The duct tape market is expanding due to its extensive use in industrial, construction, and household applications. The product’s versatility, strength, and adhesion performance across varied surfaces have contributed to consistent global demand. Market growth is driven by rising construction activity, packaging requirements, and maintenance operations across both commercial and residential sectors.

Technological improvements in adhesive formulations and backing materials have enhanced durability and weather resistance. Manufacturers are diversifying product lines with environmentally friendly and specialized variants catering to automotive, HVAC, and electrical uses.

Future market expansion will be supported by increasing infrastructure development and industrial repair activities. The segment is expected to benefit from sustained innovation and broader end-use adaptability.

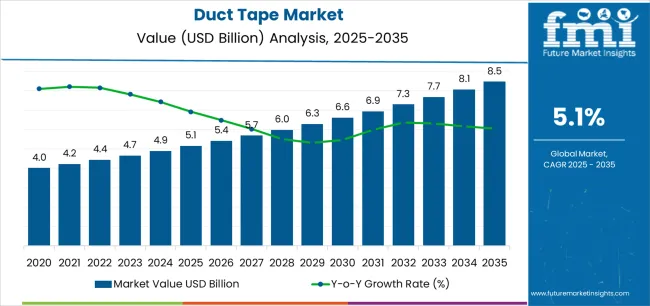

| Metric | Value |

|---|---|

| Duct Tape Market Estimated Value in (2025 E) | USD 5.1 billion |

| Duct Tape Market Forecast Value in (2035 F) | USD 8.5 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

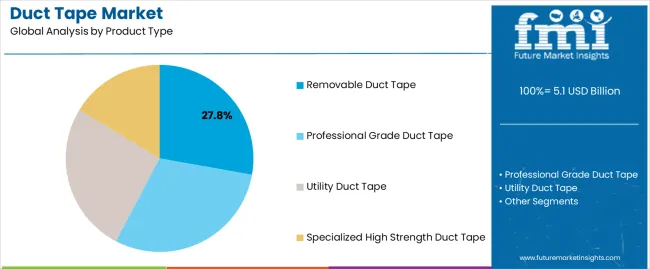

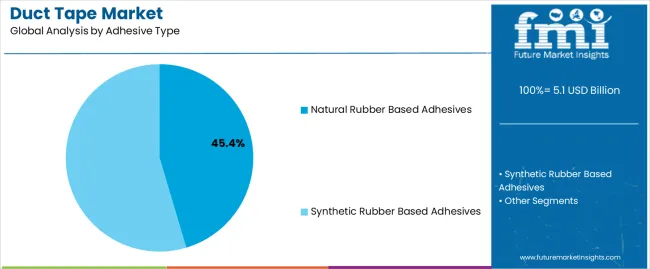

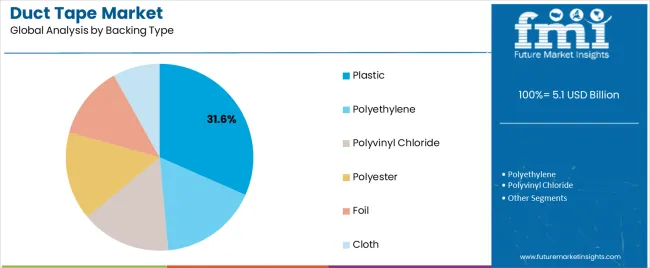

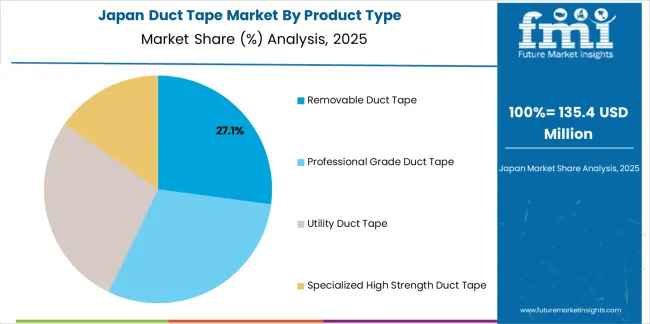

The market is segmented by Product Type, Adhesive Type, Backing Type, Application, Thickness, and End Use Industry and region. By Product Type, the market is divided into Removable Duct Tape, Professional Grade Duct Tape, Utility Duct Tape, and Specialized High Strength Duct Tape. In terms of Adhesive Type, the market is classified into Natural Rubber Based Adhesives and Synthetic Rubber Based Adhesives. Based on Backing Type, the market is segmented into Plastic, Polyethylene, Polyvinyl Chloride, Polyester, Foil, and Cloth. By Application, the market is divided into Sealing, Repairing, Holding, Waterproofing, Coding, Strapping, Splicing, and Others. By Thickness, the market is segmented into <10 Mil, 10 to 15 Mil, and >15 Mil. By End Use Industry, the market is segmented into HVAC, Building & Construction, Shipping & Logistics, Automotive, Electrical & Electronics, and DIY Activities. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The removable duct tape segment accounts for approximately 27.8% share in the product type category, favored for its versatility and ease of clean removal without residue. It is widely used in temporary bonding, stage setups, and non-permanent repair applications.

The segment’s demand is supported by growing requirements for quick-fix solutions in entertainment, construction, and event management industries. Enhanced formulations providing balanced adhesion and residue-free removal have expanded its use in professional and household contexts.

With rising emphasis on convenience and surface protection, the removable duct tape segment is projected to maintain steady growth.

The natural rubber based adhesives segment leads the adhesive type category, capturing approximately 45.4% share. This dominance stems from superior tackiness, flexibility, and high bond strength across diverse substrates.

Natural rubber adhesives offer strong performance in temperature fluctuations, making them ideal for heavy-duty industrial applications. The segment benefits from sustainability trends, as natural rubber is a renewable material that supports eco-conscious production.

Continuous improvements in formulation to enhance shear resistance and UV stability have reinforced its market position. With broad industrial acceptance and reliability in demanding environments, this segment is expected to retain its leadership.

The plastic segment holds approximately 31.6% share in the backing type category, owing to its durability, tear resistance, and moisture barrier properties. Plastic-backed duct tapes provide strong mechanical protection and are suitable for both indoor and outdoor applications.

This segment benefits from advancements in polyethylene and polypropylene materials, which improve flexibility and performance longevity. Construction, HVAC, and automotive industries are key end-users due to the material’s resilience under pressure and temperature changes.

With continued innovation in lightweight and weather-resistant plastic films, the segment is expected to sustain its growth trajectory over the forecast period.

Construction Boom Boosts Duct Tape Demand! The construction industry's constant demand for reliable adhesives and fasteners is a significant factor driving the building & construction tapes market growth.

Duct Tape is the Pit Stop Essential for Automotive Repairs! In the automotive sector, good-grade duct tape serves as a quick-fix solution for several repair and maintenance tasks.

Duct Tape Adds Flair to Electronics Packaging! Duct tape's availability in various colors and patterns makes it a creative choice for proactive packaging and branding in the consumer electronics industry.

Duct Tape's Versatility Revolutionizes Industrial Settings! Duct tape finds extensive use in manufacturing and industrial settings for multiple applications, including bundling, packaging, and labeling.

Intense competition from alternative products like adhesive tapes and fasteners hampers market expansion. Moreover, fluctuations in raw material prices, such as petroleum-based adhesives, impact the cost-effectiveness of duct tape production. Concerns are also raised by inefficiency in harsh environments and leakage through duct tape, which make it difficult to conserve energy at home.

From 2020 to 2025, the duct tape market showed sluggish growth, boasting a 3.0% CAGR. During this period, the market faced various challenges, including fluctuations in raw material prices and increased competition from alternative adhesive solutions. Despite these obstacles, innovative product developments helped sustain moderate growth in the industry. This trend has contributed to the positive outlook of the duct tape industry.

| Attributes | Quantitative Outlook |

|---|---|

| Duct Tape Market Size (2025) | USD 4.6 billion |

| Historical CAGR (2020 to 2025) | 3.0% |

Short-term Duct Tape Market Analysis

The duct tape market global forecast suggests considerable growth in the market owing to the availability of duct tape in multiple colors, patterns, and widths. This appeals to consumers looking to personalize their belongings or projects. This aspect of customization enhances the aesthetic appeal of duct tape and expands its usage beyond purely functional purposes. Whether it's crafting colorful accessories, decorating household items, or adding flair to DIY projects, the ability to customize duct tape drives consumer interest is likely to contribute to industrial tape market expansion.

Long-term Duct Tape Market Analysis

Global trends in the duct tape industry spotlight the growing demand for environmentally friendly duct tape. Increasing awareness of environmental issues prompts consumers to seek eco-friendly alternatives. Duct tape manufacturers are responding by developing more sustainable options. For instance, Lohmann unveiled their new line of high-tech adhesive tapes in June 2025. These tapes are energy-efficient and come in low-emission and low-odor varieties, which are ideal for bonding car interiors.

In addition to satisfying customer preferences, this focus on sustainability supports corporate social responsibility programs and positions eco-friendly duct tape for market expansion. This is expected to have a highly positive impact on the global demand for duct tape in the long run.

The eCommerce market is on the rise, experiencing robust growth with a CAGR of 19%. The booming eCommerce industry and growing online shopping scene have resulted in increased shipping activities. This presents new opportunities for duct tape sellers.

With more people buying online, there's a greater need for packaging materials like duct tape. This means duct tape manufacturers have a chance to expand and reach more customers. As eCommerce continues to grow, so does the demand for reliable shipping solutions, and duct tape is crucial in securing packages.

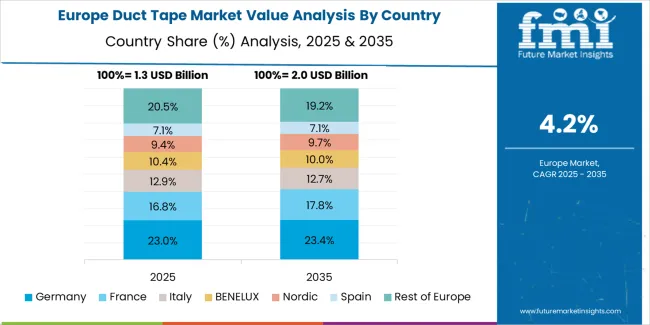

The North America duct tape market stands out as a dominant force. The market here benefits from a well-established infrastructure for manufacturing and distribution, ensuring ample supply and accessibility to consumers. Europe is witnessing continuous and steady growth in demand for duct tape. One significant driver of this trend is the expansion of construction and infrastructure projects across Europe.

The Asia Pacific duct tape industry is likely to progress significantly. The region's robust manufacturing sector, particularly in countries like China and Japan, provides a strong foundation for the production and distribution of duct tape.

| Countries | Forecasted CAGR (2025 to 2035) |

|---|---|

| United States | 4.5% |

| United Kingdom | 5.6% |

| Germany | 4.0% |

| China | 6.9% |

| Japan | 5.6% |

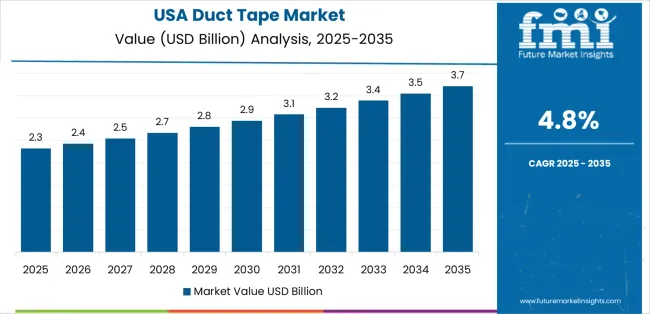

Demand for duct tape in the United States is set to rise with an anticipated CAGR of 4.5% through 2035. Key factors influencing the duct tape market include:

The United Kingdom duct tape market is expected to surge at a CAGR of 5.6% through 2035. The topmost dynamic forces supporting the duct tape adoption in the country include:

The market in Germany is likely to exhibit a CAGR of 4.0% through 2035. Reasons supporting the growth of the duct tape market in the country include:

The China Duct Tape market is forecasted to inflate at a CAGR of 6.9% through 2035. Prominent factors backing up the duct waterproof tape market growth are:

Sales of duct tape in Japan are estimated to record a CAGR of 5.6% through 2035. The primary factors bolstering the industrial tape market size are:

As far as the product type of duct tape is concerned, the professional grade duct tape segment is likely to dominate in 2025, holding 40.1% duct tape market share. Similarly, the sealing segment is expected to lead in terms of application, possessing a 31.6% revenue share of duct tape industry in 2025.

| Segment | Estimated Market Share in 2025 |

|---|---|

| Professional Grade Duct Tape | 40.1% |

| Sealing | 31.6% |

The professional grade duct tape segment is anticipated to lead the way in the market. Here are a few key factors that contribute to professional grade duct tape’s acceptance in the market:

The sealing segment takes the top spot in the duct tape market, an adhesive tape trend validated by factors such as:

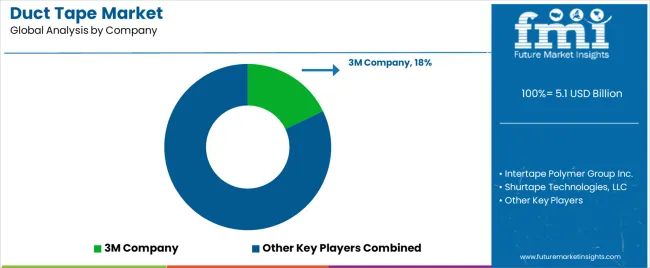

Duct tape market players employ diverse strategies to gain a competitive edge. Key brands such as 3M Company, Intertape Polymer Group Inc., Berry Global Group Inc., and Shurtape Technologies, LLC dominate the industry, offering a wide range of products catering to various needs.

Additionally, private label manufacturers contribute to the competitive landscape, providing alternatives to brand-name offerings. With a focus on durability, adhesion strength, and versatility, these companies vie for consumer preference through innovation and marketing strategies.

Recent Developments

The global duct tape market is estimated to be valued at USD 5.1 billion in 2025.

The market size for the duct tape market is projected to reach USD 8.5 billion by 2035.

The duct tape market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in duct tape market are removable duct tape, professional grade duct tape, utility duct tape and specialized high strength duct tape.

In terms of adhesive type, natural rubber based adhesives segment to command 45.4% share in the duct tape market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Key Players & Market Share in Duct Tape Industry

Ductile Iron Profile Market Size and Share Forecast Outlook 2025 to 2035

Tape Unwinder Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Duct Integrity Tester (DIT) Market Size and Share Forecast Outlook 2025 to 2035

Ductile and Grey Iron Casting Products Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Ductless Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Ducted Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Ductless Heating & Cooling Systems Market Size and Share Forecast Outlook 2025 to 2035

Tape Measure Market Size and Share Forecast Outlook 2025 to 2035

Tape Backing Materials Market Analysis by Material Type, Application, and Region through 2025 to 2035

Tape Stretching Line Market Analysis – Growth & Trends 2025 to 2035

Tapes Market Insights – Growth & Demand 2025 to 2035

Tape Banding Machine Market Overview - Demand & Growth Forecast 2025 to 2035

Duct Fans Market Growth – Trends & Forecast 2025 to 2035

Competitive Overview of Tape Dispenser Companies

Competitive Overview of Tape Backing Materials Companies

Tape & Label Adhesives Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA