The hygienic pump and valve market is experiencing consistent expansion driven by increasing demand from the food, beverage, pharmaceutical, and biotechnology industries. Growth is being supported by stringent hygiene regulations, rising production of processed food, and technological advancements in fluid handling equipment. Manufacturers are focusing on optimizing design efficiency, enhancing cleanability, and ensuring product safety to comply with international sanitary standards.

Market dynamics are being shaped by the integration of automation and smart monitoring systems that improve process control and minimize contamination risks. The future outlook remains positive as the shift toward sustainable materials and energy-efficient equipment continues to gain traction.

Expanding pharmaceutical manufacturing capacity and investments in modernization of dairy and beverage plants are expected to boost demand for hygienic pumps and valves globally Overall, long-term growth is underpinned by increasing operational standards, innovation in material technology, and a strong focus on reliability, durability, and regulatory compliance across all end-use industries.

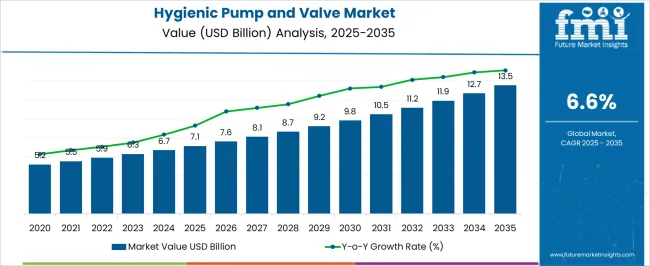

| Metric | Value |

|---|---|

| Hygienic Pump and Valve Market Estimated Value in (2025 E) | USD 7.1 billion |

| Hygienic Pump and Valve Market Forecast Value in (2035 F) | USD 13.5 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

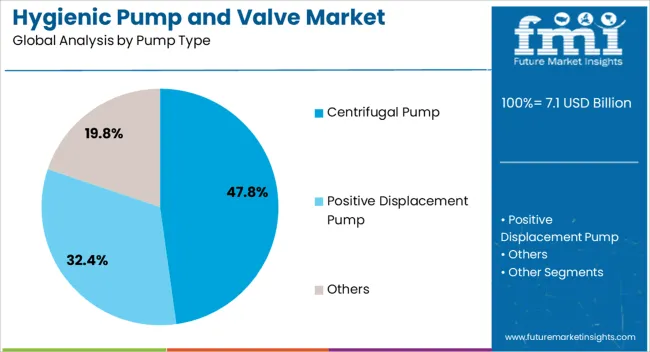

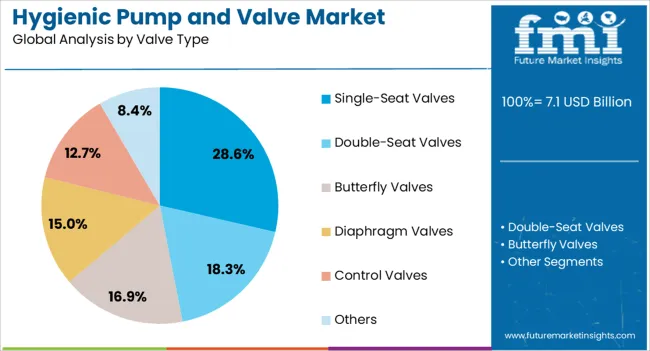

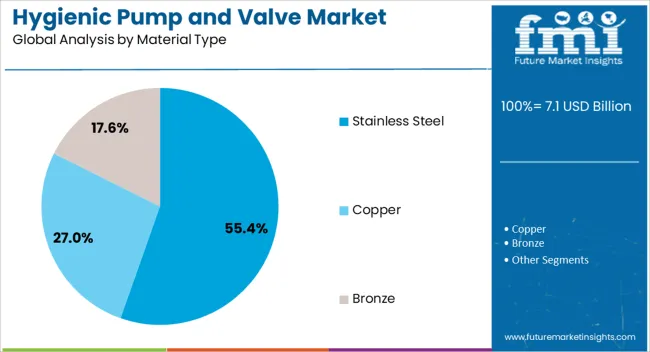

The market is segmented by Pump Type, Valve Type, Material Type, Hygiene Class, and Application and region. By Pump Type, the market is divided into Centrifugal Pump, Positive Displacement Pump, and Others. In terms of Valve Type, the market is classified into Single-Seat Valves, Double-Seat Valves, Butterfly Valves, Diaphragm Valves, Control Valves, and Others. Based on Material Type, the market is segmented into Stainless Steel, Copper, and Bronze. By Hygiene Class, the market is divided into Aseptic, Standard, and Ultraclean. By Application, the market is segmented into Food, Pharmaceutical, Cosmetics, Fine Chemistry, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The centrifugal pump segment, accounting for 47.80% of the pump type category, has been leading the market due to its superior efficiency and versatility in handling low-viscosity fluids under hygienic conditions. Its dominance is supported by extensive use in food and beverage processing, dairy operations, and pharmaceutical production where sanitary performance and ease of maintenance are critical.

The segment has benefited from innovations in impeller design and seal technology that enhance performance while minimizing downtime. Adoption has been further reinforced by its compatibility with clean-in-place systems, ensuring compliance with strict hygiene standards.

The combination of low operating cost, high reliability, and proven operational performance continues to strengthen the centrifugal pump’s position as the preferred choice across multiple hygienic applications.

The single-seat valves segment, holding 28.60% of the valve type category, has maintained leadership owing to its simple design, cost-effectiveness, and suitability for hygienic processes requiring efficient flow control. Its usage has been widely supported in applications demanding high levels of cleanliness and safety, particularly in food, beverage, and life sciences industries.

The segment’s growth has been facilitated by improved sealing mechanisms that reduce the risk of leakage and cross-contamination. Manufacturers are focusing on developing modular designs for easy maintenance and integration into automated process lines.

The reliability and straightforward construction of single-seat valves have made them an industry standard for operations emphasizing product integrity and sanitary compliance, ensuring sustained market share within the hygienic valve segment.

The stainless steel segment, representing 55.40% of the material type category, has emerged as the dominant material due to its excellent corrosion resistance, mechanical strength, and ability to withstand frequent cleaning cycles. It has been widely adopted across critical hygienic applications where durability and contamination prevention are paramount.

The segment’s leading position is supported by regulatory requirements that favor stainless steel for equipment in contact with consumable products. Its smooth surface finish and resistance to bacterial growth contribute to superior sanitary performance.

Continuous advancements in stainless steel grades and surface treatments have enhanced performance under high-temperature and high-pressure conditions Ongoing industry preference for reliable, long-lasting, and easily cleanable materials is expected to sustain stainless steel’s dominance and reinforce its critical role in hygienic pump and valve manufacturing worldwide.

| Leading Pump Type | Centrifugal Pumps |

|---|---|

| CAGR (2025 to 2035) | 6.20% |

The centrifugal pump segment is projected to record a CAGR of 6.20% through 2035. This pump type is driven by the following factors:

| Leading Valve Type | Single-seat Valves |

|---|---|

| CAGR (2025 to 2035) | 6.0% |

The single-seat valves are expected to expand at a CAGR of 6% through 2035. The segment’s growth is driven by the following factors:

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 6.80% |

| United Kingdom | 7.80% |

| China | 6.90% |

| Japan | 7.20% |

| South Korea | 7.50% |

The hygienic pump and valve market in the United States is projected to acquire a market size of USD 13.5 billion by 2035. Over the forecast period, the market is anticipated to record a CAGR of 6.8% through 2035. The top factors that are compelling the industry growth are:

The United Kingdom’s hygienic pump and valve market is expected to account for a market valuation of USD 541.4 million by 2035. The market is anticipated to register a CAGR of 7.8% through 2035. Leading growth-inducing factors include:

The China hygienic pump and valve industry is anticipated to acquire a market value of USD 1.9 billion by 2035. It is expected to expand at a CAGR of 6.9% through 2035. Top market catalysts include:

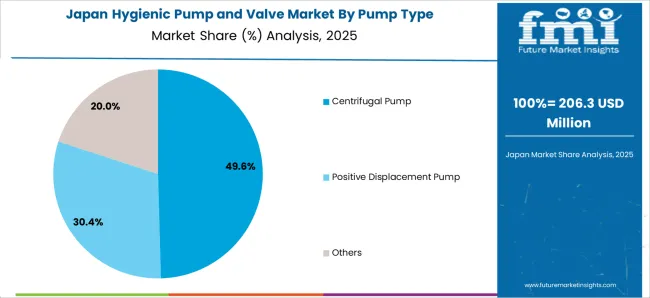

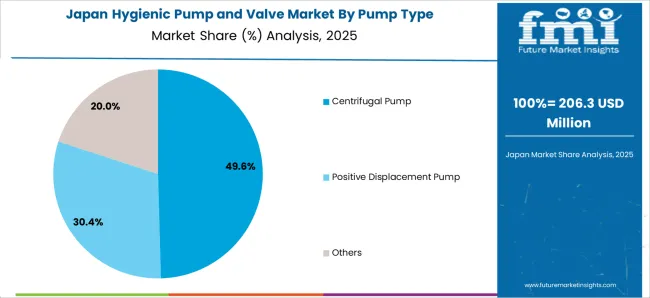

The hygienic pump and valve market in Japan is estimated to gain USD 1.3 billion by 2035, expanding at a CAGR of 7.2% through 2035. The market is expected to be motivated by the following forces:

The hygienic pump and valve market in South Korea is projected to attain a value of USD 752 million by 2035. For the time being, the market is predicted to register a CAGR of 7.5% through 2035. The following factors support the market’s growth:

Key players are focusing on the development of hygienic pumps and valves with advanced materials. Additionally, they are increasingly integrating sensors as well as connecting pumps and valves with the Industrial Internet of Things (IIoT) to raise cost-savings and efficiency for customers.

Players are further increasing their market share by entering new markets where demand for pharmaceuticals and processed food is surging.

Industry participants are strategically partnering and acquiring new companies to extend their product portfolios, access new technologies, and reach new customers. Active companies are further focusing on offering excellent technical support, customer service, and customized solutions to cater to individual customer needs.

Latest Developments in the Hygienic Pump and Valve Market

The global hygienic pump and valve market is estimated to be valued at USD 7.1 billion in 2025.

The market size for the hygienic pump and valve market is projected to reach USD 13.5 billion by 2035.

The hygienic pump and valve market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in hygienic pump and valve market are centrifugal pump, positive displacement pump and others.

In terms of valve type, single-seat valves segment to command 28.6% share in the hygienic pump and valve market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hygienic Easy-to-Clean Food Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

B2B Hygienic Paper Market Size and Share Forecast Outlook 2025 to 2035

Hand Hygienic Product Market

Pump Jack Market Forecast Outlook 2025 to 2035

Pump Testers Market Size and Share Forecast Outlook 2025 to 2035

Pumpjacks Market Size and Share Forecast Outlook 2025 to 2035

Pumps Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Seed Protein Market Size and Share Forecast Outlook 2025 to 2035

Pumped Hydro Storage Market Size and Share Forecast Outlook 2025 to 2035

Pump Tubes Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Pie Spices Market Analysis - Size, Share, and Forecast 2025 to 2035

Pump Condiment Dispensers Market - Effortless Portion Control 2025 to 2035

Pumpkin Spice Products Market Trends - Seasonal Demand & Growth 2025 to 2035

Pump Feeders Market Growth - Trends & Forecast 2025 to 2035

Pump and Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Pump and Dispenser Industry

Pumps and Trigger Spray Market Trends - Growth & Forecast 2025 to 2035

Mud Pumps Market Growth - Trends & Forecast 2025 to 2035

USA Pump and Dispenser Market Report – Demand, Trends & Industry Forecast 2025-2035

Fire Pump Test Meter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA