The cellulose fiber market is experiencing robust expansion driven by increasing demand for sustainable materials, growing environmental awareness, and the textile industry’s transition toward eco-friendly alternatives. Current market conditions reflect steady adoption across apparel, home textiles, and industrial applications as manufacturers prioritize biodegradability and reduced carbon footprint. Technological advancements in fiber processing and chemical recovery systems are enhancing production efficiency while maintaining product quality and environmental compliance.

The future outlook is positive as global brands integrate cellulose-based fibers into mainstream product lines, supported by policy incentives promoting circular economy practices. Cost optimization, coupled with improved scalability of manufacturing processes, is expected to strengthen market competitiveness.

Growth rationale is anchored in the versatility, comfort, and recyclability of cellulose fibers, along with increasing consumer preference for sustainable fabrics These drivers collectively position the market for consistent growth, supported by innovations in raw material utilization and advanced processing technologies aimed at minimizing waste and energy consumption.

| Metric | Value |

|---|---|

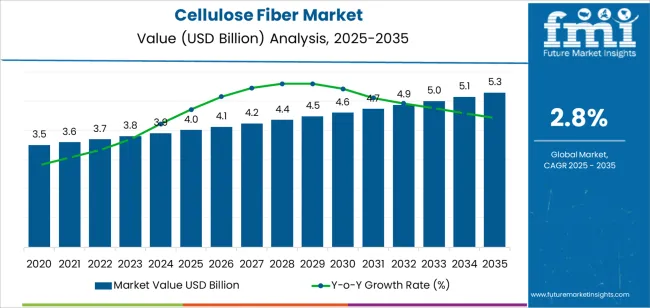

| Cellulose Fiber Market Estimated Value in (2025 E) | USD 4.0 billion |

| Cellulose Fiber Market Forecast Value in (2035 F) | USD 5.3 billion |

| Forecast CAGR (2025 to 2035) | 2.8% |

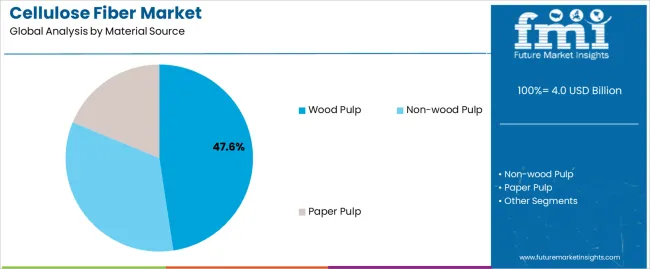

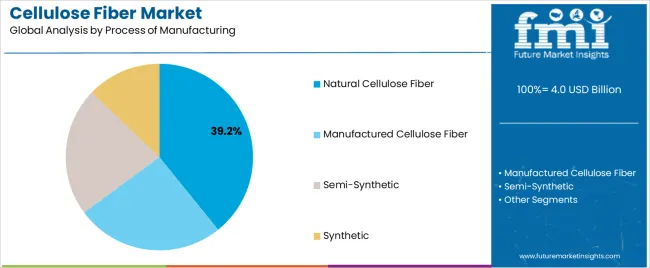

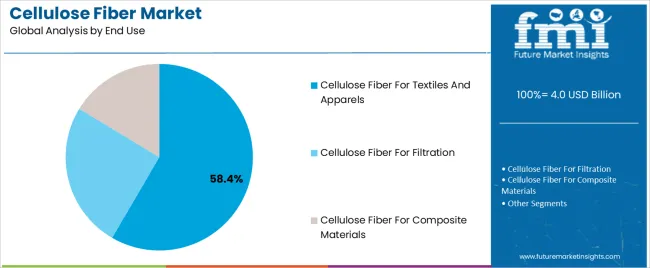

The market is segmented by Material Source, Process of Manufacturing, and End Use and region. By Material Source, the market is divided into Wood Pulp, Non-wood Pulp, and Paper Pulp. In terms of Process of Manufacturing, the market is classified into Natural Cellulose Fiber, Manufactured Cellulose Fiber, Semi-Synthetic, and Synthetic. Based on End Use, the market is segmented into Cellulose Fiber For Textiles And Apparels, Cellulose Fiber For Filtration, and Cellulose Fiber For Composite Materials. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The wood pulp segment, accounting for 47.60% of the material source category, has maintained its leadership due to abundant raw material availability and well-established processing infrastructure. Dependable supply chains and compatibility with large-scale fiber production have strengthened its dominance.

Manufacturers prefer wood pulp for its uniform cellulose content, which supports high-quality fiber output with consistent physical properties. Environmental certifications and sustainable forestry practices have further improved the market perception of wood-derived cellulose fibers.

Technological improvements in pulping and bleaching have reduced environmental impact and operational costs, reinforcing long-term supply stability The segment is expected to retain its leading position as demand for renewable and traceable fiber sources continues to rise across global textile and nonwoven industries.

The natural cellulose fiber segment, representing 39.20% of the manufacturing process category, is leading the market due to its eco-friendly production characteristics and reduced dependence on synthetic chemicals. Its inherent biodegradability and renewable sourcing have aligned well with sustainability goals adopted by global textile manufacturers.

Demand has been strengthened by growing consumer preference for organic and naturally derived fibers, particularly in apparel and home furnishing applications. Advancements in mechanical extraction and enzymatic processing have improved fiber quality and reduced production waste.

Compliance with environmental standards and lower greenhouse gas emissions are further supporting its market acceptance The segment’s growth trajectory remains positive as regulatory frameworks favor green manufacturing, ensuring continued investment and expansion in natural fiber processing facilities.

The cellulose fiber for textiles and apparels segment, holding 58.40% of the end-use category, has emerged as the dominant application area owing to sustained demand for breathable, comfortable, and sustainable fabrics. Its adoption has been reinforced by increasing integration into fast fashion and premium clothing lines emphasizing environmental responsibility.

The segment’s leadership is supported by rising consumer awareness and global initiatives encouraging the use of renewable fibers in garment production. Manufacturers are leveraging cellulose fibers to meet performance expectations while reducing dependency on petroleum-based materials.

Technological enhancements in fiber blending, dyeing, and finishing have improved fabric aesthetics and durability The segment is projected to maintain its lead as fashion brands continue to expand eco-conscious collections, making cellulose fibers a cornerstone material in the evolving sustainable textile ecosystem.

The growing demand for natural fibers across textile and construction industries, is the main driving force compelling the market expansion of cellulose fiber for textiles. Utilizing natural fibers, oils, and resins as eco-composite engineering components presents a range of novel opportunities for agricultural practices.

Applications such as papermaking, better drainage, and enhanced refinability have been made possible by applying cellulases to cellulose fibers. The bacterial cellulose material used by the burgeoning firm reduces discomfort and acts as a biological barrier against bacterial invasion. The cellulose fiber for filtration market is growing due to all these advancements and advantageous features.

| Attributes | Details |

|---|---|

| Market Value for 2020 | USD 3.5 billion |

| Market Value for 2025 | USD 3.8 billion |

| Market CAGR from 2020 to 2025 | 1.9% |

The construction industry makes substantial demand for cellulose fibers. In order to protect structures from outside damage, they are extensively utilized in the building and construction industry.

The global papermaking fiber market is growing at a rapid pace due to the rise in end-use industries, urbanization, and population. Market value growth is facilitated by the rising industrialization and urbanization of emerging nations like China, India, and Southeast Asia.

One of the main obstacles to the cellulose fiber industry's growth has been the price of cellulose fiber. The utilization of raw materials in large-scale firms is constrained due to their frequent fluctuations in price, which are inherent in the manufacturing of cellulose fiber.

The cellulose fiber sector requires a large commitment of money and expertise, making it capital-intensive. The cellulose fiber industry's primary barrier is the substantial expenditure on research and development activities to create new technology. Several obstacles to overcome include fluctuating raw material prices, dwindling cotton supplies, and government-imposed strict environmental laws about forests.

The segmented market analysis of cellulose fiber is included in the following subsection. Based on comprehensive studies, the paper pulp sector is leading the material sources category, and the textile and apparels segment is commanding the category.

| Segment | Paper Pulp |

|---|---|

| Share (2025) | 31.3% |

| Segment | Textiles and Apparels |

|---|---|

| Share (2025) | 28.3% |

The cellulose fiber market can be observed in the subsequent tables, which focus on the leading regions in North America, Europe, and Asia Pacific. A comprehensive evaluation demonstrates that Asia Pacific has enormous market opportunities for cellulose fiber.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 1.6% |

| Canada | 1.3% |

United States Lyocell Fiber Market Outlook

Canada Regenerated Cellulose Fiber Market Outlook

| Countries | CAGR (2025 to 2035) |

|---|---|

| Germany | 1% |

| United Kingdom | 1.3% |

| France | 1.9% |

| Italy | 1.4% |

| Spain | 2.5% |

Germany Rayon Fiber Market Outlook

United Kingdom Cotton Alternative Market Outlook

France Rayon Fiber Market Outlook

Italy Cotton Alternative Market Outlook

Spain Biodegradable Fiber Market Outlook

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 5.5% |

| China | 4.4% |

| Japan | 1.5% |

| South Korea | 1.9% |

| Thailand | 3.9% |

India Sustainable Fiber Market Outlook

China Biodegradable Fiber Market Outlook

Japan Papermaking Fiber Market Outlook

South Korea Sustainable Fiber Market Outlook

Thailand Natural Fiber Market Outlook

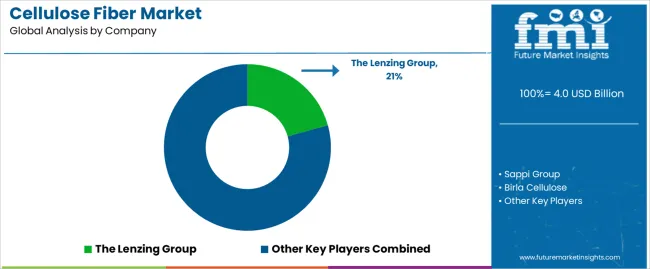

Leading producers of cellulose fiber, like Tembec Inc., Birla Cellulose, and Sappi Group, have made a name for themselves in the market by fostering innovation and establishing standards for sustainability and quality.

The Lenzing Group, Tangshan Sanyou Group Xingda Chemical Fiber Co. Ltd., and Thai Rayon Public Co. Ltd. all have important roles to play in the wide range of technological products and innovations in wood pulp fiber market.

Emerging vendors of cellulose fiber, such as Ioncell and Bacterial Cellulose Solutions, are expanding the realm of applications, questioning conventional wisdom, and providing fresh viewpoints and technological innovations. Fulida Group Holding Co., LTD. and Manasi Aoyang Technology Co. Ltd. achieved noteworthy progress in this competitive arena, enhancing the market with their distinctive goods and tactics.

With a constant focus on innovation, sustainability, and satisfying the changing needs of both industries and customers, cellulose fiber providers face intense competition as they navigate the continually evolving market.

Notable Advancements

| Company | Details |

|---|---|

| Confederation of Paper Industries (CPI) | The Confederation of Paper Industries (CPI) declared in May 2025 the opening of a new service to assess the recyclability of products and materials made of fiber for packaging. Users analyze their products online with Papercycle, a new assessment and certification program. |

| Sappi | Sappi pledged 2025 to contribute to the solution and is trying to decarbonize its activities. Next, in its long-term global commitment to climate preservation and sustainable production, it stopped using coal at its German facility in Stockstadt. The mill only ran on natural gas and renewable biomass after demolishing its coal-fired Boiler 9. |

| Birla cellulose | A garment designed by Lee Mathews and manufactured by Tree-Rree NullarborTM lyocell unveiled by Nanollose at the fashion summit in June 2025 in collaboration with Birla Cellulose. |

| IoncellOy | IoncellOy stated in May 2025 that it would begin to commercialize the manufacturing of eco-friendly textile fiber innovations. |

| Birla Cellulose | Birla Cellulose and Renewcell, a Swedish company that develops textile-to-textile recycling, inked a Letter of Intent in March 2025 to begin a long-term business relationship to produce artificial cellulosic fiber. |

The global cellulose fiber market is estimated to be valued at USD 4.0 billion in 2025.

The market size for the cellulose fiber market is projected to reach USD 5.3 billion by 2035.

The cellulose fiber market is expected to grow at a 2.8% CAGR between 2025 and 2035.

The key product types in cellulose fiber market are wood pulp, non-wood pulp and paper pulp.

In terms of process of manufacturing, natural cellulose fiber segment to command 39.2% share in the cellulose fiber market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Insights for Cellulose Fiber Providers

Cellulose Nanocrystals and Nanofibers Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Probe Hydrophone (FOPH) Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Centrifugal Fan Market Size and Share Forecast Outlook 2025 to 2035

Fiber to the Home Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Diacetate Film Market Size and Share Forecast Outlook 2025 to 2035

Fiber Based Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fiber Lid Market Forecast and Outlook 2025 to 2035

Fiberglass Tanks Market Size and Share Forecast Outlook 2025 to 2035

Fiber Sorter Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Polymer Panel and Sheet Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Derivative Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Film Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optic Tester Market Size and Share Forecast Outlook 2025 to 2035

Fiber Laser Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Ether and Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Fiber Spinning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fiber Reinforced Plastic (FRP) Panels & Sheets Market Size and Share Forecast Outlook 2025 to 2035

Fiberglass Fabric Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA