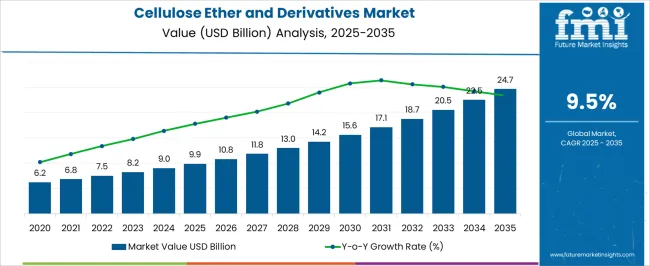

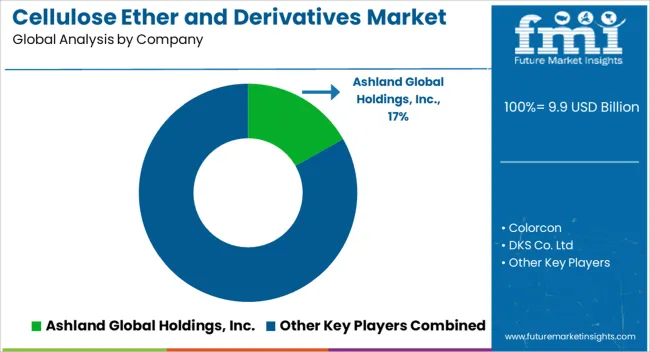

The Cellulose Ether and Derivatives Market is estimated to be valued at USD 9.9 billion in 2025 and is projected to reach USD 24.7 billion by 2035, registering a compound annual growth rate (CAGR) of 9.5% over the forecast period.

| Metric | Value |

|---|---|

| Cellulose Ether and Derivatives Market Estimated Value in (2025 E) | USD 9.9 billion |

| Cellulose Ether and Derivatives Market Forecast Value in (2035 F) | USD 24.7 billion |

| Forecast CAGR (2025 to 2035) | 9.5% |

The cellulose ether and derivatives market is experiencing steady growth, driven by their multifunctional properties in pharmaceuticals, food processing, personal care, and construction industries. Derived from natural cellulose, these compounds provide thickening, binding, water retention, and stabilizing functionalities, making them indispensable in diverse applications. The current market scenario is influenced by growing demand for sustainable, plant-based ingredients as alternatives to synthetic polymers.

Pharmaceutical demand remains a major growth driver due to their use in controlled drug release, tablet binding, and bioavailability enhancement. Rising utilization in processed food formulations and cosmetics further contributes to demand.

With ongoing research into modified cellulose derivatives for specialty applications, the market outlook remains positive. Increasing emphasis on eco-friendly and biodegradable materials is expected to accelerate long-term adoption, solidifying their role across end-use industries.

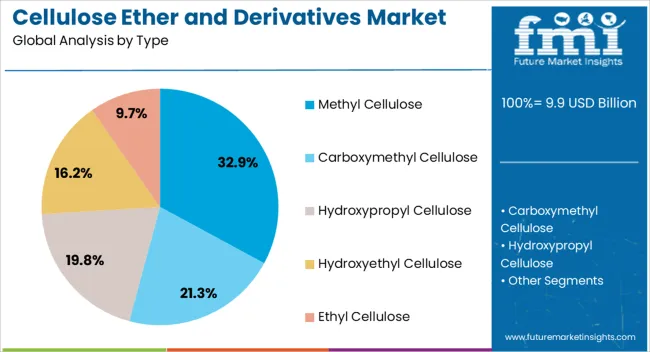

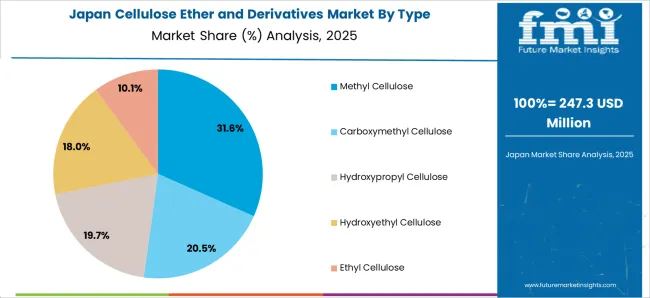

The methyl cellulose segment dominates the type category with approximately 32.90% share, supported by its extensive use in food, pharmaceutical, and construction industries. Its solubility in cold water and strong binding properties make it an essential additive in pharmaceutical formulations, bakery products, and building materials.

The segment benefits from its versatility, as it functions as a thickener, stabilizer, and film-forming agent across industries. Rising demand for gluten-free and vegan food products has reinforced its market position, while construction growth has further driven demand for methyl cellulose-based additives in cement and plaster formulations.

Continuous innovation in derivative development, including low-viscosity and tailored-performance variants, has strengthened adoption. The segment is expected to sustain its leadership as industries increasingly prioritize sustainable, plant-derived ingredients.

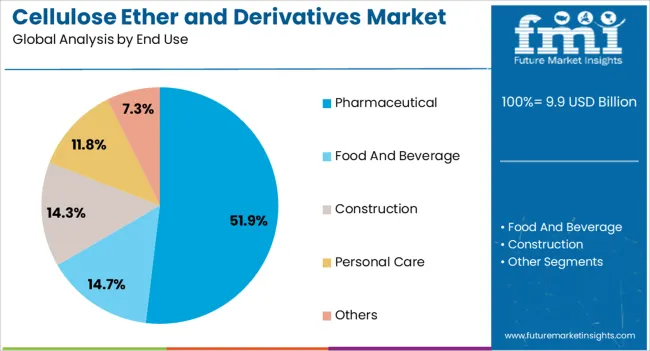

The pharmaceutical segment accounts for approximately 51.90% share in the end-use category, underscoring its dominance in the cellulose ether and derivatives market. Demand is primarily driven by the role of cellulose derivatives as excipients in drug formulations, where they provide controlled release, stability, and improved solubility.

Rising investment in generics and specialty drug development has reinforced the adoption of cellulose ethers. Their use in coating tablets, binding active ingredients, and ensuring consistent drug delivery performance positions them as critical materials in pharmaceutical manufacturing.

Stringent regulatory requirements for excipient safety and quality have further increased reliance on cellulose-based derivatives. With ongoing advancements in drug delivery technologies, demand for pharmaceutical-grade cellulose ethers is expected to remain strong over the forecast horizon.

The scope for cellulose ether and derivatives rose at a 12.3% CAGR between 2020 and 2025. The global market for cellulose ether and derivatives is anticipated to grow at a moderate CAGR of 9.6% over the forecast period 2025 to 2035.

The market experienced steady growth during the historical period from 2020 to 2025. Increased construction activities globally, especially in emerging markets, augmented the demand for cellulose ethers in construction materials.

Looking ahead to the forecast period from 2025 to 2035, the market is expected to witness significant growth. Projections consider the sustained growth in urbanization and infrastructure projects, driving the demand for construction materials containing cellulose ethers.

Cellulose ethers are commonly used in construction materials such as adhesives, mortars, and grouts. The growth of the construction industry, particularly in emerging economies, is expected to drive the demand for cellulose ethers.

The presence of alternative products or substitutes with similar functionalities can pose a challenge to the cellulose ether market.

Companies may face competition from other polymers or synthetic materials.

The below table showcases revenues in terms of the top 5 leading countries, spearheaded by Korea and Japan. The countries are expected to lead the market through 2035.

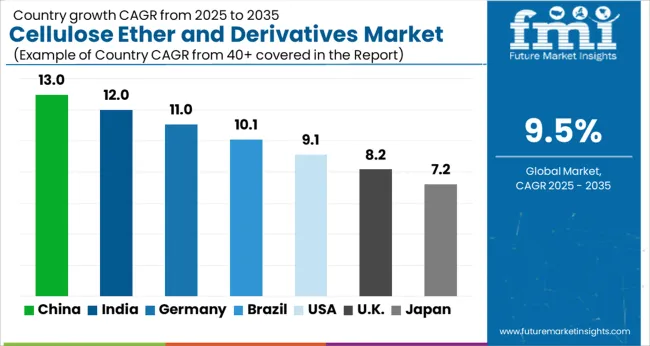

The cellulose ether and derivatives market in the United States expected to expand at a CAGR of 9.9% through 2035. Cellulose ethers find extensive use in construction materials, including adhesives, mortars, and grouts. The growth in residential and commercial construction projects contributes to the demand for cellulose ethers in the United States.

The cellulose ether and derivatives market in the United Kingdom is anticipated to expand at a CAGR of 10.8% through 2035. Cellulose ethers are commonly used in personal care and cosmetic products such as creams, lotions, and shampoos. The demand for skincare and cosmetic items in the country contributes to the growth of the cellulose ether market.

Cellulose ether and derivatives trends in China are taking a turn for the better. A 10.3% CAGR is forecast for the country from 2025 to 2035. Continuous advancements in manufacturing technologies, including modifications to enhance efficiency and reduce costs, contribute to the growth of the cellulose ether market in China.

The cellulose ether and derivatives market in Japan is poised to expand at a CAGR of 11.2% through 2035. Japan has an aging population, leading to increased healthcare needs. The growth of healthcare sector, driven by healthcare demands, supports the demand for cellulose ethers.

The cellulose ether and derivatives market in Korea is anticipated to expand at a CAGR of 12.0% through 2035. The participation of the country in global trade and export activities can contribute to the expansion of the cellulose ether market by reaching international markets.

The below table highlights how carboxymethyl cellulos segment is projected to lead the market in terms of type, and is expected to account for a CAGR of 9.4% through 2035.

Based on end use, the pharmaceutical segment is expected to account for a CAGR of 9.2% through 2035.

| Category | CAGR through 2035 |

|---|---|

| Carboxymethyl Cellulose | 9.4% |

| Pharmaceutical | 9.2% |

Based on type, the carboxymethyl cellulose segment is expected to continue dominating the cellulose ether and derivatives market. Carboxymethyl cellulose finds applications across various industries, including food and beverages, pharmaceuticals, cosmetics, and personal care products. Its versatility and ability to function as a thickener, stabilizer, and viscosity modifier contribute to its widespread use.

Carboxymethyl cellulose is commonly used in the food and beverage industry as a thickener, stabilizer, and texturizer. The demand for processed and convenience foods has driven the use of this cellulose in products such as sauces, dressings, and bakery items.

The cellulose is also utilized in the pharmaceutical industry as a binder and disintegrant in tablet formulations. The growth of the pharmaceutical sector and increasing demand for pharmaceutical excipients contribute to the demand for this segment.

In terms of end use, the pharmaceutical segment is expected to continue dominating the cellulose ether and derivatives market. Cellulose ethers, including carboxymethyl cellulose and methyl cellulose, are widely used as binders and disintegrants in pharmaceutical formulations. They contribute to the structural integrity of tablets and enhance their disintegration and dissolution properties.

Certain cellulose ethers are employed in pharmaceutical formulations to achieve controlled drug release, which is particularly important for medications requiring sustained or extended release, improving patient compliance and efficacy.

Cellulose ethers function as stabilizers for emulsions and suspensions in pharmaceutical formulations, which is crucial for drugs that are not soluble in water and require a stable formulation for effective delivery.

The cellulose ether and derivatives market is characterized by a competitive landscape shaped by key players striving for market share through innovations, strategic collaborations, and global expansion. The dynamism of the market is driven by the diverse applications of cellulose ethers in industries such as construction, pharmaceuticals, food and beverages, cosmetics, and textiles.

Company Portfolio

| Attribute | Details |

|---|---|

| Estimated Market Size in 2025 | USD 9.0 billion |

| Projected Market Valuation in 2035 | USD 22.6 billion |

| Value-based CAGR 2025 to 2035 | 9.6% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Type, End Use, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, France, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Ashland Global Holdings, Inc; Colorcon; DKS Co. Ltd; Fenchem Biotek Ltd; Hebei Jiahua Cellulose Co., Ltd; J.M. Huber Corporation; J. RETTENMAIER SOHNE Gmbh; Lamberti S.p.A; LOTTE Fine Chemicals; Nouryon Chemical Holdings B.V |

The global cellulose ether and derivatives market is estimated to be valued at USD 9.9 billion in 2025.

The market size for the cellulose ether and derivatives market is projected to reach USD 24.7 billion by 2035.

The cellulose ether and derivatives market is expected to grow at a 9.5% CAGR between 2025 and 2035.

The key product types in cellulose ether and derivatives market are methyl cellulose, carboxymethyl cellulose, hydroxypropyl cellulose, hydroxyethyl cellulose and ethyl cellulose.

In terms of end use, pharmaceutical segment to command 51.9% share in the cellulose ether and derivatives market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cellulose Diacetate Film Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Fiber Market Forecast and Outlook 2025 to 2035

Cellulose Derivative Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Film Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Esters Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Nanocrystals and Nanofibers Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Connector and Transformer Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Storage Fabric Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Storage Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Backhaul Equipment Market Size and Share Forecast Outlook 2025 to 2035

Ethernet Access Device Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Gel Market Growth, Forecast, and Analysis 2025 to 2035

Market Share Insights for Cellulose Fiber Providers

Key Players & Market Share in Cellulose Film Packaging Market

Ethernet Switch Market

Tethered Drone Market Size and Share Forecast Outlook 2025 to 2035

Netherlands Responsible Tourism Market Insights – Trends, Demand & Growth 2025-2035

Netherlands Micro CHP Market Insights – Size, Trends & Forecast 2025-2035

Polyethersulfone (PES) Market Size and Share Forecast Outlook 2025 to 2035

TSN Ethernet Chips Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA