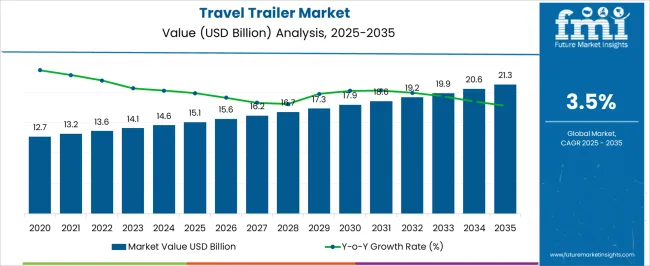

The travel trailer market is projected to grow from USD 15.1 billion in 2025 to USD 21.3 billion by 2035, with a CAGR of 3.5%. Inflection point mapping reveals a steady but gradual upward trajectory with significant milestones. Starting at USD 12.7 billion in 2024, the market shows initial growth reaching USD 15.1 billion in 2025, as demand for recreational vehicles (RVs) begins to rise, driven by consumer interest in road trips and outdoor experiences. The market continues to expand in the next few years, reaching USD 13.6 billion in 2026 and USD 14.1 billion in 2027, with consistent increases reflecting a steady shift towards travel trailers in the tourism and leisure sectors. By 2028, the market value climbs to USD 14.6 billion, fueled by new product innovations and increased consumer spending on travel experiences. From 2029 to 2035, the market sees sustained growth, reaching USD 15.6 billion in 2029, USD 16.7 billion in 2032, and USD 19.2 billion in 2035. The market’s expansion is driven by rising demand for outdoor adventures and evolving consumer lifestyles in post-pandemic times.

| Metric | Value |

|---|---|

| Travel Trailer Market Estimated Value in (2025 E) | USD 15.1 billion |

| Travel Trailer Market Forecast Value in (2035 F) | USD 21.3 billion |

| Forecast CAGR (2025 to 2035) | 3.5% |

The travel trailer market is witnessing robust expansion driven by the increasing appeal of recreational road travel, enhanced vehicle towing capacities, and a growing desire for affordable mobile accommodation. Rising participation in camping and adventure tourism, particularly among younger and middle-aged demographics, is contributing significantly to demand. As consumers look for flexible travel experiences without compromising comfort, manufacturers are prioritizing trailer designs that integrate smart interiors, modular layouts, and off-grid capabilities.

Regulatory support for tourism development, along with the expansion of trailer parks and campgrounds in developed regions, is further strengthening market adoption. Improvements in suspension systems, energy-efficient appliances, and lightweight materials are also playing a crucial role in enhancing trailer efficiency and durability.

The ability to customize interiors through software-defined control systems and IoT connectivity is expected to drive future innovation in the segment As economic uncertainties push consumers to seek cost-effective travel alternatives, travel trailers are anticipated to remain a practical and aspirational mobility solution in the near to mid-term outlook.

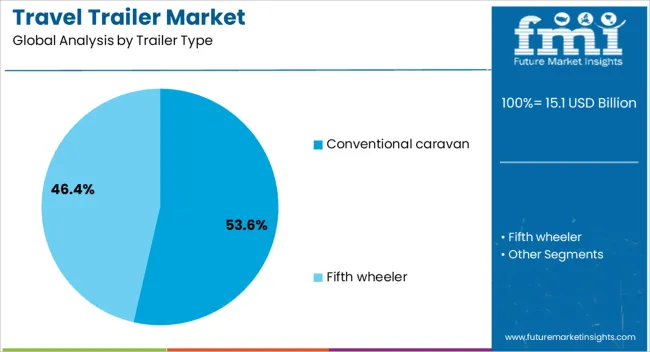

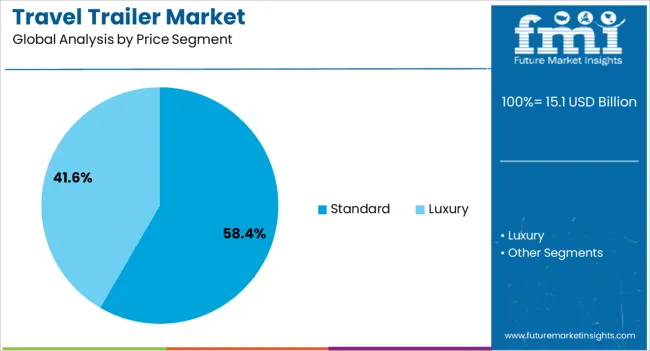

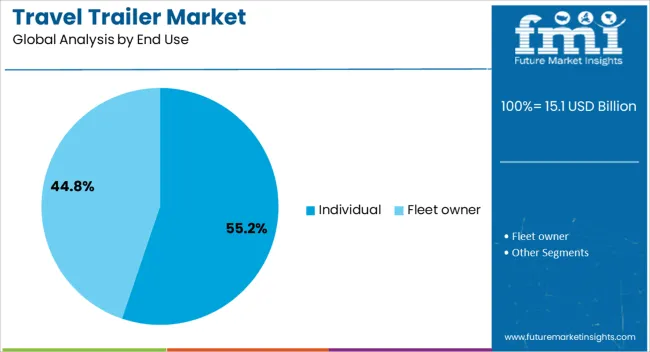

The travel trailer market is segmented by trailer type, price segment, end use, and geographic regions. By trailer type, travel trailer market is divided into Conventional caravan and Fifth wheeler. In terms of price segment, travel trailer market is classified into Standard and Luxury. Based on end use, travel trailer market is segmented into Individual and Fleet owner. Regionally, the travel trailer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The conventional caravan segment is expected to account for 53.6% of the total revenue share in the travel trailer market in 2025, establishing its position as the leading trailer type. This dominance is being attributed to the segment’s structural versatility, ease of towing, and broad consumer appeal across both experienced and first-time trailer users.

Conventional caravans are being favored for their balanced size, interior space optimization, and compatibility with a wide range of tow vehicles, making them suitable for long-distance and seasonal travel. Manufacturers have enhanced product offerings in this category through upgraded insulation, aerodynamic designs, and integrated safety systems that support multi-terrain usage.

As more travelers seek all-season functionality and at-home convenience while on the road, conventional caravans have emerged as a reliable solution offering comfort, efficiency, and value Additionally, this segment continues to benefit from established aftermarket support and extensive dealership networks, contributing to its sustained market leadership.

The standard price segment is projected to capture 58.4% of the revenue share in the travel trailer market by 2025, making it the most dominant pricing category. This segment's growth is being driven by increasing demand for mid-range travel solutions that offer a balance between affordability and features. Standard-priced travel trailers are being designed to meet essential comfort and utility needs, including kitchenettes, sleeping areas, washrooms, and basic climate control systems.

Rising inflationary pressures and cost-conscious consumer behavior have made this segment particularly attractive to individuals and families seeking recreational mobility without incurring premium expenses. Additionally, manufacturers are incorporating modular technologies and scalable upgrade options to ensure long-term usability and customization potential.

The segment has also seen consistent interest from rental and leasing businesses, further expanding its presence in both developed and emerging markets As consumers continue to prioritize value-driven purchases, the standard price segment is likely to retain a strong position across all income brackets.

The individual end use segment is forecast to hold 55.2% of the revenue share in the travel trailer market in 2025, emerging as the leading consumer category. This segment's dominance is being influenced by lifestyle shifts favoring personal freedom, remote work flexibility, and outdoor exploration. Individuals are increasingly investing in travel trailers to support long-term travel plans, digital nomad lifestyles, and cost-efficient retirement mobility.

The appeal of owning a personalized, mobile living space has led to rising interest among solo travelers, couples, and small families. Enhanced digital amenities, solar power integration, and remote connectivity are making trailers more suitable for extended usage.

The segment is further supported by favorable financing schemes and the availability of trailer-sharing platforms, which have lowered the ownership barrier for first-time users As social trends continue to move toward self-guided travel and decentralized living, individual consumers are expected to remain the primary drivers of demand in the travel trailer market.

The travel trailer market is being propelled by a surge in outdoor recreation and adventure tourism. Consumers increasingly value flexibility, affordability, and closer-to-nature experiences, making travel trailers a popular alternative to traditional vacation spending. At the same time, technology is transforming these vehicles: features such as solar panels, smart climate control, Wi-Fi boosters, and IoT-enabled systems have broadened the appeal for eco-conscious buyers and remote workers. Another growth lever comes from alternative ownership models—peer-to-peer rentals and subscription platforms—which are lowering entry barriers and expanding access to younger demographics who may not be ready for outright purchase.

Despite these positives, the industry faces notable challenges. Travel trailers carry high upfront costs along with recurring expenses for storage, insurance, and maintenance, which limit adoption among cost-sensitive households. Macroeconomic volatility further complicates demand: spikes in fuel prices or downturns in consumer spending can quickly depress trailer purchases, given they are discretionary lifestyle products. Environmental pressures are another constraint. Concerns over carbon emissions, campsite crowding, and deforestation are prompting stricter regulations on trailer usage and parking in certain regions. These restraints highlight the industry’s vulnerability to both cost structures and regulatory tightening.

Several trends are reshaping the market’s trajectory. Glamping and luxury camping are gaining ground, with consumers demanding upscale amenities that transform trailers into mobile second homes. Younger demographics millennials, Gen Z, and digital nomads are also gravitating toward trailers as flexible, mobile living solutions, especially in a post-pandemic world where remote work enables extended travel. Infrastructure expansion is reinforcing this momentum, as more RV parks, campgrounds, and rental platforms create easier access and higher utilization rates. Finally, sustainability and smart features are becoming mainstream expectations. Energy-efficient materials, solar power integration, and app-based controls are no longer niche add-ons but essential differentiators in attracting the next wave of buyers.

| Country | CAGR |

|---|---|

| China | 4.7% |

| India | 4.4% |

| Germany | 4.0% |

| France | 3.7% |

| UK | 3.3% |

| USA | 3.0% |

| Brazil | 2.6% |

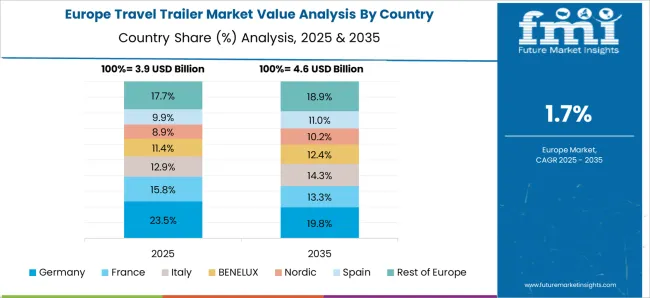

The global travel trailer market is projected to grow at a CAGR of 3.5% from 2025 to 2035. Among the key markets, China leads with a growth rate of 4.7%, followed by India at 4.4%, and France at 3.7%. The United Kingdom and the United States show more moderate growth rates of 3.3% and 3.0%, respectively. This growth is driven by increasing demand for road trips, leisure travel, and outdoor activities. Emerging markets like China and India are expanding rapidly, while developed markets continue to focus on improving travel experiences through mobile accommodation options. The analysis includes over 40+ countries, with the leading markets detailed below.

China is expected to lead the global travel trailer market, growing at a projected CAGR of 4.7% from 2025 to 2035. The country’s growing middle class, increasing disposable income, and rising interest in recreational travel are key drivers. The demand for travel trailers is growing as more people seek out road trips and leisure travel experiences. China’s expanding infrastructure, including road networks and tourist destinations, is expected to support market growth. The demand for flexible and cost-effective accommodation options for domestic and international travelers is further contributing to the market’s rise.

The travel trailer market in India is projected to grow at a CAGR of 4.4% from 2025 to 2035. The country’s expanding manufacturing sector, increasing disposable income, and growing interest in road trips are key drivers of market growth. India’s rising tourism sector and increasing number of tourists opting for leisure travel are creating demand for travel trailers. As the infrastructure improves and more destinations become accessible, the need for mobile accommodation solutions is growing. The rise in domestic and international tourism continues to contribute to the demand for travel trailers.

The travel trailer market in France is expected to grow at a steady pace, with a projected CAGR of 3.7% from 2025 to 2035. France’s strong tourism industry and interest in outdoor activities like camping and road trips are driving demand for travel trailers. The growing interest in self-contained mobile travel options for leisure trips is contributing to the market’s growth. France’s expansive network of camping sites and tourist-friendly infrastructure provides ample opportunities for the market to grow. As more people seek mobile travel experiences, the market for travel trailers is set to expand.

The travel trailer market in the United Kingdom is projected to grow at a CAGR of 3.3% from 2025 to 2035. The UK’s increasing interest in road trips, camping, and leisure travel is fueling demand for travel trailers. As more people look for flexible and affordable travel options, the market for travel trailers is growing. The development of additional camping sites and facilities, along with the rise of family and group road trips, is further contributing to the demand. The UK’s focus on enhancing travel experiences through mobile accommodation solutions is expected to drive market growth.

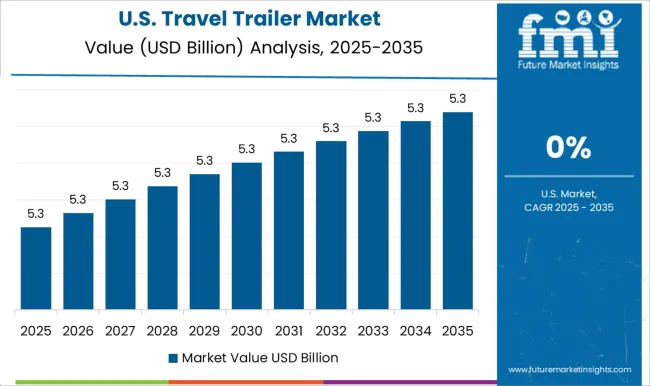

The travel trailer market in the United States is projected to grow at a CAGR of 3.0% from 2025 to 2035. The USA market is driven by the popularity of road trips, outdoor activities, and the growing interest in family vacations. As more people seek affordable and flexible accommodation for long road trips, the demand for travel trailers is rising. The USA market is also supported by the development of more campgrounds and RV parks. With increasing demand for mobile living options and outdoor travel, the travel trailer market in the USA is set for steady growth.

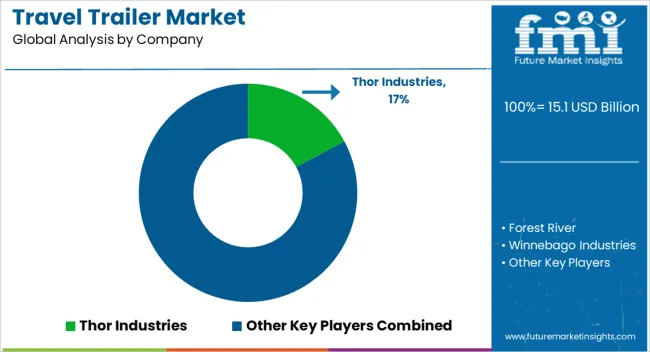

Thor Industries stands out as a major player, owning popular brands like Airstream, Jayco, and Keystone RV. Its extensive portfolio and strong reputation for quality position it as a dominant force in the industry. Forest River, a subsidiary of Berkshire Hathaway, holds a significant market share, providing a wide variety of travel trailers that cater to both luxury and budget-conscious consumers. This diverse range helps the company reach a broad market. Winnebago Industries, known for its innovative designs and high-quality products, has strengthened its market presence by acquiring brands such as Grand Design RV and Newmar, broadening its product offerings.

Grand Design RV, recognized for its customer-focused approach and durable travel trailers, has gained notable market share due to its commitment to quality. Other prominent manufacturers include Gulf Stream Coach, Keystone RV Company, Coachmen RV, KZ RV, Palomino RV, and Prime Time Manufacturing, each offering various models that cater to different preferences and budgets, from basic to high-end travel trailers.

Thor Industries

Forest River

Winnebago Industries

Grand Design RV

Gulf Stream Coach

Keystone RV Company

Coachmen RV

KZ RV

Palomino RV

Prime Time Manufacturing

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Trailer Type | Conventional caravan and Fifth wheeler |

| Price Segment | Standard and Luxury |

| End Use | Individual and Fleet owner |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Thor Industries, Forest River, Winnebago Industries, Grand Design RV, Gulf Stream Coach, Keystone RV Company, Coachmen RV, KZ RV, Palomino RV, Prime Time Manufacturing |

| Additional Attributes | Dollar sales by product type (conventional caravans, fifth-wheel trailers, pop-up campers) and end-use segments (individual consumers, fleet owners). Demand dynamics are driven by the increasing popularity of outdoor recreational activities, family travel, and the rising trend of mobile living solutions. Regional trends show robust growth in North America, Europe, and Asia-Pacific, supported by rising disposable incomes, eco-tourism, and a shift towards self-sufficient travel experiences. |

The global travel trailer market is estimated to be valued at USD 15.1 billion in 2025.

The market size for the travel trailer market is projected to reach USD 21.3 billion by 2035.

The travel trailer market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in travel trailer market are conventional caravan and fifth wheeler.

In terms of price segment, standard segment to command 58.4% share in the travel trailer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

North America Travel Trailers market Analysis from 2025 to 2035

Travel Advertising Market Size and Share Forecast Outlook 2025 to 2035

Travel Pouches Market Size and Share Forecast Outlook 2025 to 2035

Travel & Tourism User Generated Content Market Size and Share Forecast Outlook 2025 to 2035

Travel Bags Market Size and Share Forecast Outlook 2025 to 2035

Travel Vaccines Market Size and Share Forecast Outlook 2025 to 2035

Travel Accessories Market Analysis by Product Type, Material, Distribution Channel, End-User and Region 2025 to 2035

Travel Expenses Processing Market Analysis By Type, By End User, By Booking Channel, By Region Forecast: 2025 to 2035

Travel SIM MVNO Market by MVNO Type, Coverage, End User & Region Forecast till 2035

Understanding Market Share Trends in Travelers Identity Protection

Travelers Identity Protection Services Market Analysis by Service Type, by Subscription Model, by End User , by Nationality and by Region - Forecast for 2025 to 2035

Travelport GDS Systems Market Trends - Growth & Forecast 2025 to 2035

Travel Intermediaries Business Market Analysis - Growth & Forecast 2025 to 2035

Travel Agency Services Market Analysis by Services Provided, by Tourist Type, by Tour Type, by Demography, by Age Group and by Region– Forecast for 2025-2035

Market Share Distribution Among Travel Agency Services Providers

Travel Management Software Market

Travel Toiletry Market Report – Demand & Industry Growth 2024-2034

Travel and Expense Management Software Market

UK Travel Agency Services Market Report – Trends, Demand & Outlook 2025-2035

B2B Travel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA