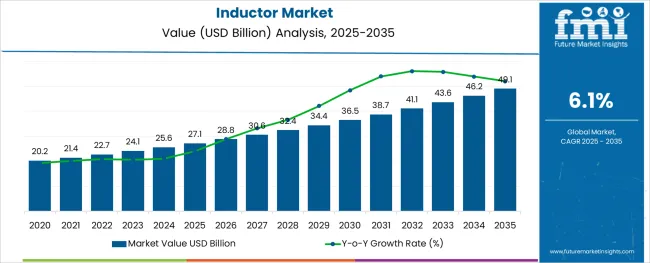

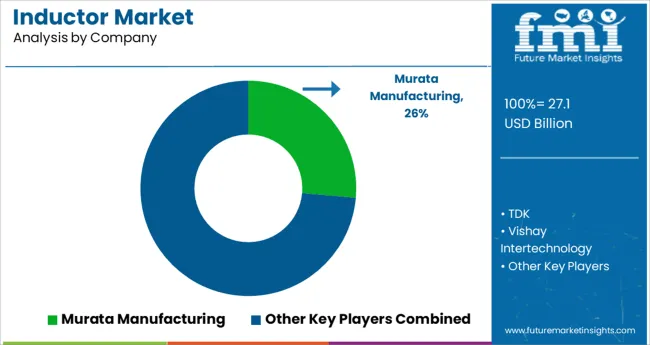

The Inductor Market is estimated to be valued at USD 27.1 billion in 2025 and is projected to reach USD 49.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

The inductor market is witnessing sustained growth, propelled by the surging demand for power electronics, miniaturized components, and energy-efficient circuit designs. As global investments intensify in renewable energy systems, electric vehicles, and high-speed communication infrastructure, inductors have become essential components in ensuring signal integrity, electromagnetic interference suppression, and voltage regulation. Technological advancements in core materials, winding techniques, and surface-mount packaging have enhanced both power density and performance, meeting the evolving requirements of compact and high-frequency applications.

Manufacturers are increasingly aligning with RoHS and other regulatory directives, favoring non-toxic and recyclable materials. Moreover, the acceleration of 5G rollout, IoT device expansion, and automotive electrification continues to open new avenues for innovation and volume adoption.

The market outlook remains promising as OEMs seek inductors that balance thermal stability, low-profile architecture, and high efficiency, especially within fast-evolving industrial, consumer electronics, and automotive domains.

The market is segmented by Inductance Type, Type, Core Type, Mounting Technique, and Application and region. By Inductance Type, the market is divided into Fixed Inductors and Variable Inductors. In terms of Type, the market is classified into Film Type, Multi-Layered, Wire Wound, and Molded. Based on Core Type, the market is segmented into Air Core, Ferrite Core, and Iron Core. By Mounting Technique, the market is divided into Surface Mount and Through Hole. By Application, the market is segmented into Automotive, Industrial, RF, Telecommunications & High-Frequency Applications, Military and Defense, Consumer Electronics, Power Generation, Transmission and Distributions, and Healthcare. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

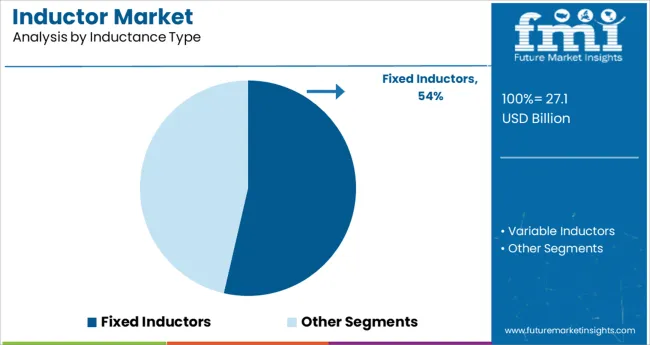

It is projected that fixed inductors will account for 53.60% of the overall inductance type segment in 2025, establishing their position as the dominant category. This segment has gained traction due to its design simplicity, stability under varying operating conditions, and cost-effectiveness for mass-production. Fixed inductors are extensively integrated into voltage regulators, filtering circuits, and RF applications, where consistent performance is essential.

Their non-adjustable configuration reduces circuit complexity and supports miniaturized designs, aligning with the downsizing trend in portable electronics and wearables. Additionally, fixed inductors exhibit enhanced mechanical reliability, which has been valued across automotive and industrial control systems.

As demand grows for robust, space-efficient passive components in high-volume production environments, the fixed inductor segment continues to lead the market by addressing both performance and scalability requirements.

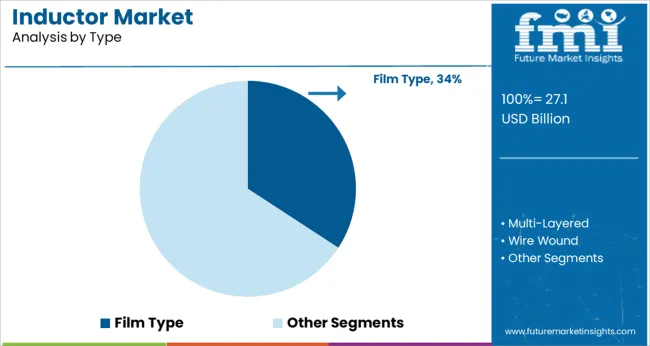

The film type sub-segment is expected to contribute 34.20% of the total market revenue within the type category by 2025, positioning it as a leading configuration. This prominence is underpinned by the film inductor's superior frequency response, thermal stability, and compact design, which are critical for high-performance and space-constrained applications.

Film inductors are commonly adopted in mobile devices, communication equipment, and precision medical electronics due to their low distortion and excellent linearity. Their ability to maintain inductance stability under varying currents and temperatures has further increased their deployment across advanced consumer electronics and power supply modules.

The high manufacturing precision and consistent electrical characteristics associated with film inductors have solidified their place in premium segments, ensuring continued growth and preference among OEMs.

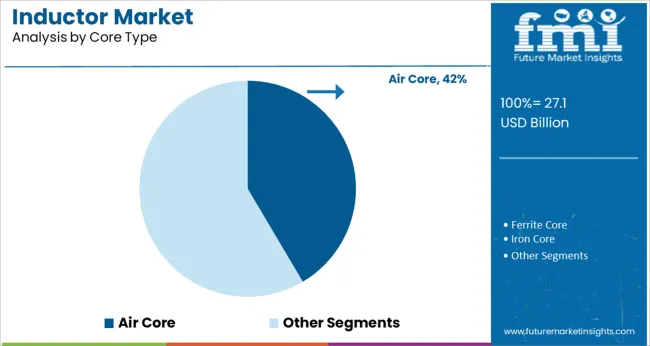

Air core inductors are projected to represent 41.50% of market revenue within the core type category in 2025, making them the most prominent core configuration. Their rise in prominence is attributed to the absence of core losses, enabling high-frequency operation with minimal signal distortion.

This segment is particularly favored in RF circuits, wireless communication systems, and test equipment, where low inductance drift and high linearity are critical. Air core inductors offer stable performance without magnetic saturation, ensuring consistent output in high-frequency or high-speed signal transmission environments.

Moreover, their lightweight construction and reduced electromagnetic interference have been recognized as strategic advantages in aerospace, telecom, and defense applications. With growing industry demand for high-speed connectivity and miniaturized components, the air core segment continues to lead by delivering reliable, distortion-free inductive performance.

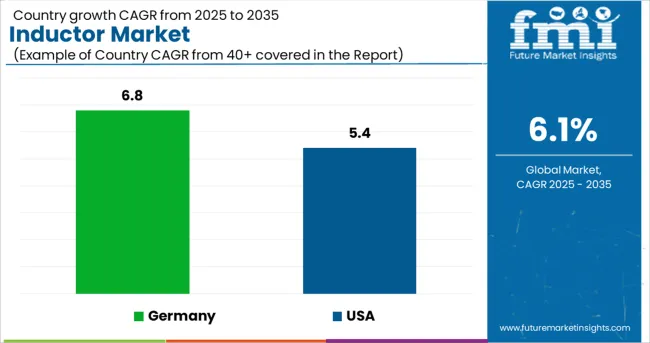

The global inductor market increased at a CAGR of about 2.9% between 2020 to 2024. However, with the rapid growth of consumer electronics and automotive industries, FMI predicts the overall inductor market to develop at 6.1% CAGR through 2035.

The trend toward electrification has grown across industries such as automotive at a rapid pace during the last few years and it is likely to further escalate during the projection period due to rising fuel prices. This is providing a major impetus to the growth of the inductor market.

Inductors, which are used in electric vehicles, provide low resistance, enhanced saturation properties, and stability over a range of temperatures. They boost a vehicle's performance and economy by decreasing energy losses and preventing unwanted self-heating.

Demand for electronics components, including inductors, is anticipated to grow as a result of increased advancements in the mobility sector and a shift in consumer preference toward electric vehicles.

Similarly, the growing adoption of inductors in consumer electronics, medical devices, and military & defense equipment is expected to boost sales in the global inductor market during the forecast period.

Rapid Digitalization and Miniaturization of Electronics to Boost Market Through 2035

Increasing demand for small-sized electronic devices such as mobile phones and tablets is boosting the sales of electronic components such as inductors. Factors such as reduced device size, reduced weight, and enhanced device performance are boosting the demand for thin film inductors across several applications.

Due to their tiny sizes, the inductors are more heat resistant and electrically stable, which helps in reducing electrical noise. Increasing disposable income and changing consumer preference towards lightweight and small-sized communication devices are leading to manufacturers focusing on developing semiconductor devices with miniature, efficient components.

The demand for small electronic components is on the rise as a result of rapid digitalization and the rising penetration of automation. Thus, the growth of the inductor market will be driven by a rapid expansion of the electronics industry, the shrinking of contemporary electronic gadgets, the rising popularity of electric vehicles, and the growing usage of advanced technology in automobiles.

Booming Consumer Electronics Sector Driving the USA Inductor Market

The USA holds around 79.7% market share of the North American inductor market and it is predicted to expand at 5.4% CAGR during the forecast period. Robust expansion of automotive and consumer electronics industries, increasing adoption of advanced technologies, and strong presence of leading manufacturers are some of the key factors driving the USA inductor market.

In the USA, consumer electronics is a very dynamic industry with rapidly changing technological developments and innovations in consumer products. The use of inductors is increasing more and more to provide low DCR characteristics and large currents. Hence, rising demand for wearable electronic devices and a growing preference for automation technology in various industries are expected to boost the demand for the inductor market during the forecast period.

Similarly, the USA market is expected to increase steadily over the forecast period, thanks to the development of new and innovative products that involve the majority of the country's leading companies. According to FMI, the USA inductor market would reach USD 3,929.9 Million in sales by the end of 2035.

Growing Popularity of Electric Vehicles to Boost Inductor Market in Germany

Germany’s inductor market is anticipated to expand at a robust CAGR of 6.8% over the forecast period. Sales in the country are projected to increase by 2x times by the end of 2035, generating revenues worth USD 932.1 million.

The rising adoption of inductors across thriving automotive and industrial sectors is a key factor boosting the growth of the German inductor market.

German manufacturers are creating inductors to boost the electronics equipment industry. As it transitions to a new energy mix, Germany's electric transmission infrastructure faces huge hurdles. The existence of significant electric vehicle automotive businesses in the area is anticipated to drive faster market expansion during the projected period.

Rising Export of Electronic Products Igniting Sales in China

With booming automotive and electrical & electronics industries China is emerging as one of the fastest-growing inductor markets across the globe. FMI predicts the China inductors market to surpass revenues of USD 795.5 Million by 2035.

Urbanization, fast economic expansion, and population growth are boosting the demand for infrastructure development in China. China has become the world's largest maker of many electronic appliances, such as color TVs, DVDs, and cell phones. China also now has a leading-edge semiconductor industry.

International investors are showing interest in China’s electronic infrastructure sector. China still has the most households without power due to its enormous population. The Chinese government is focusing on improving state electricity boards, which has resulted in a significant increase in infrastructure for rural electrification. This will continue to propel sales of inductors during the forecast period.

Similarly, the rise in the export of electronic products is playing a crucial role in expanding the inductor market. According to the World Population Review, China exported an estimated USD 2.72 trillion worth of goods and services, primarily electronic equipment and machinery such as computers, broadcast equipment, computers, integrated circuits, office machine parts, telephones, etc.

Demand to Remain High for Air Core Type Inductors in the Market

As per FMI, the air core type inductor segment will generate an absolute incremental opportunity of USD 5,143.5 Million between 2025 to 2035, making it the fastest-growing core type segment. This can be attributed to the rising usage of air-core type inductors across various end-use industries.

Air core inductors provide effective solutions for switch mode magnetic requirements, especially when focusing on high linearity, high frequency, and reduced core loss. In addition, these inductors are an ideal solution when space is not prohibitive.

Air core inductors offer numerous advantages, such as being saturation free. Inductors with ferromagnetic cores tend to become saturated as the current increases. Air core models, however, have no core to saturate, and therefore are independent of electrical currents.

Without ferromagnetic cores, these inductors eliminate iron losses as frequency increases, the cores offer better Q factor and lower distortion. Air core can achieve peak performance of up to 1GHz. They are essential for a variety of high-tech applications such as electronic products, computer devices, communication equipment, TVs, DVDs, mobile chargers, etc.

Surface Mount Technology Remains the Most Preferred Mounting Technique

According to Future Market Insights, more than 60% of the global inductor market is held by surface mount technology. The surface mount technique enables a smaller PCB design by allowing more components to be placed closer together on the board.

The surface mount technique leads to designs that are more lightweight and compact. The process for production setup is faster when it comes to the surface mount technique as compared to through-hole technology. This is because drilled holes are not required for assembly which also enables lower cost.

Growing adoption of surface mount technology mostly in printed circuit boards and consumer electronics applications will further boost the growth of this segment during the forecast period.

Amid growing preference for surface mount technology over its counterpart, the segment is expected to generate an absolute dollar potential of more than USD 5,317.2 Million between 2025 to 2035.

In recent years, there has been an increase in acquisition and growth operations to strengthen the inductor supply chain. Several major Inductor manufacturers are also studying, developing, and launching new products.

For instance,

Several producers have risen to prominence in this sector. International market leaders are concentrating on establishing partnerships and joint ventures with foreign local companies to guarantee proper local marketing of the products, acquire a competitive edge over rivals, and enjoy additional benefits including popularity in brand value over time.

This element will also present the potential for boosting production capacity, lowering production costs, and preserving market positions for both domestic and foreign firms.

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 27.1 billion |

| Projected Market Size (2035) | 49.1 billion |

| Anticipated Growth Rate (2025 to 2035) | 6.1% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | million for Value and Million Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia Pacific; and The Middle East and Africa |

| Key Countries Covered | United States of America, Canada, Mexico, Brazil, Germany, Italy, France, United Kingdom, Spain, BENELUX, Russia, China, Japan, South Korea, India, ASEAN, Australia, New Zealand, Turkey, South Africa, GCC Countries, and Northern Africa. |

| Key Segments Covered | By Inductance, By Type, By Core Type, By Mounting Technique, By Application, and By Region |

| Key Companies Profiled | Murata Manufacturing; TDK Corporation; Vishay Intertechnology; Taiyo Yuden Co., Ltd.; Chilisin; Delta Electronics; Panasonic; ABC Taiwan Electronics; Pulse Electronics; Coilcraft; Shenzhen Sunlord Electronics; Bourns Inc.; ICE Components, Inc.; Kyocera Corp AVX; Bel Fuse Inc.; Wurth Elektronik; TE Connectivity; Samsung Electro-Mechanics Co. Ltd. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global inductor market is estimated to be valued at USD 27.1 billion in 2025.

It is projected to reach USD 49.1 billion by 2035.

The market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types are fixed inductors and variable inductors.

film type segment is expected to dominate with a 34.2% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Inductors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Grade Inductors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Grade Inductor Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA