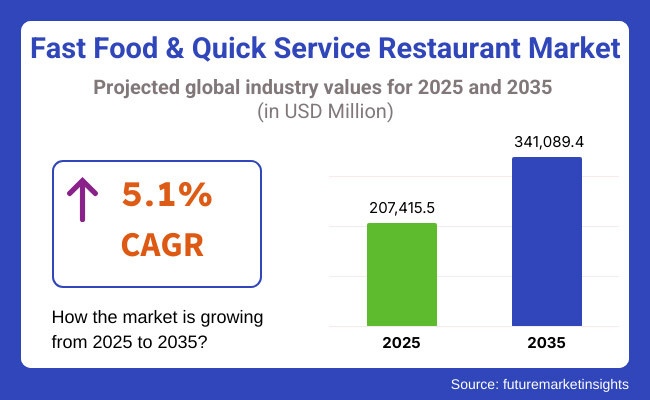

The Fast-Food and Quick-Service Restaurant (QSR) Market is projected to witness substantial growth between 2025 and 2035, driven by the rising demand for convenient and affordable dining options and the expansion of online food delivery services. The market is estimated to reach USD 207,415.5 million in 2025 and is expected to grow to USD 341,089.4 million by 2035, reflecting a compound annual growth rate (CAGR) of 5.1% throughout the assessment period.

One of the key factors influencing market expansion is the increasing urbanization and shifting consumer lifestyles, which favor quick and easily accessible meals. The fast-paced nature of modern living has led to a higher dependence on fast food and QSR chains, particularly among working professionals and younger consumers. Additionally, technological advancements in food delivery platforms and the rise of drive-thru and self-service kiosks have enhanced customer convenience, further propelling market growth.

USA cuisine, with its high level of international popularity and standardization and dominant international fast-food chain brands, leads the Cuisine Type segment. Popular American fast foods such as burgers, fried chicken, fries, sandwiches, and pizzas have taken a solid hold in the QSR market, where strong names like McDonald's, KFC, Dunkin, and Domino's Pizza are making aggressive expansions across regions.

One reason for their supremacy is the price, the uniformity, and the effective service model done by American fast food chains. Additionally, the demand for combo meals, value offerings, and customization has made American cuisine the most popular with international eaters, and this trend will endure in the quasi-fast food and QSR sector.

North America is a high-value market for the QSR and fast food industry, driven by the wide-ranging foodservice culture in the region, a high consumer base, and well-established global brands such as McDonald's, Burger King, and Subway. QSR chains and independent fast food restaurants cater to the growing consumer demand for socially acceptable, affordable, and portable food options due to the busy lifestyles people lead. The USA is the leading player in this market with its wide array of QSR chains and independent chains.

Canada is also a huge market, and demand for drive-thru and delivery is on the rise. Innovations like self-ordering kiosks, AI-driven menu set-up, and ordering through mobile applications have transformed the fast food sector. Moreover, the increasing consumer preference for healthy, organic, and plant-based fast food has resulted in QSR brands widening their product portfolio. Environmental sustainability is also one of the primary challenges as brands embrace sustainable packaging and employ waste reduction tactics to satisfy extremely strict environmental regulations.

A large part of the definitions comes from the QSR or fast food sector in Europe due to very high demand from the USA, Germany, France, and so on. Fast casual dining, which allows for higher-quality ingredients and healthier menu options compared to traditional fast food, has been steadily growing in the region. Consumers in Europe are becoming more health-conscious, driving higher sales of fast food products made with plants and organic ingredients.

Mass-market QSR brands such as KFC, Domino’s, and Five Guys are becoming more prominent as local chains roll out regional and gourmet fast foods. The strict food safety and environmental rules imposed by the European Union are establishing the standard within the industry for sustainability measures such as reduced plastic use, monitoring of carbon emissions, and waste reduction programs. In addition, an uptick in the ordering of food online has continued to fuel the sector, powered by the likes of Deliveroo and Uber Eats, with most QSRs optimizing their offerings for takeaway and home deliveries.

The fast food and QSR market in the Asia-Pacific is expected to expand at the highest CAGR during the forecast period, owing to rapid urbanization, rising disposable income levels, and changes in dietary patterns. Market size is rapidly growing in China, India, Japan, and South Korea (China, in particular, has the largest QSRs in terms of growth and consumer spending). International chains such as McDonald’s, KFC, and Domino’s Pizza are expanding rapidly in the country, while domestic fast food chains and street vendors remain strong. The increasing adoption of digital payment tools and mobile food ordering applications has further propelled the growth of the market.

Faith in convenience, low-cost, and delicious fast food remains unchanged, although there is more of an emphasis on local and fusion foods to accommodate local tastes. However, due to several regulatory challenges concerning food safety norms, hygiene, and sustainability practices, they compel QSR players to develop high-quality control processes within the region.

Challenge: Health and Nutrition Concerns

One of the widespread issues in the QSR and fast food industry, however, is the health impacts of fast food. Most fast foods are high in saturated fats, salt, and processed foods that contribute to rising obesity and lifestyle disorders. We expect consumers to gravitate toward healthy food options and QSR companies to feel pressure to reformulate their menus.

This has been accompanied by a growing consolidation on the part of many governments from country to country around tighter controls on nutritional labeling, sugar taxes, and ingredient statement requirements, which are further answered with menu innovation. Fast food chains have to juggle taste, affordability, and healthier alternatives to meet changing consumer expectations.

Opportunity: Rise of Digitalization and Sustainable Practices

Growing acceptance of digital technologies offers the fast food and QSR sector a great opportunity. Customer engagement powered by AI, intelligent drive-thrus, and digital ordering systems has driven convenience and efficiency, enabling brands to scale business and deliver customized experiences.

Furthermore, sustainability efforts are on the rise, with large QSR chains investing in plant-based options, green packaging, and carbon reduction measures. Brands that leverage technology-based solutions and emphasize sustainable practices will become the leaders in the changing fast food environment.

Between 2020 and 2024, the fast food & quick service restaurant (QSR) market experienced steady growth, driven by increasing urbanization, changing consumer lifestyles, and the rise of online food delivery platforms. The demand for convenient, affordable, and quickly prepared meals surged, particularly in metropolitan areas. The COVID-19 pandemic accelerated the adoption of drive-thru, takeaway, and contactless delivery services, reshaping operational models within the QSR sector.

Between 2025 and 2035, the fast food & quick service restaurant market will undergo a transformative shift driven by AI-driven automation, sustainability initiatives, and hyper-personalized customer experiences. Smart kitchens equipped with AI-driven cooking systems, autonomous food preparation robots, and real-time inventory tracking will enhance operational efficiency, reducing food waste and energy consumption.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter food safety regulations, calorie labeling mandates, and bans on single-use plastics. |

| Technological Advancements | AI-powered kiosks, self-checkout, robotic food prep, and smart delivery platforms. |

| Industry Applications | Drive-thru, takeaway, food delivery, and cloud kitchens. |

| Adoption of Smart Equipment | Self-service kiosks, AI-based order predictions, and drone-based food delivery. |

| Sustainability & Cost Efficiency | Plant-based menu expansion, biodegradable packaging, and energy-efficient kitchen appliances. |

| Data Analytics & Predictive Modeling | AI-driven personalized promotions, demand forecasting, and cloud-based inventory tracking. |

| Production & Supply Chain Dynamics | COVID-19 supply chain disruptions, rising commodity costs, and increased demand for alternative proteins. |

| Market Growth Drivers | Growth is driven by convenience, digital ordering, and increasing demand for plant-based fast food. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-driven food safety compliance, blockchain-based ingredient traceability, and carbon-neutral QSR policies. |

| Technological Advancements | Autonomous QSR kitchens, voice-activated AI ordering, biometric payment authentication, and blockchain traceability. |

| Industry Applications | AI-powered robotic QSRs, 3D food printing outlets, and hyper-personalized nutrition-driven menus. |

| Adoption of Smart Equipment | Fully automated robotic kitchens, AI-powered vending machines, and smart packaging with real-time freshness tracking. |

| Sustainability & Cost Efficiency | Lab-grown meat alternatives, carbon-neutral restaurant models, and AI-driven waste reduction strategies. |

| Data Analytics & Predictive Modeling | Quantum-enhanced predictive modeling for menu optimization, AI-powered nutrition tracking, and real-time customer behavior analytics. |

| Production & Supply Chain Dynamics | AI-optimized supply chains, vertical farming-based ingredient sourcing, and blockchain-enabled real-time logistics tracking. |

| Market Growth Drivers | AI-powered QSR automation, sustainable fast food solutions, and the expansion of smart dining ecosystems. |

The American fast food and quick service restaurant (QSR) market is growing steadily, fueled by soaring consumer demand for convenient and value-for-money meals, expanding digital food delivery platforms, and innovative menu development. The growing popularity of health-conscious fast food options and plant-based foods also drives market growth. The QSR sector across the nation is also witnessing automation of order processing, self-service kiosks, and the introduction of AI-based personalized menus.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.0% |

The UK QSR Market (Quick Service Restaurants) & fast food market, why the online food delivery services are rising, more international QSR chains (quick service restaurants), along with the growing grab-and-go foods, and the impact of the Covid-19 pandemic. People are choosing healthy fast food options like vegan fast food and gluten-free menus. Green packaging and sustainable sourcing are also defining the market, and QSR brands are adopting more environmentally friendly business methods.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.2% |

The EU fast food & QSR market is experiencing growth due to the increasing urban population, changing eating habits, and rising consumer preference for quick and affordable meals. Countries like Germany, France, and Spain are witnessing a surge in QSR chains integrating digital payment systems, drive-thru automation, and AI-based menu recommendations. Stringent EU food safety regulations and sustainability initiatives are pushing brands toward organic, locally sourced, and plant-based menu offerings.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.3% |

Japan's quick service restaurants (QSR) & fast food market is transforming with a robust convenience culture, increasing popularity of Western fast food chains, and the use of cutting-edge technology in food service. Robotic food preparation innovation, automated food vending machines, and self-ordering kiosks lead the market. Additionally, healthier fast food consumption patterns, such as rice-based food items and seafood restaurants, are influencing the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

South Korea's QSR and fast food market is growing with the rising impact of international QSR brands, food delivery service growth, and Korean-inspired fast food innovation demand growth. Convenience meal solutions and the late-night eating trend are driving QSR sales. Moreover, innovations like AI-powered customer interactions and contactless ordering systems are improving the fast food customer experience.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.4% |

Branded franchise restaurants are the fastest-growing segment of the QSR market, providing customers with a consistent and familiar dining experience at many locations. In contrast to independent restaurants, branded franchises concentrate on applying successful business models, maintaining uniform food quality, efficient service, and robust brand identification.

Growth in the demand for established fast food restaurants has driven franchise-based restaurant expansion, as consumers embrace convenience and brand recognition in picking eating places. The rise of franchise-led international expansion has consolidated market demand, with top fast food chains entering new markets via master franchise deals, guaranteeing mass accessibility and local menu adaptations.

The incorporation of digital ordering platforms, including AI-driven menu personalization, blockchain-secured payment, and app-based loyalty schemes, has further accelerated adoption, guaranteeing hassle-free ordering and customer retention.

Creation of franchise-backed sustainability programs, such as green packaging film, waste-minimization programs, and plant-based menu extensions, has maximized market growth by aligning QSR brands with consumer needs for environmentally friendly meal options. Use of automation technology in QSR franchises, with AI-based kitchen management, robotics-based food preparation, and electronic customer service kiosks, has solidified market growth through increased operational effectiveness and decreased labor expenses.

Although it has the edge in scalability, brand reputation, and operational uniformity, the branded franchise segment is hampered by high setup expenditure, regulation complexities, and market saturation in developed markets. Emerging trends in AI-based customer intelligence, virtual extensions of brands, and ghost kitchens are enhancing market responsiveness, paving the way for branded franchise QSRs to sustain growth globally.

American food has registered high market uptake, especially by urban consumers, youth, and foreign visitors, as QSR brands continue to extend their offerings to include typical American fast food fare. Contrary to local foods, American fast food is marked by worldwide popularity, uncomplicated preparation procedures, and prevalence.

The growing demand for American fast food, including burgers, fried chicken, hot dogs, and sandwiches, has driven adoption of this segment of cuisine, as consumers are looking for indulgent, familiar, and satisfying meals Fusion menu extensions with international takes on popular American items have driven increasing market demand, supporting diversity in taste profiles and fast food experience localization to alternate cultural markets.

Blending menu innovation for a healthy, more conscious set with organic produce, reduced-calorie content, and vegetable substitutes for standard American fare fast food further augments take-up, making health-focused consumer groups and diet-constrained market segments responsive to these items.

A major purpose in AI menu analytics creation, predictive consumer trend monitoring, real-time inventory management, and data-driven seasonal swings has saturated the market, maximizing improvements, allowing for improved response and consumer interaction. American fast food brands have solidified their market growth through online marketing efforts, such as social media-driven brand interaction, influencer-driven promotions & targeted web-based advertisement campaigns that ultimately secured enhanced consumer loyalty & brand recognition.

While the American cuisine category is buoyed by its international appeal, menu adaptability, and local compliance availability, it is weakened by growing health concerns regarding fast food, increased regulatory interest around ultra-processed foods, and changing dietary preferences towards plant-based and low-calorie foods.

However, the emergence of new innovations across the landscape spanning not just AI-based nutritional monitoring and alternative protein-based fast foods, but hybridizing of traditional and health-oriented options available at a single dine-in experience is allowing QSRs focusing on American cuisine outside of the USA to stick around in this evolving market and still grow as they carve growth opportunities out of a shrinking pie globally.

The independent QSR category has won strong market acceptance, especially among local food entrepreneurs, small business owners, and specialty consumer niches, as demand for differentiated, non-standardized fast food products keeps increasing. Independent QSRs have no creative restrictions compared to branded franchises, enabling innovation through menus, regional modifications, and tailored customer relationships. The increasing need for community-based fast food experiences with locally sourced ingredients, artisanal preparations, and culturally relevant menu options has driven the adoption of independent QSRs as consumers look for unique dining options over mass-market fast food chains.

Though it has strengths in menu versatility, local economic impact, and brand uniqueness, the independent QSR segment has drawbacks like constrained scalability, greater operating expenses than franchised operations, and more competition from global QSR chains. Yet, innovations in AI-based business analytics, cloud-based inventory management, and hybrid dine-in and delivery service models are enhancing efficiency, profitability, and competitive positioning for independent fast food entrepreneurs globally.

The regional cuisine-based QSR market has grown steadily, fueled by increasing consumer demand for ethnic and traditional fast food. In contrast to traditional American fast food, regional cuisine QSRs specialize in genuine, culturally influenced food offerings adapted to local and global tastes. Rising demand for varied fast food choices, with Indian street foods, Chinese stir-fries, Italian pizza types, and Middle Eastern shawarma wraps, has driven the adoption of regionally branded QSRs, as world consumers accept multicultural food experiences.

Although it has the edge of cultural realness, menu diversification appeal, and favorable community backing, the regional cuisine QSR segment is challenged with operational intricacies in procuring ingredients, regulatory requirements for imported food items, and market barriers to penetration in foreign markets. In spite of these, innovations in AI-based recipe adaptation, cloud kitchen business growth strategies, and cross-cultural culinary partnerships are enhancing accessibility, consumer appeal, and market viability, guaranteeing further growth for regional cuisine-oriented QSR brands globally.

The Fast-Food and Quick-Service Restaurant (QSR) Market is experiencing substantial growth due to changing consumer lifestyles, urbanization, and the rising demand for affordable and convenient dining options. The increasing popularity of drive-thru services, online food delivery platforms, and digital ordering systems has further propelled market expansion.

Additionally, growing preferences for customizable, healthier, and plant-based menu options are reshaping key players' strategies. Leading companies are investing in digital innovation, menu diversification, and sustainability initiatives to maintain their competitive edge.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| McDonald's | 18-22% |

| Yum! Brands | 15-19% |

| Darden Concepts, Inc. | 10-14% |

| Quality Is Our Recipe, LLC | 8-12% |

| Carrols Restaurant Group, Inc. | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| McDonald's | Operates a global fast-food chain offering burgers, fries, and beverages, with a focus on drive-thru, mobile app orders, and sustainability initiatives. |

| Yum! Brands | Owns KFC, Taco Bell, and Pizza Hut, specializing in fried chicken, Mexican fast food, and pizza, with a strong emphasis on global franchising and digital ordering. |

| Darden Concepts, Inc. | Operates casual dining brands like Olive Garden and LongHorn Steakhouse, focusing on sit-down quick service, Italian cuisine, and loyalty programs. |

| Quality Is Our Recipe, LLC | The parent company of Wendy’s is known for its fresh beef burgers, premium fast food, and digital ordering advancements. |

| Carrols Restaurant Group, Inc. | The largest Burger King franchisee operates thousands of locations with a focus on expansion and operational efficiency. |

Key Company Insights

McDonald's (18-22%)

As the world's largest fast food company, McDonald's remains the leader with its robust franchise system, large menu innovation, and digital evolution initiatives. The company is increasing mobile ordering, delivery alliances, and plant-based menu offerings to keep pace with changing consumer behavior.

Yum! Brands (15-19%)

A QSR giant, Yum! Brands owns KFC, Taco Bell, and Pizza Hut, utilizing robust global franchising, advertising campaigns, and menu personalization to appeal to various consumer tastes. The company is heavily investing in AI-powered digital ordering and loyalty programs.

Darden Concepts, Inc. (10-14%)

A leader in fast-casual dining, Darden Concepts owns Olive Garden, LongHorn Steakhouse, and other restaurant brands. The company focuses on dine-in experiences, loyalty rewards, and menu innovation while expanding its takeout and curbside pickup services.

Quality Is Our Recipe, LLC (8-12%)

Being the parent company of Wendy's, the brand competes on premium burger value, fresh ingredients, and digital ordering innovations.

Carrols Restaurant Group, Inc. (6-10%)

The largest Burger King franchisee, Carrols Restaurant Group, operates hundreds of Burger King locations across North America. To remain competitive, the company focuses on restaurant acquisitions, cost efficiencies, and value meal promotions.

Other Key Players (30-40% Combined)

The Fast Food & Quick Service Restaurant Market is also influenced by other regional and emerging brands such as:

The overall market size for fast food & quick service restaurant market was USD 207,415.5 Million in 2025.

The fast food & quick service restaurant market is expected to reach USD 341,089.4 Million in 2035.

The rising demand for convenient and affordable dining options, coupled with the expansion of online food delivery services fuels Fast food & quick service restaurant Market during the forecast period.

The top 5 countries which drives the development of Fast food & quick service restaurant Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of type, branded franchise restaurant to command significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Cuisine, 2019 to 2034

Table 4: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 5: North America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 6: North America Market Value (US$ Million) Forecast by Cuisine, 2019 to 2034

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 8: Latin America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 9: Latin America Market Value (US$ Million) Forecast by Cuisine, 2019 to 2034

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 11: Western Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 12: Western Europe Market Value (US$ Million) Forecast by Cuisine, 2019 to 2034

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 15: Eastern Europe Market Value (US$ Million) Forecast by Cuisine, 2019 to 2034

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by Cuisine, 2019 to 2034

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 20: East Asia Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 21: East Asia Market Value (US$ Million) Forecast by Cuisine, 2019 to 2034

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by Cuisine, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Cuisine, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 7: Global Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 8: Global Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 9: Global Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 10: Global Market Value (US$ Million) Analysis by Cuisine, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Cuisine, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Cuisine, 2024 to 2034

Figure 13: Global Market Attractiveness by Type, 2024 to 2034

Figure 14: Global Market Attractiveness by Cuisine, 2024 to 2034

Figure 15: Global Market Attractiveness by Region, 2024 to 2034

Figure 16: North America Market Value (US$ Million) by Type, 2024 to 2034

Figure 17: North America Market Value (US$ Million) by Cuisine, 2024 to 2034

Figure 18: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 22: North America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 23: North America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 24: North America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 25: North America Market Value (US$ Million) Analysis by Cuisine, 2019 to 2034

Figure 26: North America Market Value Share (%) and BPS Analysis by Cuisine, 2024 to 2034

Figure 27: North America Market Y-o-Y Growth (%) Projections by Cuisine, 2024 to 2034

Figure 28: North America Market Attractiveness by Type, 2024 to 2034

Figure 29: North America Market Attractiveness by Cuisine, 2024 to 2034

Figure 30: North America Market Attractiveness by Country, 2024 to 2034

Figure 31: Latin America Market Value (US$ Million) by Type, 2024 to 2034

Figure 32: Latin America Market Value (US$ Million) by Cuisine, 2024 to 2034

Figure 33: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 37: Latin America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 40: Latin America Market Value (US$ Million) Analysis by Cuisine, 2019 to 2034

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Cuisine, 2024 to 2034

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Cuisine, 2024 to 2034

Figure 43: Latin America Market Attractiveness by Type, 2024 to 2034

Figure 44: Latin America Market Attractiveness by Cuisine, 2024 to 2034

Figure 45: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 46: Western Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 47: Western Europe Market Value (US$ Million) by Cuisine, 2024 to 2034

Figure 48: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 52: Western Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 55: Western Europe Market Value (US$ Million) Analysis by Cuisine, 2019 to 2034

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by Cuisine, 2024 to 2034

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by Cuisine, 2024 to 2034

Figure 58: Western Europe Market Attractiveness by Type, 2024 to 2034

Figure 59: Western Europe Market Attractiveness by Cuisine, 2024 to 2034

Figure 60: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 61: Eastern Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 62: Eastern Europe Market Value (US$ Million) by Cuisine, 2024 to 2034

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by Cuisine, 2019 to 2034

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by Cuisine, 2024 to 2034

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by Cuisine, 2024 to 2034

Figure 73: Eastern Europe Market Attractiveness by Type, 2024 to 2034

Figure 74: Eastern Europe Market Attractiveness by Cuisine, 2024 to 2034

Figure 75: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 76: South Asia and Pacific Market Value (US$ Million) by Type, 2024 to 2034

Figure 77: South Asia and Pacific Market Value (US$ Million) by Cuisine, 2024 to 2034

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by Cuisine, 2019 to 2034

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by Cuisine, 2024 to 2034

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Cuisine, 2024 to 2034

Figure 88: South Asia and Pacific Market Attractiveness by Type, 2024 to 2034

Figure 89: South Asia and Pacific Market Attractiveness by Cuisine, 2024 to 2034

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 91: East Asia Market Value (US$ Million) by Type, 2024 to 2034

Figure 92: East Asia Market Value (US$ Million) by Cuisine, 2024 to 2034

Figure 93: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 97: East Asia Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 100: East Asia Market Value (US$ Million) Analysis by Cuisine, 2019 to 2034

Figure 101: East Asia Market Value Share (%) and BPS Analysis by Cuisine, 2024 to 2034

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by Cuisine, 2024 to 2034

Figure 103: East Asia Market Attractiveness by Type, 2024 to 2034

Figure 104: East Asia Market Attractiveness by Cuisine, 2024 to 2034

Figure 105: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 106: Middle East and Africa Market Value (US$ Million) by Type, 2024 to 2034

Figure 107: Middle East and Africa Market Value (US$ Million) by Cuisine, 2024 to 2034

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by Cuisine, 2019 to 2034

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by Cuisine, 2024 to 2034

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by Cuisine, 2024 to 2034

Figure 118: Middle East and Africa Market Attractiveness by Type, 2024 to 2034

Figure 119: Middle East and Africa Market Attractiveness by Cuisine, 2024 to 2034

Figure 120: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fast Curing Epoxy Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Fastener Insertion Machine Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fast-Food Reusable Market Growth – Demand & Forecast 2025 to 2035

Fast Food Containers Market Trends – Growth & Forecast 2025 to 2035

Fast Food Bag Market Trends – Growth & Forecast 2024-2034

Breakfast Drinks Market Size and Share Forecast Outlook 2025 to 2035

Breakfast Cereal Market Trends – Healthy & Indulgent Options Driving Growth 2025 to 2035

Ultrafast Lasers Market Analysis - Industry Growth & Forecast 2025 to 2035

Breakfast Takeout Market Growth – Morning Convenience & Market Expansion 2025 to 2035

Rail Fasteners Market

Analysis and Growth Projections for Vegan Fast-Food Market

Direct Fast Dyes Market Size and Share Forecast Outlook 2025 to 2035

Flange Fasteners Market Size and Share Forecast Outlook 2025 to 2035

Marine Fasteners Market

Plastic Fasteners Market Analysis by Product Type, End Use, and Region Forecast Through 2035

Assembly Fastening Tools Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fastener Manufacturing Solution Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fastener Market Analysis Size Share and Forecast Outlook 2025 to 2035

Automotive Fastener Market Size and Share Forecast Outlook 2025 to 2035

Automotive Fasteners Market Growth -Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA