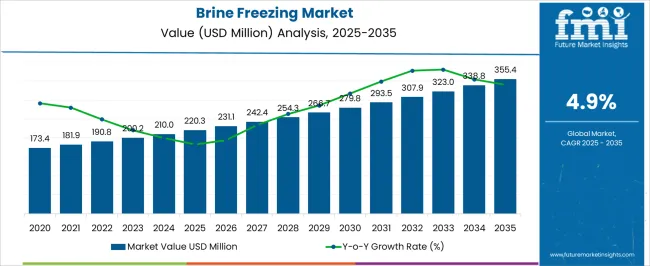

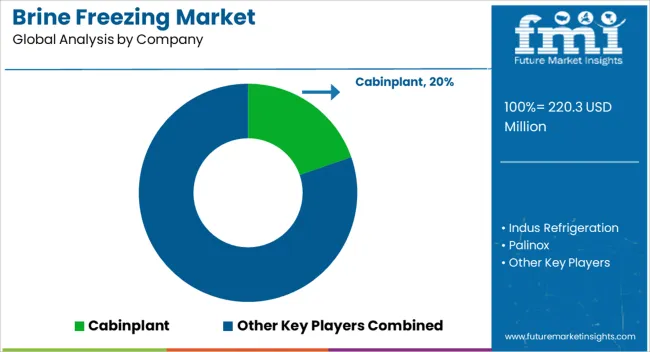

The brine freezing market is projected to reach USD 220.3 million in 2025 and is anticipated to climb to USD 355.4 million by 2035, advancing at a CAGR of 4.9%. This trajectory indicates a steadily rising curve, marked by incremental year-on-year gains that highlight both stability and resilience. Early expansion between 2025 and 2030 will be shaped by broader use of brine freezing across seafood processing, meat preservation, and cold storage facilities, where efficiency and cost competitiveness remain priorities.

By the mid-forecast horizon, the curve reflects stronger adoption in large-scale commercial storage systems and integration into modernized food logistics chains. Toward 2035, the curve demonstrates compounded growth from expanding demand in emerging economies, particularly in regions modernizing cold-chain infrastructure to reduce food wastage.

Technology improvements, operational reliability, and regulatory encouragement of energy-efficient freezing methods are expected to sustain this upward slope. Unlike more volatile curves seen in fast-disruptive sectors, the brine freezing market curve represents a measured and steady climb, showing that growth is anticipated to come from consistent, diversified applications rather than sharp spikes.

| Metric | Value |

|---|---|

| Brine Freezing Market Estimated Value in (2025 E) | USD 220.3 million |

| Brine Freezing Market Forecast Value in (2035 F) | USD 355.4 million |

| Forecast CAGR (2025 to 2035) | 4.9% |

The brine freezing market draws its momentum from four key parent industries, each contributing a defined share to its overall development. The frozen seafood and meat processing sector dominates with about 45% share, as brine freezing is widely used to preserve product quality, extend shelf life, and support large export volumes. The dairy and beverage industry contributes around 25%, where brine freezing systems are applied in chilling processes and bulk storage for milk, cheese, and related products requiring precise temperature control. Cold storage and logistics facilities account for approximately 20%, driven by rising investments in modernized warehouse infrastructure and the growing role of refrigerated transportation in global trade.

The pharmaceutical and biotechnology sector adds another 10%, where brine freezing methods assist in stabilizing sensitive compounds, vaccines, and biologics that demand low-temperature environments. Seafood and dairy stand at 70%, positioning them as the prime users, while logistics and pharmaceuticals offer complementary yet steadily expanding contributions. This distribution highlights how the brine freezing industry is not limited to food alone but is gradually embedding itself into advanced healthcare and logistics ecosystems. The balanced mix of established food-based demand and evolving pharmaceutical reliance ensures long-term resilience, giving the market both depth and diversification.

The brine freezing market is witnessing steady expansion due to its critical role in preserving seafood quality while optimizing freezing efficiency. The current market scenario is characterized by increased demand from seafood processors aiming to maintain product freshness and extend shelf life, particularly in the global seafood supply chain.

Advances in freezing technology that reduce energy consumption and enhance freezing speed have further supported market growth. Rising consumer preference for high-quality frozen seafood, alongside stricter regulations on food safety and hygiene, is driving investments in modern freezing solutions.

The future outlook remains positive, with anticipated growth fueled by expanding seafood consumption, modernization of processing facilities, and increasing adoption of sustainable freezing processes that minimize environmental impact.

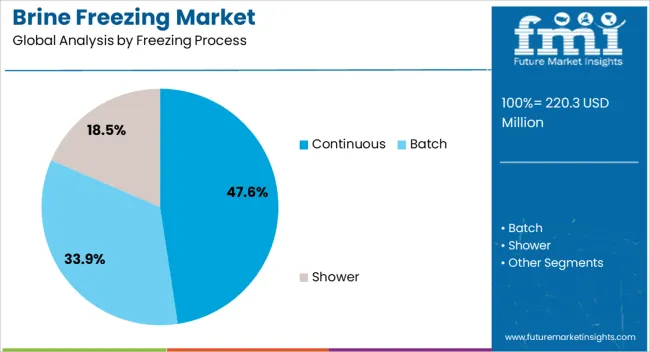

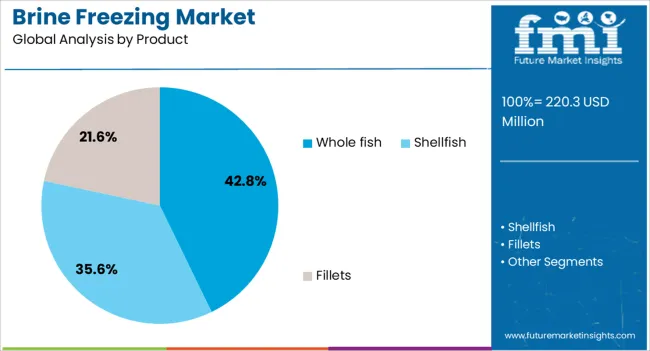

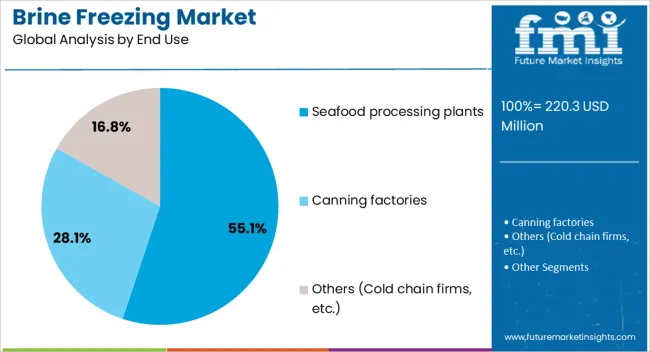

The brine freezing market is segmented by freezing process, product, end use, and geographic regions. By freezing process, brine freezing market is divided into Continuous, Batch, and Shower. In terms of product, brine freezing market is classified into Whole fish, Shellfish, and Fillets. Based on end use, brine freezing market is segmented into Seafood processing plants, Canning factories, and Others (Cold chain firms, etc.). Regionally, the brine freezing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The continuous freezing process segment is projected to hold 47.6% of the Brine Freezing market revenue share in 2025, establishing it as the leading freezing process. This dominance is attributed to the process’s ability to deliver consistent freezing quality at high throughput levels, making it ideal for large-scale seafood processing operations.

The continuous method allows for streamlined operations with reduced manual intervention, which enhances efficiency and lowers operational costs. Additionally, the process supports better temperature control, minimizing ice crystal formation and preserving the texture and taste of seafood products.

These advantages have accelerated the adoption of continuous freezing technologies, particularly in regions with high seafood export volumes where product quality and processing speed are critical factors.

The whole fish product segment is estimated to account for 42.8% of the market revenue share in 2025, marking it as the largest product category. The growth of this segment is driven by strong consumer preference for whole fish due to its perceived freshness and versatility in culinary applications.

Whole fish freezing is favored by seafood processors because it enables bulk handling and efficient storage, reducing processing steps before distribution. The ability of brine freezing to rapidly lower temperatures while maintaining product integrity makes it especially suitable for whole fish preservation.

Additionally, the rising demand for whole fish in emerging markets and the expansion of seafood export activities are reinforcing the segment’s leading position.

The seafood processing plants end use segment is expected to hold 55.1% of the market revenue share in 2025, positioning it as the dominant end user of brine freezing technologies. This prominence is linked to the sector’s requirement for rapid and uniform freezing solutions that can handle high volumes while preserving product quality.

Processing plants benefit from the energy efficiency and scalability of brine freezing systems, which support continuous operation and compliance with food safety standards. The segment’s growth is further driven by increased investments in upgrading seafood processing infrastructure, particularly in regions focused on export-driven growth.

As processing plants seek to enhance throughput and reduce product loss, the demand for advanced brine freezing solutions is projected to remain strong.

Brine freezing is being propelled by food processing, dairy, logistics, and emerging pharmaceutical adoption. These dynamics highlight how established food-based demand and new medical uses together ensure balanced long-term growth.

The food processing industry continues to be the largest adopter of brine freezing, particularly in seafood and meat preservation. Companies depend on this method to maintain freshness, improve shelf life, and meet export quality standards. Cold chain operators and exporters prefer brine freezing for its consistency, making it integral to global trade in frozen foods. The expansion of processed seafood and meat exports will remain the backbone of demand, ensuring that brine freezing maintains dominance in food-related applications across both developed and emerging regions

Dairy and beverage companies are increasingly adopting brine freezing due to its ability to deliver uniform cooling and stable temperature control. Products like milk, cheese, yogurt, and chilled beverages benefit from this process as it ensures quality retention during storage and transport. Industrial-scale producers also prefer brine freezing systems for their cost efficiency and compatibility with existing storage infrastructure. The rising consumption of dairy products and growing demand for temperature-sensitive beverages will sustain steady growth, making this sector an important pillar alongside seafood and meat processing.

Cold storage facilities and logistics providers are playing a key role in driving adoption of brine freezing. As global supply chains expand, demand for reliable freezing systems in warehouses, distribution hubs, and refrigerated trucks is increasing. These facilities rely on brine systems for energy efficiency and stable operation. The continuous investment in modernized cold chains across Asia and Latin America will accelerate this trend, positioning brine freezing as a critical enabler of food security and long-distance transportation. This reflects a transition where logistics becomes a growth accelerator beyond traditional food markets.

Pharmaceutical and biotechnology industries are slowly adopting brine freezing for applications requiring low-temperature preservation. Vaccines, biologics, and sensitive compounds benefit from the reliability of this method. Research institutions are also exploring their potential for scaling controlled environments. Though currently a smaller segment, it represents a high-value opportunity as medical cold chains expand worldwide. The growing importance of healthcare supply resilience will ensure this sector develops into a meaningful contributor. The ability of brine freezing to deliver stability gives it a unique edge in this emerging application area.

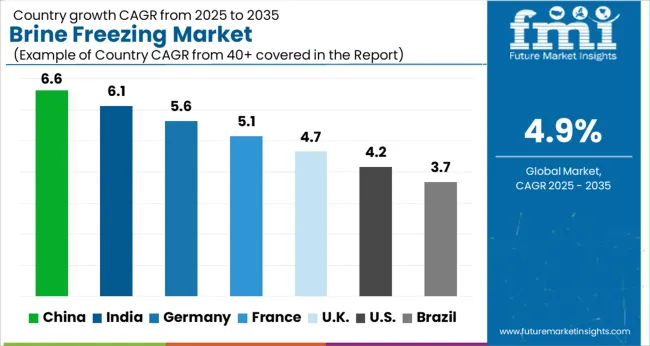

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

| USA | 4.2% |

| Brazil | 3.7% |

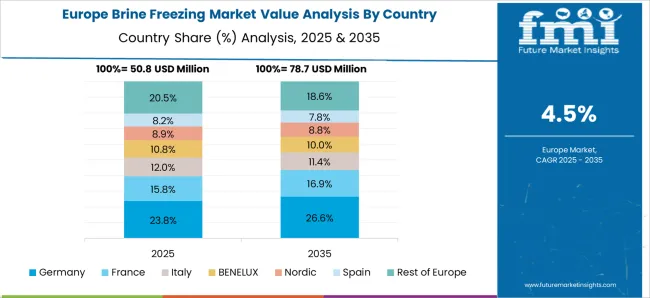

The global brine freezing market is projected to expand at a CAGR of 4.9% from 2025 to 2035. China leads with 6.6%, followed by India at 6.1%, Germany at 5.6%, France at 5.1%, the UK at 4.7%, and the USA at 4.2%. Growth is being accelerated by wider adoption of controlled freezing techniques across food processing, seafood exports, and cold chain logistics. China maintains leadership with its vast seafood industry, rising packaged food demand, and technological integration in freezing units. India is emerging strongly with growing seafood exports, dairy preservation, and government initiatives in cold chain infrastructure. Germany and France show steady adoption supported by strict EU regulations on food safety and quality control. The UK emphasizes seafood and meat exports, while the USA focuses on efficiency upgrades in food processing and pharmaceutical cold storage. The analysis covers more than 40 countries, with the leading markets outlined below.

The brine freezing market in China is projected to grow at a CAGR of 6.6% between 2025 and 2035. China dominates global demand due to its seafood industry, large-scale meat processing, and the rapid expansion of cold chain infrastructure. National initiatives promoting food preservation and safety have supported the adoption of advanced freezing technologies. Domestic manufacturers are investing in scalable brine freezing systems tailored for industrial-scale usage, while exports of frozen seafood and processed foods keep fueling production demand. China’s dominance is secured by both its industrial base and its export-driven demand, making it the global hub for brine freezing adoption.

The brine freezing market in India is forecasted to expand at a CAGR of 6.1% from 2025 to 2035, supported by rising seafood exports, processed food demand, and dairy preservation. India’s coastal states are witnessing strong adoption as frozen shrimp, fish, and poultry exports rise sharply to meet global demand. Government-backed programs for cold chain development, coupled with growing investment from private players, are strengthening infrastructure. The dairy sector, particularly in states like Gujarat and Maharashtra, also relies on brine freezing to ensure product stability during distribution. India is emerging as a high-potential growth region, with domestic consumption and export competitiveness jointly shaping its trajectory.

The brine freezing market in France is anticipated to grow at a CAGR of 5.1% between 2025 and 2035, driven by EU food safety standards, seafood imports, and demand for frozen bakery products. French processors prioritize compliance with strict hygiene and product safety regulations, which promotes the adoption of controlled freezing technologies. Meat and poultry processing facilities are expanding their reliance on brine freezing systems to meet domestic and export demands. Frozen bakery and ready-to-eat meal segments also contribute to consistent growth, reflecting evolving consumer preferences. France’s market growth reflects its structured food industry ecosystem, with compliance and quality assurance as central pillars.

The brine freezing market in the UK is projected to grow at a CAGR of 4.7% from 2025 to 2035, supported by seafood imports, frozen ready-meals, and the country’s meat export industry. Rising reliance on frozen seafood from Norway and other suppliers has led to stronger adoption of brine freezing units at ports and distribution hubs. Ready-meal manufacturers are integrating advanced freezing technologies to maintain taste and safety. Poultry and beef exports, particularly to the Middle East and EU, rely on consistent freezing methods to meet international standards. The UK market remains steady, with demand anchored in imports, exports, and consumer-driven convenience food trends.

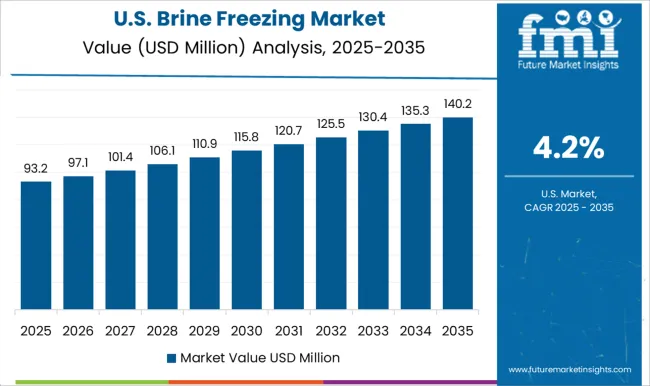

The brine freezing market in the USA is expected to grow at a CAGR of 4.2% between 2025 and 2035, driven by food processing, seafood imports, and pharmaceutical cold storage. USA meat processing plants increasingly rely on brine freezing for efficiency and consistency in large-scale operations. Rising frozen food consumption, particularly in ready-to-cook meals and seafood, is reinforcing demand. The pharmaceutical industry also adopts brine freezing for specialized cold storage applications in vaccines and biologicals. The USA market demonstrates steady growth, backed by its diversified end-use industries and large-scale consumption base.

Competition in the brine freezing market is largely shaped by factors such as equipment efficiency, energy optimization, operational reliability in continuous processing, and adaptability across seafood, meat, and processed food industries. Cabinplant and Optimar have established themselves as leading providers, with advanced freezing solutions designed for high-capacity seafood and poultry applications. Their systems are recognized for ensuring consistent product quality while minimizing energy consumption, which has become a key decision-making factor for large processing facilities. Indus Refrigeration, Palinox, and Gaictech bring strong regional presence, focusing on cost competitiveness and technical service networks, which make their offerings appealing to mid-scale processors that prioritize service availability along with affordability.

Moon-Tech and CBFI dominate in large-scale industrial applications, particularly within seafood hubs in Asia and Europe. Their equipment emphasizes productivity improvements and compliance with international food safety standards, making them valuable to companies that operate across global supply chains. SMT Coldchain Technology differentiates itself by providing freezing systems integrated into broader cold chain logistics, addressing the growing need for seamless end-to-end temperature control. Olen and Wolfking add competitive strength with mechanical durability, innovative brine circulation designs, and the ability to withstand diverse climatic environments, appealing to both emerging and mature markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 220.3 Million |

| Freezing Process | Continuous, Batch, and Shower |

| Product | Whole fish, Shellfish, and Fillets |

| End Use | Seafood processing plants, Canning factories, and Others (Cold chain firms, etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cabinplant, Indus Refrigeration, Palinox, Gaictech, Moon-Tech, Optimar, CBFI, SMT Coldchain Technology, Olen, and Wolfking |

| Additional Attributes | Dollar sales by application, share by equipment type, regional adoption trends, competitive positioning, pricing benchmarks, energy efficiency drivers, regulatory impact, and long-term demand growth. |

The global brine freezing market is estimated to be valued at USD 220.3 million in 2025.

The market size for the brine freezing market is projected to reach USD 355.4 million by 2035.

The brine freezing market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in brine freezing market are continuous, batch and shower.

In terms of product, whole fish segment to command 42.8% share in the brine freezing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Brined Vegetable Market Analysis by Nature, Type, End-use, Distribution Channel and Region through 2035

Clear Brine Fluids Market

Formate Brines Market

Lithium Extraction From Brine Technology Market Size and Share Forecast Outlook 2025 to 2035

Cell Freezing Media Market Size and Share Forecast Outlook 2025 to 2035

Blast Freezing for Frozen Food and Feed Market Size and Share Forecast Outlook 2025 to 2035

Individual Quick Freezing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Individual Quick Freezing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA