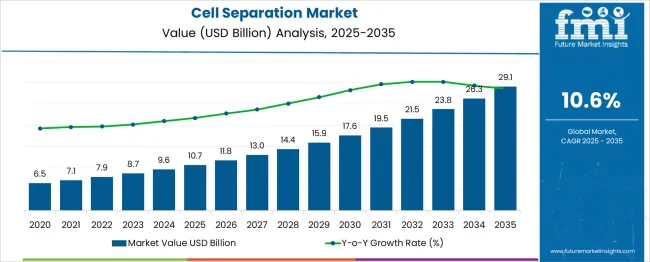

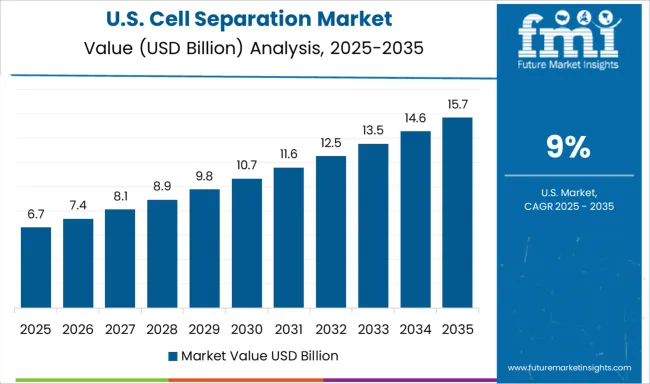

The global cell separation market is estimated to grow from USD 10.7 billion in 2025 to approximately USD 29.1 billion by 2035, recording an absolute increase of USD 18.40 billion over the forecast period. This translates into a total growth of 172.6%, with the market forecast to expand at a compound annual growth rate (CAGR) of 10.6% between 2025 and 2035. The overall market size is expected to grow by nearly 2.73X during the same period, supported by increasing research activities in stem cell therapy, growing prevalence of chronic diseases, and expanding applications in cancer research and regenerative medicine.

Between 2025 and 2030, the cell separation market is projected to expand from USD 10.7 billion to USD 17.92 billion, resulting in a value increase of USD 7.26 billion, which represents 39.5% of the total forecast growth for the decade. This phase of growth will be shaped by increasing research investments in cell therapy and regenerative medicine, expanding cancer research activities, and growing adoption of advanced cell separation techniques across academic and commercial research institutions.

From 2030 to 2035, the market is forecast to grow from USD 17.92 billion to USD 29.1 billion, adding another USD 11.14 billion, which constitutes 60.5% of the overall ten-year expansion. This period is expected to be characterized by advancement in automated cell separation technologies, expansion of clinical applications for isolated cells, and development of next-generation separation techniques that offer improved purity, viability, and scalability for therapeutic applications.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 10.7 billion |

| Forecast Value in (2035F) | USD 29.1 billion |

| Forecast CAGR (2025 to 2035) | 11% |

Market expansion is being supported by increasing prevalence of chronic diseases including cancer, cardiovascular disorders, and neurological conditions that drive demand for advanced cell-based therapies and diagnostic applications requiring high-purity cell isolation. Growing investments in stem cell research and regenerative medicine are creating opportunities for sophisticated cell separation technologies that enable isolation of specific cell populations for therapeutic and research applications.

The expanding biotechnology and pharmaceutical industries are driving sustained demand for cell separation solutions that support drug discovery, biomarker identification, and therapeutic development processes requiring precise cell isolation and characterization. Technological advancement in separation techniques including magnetic-activated cell sorting, flow cytometry, and filtration systems is enabling more efficient and scalable cell separation processes that meet evolving research and clinical requirements.

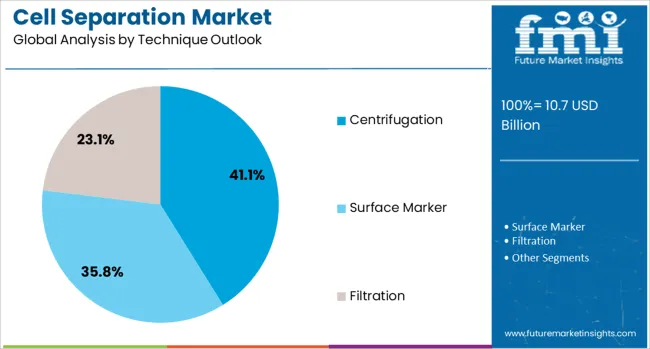

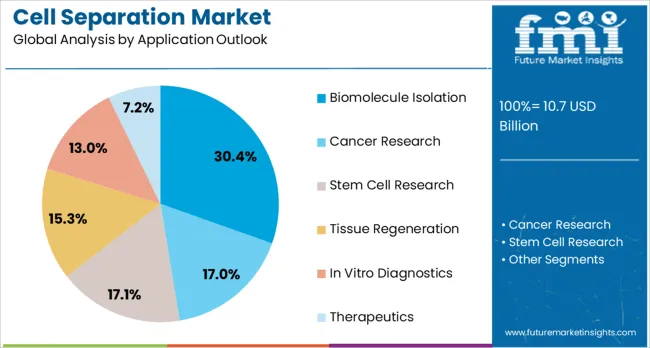

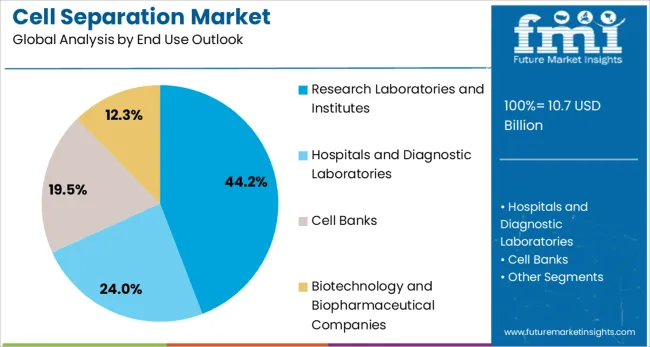

The market is segmented by product, cell type, technique, application, end use, and region. By product, the market is divided into consumables (including reagents, kits, media, and sera, beads, and disposables) and instruments (including centrifuges, flow cytometers, filtration systems, and magnetic-activated cell separator systems). Based on cell type, the market is categorized into animal cells and human cells. In terms of technique, the market is segmented into centrifugation, surface marker, and filtration. By application, the market is divided into biomolecule isolation, cancer research, stem cell research, tissue regeneration, in vitro diagnostics, and therapeutics. By end use, the market is segmented into research laboratories and institutes, hospitals and diagnostic laboratories, cell banks, and biotechnology and biopharmaceutical companies. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Consumables are projected to account for 60.3% of the Cell Separation market in 2025. This leading share is supported by recurring demand for reagents, kits, media, sera, beads, and disposables that are essential for cell separation procedures across research and clinical applications. Consumables provide the biochemical components and separation media necessary for effective cell isolation while generating consistent revenue streams for manufacturers. The segment benefits from continuous consumption patterns and expanding research activities that require ongoing supply of separation materials.

Animal cells are expected to represent 53.9% of cell separation demand in 2025. This dominant share reflects the extensive use of animal cell models in preclinical research, drug development, and basic science studies that require cell isolation for experimental applications. Animal cell separation supports diverse research applications including disease modeling, toxicity testing, and therapeutic target identification that drive consistent demand for separation technologies. The segment benefits from established research protocols and comprehensive availability of animal cell sources.

Centrifugation techniques are projected to contribute 41.1% of the market in 2025, representing established separation methods that utilize density gradient separation for cell isolation and purification applications. Centrifugation provides reliable, cost-effective separation capabilities that are widely adopted across research laboratories and clinical facilities for routine cell processing applications. The segment is supported by proven methodology, established protocols, and comprehensive equipment availability across diverse laboratory settings.

Biomolecule isolation applications are expected to represent 30.4% of cell separation demand in 2025. This segment encompasses isolation of proteins, nucleic acids, and other cellular components that require cell separation as a preliminary step for downstream analysis and purification processes. Biomolecule isolation supports diverse research and diagnostic applications across genomics, proteomics, and molecular biology that drive consistent demand for cell separation technologies.

Research laboratories and institutes are projected to contribute 44.2% of the market in 2025, representing academic institutions, government research facilities, and private research organizations that conduct fundamental and applied research requiring cell separation technologies. Research-focused end users drive innovation and adoption of advanced separation techniques while generating consistent demand for both consumables and instruments across diverse research applications.

The cell separation market is advancing rapidly due to increasing research investments in cell therapy and regenerative medicine applications that require high-purity cell isolation. However, the market faces challenges including high costs of advanced separation equipment, technical complexity of separation procedures, and stringent regulatory requirements for clinical applications that may limit adoption among smaller research facilities. Innovation in automated separation technologies and standardized protocols continue to influence market development patterns.

The growing demand for scalable cell processing is driving development of automated cell separation platforms that integrate multiple separation techniques, real-time monitoring, and standardized protocols for consistent, high-throughput cell isolation. Advanced automation systems reduce manual intervention, improve separation efficiency, and enable processing of larger sample volumes while maintaining cell viability and purity standards required for therapeutic applications.

Modern cell separation technologies are being adapted for clinical applications including CAR-T cell therapy, stem cell transplantation, and regenerative medicine treatments that require GMP-compliant cell processing and separation protocols. Advanced clinical-grade separation systems provide the sterility, traceability, and quality control capabilities necessary for therapeutic cell manufacturing while meeting regulatory requirements for patient safety and treatment efficacy.

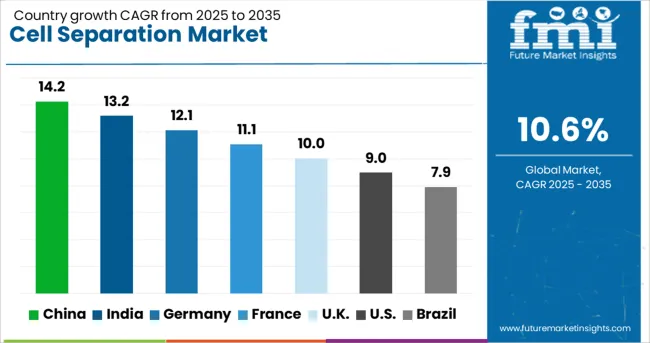

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 14.2% |

| India | 13.2% |

| Germany | 12.1% |

| France | 11.1% |

| United Kingdom | 10% |

| United States | 9% |

| Brazil | 7.9% |

The cell separation market is growing rapidly across global markets, with China leading at a 14.2% CAGR through 2035, driven by massive government investments in biotechnology research and expanding pharmaceutical industry that creates substantial demand for advanced cell separation technologies, followed by India at 13.2% supported by growing biotechnology sector and increasing research investments, while Germany records 12.1% emphasizing advanced technology and clinical applications, France grows at 11.1% with research excellence and regenerative medicine focus, the United Kingdom shows 10% growth focusing on innovation and regulatory leadership, the United States expands at 9% with technology leadership and comprehensive research infrastructure, and Brazil maintains 7.9% growth supported by healthcare research development and increasing awareness of advanced diagnostic technologies that create diverse opportunities for cell separation applications across research laboratories, biotechnology companies, and clinical institutions. The report covers an in-depth analysis of 40+ countries; six top-performing countries are highlighted below.

Revenue from cell separation in China is projected to exhibit the highest growth rate with a CAGR of 14.2% through 2035, driven by massive government investments in biotechnology research, expanding pharmaceutical industry, and growing focus on precision medicine that creates substantial demand for advanced cell separation technologies. The country's comprehensive research infrastructure development and increasing chronic disease prevalence are generating consistent demand for cell separation solutions. Major biotechnology companies are establishing research capabilities to serve growing market demand.

Revenue from cell separation in India is expanding at a CAGR of 13.2%, supported by growing biotechnology sector, increasing research investments, and expanding healthcare infrastructure that drives demand for advanced diagnostic and therapeutic technologies including cell separation systems. The country's large patient population and emerging biotechnology capabilities are creating opportunities for cell separation applications across research and clinical sectors. International and domestic companies are investing in local research capabilities and market development.

Demand for cell separation in Germany is projected to grow at a CAGR of 12.1%, supported by leadership in biotechnology research, established pharmaceutical industry, and strong emphasis on precision medicine that drives adoption of sophisticated cell separation technologies. German research institutions and biotechnology companies are implementing comprehensive cell separation capabilities that emphasize quality, precision, and clinical application potential. The market is characterized by focus on innovation and regulatory compliance.

Demand for cell separation in France is expanding at a CAGR of 11.1%, driven by established research excellence, comprehensive healthcare system, and growing emphasis on regenerative medicine that requires advanced cell separation capabilities for therapeutic applications. French research institutions are implementing sophisticated separation technologies that support diverse research applications across stem cell research, cancer research, and tissue regeneration. The market benefits from strong research funding and established biotechnology sector.

Demand for cell separation in the UK is growing at a CAGR of 10%, supported by established research capabilities, comprehensive regulatory framework, and growing emphasis on precision medicine that drives adoption of advanced cell separation technologies for research and clinical applications. British research institutions and biotechnology companies are prioritizing separation technologies that meet stringent quality and safety standards while supporting innovative research applications. The market is characterized by emphasis on innovation and clinical translation.

Demand for cell separation in the USA is expanding at a CAGR of 9%, driven by advanced research infrastructure, established biotechnology industry, and comprehensive funding for biomedical research that creates demand for sophisticated cell separation technologies across academic and commercial applications. Large biotechnology and pharmaceutical companies are implementing comprehensive separation capabilities that support drug discovery, biomarker research, and therapeutic development. The market benefits from robust research spending and established technology leadership.

Revenue from cell separation in Brazil is growing at a CAGR of 7.9%, driven by expanding healthcare research sector, increasing chronic disease prevalence, and growing awareness of advanced diagnostic and therapeutic technologies that utilize cell separation for clinical applications. The country's developing biotechnology sector and improving research infrastructure are creating opportunities for cell separation applications. Companies are developing cost-effective solutions tailored to Brazilian market requirements and research capabilities.

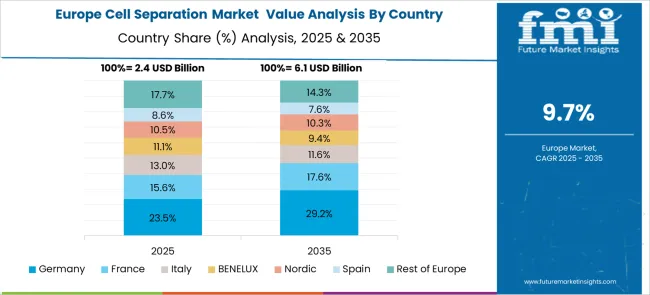

The European cell separation market is characterized by advanced research infrastructure and sophisticated biotechnology capabilities that support comprehensive cell separation applications across diverse research and clinical sectors. Countries across the region maintain strong regulatory frameworks and quality standards that promote adoption of advanced cell separation technologies while supporting clinical translation and therapeutic development initiatives. The market benefits from established research funding mechanisms, comprehensive biotechnology industry clusters, and strong emphasis on precision medicine and regenerative therapy development that creates sustained demand for innovative cell separation solutions across academic institutions, pharmaceutical companies, and clinical research organizations.

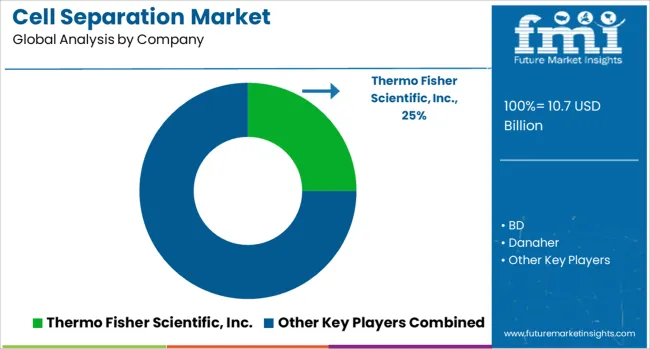

The cell separation market is defined by competition among established life sciences companies, specialized separation technology providers, and biotechnology instrument manufacturers offering comprehensive cell isolation solutions for research and clinical applications. Companies are investing in advanced separation technology development, automation integration, product portfolio expansion, and clinical application support to deliver high-performance cell separation systems that meet evolving research requirements and regulatory standards. Strategic partnerships, technology licensing, and market expansion are central to strengthening product offerings and competitive positioning.

Major cell separation companies maintain comprehensive product development capabilities and extensive technical support services that enable research institutions, biotechnology companies, and clinical laboratories to implement optimal cell isolation solutions for diverse applications and research requirements. Thermo Fisher Scientific Inc., USA-based, offers comprehensive cell separation portfolios emphasizing technology integration and application versatility across global research markets. BD provides advanced flow cytometry and cell sorting technologies with focus on clinical applications and research excellence.

Danaher delivers sophisticated separation platforms with emphasis on automation and quality assurance. Terumo Corp. and STEMCELL Technologies Inc. offer specialized cell separation solutions with focus on clinical applications and research innovation. Bio-Rad Laboratories Inc., Merck KGaA, Agilent Technologies Inc., Corning Inc., and Akadeum Life Sciences provide comprehensive cell separation expertise, advanced technology platforms, and specialized application support across global research and clinical markets.

| Items | Values |

|---|---|

| Quantitative Units | USD 29.1 billion |

| Product | Consumables (Reagents, Kits, Media, and Sera; Beads; Disposables), Instruments (Centrifuges, Flow Cytometers, Filtration Systems, Magnetic-activated Cell Separator Systems) |

| Cell Type | Animal Cells, Human Cells |

| Technique | Centrifugation, Surface Marker, Filtration |

| Application | Biomolecule Isolation, Cancer Research, Stem Cell Research, Tissue Regeneration, In Vitro Diagnostics, Therapeutics |

| End Use | Research Laboratories and Institutes, Hospitals and Diagnostic Laboratories, Cell Banks, Biotechnology and Biopharmaceutical Companies |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Thermo Fisher Scientific, Inc.; BD; Danaher; Terumo Corp.; STEMCELL Technologies Inc.; Bio-Rad Laboratories, Inc.; Merck KGaA; Agilent Technologies, Inc.; Corning Inc.; Akadeum Life Sciences |

| Additional Attributes | Dollar sales by product, cell type, technique, application, and end use, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established life sciences companies and specialized technology providers, adoption of automated separation systems and high-throughput processing capabilities, integration with clinical applications and therapeutic cell manufacturing, innovations in next-generation separation techniques and quality control systems, and development of comprehensive research support and clinical application services. |

The global cell separation market is estimated to be valued at USD 10.7 billion in 2025.

The market size for the cell separation market is projected to reach USD 29.1 billion by 2035.

The cell separation market is expected to grow at a 10.6% CAGR between 2025 and 2035.

The key product types in cell separation market are consumables, reagents, kits, media, and sera, beads, disposables, instruments, centrifuges, flow cytometers, filtration systems and magnetic-activated cell separator systems.

In terms of cell type outlook , animal cells segment to command 53.9% share in the cell separation market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA