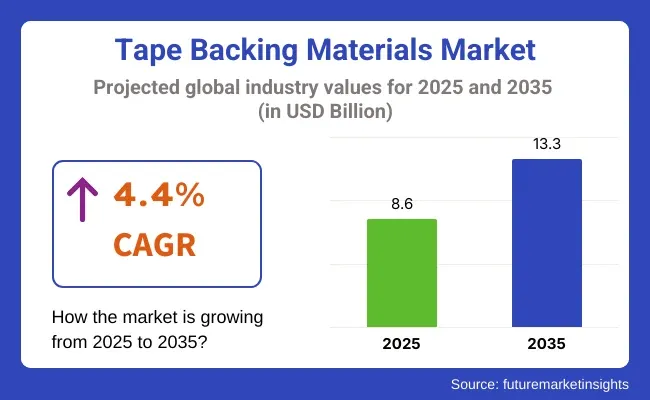

The tape backing materials market is projected to grow from USD 8.6 billion in 2025 to USD 13.3 billion by 2035, registering a CAGR of 4.4% during the forecast period. Sales in 2024 reached USD 8.2 billion, reflecting a steady increase in demand across various industries.

This growth has been attributed to the rising need for durable and efficient adhesive solutions in sectors such as packaging, electronics, automotive, and healthcare. The increasing adoption of high-performance tapes for insulation, bonding, and protection applications has further propelled the market's expansion. Additionally, the surge in e-commerce and the demand for secure packaging have led to a higher utilization of advanced tape backing materials globally.

In December 2024, Ahlstrom introduced MasterTape® Cristal, a paper-based transparent tape backing. Ahlstrom, a global leader in fiber-based specialty materials, is proud to announce the launch of MasterTape® Cristal, a paper-based transparent tape backing to reduce plastic waste and promote a more sustainable future.

“MasterTape® Cristal is the result of a close collaboration with different stakeholders, including customers and suppliers. We have partnered with the leading sustainability-driven companies to develop MasterTape® Cristal, and it has already received enthusiastic feedback from early adopters, including schools, offices, retailers, and households, who appreciate its environmental benefits without sacrificing performance”, says Laurent Lebrette, Head of R&D for Ahlstrom’s Tape business.

The shift towards sustainable and environmentally friendly solutions has significantly influenced the tape backing materials market. Manufacturers have been focusing on developing materials that are recyclable, biodegradable, and made from renewable resources. Innovations include the integration of biodegradable materials, modular designs, and the use of recycled components to reduce environmental impact.

These advancements align with global sustainability goals and regulatory requirements, making tape backing materials an attractive option for environmentally conscious industries. Additionally, the development of automated manufacturing processes has enhanced efficiency and consistency in production, further driving market growth.

The tape backing materials market is poised for significant growth, driven by increasing demand in packaging, electronics, automotive, and healthcare industries. Companies investing in sustainable materials, innovative designs, and eco-friendly production processes are expected to gain a competitive edge.

As global supply chains expand and environmental regulations become more stringent, the adoption of advanced tape backing materials is anticipated to rise, offering cost-effective and eco-friendly solutions for various applications. Furthermore, the integration of smart technologies and automation in tape backing material applications is expected to enhance operational efficiency and meet the evolving needs of various industries.

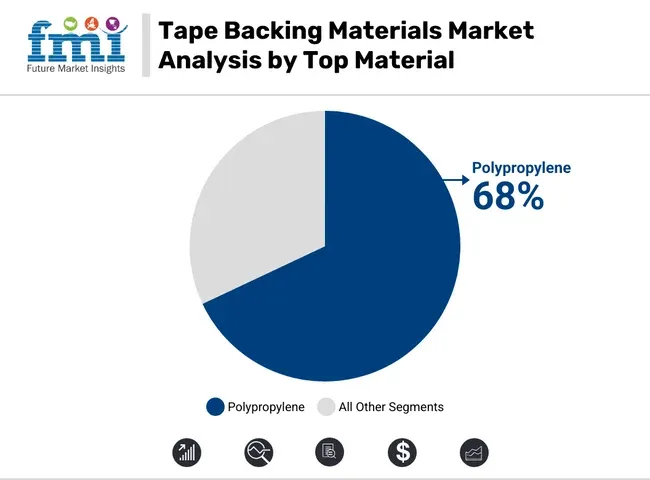

Polypropylene is projected to account for approximately 68.3% of the global tape backing materials market by 2025, as it has been extensively used for its high tensile strength, flexibility, moisture resistance, and adaptability to both industrial and consumer applications. As a thermoplastic polymer, polypropylene has been processed easily into thin films, which have served as a reliable backing material for a wide range of pressure-sensitive adhesives.

Its lightweight nature and strong dimensional stability under varying environmental conditions have enabled polypropylene to be used in applications requiring clarity, conformability, and residue-free removal. Both biaxially oriented and cast polypropylene films have been utilized for superior printability, which has made the material suitable for branding and labeling in retail packaging.

In addition, its recyclability and cost-efficiency have supported widespread adoption across industries such as logistics, automotive, electronics, and healthcare. Enhanced performance characteristics such as UV resistance, low elongation, and tear resistance have further contributed to its growing preference over alternative materials.

As high-performance, multifunctional tapes continue to replace traditional fastening and sealing methods, polypropylene is expected to remain the dominant material backing, driven by its versatile properties and strong alignment with modern manufacturing demands

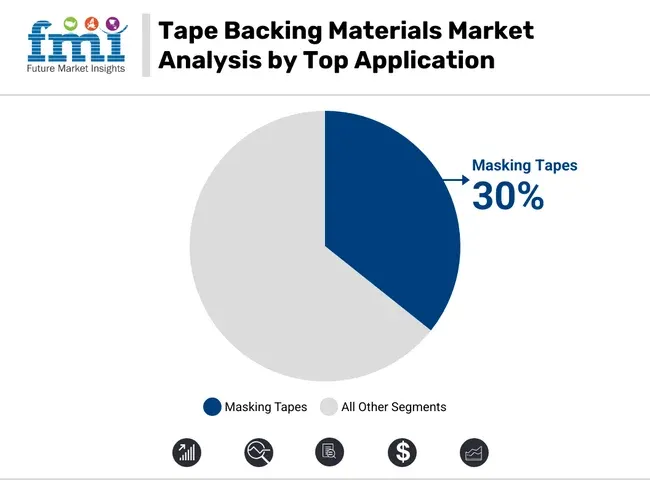

The masking tapes segment is expected to hold the largest share of the tape backing materials market by 2025, accounting for an estimated 30.1% as it has been extensively used in painting, surface preparation, light bundling, labeling, and protection applications across construction, automotive, and general-purpose industries.

Masking tapes have been developed with pressure-sensitive adhesives and backing materials designed for easy removal without surface damage or residue. Various grades of masking tapes, including general-purpose, high-temperature, and specialty variants, have been manufactured using backing materials such as crepe paper and polypropylene. These tapes have been selected based on their conformability, clean-peel characteristics, and compatibility with solvent- and water-based paints.

In automotive refinishing and industrial coating operations, masking tapes have played a critical role in achieving clean paint edges and protecting adjacent surfaces. In building maintenance, interior painting, and packaging, their utility has been enhanced by customizable widths, adhesive strengths, and color coding.

As temporary adhesion solutions continue to be favored for their ease of application, removability, and surface safety, masking tapes are expected to maintain dominance in the tape backing material market, supported by expanding DIY trends and industrial refinishing activities globally.

Expansion of the Electronics Industry to Boost Product Demand

Tape backing materials are used on a wide scale by the electronics industry for insulation, bonding, and protection of brittle components. They form the basis of any adhesive tape. In this sense, they provide a basis for adhesive tapes used in circuit board assembly, wire harnessing, and component mounting.

Polyimide films and polyester films, with their superior heat resistance, electrical insulation, and durability, make them necessary for applications in the fields of semiconductors, display panels, and battery packaging.

In smartphones, laptops, and other electronic devices, strong and flexible backing materials help secure components while allowing for efficient heat dissipation and protection against environmental factors like moisture and dust.

Growing Demand in the Healthcare Sector to Aid Market Growth

Healthcare is a significant sector that uses tape backing materials, such as medical tapes, wound dressings, and applications in surgery. They offer flexible and skin-friendly bases for adhesive medical tapes without causing irritation and providing an effective placement. In the surgical field, breathable and hypoallergenic backings in tapes are necessary for securing bandages, IV dressings, and other medical devices.

Advanced backing materials, non-woven fabrics, and polyurethane films for wearable medical devices ensure long-term wear and monitoring of various health conditions by patients without any inconvenience. The advancement in medical technology increases the demand for high-performance and biocompatibility of backing materials.

Increased Construction Projects and Infrastructures to Spur Product Sales

The construction industry has been the biggest driver of demand for strong and weather-resistant tape backing materials. Tapes are used for sealing, insulation, and bonding

Expansion of the Electronics Industry to Boost Product Demand

Tape backing materials are used on a wide scale by the electronics industry for insulation, bonding, and protection of brittle components. They form the basis of any adhesive tape. In this sense, they provide a basis for adhesive tapes used in circuit board assembly, wire harnessing, and component mounting.

Polyimide films and polyester films, with their superior heat resistance, electrical insulation, and durability, make them necessary for applications in the fields of semiconductors, display panels, and battery packaging.

In smartphones, laptops, and other electronic devices, strong and flexible backing materials help secure components while allowing for efficient heat dissipation and protection against environmental factors like moisture and dust.

Growing Demand in the Healthcare Sector to Aid Market Growth

Healthcare is a significant sector that uses tape backing materials, such as medical tapes, wound dressings, and applications in surgery. They offer flexible and skin-friendly bases for adhesive medical tapes without causing irritation and providing an effective placement. In the surgical field, breathable and hypoallergenic backings in tapes are necessary for securing bandages, IV dressings, and other medical devices.

Advanced backing materials, non-woven fabrics, and polyurethane films for wearable medical devices ensure long-term wear and monitoring of various health conditions by patients without any inconvenience. The advancement in medical technology increases the demand for high-performance and biocompatibility of backing materials.

Increased Construction Projects and Infrastructures to Spur Product Sales

The construction industry has been the biggest driver of demand for strong and weather-resistant tape backing materials. Tapes are used for sealing, insulation, and bonding applications, require materials that can withstand harsh environmental conditions. The growth of infrastructure projects worldwide has accelerated this demand even further.

Growing Demand for High-Performance and Specialty Backing Materials

High-performance and specialty materials for specific industrial applications are among the significant trends in the tape backing materials market. For example, the electronics, aerospace, and medical industries are demanding tapes with superior properties, such as heat resistance, conductivity, and chemical durability.

Such requirements have spurred innovations in backing materials, such as advanced polymers, reinforced fabrics, and multi-layered composites. Manufacturers are designing tapes with greater mechanical strength and toughness, besides extreme conditions of adaptability, to suit the ever-changing needs of high-tech industries.

Shift toward Custom and Multi-functional Tape Solutions

A mega consumer trend in the tape backing materials market is the rising demand for customized and multifunctional tape solutions. Consumers and industries increasingly seek tapes offering more than just adhesive functionality. It implies features such as thermal insulation, electrical conduction, and water resistance, which encourages innovations in backing materials.

There is an increased interest in tapes with characteristics of tailored thickness, flexibility, and strength to meet the needs of specific applications, such as use in electronics, automotive, construction, or healthcare. Manufacturers are being driven by a strong requirement to develop versatile, application-specific backing materials that offer performance while at the same time providing ease of use.

Fluctuating Prices of Raw Materials May Hamper Demand

One of the major restraining factors for the tape backing materials market is the fluctuating cost and availability of raw materials. Usually, high-quality backing material is made from polymers, paper, and specialty films.

Their prices fluctuate considerably because of disturbances in supply chains, geopolitical issues, and vagaries in crude oil prices. Manufacturers are then unable to remain cost-efficient while maintaining the quality of the product, thus making the final price to the consumer go higher.

The USA market is anticipated to witness a 30% share in 2025. The growth in the USA tape backing materials market can be attributed to the increasing consumers' demand for reliable and high-performance products across applications such as home improvement, automotive repairs, and packaging.

Consumers are currently showing interest in DIY projects and efficient home renovation, which prompts them to search for tapes that have durable backing materials that ensure easy application, strong adhesion, and clean removal.

The demand for tape backing materials in the UK market has been up as consumers generally seek quality and reliability within their purchases- associated with functions such as house renovation, interior decoration, and car repair.

Consumers also tend to favor tapes with strong, flexible backings that can support handy applications, particularly in DIY activities that demand ease of use, durability, and accurate applications. Moreover, consumers consider clean removability without residue for sensitive surface applications.

The German market is poised to register a 5.8% CAGR during the forecast period. The UK tape backing materials market is experiencing growth due to increased demand from the automotive, manufacturing, and packaging industries.

As the need for precise, durable, and reliable products grows in these sectors, businesses are turning to high-quality tape with strong backing materials for applications requiring secure adhesion and resistance to wear and tear. Additionally, with the booming trend of ecommerce, fast and secure sealing methods with easy portability have become an urgent need in packaging.

The market in China is expanding fast because of the fast growth of manufacturing and automotive sectors. Increasing requirements for high-performance tapes in assembly, labeling, and packaging lead to a rise in demand for tapes with good strength as backing materials to provide assurance of durability and good adhesion. Moreover, China's growing e-commerce market is resulting in a demand for safe, efficient packaging solutions for protecting products from damage during shipping.

Increasing e-commerce and the pressure for secure, reliable packaging solutions are seen in the demand of logistics and packaging sectors for strong, efficient tape products. Japan's interest in technology and production innovation further assists this growth in the market. With advanced manufacturing leadership, tapes with durable backing materials, providing precise adhesion and resistance to extreme conditions, are required.

As per FMI analysis, the Indian market is slated to expand at 5.7% CAGR during the forecast period. Due to the fact that India has industrial growth at its peak, demand for high-performance tapes with backing materials of long durability for purposes such as sealing, insulation, and surface protection is rising.

The trend in manufacturing through automation has also promoted the use of specialized adhesives, ensuring precision and reliability. In addition, the burgeoning e-commerce industry has further driven the need for secure packaging solutions, further expanding the market for strong and flexible tape backing materials.

The competitive landscape of the market is driven by the key players 3M, Nitto Denko Corporation, and tesa SE. The companies are innovating their products and expanding their portfolios to cater to different industries such as automotive, packaging, and electronics. For example, 3M has leveraged its research and development capabilities to introduce advanced adhesive solutions that provide better performance and durability.

Nitto Denko is still acquiring its market space by highlighting more on sustainable solutions and custom-made products for specific industry requirements. Other companies that are further strengthening their position in the market include Avery Dennison and Scapa Group with strategic partnerships and acquisitions.

While Avery Dennison is heavily investing in its manufacturing capacity expansion, Scapa Group is enhancing the quality of its products and growing its business in high-growth markets.

Other players are also expanding their geographies, particularly in emerging markets, and benefit from increased demand for specialty tape solutions across industrial applications.

Key Industry Developments

Companies such as Airlite, which specializes in sustainable and lightweight materials, have gained attention as they provide more eco-friendly alternatives to traditional backing materials. Its strategy is using renewable resources, offering products that have a reduced environmental footprint in line with the growing consumer demand for sustainability in industrial products.

The market is anticipated to reach USD 8.6 billion in 2025.

The market is predicted to reach a size of USD 13.3 billion by 2035.

Some of the key companies manufacturing the product include NITTO DENKO CORPORATION,MBK Tape Solutions, and others.

The USA is a prominent hub for product manufacturers.

Table 01: Global Market Value (US$ Million) Forecast by Region, 2015 to 2032

Table 02: Global Market Volume (Sq. Mt.) Forecast by Region, 2015 to 2032

Table 03: Global Market Value (US$ Million) Forecast by Material, 2015 to 2032

Table 04: Global Market Volume (Sq. Mt.) Forecast by Material, 2015 to 2032

Table 05: Global Market Value (US$ Million) Forecast by Tape Type, 2015 to 2032

Table 06: Global Market Volume (Sq. Mt.) Forecast by Tape Type, 2015 to 2032

Table 07: Global Market Value (US$ Million) Forecast by End Use, 2015 to 2032

Table 08: Global Market Volume (Sq. Mt.) Forecast by End Use, 2015 to 2032

Table 09: North America Market Value (US$ Million) Forecast by Country, 2015 to 2032

Table 10: North America Market Volume (Sq. Mt.) Forecast by Country, 2015 to 2032

Table 11: North America Market Value (US$ Million) Forecast by Material, 2015 to 2032

Table 12: North America Market Volume (Sq. Mt.) Forecast by Material, 2015 to 2032

Table 13: North America Market Value (US$ Million) Forecast by Tape Type, 2015 to 2032

Table 14: North America Market Volume (Sq. Mt.) Forecast by Tape Type, 2015 to 2032

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2015 to 2032

Table 16: North America Market Volume (Sq. Mt.) Forecast by End Use, 2015 to 2032

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2015 to 2032

Table 18: Latin America Market Volume (Sq. Mt.) Forecast by Country, 2015 to 2032

Table 19: Latin America Market Value (US$ Million) Forecast by Material, 2015 to 2032

Table 20: Latin America Market Volume (Sq. Mt.) Forecast by Material, 2015 to 2032

Table 21: Latin America Market Value (US$ Million) Forecast by Tape Type, 2015 to 2032

Table 22: Latin America Market Volume (Sq. Mt.) Forecast by Tape Type, 2015 to 2032

Table 23: Latin America Market Value (US$ Million) Forecast by End Use, 2015 to 2032

Table 24: Latin America Market Volume (Sq. Mt.) Forecast by End Use, 2015 to 2032

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2015 to 2032

Table 26: Europe Market Volume (Sq. Mt.) Forecast by Country, 2015 to 2032

Table 27: Europe Market Value (US$ Million) Forecast by Material, 2015 to 2032

Table 28: Europe Market Volume (Sq. Mt.) Forecast by Material, 2015 to 2032

Table 29: Europe Market Value (US$ Million) Forecast by Tape Type, 2015 to 2032

Table 30: Europe Market Volume (Sq. Mt.) Forecast by Tape Type, 2015 to 2032

Table 31: Europe Market Value (US$ Million) Forecast by End Use, 2015 to 2032

Table 32: Europe Market Volume (Sq. Mt.) Forecast by End Use, 2015 to 2032

Table 33: East Asia Market Value (US$ Million) Forecast by Country, 2015 to 2032

Table 34: East Asia Market Volume (Sq. Mt.) Forecast by Country, 2015 to 2032

Table 35: East Asia Market Value (US$ Million) Forecast by Material, 2015 to 2032

Table 36: East Asia Market Volume (Sq. Mt.) Forecast by Material, 2015 to 2032

Table 37: East Asia Market Value (US$ Million) Forecast by Tape Type, 2015 to 2032

Table 38: East Asia Market Volume (Sq. Mt.) Forecast by Tape Type, 2015 to 2032

Table 39: East Asia Market Value (US$ Million) Forecast by End Use, 2015 to 2032

Table 40: East Asia Market Volume (Sq. Mt.) Forecast by End Use, 2015 to 2032

Table 41: South Asia Market Value (US$ Million) Forecast by Country, 2015 to 2032

Table 42: South Asia Market Volume (Sq. Mt.) Forecast by Country, 2015 to 2032

Table 43: South Asia Market Value (US$ Million) Forecast by Material, 2015 to 2032

Table 44: South Asia Market Volume (Sq. Mt.) Forecast by Material, 2015 to 2032

Table 45: South Asia Market Value (US$ Million) Forecast by Tape Type, 2015 to 2032

Table 46: South Asia Market Volume (Sq. Mt.) Forecast by Tape Type, 2015 to 2032

Table 47: South Asia Market Value (US$ Million) Forecast by End Use, 2015 to 2032

Table 48: South Asia Market Volume (Sq. Mt.) Forecast by End Use, 2015 to 2032

Table 49: Oceania Market Value (US$ Million) Forecast by Country, 2015 to 2032

Table 50: Oceania Market Volume (Sq. Mt.) Forecast by Country, 2015 to 2032

Table 51: Oceania Market Value (US$ Million) Forecast by Material, 2015 to 2032

Table 52: Oceania Market Volume (Sq. Mt.) Forecast by Material, 2015 to 2032

Table 53: Oceania Market Value (US$ Million) Forecast by Tape Type, 2015 to 2032

Table 54: Oceania Market Volume (Sq. Mt.) Forecast by Tape Type, 2015 to 2032

Table 55: Oceania Market Value (US$ Million) Forecast by End Use, 2015 to 2032

Table 56: Oceania Market Volume (Sq. Mt.) Forecast by End Use, 2015 to 2032

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2015 to 2032

Table 58: Middle East and Africa Market Volume (Sq. Mt.) Forecast by Country, 2015 to 2032

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Material, 2015 to 2032

Table 60: Middle East and Africa Market Volume (Sq. Mt.) Forecast by Material, 2015 to 2032

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Tape Type, 2015 to 2032

Table 62: Middle East and Africa Market Volume (Sq. Mt.) Forecast by Tape Type, 2015 to 2032

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2015 to 2032

Table 64: Middle East and Africa Market Volume (Sq. Mt.) Forecast by End Use, 2015 to 2032

Table 65: United States of America Market Value (US$ Million) Forecast by Material, Tape Type, and End Use (2022(E) & 2032(F))

Table 66: Canada Market Value (US$ Million) Forecast by Material, Tape Type, and End Use (2022(E) & 2032(F))

Table 67: Brazil Market Value (US$ Million) Forecast by Material, Tape Type, and End Use (2022(E) & 2032(F))

Table 68: Mexico Market Value (US$ Million) Forecast by Material, Tape Type, and End Use (2022(E) & 2032(F))

Table 69: Germany Market Value (US$ Million) Forecast by Material, Tape Type, and End Use (2022(E) & 2032(F))

Table 70: Italy Market Value (US$ Million) Forecast by Material, Tape Type, and End Use (2022(E) & 2032(F))

Table 71: France Market Value (US$ Million) Forecast by Material, Tape Type, and End Use (2022(E) & 2032(F))

Table 72: Spain Market Value (US$ Million) Forecast by Material, Tape Type, and End Use (2022(E) & 2032(F))

Table 73: United Kingdom Market Value (US$ Million) Forecast by Material, Tape Type, and End Use (2022(E) & 2032(F))

Table 74: Russia Market Value (US$ Million) Forecast by Material, Tape Type, and End Use (2022(E) & 2032(F))

Table 75: China Market Value (US$ Million) Forecast by Material, Tape Type, and End Use (2022(E) & 2032(F))

Table 76: Japan Market Value (US$ Million) Forecast by Material, Tape Type, and End Use (2022(E) & 2032(F))

Table 77: India Market Value (US$ Million) Forecast by Material, Tape Type, and End Use (2022(E) & 2032(F))

Table 78: GCC Countries Market Value (US$ Million) Forecast by Material, Tape Type, and End Use (2022(E) & 2032(F))

Table 79: Australia Market Value (US$ Million) Forecast by Material, Tape Type, and End Use (2022(E) & 2032(F))

Figure 01: Global Market Value (US$ Million) by Material, 2022 to 2032

Figure 02: Global Market Value (US$ Million) by Tape Type, 2022 to 2032

Figure 03: Global Market Value (US$ Million) by End Use, 2022 to 2032

Figure 04: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 05: Global Market Value (US$ Million) Analysis by Region, 2015 to 2021

Figure 06: Global Market Volume (Sq. Mt.) Analysis by Region, 2015 to 2032

Figure 07: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 08: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 09: Global Market Value (US$ Million) Analysis by Material, 2015 to 2021

Figure 10: Global Market Volume (Sq. Mt.) Analysis by Material, 2015 to 2032

Figure 11: Global Market Value Share (%) and BPS Analysis by Material, 2022 to 2032

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material, 2022 to 2032

Figure 13: Global Market Value (US$ Million) Analysis by Tape Type, 2015 to 2021

Figure 14: Global Market Volume (Sq. Mt.) Analysis by Tape Type, 2015 to 2032

Figure 15: Global Market Value Share (%) and BPS Analysis by Tape Type, 2022 to 2032

Figure 16: Global Market Y-o-Y Growth (%) Projections by Tape Type, 2022 to 2032

Figure 17: Global Market Value (US$ Million) Analysis by End Use, 2015 to 2021

Figure 18: Global Market Volume (Sq. Mt.) Analysis by End Use, 2015 to 2032

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 21: Global Market Attractiveness by Material, 2022 to 2032

Figure 22: Global Market Attractiveness by Tape Type, 2022 to 2032

Figure 23: Global Market Attractiveness by End Use, 2022 to 2032

Figure 24: Global Market Attractiveness by End Use, 2022 to 2032

Figure 25: Global Market Attractiveness by Region, 2022 to 2032

Figure 26: North America Market Value (US$ Million) by Material, 2022 to 2032

Figure 27: North America Market Value (US$ Million) by Tape Type, 2022 to 2032

Figure 28: North America Market Value (US$ Million) by End Use, 2022 to 2032

Figure 29: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 30: North America Market Value (US$ Million) Analysis by Country, 2015 to 2021

Figure 31: North America Market Volume (Sq. Mt.) Analysis by Country, 2015 to 2032

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 34: North America Market Value (US$ Million) Analysis by Material, 2015 to 2021

Figure 35: North America Market Volume (Sq. Mt.) Analysis by Material, 2015 to 2032

Figure 36: North America Market Value Share (%) and BPS Analysis by Material, 2022 to 2032

Figure 37: North America Market Y-o-Y Growth (%) Projections by Material, 2022 to 2032

Figure 38: North America Market Value (US$ Million) Analysis by Tape Type, 2015 to 2021

Figure 39: North America Market Volume (Sq. Mt.) Analysis by Tape Type, 2015 to 2032

Figure 40: North America Market Value Share (%) and BPS Analysis by Tape Type, 2022 to 2032

Figure 41: North America Market Y-o-Y Growth (%) Projections by Tape Type, 2022 to 2032

Figure 42: North America Market Value (US$ Million) Analysis by End Use, 2015 to 2021

Figure 43: North America Market Volume (Sq. Mt.) Analysis by End Use, 2015 to 2032

Figure 44: North America Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 45: North America Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 46: North America Market Attractiveness by Material, 2022 to 2032

Figure 47: North America Market Attractiveness by Tape Type, 2022 to 2032

Figure 48: North America Market Attractiveness by End Use, 2022 to 2032

Figure 49: North America Market Attractiveness by Country, 2022 to 2032

Figure 50: Latin America Market Value (US$ Million) by Material, 2022 to 2032

Figure 51: Latin America Market Value (US$ Million) by Tape Type, 2022 to 2032

Figure 52: Latin America Market Value (US$ Million) by End Use, 2022 to 2032

Figure 53: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 54: Latin America Market Value (US$ Million) Analysis by Country, 2015 to 2021

Figure 55: Latin America Market Volume (Sq. Mt.) Analysis by Country, 2015 to 2032

Figure 56: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 57: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 58: Latin America Market Value (US$ Million) Analysis by Material, 2015 to 2021

Figure 59: Latin America Market Volume (Sq. Mt.) Analysis by Material, 2015 to 2032

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Material, 2022 to 2032

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Material, 2022 to 2032

Figure 62: Latin America Market Value (US$ Million) Analysis by Tape Type, 2015 to 2021

Figure 63: Latin America Market Volume (Sq. Mt.) Analysis by Tape Type, 2015 to 2032

Figure 64: Latin America Market Value Share (%) and BPS Analysis by Tape Type, 2022 to 2032

Figure 65: Latin America Market Y-o-Y Growth (%) Projections by Tape Type, 2022 to 2032

Figure 66: Latin America Market Value (US$ Million) Analysis by End Use, 2015 to 2021

Figure 67: Latin America Market Volume (Sq. Mt.) Analysis by End Use, 2015 to 2032

Figure 68: Latin America Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 70: Latin America Market Attractiveness by Material, 2022 to 2032

Figure 71: Latin America Market Attractiveness by Tape Type, 2022 to 2032

Figure 72: Latin America Market Attractiveness by End Use, 2022 to 2032

Figure 73: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 74: Europe Market Value (US$ Million) by Material, 2022 to 2032

Figure 75: Europe Market Value (US$ Million) by Tape Type, 2022 to 2032

Figure 76: Europe Market Value (US$ Million) by End Use, 2022 to 2032

Figure 77: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 78: Europe Market Value (US$ Million) Analysis by Country, 2015 to 2021

Figure 79: Europe Market Volume (Sq. Mt.) Analysis by Country, 2015 to 2032

Figure 80: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 81: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 82: Europe Market Value (US$ Million) Analysis by Material, 2015 to 2021

Figure 83: Europe Market Volume (Sq. Mt.) Analysis by Material, 2015 to 2032

Figure 84: Europe Market Value Share (%) and BPS Analysis by Material, 2022 to 2032

Figure 85: Europe Market Y-o-Y Growth (%) Projections by Material, 2022 to 2032

Figure 86: Europe Market Value (US$ Million) Analysis by Tape Type, 2015 to 2021

Figure 87: Europe Market Volume (Sq. Mt.) Analysis by Tape Type, 2015 to 2032

Figure 88: Europe Market Value Share (%) and BPS Analysis by Tape Type, 2022 to 2032

Figure 89: Europe Market Y-o-Y Growth (%) Projections by Tape Type, 2022 to 2032

Figure 90: Europe Market Value (US$ Million) Analysis by End Use, 2015 to 2021

Figure 91: Europe Market Volume (Sq. Mt.) Analysis by End Use, 2015 to 2032

Figure 92: Europe Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 93: Europe Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 94: Europe Market Attractiveness by Material, 2022 to 2032

Figure 95: Europe Market Attractiveness by Tape Type, 2022 to 2032

Figure 96: Europe Market Attractiveness by End Use, 2022 to 2032

Figure 97: Europe Market Attractiveness by Country, 2022 to 2032

Figure 98: East Asia Market Value (US$ Million) by Material, 2022 to 2032

Figure 99: East Asia Market Value (US$ Million) by Tape Type, 2022 to 2032

Figure 100: East Asia Market Value (US$ Million) by End Use, 2022 to 2032

Figure 101: East Asia Market Value (US$ Million) by Country, 2022 to 2032

Figure 102: East Asia Market Value (US$ Million) Analysis by Country, 2015 to 2021

Figure 103: East Asia Market Volume (Sq. Mt.) Analysis by Country, 2015 to 2032

Figure 104: East Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 105: East Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 106: East Asia Market Value (US$ Million) Analysis by Material, 2015 to 2021

Figure 107: East Asia Market Volume (Sq. Mt.) Analysis by Material, 2015 to 2032

Figure 108: East Asia Market Value Share (%) and BPS Analysis by Material, 2022 to 2032

Figure 109: East Asia Market Y-o-Y Growth (%) Projections by Material, 2022 to 2032

Figure 110: East Asia Market Value (US$ Million) Analysis by Tape Type, 2015 to 2021

Figure 111: East Asia Market Volume (Sq. Mt.) Analysis by Tape Type, 2015 to 2032

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Tape Type, 2022 to 2032

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Tape Type, 2022 to 2032

Figure 114: East Asia Market Value (US$ Million) Analysis by End Use, 2015 to 2021

Figure 115: East Asia Market Volume (Sq. Mt.) Analysis by End Use, 2015 to 2032

Figure 116: East Asia Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 117: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 118: East Asia Market Attractiveness by Material, 2022 to 2032

Figure 119: East Asia Market Attractiveness by Tape Type, 2022 to 2032

Figure 120: East Asia Market Attractiveness by End Use, 2022 to 2032

Figure 121: East Asia Market Attractiveness by Country, 2022 to 2032

Figure 122: South Asia Market Value (US$ Million) by Material, 2022 to 2032

Figure 123: South Asia Market Value (US$ Million) by Tape Type, 2022 to 2032

Figure 124: South Asia Market Value (US$ Million) by End Use, 2022 to 2032

Figure 125: South Asia Market Value (US$ Million) by Country, 2022 to 2032

Figure 126: South Asia Market Value (US$ Million) Analysis by Country, 2015 to 2021

Figure 127: South Asia Market Volume (Sq. Mt.) Analysis by Country, 2015 to 2032

Figure 128: South Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 129: South Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 130: South Asia Market Value (US$ Million) Analysis by Material, 2015 to 2021

Figure 131: South Asia Market Volume (Sq. Mt.) Analysis by Material, 2015 to 2032

Figure 132: South Asia Market Value Share (%) and BPS Analysis by Material, 2022 to 2032

Figure 133: South Asia Market Y-o-Y Growth (%) Projections by Material, 2022 to 2032

Figure 134: South Asia Market Value (US$ Million) Analysis by Tape Type, 2015 to 2021

Figure 135: South Asia Market Volume (Sq. Mt.) Analysis by Tape Type, 2015 to 2032

Figure 136: South Asia Market Value Share (%) and BPS Analysis by Tape Type, 2022 to 2032

Figure 137: South Asia Market Y-o-Y Growth (%) Projections by Tape Type, 2022 to 2032

Figure 138: South Asia Market Value (US$ Million) Analysis by End Use, 2015 to 2021

Figure 139: South Asia Market Volume (Sq. Mt.) Analysis by End Use, 2015 to 2032

Figure 140: South Asia Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 141: South Asia Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 142: South Asia Market Attractiveness by Material, 2022 to 2032

Figure 143: South Asia Market Attractiveness by Tape Type, 2022 to 2032

Figure 144: South Asia Market Attractiveness by End Use, 2022 to 2032

Figure 145: South Asia Market Attractiveness by Country, 2022 to 2032

Figure 146: Oceania Market Value (US$ Million) by Material, 2022 to 2032

Figure 147: Oceania Market Value (US$ Million) by Tape Type, 2022 to 2032

Figure 148: Oceania Market Value (US$ Million) by End Use, 2022 to 2032

Figure 149: Oceania Market Value (US$ Million) by Country, 2022 to 2032

Figure 150: Oceania Market Value (US$ Million) Analysis by Country, 2015 to 2021

Figure 151: Oceania Market Volume (Sq. Mt.) Analysis by Country, 2015 to 2032

Figure 152: Oceania Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 153: Oceania Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 154: Oceania Market Value (US$ Million) Analysis by Material, 2015 to 2021

Figure 155: Oceania Market Volume (Sq. Mt.) Analysis by Material, 2015 to 2032

Figure 156: Oceania Market Value Share (%) and BPS Analysis by Material, 2022 to 2032

Figure 157: Oceania Market Y-o-Y Growth (%) Projections by Material, 2022 to 2032

Figure 158: Oceania Market Value (US$ Million) Analysis by Tape Type, 2015 to 2021

Figure 159: Oceania Market Volume (Sq. Mt.) Analysis by Tape Type, 2015 to 2032

Figure 160: Oceania Market Value Share (%) and BPS Analysis by Tape Type, 2022 to 2032

Figure 161: Oceania Market Y-o-Y Growth (%) Projections by Tape Type, 2022 to 2032

Figure 162: Oceania Market Value (US$ Million) Analysis by End Use, 2015 to 2021

Figure 163: Oceania Market Volume (Sq. Mt.) Analysis by End Use, 2015 to 2032

Figure 164: Oceania Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 165: Oceania Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 166: Oceania Market Attractiveness by Material, 2022 to 2032

Figure 167: Oceania Market Attractiveness by Tape Type, 2022 to 2032

Figure 168: Oceania Market Attractiveness by End Use, 2022 to 2032

Figure 169: Oceania Market Attractiveness by Country, 2022 to 2032

Figure 170: Middle East and Africa Market Value (US$ Million) by Material, 2022 to 2032

Figure 171: Middle East and Africa Market Value (US$ Million) by Tape Type, 2022 to 2032

Figure 172: Middle East and Africa Market Value (US$ Million) by End Use, 2022 to 2032

Figure 173: Middle East and Africa Market Value (US$ Million) by Country, 2022 to 2032

Figure 174: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2015 to 2021

Figure 175: Middle East and Africa Market Volume (Sq. Mt.) Analysis by Country, 2015 to 2032

Figure 176: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 177: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 178: Middle East and Africa Market Value (US$ Million) Analysis by Material, 2015 to 2021

Figure 179: Middle East and Africa Market Volume (Sq. Mt.) Analysis by Material, 2015 to 2032

Figure 180: Middle East and Africa Market Value Share (%) and BPS Analysis by Material, 2022 to 2032

Figure 181: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material, 2022 to 2032

Figure 182: Middle East and Africa Market Value (US$ Million) Analysis by Tape Type, 2015 to 2021

Figure 183: Middle East and Africa Market Volume (Sq. Mt.) Analysis by Tape Type, 2015 to 2032

Figure 184: Middle East and Africa Market Value Share (%) and BPS Analysis by Tape Type, 2022 to 2032

Figure 185: Middle East and Africa Market Y-o-Y Growth (%) Projections by Tape Type, 2022 to 2032

Figure 186: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2015 to 2021

Figure 187: Middle East and Africa Market Volume (Sq. Mt.) Analysis by End Use, 2015 to 2032

Figure 188: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 189: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 190: Middle East and Africa Market Attractiveness by Material, 2022 to 2032

Figure 191: Middle East and Africa Market Attractiveness by Tape Type, 2022 to 2032

Figure 192: Middle East and Africa Market Attractiveness by End Use, 2022 to 2032

Figure 193: Middle East and Africa Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of Tape Backing Materials Companies

Tape Unwinder Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Tape Measure Market Size and Share Forecast Outlook 2025 to 2035

Tape Stretching Line Market Analysis – Growth & Trends 2025 to 2035

Tapes Market Insights – Growth & Demand 2025 to 2035

Tape Banding Machine Market Overview - Demand & Growth Forecast 2025 to 2035

Competitive Overview of Tape Dispenser Companies

Tape & Label Adhesives Market

Tape Applicator Machines Market

UV Tapes Market Growth - Trends & Forecast 2025 to 2035

PVC Tapes Market Size and Share Forecast Outlook 2025 to 2035

Leading Providers & Market Share in PVC Tapes Industry

ESD Tapes and Labels Market from 2025 to 2035

USA Tapes Market Analysis – Growth & Forecast 2024-2034

Tear Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Foam Tape Market Size and Share Forecast Outlook 2025 to 2035

Body Tape Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA