The cellulose film packaging market is growing rapidly as industries embrace biodegradable, compostable, and renewable solutions. Derived from natural fibers, cellulose film offers transparency, flexibility, and superior barrier properties, making it ideal for food, personal care, and pharmaceutical packaging. By 2035, the market is expected to reach USD 1441.5 million, growing at a compound annual growth rate (CAGR) of 4.9%. Key growth drivers include sustainability trends, advancements in material science, and regulatory efforts to reduce plastic waste.

Manufacturers are innovating with advanced coatings, enhanced mechanical properties, and tailored designs to meet diverse industry requirements. Collaborations with food, healthcare, and cosmetics sectors ensure alignment with environmental and operational goals.

| Attributes | Values |

|---|---|

| Projected Global Value (2035) | USD 1441.5 million |

| Value-based CAGR (2025 to 2035) | 4.9% |

Factors Driving Market Growth

The cellulose film packaging market is expanding due to the increasing demand for eco-friendly and versatile packaging solutions. Innovations in coatings and production processes further boost adoption.

| Category | Market Share % |

|---|---|

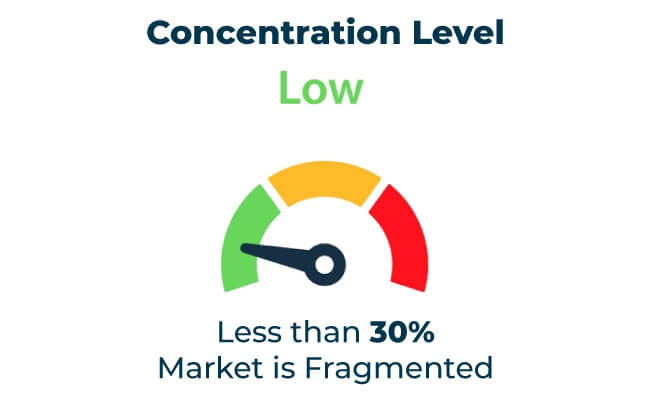

| Top 3 (Futamura, Innovia Films, Taghleef Industries) | 14% |

| Rest of Top 5 (Sappi, Tipa) | 07% |

| Next 5 of Top 10 Players | 08% |

Type of Player & Industry Share (%)

| Type of Player | MarketShare (%) |

|---|---|

| Top 10 Players | 29% |

| Next 20 Players | 48% |

| Remaining Players | 23% |

Year-on-Year Leaders

Emerging markets in Asia-Pacific, Africa, and South America present substantial growth potential. Affordable and scalable cellulose film solutions are highly demanded in these regions.

In-House vs. Contract Manufacturing

| Region | North America |

|---|---|

| Market Share (%) | 30% |

| Key Drivers | Emphasis on eco-friendly and sustainable packaging. |

| Region | Europe |

|---|---|

| Market Share (%) | 35% |

| Key Drivers | Stringent regulations on plastic reduction. |

| Region | Asia-Pacific |

|---|---|

| Market Share (%) | 25% |

| Key Drivers | Rapid industrial growth and demand for renewable solutions. |

| Region | Other Regions |

|---|---|

| Market Share (%) | 10% |

| Key Drivers | Rising demand for cost-effective, sustainable packaging. |

The cellulose film packaging market will thrive through innovations in coatings, materials, and automation. Companies prioritizing eco-friendly practices, leveraging digital tools, and enhancing material performance will lead. Automated production and energy-efficient methods will optimize processes and reduce costs.

| Tier | Key Companies |

|---|---|

| Tier 1 | Futamura, Innovia Films, Taghleef Industries |

| Tier 2 | Sappi, Tipa |

| Tier 3 | Cosmo Films, Celanese, Wipak |

The cellulose film packaging market is set for significant growth, driven by sustainability trends, regulatory support, and material innovations. Companies investing in biodegradable solutions, advanced coatings, and energy-efficient production will gain a competitive advantage.

Key Definitions

Abbreviations

Research Methodology

This report relies on primary research, secondary data analysis, and market modeling. Insights were validated through industry expert consultations.

The cellulose film packaging market includes biodegradable and compostable solutions for food, personal care, pharmaceuticals, and retail, addressing efficiency and environmental sustainability.

The demand for sustainable, compostable, and high-performance packaging fuels market growth.

The market is expected to reach USD 1441.5 million, growing at a compound annual growth rate (CAGR) of 4.9%.

Futamura, Innovia Films, and Taghleef Industries lead the market with innovative and sustainable packaging solutions.

High production costs, limited composting infrastructure, and material limitations are key challenges.

Opportunities include advancements in barrier coatings, increased composting infrastructure, and rising consumer awareness of eco-friendly packaging.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cellulose Fiber Market Forecast and Outlook 2025 to 2035

Cellulose Derivative Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Ether and Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Esters Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Nanocrystals and Nanofibers Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Gel Market Growth, Forecast, and Analysis 2025 to 2035

Market Share Insights for Cellulose Fiber Providers

Cellulose Film Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Diacetate Film Market Size and Share Forecast Outlook 2025 to 2035

Nanocellulose Coating Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Nanocellulose Barrier Coating Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Nanocellulose Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Ethyl Cellulose Market

Methyl Cellulose Market

Powdered Cellulose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ethyl Methyl Cellulose Market

Carboxymethyl Cellulose Market 2024-2034

Japan Powdered Cellulose Market, By Type, By Application, By Region, and Forecast, 2025 to 2035

Korea Powdered Cellulose Market Analysis by Source, End-use, Functionality, and Region Through 2035

Nanocrystalline cellulose Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA