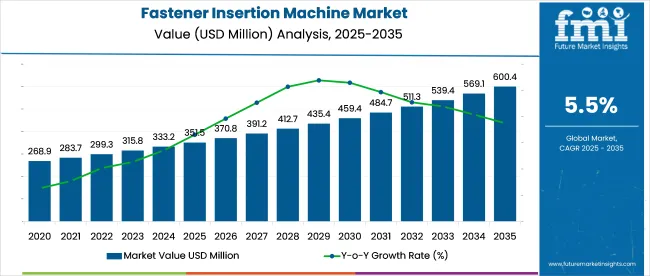

The fastener insertion machine market is expected to grow from USD 351.5 million in 2025 to approximately USD 600.4 million by 2035, registering a CAGR of 5.5%. Demand is rising as manufacturing sectors prioritize automation and precision assembly, particularly in electronics, automotive, and aerospace industries.

Component manufacturers are supplying high-tolerance feed systems and servo-driven insertion heads designed to handle specialty fasteners like clinch nuts and standoffs at cycle rates above 1,200 cycles per minute. Assemblers in automotive and electronics sectors are integrating these machines into inline modular cells, enabling real-time torque and depth monitoring to eliminate joint failures.

Subcontractors are offering turnkey solutions with pick-and-place robotics and vision inspection, reducing programming time by up to 50%. On-site aftermarket support is being structured around predictive maintenance contracts that use vibration and acoustic sensors to forecast tool wear.

Demand is strong in EV battery pack assembly and precision medical device manufacturing, where cleanroom-compatible insertion systems are accelerating adoption. Overall the shift is toward high-throughput, traceable, and compliance-ready insertion platforms that enhance assembly integrity and reduce rework.

As of 2025, the fastener insertion machine market is estimated to account for around 3-4% of the broader industrial automation equipment segment. Within the global fastener machinery space, it holds approximately 6-7%, driven by increasing automation in assembly lines. The market contributes close to 2-3% of the total automotive manufacturing equipment segment, as OEMs seek precision fastening solutions to improve throughput.

In electronics manufacturing equipment, the share stands at about 1-2%, with demand supported by circuit board and device assembly lines. Within the global assembly line equipment market, fastener insertion machines maintain a 4-5% share, reflecting their role in efficient component integration across consumer goods, aerospace, and heavy machinery production. The growth outlook remains supported by rising industrial automation globally.

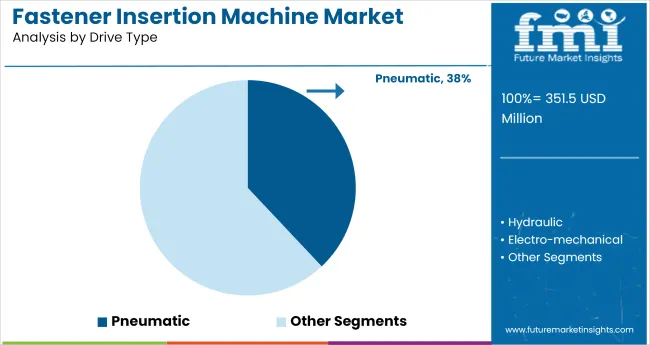

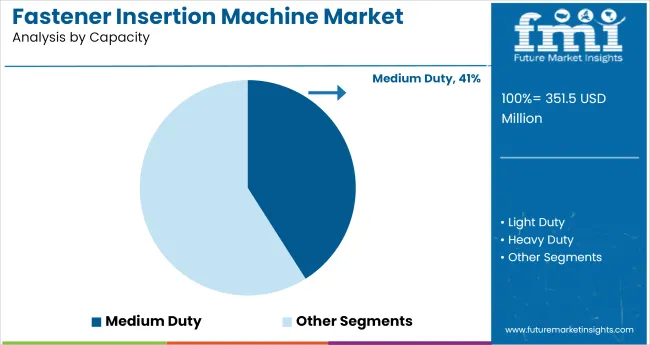

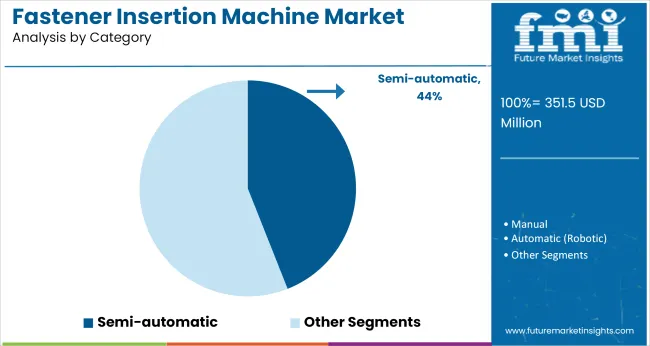

The market is gaining strong momentum across key segments such as pneumatic drive systems, medium duty capacity, semi-automatic configurations, and manufacturing end use. Growth is propelled by the demand for efficient fastening solutions, production automation, and consistent quality across global industrial sectors.

Pneumatic fastener insertion machines are forecasted to hold 38% of the market share by 2025. Their superior energy efficiency, compact design, and lower maintenance costs are driving wide-scale adoption in high-throughput industrial settings. Pneumatic systems offer consistent force application, making them suitable for repetitive fastening operations in sheet metal fabrication and automotive assembly.

Medium duty fastener insertion machines are expected to account for 41% of the global market share. These machines offer optimal performance for mid-volume production lines, balancing output capabilities with cost-effectiveness. Manufacturers in electronics, appliances, and furniture industries rely on medium-duty variants for standardized assembly.

Semi-automatic fastener insertion machines are set to capture 44% of the total market by 2025. They combine manual feeding with automated pressing, offering flexibility for mixed-batch production. Businesses with small-scale to mid-scale manufacturing operations favor semi-automatic systems for their control, affordability, and ease of operation.

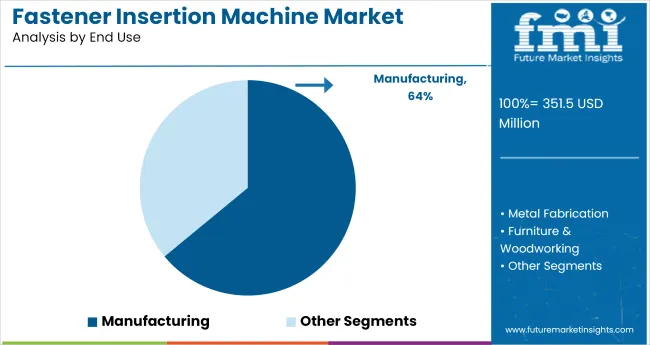

Manufacturing is poised to dominate the end use segment with a 64% market share by 2025. Fastener insertion machines are integral to modern assembly lines in industries such as electronics, aerospace, metalworking, and automotive. The rise in global industrial production and demand for consistent fastening solutions support this trend.

The market is expanding as precision assembly gains traction in automotive, aerospace, and electronics manufacturing. In 2024, global unit sales rose by 7.4%, supported by automation mandates and high-throughput requirements.

Automation and Servo-Control Upgrades Boosting Efficiency

In 2024, over 51% of new machines were servo-driven, offering programmable force and depth control. Systems now feature HMI interfaces, error detection, and barcode-based part recognition. Production lines are retrofitted with robotic arms for continuous multi-fastener insertions.

Growth in Aerospace and Sheet Metal Fabrication Applications

Aircraft interiors, avionics housings, and structural panels require precise fastening. In 2024, aerospace-grade fastener inserters made up 22% of market share. Sheet metal fabricators are investing in equipment that supports both thick and thin gauge materials with interchangeable tooling heads.

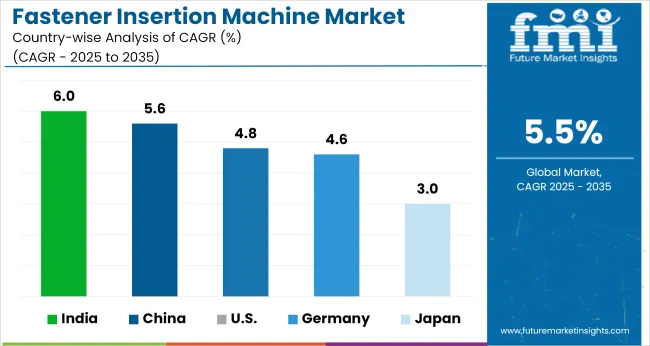

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 6.0% |

| China | 5.6% |

| United States | 4.8% |

| Germany | 4.6% |

| Japan | 3.0% |

The global market is projected to expand at a CAGR of 5.5% from 2025 to 2035. Among BRICS nations, India leads with 6.0%, outpacing the global average by nearly 9%, supported by expanding automotive and appliance sectors. China follows at 5.6%, slightly above the global benchmark, reflecting steady demand from high-volume electronics and industrial manufacturing. In contrast, OECD economies are progressing at a slower pace.

The United States posts a CAGR of 4.8%, while Germany stands at 4.6%, both trailing the global average by 13% and 16%, respectively. Japan reports the weakest growth at 3.0%, reflecting production saturation and automation transition delays.

This performance contrast reflects the stronger industrial capital investments in BRICS regions and the need for modernization in OECD countries. Several ASEAN economies, although not listed here, are anticipated to bridge the gap through low-cost manufacturing expansions and equipment imports.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

Posting a CAGR of 6.0% through 2035, Indian market is gaining traction on the back of manufacturing localization, capacity expansion, and rising automation across MSMEs. Demand is concentrated in automotive components, white goods, and electrical panels, particularly in industrial zones across Gujarat, Maharashtra, and Tamil Nadu. Competitive pricing, ease of integration, and energy-efficient models are prompting wider adoption, even among first-time automation users.

The market in China is forecast to grow at a CAGR of 5.6% from 2025 to 2035, supported by expanding use in electric vehicles, electronics, and infrastructure components. Domestic OEMs are investing in high-speed insertion solutions to meet rising production targets, with growing preference for machines offering precision control, multi-head configuration, and compatibility with MES platforms. Export-focused SMEs in Guangdong and Jiangsu are also upgrading legacy systems to improve competitiveness.

Expected to grow at a CAGR of 4.8% during the forecast period, the USA market is shaped by lifecycle equipment replacement and integration of advanced automation. Demand is pronounced in aerospace, HVAC, and electrical enclosures, where precision and repeatability are key. Vendors offering force-control features, intelligent diagnostics, and multi-size fastener compatibility are well positioned to gain share among Tier 1 suppliers and contract manufacturers.

Registering a CAGR of 4.6% through 2035, Germany’s market benefits from consistent demand across automotive, electronics, and industrial control segments. Emphasis is placed on reliability, noise reduction, and interoperability with Industry 4.0 systems. Market participants are prioritizing long-term lifecycle cost savings, fueling interest in energy-efficient, digitally monitored systems. System integrators are increasingly sourcing modular machines for seamless factory floor integration.

Expanding at a CAGR of 3.0% between 2025 and 2035, the Japanese market is driven by niche industrial needs, especially in electronics, robotics, and optics assembly. Buyers prioritize compact, high-precision insertion systems capable of operating in space-constrained, clean environments. While overall growth is moderate, quality benchmarks remain elevated. Vendors offering ultra-low noise, low-maintenance platforms with integrated error detection are poised for growth.

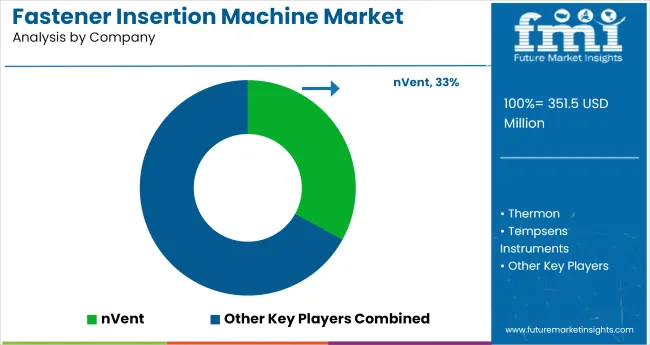

Penn Engineering, through its Haeger division, dominates the global fastener insertion machine market with an estimated 33% market share, particularly in North America and Europe, driven by its servo-driven presses and automation-ready solutions. AMADA Co., Ltd. is a strong competitor in Asia-Pacific, integrating insertion technologies within its sheet metal fabrication ecosystems, securing contracts with leading electronics and appliance OEMs.

Dongguan Insertion Machinery Co., Ltd. and ERSM Machinery have captured a combined 20-25% of the Chinese market by offering cost-efficient, semi-automated machines suited for mid-volume manufacturing. Neumatica Technologies Pvt. Ltd. is rapidly gaining traction in India’s automotive and white goods sector, driven by its pneumatic insertion systems and expanding service network across key industrial hubs.

Recent Fastener Insertion Machine Industry News

In January 2024, PennEngineering completed the acquisition of Sherex Fastening Solutions, significantly enhancing its capabilities in fastener insertion systems. This strategic move broadens its product lineup and strengthens its position in precision fastening technology, enabling deeper integration across automotive, aerospace, and industrial equipment manufacturing sectors.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 351.5 million |

| Projected Market Size (2035) | USD 600.4 million |

| CAGR (2025 to 2035) | 5.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for market value |

| Drive Types Analyzed (Segment 1) | Pneumatic, Hydraulic, Electro-mechanical, Hybrid |

| Capacities Analyzed (Segment 2) | Light Duty, Medium Duty, Heavy Duty |

| Categories Analyzed (Segment 3) | Manual, Semi-automatic, Automatic (Robotic) |

| End Uses Analyzed (Segment 4) | Manufacturing (Automotive, Aviation, Consumer Goods & Appliances, Electronics, HVAC, Others), Metal Fabrication, Furniture & Woodworking, Others |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Penn Engineering ( Haeger ), Neumatica Technologies Pvt. Ltd., ERSM Machinery, Dongguan Insertion Machinery Co., Ltd., AMADA CO., LTD. |

| Additional Attributes | Dollar sales by drive and automation type, growing integration of robotic insertion systems, demand for precision fastening in electronics and automotive, and wider adoption across small to large-scale metal fabrication units. |

The market is segmented into pneumatic, hydraulic, electro-mechanical, and hybrid drive types. Each type offers varying advantages in terms of force delivery, speed, and control across industrial applications.

Based on load capacity, the market includes light-duty, medium-duty, and heavy-duty press systems, catering to diverse operational scales from precision assembly to heavy metal forming.

Pressing systems are classified as manual, semi-automatic, and automatic (robotic), offering users flexibility based on production volume, labor efficiency, and automation needs.

End-use segmentation includes manufacturing (automotive, aviation, consumer goods & appliances, electronics, HVAC, and others), along with metal fabrication, furniture & woodworking, and various other industrial applications.

Regional analysis spans North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, and the Middle East & Africa, reflecting differences in industrial automation maturity and investment trends.

The market is valued at USD 351.5 million in 2025.

The market is expected to reach USD 600.4 million by 2035.

The market is projected to grow at a CAGR of 5.5% during the forecast period.

Pneumatic machines dominate the market with a 38% share in 2025.

India is the fastest growing country, with a projected CAGR of 6.0% between 2025 and 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bolt Insertion Machine Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Machine Tool Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Machine Tool Touch Probe Market Analysis - Size, Growth, and Forecast 2025 to 2035

Machine Mount Market Analysis - Size & Industry Trends 2025 to 2035

Machine Control System Market Growth – Trends & Forecast 2025 to 2035

Machine Automation Controller Market Growth – Trends & Forecast 2025 to 2035

Machine-to-Machine (M2M) Connections Market – IoT & Smart Devices 2025 to 2035

Machine Safety Market Analysis by Component, Industry, and Region Through 2035

Key Players & Market Share in Machine Glazed Paper Industry

Machine Vision Market Insights – Growth & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA