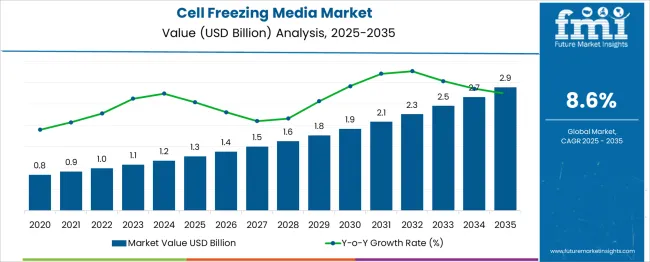

The global cell freezing media market is projected to grow from USD 1.3 billion in 2025 to approximately USD 2.9 billion by 2035, recording an absolute increase of USD 1.6 billion over the forecast period. This translates into a total growth of 127.8%, with the market forecast to expand at a compound annual growth rate (CAGR) of 8.6% between 2025 and 2035. The overall market size is expected to grow by nearly 2.3X during the same period, supported by increasing demand for stem cell research, growing adoption of cell-based therapies, and expanding applications in regenerative medicine and drug discovery.

Between 2025 and 2030, the cell freezing media market is projected to expand from USD 1.3 billion to USD 1.9 billion, resulting in a value increase of USD 0.6 billion, which represents 37.5% of the total forecast growth for the decade. This phase of growth will be shaped by rising investments in stem cell research, increasing adoption of personalized medicine approaches, and growing penetration of cell therapy applications in emerging markets. Pharmaceutical and biotechnology companies are expanding their cell preservation capabilities to support the growing demand for advanced cell-based treatments and research applications.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1.3 billion |

| Forecast Value in (2035F) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 8.6% |

From 2030 to 2035, the market is forecast to grow from USD 1.9 billion to USD 2.9 billion, adding another USD 1.0 billion, which constitutes 62.5% of the overall ten-year expansion. This period is expected to be characterized by advancement of cryopreservation technologies, integration of automated freezing systems, and development of specialized formulations for specific cell types. The growing adoption of regenerative medicine and increasing focus on biobanking applications will drive demand for high-performance cell freezing media with enhanced cell viability and reduced toxicity profiles.

Between 2020 and 2025, the cell freezing media market experienced substantial expansion, driven by increasing investment in cell therapy research and growing awareness of personalized medicine applications. The market developed as pharmaceutical companies and research institutions recognized the critical importance of effective cell preservation for advancing cellular therapeutics. The COVID-19 pandemic accelerated research activities in vaccine development and cell-based treatments, highlighting the essential role of reliable cryopreservation solutions in supporting breakthrough medical innovations.

Market expansion is being supported by the increasing global investment in regenerative medicine and cell therapy research, which requires reliable long-term preservation of various cell types including stem cells, primary cells, and specialized cell lines. Modern healthcare systems are increasingly focused on personalized treatment approaches that depend on patient-specific cell preservation and subsequent therapeutic applications. The proven efficacy of advanced freezing media formulations in maintaining cell viability and functionality makes them essential components in pharmaceutical development and clinical applications.

The growing emphasis on biobanking and large-scale cell storage facilities is driving demand for specialized freezing media that can preserve diverse cell populations under various storage conditions. Healthcare institutions and research organizations are prioritizing solutions that combine effective cryoprotection with minimal cytotoxicity and enhanced post-thaw recovery rates. The rising influence of precision medicine approaches and regulatory requirements for standardized cell preservation protocols is also contributing to increased product adoption across pharmaceutical, biotechnology, and academic research sectors.

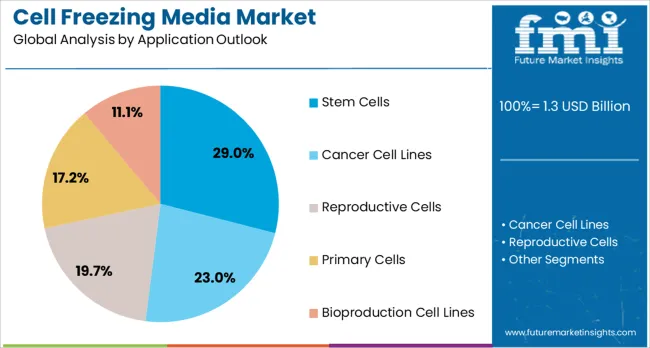

The market is segmented by product, type, cell culture type, application, end use, and region. By product, the market is divided into DMSO (with serum, without serum), glycerol (with serum, without serum), and others. Based on type, the market is categorized into slow freezing and vitrification. In terms of cell culture type, the market is segmented into suspension cell culture, 2D cell culture, 3D cell culture, and others. By application, the market is classified into stem cells (mesenchymal stem cells, hematopoietic stem cells, induced pluripotent stem cells, embryonic stem cells, others), cancer cell lines, reproductive cells, primary cells, bioproduction cell lines (CHO cells, HEK293 cells, BHK, others), and others. By end use, the market is divided into pharmaceuticals & biotechnology companies, academic & research institutes, biobanks (stem cells, reproductive cells, other cells), IVF clinics, and other end use. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The DMSO (dimethyl sulfoxide) segment is projected to account for 70.9% of the cell freezing media market in 2025, reaffirming its position as the industry's gold standard cryoprotectant. DMSO's exceptional ability to penetrate cell membranes and prevent ice crystal formation makes it the preferred choice for preserving a wide range of cell types including stem cells, primary cells, and cell lines. Its well-established safety profile and extensive validation in clinical applications continue to support its dominant market position.

This segment benefits from decades of research demonstrating DMSO's effectiveness in maintaining cell viability during cryopreservation and its compatibility with various freezing protocols. The availability of both serum-containing and serum-free formulations allows researchers and clinicians to select optimal preservation conditions based on specific cell requirements and downstream applications. With ongoing innovations in DMSO-based formulations incorporating additional protective agents and stabilizers, this segment is expected to maintain its leadership position while addressing evolving needs for specialized cell preservation solutions.

Slow freezing methods are projected to represent 67% of cell freezing media demand in 2025, underscoring their role as the most widely adopted cryopreservation approach across research and clinical applications. This controlled rate freezing technique allows for gradual dehydration of cells and prevents damaging ice crystal formation, making it suitable for preserving diverse cell populations with high post-thaw viability rates. The method's compatibility with standard laboratory equipment and established protocols supports its widespread adoption.

The segment is reinforced by its proven effectiveness across multiple cell types and its integration with automated freezing systems that ensure consistent and reproducible results. Additionally, slow freezing protocols are well-established in regulatory guidelines and quality standards, providing confidence for pharmaceutical and clinical applications. As biobanking facilities expand and cell therapy applications grow, slow freezing methods will continue to dominate demand due to their reliability, scalability, and cost-effectiveness compared to more specialized vitrification techniques.

The stem cells application segment is forecasted to contribute 29% of the cell freezing media market in 2025, reflecting the growing importance of stem cell research and therapeutic applications in regenerative medicine. This segment encompasses various stem cell types including mesenchymal stem cells (MSCs), hematopoietic stem cells (HSCs), induced pluripotent stem cells (iPSCs), and embryonic stem cells (ESCs), each requiring specialized preservation protocols to maintain their unique characteristics and differentiation potential.

The segment benefits from increasing investment in stem cell therapy development, growing clinical trial activities, and expanding applications in treating various diseases including cancer, neurological disorders, and cardiovascular conditions. Regulatory approvals for stem cell-based treatments and the establishment of specialized stem cell banks are driving demand for high-quality freezing media that can preserve stem cell functionality over extended storage periods. With continued advances in stem cell research and growing acceptance of regenerative medicine approaches, this segment represents a critical growth driver for the cell freezing media market.

The cell freezing media market is advancing rapidly due to increasing investment in cell therapy research and growing demand for personalized medicine applications. However, the market faces challenges including regulatory complexity for clinical applications, high costs of specialized formulations, and technical challenges in optimizing preservation protocols for emerging cell types. Innovation in cryoprotectant formulations and automated freezing systems continue to influence product development and market expansion patterns.

The growing number of cell therapy clinical trials and regulatory approvals is driving demand for standardized, high-quality freezing media that meet stringent safety and efficacy requirements. Pharmaceutical companies are investing in comprehensive cell preservation solutions to support their therapeutic development programs from preclinical research through commercial manufacturing. The establishment of specialized cell therapy manufacturing facilities requires reliable cryopreservation capabilities to ensure consistent product quality and patient safety.

Modern cell processing facilities are incorporating automated freezing systems that require compatible media formulations optimized for standardized protocols and consistent results. These systems enable high-throughput processing of cell samples while maintaining strict quality control standards and traceability requirements. Advanced monitoring and documentation capabilities integrated with automated systems are driving demand for validated freezing media that support regulatory compliance and operational efficiency.

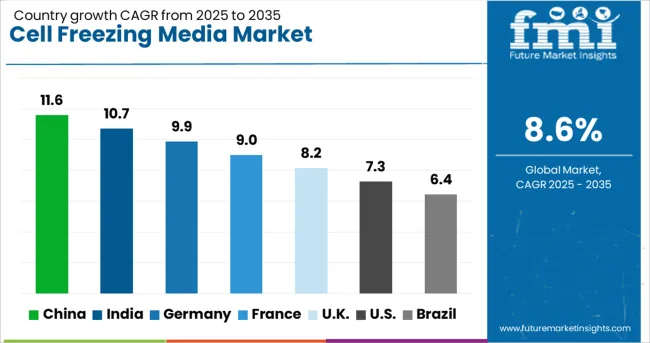

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 10.7% |

| China | 11.6% |

| Germany | 9.9% |

| France | 9% |

| UK | 8.2% |

| USA | 7.3% |

| Brazil | 6.4% |

The cell freezing media market is experiencing robust growth globally, with China leading at an 11.6% CAGR through 2035, driven by massive investment in biotechnology research, expanding pharmaceutical manufacturing capabilities, and government support for regenerative medicine initiatives. India follows closely at 10.7%, supported by growing biotechnology sector, increasing research activities, and rising adoption of advanced cell preservation technologies. Germany shows steady growth at 9.9%, emphasizing high-quality formulations and regulatory compliance. France records 9%, focusing on pharmaceutical applications and clinical research support. The UK shows 8.2% growth, prioritizing innovative cell therapy development and academic research applications. The report covers an in-depth analysis of 40+ countries; six top-performing countries are highlighted below.

Revenue from cell freezing media in China is projected to exhibit strong growth with a CAGR of 11.6% through 2035, driven by substantial government investment in biotechnology research and expanding pharmaceutical manufacturing capabilities. The country's growing focus on regenerative medicine and cell therapy development is creating significant demand for high-quality cryopreservation solutions. Major international and domestic biotechnology companies are establishing comprehensive research and manufacturing facilities to serve the expanding market for cell-based therapeutics and research applications.

Revenue from cell freezing media in India is expanding at a CAGR of 10.7%, supported by growing biotechnology sector, increasing research funding, and rising adoption of regenerative medicine approaches. The country's expanding pharmaceutical industry and growing number of research institutions are driving demand for reliable cell preservation solutions. International biotechnology companies and domestic manufacturers are establishing distribution networks to serve the growing demand for advanced cryopreservation products.

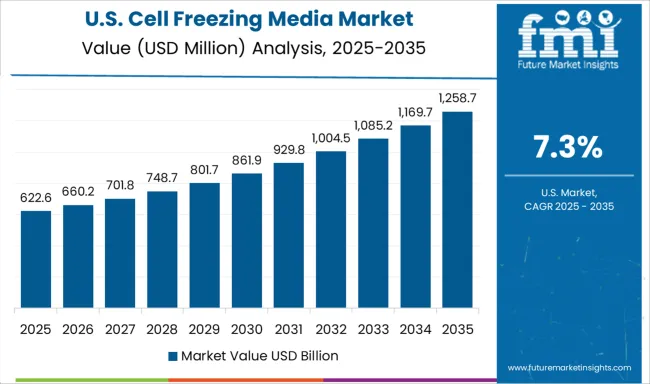

Demand for cell freezing media in the USA is projected to grow at a CAGR of 7.3%, supported by established biotechnology industry, extensive research infrastructure, and leading position in cell therapy development. American research institutions and pharmaceutical companies continue to invest heavily in regenerative medicine and personalized therapy applications. The market is characterized by strong demand for high-quality, regulatory-compliant formulations that support clinical development and commercial manufacturing requirements.

Revenue from cell freezing media in Germany is projected to grow at a CAGR of 9.9% through 2035, driven by the country's strong emphasis on quality manufacturing, regulatory compliance, and scientific excellence in biotechnology applications. German research institutions and pharmaceutical companies consistently demand high-quality formulations that meet stringent European regulatory requirements and support advanced research applications.

Revenue from cell freezing media in France is projected to grow at a CAGR of 9% through 2035, supported by the country's established pharmaceutical industry, strong research capabilities, and growing investment in regenerative medicine applications. French pharmaceutical companies and research institutions prioritize high-quality preservation solutions that support their therapeutic development programs and clinical research activities.

Revenue from cell freezing media in the UK is projected to grow at a CAGR of 8.2% through 2035, supported by the country's leadership in stem cell research, strong biotechnology sector, and innovative approach to cell therapy development. British research institutions and biotechnology companies continue to drive innovation in cell preservation technologies and therapeutic applications.

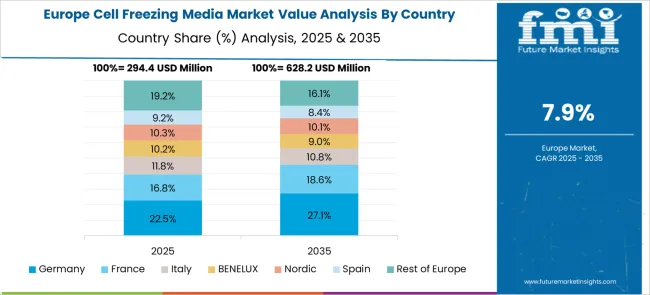

The cell freezing media market in Europe demonstrates strong development across major economies with Germany showing robust presence through its advanced biotechnology sector and significant investment in regenerative medicine research, supported by companies leveraging scientific expertise to develop specialized freezing media formulations that support diverse cell preservation applications across pharmaceutical and academic research institutions.

France represents a significant market driven by its established pharmaceutical industry and growing focus on cell therapy development, with companies like Sartorius AG and other European biotechnology firms pioneering innovative cryopreservation solutions that combine advanced formulation science with regulatory compliance for clinical applications. The country's strong research infrastructure and supportive regulatory environment continue to attract investment in cell-based therapeutic development.

The UK exhibits considerable growth through its leadership in stem cell research and cell therapy innovation, with established research institutions and emerging biotechnology companies driving demand for high-quality freezing media solutions. Italy and Spain show expanding interest in regenerative medicine applications, particularly in specialized cell therapy development and biobanking initiatives. BENELUX countries contribute through their focus on pharmaceutical manufacturing and quality standards, while Eastern Europe and Nordic regions display growing potential driven by increasing investment in biotechnology research and expanding access to advanced cell preservation technologies.

The Japanese cell freezing media market demonstrates steady growth driven by precision biotechnology focus, advanced life sciences technologies, and research preference for high-quality cryopreservation systems ensuring superior cell viability and safety compliance throughout laboratory operations. International companies establish presence through cutting-edge freezing media technologies aligning with Japan's sophisticated biotechnology industry and stringent quality standards while incorporating advanced formulation capabilities and automated freezing protocols.

The market emphasizes automated cryopreservation systems, precision media formulation excellence, and advanced cell culture innovations reflecting Japanese research precision and attention to detail in biotechnology processes. Growing investment in regenerative medicine supports intelligent freezing media systems with enhanced cell recovery, reduced contamination risk, and optimized storage performance. Japanese researchers prioritize media reliability, consistent cell viability outcomes, and regulatory compliance, creating opportunities for premium cell freezing solutions delivering exceptional performance across stem cell research, cancer studies, and bioproduction applications requiring highest quality standards.

The South Korean cell freezing media market shows exceptional growth potential driven by expanding biotechnology industry, increasing adoption of advanced life sciences technologies, and growing research focus on stem cell applications requiring efficient and reliable cryopreservation solutions. The market benefits from South Korea's technological advancement capabilities and increasing focus on biotechnology innovation competitiveness driving investment in modern cell culture technologies meeting international research standards and regulatory requirements.

Korean research institutions increasingly adopt automated freezing systems, advanced media formulations, and integrated cryopreservation technologies improving cell preservation efficiency and research outcomes while ensuring safety compliance. Growing influence of Korean biotechnology companies in global markets supports demand for sophisticated cell freezing media solutions ensuring research excellence while maintaining cost-effectiveness. Integration of digital biotechnology principles and smart laboratory technologies creates opportunities for intelligent cryopreservation systems with enhanced monitoring capabilities, predictive analytics, and real-time quality optimization across diverse research applications.

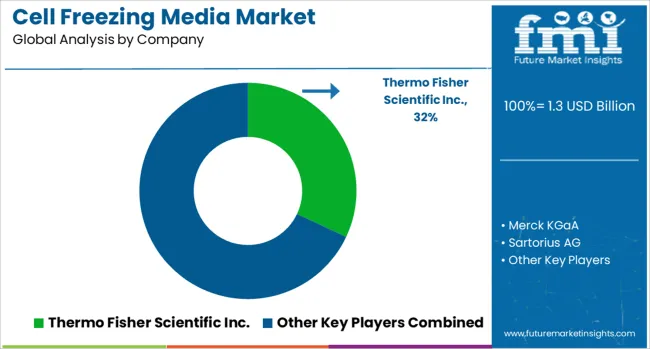

The cell freezing media market is characterized by competition among established life sciences companies, specialized biotechnology firms, and emerging cryopreservation technology providers. Companies are investing in advanced formulation development, regulatory compliance, quality assurance systems, and strategic partnerships to deliver effective, reliable, and compliant cell preservation solutions. Product innovation, regulatory approvals, and market expansion are central to strengthening product portfolios and market presence.

Thermo Fisher Scientific Inc., USA-based, leads the market with comprehensive cell culture and cryopreservation solutions, offering a wide range of freezing media formulations with emphasis on quality, consistency, and regulatory compliance. Merck KGaA, Germany, provides high-quality cell culture products including specialized freezing media with focus on innovation and global market reach. Sartorius AG, Germany, delivers advanced bioprocessing solutions including cryopreservation media with emphasis on biomanufacturing applications and quality systems.

HiMedia Laboratories, India, focuses on cost-effective, high-quality cell culture products with growing international presence. Bio-Life Solutions Inc., USA, specializes in hypothermic storage and cryopreservation solutions with innovative product formulations. Bio-Techne, USA, offers comprehensive cell biology solutions including specialized freezing media for research applications. PromoCell GmbH, Germany, provides primary cell culture solutions and specialized preservation media. Capricorn Scientific, Germany, focuses on high-quality cell culture products with emphasis on consistency and reliability.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1.3 billion |

| Product | DMSO (with serum, without serum), Glycerol (with serum, without serum), Others |

| Type | Slow freezing, Vitrification |

| Cell Culture Type | Suspension cell culture, 2D cell culture, 3D cell culture, Others |

| Application | Stem cells (MSCs, HSCs, iPSCs, ESCs, others), Cancer cell lines, Reproductive cells, Primary cells, Bioproduction cell lines (CHO cells, HEK293 cells, BHK, others), Others |

| End Use | Pharmaceuticals & biotechnology companies, Academic & research institutes, Biobanks (stem cells, reproductive cells, other cells), IVF clinics, Other end use |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Thermo Fisher Scientific Inc., Merck KGaA, Sartorius AG, HiMedia Laboratories, Bio-Life Solutions Inc., Bio-Techne, PromoCell GmbH, Capricorn Scientific, Vitrolife AB, AMSBIO, and ZENOGEN PHARMA CO., LTD. |

| Additional Attributes | Dollar sales by product type and formulation, regional demand trends, competitive landscape, end-user preferences for serum-containing versus serum-free formulations, integration with automated freezing systems, innovations in cryoprotectant combinations, cell-type specific formulations, and regulatory compliance requirements |

The global cell freezing media market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the cell freezing media market is projected to reach USD 2.9 billion by 2035.

The cell freezing media market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in cell freezing media market are DMSO with serum, without serum, glycerol, with serum, without serum and others.

In terms of type outlook , slow freezing segment to command 67.0% share in the cell freezing media market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cellulose Diacetate Film Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Fiber Market Forecast and Outlook 2025 to 2035

Cellulite Treatment Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Derivative Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Film Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cell Therapy Systems Market Size and Share Forecast Outlook 2025 to 2035

Cellular IoT Market Size and Share Forecast Outlook 2025 to 2035

Cell Isolation Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Ether and Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Cellular Push-to-talk Market Size and Share Forecast Outlook 2025 to 2035

Cell Culture Waste Aspirator Market Size and Share Forecast Outlook 2025 to 2035

Cellulosic Polymers Market Size and Share Forecast Outlook 2025 to 2035

Cellbag Bioreactor Chambers Market Size and Share Forecast Outlook 2025 to 2035

Cell Surface Markers Detection Market Size and Share Forecast Outlook 2025 to 2035

Cellular Modem Market Size and Share Forecast Outlook 2025 to 2035

Cellulite Reduction Treatments Market Size and Share Forecast Outlook 2025 to 2035

Cell Culture Supplements Market Size and Share Forecast Outlook 2025 to 2035

Cell Separation Market Size and Share Forecast Outlook 2025 to 2035

Cellulase Market Size and Share Forecast Outlook 2025 to 2035

Cellular M2M Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA