enabled large enterprises to better manage expenditure and duty-of-care obligations. Looking forward, the adoption of AI-driven personalization, dynamic pricing models, and sustainability-focused travel policies is expected to further optimize travel programs and reinforce the segment’s dominance.

The online booking segment, holding 64.70% of the booking method category, is being propelled by the rapid digitization of corporate procurement processes and the increasing preference for self-service, real-time travel management solutions. Organizations are leveraging online platforms for their ability to offer immediate price comparisons, flexible booking modifications, and integrated expense tracking.

This shift has been amplified by the widespread adoption of mobile applications, cloud-based travel management systems, and AI-enabled customer support, which have collectively enhanced booking efficiency and traveler experience. The ability to automate approvals, enforce policy compliance, and provide centralized reporting has made online channels particularly attractive to corporate travel managers.

Moreover, integration with expense management software and corporate payment systems has further streamlined workflows, reducing administrative overhead and increasing transparency. Over the forecast period, ongoing platform innovations, personalized itinerary recommendations, and the incorporation of sustainability metrics into booking tools are expected to sustain strong adoption rates and expand the segment’s value contribution to the B2B travel market.

The market has become a critical segment of the global travel industry, enabling companies, travel agencies, and tour operators to coordinate, book, and manage business travel efficiently. This market is influenced by digital platforms, corporate demand for cost optimization, and integrated booking solutions that streamline procurement, invoicing, and reporting. Travel intermediaries leverage advanced technology to provide access to flights, accommodations, and corporate services in real time. Factors such as regional economic growth, corporate globalization, and industry-specific travel requirements continue to shape demand.

The adoption of digital travel platforms has reshaped the B2B travel market by streamlining booking, reporting, and expense management processes. Automated solutions allow businesses to integrate flights, hotels, car rentals, and ancillary services in a single interface, reducing administrative workload and errors. Artificial intelligence and machine learning are increasingly being applied to optimize itineraries, predict pricing trends, and provide personalized travel solutions. Integration with enterprise resource planning systems ensures seamless expense tracking and compliance with corporate policies. The shift toward platform-based solutions has improved operational efficiency while enabling real-time data visibility, allowing travel managers to make informed decisions and control costs effectively.

Businesses increasingly rely on B2B travel solutions to optimize expenses while maintaining regulatory compliance. Advanced analytics and reporting tools help track spending patterns, negotiate corporate discounts, and ensure adherence to internal travel policies. Compliance with visa, taxation, and corporate governance regulations is facilitated through integrated booking and documentation tools. Cost pressures, especially in competitive industries, incentivize companies to adopt platforms that provide transparency and control over travel-related expenditures. This focus on cost management and compliance has become a major factor influencing corporate decision making and platform adoption, shaping the competitive landscape of the B2B travel market.

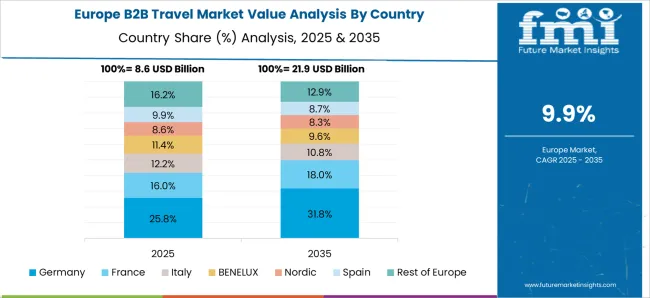

Regional growth in tourism infrastructure, transportation networks, and hotel availability has influenced B2B travel adoption. Asia Pacific, Latin America, and the Middle East are witnessing strong corporate travel demand due to expanding industrial hubs and cross-border business activities. Established markets in North America and Europe continue to maintain high usage due to mature corporate networks and integrated technology adoption. The expansion of regional air connectivity, high-quality accommodations, and seamless travel services has encouraged corporations to leverage B2B platforms to manage complex itineraries efficiently. These developments highlight how infrastructure and regional connectivity are driving the expansion and modernization of the global B2B travel ecosystem.

B2B travel providers are increasingly differentiating their offerings through advanced technology, personalized service, and integration capabilities. Mobile applications, AI-based itinerary planning, predictive analytics, and automated reporting tools enhance usability and operational efficiency.

Companies offering multi-channel support, value-added services, and real-time customer assistance are gaining a competitive advantage. Cloud-based solutions facilitate scalability and security, enabling adoption across small, medium, and large enterprises. Continuous innovation in technology and service delivery is becoming essential for providers to maintain client retention and capture market share, reflecting the critical role of innovation in sustaining growth within the B2B travel market.

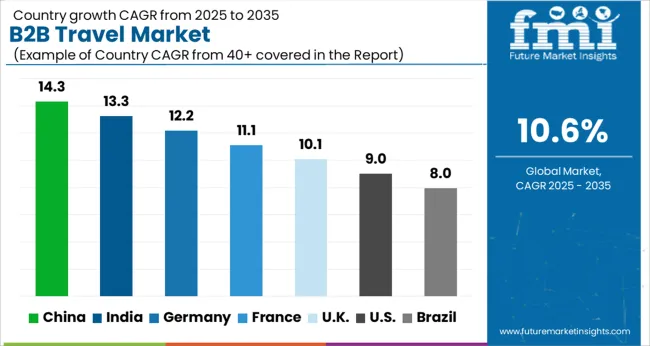

| Country | CAGR |

|---|---|

| China | 14.3% |

| India | 13.3% |

| Germany | 12.2% |

| France | 11.1% |

| UK | 10.1% |

| USA | 9.0% |

| Brazil | 8.0% |

China leads the market with a projected CAGR of 14.3%, driven by rapid corporate travel growth, expanding trade networks, and adoption of digital booking platforms. India follows at 13.3%, supported by rising business events, conferences, and increasing use of travel management solutions. Germany records 12.2%, reflecting its strong industrial base and demand for structured corporate travel services. The United Kingdom posts 10.1%, influenced by robust corporate engagement and integration of travel technology platforms. The United States registers 9.0%, with growth fueled by major enterprises optimizing travel operations and cost efficiency. These markets represent a diverse landscape of corporate travel adoption, technological integration, and service innovation. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 14.3% in the market, supported by the rapid expansion of corporate travel services and increasing business events. Companies are increasingly investing in travel management solutions to optimize logistics and cost efficiency. Technological advancements such as AI-powered booking platforms and integrated expense management are driving market adoption. The rise of multinational corporations and cross-border business activities enhances the demand for customized travel packages. As corporate expenditure on travel continues to increase, China is expected to remain a dominant contributor in the global B2B travel sector.

India is anticipated to expand at a CAGR of 13.3% in the market, fueled by increasing corporate investments and rising business tourism. Adoption of digital travel management platforms allows companies to streamline booking, reporting, and expense reconciliation. The hospitality sector is increasingly collaborating with corporate clients to offer tailored packages, enhancing the service value chain. Small and medium enterprises are also leveraging B2B travel services for operational efficiency. Continuous growth in international trade and professional conferences further strengthens the market trajectory, positioning India as one of the fast-growing B2B travel hubs in the Asia-Pacific region.

Germany is expected to witness a CAGR of 12.2% in the market, supported by a mature corporate sector and high frequency of business events. Companies increasingly rely on integrated travel management platforms to enhance cost transparency and employee convenience. The presence of multinational firms and frequent trade exhibitions creates steady demand for customized travel solutions. Sustainability considerations and compliance with corporate policies are influencing travel planning strategies. Germany’s strong focus on professional business networking and corporate efficiency ensures that the market will continue to evolve steadily, with innovative solutions driving adoption.

The United Kingdom is projected to register a CAGR of 10.1% in the market, driven by corporate investments in travel efficiency and digital solutions. Increasing reliance on travel management companies enables businesses to optimize costs and streamline booking processes. Professional events, trade exhibitions, and conferences stimulate demand for tailored travel packages. Companies are focusing on employee experience and productivity while ensuring adherence to corporate policies. Rising technological integration, including AI and analytics for travel planning, enhances adoption. The UK market reflects a growing preference for professional and streamlined corporate travel solutions across multiple industries.

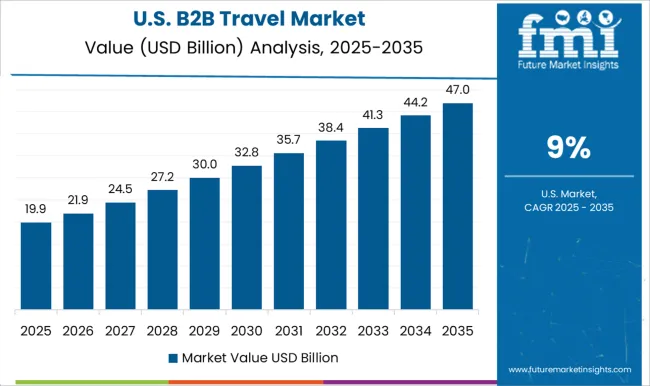

The United States is forecasted to grow at a CAGR of 9.0% in the market, supported by strong corporate travel budgets and high business mobility. Companies increasingly integrate digital travel management tools for booking, reporting, and expense tracking. The market benefits from the presence of global corporations, frequent trade shows, and professional conferences. Employee-centric services and tailored packages are becoming key differentiators for providers. Adoption of sustainable travel solutions and compliance with corporate policies further strengthens market positioning. The US remains a significant contributor to the global B2B travel ecosystem with a mature and highly organized corporate segment.

The market is dominated by global travel management companies, technology-driven platforms, and corporate service providers that cater to the business travel segment. Carlson Wagonlit Travel (CWT) and BCD Travel are prominent players, offering end-to-end travel management solutions, including booking, expense management, and analytics for multinational corporations. American Express Global Business Travel (GBT) leverages its global network and digital platforms to streamline corporate travel operations, while Sabre Corporation provides critical technology infrastructure and software solutions that enable real-time booking, inventory management, and traveler tracking. Flight Centre Travel Group and AMEX GBT Egencia have established a strong presence through integrated travel platforms, combining service efficiency with data-driven insights to optimize corporate travel programs.

CTM (Corporate Travel Management) and ATPI specialize in tailored solutions for industry-specific travel needs, offering global coverage with localized expertise. Frosch and Altour provide consulting-led approaches and personalized account management, ensuring compliance with corporate travel policies and cost optimization. Collectively, these providers drive operational efficiency, improve traveler experiences, and support strategic business travel planning, positioning themselves as essential partners for corporations navigating the increasingly complex and technology-driven B2B travel ecosystem.

| Item | Value |

|---|---|

| Quantitative Units | USD 37.6 Billion |

| Service Type | Meetings, Incentives, Conferences, and Exhibitions (MICE), Transportation, Accommodation, Travel insurance, Other services, Visa services, Concierge services, and Travel consulting |

| Enterprise Size | Large enterprises and Small and Medium Enterprises (SME) |

| Booking Method | Online booking and Offline booking |

| End User | Financial services & consulting, Technology & manufacturing, Healthcare & pharmaceuticals, Government & education, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Carlson Wagonlit Travel (CWT), BCD Travel, American Express Global Business Travel (GBT), Sabre Corporation, Flight Centre Travel Group, AMEX GBT Egencia, CTM (Corporate Travel Management), ATPI, Frosch, and Altour |

| Additional Attributes | Dollar sales by service type and industry segment, demand dynamics across corporate travel, meetings, and incentive programs, regional trends in business travel adoption, innovation in digital booking platforms, personalized services, and cost management, environmental impact of travel-related emissions, and emerging use cases in virtual meetings, hybrid events, and sustainable corporate travel solutions. |

The global B2B travel market is estimated to be valued at USD 37.6 billion in 2025.

The market size for the B2B travel market is projected to reach USD 102.8 billion by 2035.

The B2B travel market is expected to grow at a 10.6% CAGR between 2025 and 2035.

The key product types in B2B travel market are meetings, incentives, conferences, and exhibitions (MICE), transportation, accommodation, travel insurance, other services, visa services, concierge services and travel consulting.

In terms of enterprise size, large enterprises segment to command 58.3% share in the B2B travel market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

B2B Services Review Platforms Market Size and Share Forecast Outlook 2025 to 2035

B2B Middleware Market Size and Share Forecast Outlook 2025 to 2035

B2B Hygienic Paper Market Size and Share Forecast Outlook 2025 to 2035

B2B Sports Nutrition Market Analysis by Form, Application, Packaging, Distribution Channel and Region through 2035

B2B Telecommunication Market Analysis by Solution, End-User, Vertical, and Region from 2025 to 2035

B2B Payments Platform Market

Travel Advertising Market Size and Share Forecast Outlook 2025 to 2035

Travel Pouches Market Size and Share Forecast Outlook 2025 to 2035

Travel Trailer Market Size and Share Forecast Outlook 2025 to 2035

Travel & Tourism User Generated Content Market Size and Share Forecast Outlook 2025 to 2035

Travel Bags Market Size and Share Forecast Outlook 2025 to 2035

Travel Vaccines Market Size and Share Forecast Outlook 2025 to 2035

Travel Accessories Market Analysis by Product Type, Material, Distribution Channel, End-User and Region 2025 to 2035

Travel Expenses Processing Market Analysis By Type, By End User, By Booking Channel, By Region Forecast: 2025 to 2035

Travel SIM MVNO Market by MVNO Type, Coverage, End User & Region Forecast till 2035

Understanding Market Share Trends in Travelers Identity Protection

Travelers Identity Protection Services Market Analysis by Service Type, by Subscription Model, by End User , by Nationality and by Region - Forecast for 2025 to 2035

Travel Intermediaries Business Market Analysis - Growth & Forecast 2025 to 2035

Travelport GDS Systems Market Trends - Growth & Forecast 2025 to 2035

Travel Agency Services Market Analysis by Services Provided, by Tourist Type, by Tour Type, by Demography, by Age Group and by Region– Forecast for 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA