Top Dynamics and Industry Trends Shaping the Tape Unwinder Market

The tape unwinder market is experiencing robust growth driven by the increasing demand for efficient material handling, packaging automation, and consistent adhesive application across industrial operations. The current scenario reflects rising adoption of automated unwinding systems, improved productivity standards, and advancements in mechanical design to enhance precision and speed. Manufacturers are focusing on integrating sensor-based control mechanisms and digital monitoring features to reduce downtime and ensure uniform tape dispensing.

Expanding manufacturing activities, particularly in electronics, automotive, and logistics sectors, are contributing to sustained demand. The future outlook is supported by industrial automation trends, higher throughput requirements, and the need for cost-efficient tape management solutions.

Growth rationale is underpinned by the ability of tape unwinders to streamline production workflows, minimize waste, and improve operational safety Continuous technological development and product customization for specialized end uses are expected to strengthen market competitiveness and drive long-term expansion across global industrial sectors.

Quick Stats for Tape Unwinder Market

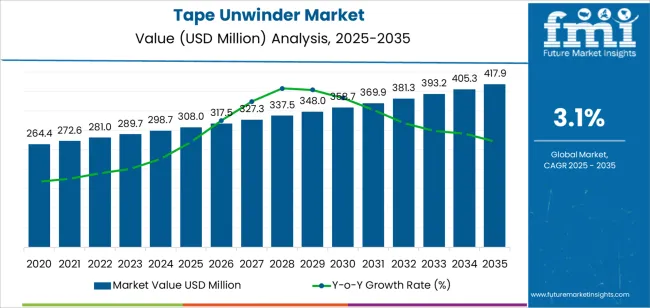

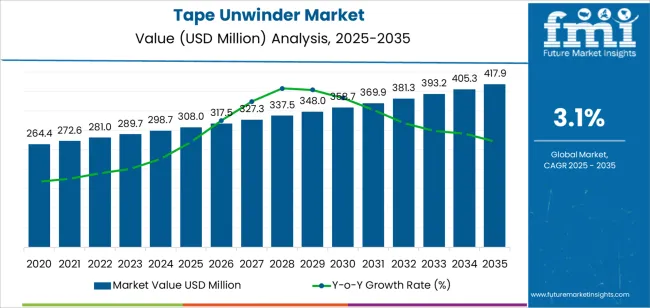

- Tape Unwinder Market Industry Value (2025): USD 308.0 million

- Tape Unwinder Market Forecast Value (2035): USD 417.9 million

- Tape Unwinder Market Forecast CAGR: 3.1%

- Leading Segment in Tape Unwinder Market in 2025: Automatic (61.4%)

- Key Growth Region in Tape Unwinder Market: North America, Asia-Pacific, Europe

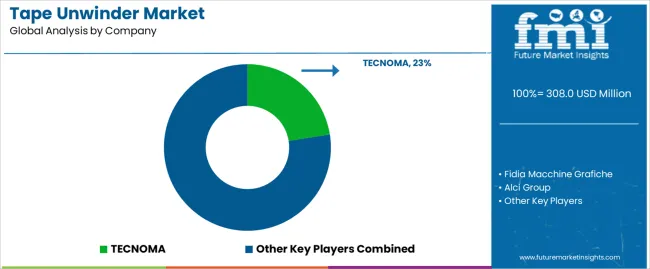

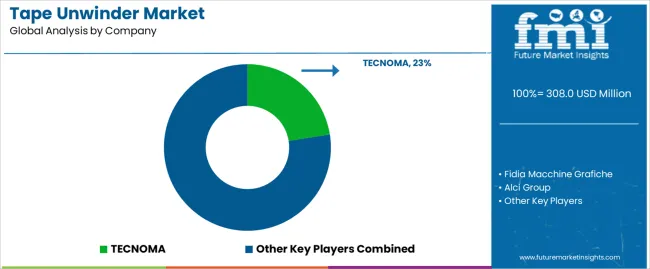

- Top Key Players in Tape Unwinder Market: TECNOMA, Fidia Macchine Grafiche, Alci Group

| Metric |

Value |

| Tape Unwinder Market Estimated Value in (2025 E) |

USD 308.0 million |

| Tape Unwinder Market Forecast Value in (2035 F) |

USD 417.9 million |

| Forecast CAGR (2025 to 2035) |

3.1% |

Segmental Analysis

The market is segmented by Technology, Product Type, and End Use and region. By Technology, the market is divided into Automatic and Semi-Automatic. In terms of Product Type, the market is classified into Table Top, Definite Length Unwinder, and Stretchable Tape Unwinder. Based on End Use, the market is segmented into Industrial and Office & Commercial. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Insights into the Technology Segment

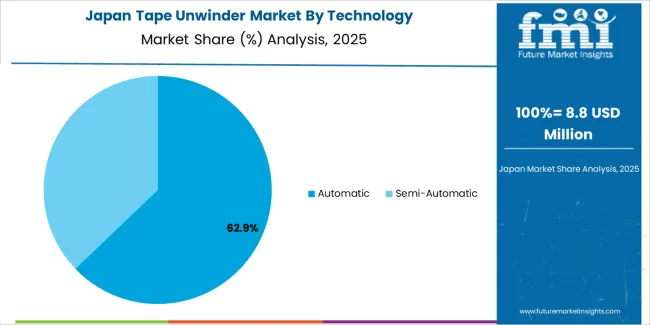

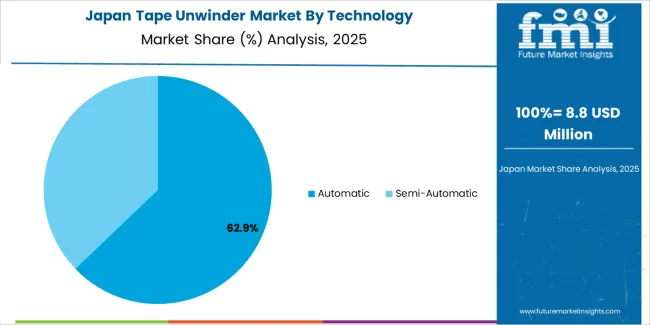

The automatic segment, accounting for 61.40% of the technology category, has emerged as the dominant technology due to its superior efficiency, precision control, and reduced manual intervention. Market adoption has been driven by the growing emphasis on automated production lines and the need for consistent tape handling in high-volume applications.

Integration of programmable logic controls and servo-driven systems has enhanced speed regulation and tape alignment accuracy. Industries have increasingly preferred automatic systems for their ability to lower operational errors, improve safety, and deliver continuous output.

The segment’s strong share is further supported by its scalability across various production environments and compatibility with different tape materials With ongoing innovations in machine intelligence and remote monitoring, automatic tape unwinders are expected to remain the preferred choice for manufacturers seeking high productivity and long-term operational reliability.

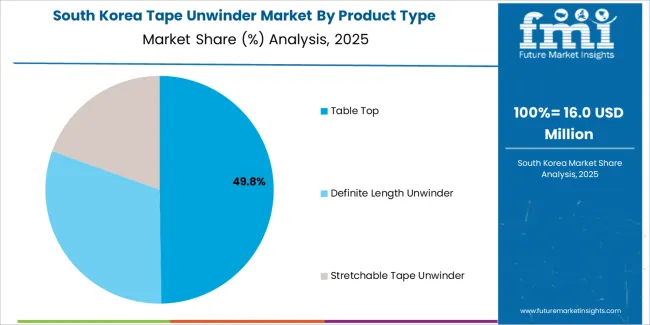

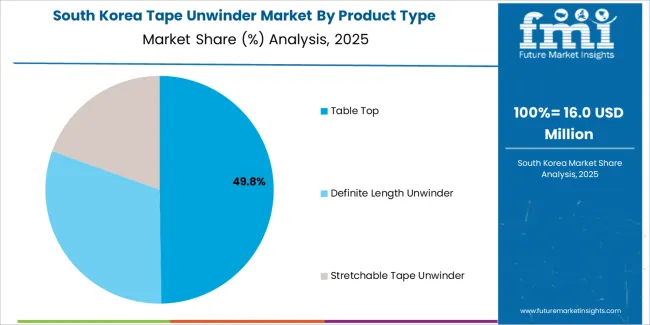

Insights into the Product Type Segment

The table top segment, representing 47.80% of the product type category, leads the market owing to its compact design, ease of installation, and versatility across small- to mid-scale manufacturing setups. Demand has been driven by cost-effective operation and suitability for applications requiring moderate output levels.

The segment’s growth is reinforced by its adaptability in laboratories, assembly units, and packaging facilities where space optimization is crucial. Enhanced ergonomics, improved tape feed mechanisms, and adjustable tension systems have increased user efficiency and minimized waste.

Continuous product enhancements to improve durability and operator comfort are supporting broader adoption As industries continue to prioritize flexible and portable unwinding solutions, the table top segment is anticipated to sustain its leadership position and expand its footprint across multiple end-use environments.

Insights into the End Use Segment

The industrial segment, holding 68.20% of the end use category, has maintained a commanding position due to widespread utilization across packaging, electronics, and automotive manufacturing lines. Consistent demand for high-speed, precise tape application in assembly and packaging operations has driven adoption.

The segment’s dominance is supported by large-scale integration of unwinders into automated production systems where efficiency and accuracy are critical. Industrial users favor these machines for their ability to handle varied tape widths, maintain consistent tension, and withstand continuous operation under demanding conditions.

Growth is also supported by increasing capital investments in automation and the global shift toward lean manufacturing With continuous technological upgrades and the expansion of manufacturing capacity in emerging economies, the industrial segment is expected to sustain strong growth momentum and remain a key driver of overall market performance.

Tape Unwinder Market Size and Share Forecast Outlook From 2025 to 2035

- Increasing use of adhesive tapes in various industries, including automotive, construction, and healthcare, is driving the growth of the tape unwinder market.

- Industries rely heavily on the use of adhesive tapes for various applications, and tape unwinders provide a convenient and efficient way to dispense these tapes.

- Rising popularity of eCommerce leads to an increase in the demand for packaging materials.

- As online shopping continues to grow, businesses are looking for ways to streamline their packaging processes and reduce costs.

- Tape unwinders play a crucial role in this process by allowing companies to dispense tape quickly and efficiently, which helps to speed up the packaging process and save time.

- Manufacturers are constantly improving the design and functionality of tape unwinders to cater to the specific needs of different industries.

- Rising need for automation and efficiency in manufacturing processes.

- Tape unwinders can be integrated into automated packaging lines, which helps to reduce labour costs and increase productivity.

- Growing trend of sustainability and eco-friendliness is driving demand for tape unwinders.

- Many businesses are looking for ways to reduce waste and increase efficiency in their packaging processes, and tape unwinders provide a sustainable and cost-effective solution.

Lucrative Opportunities Transforming the Tape Unwinder Market

- Increasing demand for packaging and shipping products across various industries is expected to create significant opportunities during the forecast period.

- As more businesses move towards online sales, the need for efficient packaging and shipping solutions has grown, leading to an increased demand for tape unwinders.

- The expansion into emerging markets is expected to create lucrative opportunities in the industry.

- The adoption of new technologies, such as automation and artificial intelligence (AI), has the potential to revolutionize the market.

- Companies that can leverage these technologies to develop more efficient and effective tape unwinders will be well-positioned to gain a competitive advantage and increase their market share.

Factors Restraining the Demand for Tape Unwinder

- Growing need for automation and efficiency, many companies are shifting towards digital solutions that offer more control and precision in their packaging processes.

- The shift toward digital solutions is reducing the demand for traditional tape unwinders, which are manual and require a lot of human intervention.

- Rising competition from alternative packaging solutions is expected to hinder market growth during the forecast period.

- For instance, many companies are now using stretch wrap machines that offer better efficiency and faster packaging times. This trend is driving down the demand for tape unwinders in the market.

- The price of materials such as steel, aluminum, and plastic has been increasing in recent years, which is driving up the cost of production for tape unwinders.

- Companies are finding it difficult to maintain profitability in the market.

- Challenges related to sustainability.

- Many consumers are now demanding eco-friendly packaging solutions that reduce waste and promote sustainability.

- Sustainability leads to demand for packaging solutions that are made from renewable materials and can be recycled easily.

- This shift towards sustainability is forcing manufacturers to rethink their packaging strategies, which is impacting the demand for tape unwinders in the market.

Tape Unwinder Industry Analysis by Top Investment Segments

In terms of Technology, the Automatic Segment Leads the Market Growth

| Attributes |

Details |

| Top Technology |

Automatic |

| Market Share in 2025 |

76.2% |

- Increasing demand for automation and efficiency in the packaging industry is boosting the segment’s growth.

- With the growing need for speed and precision in packaging processes, many companies are shifting towards automated solutions that offer better control and accuracy.

- The increasing need to reduce waste and improve accuracy in the packaging process is driving the growth for automatic tape unwinder segment.

- The increasing demand for eCommerce and online shopping is also driving the growth of the automatic tape unwinder market.

- With the rising demand for fast and efficient shipping, many companies are adopting automated packaging solutions that can handle high volumes of orders quickly and accurately.

In terms of End Use, the Industrial Segment is dominating the Market

| Attributes |

Details |

| Top End Use |

Industrial |

| Market Share in 2025 |

71.2% |

- Increasing demand for heavy-duty packaging and shipping applications in various industries such as automotive, construction, and manufacturing.

- Rising need for automation and efficiency in the packaging industry, many companies are adopting industrial tape unwinders that can handle high volumes of orders quickly and accurately.

- Industrial tape unwinders are equipped with advanced features such as adjustable tension control, automatic cutting, and programmable lengths that help to reduce waste and improve accuracy in the packaging process.

- With an increasing focus on sustainability and eco-friendliness, many companies are adopting industrial tape unwinders that use recyclable materials and reduce waste in the packaging process.

Analysis of Top Countries Manufacturing, Operating, Distributing, and Using Tape Unwinders

| Countries |

CAGR through 2035 |

| United States |

2.1% |

| United Kingdom |

3.1% |

| China |

5.2% |

| Japan |

2.8% |

| South Korea |

4.1% |

Increasing Use of Adhesive Tapes in Various Industries in the United States

- The growing eCommerce industry has contributed to the rising demand for adhesive tapes and, in turn, tape unwinders in United States.

- Rising demand for automation in manufacturing processes also drives growth in the market.

- The United States is also home to a large number of small and medium-sized enterprises (SMEs) that extensively use adhesive tapes for packaging and other applications.

- These SMEs often require cost-effective and efficient solutions for their packaging needs, and tape unwinders provide them with a solution that helps reduce their packaging costs and increase their productivity.

- The United States is a hub for innovation and technological advancements.

- The tape unwinder market in the United States is characterized by the introduction of new and advanced tape unwinders that are efficient, cost-effective, and equipped with advanced features.

- Advancements have further boosted the demand for tape unwinders in the United States.

Increasing Demand for Medical and Healthcare Products in the United Kingdom

- Adhesive tapes are widely used in medical and healthcare products, including wound care, surgical, and diagnostic products. The increasing demand for medical and healthcare products, coupled with the need for safe and efficient packaging solutions, has led to a rise in demand for tape unwinders in the United Kingdom.

- The United Kingdom has a well-established e-commerce industry, with many companies offering online shopping and home delivery services.

- The growth of the eCommerce industry has led to an increase in the use of adhesive tapes for packaging and shipping products in the United Kingdom.

- Tape unwinders enable companies to efficiently and cost-effectively package and ship their products, meeting the demands of the growing eCommerce industry.

- The United Kingdom is also home to a large number of food and beverage companies that require efficient and safe packaging solutions.

- The United Kingdom has a highly skilled workforce and a strong focus on research and development. R&D activities leads to the development of new and advanced tape unwinders that cater to the specific needs of various industries.

Increase in Demand for Tape Unwinders in China

- Adhesive tapes are widely used in the manufacturing industry for various applications, including packaging, assembly, and labeling. This has led to a rise in demand for tape unwinders in China.

- China is a hub for innovation and technological advancements, driving growth in the market.

- The tape unwinder market in China is characterized by the introduction of new and advanced tape unwinders that are efficient, cost-effective, and equipped with advanced features. These advancements have further boosted the demand for tape unwinders in China.

- Chinese government has implemented several initiatives to promote the growth of the manufacturing industry, such as the 'Made in China 2025' plan.

- This plan aims to promote the development of high-tech industries, including robotics and automation, which is expected to drive the demand for tape unwinders in the country.

Rise in the Manufacturing Sector in Japan

- Increase in manufacturing activities, the demand for tape unwinders has also increased as these machines are an essential part of the production process.

- The automotive industry, in particular, has been a major contributor to the growth of the tape unwinder market in Japan.

- Japanese government has been investing heavily in infrastructure development in the country, which leads to an increase in construction activities.

- As a result, there has been a rise in the demand for tape unwinders that can be used for various applications in the construction industry.

Growing Trend of Automation in the Manufacturing Industry in South Korea

- The country's focus on innovation and technology is also expected to drive growth in the market.

- South Korea is known for its advancements in technology, and this has led to the development of high-quality tape unwinders that are efficient and reliable. This has resulted in an increase in demand for South Korean-made tape unwinders.

- Rising demand for eco-friendly and sustainable packaging solutions has also contributed to the growth of the market in South Korea.

- As consumers become more environmentally conscious, there has been a shift towards sustainable packaging materials, and adhesive tapes are no exception.

- Sustaibility leads to increase in the demand for tape unwinders that can efficiently unwind eco-friendly and sustainable tapes.

- Growing trend of automation in the manufacturing industry has contributed to the growth of the tape unwinder market in South Korea.

- Companies increasingly adopt automation technologies to improve efficiency and reduce costs, there has been an increase in the demand for tape unwinders that can be integrated into automated manufacturing processes.

Key Tape Unwinder Market Players and Concentration

The market is highly competitive, with several players vying for higher market share. The market is largely dominated by established players with a strong brand reputation and extensive distribution networks.

These players have a significant advantage over new entrants due to their ability to leverage economies of scale to offer competitive pricing and a wider range of products.

Company Portfolio

Alci Group

Alci Group is a leading manufacturer of converting machinery for the printing and packaging industry, including tape unwinder products. The company offers a wide range of tape unwinder products that cater to different needs and requirements of its customers. Alci Group's tape unwinder products are designed to improve productivity, reduce waste, and enhance efficiency.

The company's tape unwinder products are used in various industries, including food and beverage, pharmaceutical, and cosmetics. Alci Group is committed to innovation and provides customized solutions to meet the unique needs of its customers.

Fidia Macchine Grafiche

Fidia Macchine Grafiche is a global leader in the manufacturing of printing and converting machinery, including tape unwinder products. The company offers a wide range of tape unwinder products that cater to different industries and applications.

Fidia Macchine Grafiche's tape unwinder products are designed to improve productivity, reduce waste, and enhance efficiency. The company's tape unwinder products are used in various industries, including food and beverage, pharmaceutical, and cosmetics.

The company is known for its high-quality products and exceptional customer service. Fidia Macchine Grafiche is committed to sustainability and offers eco-friendly tape unwinder products that are made from recycled materials.

Leading Suppliers of Tape Unwinder

- TECNOMA

- Fidia Macchine Grafiche

- Alci Group

Key Shifting Preferences Covered in Tape Unwinder Market Report

- Tape Roll Unwinding Systems Market Report

- Tape Roll Holder Industry Analysis

- Manual Tape Unwinders Sales Assessment

- Automatic Tape Dispensers Market Overview

- Tape Dispensing Equipment Pricing Outlook

Top Segments Studied in the Tape Unwinder Market Report

By Technology:

By Product Type:

- Table Top

- Definite Length Unwinder

- Stretchable Tape Unwinder

By End Use:

- Industrial

- Office & Commercial

By Region:

- North America

- Latin America

- East Asia

- South Asia

- Europe

- Oceania

- MEA

Frequently Asked Questions

How big is the tape unwinder market in 2025?

The global tape unwinder market is estimated to be valued at USD 308.0 million in 2025.

What will be the size of tape unwinder market in 2035?

The market size for the tape unwinder market is projected to reach USD 417.9 million by 2035.

How much will be the tape unwinder market growth between 2025 and 2035?

The tape unwinder market is expected to grow at a 3.1% CAGR between 2025 and 2035.

What are the key product types in the tape unwinder market?

The key product types in tape unwinder market are automatic and semi-automatic.

Which product type segment to contribute significant share in the tape unwinder market in 2025?

In terms of product type, table top segment to command 47.8% share in the tape unwinder market in 2025.