The Latin America Food Service Equipment Sales are estimated around USD 5,279.4 million in 2025 to USD 7,491.0 million by 2035, with a compound annual growth rate (CAGR) of 4.0% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 5,279.4 million |

| Projected Latin America Value (2035F) | USD 7,491.0 million |

| Value-based CAGR (2025 to 2035) | 4.0% |

The Latin American food service equipment industry is experiencing steady growth, driven by the expansion of the hospitality sector, increasing urbanization, and rising consumer demand for quick-service and fine-dining restaurants. As the region witnesses a surge in fast food chains, cafés, cloud kitchens, and institutional catering services, the need for modern, efficient, and energy-saving kitchen equipment has increased significantly.

Key segments within the industry include cooking equipment (ovens, fryers, grills), refrigeration systems, food preparation equipment, dishwashing systems, and storage solutions. The shift toward automated and smart kitchen appliances is also gaining traction, particularly as food service operators seek to improve operational efficiency, reduce energy costs, and meet evolving food safety standards.

Brazil and Mexico are the largest markets, accounting for a significant share due to their expanding food service sector and growing tourism industry. Meanwhile, emerging economies in the region are witnessing increasing investment in commercial kitchen infrastructure, supported by the rise of franchise-based food chains and cloud kitchens.

Additionally, the industry is seeing a growing emphasis on sustainable and eco-friendly equipment, with manufacturers focusing on energy-efficient solutions to align with green kitchen initiatives. As the demand for high-performance and technologically advanced food service equipment continues to rise, the Latin American market is poised for strong growth in the coming years.

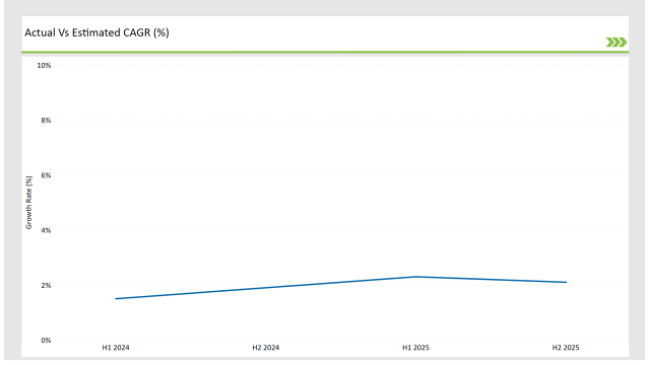

The table reflect a thoroughrelative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Latin AmericanFood Service EquipmentIndustry. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 1.5% |

| H2 (2024 to 2034) | 1.9% |

| H1 (2025 to 2035) | 2.3% |

| H2 (2025 to 2035) | 2.1% |

H1 signifies period from January to June, H2 Signifies period from July to December

For the Latin AmericanFood Service Equipment market, the sector is predicted to grow at a CAGR of 1.5% during the first half of 2024, with an increase to 1.9% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 2.3% in H1 but is expected to rise to 2.1% in H2.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Electrolux has focused equipment like the SkyLine Combi Oven, which automatically notifies the SkyLine Blast Chiller to prepare for blast chilling. The company is prioritizing products that are rigorously tested and validated by the exclusive Electrolux International Academy. |

| Jan 2025 | Reading Bakery Systems (RBS) introduced the Thomas L. Green Emithermic XE Oven, a more energy-efficient and environmentally friendly alternative to traditional Direct Gas Fired (DGF) ovens. This oven reduces energy use, lowers emissions, and simplifies cleaning while enhancing cracker baking performance. |

Expansion of Quick-Service Restaurants (QSRs) and Cloud Kitchens

The rapid growth of fast-food chains, delivery-only cloud kitchens, and franchise-based restaurants is significantly driving demand for advanced food service equipment. As consumer preferences shift toward convenience, takeout, and online food delivery, restaurant operators are investing in high-efficiency cooking, refrigeration, and food preparation equipment to streamline operations and meet rising demand.

Adoption of Energy-Efficient and Smart Kitchen Equipment

With increasing emphasis on sustainability and cost savings, food service providers are opting for energy-efficient, automated, and IoT-enabled kitchen appliances. Advanced equipment such as smart ovens, induction cooktops, and automated dishwashers not only reduce energy consumption and operational costs but also enhance food safety and quality control, making them a crucial factor in market growth.

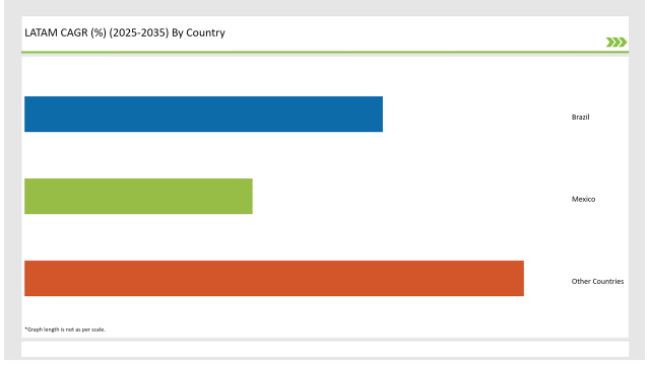

The below table reflects data for the estimated share of the top markets.

| Countries | Market Share (%) |

|---|---|

| Brazil | 33% |

| Mexico | 21% |

| Other Countries | 46% |

Brazil's strong position in the food service equipment market is driven by its large hospitality industry, with approximately 32,000 hotels and a vibrant restaurant scene, including notable establishments on global rankings like the 'World's 50 Best.

The extensive hospitality sector, coupled with increasing demand for energy-efficient, modern kitchen equipment, creates growth opportunities for the food service equipment market. Additionally, Brazil’s diverse culinary heritage encourages continuous innovation and adoption of advanced food service solutions, positioning it as a leading player in Latin America.

Mexico’s food service equipment market is bolstered by its nearly 24,700 hotels and an expansive restaurant sector, which is also gaining recognition in global culinary rankings. The growth in the hospitality sector, particularly in tourist-heavy regions, drives demand for advanced and high-quality kitchen and restaurant equipment.

With Mexico being a top destination for international tourists, the expansion of hotels, resorts, and restaurants fuels the need for food service solutions, contributing to the market's growth in the country. Additionally, rising consumer preference for high-quality dining experiences further boosts the demand for cutting-edge food service technology.

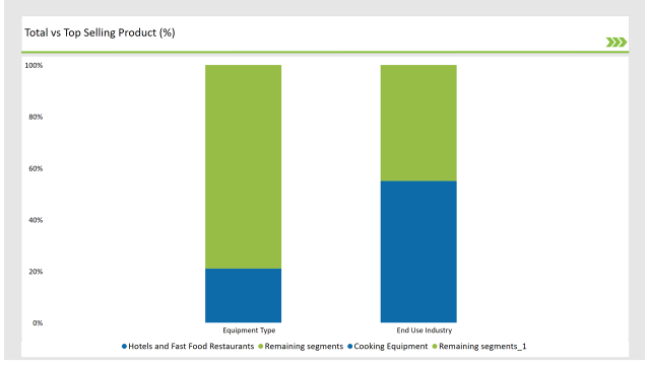

% share of Individual Categories End Use Industry and Equipment Type in 2025

| Main Segment | Market Share (%) |

|---|---|

| End Use Industry (Hotels and Fast Food Restaurants) | 55% |

| Remaining segments | 45% |

In the Hotels and Fast Food Restaurants segment, various types of food service equipment are critical to ensuring efficient operations and high-quality service. For cooking, combi ovens are widely used in both hotels and fast food restaurants due to their versatility in baking, steaming, and roasting.

Fryers are essential in fast food establishments, especially for preparing items like fries, chicken, and snacks, while grills and griddles are common for grilling burgers, sandwiches, and other quick-service items. Refrigeration equipment such as commercial refrigerators and freezers plays a key role in preserving perishable ingredients, ensuring they remain fresh for extended periods.

Cold storage units are also used in hotels to store large quantities of fresh produce, meat, and dairy. In food preparation, mixers and blenders are commonly found in both sectors, used for making sauces, smoothies, and milkshakes, while food processors help in efficiently slicing, dicing, and chopping ingredients.

Additionally, commercial dishwashers are crucial in maintaining cleanliness and hygiene in both settings, supported by cleaning stations and waste disposal units to ensure sanitary conditions in busy food preparation areas. These essential equipment types help maintain efficiency, quality, and hygiene in the fast-paced environment of hotels and fast food restaurants.

| Main Segment | Market Share (%) |

|---|---|

| Equipment Type (Cooking Equipment) | 21% |

| Remaining segments | 79% |

This significant share highlights the critical role that cooking equipment plays in the smooth functioning of commercial kitchens, especially in high-demand sectors like hotels, restaurants, and fast food outlets. In this segment, combi ovens, fryers, and griddles are some of the most commonly used equipment.

Combi ovens are favored for their versatility, allowing for various cooking methods such as baking, roasting, and steaming in one unit. Fryers are essential in fast food restaurants for preparing popular items like fries, chicken, and snacks, while griddles are widely used for grilling burgers, sandwiches, and other quick-service items. These cooking equipment types help food service establishments maintain high production speeds, consistent food quality, and operational efficiency.

As the demand for quick, efficient, and high-quality food service continues to grow across Latin America, the cooking equipment segment remains a key driver of the food service equipment market. The segment's growth is further fueled by innovations in energy efficiency, automation, and multi-functional capabilities in cooking equipment.

2025 Market share of Latin America Food Service Equipmentmanufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Ali Group | 14% |

| Fagor Industrial | 9% |

| Hobart Corporation | 11% |

| Electrolux Professional | 7% |

| Rational AG | 5% |

| Middleby Corporation | 6% |

| Others | 48% |

Note: The above chart is indicative in nature

The market concentration in the Latin American cooking equipment industry is moderate, with a mix of well-established global players and regional manufacturers competing for market share. A few key international players dominate the market, particularly Ali Group, Hobart Corporation, and FagorIndustrial, which together account for a significant portion of the market share.

These companies have a strong presence due to their broad product offerings, including combi ovens, fryers, grills, and other essential cooking equipment for the food service industry. Despite the dominance of major international brands, regional players also hold a notable share, offering products that cater to the specific needs of local markets in terms of pricing, customization, and after-sales support.

Companies such as Electrolux Professional and Middleby Corporation have established themselves as strong contenders, focusing on innovation and energy-efficient products that appeal to both small and large-scale commercial kitchens in Latin America.

While these global and regional players lead the market, there is still room for smaller, local manufacturers to carve out niches by offering specialized products, cost-effective solutions, and localized customer service. This combination of global dominance and regional competition results in a moderately concentrated market with room for growth and diversification

As per End Use Industry, the industry has been categorized into Hotels, Fast Food Restaurants, Commercial Kitchens (Catering), Institutional Canteens and Cafeteria, Bakery, Travel Retail Services (Airways, Ships, Railways), Household.

As per Equipment Type, the industry has been categorized into Food and Drink Preparation Equipment, Cooking Equipment, Heating and Holding Equipment, Dishwasher and Sanitation Equipment, Refrigerators and Chillers, Baking Equipment, Food Packaging and Wrapping Equipment.

Industry analysis has been carried out in key countries of Mexico and Brazil and Rest of Latin America.

The Latin America Food Service Equipment market is projected to grow at a CAGR of 4.0% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 7,491.0 million.

Combi ovens, fryers, and griddles are the most commonly used cooking equipment in Latin American commercial kitchens. These products are favored for their versatility, efficiency, and ability to handle high-volume food preparation in fast-paced environments.

Key players include Ali Group, Fagor Industrial, Hobart Corporation, Electrolux Professional, Rational AG, Middle by Corporation, and Cleveland Range. These companies provide a wide range of cooking equipment for commercial kitchens in hotels, restaurants, and fast food chai.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Food Testing Services Market Growth – Trends, Demand & Innovations 2025–2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Market Share Distribution Among Food Service Equipment Companies

Latin America Food Emulsifier Market Outlook – Share, Growth & Forecast 2025–2035

Latin America Food Stabilizers Market Trends – Growth, Demand & Forecast 2025–2035

Latin America OTT Services Market Trends and Forecast 2025 to 2035

UK Food Service Equipment Market Trends – Growth, Demand & Forecast 2025–2035

Latin America Frozen Food Market Outlook – Share, Growth & Forecast 2025–2035

USA Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Latin America Banking as a Service (BaaS) Platform Market - Growth & Demand 2025 to 2035

Latin America Construction Equipment Market Growth - Trends & Forecast 2025 to 2035

Latin America Allergen Free Food Market Insights – Trends, Demand & Growth 2025–2035

Latin America Postbiotic Pet Food Market Analysis – Trends, Demand & Forecast 2025-2035

ASEAN Food Service Equipment Market Trends – Growth, Demand & Forecast 2025–2035

Europe Food Service Equipment Market Outlook – Size, Trends & Forecast 2025–2035

Australia Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Commercial Food Service Equipment Market Growth – Trends & Forecast 2024-2034

Weatherization Services Market in North and Latin America - Trends & Forecast 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Cloud Backup Service Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA