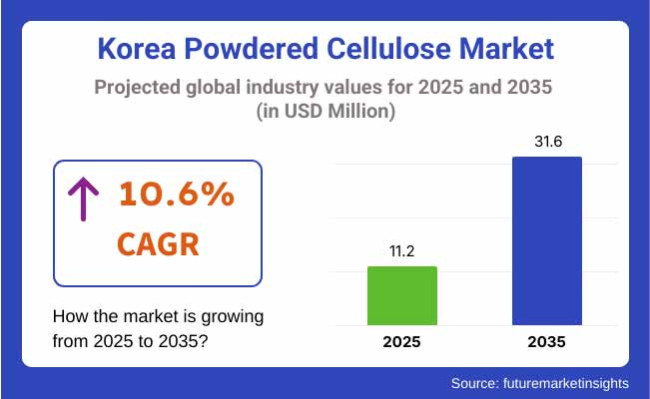

The Korea powdered cellulose market is poised to exhibit USD 11.2 million in 2025. The industry is slated to depict 10.6% CAGR from 2025 to 2035, witnessing USD 31.6 million by 2035.

The industry is expanding rapidly as a result of a fusion of consumer culture, industrial needs, and sustainability objectives. As an organic plant-derived element, the product is gaining popularity in food applications. Natural and clean-label tendencies are a definite shift with a heightened sense of health awareness among Korean consumers.

The product is a good thickener, stabilizer, and emulsifier in low-fat foods, gluten-free foods, and processed foods. Dietary trends are driving demand with consumers looking for healthier substitutes free from artificial preservatives and additives. Powdered cellulose, being a vegetarian product, aligns ideally with the increased demand for products that meet clean, natural consumption.

Other than food, the cosmetics and pharmaceutical industries are also playing an important role in adding value to the growth of the industry. In the pharmaceutical industry, the product serves as a filler and a binder in capsules and tablets.

The fact that it helps add stability and improve the physical characteristics of pills makes it an essential component of drug products. Likewise, in cosmetics, the product is used as a thickener in creams, lotions, and personal care products. The growing demand for natural, effective, and safe cosmetics generated a higher demand for cellulose derivatives.

The other major industry driver is the trend towards sustainability in South Korea. The product, being a renewable plant-based and biodegradable product, is highly poised to support the nation's environmental objectives. The increasing need for green packaging, especially in the packaging and paper sectors, has also contributed to the increase in the use of the product as a main material. Since South Korea continues to support sustainable practices and green alternatives, the industry will grow as it is adaptable and supports current consumer culture.

End-use trends in the Korean powdered cellulose market mirror increased demand for green, natural ingredients in food, pharmaceuticals, and cosmetics. In food markets, consumers prefer clean labels and healthy ingredients and are increasingly adopting the product as a natural ingredient to thicken and stabilize low-fat and gluten-free food products.

In the pharmaceutical industry, natural binders in tableting are becoming more popular with the clean-label trend. In cosmetics, the product is also appreciated for its natural texture and thickening effects. Purchase specifications in such markets are directed toward product purity, safety, and sustainability with environmentally friendly material preferences, particularly for packaging and cosmetic applications. Competitive pricing and high standards of quality are the deciding criteria in purchasing decisions across all segments.

In the Korea powdered cellulose market, from 2020 to 2024, demand was fueled by growing consumer interest in natural ingredients and sustainability in the food, pharmaceutical, and cosmetic sectors. Clean-label and green trends prompted manufacturers to add more cellulose-containing ingredients to their products, especially in gluten-free and low-fat foods.

With greater emphasis on sustainability, the product was also used more widely to create biodegradable packaging. Over the period of the next decade 2025 to 2035, the sector will experience even more innovation with advancements in the cellulose processing that will permit even more wide-ranging applications, including the production of high-performance new types of biodegradable plastics.

Additionally, as consumer demand for nature and plant-source foodstuffs and cosmetics rises further, the product will be used more and more in product formulas across many diverse industries.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| Trends (2020 to 2024) | Trends (2025 to 2035) |

|---|---|

| Growing demand for the product in clean-label and sustainable products, especially in gluten-free and low-fat foods. | Advances in cellulose processing technology to facilitate broader applications, such as biodegradable plastics. |

| The demand was majorly driven by sustainability concerns. | Creation of new biodegradable packaging methods with cellulose, thus emerging as a central material for packaging innovations. |

| Expansion in the pharmaceutical sector, with the product being used as a natural binder and filler in tablet and capsule formulations. | Further adoption in pharmaceutical and cosmetic formulations, with a focus on natural, eco-friendly alternatives to synthetic materials. |

| Rising consumer demand for natural, plant-based ingredients in personal care and food products. | The product is now a mainstay ingredient in natural and plant-based products throughout the beauty, wellness, and food industries. |

The Korea powdered cellulose market is also vulnerable to several risks related to supply chain disruptions, raw material price volatility, and increased competition. The most significant among these risks is raw material price volatility, such as wood and other plant fibers that are utilized to manufacture cellulose. Any discontinuation in supply of these raw materials due to geopolitical disputes or climate shifts will lead to the rise of prices or availability gaps in supply.

The industry is also subject to regulatory risk, since tightening of environmental regulations or food and cosmetic ingredient regulations may limit the use of the product in some applications. Moreover, the dependence on particular industries such as food, cosmetics, and pharmaceuticals exposes the industry to a decline in any one of them.

For example, a sudden decline in demand for processed food or personal care products would influence the overall industry demand for the product. Lastly, while sustainability continues to be a main driver, companies that fail to innovate or get aligned with green initiatives can lose industry share to more agile, sustainable players.

The most significant end application of the product in South Korea is the food and beverages industry. Its usage as an ingredient has been growing, primarily due to the fact that it is versatile and functional. Particularly, the product is used in bakery and confectionery products, where it is being used as a source of dietary fiber and as a fat replacement, and also assists in formulating healthier food products.

Its texture improvement and shelf-life-extending capacity makes it the go-to in the processed food use, where consumers more and more desire cleaner labels and all-natural ingredients. The product is also common in meat and poultry uses, where it improves the texture and moisture retention as well as functioning as a fat replacer in low-fat systems.

Another significant application in the food and beverage industry is in milk products, where the product is employed as a stabilizer and thickener in such items as cheese, ice cream, and yogurt. It is applied in beverages too, particularly low-calorie beverages and smoothies, where it enhances viscosity and acts as a source of fiber in the diet. The growing customer demand for healthful, functional, and clean-label foods has made the product a favorable option in the industry.

The major function of the product in South Korea is as a stabilizer and thickener for the food and beverage industry. The product finds extensive application in this capacity since it can enhance the texture and consistency of products.

Powdered cellulose, when used as a thickener, is added to various food items such as sauces, dressings, soups, and beverages, where it adds viscosity without significantly altering the flavor. It is hence a good choice for low-fat and low-calorie foods because it helps deliver the desired mouthfeel and texture that could otherwise be compromised by the lack of fats.

Apart from functioning as a thickener, the product also serves as a stabilizer. It maintains the quality and consistency of food products, particularly in emulsions and suspensions where the ingredients would separate over time.

The industry in South Korea is observing steady growth with its extensive applications in a number of industries such as food and beverages, pharmaceuticals, cosmetics, and textiles. The companies are working continuously to come up with novel products in order to meet the growing demand for healthier, greener, and functional products. South Korean consumers increasingly favor clean-label products, and powdered cellulose fits nicely into the trend due to its natural, plant-based origin and extensive list of beneficial attributes.

The marketplace is dominated by local as well as international players who offer products of varied grades to cater to diverse needs ranging from thickening and stabilizing to taking care of dietary fiber needs. As demand for natural and functional ingredients increases, competition increases, with companies focusing on R&D, product differentiation, and creating strong distribution networks to extend reach to different consumer segments. E-commerce and online platforms are growing more important as primary selling channels for powdered cellulose, propelling innovation and the development of value-added products.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| HNB BIO CO., LTD | 8-12% |

| J. Rettenmaier & Söhne GmbH + Co KG | 12-15% |

| CFF GmbH & Co. KG | 10-13% |

| Jelu-Werk J. Heeler GmbH & Co KG | 8-10% |

| InterFiber Sp. Z.O.O | 5-8% |

| Ankit Pulps and Boards PVT. LTD | 4-6% |

| Accent Microcell Pvt. Ltd. | 3-5% |

| NB Entrepreneurs | 3-5% |

| Mikro-Technik GmbH & Co KG | 2-4% |

| Central Drug House (P) Ltd | 2-4% |

| Natural Fiber Solutions | 2-3% |

| Parnacell Chemical Pvt. Ltd. | 2-3% |

| AROMATICS. | 1-2% |

| Maple Biotech Pvt. Ltd | 1-2% |

| FineCell Sweden AB | 1-2% |

| Company Name | Key Offerings/Activities |

|---|---|

| HNB BIO CO., LTD | Manufactures products made from natural plant fibers for sustainable food, pharmaceuticals, and cosmetic applications. |

| J. Rettenmaier & Söhne GmbH + Co KG | Provides quality cellulose fibers applied in food, drinks, and pharmaceuticals. Renowned for its product innovation, such as cellulose derivatives and novel processing techniques. |

| CFF GmbH & Co. KG | Specializes in high-purity products for various applications, such as functional food ingredients, cosmetics, and pharmaceuticals. Renowned for manufacturing environmentally friendly products. |

| Jelu-Werk J. Heeler GmbH & Co KG | Provides a variety of cellulose products, such as powdered cellulose for application in food, health supplements, and medical use. Emphasizes high-quality production and sustainable sourcing. |

| InterFiber Sp. Z.O.O | Offers products with emphasis on utilization in the food, pharmaceutical, and industrial industries, with emphasis on product purity and sustainability. |

| Ankit Pulps and Boards PVT. LTD | Offers natural products for application in food, beverage, and paper industries. Their products emphasize function and quality, with more emphasis on sustainability. |

| Accent Microcell Pvt. Ltd. | Provides products to be used in food and cosmetics industries, with a focus on high purity and natural sources of fiber. Has the major focus as organic certifications. |

| NB Entrepreneurs | Specializes in the sale of products to food and beverage industries, offering functional ingredients that aid in texture, stability, and dietary fiber content. |

| Mikro-Technik GmbH & Co KG | Provides cellulose products for a range of applications, including food and pharmaceuticals, focusing on high-precision processing methods to ensure product quality. |

| Central Drug House (P) Ltd | Supplies products for pharmaceutical applications, especially in tablet binding and as a filler in capsules. Focuses on meeting the high standards of the pharmaceutical industry. |

| Natural Fiber Solutions | Has a focus on sustainable, natural fiber-derived cellulose products for food and health supplements, with a commitment to environmentally friendly sourcing and production practices. |

| Parnacell Chemical Pvt. Ltd. | Is dedicated to powdered cellulose for pharmaceutical and food industries, with a focus on the functional benefits of cellulose in dietetics and health. |

| AROMATICS. | Supplies cellulose ingredients for food special applications, with an emphasis on clean-label products and natural fibers as dietary fiber boosters. |

| Maple Biotech Pvt. Ltd | Supplies cellulose products for food, pharmaceutical, and cosmetic applications, with a concentration on premium cellulose fibers and custom solutions. |

| FineCell Sweden AB | Has expertise in novel cellulose solutions for food and health products, with an emphasis on providing natural, clean-label ingredients that improve product stability and texture. |

Strategic Outlook

HNB BIO CO., LTD (8-12%)

HNB BIO is making inroads in the South Korean powdered cellulose market through its portfolio of high-quality, natural cellulose products. The company's emphasis on clean-label products and sustainable sourcing resonates with increasing consumer demand for natural, functional ingredients. With increasing demand for natural fibers in food and pharmaceutical applications, HNB BIO's dedication to purity and quality will ensure it remains a strong competitor.

J. Rettenmaier & Söhne GmbH + Co KG (12-15%)

J. Rettenmaier & Söhne is a market leader with a broad portfolio of products that focus on high quality and innovation. The company's commitment to sustainable, environmentally friendly production processes and its experience in delivering customized solutions for different applications establish it as an industry leader in Korea. With increasing consumer demand for clean-label products, J. Rettenmaier & Söhne is poised to address the changing needs of the industry.

CFF GmbH & Co. KG (10-13%)

CFF GmbH specializes in high-purity powdered cellulose that serves multiple industries such as food, pharmaceuticals, and cosmetics. The focus of the company on sustainable and functional products resonates with the growing trend towards natural ingredients in South Korea. As a company with a strong focus on quality and sustainability, CFF GmbH is poised to maintain its growth within the competitive industry.

Jelu-Werk J. Heeler GmbH & Co KG (8-10%)

Jelu-Werk has a reputation for producing high-quality products utilized in food, pharmaceuticals, and medical industries. Its emphasis on innovation, purity of product, and environmentally friendly production methods ensures that it is competitive in the South Korean industry. As demand for natural and functional ingredients rises, the products of Jelu-Werk will continue to make inroads.

Other Companies (30-40% Combined)

Other players like InterFiber, Ankit Pulps and Boards, Accent Microcell, Mikro-Technik, and Natural Fiber Solutions have a combined industry share of 30-40%. These players specialize in offering high-quality, sustainable, and specialized products for specific industries, including food, pharmaceuticals, and cosmetics. By concentrating on niche applications and highlighting product functionality and natural origin, these players are key drivers of innovation in the South Korean powdered cellulose industry.

In terms of source, the industry is classified into soft & hard wood pulp, cotton linter pulp, bamboo, wheat straw pulp, and others.

With respect to end-use, the industry is divided into food & beverage industry, pharmaceuticals, cosmetics, construction industry, chemical industry, leather industry, textile industry, and paper industry.

In terms of functionality, the industry is divided into thickener, stabilizer, emulsifier, gelling, coating agent, and others.

Regionally, the industry is divided into South Gyeongsang, North Jeolla, South Jeolla, Jeju, and the rest of Korea.

The industry is expected to reach USD 11.2 million in 2025.

The market is projected to witness USD 31.6 million by 2035.

The food & beverages industry uses it the most.

Leading companies include HNB BIO CO., LTD, J. Rettenmaier & Söhne GmbH + Co KG, CFF GmbH & Co. KG, Jelu-Werk J. Heeler GmbH & Co KG, InterFiber Sp. Z.O.O, Ankit Pulps and Boards PVT. LTD, Accent Microcell Pvt. Ltd., NB Entrepreneurs, Mikro-Technik GmbH & Co KG, Central Drug House (P) Ltd, Natural Fiber Solutions, Parnacell Chemical Pvt. Ltd., AROMATICS., Maple Biotech Pvt. Ltd, and FineCell Sweden AB.

Table 1: Industry Analysis and Outlook Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Industry Analysis and Outlook Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Industry Analysis and Outlook Value (US$ Million) Forecast by Source, 2018 to 2033

Table 4: Industry Analysis and Outlook Volume (Tons) Forecast by Source, 2018 to 2033

Table 5: Industry Analysis and Outlook Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 6: Industry Analysis and Outlook Volume (Tons) Forecast by End-use, 2018 to 2033

Table 7: Industry Analysis and Outlook Value (US$ Million) Forecast by Functionality, 2018 to 2033

Table 8: Industry Analysis and Outlook Volume (Tons) Forecast by Functionality, 2018 to 2033

Table 9: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Source, 2018 to 2033

Table 10: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Forecast by Source, 2018 to 2033

Table 11: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 12: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Forecast by End-use, 2018 to 2033

Table 13: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Forecast by Functionality, 2018 to 2033

Table 14: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Forecast by Functionality, 2018 to 2033

Table 15: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Source, 2018 to 2033

Table 16: North Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Source, 2018 to 2033

Table 17: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 18: North Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by End-use, 2018 to 2033

Table 19: North Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Functionality, 2018 to 2033

Table 20: North Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Functionality, 2018 to 2033

Table 21: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Source, 2018 to 2033

Table 22: South Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Source, 2018 to 2033

Table 23: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 24: South Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by End-use, 2018 to 2033

Table 25: South Jeolla Industry Analysis and Outlook Value (US$ Million) Forecast by Functionality, 2018 to 2033

Table 26: South Jeolla Industry Analysis and Outlook Volume (Tons) Forecast by Functionality, 2018 to 2033

Table 27: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Source, 2018 to 2033

Table 28: Jeju Industry Analysis and Outlook Volume (Tons) Forecast by Source, 2018 to 2033

Table 29: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 30: Jeju Industry Analysis and Outlook Volume (Tons) Forecast by End-use, 2018 to 2033

Table 31: Jeju Industry Analysis and Outlook Value (US$ Million) Forecast by Functionality, 2018 to 2033

Table 32: Jeju Industry Analysis and Outlook Volume (Tons) Forecast by Functionality, 2018 to 2033

Figure 1: Industry Analysis and Outlook Value (US$ Million) by Source, 2023 to 2033

Figure 2: Industry Analysis and Outlook Value (US$ Million) by End-use, 2023 to 2033

Figure 3: Industry Analysis and Outlook Value (US$ Million) by Functionality, 2023 to 2033

Figure 4: Industry Analysis and Outlook Value (US$ Million) by Region, 2023 to 2033

Figure 5: Industry Analysis and Outlook Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Industry Analysis and Outlook Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Industry Analysis and Outlook Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 10: Industry Analysis and Outlook Volume (Tons) Analysis by Source, 2018 to 2033

Figure 11: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 12: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 13: Industry Analysis and Outlook Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 14: Industry Analysis and Outlook Volume (Tons) Analysis by End-use, 2018 to 2033

Figure 15: Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 16: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 17: Industry Analysis and Outlook Value (US$ Million) Analysis by Functionality, 2018 to 2033

Figure 18: Industry Analysis and Outlook Volume (Tons) Analysis by Functionality, 2018 to 2033

Figure 19: Industry Analysis and Outlook Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 20: Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 21: Industry Analysis and Outlook Attractiveness by Source, 2023 to 2033

Figure 22: Industry Analysis and Outlook Attractiveness by End-use, 2023 to 2033

Figure 23: Industry Analysis and Outlook Attractiveness by Functionality, 2023 to 2033

Figure 24: Industry Analysis and Outlook Attractiveness by Region, 2023 to 2033

Figure 25: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Source, 2023 to 2033

Figure 26: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by End-use, 2023 to 2033

Figure 27: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) by Functionality, 2023 to 2033

Figure 28: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 29: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Analysis by Source, 2018 to 2033

Figure 30: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 31: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 32: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 33: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Analysis by End-use, 2018 to 2033

Figure 34: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 35: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 36: South Gyeongsang Industry Analysis and Outlook Value (US$ Million) Analysis by Functionality, 2018 to 2033

Figure 37: South Gyeongsang Industry Analysis and Outlook Volume (Tons) Analysis by Functionality, 2018 to 2033

Figure 38: South Gyeongsang Industry Analysis and Outlook Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 39: South Gyeongsang Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 40: South Gyeongsang Industry Analysis and Outlook Attractiveness by Source, 2023 to 2033

Figure 41: South Gyeongsang Industry Analysis and Outlook Attractiveness by End-use, 2023 to 2033

Figure 42: South Gyeongsang Industry Analysis and Outlook Attractiveness by Functionality, 2023 to 2033

Figure 43: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Source, 2023 to 2033

Figure 44: North Jeolla Industry Analysis and Outlook Value (US$ Million) by End-use, 2023 to 2033

Figure 45: North Jeolla Industry Analysis and Outlook Value (US$ Million) by Functionality, 2023 to 2033

Figure 46: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 47: North Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Source, 2018 to 2033

Figure 48: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 49: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 50: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 51: North Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by End-use, 2018 to 2033

Figure 52: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 53: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 54: North Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Functionality, 2018 to 2033

Figure 55: North Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Functionality, 2018 to 2033

Figure 56: North Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 57: North Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 58: North Jeolla Industry Analysis and Outlook Attractiveness by Source, 2023 to 2033

Figure 59: North Jeolla Industry Analysis and Outlook Attractiveness by End-use, 2023 to 2033

Figure 60: North Jeolla Industry Analysis and Outlook Attractiveness by Functionality, 2023 to 2033

Figure 61: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Source, 2023 to 2033

Figure 62: South Jeolla Industry Analysis and Outlook Value (US$ Million) by End-use, 2023 to 2033

Figure 63: South Jeolla Industry Analysis and Outlook Value (US$ Million) by Functionality, 2023 to 2033

Figure 64: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 65: South Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Source, 2018 to 2033

Figure 66: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 67: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 68: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 69: South Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by End-use, 2018 to 2033

Figure 70: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 71: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 72: South Jeolla Industry Analysis and Outlook Value (US$ Million) Analysis by Functionality, 2018 to 2033

Figure 73: South Jeolla Industry Analysis and Outlook Volume (Tons) Analysis by Functionality, 2018 to 2033

Figure 74: South Jeolla Industry Analysis and Outlook Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 75: South Jeolla Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 76: South Jeolla Industry Analysis and Outlook Attractiveness by Source, 2023 to 2033

Figure 77: South Jeolla Industry Analysis and Outlook Attractiveness by End-use, 2023 to 2033

Figure 78: South Jeolla Industry Analysis and Outlook Attractiveness by Functionality, 2023 to 2033

Figure 79: Jeju Industry Analysis and Outlook Value (US$ Million) by Source, 2023 to 2033

Figure 80: Jeju Industry Analysis and Outlook Value (US$ Million) by End-use, 2023 to 2033

Figure 81: Jeju Industry Analysis and Outlook Value (US$ Million) by Functionality, 2023 to 2033

Figure 82: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 83: Jeju Industry Analysis and Outlook Volume (Tons) Analysis by Source, 2018 to 2033

Figure 84: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 85: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 86: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 87: Jeju Industry Analysis and Outlook Volume (Tons) Analysis by End-use, 2018 to 2033

Figure 88: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 89: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 90: Jeju Industry Analysis and Outlook Value (US$ Million) Analysis by Functionality, 2018 to 2033

Figure 91: Jeju Industry Analysis and Outlook Volume (Tons) Analysis by Functionality, 2018 to 2033

Figure 92: Jeju Industry Analysis and Outlook Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 93: Jeju Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 94: Jeju Industry Analysis and Outlook Attractiveness by Source, 2023 to 2033

Figure 95: Jeju Industry Analysis and Outlook Attractiveness by End-use, 2023 to 2033

Figure 96: Jeju Industry Analysis and Outlook Attractiveness by Functionality, 2023 to 2033

Figure 97: Rest of Industry Analysis and Outlook Value (US$ Million) by Source, 2023 to 2033

Figure 98: Rest of Industry Analysis and Outlook Value (US$ Million) by End-use, 2023 to 2033

Figure 99: Rest of Industry Analysis and Outlook Value (US$ Million) by Functionality, 2023 to 2033

Figure 100: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 101: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Source, 2018 to 2033

Figure 102: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 103: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 104: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 105: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by End-use, 2018 to 2033

Figure 106: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 107: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 108: Rest of Industry Analysis and Outlook Value (US$ Million) Analysis by Functionality, 2018 to 2033

Figure 109: Rest of Industry Analysis and Outlook Volume (Tons) Analysis by Functionality, 2018 to 2033

Figure 110: Rest of Industry Analysis and Outlook Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 111: Rest of Industry Analysis and Outlook Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 112: Rest of Industry Analysis and Outlook Attractiveness by Source, 2023 to 2033

Figure 113: Rest of Industry Analysis and Outlook Attractiveness by End-use, 2023 to 2033

Figure 114: Rest of Industry Analysis and Outlook Attractiveness by Functionality, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Powdered Cellulose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Japan Powdered Cellulose Market, By Type, By Application, By Region, and Forecast, 2025 to 2035

Demand for Powdered Cellulose in EU Size and Share Forecast Outlook 2025 to 2035

Western Europe Powdered Cellulose Market Analysis by Source, End-use, Functionality, and Country Through 2035

Cellulose Diacetate Film Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Fiber Market Forecast and Outlook 2025 to 2035

Cellulose Derivative Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Film Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Ether and Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Korea Automotive Performance Tuning and Engine Remapping Service Industry Size and Share Forecast Outlook 2025 to 2035

Korea Smart Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Korea Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Korea Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

Cellulose Esters Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Nanocrystals and Nanofibers Market Size and Share Forecast Outlook 2025 to 2035

Powdered Soft Drinks Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Gel Market Growth, Forecast, and Analysis 2025 to 2035

Korea Isomalt Industry – Market Trends & Industry Growth 2025 to 2035

Korea Probiotic Supplement Industry – Industry Insights & Demand 2025 to 2035

Korea Calcium Supplement Market is segmented by form,end-use, application and province through 2025 to 2035.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA