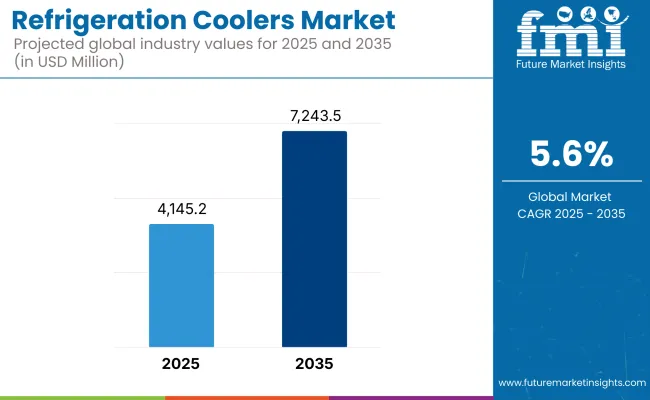

The refrigeration coolers market is anticipated to witness significant growth between 2025 and 2035, driven by increasing demand for energy-efficient cooling solutions across various industries. The market was valued at USD 4,145.2 million in 2025 and is projected to reach USD 7,243.5 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.6% over the forecast period.

Several factors contribute to the market's expansion. The rising adoption of eco-friendly and energy-efficient refrigeration systems in the food & beverage, healthcare, and retail sectors is a primary growth driver. Additionally, advancements in smart cooling technologies and increasing government regulations promoting the use of low-GWP (Global Warming Potential) refrigerants are further fuelling market demand.

Despite the promising outlook, the market faces challenges such as high initial investment costs, stringent environmental regulations, and maintenance complexities. However, the ongoing transition toward sustainable refrigeration solutions and digital monitoring technologies is expected to create lucrative opportunities for market players.

Growth in the refrigeration coolers market continues as advanced cooling solution grows in demand along with energy efficiency regulations and technological advancements. The market will also continue to expand in the upcoming decade due to focus on sustainability across industries, and implementation of smart refrigeration systems.

The refrigeration coolers market is notably led by North America, where food processing, retail, and healthcare sectors dominate. Additionally, the West Coast presents lucrative opportunities for the refrigeration coolers market as fast-casual dining establishments and disposable food packaging are on the rise. Supermarkets, cold storage facilities, and drug companies are among the big demand generators for advanced refrigeration solutions in the United States and Canada, which are top markets for this equipment.

With an increasing emphasis on energy efficiency and sustainability, there has been a rise in the use of eco-friendly refrigerants and smart cooling technologies. However, there remain obstacles in terms of tight environmental regulations and high upfront capital expenditure. Innovations by manufacturers such as energy-efficient compressors and IoT-enabled monitoring systems are being adopted to improve operational efficiency while meeting regulation compliance.

Europe is a prominent market for refrigeration coolers due to the presence of stringent food safety regulations, as well as sustainability initiatives. Due to the large demand for advanced refrigeration systems in food retail, logistics and medical applications, countries like Germany, France, UK and Italy will yield high demand for it.

Indeed, strict fluorinated gas (F-gas) regulations in the EU have further driven an energy efficient transition toward natural refrigerants and effective cooling technologies. Small and medium-sized businesses face challenges due to high installation and maintenance costs. Modular refrigeration solution providers and hybrid cooling systems players are at the forefront of most sustainable operational practices in the industry, driven by the need to curtail operational costs without compromising regulatory compliance.

The Asia-Pacific refrigeration coolers market is gaining traction due to the region’s rapid urbanization, expanding retail infrastructure, and increasing demand for cold chain logistics. The major markets of China, India, Japan and South Korea are propelling market growth, with the food delivery, e-commerce and pharmaceutical sectors booming.

Market trends are being driven by government policies advocating for energy efficient cooling systems and the prohibition of high-GWP refrigerants. But high electricity prices and inadequate access to advanced cooling systems continue to pose challenges. In order to resolve these factors, manufacturers are focusing on research and development to come up with energy-efficient, region-specific, affordable refrigeration systems.

Challenges - Energy Efficiency and Environmental Regulations

These are usually specific and one of the major requirements in the refrigeration coolers market. All around the globe, governments have been legislating increasingly stringent limits on greenhouse gas emissions and refrigerant use, from the phase out of hydrofluorocarbons (HFCs) via the Kigali Amendment. These evolving policies necessitate that manufacturers that invest in alternative refrigerants (natural refrigerants (CO₂, ammonia, and hydrocarbons)) and energy-efficient cooling technology, which may incur extra production costs.

Opportunities - Advancements in Smart and Sustainable Cooling Technologies

The transition towards green and intelligent refrigeration systems is a huge growth opportunity. The industry is seeing a transformation with developments like IoT-based cooling systems, AI integrated temperature control systems, and energy-saving inverter compressors. Request for low-carbon footprint cooling systems is witnessing a steep rise in sectors such as retail, food & beverage, pharmaceuticals, and data centers, further contributing to the investments made for development of sustainable cooling solutions.

Renewable Energy Integration: Companies that invest in integrating renewable energy generation into their facilities will be at the forefront of the net-zero shift, as they will be better positioned to operate at minimal or zero emissions and also be able to leverage energy cost savings.

The transition to energy-efficient refrigeration coolers became stronger between 2020 and 2024, as growing electricity prices and stricter regulations put pressure on the refrigeration industry. Smart monitoring systems and the use of natural refrigerants also increased steadily, but because of their high investment cost, this did not lead to broad adoption.

The future is bright as we look towards 2025 to 2035 with mass adoption of AI-based cooling solutions, autonomous temperature control, and heat recovery systems that allow the industry to lead in energy efficiency. Solar-powered refrigeration and modular cooling systems will transform market dynamics, in line with global sustainability goals.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter energy efficiency and refrigerant regulations |

| Technological Advancements | Growth of IoT-based remote monitoring |

| Industry Adoption | Gradual shift to eco-friendly and high-efficiency coolers |

| Supply Chain and Sourcing | Increased demand for sustainable refrigerants |

| Market Competition | Traditional manufacturers and emerging eco-friendly start-ups |

| Market Growth Drivers | Growing food & beverage and retail refrigeration needs |

| Sustainability and Energy Efficiency | Initial phase of transitioning to sustainable cooling |

| Consumer Preferences | Preference for cost-efficient and durable refrigeration units |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Widespread adoption of low-GWP and natural refrigerants |

| Technological Advancements | AI-driven predictive cooling and automated temperature controls |

| Industry Adoption | Dominance of smart and modular cooling solutions |

| Supply Chain and Sourcing | Widespread use of energy-efficient compressors and renewable-powered systems |

| Market Competition | Leading players investing in net-zero cooling solutions |

| Market Growth Drivers | Expansion of cold chain logistics, pharmaceuticals, and data centre cooling |

| Sustainability and Energy Efficiency | Carbon-neutral refrigeration and widespread solar-powered systems |

| Consumer Preferences | Demand for AI-powered, sustainable, and self-regulating cooling systems |

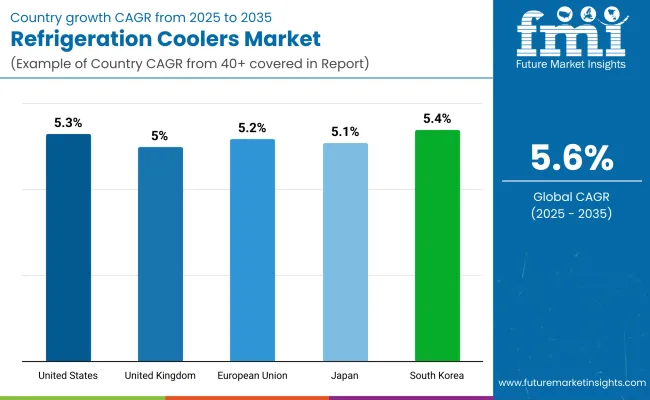

Driven by high demand from thermal-sensitive applications like food and beverage, pharmaceuticals, and retail, the United States continues to be a strong market for refrigeration coolers. Surging cold storage facilities, growing preference for energy-efficient thermal solution coupled with stringent rules for maintaining food safety are the factors fuelling market growth. The countries demand for advanced refrigeration technology has also been further stimulated by the boom of e-commerce grocery services.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.3% |

The United Kingdom refrigeration coolers market is further anticipated to grow steadily over the next few years backed by the expanding food retail sector, demand for temperature-controlled pharmaceuticals, and government incentives for energy-efficient cooling systems. Increasing utilization of eco-friendly refrigeration technologies like CO2-based cooling solutions is further contributing to market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.0% |

Substantial growth in refrigeration coolers market is expected from European region especially macros like Germany, France and Italy. The growing demand for cold chain logistics in the food and pharmaceutical industries, along with stringent regulations regarding fluorinated greenhouse gases (F-gases), is paving the way for green refrigeration systems. Additionally, strong representation of established refrigeration equipment manufacturers is another factor fuelling the growth of market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.2% |

The increasing adoption of energy-efficient cooling technologies, government supporting policies for environmentally friendly refrigeration systems, varied retail and convenience store expansion are the primary drivers of Japan refrigeration coolers market. The increasing requirement for frozen food and an efficient pharmaceutical storage solution are acting as fuel for the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

The demand for refrigeration coolers is growing across South Korea with rapid urbanization, rising demand for commercial refrigeration in low-temperature markets such as supermarkets and restaurants; and investments in cold chain logistics. Additionally, government assistance on sustainable refrigeration practices and the adoption of next generation cooling technologies accelerate market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.4% |

Businesses need energy-efficient and technologically advanced cooling solutions, driving significant growth in the refrigeration coolers market. From food & beverage to retail, hospitality, pharmaceuticals, and logistics, these coolers are critical for temperature management for product preservation and safety.

With increased focus on environmental sustainability and strict energy standards, eco-friendly refrigeration solutions have been embraced even more. Smart temperature control, IoT connectivity, and advanced insulation technologies are among the key features manufacturers are working on for these next-gen refrigeration coolers to make them even more energy-efficient without compromising cooling performance.

The refrigeration coolers market has been driven by growing urbanization, rising number of convenience stores, and emphasis on reduction of food wastage. The transition to natural refrigerants and sustainable cooling systems is also anticipated to have a profound impact on market developments. This growth is due to the increasing expectations of businesses and consumers for reliability, energy efficiency, and cost-effectiveness, resulting in more innovative refrigeration coolers becoming available across a variety of industries.

Display showcases and storage water coolers highly contribute to the market size of water coolers among different products owing to their high usage in commercial and industrial environments.

The market is split, with display showcases accounting for a majority of the market, driven largely by retail and foodservice. Supermarkets, convenience stores, bakeries and restaurants widely use these coolers to keeps perishable food and beverages on display while keeping optimal freshness. On the other hand, increase in demand for fresh and visually appealing products has led to retailers investing in high-quality display refrigeration units.

On top of that innovations in LED lighting, anti-fog glass, and digital temperature regulation have made modern display showcases more energy efficient and aesthetically pleasing. With food safety standards becoming more stringent globally, businesses are emphasizing refrigeration solutions to increase shelf life and lessen spoilage, leading to sustained demand for these products.

The other important segment is storage water cooler, which is used extensively in commercial offices, educational institutions, possibly medical facilities and even in public areas. The rising awareness about hydration and increasing demand for chilled drinking water solutions have contributed to the adoption of storage water coolers. Designed to service high foot-fall areas, the units deliver cold water in a consistent and hygienically sealed manner.

New compressor technology and eco-friendly refrigerants have evolved the recycling water coolers to become more energy-efficient and environmentally sustainable. The increasing proliferation of touchless dispensing systems and ultraviolet-based purification systems is anticipated to further propel the market growth, especially in health-focused consumers.

In a wide variety of commercial environments, the growing requirement for effective chilling answers is also creating a steady escalator for display showcases in addition to storage water coolers and they are integral a part of the Refrigeration Coolers Market.

In systems type segment, autonomous refrigerators and remote-controlled refrigerators have seen an increasing incorporation, addressing various operational requirements of industries.

Self-contained refrigerators are well accepted appliances in small and medium-sized retail stores, foodservice outlets and convenience stores owing to the ease of their installations and are space efficient. These units are equipped with integrated compressors and cooling systems, allowing them to operate without external refrigeration infrastructure.

Due to their plug-and-play capabilities, not only are they perfect for businesses who need a quick and easy refrigeration option, but they're also a cost-effective solution. Moreover, the development of energy-efficient compressors and green refrigerants has improved the sustainability of self-contained refrigeration units, corresponding with international environmental regulations. However, the demand for self-contained refrigerators is likely to see steady growth with the growing QSR sector and the upsurge specialty grocery stores with small formats.

On the other hand, the remote-controlled refrigerators are hugely popular in large-scale commercial and industrial applications. This is typically used in supermarkets, cold storage units, and distribution centres that need centralized cooling systems. Remote controlled refrigerators, by locating the compressor and condensing unit in a separate mechanical room, reduce noise, and heat emissions within the store environment, making it more comfortable for customers and employees.

These systems can also be customized to suit your refrigeration capacity and energy management needs, adding convenience for businesses seeking to maximize operational efficiency. The increasing trend toward smart refrigeration technologies, remote monitoring, and predictive maintenance has also facilitated the adoption of remotely operated cooling systems.

Self-contained and remotely operated refrigerators would go on to drive the trends for refrigeration coolers market as energy efficiency and operational flexibility gain primacy for businesses in the near future.

Growing demand for refrigeration coolers in retail, food & beverage, pharmaceutical, & hospitality industries has accelerated the growth of refrigeration coolers market. A refrigeration cooler provides effective cooling with energy savings and improved temperature control, making it a popular option in commercial and industrial applications. Manufacturers are steadying on sustainability, smart cooling technologies, and eco-friendly refrigerants in line with changing industry norms.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| True Manufacturing | 20-24% |

| Hussmann Corporation | 15-19% |

| Dover Corporation | 12-16% |

| Turbo Air | 10-14% |

| Other Companies (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| True Manufacturing | Specializes in high-performance, energy-efficient refrigeration coolers with smart monitoring systems. |

| Hussmann Corporation | Develops advanced cooling solutions with a focus on retail and supermarket refrigeration. |

| Dover Corporation | Provides IoT-enabled refrigeration systems for efficient cooling performance and remote monitoring. |

| Turbo Air | Offers compact and space-saving refrigeration coolers designed for restaurants and commercial kitchens. |

Key Company Insights

True Manufacturing (20-24%)

Leader in available efficiency in the refrigeration coolers market. Its emphasis on green refrigerants, intelligent temperature control, and digital tracking has also bolstered its market share.

Hussmann Corporation (15-19%)

The Hussmann Corporation is a provider of commercial refrigeration products, including supermarket and convenience store cooling systems. Incorporation of LED lighting for energy efficiency and improved temperature management also add to the company's competitive advantage.

Dover Corporation (12-16%)

Dover Corporation is focused on technological innovation, providing IoT-enabled refrigeration systems optimizing both cooling performance and energy consumption. Track your food as it moves through the smart refrigeration solutions that make it possible for businesses to increase operational efficiency while lowering expenditure.

Turbo Air (10-14%)

Turbo Air refrigeration coolers are the best for cafe, small retail store and food service businesses because they are compact and high efficiency. Turbo Air refrigerating equipment. Self-cleaning condenser technology helps to maintain performance, reliability and long-term efficiency.

Other Players (30-40% Combined)

Due to the competitiveness in the refrigeration coolers market, many new players are entering into energy efficient solutions, sustainable cooling technologies, and smart refrigeration solutions. Key players include:

The overall market size for the refrigeration coolers market was USD 4,145.2 million in 2025.

The refrigeration coolers market is expected to reach USD 7,243.5 million in 2035.

The demand for refrigeration coolers is expected to rise due to increasing adoption of energy-efficient cooling solutions, rising demand from the food & beverage and pharmaceutical industries, and advancements in refrigeration technologies aimed at reducing environmental impact.

The top five countries driving the development of the refrigeration coolers market are the USA, China, Germany, Japan, and India.

Air-cooled refrigeration coolers and water-cooled refrigeration coolers are expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Refrigeration and Air Conditioning Compressors Market Size and Share Forecast Outlook 2025 to 2035

Refrigeration Compressor Market Size and Share Forecast Outlook 2025 to 2035

Refrigeration Oil Market Growth - Trends & Forecast 2025 to 2035

Refrigeration Compressor Industry Analysis in Western Europe Analysis by Product Type, Refrigerant Type, Application and Country - Forecast for 2025 to 2035

Korea Refrigeration Compressor Market Analysis by Product Type, Application, Refrigerant Type, and Province through 2035

Refrigeration Leak Detector Market Growth - Trends & Forecast 2025 to 2035

Key Players & Market Share in Refrigeration and Air Conditioning Compressors

Refrigeration Gauge Market

Refrigeration Monitoring Market

Bar Refrigeration Market

Japan Refrigeration Compressor Market Analysis by Product Type, Application, Refrigerant Type, and City through 2035

Beverage Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Commercial Refrigeration System Market Size and Share Forecast Outlook 2025 to 2035

Commercial Refrigeration Compressor Market Growth - Trends, Demand & Innovations 2025 to 2035

Commercial Refrigeration Equipment Market Growth – Trends & Forecast 2024-2034

Subcritical CO2 Refrigeration System Market Size and Share Forecast Outlook 2025 to 2035

Commercial Food Refrigeration Equipment Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

United States Commercial Refrigeration Equipment Market Forecast and Outlook 2025 to 2035

North America Commercial Refrigeration Equipment Industry Analysis by Product Type, Application, and Country through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA