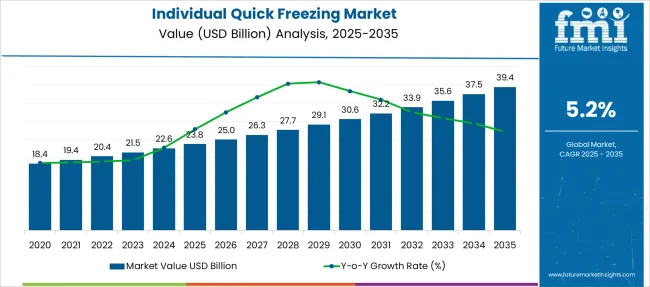

The Individual Quick Freezing Market is estimated to be valued at USD 23.8 billion in 2025 and is projected to reach USD 39.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

| Metric | Value |

|---|---|

| Individual Quick Freezing Market Estimated Value in (2025 E) | USD 23.8 billion |

| Individual Quick Freezing Market Forecast Value in (2035 F) | USD 39.4 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The individual quick freezing (IQF) market is advancing steadily, driven by increasing demand for premium frozen food products that retain texture, flavor, and nutritional value. Rising consumer preference for convenience without compromising quality has elevated the adoption of IQF technologies across food processing industries globally.

In particular, frozen fruits, vegetables, seafood, and ready-to-cook meals are benefiting from IQF’s capability to preserve individual units without clumping. The foodservice sector, supported by retail and e-commerce growth, is playing a crucial role in expanding market reach.

Looking ahead, the market is poised for sustained growth as manufacturers prioritize innovations in freezing efficiency, energy optimization, and automation. Expanding cold chain infrastructure in emerging economies and rising awareness regarding food safety and shelf-life extension are further anticipated to reinforce long-term market demand for IQF solutions.

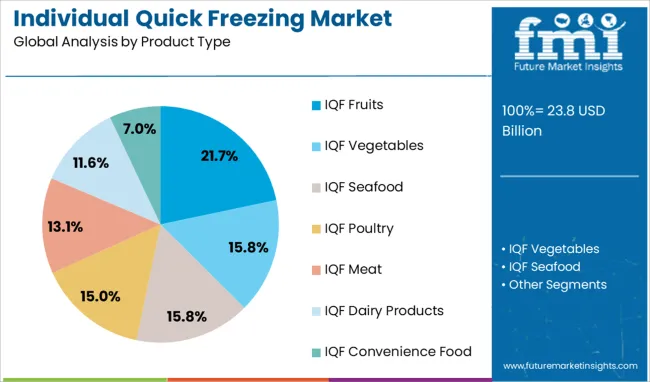

The individual quick freezing market is segmented by product type, equipment type, technology, packaging type, application and geographic regions. The individual quick freezing market is divided by product type into IQF Fruits, IQF Vegetables, IQF Seafood, IQF Poultry, IQF Meat, IQF Dairy Products, and IQF Convenience Food.

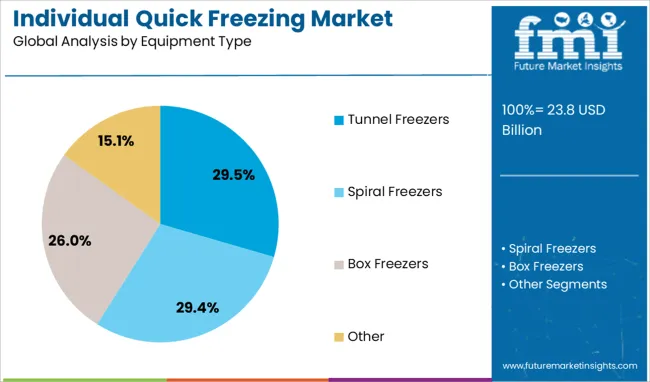

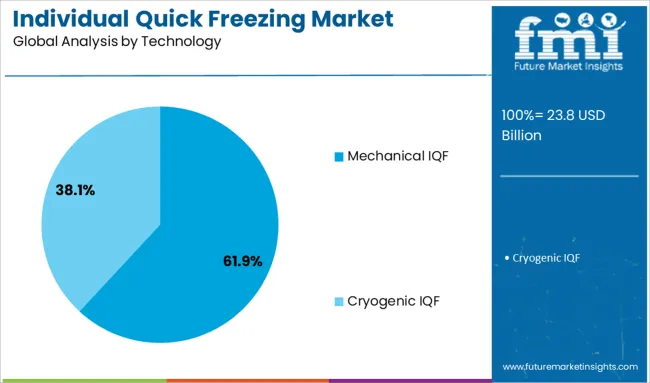

In terms of equipment type, the individual quick freezing market is classified into Tunnel Freezers, Spiral Freezers, Box Freezers, and Other. Based on the technology of the individual quick freezing market, it is segmented into Mechanical IQF and Cryogenic IQF. The individual quick freezing market is segmented by packaging type into Bags, Cartons, Trays, and Others.

By application, the individual quick freezing market is segmented into Food Processing Industry, Retail, and Catering and HoReCa. Regionally, the individual quick freezing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

IQF fruits represent 21.7% of the product type category, reflecting growing consumer and industrial demand for frozen fruit ingredients with preserved integrity and nutritional content. This segment is gaining traction among bakeries, beverage producers, and health-conscious consumers seeking year-round access to seasonal fruits.

The increasing popularity of smoothies, frozen desserts, and functional foods has fueled the need for high-quality, non-clumped fruit portions, driving preference for IQF formats. Suppliers are investing in clean-label practices and expanded fruit varieties to meet the demand from both foodservice and retail markets.

Additionally, rising awareness of food waste reduction through portion-controlled frozen fruits is enhancing the appeal of this segment. Continued growth is expected as food manufacturers prioritize IQF fruits for their versatility, minimal processing, and extended shelf life.

Tunnel freezers lead the equipment type category with a 29.5% market share, supported by their high-volume throughput and suitability for continuous freezing operations. These systems are widely adopted in large-scale production environments where speed, consistency, and hygiene are critical.

Tunnel freezers are favored for processing diverse food categories such as berries, seafood, poultry, and bakery products, providing uniform freezing across individual units. Their energy-efficient operation and capability to maintain product quality make them a preferred choice for industrial processors.

Innovations in airflow design, automation, and CIP (clean-in-place) functionality are enhancing the performance and ease of maintenance in these systems. As global food demand rises and automation becomes essential in processing facilities, the tunnel freezer segment is projected to maintain steady growth due to its operational reliability and scalability.

Mechanical IQF holds a dominant 61.9% share in the technology segment, underscoring its widespread acceptance as a cost-effective and energy-efficient freezing method. This technology operates through the use of cold air flow and movement mechanisms that separate and freeze individual food pieces, making it ideal for fruits, vegetables, meat, and seafood.

Mechanical IQF systems are valued for their simplicity, lower capital investment, and adaptability across multiple product lines. Food processors favor this approach for its speed, product consistency, and ease of integration into existing processing lines.

With growing emphasis on food quality, mechanical IQF continues to outperform alternative methods in terms of product integrity and moisture retention. The segment is expected to retain its leadership as manufacturers seek reliable and scalable freezing technologies to meet the expanding demand for high-quality frozen foods.

The IQF market is expanding due to rising demand for frozen convenience foods, improved cold chain infrastructure, and growing use in fruit and vegetable processing. Advancements in equipment design and strategic collaborations further strengthen its global adoption.

The IQF market is being driven by increasing consumer preference for frozen fruits, vegetables, seafood, and ready-to-eat meals. Busy lifestyles and the need for convenient meal solutions have boosted the demand for IQF products that offer extended shelf life without compromising nutritional integrity. Foodservice chains and quick-service restaurants are major contributors to this demand, incorporating IQF ingredients for consistent quality and operational efficiency. The surge in frozen snacks and bakery items further reinforces the adoption of IQF technology across developed and emerging economies. This trend has positioned IQF as a preferred method for preserving freshness and texture, creating opportunities for suppliers in retail and commercial food processing sectors.

Infrastructure development in cold storage and transportation has become a key factor in IQF market growth. Investments in advanced refrigeration systems, energy-efficient storage facilities, and temperature-controlled logistics networks enable wider penetration of IQF products across global markets. Emerging economies are prioritizing cold chain expansion to reduce food wastage and meet growing demand for processed and frozen foods. Partnerships between logistics providers and food processing companies ensure seamless supply chain operations. This development not only supports bulk storage and distribution but also enhances quality assurance, thereby strengthening IQF adoption across multiple food categories globally.

IQF technology has found strong adoption in fruit and vegetable processing due to its ability to preserve natural taste, color, and nutrients. Fresh produce such as berries, peas, corn, and tropical fruits are commonly processed using IQF to meet seasonal demand year-round. The flexibility offered by IQF in maintaining individual portions without clumping makes it attractive for both retail and industrial applications. Health-conscious consumers are increasingly opting for frozen produce as an alternative to canned or chemically preserved options. This demand surge has encouraged processors to scale production capacities and integrate IQF systems to meet both domestic and export requirements.

The IQF market is witnessing significant advancements in equipment design and automation for improved efficiency and cost control. Manufacturers are focusing on energy-saving solutions and optimized airflow systems to ensure uniform freezing across product batches. Competitive strategies include strategic mergers, capacity expansions, and collaborations between equipment suppliers and food producers to address growing demand in emerging markets. Companies are also investing in R&D for faster freezing times and better preservation techniques to differentiate themselves. This combination of technology upgrades and strategic alliances positions industry leaders to maintain strong market dominance while catering to diverse customer needs globally.

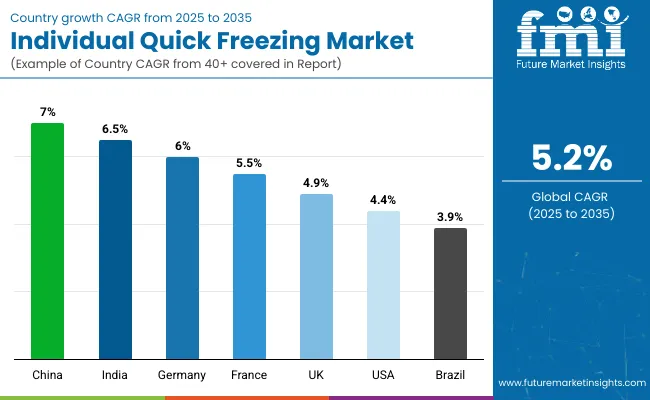

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

The individual quick freezing (IQF) market, forecasted to grow at a global CAGR of 5.2% from 2025 to 2035, is showing strong regional dynamics. China leads the segment with an impressive CAGR of 7.0%, supported by large-scale frozen food processing investments and a rising appetite for convenience-oriented meal solutions. India follows closely at 6.5%, driven by rapid cold chain development and growing adoption of frozen vegetables and snacks in metropolitan areas. Germany records a 6.0% CAGR due to demand from bakery and meat processing sectors and heightened awareness of nutritional retention through IQF technology.

France and the United Kingdom are demonstrating steady growth with CAGRs of 5.5% and 4.9%, respectively, driven by premium frozen fruit and vegetable segments catering to health-conscious consumers. The United States shows moderate growth at 4.4%, where established infrastructure is complemented by innovations in packaging and premium offerings for retail and foodservice sectors. While developed regions maintain stable demand, Asia-Pacific emerges as a hotspot for IQF adoption through investment in advanced freezing technologies and integrated logistics networks. The report provides an in-depth analysis covering 40+ countries, with detailed insights shared for the top five markets as reference benchmarks.

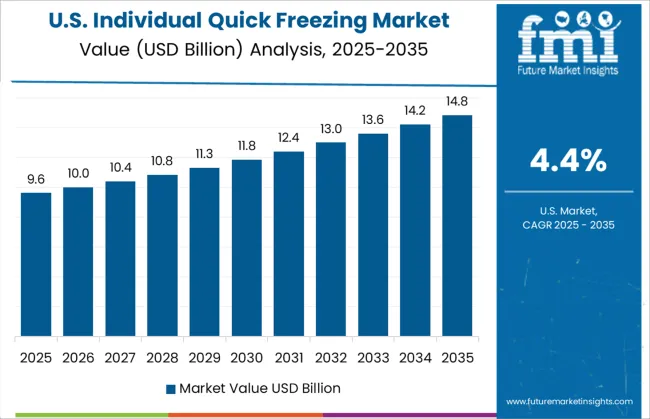

The CAGR of the IQF market in the United States moved from around 3.2% during 2020–2024 to 4.4% for 2025–2035, supported by an increasing reliance on frozen fruits, vegetables, and ready-to-eat meals. The transition was driven by heightened consumer preference for convenient and nutritious options, reinforced by improved cold chain infrastructure. Expansion of premium frozen snack categories and retail freezer space further propelled market dynamics. Strong adoption by foodservice chains for portion-controlled ingredients has supported consistent product quality in high-volume operations. IQF suppliers in the USA are leveraging automation and energy-efficient freezing technology to lower operational costs and ensure scalability. The domestic market benefits from established e-commerce platforms offering quick delivery of frozen items, complementing growing interest in health-focused frozen produce.

The CAGR in the United Kingdom advanced from nearly 3.6% in 2020–2024 to 4.9% for the period 2025–2035, influenced by higher demand for IQF berries, vegetables, and ready meals among health-conscious consumers. Rising adoption of portion-controlled frozen produce in foodservice sectors has accelerated usage in quick-service restaurants and institutional kitchens. The UK market also benefits from the growing popularity of plant-based frozen meals and seasonal fruit offerings, supported by IQF technology’s ability to preserve taste and nutritional integrity. Supermarkets and convenience stores are enhancing freezer space, while private-label brands are introducing premium frozen assortments. Digital grocery platforms have further widened access to frozen items, ensuring consistent sales growth in both urban and rural areas.

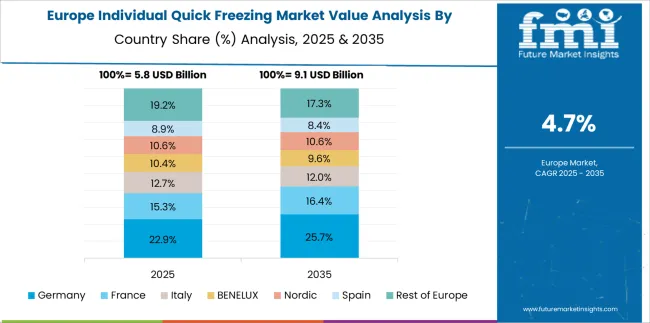

The CAGR in France improved from 4.2% during 2020–2024 to 5.5% for 2025–2035, reflecting stronger consumption of frozen fruits, premium desserts, and ready-to-bake items. French consumers have shown an affinity for gourmet frozen products that retain authentic flavors and quality standards. The IQF sector benefits from robust demand in patisserie and bakery applications, coupled with rising exports of frozen produce across Europe. Enhanced cold storage capabilities and collaboration between suppliers and logistics providers have ensured better quality maintenance during transit. The rapid uptake of IQF fruit in dairy-based products like yogurts and smoothies further underscores market strength.

The China market accelerated from approximately 5.8% in 2020–2024 to 7.0% during 2025–2035, fueled by strong penetration of frozen food products in retail and foodservice channels. Rising urban incomes and greater freezer ownership in households have driven higher consumption of IQF vegetables, seafood, and fruits. Domestic processors are heavily investing in advanced freezing lines to meet demand from supermarkets and QSR chains. Government-led initiatives to reduce food waste and promote frozen preservation techniques have bolstered market acceptance. Integration of IQF solutions into e-commerce platforms such as JD.com and Alibaba has further transformed distribution efficiency.

The CAGR value increased from 5.4% during 2020–2024 to 6.5% for 2025–2035, driven by expanding frozen food adoption in urban households and institutional kitchens. Demand for IQF peas, sweet corn, and mixed vegetables has surged due to greater convenience and year-round availability. The rise of organized retail chains and rapid penetration of freezer-equipped mom-and-pop stores have strengthened accessibility. Cloud kitchens and QSR chains are leveraging IQF solutions for ingredient standardization and waste reduction. Strong cold chain investments, supported by public-private partnerships, continue to address infrastructure gaps.

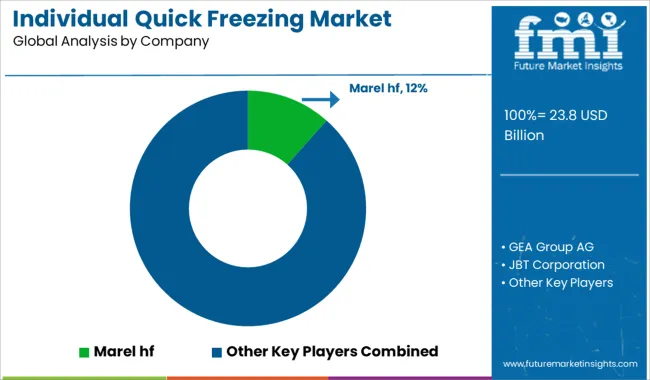

The individual quick freezing (IQF) market is driven by global leaders focusing on advanced freezing technologies and energy-efficient solutions to meet rising demand in food processing. Marel hf and GEA Group AG dominate the sector by providing integrated freezing systems with automation capabilities tailored for large-scale poultry, meat, and seafood processors.

JBT Corporation emphasizes innovative cryogenic freezing systems that ensure superior product quality and reduce operational costs. Air Liquide S.A. and The Linde Group are recognized for their cryogenic expertise, offering liquid nitrogen and carbon dioxide-based freezing systems that optimize speed and energy performance.

Companies such as Cryogenic Systems Equipment (CSE) GmbH, OctoFrost Group, and Starfrost (UK) Ltd. focus on delivering customizable IQF solutions for fruits, vegetables, and bakery items, ensuring minimal product dehydration and texture preservation. Scanico A/S and Skaginn 3X are strengthening their portfolios with spiral and plate freezers for high-capacity production lines, while Advanced Equipment Inc. and Unifreezing Ltd. are leveraging compact designs for small and mid-scale processors.

Van Abeelen Keuringen B.V. and NESPAK SRL bring European engineering excellence to modular freezing systems with advanced airflow controls. These companies are investing in R&D for improved energy efficiency, digital monitoring, and hygienic designs, addressing growing regulatory compliance and quality assurance requirements. Strategic collaborations, retrofitting of existing facilities, and after-sales service enhancements remain key initiatives, ensuring their leadership in a competitive IQF landscape.

Expansion of cold chain logistics and energy-efficient freezing technologies will support adoption across emerging economies. Strategic collaborations between equipment manufacturers and food processors, along with investments in automation and advanced cryogenic systems, are expected to enhance operational efficiency. Increased preference for high-quality frozen products in retail and foodservice segments will accelerate market growth, making capacity expansion and product differentiation critical strategies for leading players.

| Item | Value |

|---|---|

| Quantitative Units | USD 23.8 Billion |

| Product Type | IQF Fruits, IQF Vegetables, IQF Seafood, IQF Poultry, IQF Meat, IQF Dairy Products, and IQF Convenience Food |

| Equipment Type | Tunnel Freezers, Spiral Freezers, Box Freezers, and Other |

| Technology | Mechanical IQF and Cryogenic IQF |

| Packaging Type | Bags, Cartons, Trays, and Others |

| Application | Food Processing Industry, Retail, and Catering and HoReCa |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Marel hf, GEA Group AG, JBT Corporation, Air Liquide S.A., Cryogenic Systems Equipment (CSE) GmbH, OctoFrost Group, Starfrost (UK) Ltd., The Linde Group, Scanico A/S, Skaginn 3X, Advanced Equipment Inc., Unifreezing Ltd., Van Abeelen Keuringen B.V., and NESPAK SRL |

| Additional Attributes | Dollar sales, share, regional demand trends, equipment adoption rates, end-user segments, pricing benchmarks, competitor strategies, capacity expansion, regulatory requirements, and future growth opportunities. |

The global individual quick freezing market is estimated to be valued at USD 23.8 billion in 2025.

The market size for the individual quick freezing market is projected to reach USD 39.4 billion by 2035.

The individual quick freezing market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in individual quick freezing market are iqf fruits, iqf vegetables, iqf seafood, iqf poultry, iqf meat, iqf dairy products and iqf convenience food.

In terms of equipment type, tunnel freezers segment to command 29.5% share in the individual quick freezing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Individual Quick Freezing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Airport Quick Service Restaurant Market Size and Share Forecast Outlook 2025 to 2035

Fast Food & Quick Service Restaurant Market Trends – Growth & Forecast 2025 to 2035

Cell Freezing Media Market Size and Share Forecast Outlook 2025 to 2035

Brine Freezing Market Size and Share Forecast Outlook 2025 to 2035

Blast Freezing for Frozen Food and Feed Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA