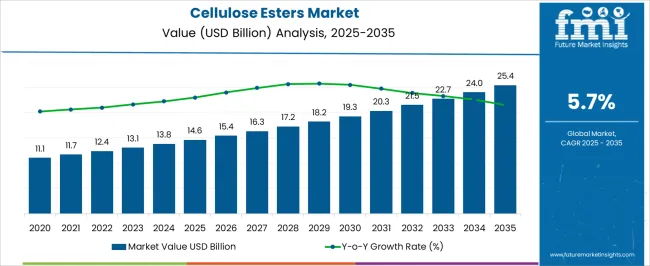

The cellulose esters market is expected to grow from USD 14.6 billion in 2025 to USD 25.4 billion in 2035, reflecting a CAGR of 5.7%. This expansion represents an absolute dollar opportunity of USD 10.8 billion over the forecast period. Early growth is steady, with the market increasing from USD 15.4 billion in 2026 to USD 17.2 billion in 2029, demonstrating incremental gains that establish a strong foundation.

By 2031, the market will reach USD 19.3 billion, reflecting mid-term momentum. These increases provide manufacturers and distributors opportunities to expand capacity, optimize supply chains, and capture rising revenue in this expanding segment.

In the later stage, the market experiences the most significant absolute dollar gains, rising from USD 21.5 billion in 2032 to USD 25.4 billion in 2035. This period contributes nearly USD 3.9 billion in incremental revenue, with annual increments accelerating toward the end of the forecast. Intermediate benchmarks, such as USD 22.7 billion in 2033 and USD 24.0 billion in 2034, act as bridging periods that sustain momentum. The cumulative USD 10.8 billion opportunity highlights substantial long-term revenue potential, enabling stakeholders to align investments, production, and distribution strategies for maximum market capture.

| Metric | Value |

|---|---|

| Cellulose Esters Market Estimated Value in (2025 E) | USD 14.6 billion |

| Cellulose Esters Market Forecast Value in (2035 F) | USD 25.4 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

In the cellulose esters market, the first breakpoint occurs between 2025 and 2027, as the market grows from USD 14.6 billion to USD 15.4 billion. This early phase reflects steady adoption with moderate annual increments of around USD 0.4 billion, establishing a foundation for predictable growth. The next significant breakpoint is observed between 2029 and 2031, when the market rises from USD 17.2 billion to USD 19.3 billion.

During this phase, absolute dollar gains accelerate, signaling mid-stage expansion. These periods are critical for manufacturers and distributors to scale production, strengthen supply chains, and capture incremental revenue efficiently.

Major breakpoint emerges between 2032 and 2035, when the market surges from USD 21.5 billion to USD 25.4 billion, representing the largest absolute dollar growth in the forecast period. Intermediate years, such as USD 22.7 billion in 2033 and USD 24.0 billion in 2034, act as bridging periods sustaining momentum before peak values are achieved. Recognizing these breakpoints allows stakeholders to strategically plan investments, optimize operations, and maximize revenue potential.

The market is advancing steadily due to its essential role in producing environmentally friendly and sustainable materials across multiple industries. Current demand is being driven by increasing consumer preference for bio-based and renewable raw materials, coupled with regulatory pressures to reduce reliance on petroleum-based products.

Advancements in formulation technologies and growing industrial applications are enhancing product versatility, expanding the range of end uses. The market outlook is positive as manufacturers continue to innovate cellulose ester derivatives tailored to meet stringent environmental standards and performance requirements.

Investments in production capacity and the expansion of application areas, particularly in coatings, films, and adhesives, are expected to support sustained market growth. Furthermore, increasing urbanization and industrialization worldwide are driving demand from key end-use sectors, encouraging further adoption of cellulose esters as sustainable alternatives.

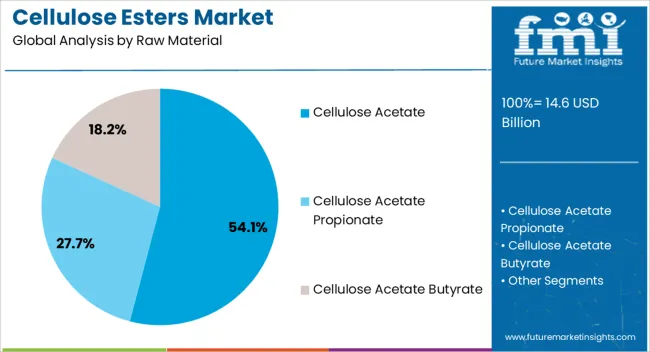

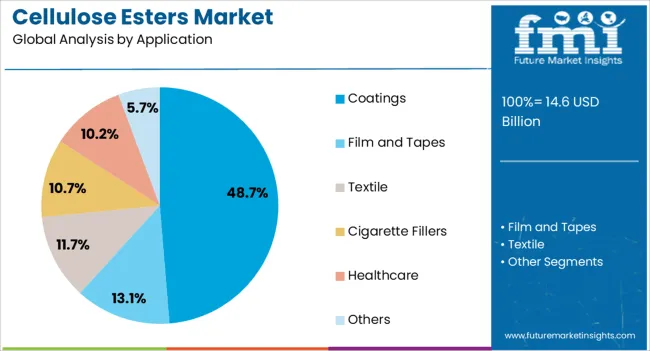

The cellulose esters market is segmented by raw material, application, end use industry, and geographic regions. By raw material, cellulose esters market is divided into Cellulose Acetate, Cellulose Acetate Propionate, and Cellulose Acetate Butyrate. In terms of application, cellulose esters market is classified into Coatings, Film and Tapes, Textile, Cigarette Fillers, Healthcare, and Others.

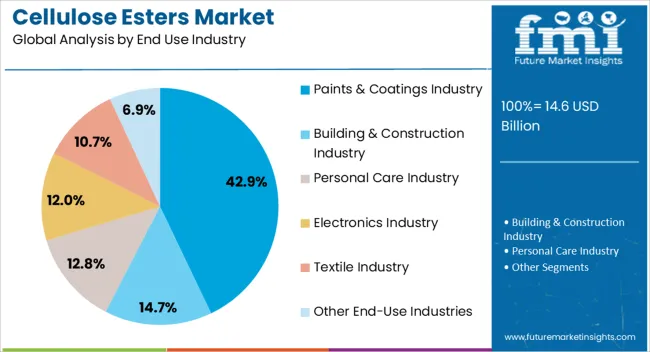

Based on end-use industry, the cellulose esters market is segmented into the Paints & Coatings Industry, Building & Construction Industry, Personal Care Industry, Electronics Industry, Textile Industry, and Other End-Use Industries. Regionally, the cellulose esters industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Cellulose Acetate raw material segment is anticipated to hold 54.1% of the overall revenue share in 2025, establishing it as the dominant raw material within the Cellulose Esters market. This predominance is attributed to its well-established manufacturing processes and favorable balance between performance and cost.

The segment’s growth has been supported by its excellent film-forming properties, biodegradability, and compatibility with various additives, making it a preferred choice in many formulations. Moreover, the versatility of cellulose acetate in delivering clarity, strength, and chemical resistance has expanded its adoption across multiple industrial applications. The segment benefits from continuous innovations in production techniques that enhance material properties and reduce environmental impact, thereby increasing its appeal in sustainability-focused markets.

The Coatings application segment is expected to account for 48.7% of the total market revenue in 2025, leading all application types within the Cellulose Esters market. This leading share is being driven by the growing demand for eco-friendly and high-performance coating materials across industrial and decorative sectors.

The use of cellulose esters in coatings is favored due to their excellent film-forming ability, rapid drying characteristics, and compatibility with waterborne and solvent-based systems. Increasing regulatory restrictions on volatile organic compounds have accelerated the shift towards cellulose ester-based coatings as safer and sustainable alternatives. Additionally, the segment is benefiting from rising investments in architectural and automotive coatings, where enhanced durability and aesthetic qualities are critical. The ability to customize coating formulations by varying cellulose ester properties has further reinforced growth prospects.

The Paints & Coatings Industry end-use segment is projected to hold 42.9% of the market revenue in 2025, positioning it as the largest end-use sector for cellulose esters. This leadership is being driven by the increased demand for environmentally compliant and performance-enhancing additives in paints and coatings formulations.

The segment’s growth has been supported by trends towards sustainable construction materials and stricter environmental regulations globally. The compatibility of cellulose esters with a wide range of resin systems has facilitated their integration into various paint formulations, enhancing properties such as adhesion, gloss, and film toughness.

The rising demand for architectural and industrial coatings, driven by expanding construction and automotive industries, has also contributed to the segment’s prominence. As manufacturers continue to seek green alternatives, cellulose esters are anticipated to maintain their critical role in this sector.

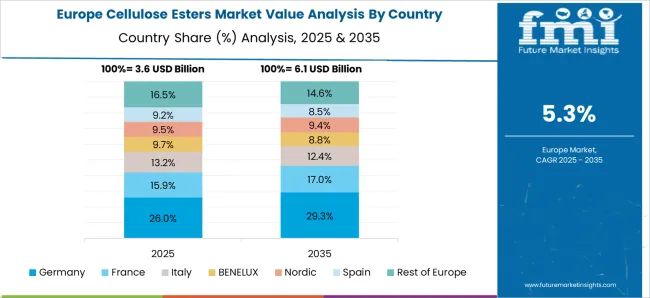

The cellulose esters market is growing due to increasing demand in coatings, films, plastics, and specialty chemicals across packaging, automotive, and construction industries. North America and Europe lead with high-performance, solvent-resistant cellulose esters for coatings and engineering applications. Asia-Pacific is witnessing rapid growth driven by packaging, consumer goods, and automotive sectors. Manufacturers differentiate through viscosity grade, acetyl content, solubility, and film-forming properties. Regional variations in industrial capacity, regulatory frameworks, and end-use demand influence adoption, procurement strategies, and competitive positioning globally.

Cellulose esters vary by viscosity, degree of polymerization, and solubility, determining suitability for coatings, adhesives, and film applications. Europe and North America focus on high-viscosity, fully soluble grades for specialty coatings, automotive finishes, and industrial adhesives that demand durability and uniform film formation. Asia-Pacific markets prioritize medium-viscosity, cost-effective grades for packaging films, laminates, and consumer goods applications where volume and affordability are key. Differences in viscosity and solubility affect processing efficiency, product performance, and quality consistency. Leading suppliers offer a wide range of viscosity grades with precise solubility parameters for high-value applications, while regional producers provide standardized grades optimized for large-scale, cost-sensitive use. Viscosity contrasts directly shape adoption, performance, and market segmentation globally.

The degree of acetylation and chemical structure of cellulose esters influence mechanical strength, thermal stability, and chemical resistance. North America and Europe prefer fully or partially acetylated cellulose esters for coatings, plastics, and high-performance films that require superior chemical and temperature resistance. Asia-Pacific markets use lower acetyl content grades for packaging, laminates, and mass-market applications where cost efficiency and ease of processing are prioritized. Differences in acetyl content impact compatibility with solvents, additives, and end-use requirements. Manufacturers offering tailored acetyl profiles for specific applications gain premium contracts, while regional producers focus on general-purpose, cost-effective grades. Composition contrasts shape adoption, functionality, and competitiveness across industrial and consumer markets globally.

Compliance with environmental and safety regulations, including VOC limits, REACH, and FDA food-contact standards, strongly affects cellulose ester adoption. Europe and North America enforce stringent regulatory compliance, demanding solvent-resistant, non-toxic, and eco-friendly formulations for coatings, films, and packaging. Asia-Pacific markets demonstrate variability, with high-budget industrial projects adhering to global regulations, while smaller facilities follow local standards. Differences in regulatory compliance influence product formulation, certification requirements, and market entry timelines. Suppliers offering environmentally compliant cellulose esters gain access to premium applications, while regional producers focus on basic compliance and cost efficiency. Regulatory contrasts determine adoption, market positioning, and competitiveness across global regions.

Cellulose esters are used across coatings, plastics, films, adhesives, and pharmaceuticals. North America and Europe emphasize high-value, specialized applications requiring precise formulation, chemical resistance, and performance consistency in automotive, electronics, and specialty packaging. Asia-Pacific adoption is driven by high-volume consumer packaging, laminates, and mass-market coatings, where cost-effectiveness and large-scale supply dominate. Differences in end-use demand affect production planning, supply chain management, and product differentiation. Leading suppliers target specialized industries with tailored grades, while regional producers address bulk, general-purpose applications. Application contrasts influence market segmentation, adoption rates, and long-term growth prospects across industrial and consumer sectors globally.

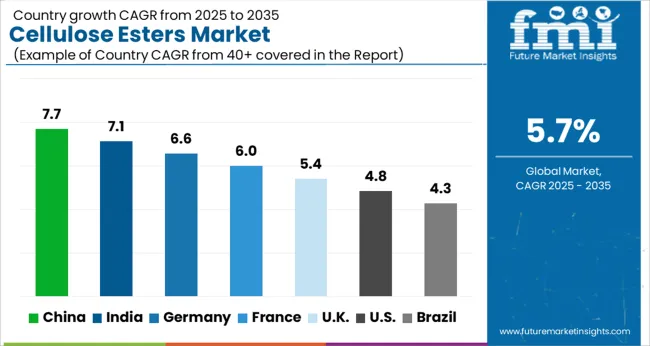

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

| USA | 4.8% |

| Brazil | 4.3% |

The global cellulose esters market was projected to grow at a 5.7% CAGR through 2035, driven by demand in coatings, films, adhesives, and specialty applications. Among BRICS nations, China recorded 7.7% growth as large-scale production and processing facilities were commissioned and compliance with industrial and quality standards was enforced, while India, at 7.1% growth, saw expansion of manufacturing units to meet rising regional demand.

In the OECD region, Germany, at 6.6% maintained substantial output under strict industrial and operational regulations, while the United Kingdom, at 5.4% relied on moderate-scale operations for coatings and specialty applications. The USA, expanding at 4.8%, remained a mature market with steady demand across industrial, commercial, and specialty segments, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The cellulose esters market in China is growing at a CAGR of 7.7% driven by rising demand from coatings, films, adhesives, and plastics industries. Manufacturers are adopting cellulose esters to improve product performance, transparency, and film-forming properties in industrial and commercial applications. Growth is supported by expanding automotive, packaging, and construction sectors, where cellulose esters are used for high-quality coatings, laminates, and flexible films. Suppliers provide high purity cellulose esters with consistent quality, tailored for different industrial applications. Distribution through chemical distributors, industrial suppliers, and direct sales channels ensures wide market accessibility. Adoption is further driven by the need for durable, versatile, and cost effective polymer solutions. China remains a leading market due to strong industrial growth, expanding manufacturing sectors, and rising demand for high performance materials in coatings and plastics.

India is witnessing growth at a CAGR of 7.1% in the cellulose esters market due to increasing adoption in coatings, packaging films, adhesives, and plastic products. Industries are using cellulose esters to enhance product durability, film clarity, and surface finish in industrial and commercial applications. Growth is supported by expanding automotive, packaging, and construction sectors that demand high quality polymer solutions. Suppliers provide cellulose esters with consistent performance, purity, and compatibility for diverse industrial applications.

Distribution through chemical distributors, industrial suppliers, and e-commerce platforms ensures accessibility across urban and semi-urban regions. Adoption is further driven by increasing industrialization, rising demand for high performance coatings, and flexible packaging requirements. India continues to see strong market growth due to expanding manufacturing capabilities and rising industrial demand for advanced polymer solutions.

Germany is growing at a CAGR of 6.6% in the cellulose esters market due to demand from coatings, adhesive, and packaging industries. Manufacturers use cellulose esters to enhance product properties such as film strength, transparency, and durability in industrial and commercial applications. Growth is supported by strong automotive, construction, and packaging sectors, as well as demand for environmentally compliant polymer solutions. Suppliers provide high quality cellulose esters tailored to meet industrial standards for coatings, laminates, and films. Distribution channels include chemical distributors, industrial suppliers, and direct sales networks, ensuring wide market access. Adoption is further driven by the need for high performance materials, reliable quality, and industrial efficiency. Germany remains a key European market due to its advanced manufacturing base and demand for high quality polymer solutions.

The United Kingdom market is expanding at a CAGR of 5.4% due to increasing adoption in coatings, packaging, adhesives, and films industries. Companies implement cellulose esters to improve product durability, transparency, and performance in industrial applications. Growth is supported by rising demand in automotive, construction, and packaging sectors. Suppliers provide cellulose esters with consistent quality, high purity, and compatibility for diverse industrial applications. Distribution through chemical distributors, industrial suppliers, and online platforms ensures wide accessibility. Adoption is further driven by the need for high performance and versatile polymer solutions in coatings and films. The United Kingdom continues to see steady market growth due to increasing industrial demand and the requirement for advanced material solutions across multiple sectors.

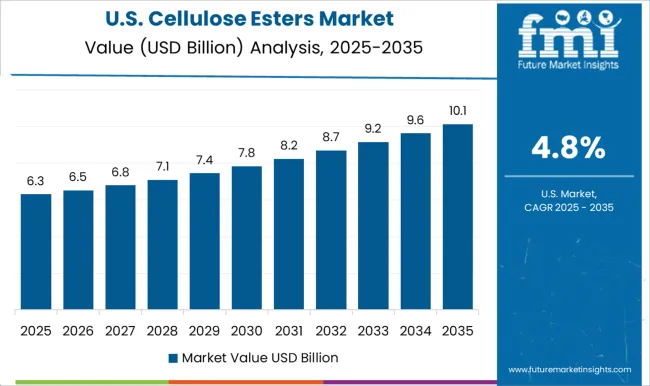

The United States market is growing at a CAGR of 4.8% supported by rising adoption in coatings, films, adhesives, and plastics industries. Manufacturers implement cellulose esters to enhance product performance, clarity, and durability in industrial and commercial applications. Growth is supported by demand from automotive, packaging, and construction sectors requiring high quality polymer solutions. Suppliers provide high purity and versatile cellulose esters suitable for diverse industrial needs. Distribution channels include chemical distributors, industrial suppliers, and direct sales networks, ensuring broad market accessibility. Adoption is further driven by the need for reliable, cost effective, and high performance materials in coatings and packaging applications. The United States remains a key market due to strong industrial demand and ongoing expansion of manufacturing and packaging sectors.

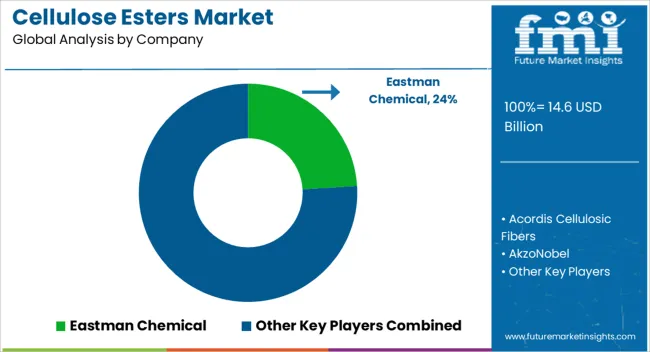

The cellulose esters market is served by major suppliers including Eastman Chemical, Acordis Cellulosic Fibers, AkzoNobel, Ashland, Borregaard, Celanese, China National Tobacco Corporation, Daicel, J.M. Huber, Mitsubishi Chemical Holdings, Rayonier Advanced Materials, Rhodia Acetow International, Sappi, Sichuan Push Acetati, and Solvay. These companies specialize in producing cellulose acetate, cellulose nitrate, and other ester derivatives that are widely used in coatings, films, plastics, textiles, and specialty chemical applications. Cellulose esters are valued for their transparency, chemical resistance, and film-forming properties, making them integral to both industrial and consumer products. Key players like Eastman Chemical, Celanese, and Daicel focus on high-purity and specialty cellulose esters suitable for applications in pharmaceuticals, packaging, and electronics. Companies such as Mitsubishi Chemical Holdings, Borregaard, and Rayonier Advanced Materials emphasize sustainable sourcing and large-scale production for textiles, coatings, and films.

Regional suppliers, including China National Tobacco Corporation and Sichuan Push Acetati, cater to local industrial demands, providing cost-effective solutions for packaging, printing, and cigarette filters. Market trends indicate an increasing demand for bio-based and eco-friendly cellulose esters as industries look to replace petroleum-derived plastics with renewable alternatives. Suppliers are investing in process optimization, product standardization, and technical support services to enhance performance and broaden the application range. The adoption of cellulose esters in electronics, medical devices, and advanced coatings continues to drive innovation, with manufacturers expanding research into improved mechanical strength, thermal stability, and barrier properties to meet diverse industrial needs.

| Item | Value |

|---|---|

| Quantitative Units | USD 14.6 Billion |

| Raw Material | Cellulose Acetate, Cellulose Acetate Propionate, and Cellulose Acetate Butyrate |

| Application | Coatings, Film and Tapes, Textile, Cigarette Fillers, Healthcare, and Others |

| End Use Industry | Paints & Coatings Industry, Building & Construction Industry, Personal Care Industry, Electronics Industry, Textile Industry, and Other End-Use Industries |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Eastman Chemical, Acordis Cellulosic Fibers, AkzoNobel, Ashland, Borregaard, Celanese, China National Tobacco Corporation, Daicel, J.M. Huber, Mitsubishi Chemical Holdings, Rayonier Advanced Materials, Rhodia Acetow International, Sappi, Sichuan Push Acetati, and Solvay |

| Additional Attributes | Dollar sales vary by product type, including cellulose acetate, cellulose nitrate, and cellulose propionate; by application, such as coatings, films, plastics, textiles, and pharmaceuticals; by end-use industry, spanning packaging, automotive, consumer goods, and healthcare; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising demand for biodegradable materials, sustainable packaging, and specialty polymers. |

The global cellulose esters market is estimated to be valued at USD 14.6 billion in 2025.

The market size for the cellulose esters market is projected to reach USD 25.4 billion by 2035.

The cellulose esters market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in cellulose esters market are cellulose acetate, cellulose acetate propionate and cellulose acetate butyrate.

In terms of application, coatings segment to command 48.7% share in the cellulose esters market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cellulose Fiber Market Forecast and Outlook 2025 to 2035

Cellulose Derivative Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Film Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Ether and Derivatives Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Nanocrystals and Nanofibers Market Size and Share Forecast Outlook 2025 to 2035

Cellulose Gel Market Growth, Forecast, and Analysis 2025 to 2035

Market Share Insights for Cellulose Fiber Providers

Key Players & Market Share in Cellulose Film Packaging Market

Nanocellulose Coating Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Nanocellulose Barrier Coating Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Nanocellulose Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Ethyl Cellulose Market

Methyl Cellulose Market

Powdered Cellulose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ethyl Methyl Cellulose Market

Carboxymethyl Cellulose Market 2024-2034

Korea Powdered Cellulose Market Analysis by Source, End-use, Functionality, and Region Through 2035

Japan Powdered Cellulose Market, By Type, By Application, By Region, and Forecast, 2025 to 2035

Nanocrystalline cellulose Market Size and Share Forecast Outlook 2025 to 2035

Microcrystalline Cellulose Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA