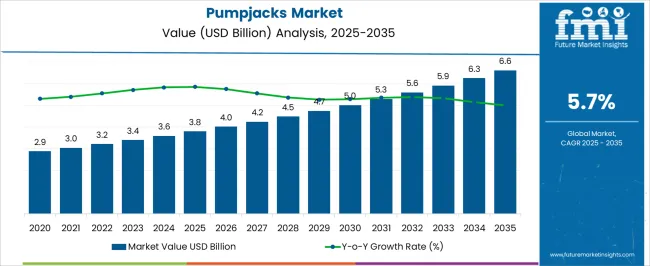

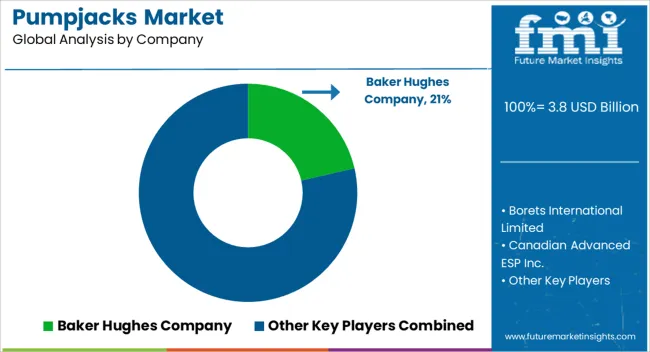

The pumpjacks market is estimated to be valued at USD 3.8 billion in 2025 and is projected to reach USD 6.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

Analysis of the cost structure indicates that raw materials, primarily steel and high-strength alloys, constitute a significant portion of the production cost, alongside machining, fabrication, and assembly operations. Labor and energy expenses for manufacturing and site installation further influence the total cost, while ongoing maintenance and servicing contribute to the operational expenditure across the value chain. The value chain begins with raw material procurement, followed by component fabrication, mechanical assembly, and quality assurance testing. Equipment deployment at oilfields involves transportation, site preparation, installation, and commissioning, often accompanied by integration with monitoring and control systems.

Post-installation, the value chain extends to operational management, preventive maintenance, and eventual retrofitting or replacement, which collectively support revenue generation beyond initial sales. Between 2025 and 2035, the market shows incremental growth from USD 3.8 billion to USD 6.6 billion, reflecting gradual scaling across mature and emerging oil-producing regions. Value addition is increasingly influenced by technological improvements such as automated monitoring, enhanced energy efficiency, and modular designs, which optimize both upfront and operational costs. The market exhibits a cost-intensive but systematically structured value chain, where raw materials, assembly efficiency, and operational management drive profitability and long-term market resilience.

| Metric | Value |

|---|---|

| Pumpjacks Market Estimated Value in (2025 E) | USD 3.8 billion |

| Pumpjacks Market Forecast Value in (2035 F) | USD 6.6 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The pumpjacks market represents a specialized segment within the global oilfield and petroleum extraction industry, emphasizing mechanical efficiency, durability, and continuous crude oil production. Within the broader oilfield equipment sector, it accounts for about 5.7%, driven by demand from onshore oilfields and aging wells requiring artificial lift solutions. In the oil extraction and production equipment segment, it secures 6.2%, reflecting reliance on mechanical pumping systems for consistent crude recovery. Across the energy infrastructure and petroleum services market, the share is 4.3%, supporting both small and large-scale production operations. Within the well intervention and enhanced oil recovery category, it represents 3.9%, highlighting use in secondary and tertiary extraction techniques. In the industrial energy solutions sector, it contributes about 3.5%, emphasizing adoption for reliable long-term production and low-maintenance operational requirements.

Recent developments in this market have focused on automation, energy efficiency, and remote monitoring integration. Innovations include variable speed drives, digital sensors for real-time performance tracking, and IoT-enabled predictive maintenance systems to reduce downtime. Key players are collaborating with oilfield service companies and energy operators to optimize pumpjack performance and extend operational life. Adoption of modular designs and low-energy consumption motors is gaining traction to improve efficiency and reduce operating costs. The hybrid systems combining solar or electric assist with mechanical pumping are being deployed to lower environmental impact and improve sustainability. These trends demonstrate how efficiency, digitalization, and innovation are shaping the pumpjacks market.

The pumpjacks market is experiencing stable growth driven by consistent global demand for crude oil extraction and the ongoing need for efficient artificial lift systems in mature oilfields. Aging wells with declining natural reservoir pressure are increasingly relying on pumpjack installations to maintain production efficiency.

Technological enhancements in motor efficiency, remote monitoring, and structural durability have extended operational lifespans while reducing maintenance costs. Additionally, demand in both onshore and marginal oilfields has remained resilient due to pumpjacks’ proven reliability and adaptability across diverse geographies and operational conditions.

While renewable energy adoption is rising, the long-term reliance on oil in industrial processes and transportation is sustaining market relevance. The outlook remains positive as operators continue to invest in equipment upgrades, automation integration, and region-specific customization to optimize extraction rates and operational safety.

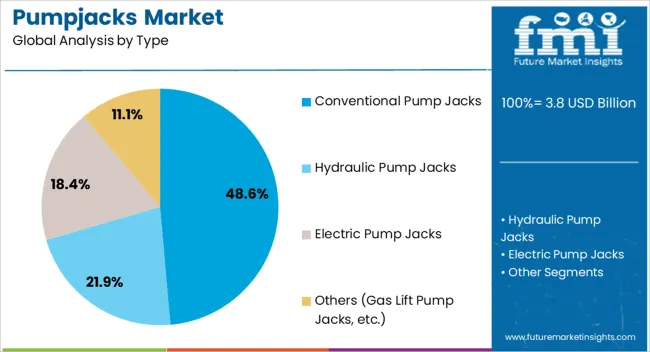

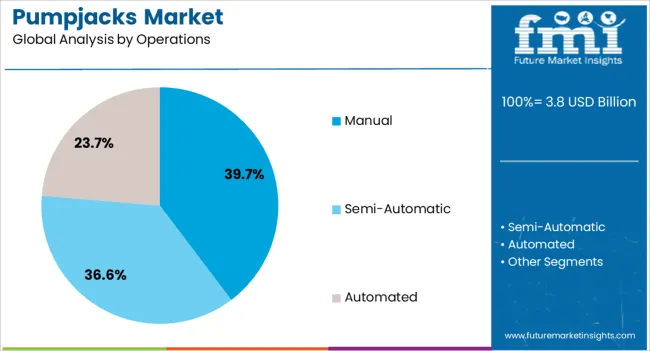

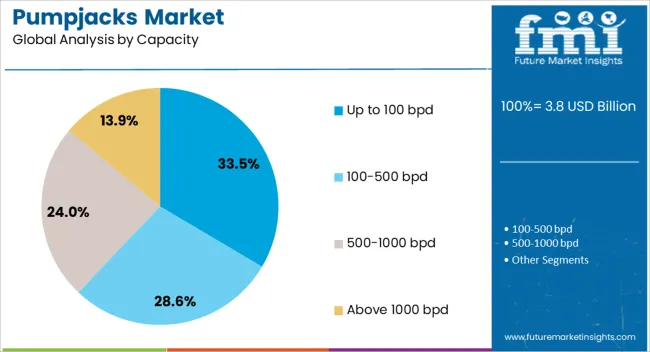

The pumpjacks market is segmented by type, operations, capacity, end-use, distribution channel, and geographic regions. By type, pumpjacks market is divided into conventional pump jacks, hydraulic pump jacks, electric pump jacks, and others (Gas Lift Pump Jacks, etc.). In terms of operations, pumpjacks market is classified into manual, semi-automatic, and automated. Based on capacity, pumpjacks market is segmented into up to 100 bpd, 100-500 bpd, 500-1000 bpd, and above 1000 bpd. By end-use, pumpjacks market is segmented into oil and gas industry, mining industry, agriculture, and others (construction, geothermal energy production, etc.). By distribution channel, pumpjacks market is segmented into direct and indirect. Regionally, the pumpjacks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The conventional pump jacks type segment is expected to hold 48.60% of the total market revenue by 2025, making it the leading type category. This dominance is attributed to its proven mechanical reliability, ease of operation, and adaptability in varied geological conditions.

Conventional units have a long-standing track record of efficient oil extraction from both shallow and deep wells, making them a preferred choice for operators seeking cost-effective artificial lift solutions. Their simpler design allows for easier maintenance, lower downtime, and faster deployment in the field.

The segment’s sustained use in mature and marginal fields has reinforced its strong market position.

The manual operations segment is projected to account for 39.70% of total market revenue by 2025, positioning it as the top operational mode. Its prevalence is linked to lower capital investment requirements and operational flexibility in remote or small-scale fields where automated systems may not be economically viable.

Manual pumpjack systems allow operators to maintain production with minimal infrastructure investment while retaining control over operation timing and maintenance schedules.

The segment’s cost advantages and suitability for low-production wells have sustained its market leadership.

The up to 100 bpd capacity segment is anticipated to represent 33.50% of market revenue by 2025, making it the leading capacity category. This capacity range is well-suited for low to moderate output wells, particularly in mature fields where production rates have declined.

Operators in both developed and emerging oil markets have adopted this capacity range for its balance between output efficiency and operational cost control.

Its compatibility with both manual and automated systems further broadens its applicability, ensuring continued dominance in the pumpjacks market.

The market has grown significantly due to the rising demand for crude oil extraction and enhanced recovery techniques in onshore oilfields. Pumpjacks, also known as nodding donkeys or beam pumps, are widely used to lift crude oil from wells with insufficient reservoir pressure. Growth has been influenced by expanding oil exploration activities, aging wells requiring artificial lift, and advancements in pumpjack efficiency and automation. Technological innovations, including variable speed drives, remote monitoring, and corrosion-resistant materials, have enhanced operational reliability and energy efficiency.

Pumpjacks are extensively deployed in onshore oilfields where natural reservoir pressure is insufficient to push crude oil to the surface. These mechanical devices enable continuous extraction, maintaining production from aging or low-pressure wells. Operators prefer pumpjacks for their reliability, ease of maintenance, and ability to operate under harsh environmental conditions. In regions with mature oilfields, retrofitting existing wells with modern pumpjack systems allows extended well life and optimized production. The adoption of automated and digitally controlled pumpjacks improves monitoring, reduces downtime, and ensures consistent output. Increasing oil demand and the necessity to maintain production levels from legacy wells continue to drive the global adoption of pumpjack technologies.

Recent technological advancements have improved the efficiency, reliability, and monitoring capabilities of pumpjacks. Variable speed drives, hydraulic systems, and automated controllers allow better energy utilization and precise control over pumping operations. Remote monitoring and IoT integration enable real-time diagnostics, predictive maintenance, and operational optimization. Corrosion-resistant coatings, wear-resistant components, and modular designs extend equipment life in challenging conditions such as high salinity, extreme temperatures, or abrasive fluids. These innovations reduce maintenance costs, enhance performance, and improve safety for operators. By increasing operational efficiency and lowering total cost of ownership, modern pumpjacks have become more attractive for oilfield operators globally.

The market benefits from the expansion of oilfield services and energy infrastructure development. New onshore drilling projects, rehabilitation of aging wells, and secondary recovery techniques all require reliable artificial lift solutions. Service providers and oilfield contractors are increasingly investing in modern pumpjack systems to improve production efficiency, minimize operational downtime, and comply with safety and environmental standards. Additionally, investments in energy infrastructure, particularly in emerging economies, create demand for portable, modular, and easily maintainable pumpjacks. This trend ensures that pumpjacks remain a critical component of upstream oilfield operations, supporting both traditional crude production and enhanced recovery initiatives.

Despite growth, the pumpjacks market faces challenges related to environmental regulations, energy consumption, and maintenance costs. Strict emission and noise standards in several countries require manufacturers to develop compliant and efficient pumping solutions. Harsh operating environments can increase wear and tear, necessitating frequent inspections, lubrication, and component replacement. Fluctuating oil prices and operational expenditure pressures can impact capital investment in new pumpjack installations. Market players are addressing these challenges by adopting energy-efficient drives, corrosion-resistant materials, and predictive maintenance technologies. While operational hurdles exist, the ongoing need for onshore oil extraction ensures steady demand for pumpjacks worldwide.

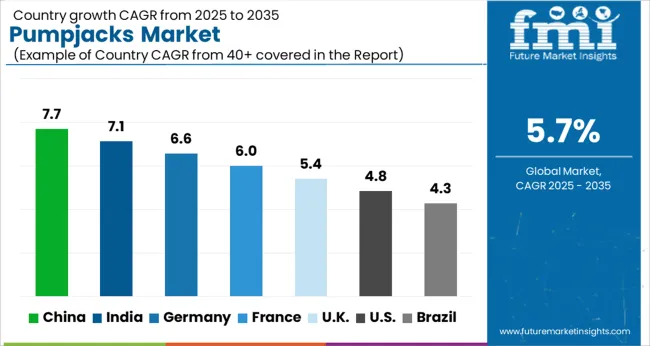

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

| USA | 4.8% |

| Brazil | 4.3% |

The market is projected to expand at a CAGR of 5.7 percent from 2025 to 2035, driven by rising oil extraction activities and modernization of energy infrastructure. Germany achieved 6.6%, supported by technological upgrades in oil recovery methods. India recorded 7.1%, reflecting increasing investments in onshore oilfields. China led with 7.7%, driven by growing domestic energy demand and enhanced oil production strategies. The United Kingdom reached 5.4%, backed by offshore oil extraction and efficiency improvements. The United States accounted for 4.8%, with stable demand in mature oilfields and maintenance operations. These countries collectively illustrate the leading hubs producing, deploying, and innovating pumpjack technologies worldwide. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 7.7%, driven by increasing oil exploration, upstream energy investments, and demand for onshore crude extraction equipment. Adoption has been reinforced by domestic manufacturers offering high efficiency, automated, and durable pumpjacks suitable for diverse oilfield conditions. Technological integration, including remote monitoring and predictive maintenance, enhances operational reliability. Rising investments in energy infrastructure and support for domestic oil production projects further stimulate market growth.

India is expected to grow at a CAGR of 7.1%, supported by rising domestic oil exploration and increased upstream investment. Adoption has been reinforced by demand for robust, low maintenance, and cost efficient pumpjacks for onshore oilfields. Domestic manufacturers and international collaborators supply both conventional and hydraulic pump systems. Government initiatives to enhance energy self-sufficiency and investment in new oilfield development support sustained growth.

Germany is projected to grow at a CAGR of 6.6%, driven by modest onshore oil exploration, small scale extraction projects, and technological upgrades in existing fields. Adoption has been reinforced by high reliability, precision, and energy efficient pumpjack solutions for smaller production sites. Manufacturers focus on advanced materials, automation, and compliance with European environmental standards. Deployment in industrial and energy sectors for niche extraction supports market continuity.

The United Kingdom is expected to grow at a CAGR of 5.4%, supported by adoption in onshore oilfields, energy projects, and marginal field extraction. Imports dominate high capacity and automated pumpjack solutions, while domestic manufacturers focus on low maintenance and smaller scale units. Upgrades of aging infrastructure and technological modernization drive incremental demand. The pumpjacks market in the U.K. is experiencing growth due to the continued focus on maximizing output from mature oilfields and ensuring energy security amid global supply uncertainties. Many of the country’s onshore and offshore wells are in late production stages, requiring reliable artificial lift systems such as pumpjacks to sustain crude oil extraction.

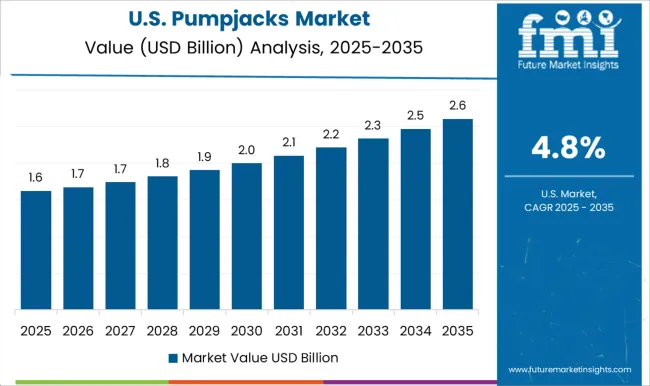

The United States is projected to grow at a CAGR of 4.8%, driven by adoption in shale and conventional onshore oilfields, with a focus on hydraulic, automated, and energy efficient pumpjacks. Domestic manufacturers emphasize durability, remote monitoring, and predictive maintenance. Sustained demand is supported by oilfield modernization, enhanced recovery techniques, and expanding upstream production projects. The pumpjacks market in the U.S. is growing due to the country’s large number of mature oilfields, particularly in regions like Texas, Oklahoma, and North Dakota, where artificial lift systems are essential to maintain production levels. With the shale boom and unconventional drilling continuing to play a major role, pumpjacks remain a cost-effective solution for enhancing crude oil recovery.

The market is led by a blend of global oilfield service providers, equipment manufacturers, and energy companies, offering solutions for crude oil extraction and artificial lift applications. Baker Hughes Company, Halliburton, and Schlumberger focus on advanced pumpjack systems integrated with digital monitoring and automation technologies to enhance operational efficiency and reduce downtime. Lufkin Industries LLC, Dover Corporation, and FMC Technologies provide robust mechanical designs and modular units suitable for both onshore and offshore operations, emphasizing durability and ease of maintenance.

Canadian Advanced ESP Inc., Borets International Limited, and Cavins Oil Well Tools deliver specialized solutions including high-capacity, customizable pumpjacks designed for varying well conditions and production requirements. Gardner Denver Holdings Inc., General Electric Company, and National Oilwell Varco, Inc. offer energy-efficient pumping solutions and aftermarket support, ensuring reliable performance and prolonged equipment lifespan.

Occidental Petroleum Corporation and Tenaris S.A. contribute through vertically integrated supply, combining pumpjack manufacturing with oilfield services. Competitive dynamics are shaped by technological innovation, energy efficiency, regulatory compliance, and service capabilities. Companies invest in predictive maintenance, IoT-enabled monitoring, and enhanced materials to withstand extreme environments. Market growth is driven by increasing oil production activities, aging well infrastructure, and the need for reliable artificial lift systems, prompting players to focus on performance optimization, cost efficiency, and global service networks.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.8 billion |

| Type | Conventional Pump Jacks, Hydraulic Pump Jacks, Electric Pump Jacks, and Others (Gas Lift Pump Jacks, etc.) |

| Operations | Manual, Semi-Automatic, and Automated |

| Capacity | Up to 100 bpd, 100-500 bpd, 500-1000 bpd, and Above 1000 bpd |

| End-use | Oil and Gas Industry, Mining Industry, Agriculture, and Others (Construction, Geothermal Energy Production, etc.) |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Baker Hughes Company, Borets International Limited, Canadian Advanced ESP Inc., Cavins Oil Well Tools, Dover Corporation, FMC Technologies Inc., Gardner Denver Holdings Inc., General Electric Company, Halliburton Company, Lufkin Industries LLC, National Oilwell Varco, Inc., Occidental Petroleum Corporation, Schlumberger Limited, Tenaris S.A., and Weatherford International |

| Additional Attributes | Dollar sales by pumpjack type and application, demand dynamics across onshore oil extraction, enhanced oil recovery, and energy infrastructure sectors, regional trends in upstream oilfield adoption, innovation in efficiency, automation, and remote monitoring, environmental impact of energy consumption and emissions, and emerging use cases in marginal field development, unconventional oil extraction, and digital oilfield integration. |

The global pumpjacks market is estimated to be valued at USD 3.8 billion in 2025.

The market size for the pumpjacks market is projected to reach USD 6.6 billion by 2035.

The pumpjacks market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in pumpjacks market are conventional pump jacks, hydraulic pump jacks, electric pump jacks and others (gas lift pump jacks, etc.).

In terms of operations, manual segment to command 39.7% share in the pumpjacks market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA