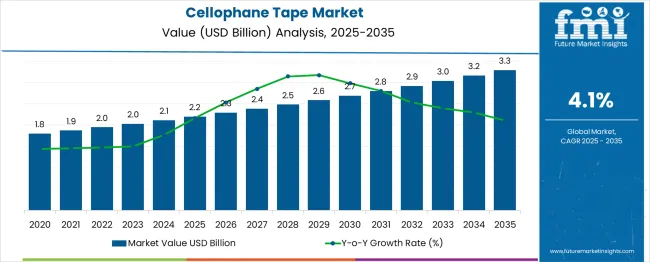

In 2025, the global cellophane tape market is estimated at USD 2.2 billion and is projected to reach USD 3.3 billion by 2035, growing at a CAGR of 4.1%. This reflects a steady rise in annual demand, with year-on-year gains increasing from around USD 90 million to nearly USD 140 million by the end of the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2.2 billion |

| Industry Value (2035F) | USD 3.3 billion |

| CAGR (2025 to 2035) | 4.1% |

Growth is primarily driven by the packaging needs of the e-commerce sector, expansion in retail, and widespread use in office and consumer applications. Rising demand for biodegradable and green cellophane tapes made from regenerated cellulose is shaping product development. Innovations in specialty tapes with tamper-evident and weather-resistant properties are also contributing to the market’s upward trajectory.

The market operates within a network of broader industries, each contributing to its market share. Current estimates indicate that the packaging industry accounts for approximately 40% of the market, due to its extensive use of adhesive tapes in sealing and product protection. The stationery and office supplies segment contributes around 25%, driven by widespread application in schools, offices, and households.

The retail and consumer goods market follows with a 15% share, reflecting demand from end-users for everyday utility. The adhesives and sealants sector, representing 10%, supports the market through raw materials and innovation in adhesive formulations. The logistics and transportation make up 10%, as tapes play a key role in packaging, labeling, and securing goods in transit

Len Gould, president and CEO of Q.E.P. Co., Inc., stated, “Our investments in advanced adhesive manufacturing technology ensure we deliver best-in-class American-made products. In a market dominated by private equity and foreign players, ROBERTS® stands as the alternative - combining innovation, quality, and 100% service reliability for global customers.”

This statement, issued in the company’s July 2025 press release, reinforces Q.E.P.’s commitment to domestic manufacturing and long-term value creation. By prioritizing technological advancement and supply chain dependability, the company positions ROBERTS® as a performance-driven, trusted choice in an increasingly competitive and consolidated adhesives market.

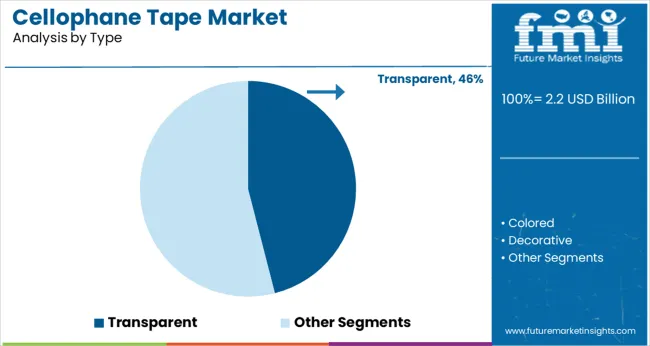

The global cellophane tape market remains strong due to high-volume consumption across stationery, e-commerce, education, and office supply chains. Transparent and acrylic tapes dominate usage due to their clarity, durability, and compatibility with automated dispensers.

Transparent cellophane tapes lead the global market with a 46% share due to their versatility and visual clarity across home, office, and commercial uses. They're heavily used in document sealing, gift wrapping, packaging, and repairs.

Major players like 3M (Scotch), Tesa SE, and Nichiban manufacture UV-stable, anti-yellowing transparent tapes that maintain adhesion over time. In education and office supply chains, these tapes account for over 60% of demand. Transparency also helps in barcode and label visibility, making them popular for retail labeling.

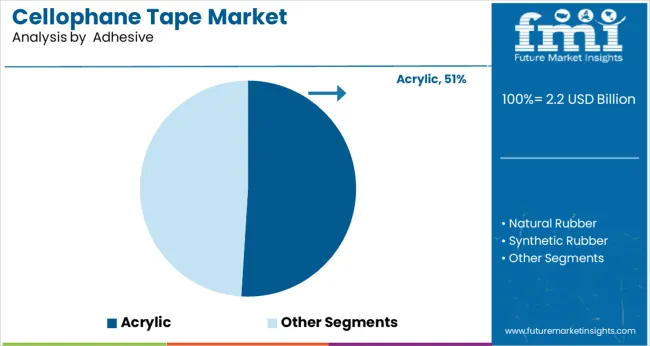

Acrylic adhesives dominate the cellophane tape market with 51% global share due to superior bonding performance, weather resistance, and non-toxic composition. Acrylic-based tapes are especially useful in climates with temperature variability, often used in e-commerce and retail packaging.

Compared to natural rubber adhesives, acrylic types offer longer shelf life and less odor. Companies like Intertape Polymer Group, Sekisui, and Tartan Tape manufacture acrylic-backed cellophane products compatible with both manual and automated application systems.

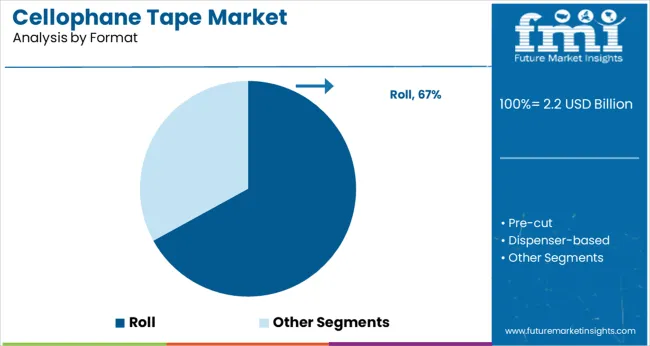

Roll-format tapes lead by 67% in the market due to ease of application, storage, and availability across size variants. Most consumer and professional-grade tapes come in standard rolls of 10-66 meters and widths of 12-25 mm.

Major brands like Scotch, Fevistik, and Tesa offer coreless and core-based roll tapes suited for bulk and single-use applications. In B2B settings, jumbo rolls are used in high-speed automatic dispensers. E-commerce and logistics companies prefer roll format due to reduced wastage and manual effort.

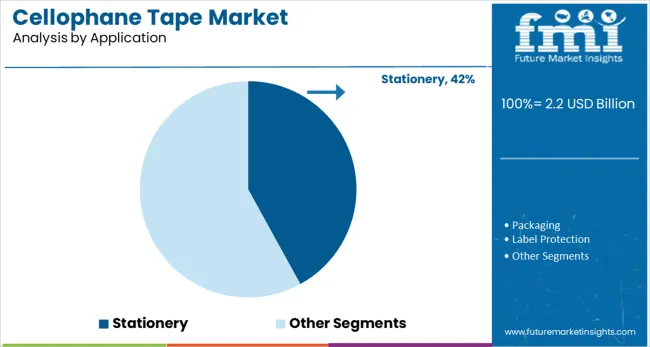

Stationery and label protection use cases account for 42% of total tape applications in 2025, spanning both home and commercial demand. Students, offices, and retailers rely on clear tape for securing documents, reinforcing torn pages, and protecting printed labels.

Printable transparent tape is gaining traction in retail display labeling and temporary signage. Pre-cut and decorative variants are growing in education markets. School boards, educational NGOs, and institutional suppliers represent recurring bulk buyers in this segment.

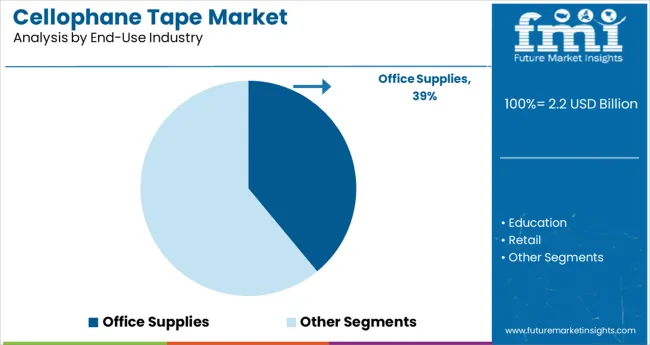

Office supplies represent the highest end-use demand in the market at 39%. Government departments, BPOs, banks, and corporate campuses use large volumes of cellophane tape for administrative tasks. In B2B distribution, combo packs of 6, 12, or 24 rolls are most popular.

Brands like Scotch, Office Depot, and Staples Private Label dominate this space. Desktop dispensers, double-roll systems, and refill packs are frequently ordered through institutional procurement platforms, reflecting high-frequency usage.

The market continues to serve retail, office, and industrial packaging needs. Global sales reached 17.4 billion square meters in 2024, with 61% used in carton sealing and labeling. Demand remains tied to logistics throughput, small parcel volumes, and consumer movement toward eco-friendly paper-based adhesives in select regions.

Logistics and Packaging Sectors Remain the Primary Usage DriversCarton sealing applications accounted for 61% of cellophane tape consumption by area in 2024, driven by high turnover in e-commerce packaging and retail fulfillment hubs.

Multi-roll pack formats saw 8.6% volume growth YoY in wholesale distribution. Thermal resistance and secure adhesion under variable humidity supported continued use in transit packaging despite growing interest in polymer-free options.

Paper-Based and Biodegradable Variants Gaining Regional TractionDemand for non-synthetic alternatives rose by 5.1% in 2024, with starch-based adhesives and cellulose backings expanding presence in Western Europe and parts of East Asia.

Japan led adoption of compostable tapes in municipal office supply tenders, while Germany and the Netherlands introduced procurement preferences for plastic-free adhesives in institutional packaging. Biodegradable cellophane rolls averaged £1.68 per unit, 34% higher than synthetic options.

Office Supply Segment Holding Share Amid Digital TransitionStationery applications accounted for 22% of total tape usage volume, down slightly from 24% in 2023 as digital workflows expanded. Despite this shift, branded retail packs remained stable in school and craft channels. Transparent rolls with serrated edges and no-dispenser designs saw modest growth due to increased preference for minimal plastic packaging.

Production Shifts Linked to Raw Material Inputs and Trade RoutesImport substitution trends in Southeast Asia led to a 9.3% increase in local cellophane film extrusion capacity. Feedstock volatility in cotton linters and wood pulp affected pricing in Q1 2025, with roll costs fluctuating by up to 11% in key markets. Shipping delays from East Asian hubs prompted North American suppliers to increase safety stock levels by an average of 7-10 days.

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 4.8% |

| China | 4.5% |

| USA | 4.0% |

| Canada | 3.8% |

| Germany | 3.7% |

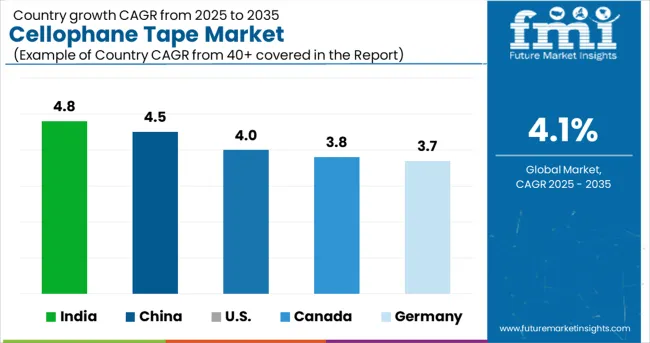

The global market is forecasted to grow at a CAGR of 4.1% from 2025 to 2035. Among the profiled countries, India (BRICS) records the highest growth at 4.8%, exceeding the global rate by 0.7 percentage points. China (BRICS) also outperforms the global average at 4.5% (+0.4%).

The United States (OECD) posts a near-average 4.0%, just 0.1% below the global benchmark. Meanwhile, Canada and Germany (both OECD) trail at 3.8% and 3.7%, respectively. This divergence reflects higher consumption trends and industrial packaging activity in BRICS economies, supported by increasing e-commerce and domestic manufacturing, while growth in OECD markets remains steadier and more mature.

The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

The United States market for cellophane tape is forecast to grow at 4.0% CAGR, slightly under the global average. From 2020 to 2024, growth averaged 3.4%, supported by consistent demand in retail packaging, logistics, and commercial office supplies.

Online retail fulfillment continues to drive usage of transparent adhesive products for primary and secondary packaging. Additionally, niche applications such as anti-static cellophane tape are expanding across electronics and semiconductor logistics.

Canada is expected to grow at 3.8% CAGR, marginally below global levels. Growth stabilized from a 3.1% CAGR between 2020 and 2024, largely driven by food processing, pharma secondary packaging, and clean-label printing industries.

Environmental preferences are shaping procurement policies, pushing retailers and brand owners to switch from plastic-based to cellulose-based tapes. Demand is gaining from boutique brands focused on green wrapping and biodegradable solutions in urban centers.

The marketin Germany is projected to grow at 3.7% CAGR, a modest pace relative to the global average. From 2020 to 2024, the market increased by 2.9%, with demand driven by eco-focused consumer goods and regulatory pressure on plastic packaging.

Cellulose-based tapes are gaining traction in export-ready applications due to compliance with EU Green Deal guidelines. Several paper converting facilities in Bavaria and North Rhine-Westphalia have begun co-locating tape converting lines for integrated production.

China is anticipated to grow at 4.5% CAGR, above the global benchmark. Between 2020 and 2024, CAGR stood at 3.6%, with growth fueled by FMCG manufacturing, stationery exports, and packaging standardization.

Expanding logistics networks and e-commerce warehousing continue to boost consumption. Regional manufacturers are diversifying offerings to include custom-printed cellophane tape for retail branding and tamper-evidence in the pharmaceutical supply chain.

India is projected to lead the group with a 4.8% CAGR, outpacing global growth. From 2020 to 2024, CAGR was 3.9%, reflecting expanding consumption in FMCG distribution, organized retail, and textbook packaging in the education sector.

Local converters are scaling capacity to meet demand for tamper-proof and printable tape for value-driven packaging. Rising procurement from Tier 2 and Tier 3 urban centers is diversifying demand across both premium and commodity tape segments.

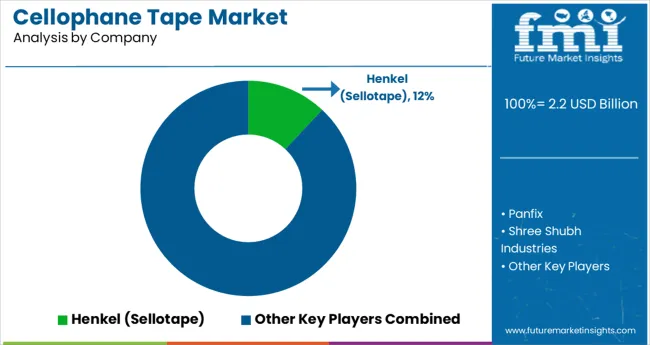

Leading Players - Henkel holding 21% The industry is led by Henkel (Sellotape), which dominates with its strong brand recognition and diversified product range for consumer and industrial use.

Panfix and Bagla Group compete through aggressive pricing and regional distribution networks in Asia. Emerging players like Twin Tech India and Shree Shubh Industries focus on niche segments, such as customized printing and specialty adhesives.

Louis Tape and Globe Industries Corporation target export markets with competitively priced bulk offerings.Entry barriers include high production costs for quality adhesives, established brand loyalty, and stringent performance standards. Large-scale manufacturers benefit from economies of scale, while smaller firms compete through localized supply chains and tailored solutions.

Recent Cellophane Tape Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 2.2 billion |

| Projected Market Size (2035) | USD 3.3 billion |

| CAGR (2025 to 2035) | 4.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Product Types Analyzed | Transparent, Colored, Decorative, Printed |

| Adhesive Types Analyzed | Acrylic, Natural Rubber, Synthetic Rubber |

| Applications Analyzed | Stationery, Packaging, Label Protection, Arts & Crafts |

| Format Types Analyzed | Roll, Pre-cut, Dispenser- based |

| End Use Industries Analyzed | Office Supplies, Education, Retail, E-commerce |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Indonesia, Brazil, Mexico, Argentina, South Africa, Egypt, GCC Countries |

| Key Players Influencing the Market | Henkel (Sellotape), Panfix, Shree Shubh Industries, Packaging Peddler, Ajilo International, Louis Tape, Twin Tech India, Bagla Group, Globe Industries Corporation |

| Additional Attributes | Dollar sales by format and adhesive type, demand shift toward dispenser-based tapes in office and retail, eco-friendly acrylic adhesives gain traction, colored and printed tape popular in branding and promotions |

By Type:

By Adhesive:

By Application:

By Format:

By End-Use Industry:

By Region:

The industry is expected to reach USD 3.3 billion by 2035.

The industry will grow at a CAGR of 4.1% over the forecast period.

Transparent cellophane tapes lead with a 46% market share.

Acrylic adhesives hold the largest share at 51% in 2025.

Henkel (Sellotape) leads with an estimated 21% global market share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tape Unwinder Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Tape Measure Market Size and Share Forecast Outlook 2025 to 2035

Tape Backing Materials Market Analysis by Material Type, Application, and Region through 2025 to 2035

Tape Stretching Line Market Analysis – Growth & Trends 2025 to 2035

Tapes Market Insights – Growth & Demand 2025 to 2035

Tape Banding Machine Market Overview - Demand & Growth Forecast 2025 to 2035

Competitive Overview of Tape Dispenser Companies

Competitive Overview of Tape Backing Materials Companies

Tape & Label Adhesives Market

Tape Applicator Machines Market

UV Tapes Market Growth - Trends & Forecast 2025 to 2035

PVC Tapes Market Size and Share Forecast Outlook 2025 to 2035

Leading Providers & Market Share in PVC Tapes Industry

ESD Tapes and Labels Market from 2025 to 2035

USA Tapes Market Analysis – Growth & Forecast 2024-2034

Duct Tape Market Size and Share Forecast Outlook 2025 to 2035

Tear Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA