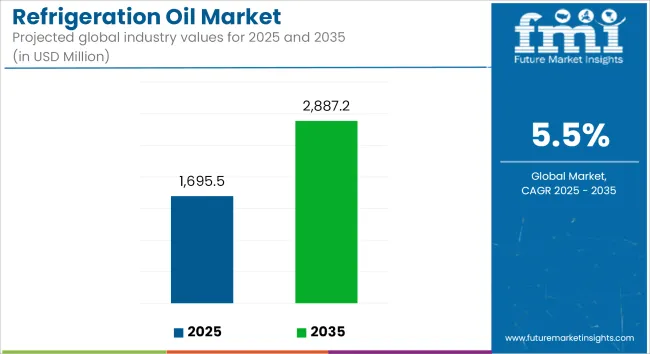

The global refrigeration oil market is projected to grow from USD 1,695.5 million in 2025 to USD 2,887.2 million by 2035, reflecting a CAGR of 5.5% over the forecast period. Growth is being supported by increased deployment of energy-efficient cooling systems, expansion of cold chain infrastructure, and a shift toward environmentally compliant refrigeration technologies.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,695.5 million |

| Industry Value (2035F) | USD 2,887.2 million |

| CAGR (2025 to 2035) | 5.5% |

Refrigeration oil is being used to lubricate compressors in cooling and air-conditioning systems, ensuring smooth operation, minimizing friction, and facilitating heat dissipation. As refrigerant regulations tighten globally, synthetic oils compatible with low-GWP (Global Warming Potential) refrigerants are being adopted in commercial and industrial cooling applications. These oils are being formulated to perform under the thermodynamic requirements of advanced refrigerant blends, particularly HFOs (hydrofluoroolefins).

Cold storage and logistics applications are contributing significantly to demand. Pharmaceutical storage, food preservation, and perishable goods transport are being expanded across regions, driving new installations of refrigeration systems and associated lubricant consumption. In commercial buildings, HVAC retrofits and new system installations are being encouraged by government efficiency mandates and urban development initiatives.

In the manufacturing sector, industrial refrigeration units are being upgraded with next-generation oils designed for improved thermal and oxidative stability. Equipment downtime is being reduced through enhanced lubrication, which is contributing to higher system uptime and reduced maintenance costs. Synthetic refrigeration oils, such as POE (polyol ester) and PAG (polyalkylene glycol) types, are being favored for their compatibility with HFC alternatives and their extended service life.

Technological advancements in refrigeration oil are being observed in the development of nanotechnology-enhanced lubricants, which offer improved thermal conductivity and load-bearing capacity. Research is also being directed toward smart oils that can monitor wear or degradation characteristics through embedded additives, aligning with the growing use of IoT and AI-enabled monitoring systems in refrigeration equipment.

The refrigeration oil market is expected to continue expanding steadily as refrigerant transitions progress and sustainability goals influence equipment specifications. New refrigerant-oil pairings, improved compressor designs, and broader integration of predictive maintenance systems are expected to support demand in near future.

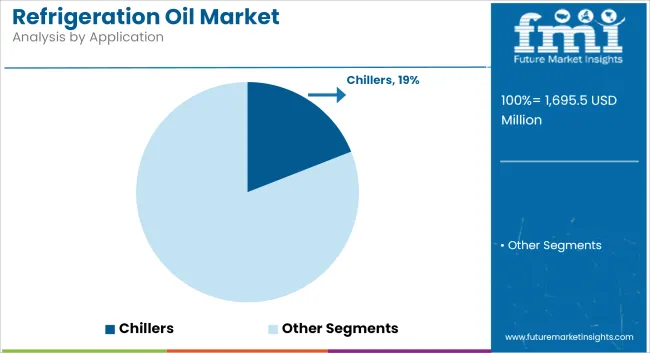

Chillers are projected to hold approximately 19% of the global refrigeration oil market share in 2025 and are expected to grow at a CAGR of 5.6% through 2035. These systems are extensively used in commercial buildings, process industries, and data centers, where efficient heat removal is essential for operational stability.

Refrigeration oils play a key role in lubricating compressors within chillers, improving system reliability and reducing energy consumption. As the global demand for cooling infrastructure increases, particularly in hot-climate urban centers and cold chain logistics, the need for high-performance oils designed for continuous operation and thermal stability continues to rise.

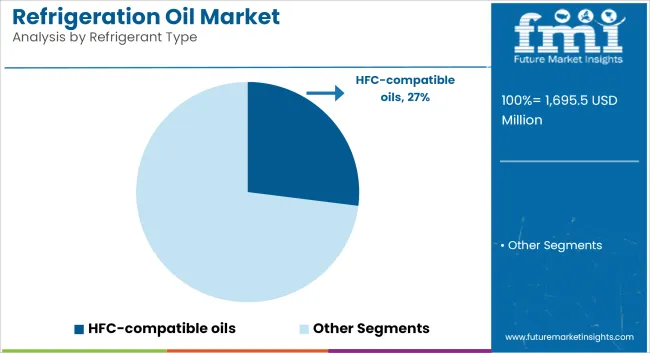

HFC-compatible refrigeration oils are estimated to account for approximately 27% of the global market share in 2025 and are projected to grow at a CAGR of 5.4% through 2035. Oils formulated for HFC refrigerants such as R-134a and R-410A are widely used across air conditioning, supermarket refrigeration, and transport cooling systems.

While HFCs are being gradually phased down in some regions due to their high global warming potential (GWP), the substantial existing infrastructure continues to support demand for compatible synthetic oils such as POE (polyol ester) and PAG (polyalkylene glycol). As OEMs and service providers balance regulatory transition and maintenance of legacy systems, the HFC segment is expected to retain relevance in the medium term across developed and developing economies.

Stringent Environmental Regulations on Refrigerants and Lubricants

The most significant challenge in handling refrigeration oils is the fact that they are subjected to stringent environmental regulations on refrigerants and lubricants. The manufacturers are being forced to change from high-GWP refrigerants, such as HFCs and HCFCs, to more ecological mixtures of lubricants, including some with vegetable oil being additionally added.

On the other hand, the transformation into eco-friendly refrigerants inevitably causes the need for the reformulation of refrigeration oils, which is a difficult issue with respect to the performance, cost, and supply chain adjustments. Adaptation to changing environmental regulations in different geographies can be complicated and result in hurdles to product development and marketing.

High Costs Associated with Synthetic Refrigeration Oils

Synthetic refrigeration oils, despite their excellent performance, are produced and applied with costs that are higher than mineral-based refrigeration oils. This cost factor restricts the market in price-sensitive industries and developing countries which remain a key problem.

The synthetic lubricants raw material price alternations have a direct impact on the market and have brought about instability for the producers and consumers. As a result, many companies have resulted in concentrating on methods which lower the cost of production, developing localized supply chains, and offering hybrid lube options to aid market affordability and accessibility.

Advancements in Smart Refrigeration and AI-Based Lubrication Monitoring

The connection of smart refrigeration systems to AI-based lubrication monitoring is creating exclusivity in the refrigeration oil market. The new cooling system trend with the digital tools and automated lubrication control, together with predictive maintenance, has broadened the horizon of the industry for an easy-to-use and energy-efficient solution.

The IoT solutions that allow for the securing of HVAC systems and refrigeration energy efficiency in a real-time manner also cover the performance of lubrication, viscosity levels, and oil lifetime. The developments in this area promise to knock the market for the fresh round of next-gen revision oils that are developed for smart, connected cooling applications.

Growing Demand in Data Centers, Cold Chain Logistics, and Green Buildings

The demand for high-performance refrigeration oils is on the rise as data centers are being built, logistic cold chains are expanding, and green building initiatives are being implemented more and more. The digitalization and cloud computing industries are driving the investments in data center cooling systems where high-efficiency lubrication is a critical factor for operational reliability.

The global concentration on food security and pharmaceutical cold storage has also a role to play in the market expansion, as the industries are investing in the sustainable and energy-efficient refrigeration solutions. Furthermore, the embrace of the green building with smart HVAC systems is endorsing the low-emission, high-efficiency refrigeration oils and so the continuity in the market growth.

The refrigeration oil sector in the United States is at a steady increase because of the growth in cold storage facilities, the tendency of using more energy-efficient HVAC systems, and more food processing industries. The increase in e-commerce grocery delivery services is a factor that drives the demand for commercial refrigeration systems, which in turn raises the request for high-performance refrigeration oils.

EPA laws on refrigerants and energy efficiency standards are compelling manufacturers to make low-global-warming-potential (GWP) plus environmentally friendly refrigeration oils. The pharmaceutical cold chain is the one that is now extending.

This type of cold chain is important in storing temperature-sensitive vaccines and biologics, which are now needed more than ever-high-stability refrigeration lubricants. In the term of use and application of synthetic refrigerants, the focus is shifting from achieving lower GWP to providing more stability to the component in the operating temperature range.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.7% |

The market for refrigeration oil in the United Kingdom is currently on the rise. This is mainly due to the increased embrace of eco-friendly refrigeration, the low refrigerant fluid regulations, and the expansion of retail refrigeration which are among the main drivers. The government is supporting the use of such systems with its Net Zero 2050 goals, which results in a higher demand for synthetic, eco-friendly refrigeration oils.

The rapid online grocery and food retail growth in the UK is a major factor contributing to this. As more supermarkets and distribution centers are turning to high-efficiency refrigeration units, the demand for grade A refrigeration oils are further elevated.

Some of the HVAC automation's latest developments and the smart cooling technologies lead to higher integration of the low-viscosity synthetic oils among the intelligent cooling systems which, therefore, tend to work more effectively and use less energy.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.3% |

The European Union refrigeration oil market is steadily increasing its size with adverse environmental conditions such as refrigerant emission, along with the surging food cold chain industry, and the growing acceptance of renewable energy-powered cooling systems mainly through the help of IG-U environmental controls of the F-Gas Regulation, which envisages the gradual elimination of high-GWP refrigerants, thus causing industries to adapt to synthetic refrigeration oils that are compatible with next-gen refrigerants.

Industrial refrigeration lubricants are receiving a push from food & beverage processing sector growth especially in Germany, France, and Italy. The utilization of solar-assisted and CO₂-based refrigeration systems creates bio-based and ultra-low-viscosity refrigeration oils which means a higher innovation rate.

The emergence of LEED projects and district cooling plans in cities is making the use of high-efficiency lubricants in HVAC systems for commercial buildings more common place.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.5% |

The Japan refrigeration oil market is on the rise because of the installation of advanced HVAC systems, the growing trend of low-GWP refrigerants, and the increasing demand for semiconductor and electronics cooling applications. Japan's leading manufacturing and semiconductor sectors are deeply in need of high-performance refrigeration oils and usually use them for precision cooling.

The surge in electric vehicle (EV) battery cooling devices is a primary factor for the demand of ultra-low-density refrigeration oils, which therefore improves thermal management in battery packs. Synthetic and biodegradable refrigeration oils are gaining higher ground due to the strict environmental laws imposed by Japan.

The ongoing development of zero-energy buildings (ZEBs) and district cooling systems is yet another factor that fuels the market with energy-efficient lubes in smart HVAC applications.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.2% |

The refrigeration oil market in South Korea is showing a consistent uptrend, driven by the expansion of cold chain logistics, increased production of semiconductors, and the launch of green HVAC systems. Among these factors, it is the launching of e-commerce and the food delivery business that is pushing the demand for temperature-controlled warehouses, which, in turn, is leading to increased sales of the high-efficiency refrigeration oils.

With South Korea becoming the key player in the production of semiconductors and display panels, there is a growing extra demand for specialized refrigeration oils that are utilized in precision cooling systems in cleanroom environments.

Besides, the government's drive to cut down the carbon emissions that result from the HVAC and industrial refrigeration units is affirming the switch to lubricants that are compatible with the refrigerants of low GWP.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.4% |

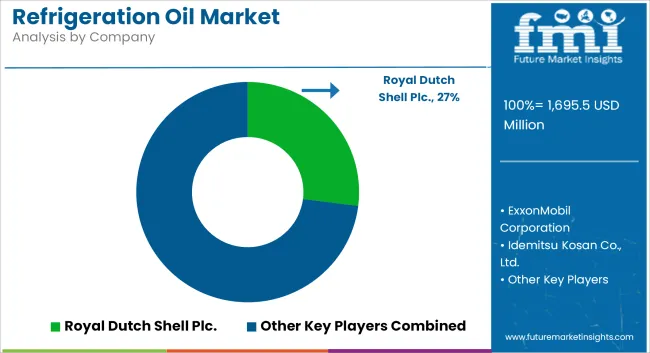

The refrigeration oil market is becoming more competitive as companies develop environmentally sustainable oils compatible with low-GWP refrigerants. Focus is on enhancing thermal stability, chemical resistance, and energy efficiency, which improve system performance, reduce emissions, and boost compressor efficiency. These innovations align with global climate goals and address the evolving needs of modern refrigeration systems.

The global refrigeration oil market is projected to reach USD 1,695.5 million by the end of 2025.

The market is anticipated to grow at a CAGR of 5.5% over the forecast period.

By 2035, the refrigeration oil market is expected to reach USD 2,887.2 million.

The air conditioners segment is expected to dominate due to rising demand for residential and commercial air conditioning systems, coupled with advancements in energy-efficient cooling technologies.

Key players in the refrigeration oil market include ExxonMobil Corporation, Idemitsu Kosan Co., Ltd., TotalEnergies, Shell plc, and FUCHS Petrolub SE.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Refrigeration and Air Conditioning Compressors Market Size and Share Forecast Outlook 2025 to 2035

Refrigeration Compressor Market Size and Share Forecast Outlook 2025 to 2035

Refrigeration Compressor Industry Analysis in Western Europe Analysis by Product Type, Refrigerant Type, Application and Country - Forecast for 2025 to 2035

Korea Refrigeration Compressor Market Analysis by Product Type, Application, Refrigerant Type, and Province through 2035

Refrigeration Coolers Market Growth – Trends & Forecast 2025 to 2035

Refrigeration Leak Detector Market Growth - Trends & Forecast 2025 to 2035

Key Players & Market Share in Refrigeration and Air Conditioning Compressors

Refrigeration Gauge Market

Refrigeration Monitoring Market

Bar Refrigeration Market

Japan Refrigeration Compressor Market Analysis by Product Type, Application, Refrigerant Type, and City through 2035

Beverage Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Commercial Refrigeration System Market Size and Share Forecast Outlook 2025 to 2035

Commercial Refrigeration Compressor Market Growth - Trends, Demand & Innovations 2025 to 2035

Commercial Refrigeration Equipment Market Growth – Trends & Forecast 2024-2034

Commercial Food Refrigeration Equipment Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

United States Commercial Refrigeration Equipment Market Size and Share Forecast Outlook 2025 to 2035

North America Commercial Refrigeration Equipment Industry Analysis by Product Type, Application, and Country through 2035

Commercial Undercounter & Worktop Refrigeration Market – Compact Cooling Solutions 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA